Helen of Troy SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Helen of Troy Bundle

Helen of Troy's legendary beauty (Strength) sparked a devastating war (Weakness), while her influence (Opportunity) could have united kingdoms, yet instead fractured them (Threat). This captivating figure offers a unique lens into the interplay of personal attributes and geopolitical consequences.

Want the full story behind Helen's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Helen of Troy’s strength lies in its diverse and powerful brand portfolio, encompassing popular names like OXO, Hydro Flask, and Braun. This broad range of trusted brands across beauty, health, and home segments significantly broadens its customer reach and cushions against market volatility.

Many of these flagship brands hold dominant positions, frequently securing the top two spots within their respective U.S. market categories. This market leadership underscores the strong consumer loyalty and brand equity Helen of Troy has cultivated.

Helen of Troy has a strong history of making smart acquisitions that boost its brand lineup and revenue. For instance, the acquisitions of Olive & June and Curlsmith have significantly strengthened its position in the growing beauty and wellness markets, adding approximately $200 million in combined net sales. This strategic move enhances market share and diversifies its revenue streams.

The company also demonstrates a commitment to portfolio optimization through divestitures. The sale of its Personal Care business in 2021 for $470 million allowed Helen of Troy to focus resources on higher-growth categories. This disciplined approach to mergers and acquisitions ensures the company remains agile and aligned with market trends, ultimately driving long-term growth and shareholder value.

Helen of Troy is making strides with Project Pegasus, a global restructuring effort aimed at boosting operating margins. This initiative focuses on enhancing efficiency and cutting costs across the board.

The company anticipates substantial annualized pre-tax operating profit improvements, with a significant portion expected to be realized by the close of fiscal year 2027. For instance, in fiscal year 2024, the company reported achieving $45 million in cost savings from these initiatives.

These operational improvements are designed to streamline Helen of Troy's organization, freeing up resources. These resources can then be strategically reinvested into crucial areas like brand development and product innovation, strengthening the company's competitive position.

Strong Distribution Channels and International Presence

Helen of Troy leverages a robust network of distribution channels, encompassing mass merchandisers, online retailers, and specialty stores globally. This multifaceted approach ensures widespread product availability and access to diverse consumer segments.

The company’s strategic international expansion is a key strength, evidenced by growing international sales. For fiscal year 2025, international revenue represented a significant percentage of total sales, demonstrating Helen of Troy's successful penetration of overseas markets. This global reach not only broadens its customer base but also mitigates risks associated with over-reliance on any single domestic market, thereby strengthening its overall revenue diversification.

- Extensive Distribution Network: Access to mass merchandisers, e-commerce platforms, and specialty retailers worldwide.

- Growing International Sales: International revenue contributed significantly to total revenue in fiscal 2025.

- Global Market Penetration: Taps into new customer bases and reduces domestic market dependency.

- Revenue Diversification: Reduces reliance on single markets, enhancing financial stability.

Focus on Innovation and Quality

Helen of Troy's dedication to innovation and quality is a significant strength, allowing them to consistently offer solutions that resonate with consumers and foster strong brand loyalty. This commitment is evident in their strategic investments in new product development and sophisticated marketing approaches, leveraging data analytics and deep consumer insights. For instance, in fiscal year 2024, the company reported net sales of $2.0 billion, with a continued emphasis on driving growth through product innovation.

This focus ensures their product portfolio remains competitive and attractive to ever-changing consumer demands. The company actively seeks to enhance existing products and introduce novel offerings, reinforcing their market position.

- Brand Loyalty: Consistent delivery of high-quality, innovative products builds trust and repeat business.

- Competitive Edge: Investment in R&D and consumer insights keeps them ahead of market trends.

- Market Relevance: Continuous product improvement ensures alignment with evolving consumer preferences.

- Financial Backing: $2.0 billion in net sales for FY2024 underscores the market's acceptance of their innovative approach.

Helen of Troy's diverse brand portfolio, featuring names like OXO and Hydro Flask, provides broad market reach and resilience. Many of these brands hold leading positions in their respective U.S. categories, indicating strong consumer loyalty.

