Helen of Troy Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Helen of Troy Bundle

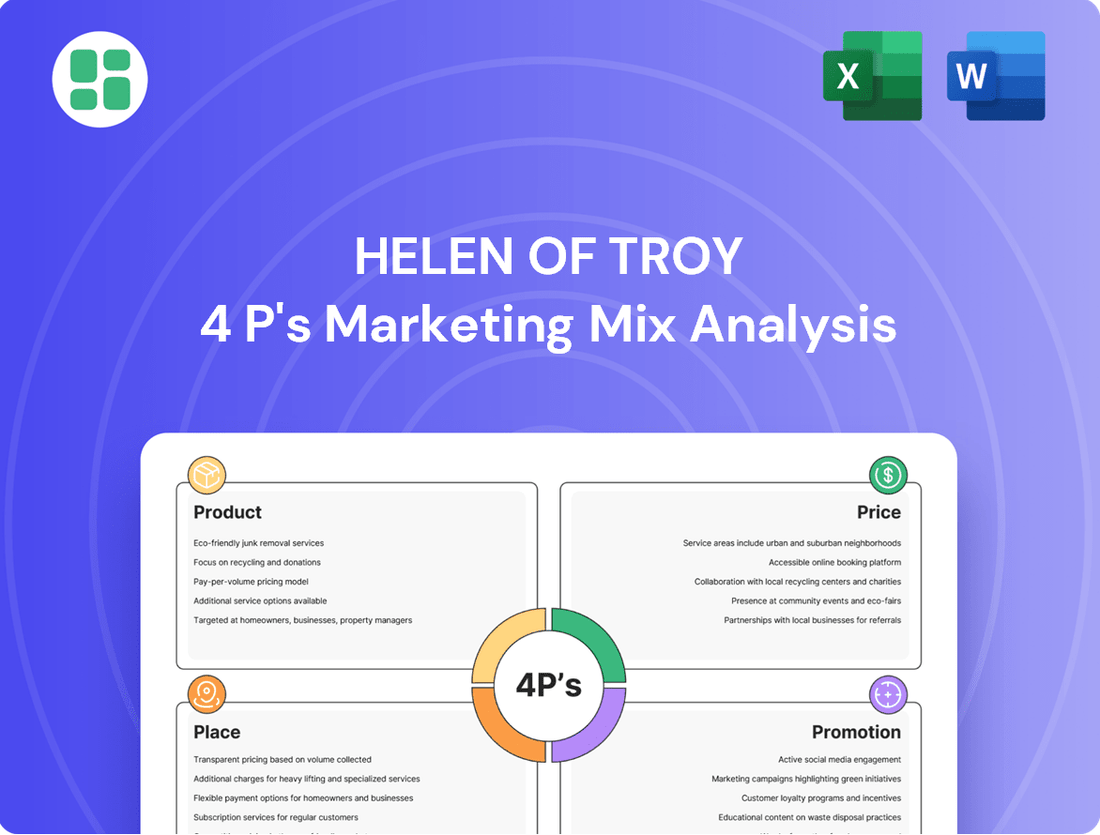

Uncover the strategic brilliance behind Helen of Troy's success by diving deep into their Product, Price, Place, and Promotion. This analysis reveals how their diverse product portfolio, value-driven pricing, strategic distribution, and impactful promotional campaigns create a compelling market presence.

Go beyond the surface and gain access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Helen of Troy. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Helen of Troy's diverse brand portfolio spans both Beauty & Wellness and Home & Outdoor categories, offering a wide range of consumer goods. This includes popular names like OXO, Hydro Flask, Vicks, Braun, and Honeywell, alongside newer additions such as Drybar and Revlon.

The company strategically manages a collection of strong, purpose-driven brands, each catering to distinct consumer needs and preferences. This broad offering allows Helen of Troy to capture market share across various consumer touchpoints, from kitchen essentials to personal care and hydration solutions.

