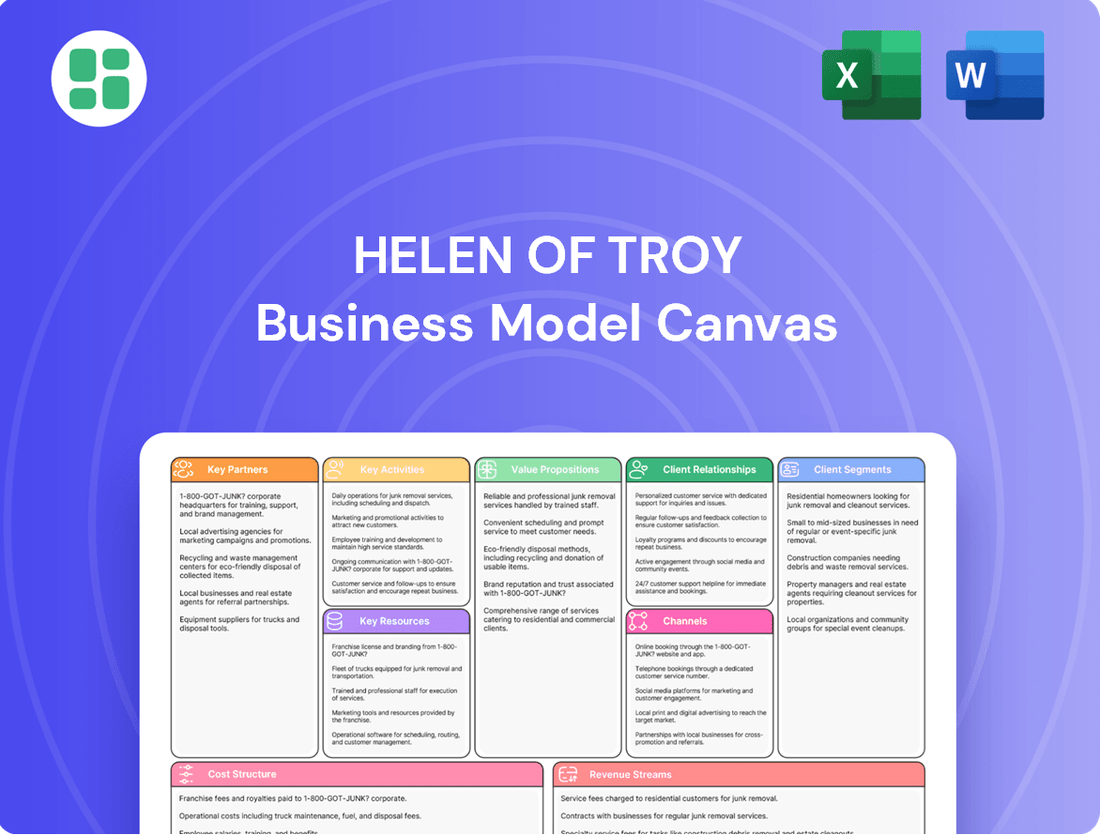

Helen of Troy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Helen of Troy Bundle

Uncover the strategic genius behind Helen of Troy's enduring success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they effectively manage customer relationships, leverage key resources, and drive revenue streams in a dynamic market. Gain actionable insights to fuel your own business growth.

Partnerships

Helen of Troy's strategic retail partnerships are the backbone of its distribution network. They work closely with major players like Walmart, Target, and Amazon, which are critical for reaching a vast consumer base across different shopping channels.

These collaborations extend beyond just stocking shelves; they often involve joint marketing initiatives and product placement strategies. In 2024, e-commerce continued its significant growth, with Helen of Troy leveraging these platforms to capture a larger share of online sales, which are projected to be a substantial portion of their revenue.

The company also engages with specialty retailers, allowing them to target niche markets and offer a more curated selection of products. This multi-channel approach ensures broad market penetration and accessibility for their diverse brand portfolio.

Helen of Troy leverages a robust network of third-party manufacturers, primarily located in Asia, and numerous raw material suppliers globally. This reliance on external partners is crucial for producing their wide array of products, from personal care appliances to water filtration systems.

In 2024, the company continued to emphasize optimizing these relationships to ensure cost efficiency and maintain stringent quality control standards across its diverse product lines. Timely delivery remains a key performance indicator, directly impacted by the strength and reliability of these manufacturing and supply chain partnerships.

Helen of Troy's success hinges on robust partnerships with logistics and distribution providers. These include collaborations with major freight forwarders to manage international shipping, warehousing companies for efficient inventory storage across key regions, and specialized last-mile delivery services to ensure timely product arrival for consumers.

In 2024, the company continued to optimize its supply chain by working with providers that offer advanced tracking and analytics. For instance, their reliance on third-party logistics (3PL) partners allows for greater flexibility and scalability in handling fluctuating demand, a critical factor in the fast-paced consumer goods market.

Innovation and Technology Collaborators

Helen of Troy actively seeks partnerships with design firms, technology providers, and research institutions to fuel product innovation and bolster its digital infrastructure. These alliances are crucial for developing cutting-edge product features, refining user experiences, and strengthening its e-commerce operations. For instance, in fiscal year 2024, the company continued to invest in digital advancements to enhance customer engagement and streamline online sales channels.

These collaborations are designed to accelerate the development of next-generation products and improve the overall customer journey. By leveraging external expertise, Helen of Troy can bring more advanced and desirable products to market faster. This strategic approach ensures they remain competitive in a rapidly evolving consumer landscape.

Key areas of focus for these partnerships include:

- Product Design and Development: Collaborating with design studios for aesthetic and functional enhancements.

- Technological Integration: Partnering with tech firms for smart features and connected home capabilities.