Strategic acquisitions, such as Olive & June and Curlsmith, have bolstered its presence in key growth markets, adding approximately $200 million in combined net sales. The company also benefits from operational improvements through Project Pegasus, which aims to enhance efficiency and reduce costs, projecting significant pre-tax operating profit improvements.

The company's extensive distribution network and successful international expansion are significant strengths, with international revenue contributing a notable portion of its total sales in fiscal year 2025. This global presence diversifies revenue and reduces reliance on any single market.

Helen of Troy's commitment to innovation and quality, backed by $2.0 billion in net sales for fiscal year 2024, ensures its products remain competitive and aligned with consumer demands, fostering enduring brand loyalty.

| Strength | Description | Supporting Data |

|---|---|---|

| Brand Portfolio | Diverse, leading brands across multiple consumer segments. | Acquisitions like Olive & June and Curlsmith added ~$200M in net sales. |

| Market Leadership | Top two positions in many U.S. market categories. | Demonstrates strong brand equity and consumer preference. |

| Operational Efficiency | Project Pegasus aims to boost operating margins through restructuring. | Achieved $45M in cost savings in FY2024 from these initiatives. |

| Global Reach | Extensive distribution and growing international sales. | International revenue a significant percentage of total sales in FY2025. |

| Innovation & Quality | Focus on R&D and consumer insights for product development. | FY2024 net sales of $2.0 billion reflect market acceptance. |

What is included in the product

Analyzes Helen of Troy’s competitive position through key internal and external factors, highlighting its brand strength and market opportunities while acknowledging potential supply chain vulnerabilities and competitive pressures.

Helps identify and mitigate potential relationship disruptions by analyzing strengths, weaknesses, opportunities, and threats in personal alliances.

Offers a structured framework to understand the impact of personal attributes and external factors on relationship stability.

Weaknesses

Helen of Troy has faced a noticeable dip in its financial performance, with consolidated net sales falling by 10.8% in the first quarter of fiscal year 2026. This follows a 0.7% decrease in net sales in the fourth quarter of fiscal year 2025, indicating a challenging period for the company.

The primary drivers behind this sales decline include disruptions from tariffs impacting trade, a cautious approach from retailers in placing new orders, and a general softening of consumer demand across various product categories. These external and internal pressures have collectively impacted the company's top-line growth.

Specifically, the Beauty & Wellness segment has been a significant contributor to this weakness, experiencing substantial declines. This is largely due to decreased consumer interest in hair appliances and a slowdown in the prestige hair liquids market, reflecting shifting consumer preferences and economic sensitivities.

Helen of Troy is vulnerable to shifting global tariff landscapes, especially those impacting goods from China. These tariffs have directly caused order cancellations and escalated operational expenses, eating into profitability.

The company's financial performance is further strained by ongoing supply chain disruptions and rising logistics expenses. For instance, in the fiscal year ending February 2024, Helen of Troy reported a net sales decline of 7.4%, partly attributed to these external pressures.

While the company is making strides in diversifying its supplier base to mitigate these risks, the current geopolitical and trade climate introduces persistent uncertainty and downward pressure on profit margins.

Helen of Troy has faced significant operational hurdles, notably with the automation rollout at its Tennessee distribution center. This has led to a slowdown in processing and fulfillment, directly impacting their ability to get products to customers efficiently.

Integration of new acquisitions, such as Curlsmith, has also presented challenges. Merging systems and processes can be complex, and for Helen of Troy, this has contributed to disruptions in their supply chain and increased logistics expenses, as reported in their recent financial disclosures for the fiscal year ending March 31, 2024.

These combined operational and integration issues have negatively affected sales and overall efficiency, with the company acknowledging these as key areas requiring remediation. While steps are being taken to address these weaknesses, the ongoing nature of these challenges poses a risk to service levels and profitability in the near term.

Softer Consumer Demand and Promotional Environment

Helen of Troy is facing a challenging consumer spending landscape. Shoppers are increasingly focusing on essential goods, leading to weaker demand for discretionary items. This trend puts pressure on sales across various product categories.

The current economic climate is also fostering a more promotional retail environment. This can negatively impact Helen of Troy's gross profit margins as the company may need to offer discounts to attract customers. For instance, during the third quarter of fiscal year 2024, the company noted a shift towards value-oriented products.