In fiscal year 2024, Helen of Troy reported net sales of $2.03 billion, with its Health & Home segment contributing significantly, showcasing the strength of its established brands in essential categories.

Helen of Troy's commitment to innovation is a cornerstone of its strategy, focusing on new product development and design to secure and expand market leadership. This drive for novelty ensures their brands remain relevant and appealing to consumers.

A prime example is Osprey's upcoming Fall 2025 collection, which highlights a significant push towards sustainability. This new line will incorporate recycled fabrics and introduce an innovative end-of-use recycling program, demonstrating a tangible evolution in product features and a response to growing environmental consciousness.

The company consistently allocates resources to research and development, fueling the pipeline with fresh, market-ready products. This ongoing investment is crucial for maintaining a competitive edge and meeting the dynamic demands of consumers in their respective categories.

Helen of Troy's marketing strategy heavily emphasizes its Leadership Brands, which are key drivers of growth and market presence. These brands, such as OXO, Hydro Flask, and Osprey, are not just products but powerful assets that the company cultivates to capture and expand market share.

The company's growth plan, 'Elevate for Growth,' specifically targets these leadership brands for enhanced product development and increased brand equity. This focus ensures that resources are directed towards the most impactful areas of the business, aiming for sustained revenue increases and a stronger competitive position.

For instance, Hydro Flask, a prominent Leadership Brand, has seen significant success. In fiscal year 2024, Helen of Troy reported that its Health & Wellness segment, which includes Hydro Flask, achieved net sales of $587.5 million, demonstrating the brand's substantial contribution to the company's overall financial performance.

Acquisition Strategy for Portfolio Enhancement

Helen of Troy’s acquisition strategy is a cornerstone of its product enhancement, aiming to diversify its portfolio and solidify its market position. The company actively seeks opportunities to enter new, high-growth categories and expand its existing brand families.

A prime example of this strategy in action is the November 2024 acquisition of Olive & June, a direct-to-consumer and retail nail care brand. This move significantly broadens Helen of Troy’s footprint, extending its reach from its traditional hair care focus into the lucrative and expanding at-home beauty and personal care market.

This strategic acquisition is projected to be accretive to Helen of Troy’s financial performance, contributing positively to both revenue growth and profit margins. The integration of Olive & June aligns with the company's broader objective of achieving sustainable, profitable growth through targeted market expansion and brand diversification.

- Strategic Expansion: Acquisitions like Olive & June are key to diversifying Helen of Troy's product categories.

- Market Penetration: The Olive & June acquisition allows entry into the growing at-home beauty sector.

- Financial Accretion: The strategy is designed to boost revenue and improve profit margins.

- Portfolio Enhancement: This approach strengthens Helen of Troy's overall brand portfolio and market competitiveness.

Quality and Consumer-Centric Solutions

Helen of Troy's product strategy centers on delivering high-quality solutions meticulously designed to meet and exceed consumer needs. This commitment is evident in their continuous innovation and product development, ensuring their offerings are not just functional but also desirable, effectively addressing specific consumer pain points or aspirations.

Their approach emphasizes creating products that offer a distinct advantage over competitors by providing superior problem-solving capabilities or fulfilling unmet desires. This consumer-centric focus is a cornerstone of their brand revitalization, driving efforts to build stronger connections with their customer base.

For instance, in fiscal year 2024, Helen of Troy reported net sales of $1.9 billion, with a significant portion attributed to brands that have undergone strategic revitalization, underscoring the impact of their quality and consumer-focused product initiatives.

- Consumer Obsession: Helen of Troy prioritizes understanding and addressing consumer needs in product design and features.

- Quality Differentiation: The company aims to stand out by offering products that are perceived as higher quality and more effective problem solvers.

- Brand Revitalization: Product quality and consumer-centric solutions are key pillars supporting the company's broader brand enhancement strategy.

