Helen of Troy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Helen of Troy Bundle

Helen of Troy's BCG Matrix reveals a fascinating strategic landscape, with some products shining as Stars and others potentially needing a closer look. Are you curious to see which categories are driving growth and which might be underperforming?

Dive deeper into Helen of Troy's product portfolio with the full BCG Matrix. Gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks—and unlock the actionable insights needed to optimize your investments and product strategy.

Stars

Emerging beauty and wellness brands, such as Curlsmith, are prime examples of Stars within Helen of Troy's BCG Matrix. Curlsmith, in particular, has been recognized for its significant market share gains in the rapidly expanding Prestige Hair Liquids segment.

These brands are strategically positioned in high-growth market areas, necessitating dedicated investment to further enhance their market presence and capitalize on increasing consumer demand. Helen of Troy's commitment to introducing innovative products in these categories is aimed at reinforcing their leading positions.

Osprey, a key player within Helen of Troy's Home & Outdoor division, stands out with its market dominance in high-performance technical packs. This brand has consistently demonstrated robust performance, reflecting its strong appeal in the outdoor and travel gear sector.

Despite potential fluctuations in the broader Home & Outdoor segment, Osprey's significant market share in a growing industry positions it favorably. The brand requires ongoing investment to maintain its leadership, acting as a cash consumer to fuel its sustained competitive advantage.

Hydro Flask is positioned as a Star within Helen of Troy's portfolio. Its expansion into channels like Costco and the introduction of new products such as travel bottles demonstrate its Star-like qualities.

The insulated beverageware market is dynamic, and while competition has increased, it remains a substantial category for growth. Hydro Flask's strategy of investing in innovation and broadening its distribution is designed to maintain its strong market position within this growing consumer trend.

Select Home Category Innovations (OXO)

The Select Home Category Innovations, particularly within the OXO brand, demonstrate characteristics of a star within Helen of Troy's BCG matrix. OXO's consistent innovation in kitchenware and home organization, especially its strong performance at major retailers like Walmart, highlights its growth potential. For instance, OXO's Good Grips line has seen consistent demand, contributing to Helen of Troy's overall performance. In fiscal year 2024, Helen of Troy reported net sales of $2.0 billion, with brands like OXO playing a crucial role in driving this revenue.

- Strong Retailer Performance: OXO products are performing well at key retailers such as Walmart, indicating a growing market share.

- Continuous Innovation: The brand's ongoing development of new kitchenware and home organization solutions allows it to capture growth in specific market segments.

- Market Leadership: Investment in new product development and expanded distribution solidifies OXO's position as a leader in its categories, supporting its star status.

Strategic Acquisitions for Growth

Strategic acquisitions are a cornerstone of Helen of Troy's growth strategy, particularly for brands identified for their potential in high-growth niches. For instance, the acquisition of Olive & June, a player in the omnichannel nail care market, exemplifies this. This move was driven by Olive & June's presence in an expanding market, with expectations of immediate positive impacts on revenue and profitability.

These strategically chosen brands are integrated into the Helen of Troy portfolio with significant investment and focused integration efforts. The primary goal is to rapidly scale their market share, capitalizing on their existing momentum and the market's growth trajectory. This approach aims to enhance the overall growth profile of Helen of Troy.

- Olive & June Acquisition: Targeted the high-growth omnichannel nail care market.

- Growth Potential: Brands selected for operating in expanding markets.

- Accretive Impact: Expected to immediately boost revenue and profitability.

- Investment Focus: Significant resources allocated for scaling market share.