A notable observation is the consumer migration towards lower-priced alternatives. This shift directly affects Helen of Troy's sales volumes and overall profitability, as it indicates a price-sensitive customer base.

- Softer Demand: Consumers are prioritizing necessities over discretionary purchases.

- Promotional Environment: Increased discounting by competitors and retailers can pressure margins.

- Shift to Value: Consumers are opting for lower-priced alternatives, impacting sales mix.

- Margin Compression: The combination of softer demand and promotional activity can reduce profitability.

Segment-Specific Performance Disparities

Helen of Troy's performance isn't uniform across all its business areas. While segments like Home & Outdoor showed promising growth in the third quarter of fiscal year 2025, and Wellness, OXO, Osprey, and International performed well in the fourth quarter of fiscal year 2025, other parts of the business are facing headwinds.

Specifically, the Beauty & Wellness segment has seen a downturn. This is attributed to increased competition and a less severe flu season than anticipated, which typically drives demand for certain wellness products. This disparity highlights the need for strategic adjustments to strengthen weaker brands and refine market approaches.

- Uneven Segment Growth: Home & Outdoor grew in Q3 FY2025, while Wellness, OXO, Osprey, and International saw gains in Q4 FY2025.

- Beauty & Wellness Challenges: This segment experienced declines due to heightened competition and a weaker-than-expected illness season.

- Strategic Imperative: The company must focus on bolstering brand strength and adapting market strategies in underperforming areas.

Helen of Troy faces significant challenges with its Beauty & Wellness segment, which saw substantial declines due to reduced consumer interest in hair appliances and a slowdown in the prestige hair liquids market. This segment's weakness, coupled with a general softening of consumer demand for discretionary items, impacts overall sales. The company is also vulnerable to global tariff disruptions, which have led to order cancellations and increased operational costs.

Operational inefficiencies, particularly the rollout issues at the Tennessee distribution center, have hampered fulfillment and delivery. Furthermore, integrating new acquisitions, like Curlsmith, has added complexity, contributing to supply chain disruptions and higher logistics expenses. These factors collectively pressure profitability and service levels.

| Weakness | Description | Impact | Relevant Period |

| Beauty & Wellness Decline | Reduced consumer interest in hair appliances and prestige hair liquids. | Significant sales decline in the segment. | Fiscal Year 2026 (Q1) |

| Consumer Spending Softness | Consumers prioritizing necessities over discretionary purchases. | Weaker demand across various product categories. | Fiscal Year 2026 (Q1) |

| Tariff Disruptions | Impact of tariffs on goods from China. | Order cancellations and escalated operational expenses. | Fiscal Year 2024 |

| Operational Inefficiencies | Rollout issues at Tennessee distribution center impacting fulfillment. | Slowdown in processing and fulfillment. | Fiscal Year 2024 |

| Acquisition Integration Challenges | Complexity in merging systems and processes for acquisitions like Curlsmith. | Supply chain disruptions and increased logistics expenses. | Fiscal Year 2024 |