Helen of Troy's product strategy focuses on high-quality, consumer-centric solutions, driving innovation and brand revitalization. This approach ensures their offerings address specific needs and outperform competitors. In fiscal year 2024, net sales reached $1.9 billion, with a significant portion stemming from revitalized brands, highlighting the success of their quality and consumer-focused product initiatives.

| Product Focus | Key Strategy | Fiscal Year 2024 Data |

|---|---|---|

| High-Quality Solutions | Consumer Needs & Problem Solving | Net Sales: $1.9 Billion |

| Innovation & Design | Brand Revitalization & Differentiation | Significant Contribution from Revitalized Brands |

| Market Leadership | Expanding Leadership Brands (e.g., OXO, Hydro Flask) | Health & Wellness Segment Sales: $587.5 Million (includes Hydro Flask) |

What is included in the product

This analysis delves into Helen of Troy's marketing mix, examining how their diverse product portfolio, strategic pricing, extensive distribution channels, and targeted promotional efforts contribute to their market leadership.

This analysis distills the 4Ps of Helen of Troy into actionable strategies that directly address market pain points, offering a clear roadmap for competitive advantage.

Place

Helen of Troy leverages a multi-channel distribution network to ensure its diverse product portfolio, including brands like OXO, Hydro Flask, and Honeywell, reaches consumers effectively. This strategy encompasses mass merchandisers, online giants, and specialty retailers, aiming for broad market penetration and accessibility. For instance, their presence in major online marketplaces and physical stores like Target and Bed Bath & Beyond (as of their 2024 fiscal year reporting) highlights this commitment.

The company’s distribution footprint is vast, spanning sporting goods stores, department stores, drugstores, home improvement outlets, grocery chains, and even prestige beauty and beauty supply retailers. This broad reach, supported by wholesalers and warehouse clubs, allows Helen of Troy to capture a wide spectrum of consumer purchasing habits and preferences across different market segments, contributing to their overall sales strategy.

Helen of Troy is notably expanding its e-commerce and direct-to-consumer (DTC) footprint. The company has reported a significant rise in online channel sales, with its home category showing particular strength. This growth is fueled by a strategic emphasis on leveraging major e-commerce platforms to reach a wider customer base.

The home and outdoor division is at the forefront of this digital push, effectively utilizing platforms like Klaviyo for integrated email and SMS marketing campaigns. This approach is designed to deepen customer engagement and foster loyalty, demonstrating a commitment to direct consumer relationships and digital-first distribution strategies.

Helen of Troy is actively pursuing international market expansion, a key component of its growth strategy. For fiscal year 2025, the company reported that international sales represented a significant portion of its revenue, demonstrating a clear upward trend.

This global push is designed to build a more resilient business by diversifying income sources, lessening dependence on any single market. The company plans to capitalize on its well-recognized brands and existing distribution networks across various continents to achieve this.

Strategic Distribution Facilities and Logistics

Helen of Troy is strategically optimizing its distribution network, leveraging its operational scale and assets to improve logistics and product availability. A key element is their new, state-of-the-art distribution center in Tennessee, designed to boost efficiency across the supply chain.

While the initial rollout of automation and system integration at the Tennessee facility presented some startup challenges, the company is actively implementing improvements. These efforts are geared towards achieving best-in-class service levels and fine-tuning their overall supply chain network to better serve customer demand.

- Tennessee Distribution Center: A significant investment in modern logistics infrastructure to enhance operational efficiency.

- Supply Chain Optimization: Ongoing efforts to refine the supply chain network for improved product availability and service.

- Automation Integration: Addressing initial challenges to fully leverage new technology for seamless operations.

New and Expanded Retailer Distribution

Helen of Troy is strategically focusing on securing new and broadening its existing retailer distribution channels. This push is particularly evident in high-growth areas such as insulated beverageware and home goods. The company is dedicated to reinforcing its relationships with key retail partners and optimizing its go-to-market strategies to ensure its products are readily available to consumers and to maximize sales opportunities.