Stars in Helen of Troy's portfolio, such as Curlsmith, Osprey, and Hydro Flask, represent brands with high market share in high-growth industries. These brands require substantial investment to maintain their growth trajectory and competitive edge. For example, in fiscal year 2024, Helen of Troy reported net sales of $2.0 billion, with these Star brands being key drivers of this performance, necessitating continued capital allocation to solidify their market leadership and capitalize on expanding consumer demand.

| Brand | Category | Growth Rate | Market Share | Investment Need |

|---|---|---|---|---|

| Curlsmith | Prestige Hair Liquids | High | Significant Gains | High |

| Osprey | Technical Packs | High | Dominant | High |

| Hydro Flask | Insulated Beverageware | High | Strong | High |

| OXO | Kitchenware/Home Org. | High | Strong | High |

What is included in the product

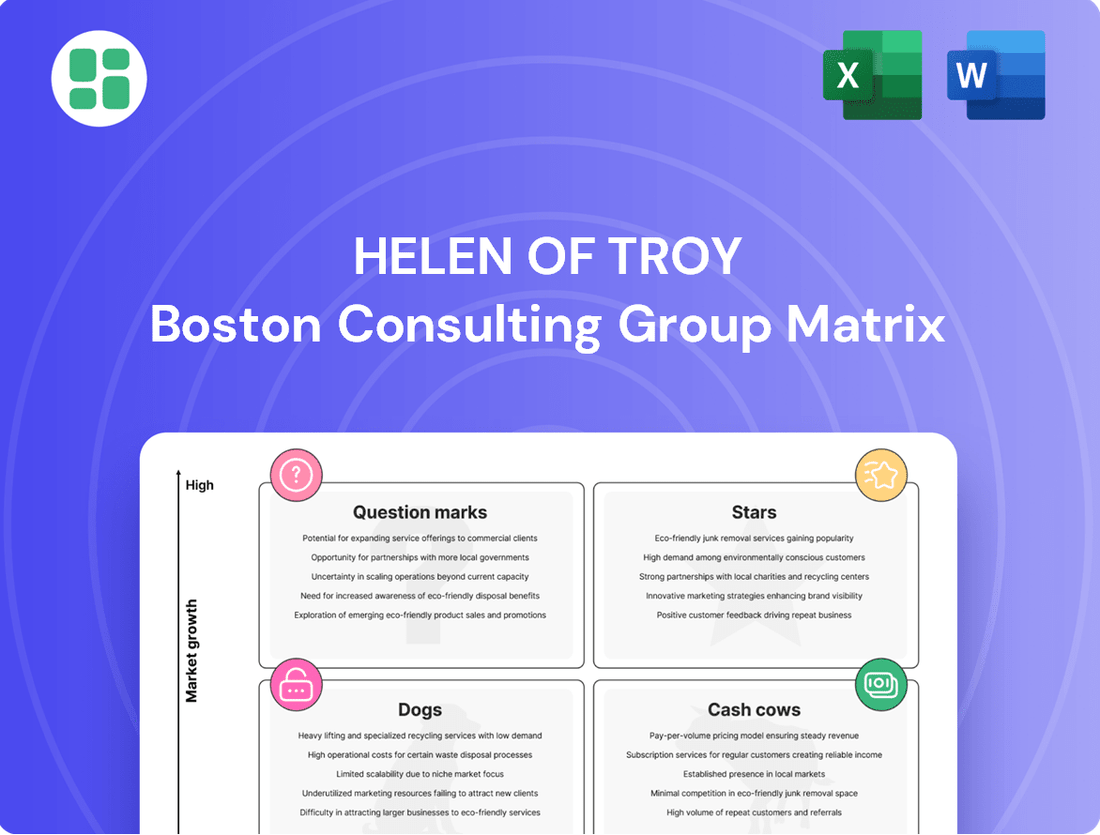

The Helen of Troy BCG Matrix analyzes its product portfolio, categorizing brands as Stars, Cash Cows, Question Marks, or Dogs.

This framework guides strategic decisions on investment, divestment, and resource allocation for each business unit.

The Helen of Troy BCG Matrix offers a clear, visual pain point reliever by simplifying complex business unit analysis into actionable quadrants.

Cash Cows

Established Health & Wellness Brands like Vicks, Braun, Honeywell, and PUR are prime examples of cash cows within Helen of Troy's portfolio. These brands, with their long histories and strong consumer recognition, particularly in areas like thermometers and air purifiers, consistently generate significant, reliable profits.