Preview the Actual Deliverable

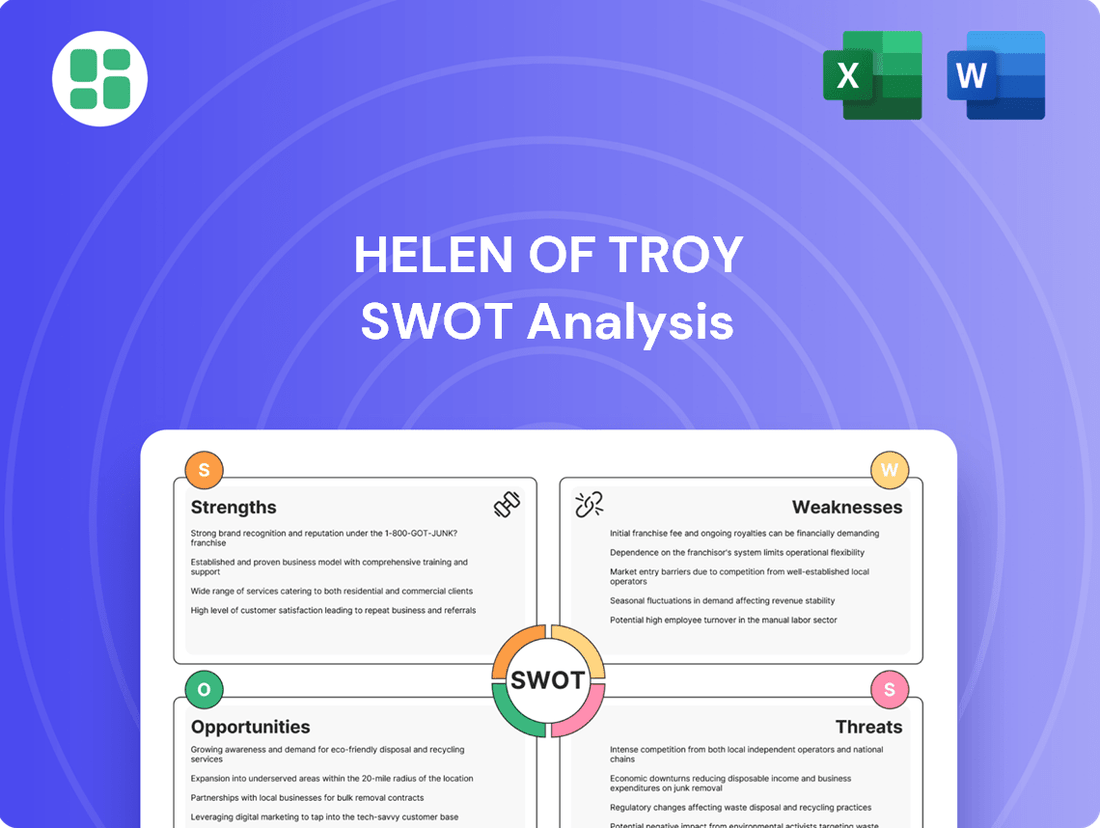

Helen of Troy SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Helen of Troy's strengths, weaknesses, opportunities, and threats in a comprehensive and structured format.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a complete understanding of the factors influencing Helen's narrative and impact.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, providing actionable insights into Helen of Troy's strategic position.

Opportunities

Helen of Troy has a considerable opportunity to grow its presence in international markets. In fiscal year 2024, international sales represented about 20% of the company's total revenue, indicating a strong foundation for further expansion.

By concentrating more on international sales, Helen of Troy can increase its overall revenue, spread out geographical risks, and enhance its global brand recognition and market share. The company has already experienced positive growth in its international operations across several of its brands.

Helen of Troy's e-commerce presence, already accounting for approximately 25% of its 2024 net sales, presents a significant avenue for expansion. The company can capitalize on this by further strengthening its online sales infrastructure and deepening direct-to-consumer (DTC) engagement.

By investing in sophisticated data analytics and refining its digital marketing strategies, Helen of Troy can broaden its customer reach and cultivate more direct relationships. This focus is crucial for capturing a greater portion of the rapidly expanding online retail sector.

Implementing robust loyalty programs and upgrading existing DTC platforms are key strategies to accelerate this growth. These initiatives will not only drive repeat business but also enhance overall customer lifetime value.

Helen of Troy's strategic move to diversify production away from China is a key opportunity. This initiative directly addresses the risks associated with tariffs and aims to build a more robust supply chain. The company's target to have less than 25% of its cost of goods sold exposed to China tariffs by fiscal year 2026 highlights a commitment to mitigating these financial headwinds.

By reducing its reliance on a single manufacturing hub, Helen of Troy can unlock greater operational flexibility and cost efficiencies. This geographic diversification not only strengthens its competitive position but also enhances long-term stability, making the company less vulnerable to geopolitical and trade-related disruptions.

Leveraging Project Pegasus for Reinvestment and Margin Expansion

Project Pegasus is poised to unlock substantial financial flexibility for Helen of Troy, with projected annualized operating profit improvements ranging from $75 million to $85 million by fiscal year 2027. This significant cost savings presents a prime opportunity to fuel strategic reinvestment.

These freed-up resources can be channeled into critical growth areas. Think enhanced brand building initiatives, accelerated new product development pipelines, more impactful marketing campaigns, and deeper collaborations with retail partners.

- Brand Building: Invest in campaigns that resonate with evolving consumer preferences.

- Product Innovation: Allocate capital to R&D for next-generation products.