- Digital Platform Enhancement: Working with e-commerce specialists to optimize online sales and customer interaction.

- Research and Development: Engaging with R&D institutions for material science and manufacturing process improvements.

Marketing and Advertising Agencies

Helen of Troy collaborates with specialized marketing and advertising agencies to craft impactful promotional strategies for its extensive brand lineup. These partnerships are crucial for developing creative campaigns that resonate with specific consumer segments across diverse media platforms.

These collaborations are vital for building robust brand awareness and driving consumer engagement. For instance, in fiscal year 2024, Helen of Troy reported net sales of $2.1 billion, underscoring the importance of effective marketing in achieving these financial results.

- Brand Campaign Development: Agencies assist in conceptualizing and executing integrated marketing campaigns that highlight product benefits and brand values.

- Target Audience Reach: Leveraging agency expertise ensures campaigns effectively reach and engage key demographic groups through optimized media buys and creative messaging.

- Brand Equity Enhancement: Consistent and compelling brand representation across all touchpoints, facilitated by these partnerships, strengthens brand loyalty and market position.

Helen of Troy's key partnerships extend to specialized marketing and advertising agencies, crucial for amplifying its brand presence. These collaborations in 2024 focused on creating targeted campaigns, contributing to their net sales of $2.1 billion for the fiscal year. By leveraging agency expertise, the company effectively reaches diverse consumer segments, enhancing brand awareness and driving engagement across various media platforms.

What is included in the product

A detailed breakdown of Helen of Troy's strategic approach, this Business Model Canvas outlines their customer segments, value propositions, and revenue streams.

It offers a clear and structured view of their operations, key resources, and cost structure, perfect for understanding their market position.

Simplifies complex business strategies into a clear, actionable framework, easing the pain of strategic planning.

Provides a visual roadmap to identify and address critical business challenges, alleviating the burden of undefined direction.

Activities

Helen of Troy's key activities heavily revolve around the continuous research, design, and development of innovative consumer products. This spans their core categories: beauty, health, and home. The company actively seeks to identify unmet market needs and translate those insights into tangible product concepts.

This development process involves rigorous conceptualization and execution to bring new products to market. For instance, in 2023, Helen of Troy launched several new products across its brands, including the Hydro Flask Wide Mouth Straw Lid and the Honeywell HPA300 Air Purifier, demonstrating their commitment to product innovation driven by market demand.

Helen of Troy's brand management and marketing efforts are central to its success, involving the strategic development and promotion of its diverse brand portfolio. This includes significant investment in advertising, digital marketing, and consumer promotions to cultivate strong brand recognition and loyalty.

In 2024, the company continued to focus on enhancing its brand presence across various channels, aiming to drive consumer demand for its products. For instance, its Housewares segment, featuring brands like OXO and Hydro Flask, saw continued consumer engagement through targeted digital campaigns and product innovation, contributing to sustained sales growth.

Helen of Troy manages its global sales and distribution by overseeing sales operations and ensuring products reach consumers through diverse channels worldwide. This critical activity involves cultivating strong relationships with retail partners, streamlining e-commerce sales, and actively pursuing expansion into new international markets.

In 2024, Helen of Troy continued to focus on its omni-channel strategy, aiming to enhance both its direct-to-consumer (DTC) e-commerce presence and its relationships with major brick-and-mortar retailers. The company reported that its net sales for the fiscal year ended March 31, 2024, were $2.05 billion, demonstrating the scale of its global distribution efforts.

Supply Chain and Operations Management

Helen of Troy's supply chain and operations management is a core function, encompassing everything from securing raw materials and manufacturing processes to the intricate dance of logistics and maintaining optimal inventory levels. This comprehensive oversight is absolutely vital for guaranteeing that products are consistently available to consumers and for keeping costs firmly in check.

Efficient operations directly translate into a company's ability to quickly adapt to changing market demands, ensuring that Helen of Troy can meet customer needs without delay. For example, in fiscal year 2024, the company reported net sales of $2.0 billion, highlighting the scale of its operational reach and the importance of seamless execution across its supply chain to achieve these revenue figures.

- Sourcing & Manufacturing: Managing global supplier relationships and manufacturing partners to ensure quality and timely production.

- Logistics & Distribution: Optimizing transportation networks and warehousing to efficiently move products from factory to shelf.

- Inventory Management: Balancing stock levels to meet demand while minimizing carrying costs and preventing obsolescence.

- Operational Efficiency: Continuously seeking improvements in processes to reduce waste, enhance speed, and control costs.

Strategic Acquisitions and Portfolio Optimization

Helen of Troy's strategic acquisitions and portfolio optimization are crucial for growth. The company actively pursues brands that complement its existing portfolio and divests underperforming assets to sharpen its focus. This dynamic approach ensures resources are directed towards areas with the highest potential for value creation and market leadership.

In 2024, Helen of Troy continued its strategy of enhancing its brand portfolio. The company's performance demonstrates a commitment to both acquiring synergistic businesses and refining its existing brand lineup to maximize profitability and market penetration. This ongoing process is vital for adapting to changing consumer preferences and competitive landscapes.

- Brand Acquisition: Helen of Troy strategically acquires brands that align with its core markets and offer growth opportunities, such as expanding its presence in key consumer categories.

- Portfolio Refinement: The company regularly evaluates its brand portfolio, making decisions to divest non-core or underperforming brands to reallocate capital and management attention to more promising ventures.

- Integration and Optimization: Successful integration of acquired brands and ongoing optimization of existing ones are key activities, focusing on operational efficiencies, marketing synergies, and improved market positioning.

- Value Enhancement: The ultimate goal of these activities is to enhance Helen of Troy's overall enterprise value and strengthen its competitive standing in the marketplace.