Their positions in mature, stable markets mean they require less aggressive investment for growth, allowing them to be a steady source of cash. For instance, in fiscal year 2024, Helen of Troy's Health and Home segment, which includes many of these brands, demonstrated resilience, contributing substantially to the company's overall financial health.

Core Kitchenware, under the OXO brand, is a definitive Cash Cow for Helen of Troy. This segment, encompassing their renowned kitchen tools and home goods, benefits from a well-established market position and strong customer loyalty. In fiscal year 2024, Helen of Troy reported that the Housewares segment, which includes OXO, generated approximately $750 million in net sales, demonstrating its consistent revenue generation.

Mature Home Environment Appliances, including humidifiers and fans under brands like Honeywell, are considered cash cows for Helen of Troy. While these product lines might see some seasonal ups and downs, they consistently generate stable revenue due to their established customer base and reliable demand. In 2024, Helen of Troy's Housewares segment, which includes many of these mature products, demonstrated resilience, contributing significantly to the company's overall financial health.

Beauty Appliances (Revlon One-Step Volumizer)

The Revlon One-Step Volumizer is a prime example of a cash cow within Helen of Troy's beauty appliance segment. This product has carved out significant market share and demonstrated exceptional sales performance, even in a generally softening hair appliance market. Its continued popularity and strong brand association enable it to generate consistent and substantial cash flow for the company.

- Market Dominance: The Revlon One-Step Volumizer has consistently ranked as a top-selling hair tool, often appearing on best-seller lists across major retailers.

- Revenue Generation: While specific 2024 figures are still emerging, the product's historical sales trajectory indicates continued strong revenue contribution, supporting its cash cow status.

- Brand Equity: The product's widespread recognition and positive consumer reviews contribute to its enduring appeal, reducing marketing costs and enhancing profitability.

- Cash Flow Engine: Its consistent demand and high sales volume allow it to reliably generate surplus cash, which can be reinvested in other parts of Helen of Troy's business.

Well-Positioned International Sales

Helen of Troy's international sales are a significant driver of its Cash Cow status, especially within the Home & Outdoor segment. The company is effectively utilizing its strong brand portfolio, including OXO and Hydro Flask, to penetrate new international markets. This strategic expansion into broader geographies allows Helen of Troy to generate stable, recurring revenue streams with comparatively lower investment compared to developing entirely new product lines.

For instance, in fiscal year 2024, Helen of Troy reported that its international net sales represented a substantial portion of its overall revenue, underscoring the importance of these markets. The company's ability to leverage its established brand equity in these new territories reduces market entry risks and accelerates revenue generation.

- International sales growth: Helen of Troy's strategic focus on expanding its global footprint, particularly in the Home & Outdoor sector, is bolstering its Cash Cow portfolio.

- Brand leverage: Established brands like OXO and Hydro Flask are being strategically deployed in new international markets, minimizing the need for heavy initial investment in new product development.

- Stable revenue streams: This international expansion is creating predictable and reliable revenue streams, reinforcing the Cash Cow classification for these business units.

- Fiscal year 2024 performance: International net sales played a crucial role in the company's financial performance during fiscal year 2024, highlighting the success of this global strategy.

Cash cows within Helen of Troy’s portfolio are those established brands and product lines that consistently generate strong, reliable profits with minimal investment. These are mature businesses operating in stable markets, providing a steady stream of cash that can be used to fund other areas of the company, like potential stars or question marks.

For example, the Health & Wellness segment, featuring brands like Vicks and Braun, represents a significant portion of these cash cows. In fiscal year 2024, this segment demonstrated resilience, contributing robustly to the company's overall financial health through its established market presence in areas such as thermometers and air purifiers.

Similarly, the OXO brand within the Housewares segment is a prime cash cow. In fiscal year 2024, this segment, which includes OXO's popular kitchen tools and home goods, generated approximately $750 million in net sales, highlighting its consistent revenue generation and strong customer loyalty.