This expansion is crucial for increasing market penetration and capturing a larger share in competitive segments. For instance, in fiscal year 2024, Helen of Troy reported net sales of $2.0 billion, with a significant portion driven by strong retail execution and expanded product placement. The company's efforts are aimed at making its popular brands, like Hydro Flask and OXO, more visible and accessible across a wider range of retail environments.

- Expanding into new retail banners: Helen of Troy is actively seeking placement in retailers where its brands are not currently present.

- Deepening relationships with existing partners: The company is working to increase its product assortment and promotional support within current retail accounts.

- Focus on key growth categories: Distribution expansion is prioritized in segments like insulated beverageware and home, which have shown robust consumer demand.

- Improving in-store visibility: Efforts are underway to enhance product placement and merchandising within stores to drive impulse purchases and brand awareness.

Helen of Troy’s place strategy centers on a broad, multi-channel approach, ensuring its brands like Hydro Flask and OXO are accessible across diverse retail environments. This includes a significant presence in mass merchandisers, online marketplaces, and specialty stores, aiming for widespread market penetration.

The company is actively enhancing its e-commerce and direct-to-consumer (DTC) capabilities, recognizing the growing importance of online sales channels, particularly within its home category. This digital focus is supported by strategic use of marketing platforms to deepen customer engagement.

International expansion is a key pillar, with global sales contributing a notable portion of revenue in fiscal year 2025, diversifying income and reducing market dependency. This global reach is built upon established brands and existing distribution networks.

Operational efficiency is being boosted by investments in logistics, such as the new Tennessee distribution center, designed to improve supply chain performance and product availability, despite initial integration challenges.

| Distribution Channel | Key Brands | Fiscal Year 2024 Net Sales (approx.) |

|---|---|---|

| Mass Merchandisers | OXO, Honeywell | Significant portion of $2.0 billion |

| Online Marketplaces & DTC | Hydro Flask, OXO | Growing rapidly, strong in Home |

| Specialty Retailers | Hydro Flask | Key for premium placement |

| International Markets | All | Increasingly significant revenue contributor |

Full Version Awaits

Helen of Troy 4P's Marketing Mix Analysis

The preview you see is the same document you'll receive instantly after purchase—no surprises. This comprehensive analysis of Helen of Troy's 4P's Marketing Mix is fully complete and ready for your immediate use.

Promotion

Helen of Troy is strategically increasing its marketing investment, recognizing its importance for brand longevity and growth. This proactive approach is designed to boost brand awareness and capture consumer attention in a competitive market.

For fiscal year 2025, the company has earmarked a significant year-over-year increase in growth investment spending. This commitment underscores their focus on long-term brand health and market penetration.

Helen of Troy is actively revitalizing its brand portfolio through enhanced marketing, innovation, and execution. This strategy is heavily reliant on a data-driven approach to understand consumers and optimize campaigns. For instance, in fiscal year 2024, the company reported net sales of $2.0 billion, demonstrating the scale of their operations and the potential impact of these revitalization efforts.

The company is investing in innovative creative strategies and dynamic media campaigns to boost brand presence. By leveraging advanced data analytics and consumer insights, Helen of Troy aims to significantly improve the effectiveness and productivity of its marketing spend across all its brands. This focus on data ensures that marketing investments are targeted and yield better returns.

Helen of Troy leverages targeted promotional programs and trade discounts, especially within its Beauty & Wellness division, to drive sales and connect with customers. These initiatives are crucial for moving inventory and encouraging repeat purchases.

Recent marketing efforts for brands like Hydro Flask and Drybar exemplify this strategy. Campaigns for these popular brands focus on attracting a wider audience and showcasing innovative new product designs and expanded product lines, aiming to boost brand visibility and market share.

