Helen of Troy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Helen of Troy Bundle

Helen of Troy faces a dynamic competitive landscape, with significant pressure from rivals in the consumer goods sector and the constant threat of new entrants keen to capture market share. Understanding the power of their buyers and the availability of substitutes is crucial for their strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Helen of Troy’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Helen of Troy's bargaining power of suppliers is influenced by a concentrated supplier base for key components. If a significant portion of its essential materials or specialized parts comes from a few dominant providers, the company's ability to negotiate favorable pricing and terms diminishes. This concentration can lead to increased costs and potential supply chain vulnerabilities, as seen in past distribution challenges.

Helen of Troy faces a reduced bargaining power with its suppliers if switching to new ones incurs substantial costs. These costs can include retooling manufacturing lines, the expense and time of requalifying materials, and the potential disruption to established, reliable supply chains. For instance, in 2023, the company reported that its Cost of Goods Sold (COGS) was $1.19 billion, highlighting the significant financial impact of sourcing raw materials and components.

The company's Project Pegasus, a strategic initiative focused on supply chain optimization, directly addresses this by aiming to streamline operations and simplify its supplier relationships. By reducing these switching costs, Helen of Troy can enhance its leverage when negotiating terms with its suppliers, potentially leading to more favorable pricing and improved supply chain resilience.

Supplier product differentiation significantly impacts Helen of Troy's bargaining power. When suppliers offer unique, proprietary components, especially those critical for the innovative features of brands like OXO or Hydro Flask, their leverage increases. This reliance on specialized materials, which contribute to the distinct quality and performance of Helen of Troy's products, means suppliers can command better terms.

Threat of Forward Integration by Suppliers

If a supplier were to credibly threaten to move into the consumer products market, Helen of Troy's (HELE) bargaining power would naturally decrease. This is because the supplier would then be a competitor, not just a provider of inputs. While this threat is typically less concerning for suppliers of basic raw materials, it could become a significant factor for those providing specialized components or proprietary technologies that are crucial to HELE's product differentiation.

The broad range of products Helen of Troy offers, from personal care to housewares, means that the risk associated with forward integration by suppliers is likely spread across various types of suppliers. For instance, a manufacturer of small appliance motors might pose a different level of integration threat than a supplier of plastic resins. In 2024, companies like Helen of Troy continue to navigate complex supply chains where the potential for supplier consolidation or strategic shifts remains a dynamic consideration.

- Supplier Forward Integration Threat: A supplier's ability to enter Helen of Troy's market directly weakens Helen of Troy's negotiation leverage.

- Component Specificity Matters: The threat is amplified for suppliers of unique or technologically advanced components compared to commodity material providers.

- Portfolio Diversification: Helen of Troy's wide product range may mitigate the overall impact of any single supplier's integration threat.

- 2024 Market Dynamics: Ongoing supply chain realignments in 2024 highlight the importance of monitoring supplier strategic intentions.

Supplier Importance to Helen of Troy's Cost Structure

The bargaining power of suppliers for Helen of Troy is directly tied to how much their costs impact the company's overall product expenses. When supplier costs make up a large chunk of the final price, suppliers gain more leverage.

Helen of Troy's strategic initiatives, such as Project Pegasus, are designed to tackle this by focusing on reducing the cost of goods sold. This involves efforts to lessen dependence on expensive suppliers or to secure more favorable pricing agreements.

- Supplier cost as a percentage of total product cost: A higher percentage grants suppliers more power.

- Project Pegasus cost savings: Focused on reducing cost of goods sold, impacting supplier negotiations.

- Supplier concentration: Fewer suppliers generally mean more supplier power.

- Availability of substitute inputs: If substitutes are readily available, supplier power is reduced.

Helen of Troy's bargaining power with suppliers is influenced by the concentration of its supplier base and the specificity of the components it sources. When a few suppliers dominate the provision of critical materials, their leverage increases, potentially driving up costs. For example, in fiscal year 2024, Helen of Troy's Cost of Goods Sold (COGS) was approximately $1.17 billion, underscoring the significant financial impact of its sourcing decisions.