- Marketing Enhancement: Boost digital and traditional marketing efforts for wider reach.

- Retail Partnerships: Strengthen relationships through co-marketing and improved in-store experiences.

By strategically deploying these savings, Helen of Troy can transform operational efficiencies directly into powerful growth catalysts, driving both top-line expansion and further margin enhancement.

Expansion into High-Growth Product Categories (e.g., Digital Health)

Helen of Troy can significantly expand by focusing on high-growth areas like digital health. This sector is anticipated to hit $660 billion by 2025, offering substantial revenue potential. The company's established presence in wellness, bolstered by brands such as Vicks and Braun, provides a strong foundation to tap into growing consumer demand for health tech.

Strategic moves in digital health could include acquiring innovative companies or developing new product lines. This diversification would not only open new income avenues but also position Helen of Troy at the forefront of evolving consumer health trends.

- Market Growth: Digital health market projected to reach $660 billion by 2025.

- Brand Synergy: Leverage Vicks and Braun brands for health tech integration.

- Strategic Acquisitions: Potential to acquire digital health startups for rapid market entry.

- Consumer Trend Alignment: Capitalize on increasing consumer focus on health and wellness technologies.

Helen of Troy has a significant opportunity to expand its international footprint, with international sales comprising roughly 20% of its total revenue in fiscal year 2024. This strategic focus can drive revenue growth and diversify geographical risk.

The company's robust e-commerce channel, already accounting for about 25% of 2024 net sales, offers a prime avenue for expansion through enhanced online infrastructure and direct-to-consumer (DTC) engagement.

Diversifying production away from China presents a key opportunity to mitigate tariff risks and build a more resilient supply chain, with a target to reduce China-exposed cost of goods sold to under 25% by fiscal year 2026.

Project Pegasus is expected to generate annualized operating profit improvements of $75 million to $85 million by fiscal year 2027, providing capital for reinvestment in brand building, product innovation, and marketing.

Entering the high-growth digital health market, projected to reach $660 billion by 2025, is another significant opportunity, leveraging existing wellness brands like Vicks and Braun.

| Opportunity Area | Current Status (FY24) | Projected Impact/Target | Key Actions |

|---|---|---|---|

| International Expansion | 20% of total revenue | Increased revenue, reduced geographic risk | Concentrate on international sales growth |

| E-commerce Growth | 25% of net sales | Broader customer reach, deeper DTC engagement | Strengthen online infrastructure, refine digital marketing |

| Supply Chain Diversification | Reducing China reliance | Mitigate tariff risks, enhance operational flexibility | Target <25% China COGS exposure by FY26 |

| Project Pegasus Savings | N/A (projected) | $75M-$85M annualized operating profit improvement by FY27 | Reinvest savings in growth initiatives |

| Digital Health Market Entry | N/A (potential) | Tap into $660B market by 2025 | Acquire companies or develop new product lines |

Threats

Helen of Troy operates in consumer product categories that are incredibly crowded, meaning they must constantly innovate and find smart ways to stand out to keep their share of the market. This intense rivalry can put a strain on their pricing strategies, marketing budgets, and ultimately, how much profit they make.

The company is up against strong competition in areas like beauty, health, and home goods. Competitors are always changing their products and strategies to match what consumers want, and they frequently introduce new items. For instance, in the housewares segment, which saw a 5% net sales decrease in the fiscal year ending March 31, 2024, competition from both established brands and emerging players is a constant challenge.

Macroeconomic headwinds are a significant concern for Helen of Troy. Declining consumer confidence, as seen in various economic indicators throughout 2024 and into early 2025, directly impacts discretionary spending. For instance, if consumer sentiment surveys show a sharp drop, it signals consumers are less likely to purchase non-essential items, which could affect Helen of Troy's product lines.

Inflationary pressures are another major threat. Rising prices for everyday goods reduce consumers' purchasing power, potentially forcing them to trade down to cheaper alternatives or simply buy less. This dynamic can lead to a noticeable decrease in demand for Helen of Troy's offerings, especially in categories where price sensitivity is high.

The current economic climate, characterized by an increasingly stretched consumer, creates a more promotional environment. This means Helen of Troy may face greater pressure to offer discounts to drive sales, which can directly impact both top-line revenue and the company's gross margins. For example, if competitors aggressively discount, Helen of Troy might be compelled to follow suit, eroding profitability.