Public Relations and Awards Recognition

Public relations and awards recognition are crucial for Helen of Troy's brands. For instance, Curlsmith securing an Allure Best Beauty of 2024 Award directly translates to positive public relations, bolstering its market standing. This type of recognition validates product quality and innovation.

Such awards serve as powerful endorsements, enhancing brand credibility and effectively communicating unique selling propositions to consumers. In 2023, Helen of Troy reported net sales of $2.03 billion, with its Beauty segment contributing significantly, underscoring the importance of brand-level achievements in driving overall performance.

The impact of these accolades can be seen in:

- Enhanced Brand Trust: Awards act as third-party validation, increasing consumer confidence.

- Improved Market Perception: Recognition elevates a brand's image against competitors.

- Marketing Leverage: Award wins provide compelling content for advertising and promotional campaigns.

- Attracting Talent: Prestigious awards can make brands more appealing to potential employees and partners.

Digital Engagement and Social Media

Helen of Troy is leaning heavily into digital engagement to build strong connections with consumers, particularly for brands like Olive & June. This digital-first strategy is designed to foster brand loyalty and boost social media interaction. For instance, their Q1 FY24 results showed continued investment in digital marketing, contributing to brand growth.

The company leverages sophisticated digital tools for promotion. Platforms like Klaviyo are used for targeted email and SMS marketing campaigns. This approach also involves creating exclusion lists and lookalike audiences for paid media, ensuring promotional efforts are efficient and reach the right potential customers. This focus on data-driven digital outreach is key to their promotional strategy.

- Digital-First Focus: Olive & June exemplifies Helen of Troy's commitment to digital channels for brand building and customer engagement.

- Email & SMS Marketing: Utilization of platforms like Klaviyo for direct customer communication via email and text messages.

- Targeted Paid Media: Employing exclusion lists and lookalike audiences to optimize paid advertising spend and reach.

- Q1 FY24 Performance: The company's financial reports indicate ongoing investment in digital promotion as a driver of brand performance.

Helen of Troy is significantly boosting its marketing investments, aiming for substantial year-over-year increases in growth spending for fiscal year 2025 to enhance brand awareness and market penetration.

The company employs a multi-faceted promotional strategy, including targeted digital campaigns, public relations via awards, and direct customer outreach through email and SMS marketing. This approach is data-driven, utilizing tools like Klaviyo to optimize reach and efficiency.

Recent efforts highlight this, with brands like Hydro Flask and Drybar focusing on new product designs and expanded lines, while Curlsmith's Allure Best Beauty Award win showcases the power of earned media. This comprehensive promotional mix is designed to drive sales and build lasting brand loyalty.

| Fiscal Year | Net Sales (USD Billions) | Marketing Investment Focus |

|---|---|---|

| 2023 | 2.03 | Broad brand revitalization, digital engagement |

| 2024 | 2.0 | Increased marketing investment, data-driven campaigns |

| 2025 (Projected) | Significant year-over-year increase in growth investment |

Price

Helen of Troy strategically employs competitive pricing to solidify its market leadership, complementing its strengths in product innovation and quality. The company ensures its offerings are priced attractively and within reach of its intended consumers, aligning with the value proposition across its broad product range.

Helen of Troy is actively reviewing its pricing strategies, with a focus on implementing targeted price increases across its product lines. This approach is being developed in collaboration with retail partners to address the financial pressures stemming from tariffs and shifts in international trade regulations.

The company is carefully balancing these potential price adjustments against established product and price ceilings. The goal is to ensure that any increases are managed in a way that continues to support healthy consumer demand for its brands.

Helen of Troy expects its gross margin to narrow because of a more promotional market and a less advantageous sales mix. This indicates the company relies on sales events and price reductions, impacting its profit margins, particularly when consumer spending slows.

For fiscal year 2025, Helen of Troy projected a gross profit margin between 38.3% and 39.3%. This forecast reflects the anticipated pressures from increased promotional activities and shifts in product sales, which can dilute overall profitability.