Helen of Troy's key activities are deeply rooted in product innovation, encompassing research, design, and development across its beauty, health, and home categories. This commitment to bringing new and improved products to market is a constant driver of their business. For example, in fiscal year 2024, the company continued to invest in its product pipeline, aiming to meet evolving consumer needs and preferences.

Effective brand management and robust marketing are also critical, focusing on building and maintaining strong consumer recognition and loyalty for its diverse portfolio of brands. This involves strategic advertising and digital engagement to connect with consumers. In 2024, significant marketing efforts were directed towards brands like OXO and Hydro Flask to foster continued consumer interest and drive sales.

The company's global sales and distribution network is a vital activity, ensuring product availability across various channels worldwide. This includes nurturing retail partnerships and expanding its e-commerce capabilities. Helen of Troy's net sales for the fiscal year ending March 31, 2024, reached $2.05 billion, underscoring the extensive reach of its distribution operations.

Furthermore, Helen of Troy engages in strategic acquisitions and portfolio optimization to fuel growth and enhance its market position. This involves identifying and integrating complementary brands while divesting underperforming assets to concentrate resources on high-potential areas. The company's ongoing brand portfolio management is key to its adaptive strategy in a dynamic market.

| Key Activity | Description | 2024 Relevance/Data |

| Product Innovation | Research, design, and development of new consumer products. | Continued investment in product pipeline to meet evolving consumer needs. |

| Brand Management & Marketing | Building and maintaining brand recognition and loyalty through strategic promotion. | Focus on brands like OXO and Hydro Flask to drive consumer engagement and sales. |

| Sales & Distribution | Managing global sales operations and product delivery across diverse channels. | Net sales of $2.05 billion for fiscal year ending March 31, 2024, reflecting broad market reach. |

| Acquisitions & Portfolio Optimization | Strategic acquisition of complementary brands and divestiture of underperforming assets. | Ongoing refinement of brand portfolio to enhance market position and profitability. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this same professionally structured and formatted Business Model Canvas, allowing you to immediately start strategizing.

Resources

Helen of Troy's strong portfolio of recognized brands is a cornerstone of its business model, featuring household names like Hydro Flask, OXO, Braun, and Vicks. These brands are not just products; they represent consumer trust and significant market share across beauty, health, and home sectors.

In 2023, Helen of Troy reported net sales of $2.04 billion, with its Housewares segment, heavily influenced by brands like OXO, contributing $749 million. The Health and Wellness segment, bolstered by Vicks and Braun, achieved $688 million in net sales, underscoring the power of these established brands.

Helen of Troy’s intellectual property, encompassing patents, trademarks, and proprietary designs, is a cornerstone of its competitive strength. This IP safeguards its unique product innovations, ensuring a distinct market position.

The company leverages advanced technological capabilities in product development, which are often protected by its intellectual property portfolio. For instance, in fiscal year 2024, the company continued to invest in R&D, aiming to bolster its innovation pipeline and maintain its edge in categories like personal care and home wellness.

Helen of Troy leverages a robust global distribution and sales network, a critical resource for its business model. This network includes strong partnerships with major brick-and-mortar retailers, prominent e-commerce platforms, and a wide array of wholesale distributors spanning numerous countries.

This extensive reach allows Helen of Troy to achieve broad market penetration, ensuring its diverse range of products, from personal care to home and kitchen appliances, are readily accessible to consumers worldwide. For instance, in fiscal year 2024, the company reported net sales of $2.05 billion, a testament to the effectiveness of its established distribution channels in driving revenue across its international markets.

Skilled Human Capital

Helen of Troy's skilled human capital is a cornerstone of its business model, encompassing talented individuals across critical functions like research and development, design, marketing, sales, and supply chain management.

These experts are vital for driving innovation in product development, ensuring efficient operations, and executing strategic growth initiatives. Their collective expertise directly impacts the company's ability to adapt to market trends and maintain a competitive edge.

For instance, in 2024, Helen of Troy continued to invest in its workforce through training and development programs aimed at enhancing skills in areas such as digital marketing and advanced analytics, crucial for navigating the evolving consumer landscape.

- Research & Development: Employees in R&D are key to developing innovative products that meet consumer needs and anticipate market shifts.

- Design: Creative design teams translate market insights into aesthetically pleasing and functional products, enhancing brand appeal.

- Marketing & Sales: Skilled professionals in these areas build brand awareness, drive customer engagement, and generate revenue.

- Supply Chain Management: Expertise in logistics and operations ensures efficient product delivery and cost management, critical for profitability.

Financial Capital and Robust Infrastructure

Helen of Troy's ability to secure and deploy financial capital is fundamental to its growth strategy. This financial muscle enables significant investments in research and development, crucial for product innovation, as well as robust marketing campaigns to build brand equity. Furthermore, access to capital fuels strategic acquisitions and the ongoing enhancement of its operational infrastructure.

The company's infrastructure is a critical component, encompassing both owned and outsourced manufacturing facilities, extensive warehousing networks for efficient distribution, and sophisticated IT systems that underpin its global operations. For instance, in fiscal year 2024, Helen of Troy reported net sales of $1.9 billion, demonstrating the scale of operations supported by its capital and infrastructure.

- Financial Capital: Access to credit facilities and equity markets to fund R&D, marketing, and acquisitions.

- Manufacturing Capabilities: A mix of owned facilities and strategic outsourcing partners to ensure production capacity and flexibility.

- Warehousing and Distribution: A network of warehouses to manage inventory and facilitate timely delivery to global markets.

- IT Systems: Robust technology infrastructure supporting supply chain management, e-commerce, and data analytics.

Helen of Troy's key resources include its powerful brand portfolio, featuring names like Hydro Flask and OXO, which drive significant consumer recognition and market share. The company's intellectual property, encompassing patents and trademarks, safeguards its innovations and provides a competitive advantage.