The company's efforts, like Project Pegasus, aim to streamline its supply chain and reduce reliance on single-source suppliers, thereby enhancing its negotiation position. Furthermore, the threat of supplier forward integration, particularly for specialized components that differentiate brands like Hydro Flask, can shift power towards suppliers.

| Factor | Impact on Helen of Troy's Bargaining Power | 2024 Relevance |

|---|---|---|

| Supplier Concentration | High concentration = Lower HELE power | Key suppliers for housewares and personal care |

| Component Differentiation | Unique components = Higher supplier power | Materials for OXO and Hydro Flask |

| Switching Costs | High costs = Lower HELE power | Retooling and requalification expenses |

| Supplier Forward Integration Threat | Credible threat = Lower HELE power | Potential for component makers to enter HELE's market |

What is included in the product

Tailored exclusively for Helen of Troy, analyzing its position within its competitive landscape by examining industry rivalry, buyer and supplier power, threat of new entrants, and substitute products.

Instantly identify and quantify the impact of each Porter's Five Forces on your business, allowing for targeted pain point relief.

Customers Bargaining Power

Helen of Troy's extensive distribution through mass merchandisers and major e-commerce platforms means its customers, like Walmart and Amazon, wield considerable bargaining power. These large retailers, by virtue of their sheer volume of purchases, can negotiate for lower prices, demand significant promotional support, and dictate favorable payment terms, directly impacting Helen of Troy's profit margins.

In the consumer products sector, especially for frequently purchased items, end consumers often exhibit significant price sensitivity. This is particularly true when economic conditions are uncertain, as seen in 2024 with persistent inflation impacting household budgets. Consumers actively seek out deals and compare prices, which directly influences retailer behavior.

This heightened consumer price sensitivity translates into considerable pressure on retailers to maintain competitive pricing. Consequently, retailers often pass this pressure upstream to their suppliers, including companies like Helen of Troy. They might demand lower wholesale prices or request more aggressive promotional support to keep their own shelf prices attractive.

The vast availability of consumer products significantly empowers customers by offering numerous alternatives to Helen of Troy's offerings. If Helen of Troy's products don't align with their price or quality expectations, consumers can easily switch to competing brands or different product categories, thereby exerting considerable bargaining power.

This ease of switching is a key driver of customer power. For example, in the competitive housewares market, consumers can readily find alternatives from brands like OXO, OXO Good Grips, or even private label brands at major retailers, impacting Helen of Troy's pricing flexibility.

To counteract this, Helen of Troy's brand strength and continuous product innovation become paramount. By consistently delivering high-quality, differentiated products and building strong brand loyalty, the company can mitigate the impact of readily available substitutes and retain its customer base, as seen in their focus on brands like OXO and Hydro Flask.

Customer's Ability to Integrate Backward

Large retail customers possess the theoretical ability to integrate backward by developing their own private label brands. This capability directly challenges Helen of Troy's existing product lines, significantly increasing the retailers' bargaining power. For instance, a major retailer could decide to produce a similar product at a lower cost under their own brand, thereby reducing reliance on Helen of Troy's offerings.

Helen of Troy mitigates this threat by focusing on building strong, recognizable brands that foster consumer loyalty. This brand equity makes it more difficult for private labels to capture market share, as consumers often prioritize brand trust and perceived quality. In 2023, Helen of Troy reported net sales of $1.94 billion, demonstrating the strength of its brand portfolio across various categories.

- Customer Backward Integration Threat: Major retailers can create private label alternatives to Helen of Troy's products.

- Impact on Bargaining Power: This potential for self-supply empowers large customers to negotiate more favorable terms.

- Helen of Troy's Defense: Emphasis on brand building and consumer preference creates a barrier against private label competition.