Helen of Troy faces significant headwinds from rapidly evolving global tariff policies, especially those targeting imports from China. These shifting regulations introduce considerable uncertainty and can disrupt supply chains, directly impacting the company's cost structure and operational efficiency.

The imposition of tariffs directly increases the cost of goods for Helen of Troy, potentially squeezing profit margins. Furthermore, these policies can lead to trade disruptions, causing delays and making it harder to source necessary components or finished products, which in turn can prompt retailers to reduce or cancel direct import orders.

The company recognizes that these dynamic tariff landscapes can have far-reaching and unpredictable consequences. They can influence inflation rates, dampen consumer confidence, and ultimately create instability within broader macroeconomic conditions, making strategic planning more challenging.

Supply Chain Disruptions and Cost Increases

Helen of Troy faces significant risks from supply chain disruptions and rising costs. Beyond tariffs, the company is exposed to increased manufacturing and shipping expenses, alongside fluctuating raw material prices. For instance, global shipping costs saw substantial increases throughout 2021 and 2022, impacting many consumer goods companies, and while some of these pressures eased by early 2024, volatility remains a concern.

Operational hiccups at Helen of Troy's distribution centers can also cause delays and inflate logistics expenditures. These external pressures directly translate to a higher cost of goods sold, which in turn can erode gross profit margins and hinder overall operational efficiency. For example, in its fiscal year ending March 31, 2024, the company reported that rising inbound freight costs had a notable impact on its profitability.

- Supply Chain Vulnerability: Exposure to global shipping cost fluctuations and manufacturing cost increases.

- Raw Material Volatility: Susceptibility to price swings in essential materials impacting production costs.

- Logistics Expenses: Potential for increased costs due to operational inefficiencies at distribution facilities.

- Margin Impact: Direct correlation between these disruptions and higher cost of goods sold, pressuring gross profit margins.

Brand and Product Specific Sales Declines

Helen of Troy faces a threat from declining sales in specific product categories. For instance, the insulated beverageware segment, a key area for the company, has experienced softer demand. This trend is also evident in other categories like hair appliances and prestige hair liquids, indicating a broader challenge in maintaining sales momentum across diverse product lines.

These category-specific downturns can significantly impact overall financial performance. For the fiscal year ending March 31, 2024, Helen of Troy reported net sales of $1.97 billion, a decrease from the previous year. This decline underscores the vulnerability of relying on specific product categories that may be susceptible to market shifts or increased competition.

- Insulated Beverageware: Facing softer demand, impacting a historically strong category.

- Hair Appliances: Experiencing a slowdown in sales, suggesting market saturation or changing consumer preferences.

- Prestige Hair Liquids: Also showing weaker demand, indicating potential issues with product positioning or competitive offerings.

- Overall Impact: These declines, if not countered by innovation or strategic adjustments, pose a risk to Helen of Troy's total revenue and market share.

Intense competition in crowded consumer product markets forces Helen of Troy to constantly innovate and differentiate. This rivalry pressures pricing, marketing, and profitability, especially in segments like housewares, which saw a 5% net sales decrease in fiscal year 2024. Macroeconomic factors like declining consumer confidence and inflation further threaten sales by reducing discretionary spending and purchasing power, leading to a more promotional environment where discounts can erode margins.

Helen of Troy is vulnerable to supply chain disruptions and rising costs, including increased manufacturing, shipping, and raw material expenses. For instance, higher inbound freight costs impacted profitability in fiscal year 2024. Furthermore, shifts in global tariff policies, particularly those affecting imports from China, introduce uncertainty, increase costs, and can disrupt operations, potentially leading retailers to reduce orders.

Declining sales in key product categories, such as insulated beverageware, hair appliances, and prestige hair liquids, pose a significant threat. These downturns impact overall financial performance, as evidenced by the fiscal year ending March 31, 2024, when net sales decreased to $1.97 billion. This highlights the risk associated with reliance on specific product lines susceptible to market shifts or heightened competition.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible data, including Helen of Troy's official financial filings, comprehensive market research reports, and insights from industry experts to ensure an accurate and actionable assessment.