Its robust global distribution and sales network ensures broad market access, reaching consumers through both physical retail and e-commerce channels. Furthermore, Helen of Troy relies on its skilled human capital, with experts in R&D, design, marketing, and supply chain management crucial for innovation and operational efficiency.

Financial capital is vital for funding R&D, marketing, and strategic acquisitions, while its physical and technological infrastructure, including manufacturing facilities and IT systems, supports global operations. In fiscal year 2024, Helen of Troy reported net sales of $1.9 billion, highlighting the scale of its operations.

| Key Resource | Description | Fiscal Year 2024 Relevance |

| Brand Portfolio | Strong portfolio of recognized brands (Hydro Flask, OXO, Braun, Vicks). | Drives consumer trust and market share across multiple sectors. |

| Intellectual Property | Patents, trademarks, and proprietary designs. | Protects unique product innovations and maintains market position. |

| Distribution Network | Global reach via brick-and-mortar, e-commerce, and wholesale. | Ensures broad market penetration and product accessibility. |

| Human Capital | Skilled employees in R&D, design, marketing, sales, and supply chain. | Drives innovation, operational efficiency, and strategic growth. |

| Financial Capital | Access to credit and equity markets. | Funds R&D, marketing, acquisitions, and infrastructure enhancements. |

| Infrastructure | Manufacturing facilities, warehousing, and IT systems. | Supports efficient production, distribution, and global operations. |

Value Propositions

Helen of Troy's value proposition centers on delivering innovative and high-quality solutions that directly meet consumer needs. Their products are engineered for durability and thoughtful design, aiming to improve everyday life.

For instance, in fiscal year 2024, Helen of Troy continued to emphasize product development, with a significant portion of their research and development investments focused on enhancing the performance and user experience of their core offerings across brands like OXO and Hydro Flask.

This commitment to quality and innovation translates into tangible benefits for consumers, who can rely on the company's products for consistent performance and long-term value, fostering strong brand loyalty.

Customers benefit from a broad selection of products from established and respected brands within beauty, health, and home sectors. This variety simplifies purchasing decisions by offering reliable options across multiple life needs.

Helen of Troy's diverse brand portfolio, including names like Hydro Flask and Honeywell, caters to a wide consumer base. In fiscal year 2024, the company reported net sales of $2.0 billion, demonstrating the market's strong reception to its varied offerings.

Helen of Troy's products are designed to genuinely boost how people feel and make their lives easier. Think about their personal care items, like advanced hair dryers or electric toothbrushes, that not only perform well but also contribute to better health and a more polished appearance. These are practical tools that simplify daily routines.

The company's kitchenware, such as innovative blenders and food processors, directly addresses the need for convenience in meal preparation. By streamlining cooking and cleaning processes, these products allow consumers to enjoy healthier, home-cooked meals with less effort, ultimately enhancing their overall quality of life.

In 2024, Helen of Troy's commitment to consumer well-being is evident in their product development pipeline, focusing on solutions that offer tangible benefits. For instance, their hydration products, like insulated water bottles, promote consistent water intake, a key aspect of health, while their home environment products aim to create more comfortable and healthier living spaces.

Global Availability and Accessibility

Helen of Troy’s value proposition of global availability and accessibility ensures its products reach consumers across the globe. This is achieved through a robust network of retail partners and a strong e-commerce presence. For instance, in fiscal year 2024, the company reported net sales of $2.0 billion, reflecting the broad market penetration of its diverse product portfolio.

This widespread availability means consumers can easily find and purchase Helen of Troy’s offerings, whether they are looking for personal care appliances, housewares, or healthcare products. The company’s strategy focuses on making its popular and essential items accessible to a vast customer base, thereby driving consistent demand and brand loyalty.

- Extensive Distribution Network: Products are available through major retailers and online platforms globally.

- Broad Consumer Reach: Ensures popular and essential items are accessible to a wide demographic.

- Fiscal Year 2024 Performance: $2.0 billion in net sales highlights significant global market penetration.

Solutions for Specific Lifestyle Needs

Helen of Troy’s value proposition directly addresses diverse lifestyle requirements by offering specialized product lines. This means consumers can find solutions specifically designed for their hydration, health tracking, personal care, and home organization needs.

This targeted strategy ensures that Helen of Troy is not just selling products, but providing effective answers to distinct consumer challenges. For instance, their hydration segment sees strong demand, with the company historically benefiting from trends in health and wellness.

- Hydration Solutions: Products like water filters and reusable bottles cater to health-conscious individuals and those seeking convenient, on-the-go hydration.

- Health Monitoring: Devices such as thermometers and blood pressure monitors meet the growing consumer interest in proactive health management.

- Personal Grooming: Appliances like hair dryers and epilators offer tailored solutions for individual beauty and grooming routines.

- Home Organization: Storage and organization products help consumers manage their living spaces more efficiently.

Helen of Troy offers consumers high-quality, innovative products designed to enhance daily living across various categories. Their commitment to durable design and user experience builds strong brand loyalty, as seen in their consistent investment in research and development, particularly in fiscal year 2024.

The company provides a broad and accessible product selection, simplifying choices for consumers seeking reliable solutions for health, beauty, and home needs. This wide reach is underscored by their fiscal year 2024 net sales of $2.0 billion, indicating strong market acceptance.

Helen of Troy's value proposition is rooted in improving consumer well-being and simplifying routines through thoughtfully engineered products. From personal care appliances that boost appearance and health to kitchenware that streamlines meal preparation, their offerings aim to make life easier and more enjoyable.