- Brand Strength Example: Helen of Troy's $1.94 billion in net sales for 2023 underscores the value of its established brands.

Customer Information and Transparency

Customers today have unprecedented access to information, thanks to the internet and readily available price comparison tools. This means they can easily research product features, assess quality, and compare prices across different brands. For instance, in the consumer goods sector, where Helen of Troy operates, online reviews and detailed product specifications empower buyers to make more informed decisions than ever before.

This heightened transparency directly translates into increased customer bargaining power. When customers can effortlessly identify the best value propositions, they are more likely to switch to competitors if they perceive a better deal or superior offering. This forces companies like Helen of Troy to constantly demonstrate why their products are worth the price, relying heavily on brand reputation and the perceived value they deliver.

- Informed Purchasing Decisions: Consumers can now easily compare product specifications, read reviews, and check prices online, significantly reducing information asymmetry.

- Price Sensitivity: Widespread access to pricing data makes customers more sensitive to price differences, potentially leading them to switch brands for cost savings.

- Brand Loyalty Challenge: Helen of Troy, like other consumer goods companies, must continually reinforce its brand value and product differentiation to retain customers in a transparent market.

The bargaining power of Helen of Troy's customers is substantial, driven by market concentration and the availability of alternatives. Large retailers like Walmart and Target, which represent significant sales volumes for Helen of Troy, can leverage their purchasing power to negotiate favorable pricing and terms. For instance, in 2024, the ongoing focus on value by consumers pressured retailers to seek cost efficiencies from their suppliers.

The ease with which consumers can switch between brands, particularly in competitive segments like housewares and personal care, further amplifies customer power. This is evident in the diverse range of readily available substitutes, from established competitors to private label offerings, forcing Helen of Troy to maintain competitive pricing and strong brand differentiation to retain market share.

A key aspect of customer power is the threat of backward integration, where large retailers could develop their own private label brands to directly compete with Helen of Troy's products. This capability gives them leverage in negotiations, as they can reduce their dependence on Helen of Troy's offerings. Helen of Troy's strategy to counter this involves building robust brand equity, as demonstrated by its reported net sales of $1.94 billion in fiscal year 2023, which highlights the strength of its brand portfolio.