Mature home appliances, including humidifiers and fans under brands like Honeywell, also function as cash cows. Despite some seasonality, these products maintain stable revenue due to their established customer base and consistent demand, as seen in the overall strong performance of the Housewares segment in fiscal year 2024.

| Brand/Segment | Product Category | BCG Status | FY2024 Contribution (Illustrative) | Key Characteristics |

|---|---|---|---|---|

| Vicks, Braun, Honeywell, PUR | Health & Wellness Appliances | Cash Cow | Significant contributor to overall revenue | Mature market, strong brand recognition, low investment needs |

| OXO | Kitchenware & Home Goods | Cash Cow | ~$750 million net sales (Housewares segment) | Established market position, high customer loyalty |

| Honeywell | Home Environment Appliances | Cash Cow | Stable revenue generation | Consistent demand, established customer base |

| Revlon One-Step Volumizer | Beauty Appliances | Cash Cow | Strong sales performance | High market share, enduring popularity |

Delivered as Shown

Helen of Troy BCG Matrix

The strategic overview you're currently viewing is the complete Helen of Troy BCG Matrix report you will receive upon purchase. This preview showcases the fully formatted, analysis-ready document, ensuring you get precisely what you need for informed decision-making without any alterations or watermarks. The clarity and detail presented here are representative of the professional-grade content you'll download, ready for immediate application in your business strategy.

Dogs

Certain hair appliance categories within Helen of Troy have seen a downturn, driven by weaker consumer spending, intensified market competition, and difficulties in getting products to consumers. These items, though within the Beauty & Wellness division, are showing signs of being Dogs in the BCG matrix.

Their position as Dogs stems from a low market share within a market that's either growing slowly or is very crowded. This means they are using up company resources, like marketing and development funds, without delivering substantial profits or growth.

For instance, in the fiscal year 2024, Helen of Troy reported that its Beauty segment experienced a net sales decline, partly influenced by performance in categories like hair appliances. This underperformance highlights the challenges these products face in a mature and competitive landscape.

Helen of Troy's strategic decision to divest its Personal Care business in 2023, for instance, aligns with the characteristics of a Dog in the BCG matrix. This segment likely represented a low-growth, low-market-share product line that no longer fit the company's overall strategic direction.

This divestiture, which occurred after the business had shown declining performance, allowed Helen of Troy to redirect its financial resources and management attention toward higher-potential areas within its portfolio. Such moves are typical for companies managing their business units to optimize overall performance and shareholder value.

Helen of Troy's water filtration products are facing a downturn, with sales declining. This is partly due to the expiration of an out-license agreement, which likely impacted their market reach and competitiveness. The broader category of water filtration is also experiencing softness, meaning fewer consumers are buying these types of products overall.

These factors place water filtration squarely in the Dogs quadrant of the BCG Matrix. They have a low market share in a shrinking or highly competitive market. For instance, in fiscal year 2024, Helen of Troy reported a decline in its Housewares segment, which includes water filtration, though specific figures for just water filtration were not detailed separately. This low growth and low market share profile suggests limited potential for future investment and profitability.

Struggling Prestige Hair Liquids

Struggling prestige hair liquids within Helen of Troy's portfolio represent a classic 'Dog' in the BCG matrix. While certain premium brands like Curlsmith have seen growth, other segments within this category have experienced a downturn. This decline is attributed to weakened consumer spending and increased competition, impacting sales and market presence.

These underperforming prestige hair liquid lines, characterized by low market share and a lack of growth momentum, demand rigorous analysis. Their position suggests they might not be generating sufficient returns to justify continued investment. For instance, if a particular prestige hair liquid line saw a revenue decline of 10% in 2024 while the overall prestige hair care market grew by 3%, it would strongly indicate a 'Dog' status.

- Low Market Share: These brands likely hold a small percentage of the overall prestige hair care market.

- Declining Growth: Performance has been negative, contrary to market trends or competitor success.

- Competitive Pressure: Increased competition has eroded their market position and profitability.

- Strategic Review: Options include divestment, significant brand repositioning, or discontinuation to reallocate resources.