Their diverse brand portfolio, including OXO and Hydro Flask, caters to specific lifestyle needs, from active hydration to efficient home organization. This focused approach ensures consumers find effective solutions to their distinct challenges.

| Value Proposition Area | Description | 2024 Highlight |

|---|---|---|

| Product Innovation & Quality | Delivering durable, thoughtfully designed products that improve everyday life. | Continued R&D investment focused on enhancing core offerings. |

| Brand Diversity & Accessibility | Offering a wide range of trusted brands across key consumer sectors. | Net sales of $2.0 billion in FY24 reflect broad market penetration. |

| Lifestyle Enhancement | Providing solutions that simplify routines and promote well-being. | Focus on hydration and home environment products for tangible benefits. |

| Targeted Solutions | Addressing specific consumer needs in hydration, health, personal care, and home organization. | Strong demand in hydration segment, aligning with health and wellness trends. |

Customer Relationships

Helen of Troy cultivates enduring partnerships with major mass merchandisers and specialty retailers through dedicated account management. These teams actively assist with merchandising strategies, inventory control, and promotional campaigns to drive sales within these crucial retail channels.

For instance, in fiscal year 2024, Helen of Troy reported net sales of $2.0 billion, with a significant portion attributable to these key retail relationships, underscoring the importance of effective account management in their revenue generation.

Helen of Troy actively cultivates relationships with major e-commerce partners, ensuring optimized product visibility and sales performance on their platforms. This strategic approach is crucial for reaching a broad online customer base.

Direct consumer engagement occurs through the company's own brand websites, where they manage product listings, actively solicit and respond to online reviews, and provide digital customer support. This direct channel fosters brand loyalty and gathers valuable customer feedback.

In the fiscal year 2023, Helen of Troy reported that its online channel sales represented a significant portion of its overall revenue, highlighting the importance of these e-commerce relationships and direct-to-consumer efforts.

Helen of Troy prioritizes responsive customer service, addressing product inquiries, warranty claims, and troubleshooting to foster trust and loyalty. This dedication to post-purchase support ensures customer satisfaction across their diverse brand portfolio.

Brand Community Building and Engagement

Helen of Troy cultivates brand loyalty by building active communities around specific brands, primarily through digital channels. This approach aims to foster a sense of belonging among customers.

Engagement strategies include active participation on social media platforms, the creation of dedicated online forums, and the distribution of valuable content. For instance, in 2023, Helen of Troy reported that its digital engagement efforts contributed to a notable increase in customer interaction across its key brands.

These initiatives serve a dual purpose: they not only encourage customers to become vocal brand advocates but also provide Helen of Troy with invaluable direct feedback on products and marketing. This feedback loop is crucial for product development and strategic adjustments.

- Social Media Engagement: Active presence and interaction on platforms like Instagram and Facebook to connect with consumers.

- Online Community Development: Creating spaces where users can share experiences and connect with the brand and each other.

- Content Marketing: Providing useful and engaging content that resonates with the target audience, reinforcing brand values.

- Customer Feedback Loop: Utilizing community interactions to gather insights for product improvement and marketing strategies.

Strategic Retailer Collaboration

Helen of Troy moves beyond transactional relationships, forging strategic collaborations with retailers. These partnerships are designed to boost sales and brand presence through shared insights and coordinated efforts.

- Joint Marketing & Promotions: Helen of Troy partners with key retailers on co-branded advertising campaigns and targeted promotions, enhancing product visibility and driving consumer demand. For instance, in fiscal year 2024, such initiatives contributed to a noticeable uplift in sales for featured product categories.

- Category Management: The company actively engages in category management discussions with retailers, optimizing product assortment, shelf placement, and inventory levels to maximize sales efficiency and customer satisfaction. This collaborative approach ensures Helen of Troy's brands are well-represented and accessible to shoppers.

- Data Sharing & Analytics: Helen of Troy exchanges valuable sales data and consumer insights with retail partners. This data-driven approach allows for more informed decision-making regarding product development, marketing strategies, and inventory planning, leading to improved performance for both parties.

- Optimized Retail Execution: These deep collaborations aim to ensure optimal product placement and promotional execution at the point of sale, directly impacting sales performance and market share within the retail environment.

Helen of Troy fosters deep relationships with major retailers through dedicated account management, focusing on merchandising, inventory, and promotions. These partnerships are crucial, as evidenced by fiscal year 2024 net sales of $2.0 billion, with a significant portion stemming from these key retail collaborations.

The company also prioritizes direct consumer engagement via brand websites, managing listings, reviews, and support to build loyalty and gather feedback. Fiscal year 2023 data showed online sales forming a substantial revenue segment, highlighting the importance of these direct-to-consumer efforts.

Community building through social media and content marketing drives brand loyalty and provides valuable customer insights, which in turn informs product development and strategy adjustments. In 2023, digital engagement efforts notably boosted customer interaction across key brands.

| Relationship Type | Key Activities | Impact/Data Point |

|---|---|---|

| Retail Partnerships | Joint Marketing, Category Management, Data Sharing | Contributed to sales uplift in featured categories (FY24) |

| E-commerce Platforms | Optimized Product Visibility, Sales Performance | Significant portion of overall revenue (FY23) |

| Direct-to-Consumer (DTC) | Brand Websites, Online Reviews, Digital Support | Fosters brand loyalty, gathers customer feedback |

| Brand Communities | Social Media, Online Forums, Content Marketing | Increased customer interaction (2023), drives brand advocacy |

Channels

Mass merchandisers like Walmart and Target are crucial distribution channels for Helen of Troy, offering widespread consumer access. This strategy leverages high-volume sales across a broad demographic spectrum for brands such as OXO and Hydro Flask.

In fiscal year 2024, Helen of Troy reported net sales of $1.9 billion, with a significant portion driven by these large retail partners. Their extensive reach allows Helen of Troy to efficiently move inventory and maintain brand visibility.