Preview Before You Purchase

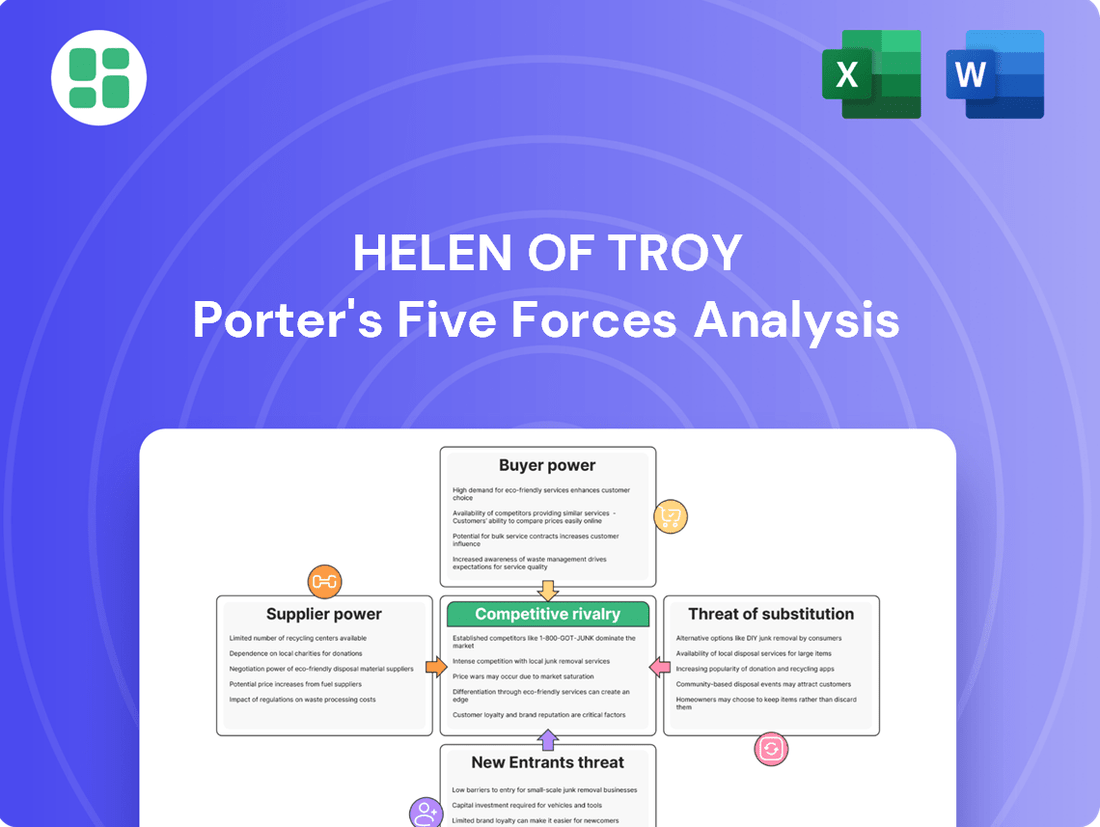

Helen of Troy Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Helen of Troy, providing a detailed examination of the competitive landscape. The document you see here is precisely what you will receive immediately after your purchase, ensuring full transparency and no hidden surprises. You'll gain immediate access to this professionally formatted analysis, ready for your strategic planning needs.

Rivalry Among Competitors

Helen of Troy operates in highly fragmented markets, including beauty, health, and home consumer products, where a vast number of global and local competitors vie for market share. This intense fragmentation means the company constantly faces rivalry from both well-established brands and agile new entrants across its diverse product lines.

The sheer volume of competitors intensifies the struggle for crucial retail shelf space, online visibility, and ultimately, consumer attention. For instance, in the competitive beauty sector, brands like L'Oréal, Estée Lauder, and Procter & Gamble are major players, while numerous smaller, direct-to-consumer brands are rapidly gaining traction, as seen in the growth of indie beauty brands throughout 2024.

The consumer products industry, while offering pockets of growth, is largely mature. This maturity intensifies competition as companies vie for existing market share rather than benefiting from broad market expansion. For Helen of Troy, this means growth often necessitates outperforming rivals directly.

In fiscal year 2024, Helen of Troy reported net sales of $1.9 billion, a decrease from the previous year. This sales trend highlights the competitive pressures within its operating segments, where gaining ground often requires winning customers from competitors due to the mature nature of many product categories.

Helen of Troy strives to stand out by offering innovative, high-quality products under well-known brands such as OXO and Hydro Flask. For instance, Hydro Flask's insulated drinkware has cultivated a dedicated following, allowing for premium pricing. This focus on perceived quality and unique features aims to build robust brand loyalty, a crucial defense against competitors who might engage in price wars.

High Fixed Costs and Exit Barriers

Companies in the consumer products sector, like Helen of Troy, often face substantial fixed costs. These are tied to significant investments in manufacturing facilities, extensive distribution networks, and broad marketing campaigns. For instance, establishing and maintaining a global supply chain for products like water purifiers or personal care items requires considerable upfront and ongoing capital expenditure.

When fixed costs are high, companies can feel pressured to maintain production even when demand softens. This can lead to a scenario where they engage in price competition to clear excess inventory, intensifying rivalry. In 2023, Helen of Troy reported net sales of $2.03 billion, demonstrating the scale of operations that necessitates managing these fixed cost pressures.

Exit barriers also play a crucial role in competitive rivalry. If a company has invested in highly specialized machinery or brand-specific distribution channels, it becomes difficult and costly to exit the market. This can trap less efficient or profitable competitors, who might continue to operate and exert competitive pressure, even when facing financial strain.