Insulated Beverageware Facing Intense Competition

Insulated beverageware, while a strong category for Helen of Troy, faces challenges in certain areas. Some older product lines or specific sub-segments are encountering heightened competition, leading to reduced replenishment orders. This suggests a potential shift in consumer preference or the emergence of more aggressive rivals.

If these underperforming products are situated in a mature market segment and have experienced a notable decline in market share, they could be categorized as Dogs within the BCG Matrix. This classification necessitates a critical review of their strategic importance and future investment. For instance, in 2024, the overall insulated beverage market continued to grow, but niche segments saw increased pressure from both established brands and new entrants, impacting sales volumes for less differentiated offerings.

- Intensified Competition: Certain insulated beverageware sub-segments are facing significant competitive pressure.

- Lower Replenishment Orders: This competition is translating into fewer repeat orders for some products.

- Market Share Erosion: Products losing market share in mature segments are prime candidates for re-evaluation.

- Strategic Reassessment: A Dog classification requires a thorough review of investment and product strategy.

Certain hair appliance categories within Helen of Troy are exhibiting characteristics of Dogs in the BCG matrix due to declining sales, intense competition, and distribution challenges. These products hold a low market share in a slow-growing or saturated market, consuming resources without generating significant returns.

The Beauty segment's net sales decline in fiscal year 2024, influenced by underperforming hair appliances, underscores their Dog status. This situation necessitates a strategic review, potentially leading to divestment or reallocation of resources to more promising business units.

Helen of Troy's divestiture of its Personal Care business in 2023 exemplifies managing a Dog. This move allowed the company to focus capital and attention on higher-growth opportunities, optimizing its overall portfolio performance.

Water filtration products also fall into the Dog category, marked by declining sales, partly due to an expired out-license agreement and broader market softness. The Housewares segment, which includes water filtration, saw a decline in fiscal year 2024, reinforcing the low growth and low market share profile of these items.

Question Marks

Helen of Troy's new product introductions, especially those targeting emerging trends or niche markets, begin as Question Marks in the BCG matrix. These products are in sectors with high growth potential, but they currently possess a small slice of the market. For example, in 2024, the company continued to explore innovations in areas like sustainable home goods and advanced personal care technology, which represent these early-stage ventures.

Significant investment in marketing, research and development, and distribution is crucial for these Question Marks. The goal is to nurture them into Stars by increasing their market share within these high-growth industries. The success of these initiatives will determine if Helen of Troy can capture a leading position in these developing product categories.

Exploration in novel beauty and wellness segments represents Helen of Troy's potential question marks. These are areas where the company is investing in new ventures or early-stage products, aiming to tap into emerging trends where it doesn't yet hold a strong market position.

These initiatives, while holding promise for future growth, are currently cash consumers as they build market presence and scale. For instance, the company might be exploring innovative skincare technologies or sustainable wellness products that are still in their nascent stages of development and market penetration.

Helen of Troy's focus on digital and direct-to-consumer (DTC) initiatives reflects a strategic pivot toward capturing higher growth potential. These efforts involve significant investment in digital marketing capabilities and data analytics to better understand and engage consumers directly. For instance, in fiscal year 2024, the company reported that its online channel sales grew by 10.5%, highlighting the increasing importance of this DTC push.

While these digital channels offer promising avenues for expansion, their market share for specific product lines remains in development, positioning them as question marks in the BCG matrix. Success in these areas is contingent on the company's ability to effectively scale its digital operations and capture a larger portion of the online market, a challenge that requires continuous adaptation to evolving consumer behavior and technological advancements.

International Market Expansion for Newer Brands

Expanding newer or less established brands into international markets where Helen of Troy's presence is still developing can be classified as Question Marks in the BCG Matrix. These markets offer high growth opportunities, but the brands currently have low market share and require substantial investment in localized marketing and distribution to gain traction. For instance, Helen of Troy’s Health & Home segment, which includes brands like Braun, saw international net sales grow significantly in recent years, indicating potential for expansion of its newer product lines in these developing regions.