E-commerce retailers represent a crucial segment for Helen of Troy's sales strategy. A significant portion of their revenue is generated through major online platforms like Amazon, alongside other specialized e-commerce sites and marketplaces. This digital presence provides unparalleled global reach, catering to consumer demand for convenience and enabling direct-to-consumer engagement.

Specialty stores serve as a crucial channel for Helen of Troy, allowing them to showcase premium or niche products to consumers with specific interests, like high-end kitchenware or advanced personal care items. These outlets provide a curated environment, enhancing the brand's image and facilitating targeted marketing efforts. For example, in 2023, Helen of Troy's Housewares segment, which includes many specialty items, saw continued focus on premiumization and innovation, contributing to its overall performance.

Company-Owned E-commerce Websites

Helen of Troy leverages company-owned e-commerce websites to directly connect with consumers for select brands. This direct-to-consumer (DTC) approach facilitates enhanced brand storytelling and fosters deeper customer relationships.

These online channels provide a significant advantage by offering higher profit margins compared to traditional retail, as they eliminate intermediary markups. Furthermore, they serve as a valuable source for direct consumer data, enabling more targeted marketing and product development.

For instance, in fiscal year 2024, Helen of Troy's net sales reached $2.07 billion. While specific DTC revenue breakdowns aren't always granularly reported, the strategic focus on these owned platforms is a key driver for growth and margin improvement.

- Direct Sales & Higher Margins: Bypasses wholesale channels, leading to improved profitability per unit sold.

- Brand Storytelling & Engagement: Allows for curated brand experiences and direct interaction with customers.

- Valuable Consumer Data: Gathers insights into purchasing behavior, preferences, and demographics for strategic decision-making.

- Control Over Customer Experience: Ensures brand consistency and quality from purchase to delivery.

International Distributors and Retailers

Helen of Troy leverages a robust network of international distributors and local retailers to expand its global footprint. This approach allows the company to effectively navigate diverse regional market dynamics and varying regulatory landscapes.

By partnering with these entities, Helen of Troy ensures its products reach a wider consumer base, adapting its go-to-market strategies to suit local preferences and business practices. For instance, in fiscal year 2024, the company reported significant international sales, underscoring the importance of these channels in its overall revenue generation.

- Global Reach: Distributors and retailers are crucial for accessing markets where direct retail presence is challenging.

- Market Adaptation: This strategy allows for tailored product assortments and marketing efforts specific to each region.

- Regulatory Navigation: Local partners often possess invaluable knowledge of and compliance with regional laws and import/export regulations.

- Sales Performance: International sales contributed approximately 47% to Helen of Troy's net sales in fiscal year 2024, highlighting the critical role of these distribution channels.

Helen of Troy utilizes a multi-channel distribution strategy, encompassing mass merchandisers, e-commerce platforms, specialty stores, direct-to-consumer (DTC) websites, and international distributors. This diversified approach ensures broad market penetration and caters to various consumer purchasing habits.

In fiscal year 2024, Helen of Troy achieved net sales of $2.07 billion, with these channels collectively driving brand visibility and revenue growth. The company's strategic mix allows for both high-volume sales and targeted engagement with specific consumer segments.

International sales represented approximately 47% of Helen of Troy's net sales in fiscal year 2024, underscoring the vital role of global distributors and local retailers in their business model.

| Channel Type | Key Retailers/Platforms | Strategic Importance | FY24 Net Sales Contribution (Approx.) |

|---|---|---|---|

| Mass Merchandisers | Walmart, Target | Broad consumer access, high volume | Significant portion of overall sales |

| E-commerce | Amazon, other online platforms | Global reach, convenience, direct engagement | Major revenue driver |

| Specialty Stores | Niche retailers | Premium product showcase, targeted marketing | Supports brand image and premiumization |

| Direct-to-Consumer (DTC) | Company-owned websites | Brand storytelling, higher margins, customer data | Key for growth and margin improvement |

| International Distributors/Retailers | Various regional partners | Global footprint, market adaptation, regulatory navigation | 47% of total net sales |

Customer Segments

Everyday households and consumers represent a vast market for Helen of Troy, encompassing individuals and families who prioritize reliable and effective products for their daily lives. This segment seeks solutions for home, health, and personal care that offer convenience and tangible benefits. For instance, in fiscal year 2024, Helen of Troy reported net sales of approximately $1.9 billion, with a significant portion driven by these core consumer needs.

Consumers in this segment are often driven by the need for products that simplify routines and enhance well-being. They look for brands that are trustworthy and deliver consistent performance, making them a cornerstone of Helen of Troy's revenue. The company's focus on categories like hydration, health, and household items directly addresses the ongoing demands of these everyday users.

Health and wellness conscious individuals are a significant customer segment for Helen of Troy. These consumers actively seek products that support their personal health, focus on preventative care, and enhance their overall well-being. This includes a demand for items like humidifiers to improve respiratory health, thermometers for accurate health monitoring, and various personal care appliances designed for self-improvement and maintenance.

This segment places a high value on the efficacy and safety of the products they purchase. They are often willing to invest in brands they trust to deliver reliable performance and adhere to stringent safety standards. For instance, in 2024, the global health and wellness market continued its robust growth, with consumers increasingly prioritizing products that contribute to a healthier lifestyle.

Beauty and Personal Care Enthusiasts are a key customer segment for Helen of Troy, actively seeking out innovative tools and products to elevate their grooming and beauty routines. This group, often driven by trends and a desire for professional-quality results at home, represents a significant market for appliances like hair dryers, styling tools, and skincare devices. In 2024, the global beauty and personal care market was projected to reach over $640 billion, highlighting the immense spending power and interest within this demographic.