Value Proposition in Economic Downturns

Helen of Troy's value proposition becomes particularly potent during economic downturns. Brands like OXO Good Grips and Hydro Flask offer durable, long-lasting solutions that consumers perceive as good long-term investments, helping them save money over time. This focus on value is crucial when consumers are more budget-conscious.

During fiscal year 2024, Helen of Troy saw net sales of $1.96 billion, with a strategic emphasis on driving profitable growth. The company's pricing strategy aims to balance premium brand perception with accessibility, especially for categories where consumers seek cost-effective alternatives without compromising quality.

The company’s approach to pricing in challenging economic climates is reflected in its portfolio management. For instance, during periods of economic strain:

- Value-Oriented Brands: Brands like OXO are positioned to offer superior functionality and durability, justifying their price point as a cost-saving measure in the long run.

- Promotional Strategies: Helen of Troy leverages targeted promotions and value packs across its brands to attract price-sensitive consumers.

- Channel Optimization: Ensuring availability through various retail channels, including discount retailers, allows the company to reach a broader customer base facing economic pressures.

Pricing Decisions Influenced by Cost Mitigation

Helen of Troy's pricing decisions are significantly influenced by its cost mitigation efforts, particularly through Project Pegasus. This restructuring initiative is designed to unlock substantial cost savings, with a key focus on reducing the cost of goods sold (COGS). For instance, the company projected over $150 million in annualized savings from Project Pegasus by the end of fiscal year 2025, with a significant portion impacting COGS.

These COGS reductions provide Helen of Troy with greater pricing flexibility. Lower production costs can allow the company to maintain more competitive price points in the market, potentially increasing sales volume and market share. Alternatively, the savings can be reinvested into product innovation, marketing, or other strategic initiatives that support long-term brand value and pricing power.

- Project Pegasus Savings: Aiming for over $150 million in annualized savings by FY2025.

- COGS Reduction Impact: Direct influence on the cost structure, enabling pricing adjustments.

- Competitive Pricing: Lower costs allow for more aggressive pricing strategies to gain market share.

- Strategic Reinvestment: Savings can fund R&D and marketing, supporting premium pricing in the future.

Helen of Troy's pricing strategy is a dynamic interplay of competitive positioning and cost management. The company aims to strike a balance, ensuring its brands, like Hydro Flask and OXO, remain accessible while reflecting their inherent quality and value. This approach is crucial for maintaining consumer demand, especially in fluctuating economic conditions.

The company is navigating increased costs by strategically adjusting prices, a move influenced by external factors such as tariffs. For fiscal year 2025, Helen of Troy projected a gross profit margin between 38.3% and 39.3%, a figure that reflects these anticipated pressures and the impact of promotional activities.

Cost reduction initiatives, notably Project Pegasus, are central to Helen of Troy's pricing flexibility. With projections of over $150 million in annualized savings by the end of fiscal year 2025, the company can either maintain competitive price points or reinvest in brand development, ultimately supporting its long-term pricing power.

Helen of Troy's net sales reached $1.96 billion in fiscal year 2024, underscoring the importance of a pricing strategy that supports profitable growth. The company leverages value-oriented brands and targeted promotions to appeal to a broad consumer base, particularly those seeking cost-effective, durable solutions.

| Metric | FY2024 (Actual) | FY2025 (Projected) |

|---|---|---|

| Net Sales | $1.96 billion | N/A |

| Gross Profit Margin | N/A | 38.3% - 39.3% |

| Projected Savings (Pegasus) | N/A | Over $150 million (annualized by FY2025) |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Helen of Troy leverages a blend of official company disclosures, including SEC filings and investor presentations, alongside direct observations of their product offerings and pricing strategies on e-commerce platforms and their brand websites. We also incorporate insights from industry reports and competitive analyses to provide a comprehensive view.