The strategy for these Question Marks involves careful market selection and targeted investment. Brands need to build awareness and establish distribution channels, often through partnerships or direct market entry strategies. The goal is to increase market share in these high-growth areas, eventually moving them towards becoming Stars.

- High Growth Potential: Emerging economies often present robust GDP growth rates, creating fertile ground for new brands.

- Low Market Share: Newer brands typically start with minimal penetration in these unfamiliar territories.

- Significant Investment Required: Localized marketing campaigns, supply chain development, and regulatory compliance demand substantial capital outlay.

- Strategic Goal: To convert these Question Marks into Stars by capturing market share and achieving profitability in high-growth international markets.

Brands in Categories with Shifting Consumer Preferences

Helen of Troy's brands operating in categories experiencing rapid shifts in consumer preferences, such as personal care appliances or smart home devices, would fall into the Question Marks quadrant. These are areas where the company is actively investing to adapt and capture emerging market share. For example, in 2023, Helen of Troy reported a net sales increase of 1.7% to $2.3 billion, with growth in categories like health and wellness, indicating a response to evolving consumer needs.

The company's strategy involves significant investment in innovation and market repositioning to navigate these dynamic landscapes. This requires substantial capital outlay for research and development, marketing campaigns, and potentially acquisitions to stay ahead of trends. The success of these ventures is not guaranteed, making them inherently risky but offering the potential for high future returns if they can effectively capture new consumer demand.

- Adapting to Evolving Consumer Tastes: Helen of Troy is actively investing in product development and marketing for categories where consumer preferences are rapidly changing, such as smart home devices and advanced personal care technology.

- Navigating Technological Disruption: The company is allocating resources to stay competitive in sectors experiencing significant technological advancements, aiming to integrate new features and functionalities into its product lines.

- Investment in Innovation and Re-positioning: Significant capital is being deployed to foster innovation and reposition brands to meet emerging market demands, reflecting a proactive approach to potential high-growth areas.

- Uncertainty and High Investment Needs: While these categories offer future growth potential, they also carry inherent risks due to the unpredictable nature of consumer trends and the substantial investment required for successful market penetration.

Question Marks in Helen of Troy's BCG matrix represent products or ventures in high-growth markets where the company currently holds a low market share. These are often new product introductions or expansion into nascent categories. For instance, Helen of Troy's continued exploration in sustainable home goods and advanced personal care technology in 2024 exemplifies these early-stage, high-potential, but low-penetration ventures.

Significant investment is channeled into these Question Marks to boost market share and transform them into Stars. This includes funding for research and development, marketing, and distribution enhancements. The company's strategic focus on digital and direct-to-consumer (DTC) initiatives, which saw online channel sales grow by 10.5% in fiscal year 2024, also fits this profile, as these channels are still developing their market share for specific product lines.

International expansion of less established brands also falls under Question Marks. Markets with high growth potential, such as emerging economies, require substantial investment in localized marketing and distribution to gain traction. For example, while Helen of Troy's Health & Home segment experienced international sales growth, newer product lines within this segment in developing regions are considered Question Marks.

These ventures, while promising for future growth, are currently cash consumers as they build market presence. The company's investment in innovation for categories like smart home devices, where consumer preferences are rapidly changing, also represents a Question Mark. This strategy involves significant capital outlay with uncertain outcomes, aiming to capture new consumer demand.

| Category/Initiative | Market Growth | Market Share | Investment Need | Strategic Objective |

| Sustainable Home Goods (2024) | High | Low | High | Increase market share to become a Star |

| Advanced Personal Care Tech (2024) | High | Low | High | Increase market share to become a Star |

| Digital/DTC Channels | High | Developing | Moderate to High | Capture significant online market share |

| Newer Brands in Emerging Markets | High | Low | High | Establish presence and grow share |

| Smart Home Devices | High | Low | High | Adapt to trends and capture demand |

BCG Matrix Data Sources

Our Helen of Troy BCG Matrix leverages comprehensive data from annual reports, investor presentations, and market research firms. This ensures accurate assessment of market share and growth potential.