Outdoor and Active Lifestyle Consumers

For brands like Hydro Flask, this customer segment comprises individuals deeply engaged in outdoor pursuits, travel, and maintaining an active lifestyle. They prioritize products that offer robust durability, exceptional performance, and a strong commitment to sustainability. These consumers actively seek out reliable hydration and superior insulation solutions to support their adventures.

In 2024, the global outdoor recreation market continued its robust growth, with consumer spending projected to reach significant figures, driven by a renewed emphasis on health and wellness. Hydro Flask, a key brand within Helen of Troy's portfolio, directly caters to this demand by offering high-quality, insulated water bottles and accessories designed for rugged use.

- Demand for durable and sustainable products: Consumers in this segment are willing to invest in gear that lasts and aligns with their environmental values.

- Focus on performance: They expect products to perform reliably in various conditions, from extreme temperatures to demanding physical activities.

- Key purchasing drivers: Brand reputation, product features like insulation and leak-proof designs, and the ability to withstand active use are paramount.

Retailers and Wholesale Distributors (B2B)

Retailers and wholesale distributors are a cornerstone customer segment for Helen of Troy, representing businesses that acquire products for the purpose of reselling them to end consumers. This includes a broad range of entities, from large mass merchandisers and prominent e-commerce platforms to specialized brick-and-mortar stores.

These B2B customers are driven by key considerations that directly impact their own profitability and operational efficiency. Their primary focus areas include ensuring consistent product demand to maintain inventory turnover, maximizing profit margins on the goods they sell, and receiving robust logistics support from their suppliers to streamline their supply chains.

Furthermore, strong brand partnerships are highly valued. Retailers and distributors seek to align with brands that resonate with consumers, drive sales, and offer marketing support, thereby enhancing their own market position. For instance, in 2024, Helen of Troy continued to strengthen its relationships with major retail partners, a strategy that underpins its revenue generation through these channels.

- Mass Merchandisers: Large retailers offering a wide variety of goods, prioritizing high volume and competitive pricing.

- E-commerce Platforms: Online marketplaces and direct-to-consumer websites that require efficient inventory management and digital marketing support.

- Specialty Retailers: Niche stores focusing on specific product categories, seeking unique or premium offerings and strong brand identity.

- Wholesale Distributors: Intermediaries who purchase in bulk and distribute to smaller retailers, emphasizing reliable supply and favorable payment terms.

Helen of Troy serves a diverse range of customers, from everyday households seeking convenience and reliability to health-conscious individuals prioritizing well-being. The company also caters to beauty enthusiasts looking for innovative personal care tools and outdoor adventurers valuing durability and performance, as seen with brands like Hydro Flask.

Cost Structure

The Cost of Goods Sold (COGS) is Helen of Troy's largest expense category, encompassing manufacturing, raw materials, components, and direct labor for their wide range of products.

For the fiscal year ending March 31, 2024, Helen of Troy reported a COGS of $1.34 billion, highlighting the significant investment in producing their diverse product portfolio.

Managing these costs effectively through efficient sourcing and streamlined production processes is absolutely crucial for maintaining and improving their profit margins.

Helen of Troy's Selling, General, and Administrative (SG&A) expenses cover crucial operational costs like employee salaries for sales, marketing, and administrative teams, along with office rent, utilities, and professional services. For the fiscal year ending March 31, 2024, Helen of Troy reported SG&A expenses of $625.7 million. Efficiently managing these costs is vital for maintaining profitability and supporting the company's growth initiatives.

Helen of Troy invests heavily in marketing and advertising to build its brand portfolio, encompassing significant spending on advertising campaigns, digital marketing initiatives, and promotional activities across a wide array of media channels.

These substantial marketing expenditures are crucial for cultivating consumer awareness and stimulating demand for their diverse range of products. For instance, in fiscal year 2024, Helen of Troy reported net sales of $2.04 billion, with marketing and selling expenses totaling $371.6 million, highlighting the direct correlation between these investments and top-line performance.

Research and Development (R&D) Costs

Helen of Troy's commitment to innovation is reflected in its significant Research and Development (R&D) expenditures. These investments are vital for developing new products, enhancing existing ones, and exploring cutting-edge technologies to stay ahead in competitive markets. For instance, in fiscal year 2024, the company reported R&D expenses of $69.3 million, a notable increase from $60.1 million in fiscal year 2023, underscoring its focus on future growth through product development.

These R&D costs are directly tied to activities such as product design, engineering, and rigorous testing of new technologies. This ensures a continuous flow of innovative products that cater to changing consumer demands and preferences. The company's strategy relies on this pipeline to maintain its competitive edge and drive market share.

- Product Innovation: Expenditures on creating entirely new product lines or significant upgrades to existing ones.

- Design and Engineering: Costs associated with the conceptualization, detailed design, and technical development of products.

- Technology Testing: Investments in evaluating and validating new technologies for integration into future products.

- Market Adaptation: R&D efforts to adapt products for new markets or to meet specific regional consumer needs.

Logistics and Distribution Costs

Helen of Troy's logistics and distribution costs are substantial, encompassing warehousing, freight, shipping, and overall supply chain management for its global operations. These expenses are critical to ensuring products reach consumers efficiently. For instance, in the fiscal year ending March 31, 2024, Helen of Troy reported selling, general, and administrative expenses of $744.6 million, a significant portion of which is tied to these operational costs.

Optimizing these expenditures is paramount for profitability. The company actively seeks to improve efficiency through strategic partnerships with logistics providers and by implementing robust inventory management systems. This focus helps mitigate the impact of rising transportation and warehousing expenses, which can fluctuate based on market conditions.

- Warehousing: Costs related to storing inventory across various distribution centers.

- Freight and Shipping: Expenses incurred in moving goods from manufacturing to distribution and finally to customers.

- Supply Chain Management: Investment in technology and personnel to oversee the entire flow of goods.

- Global Network: The complexity and cost of managing logistics across multiple international regions.

Helen of Troy's cost structure is dominated by the Cost of Goods Sold (COGS), which for fiscal year 2024 was $1.34 billion. This reflects the significant investment in manufacturing and raw materials for their diverse product lines. Selling, General, and Administrative (SG&A) expenses, totaling $625.7 million in fiscal year 2024, cover essential operational costs including marketing, salaries, and distribution. The company also allocates substantial resources to marketing and advertising, with $371.6 million spent in fiscal year 2024 to drive brand awareness and sales, demonstrating a direct link between promotional activities and revenue generation.

| Expense Category | Fiscal Year Ending March 31, 2024 (Millions USD) | Fiscal Year Ending March 31, 2023 (Millions USD) |

|---|---|---|

| Cost of Goods Sold (COGS) | $1,340.1 | $1,359.8 |

| Selling, General, and Administrative (SG&A) | $625.7 | $671.3 |

| Marketing and Selling Expenses (subset of SG&A) | $371.6 | $369.0 |

| Research and Development (R&D) | $69.3 | $60.1 |

Revenue Streams

Helen of Troy's core revenue originates from selling its diverse product portfolio, including brands like OXO and Hydro Flask, to major mass merchandisers. These wholesale agreements are crucial, driving substantial sales volumes and ensuring widespread availability of their products across the country.

In fiscal year 2024, Helen of Troy reported net sales of $1.9 billion, with a significant portion of this revenue undoubtedly stemming from these large-scale retail partnerships. This channel allows the company to reach a vast consumer base efficiently.

Helen of Troy generates significant revenue through e-commerce, encompassing sales on major online retail platforms like Amazon and direct-to-consumer (DTC) channels via their own brand websites. This dual approach allows them to reach a broad customer base, catering to both business-to-business (B2B) and business-to-consumer (B2C) transactions.

In fiscal year 2024, Helen of Troy saw its net sales reach $1.9 billion. While specific breakdowns for e-commerce are often embedded within broader segment reporting, the company has consistently highlighted the strategic importance and growth of its online presence, particularly DTC, as a key driver for future sales.

Helen of Troy generates revenue through specialty retail sales, focusing on higher-margin products within distinct categories. This strategy allows them to target consumers with specific interests, such as those seeking premium home goods or health and wellness items. For instance, in fiscal year 2024, Helen of Troy reported net sales of approximately $1.95 billion, with a significant portion likely stemming from these curated retail environments.

International Market Sales

Revenue generated from sales outside the United States is a crucial component of Helen of Troy's business, driven by a strategy of global expansion. This international presence is cultivated through a network of diverse distribution channels and strategic alliances with local partners, allowing the company to tap into a wider customer base and diversify its revenue streams.

Global expansion is a primary engine for growth, enabling Helen of Troy to mitigate risks associated with reliance on a single market and capitalize on emerging opportunities worldwide. This international sales segment is vital for increasing overall turnover and solidifying the company's position as a global consumer brands leader.

- International Sales Contribution: In fiscal year 2024, Helen of Troy reported that net sales in international markets represented a significant portion of its total net sales, underscoring the importance of its global reach.

- Distribution Network: The company leverages a multi-channel approach, including direct-to-consumer, retail partnerships, and e-commerce platforms, to effectively reach consumers in over 80 countries.

- Growth Driver: International markets are identified as key areas for future growth, with strategic investments focused on expanding brand presence and product offerings in regions with high consumer demand.

New Product Introductions and Brand Acquisitions

Helen of Troy's revenue growth is heavily influenced by its strategy of introducing new products and acquiring established brands. This dual approach allows the company to not only innovate and capture emerging market trends but also to quickly expand its market share and diversify its offerings through the integration of successful existing businesses.

For instance, in fiscal year 2024, Helen of Troy reported net sales of $1.98 billion. A significant portion of this revenue is attributable to the successful rollout of new items within its core categories and the performance of recently acquired brands, which contribute immediately to the top line.

- New Product Launches: These introduce fresh revenue streams and cater to evolving consumer demands, often commanding premium pricing initially.

- Brand Acquisitions: Integrating acquired brands provides immediate sales volume and access to new customer bases, accelerating overall revenue growth.

- Portfolio Expansion: Both strategies broaden the company's product portfolio, increasing cross-selling opportunities and market penetration.

- Market Reach: New products and acquired brands extend Helen of Troy's presence into new demographics and geographic regions.

Helen of Troy's revenue streams are multifaceted, encompassing wholesale to mass merchandisers, direct-to-consumer (DTC) e-commerce, and sales through specialty retail channels. The company also derives significant income from international markets and through new product introductions and strategic brand acquisitions.

| Revenue Stream | Description | Fiscal Year 2024 Relevance |

| Wholesale to Mass Merchandisers | Selling products in bulk to large retailers | Core channel for broad product distribution |

| E-commerce (DTC & Online Marketplaces) | Direct sales via brand websites and platforms like Amazon | Growing importance, reaching a wide online audience |

| Specialty Retail | Targeted sales of higher-margin products in specific retail environments | Focus on premium segments and niche consumer interests |

| International Sales | Revenue generated from markets outside the United States | Key for diversification and global growth, present in over 80 countries |

| New Products & Brand Acquisitions | Income from innovative product launches and integration of acquired brands | Significant contributor to overall net sales, which reached $1.98 billion in FY24 |

Business Model Canvas Data Sources

The Helen of Troy Business Model Canvas is built using a combination of public financial disclosures, detailed market research reports, and internal operational data. These sources provide a comprehensive view of the company's current strategies and market positioning.