- High Fixed Costs: Significant investments in manufacturing, distribution, and marketing create substantial operating leverage for consumer product companies.

- Production Pressure: High fixed costs can compel companies to maintain production volumes, potentially leading to price wars during demand downturns.

- Exit Barriers: Specialized assets and significant switching costs can prevent less profitable firms from exiting the market, prolonging competitive intensity.

- Industry Dynamics: These factors contribute to a competitive landscape where scale and efficiency are paramount for sustained profitability.

Competitive Intensity from Private Labels and Own Brands

Helen of Troy contends with significant competitive intensity not only from established rivals but also from the growing presence of private label brands offered by retailers. These store-owned brands frequently undercut national brands on price, directly impacting Helen of Troy's market share and pricing power. For instance, in 2024, many major retailers continued to expand their private label offerings across various categories, aiming to capture a larger share of consumer spending by providing value-oriented alternatives.

The proliferation of e-commerce platforms has further amplified this rivalry by enabling smaller, agile brands to adopt direct-to-consumer (DTC) models. This bypasses traditional distribution channels, allowing these emerging competitors to reach consumers directly, often with innovative products and aggressive marketing. This trend has put pressure on established players like Helen of Troy to adapt their strategies and maintain relevance in an increasingly fragmented market.

Helen of Troy's strategic response involves reinforcing and deepening its relationships with key retail partners. By collaborating closely with retailers, the company aims to secure prominent shelf space, participate in joint marketing initiatives, and better understand evolving consumer demands. This approach is crucial for navigating the competitive landscape shaped by private labels and DTC brands, ensuring Helen of Troy's products remain visible and appealing to shoppers.

- Private Label Growth: Retailers' private label brands are increasingly capturing market share, offering consumers lower price points and often comparable quality.

- E-commerce Impact: Online platforms facilitate the rise of DTC brands, intensifying competition by lowering barriers to entry and increasing product variety.

- Strategic Partnerships: Helen of Troy focuses on strengthening retailer collaborations to enhance brand visibility and navigate competitive pressures.

Helen of Troy faces intense competition across its diverse consumer product segments, from established global brands to nimble direct-to-consumer (DTC) entrants. This rivalry is amplified by high fixed costs within the industry, which can pressure companies to maintain production and potentially engage in price competition, especially during market downturns. In fiscal year 2024, Helen of Troy's net sales were $1.9 billion, reflecting the challenging environment where gaining market share often means directly competing for consumers.

The rise of private label brands from retailers further intensifies this competitive pressure, offering consumers lower-priced alternatives. For instance, in 2024, retailers continued expanding their private label selections, directly challenging national brands. E-commerce also fuels this by enabling new DTC brands to reach consumers directly, forcing established players like Helen of Troy to strengthen retail partnerships and innovate to maintain visibility and appeal.

SSubstitutes Threaten

Consumers may choose products that serve a similar purpose but come from completely different product categories. For example, instead of buying a dedicated water flosser, someone might opt for a toothbrush with a built-in water jet or even a simple toothpick. This widens the competitive landscape significantly for companies like Helen of Troy.

This threat is particularly relevant when considering everyday needs. A study in 2024 indicated that a significant portion of consumers, around 35%, actively seek multi-functional items to reduce clutter and cost. This behavior means that a company selling specialized kitchen appliances must also consider the appeal of versatile tools or even repurposed household items as substitutes.

Many of Helen of Troy's offerings, especially in health, beauty, and household goods, face competition from lower-cost alternatives or do-it-yourself (DIY) solutions. Consumers can opt for generic brands or even create their own remedies, bypassing premium or branded products. This threat is amplified in 2024 as a softer economic climate and increased consumer price sensitivity make budget-friendly options more attractive.

Shifting consumer preferences, like the growing demand for sustainable and eco-friendly products, present a significant threat of substitution for Helen of Troy. For instance, a surge in consumer adoption of digital streaming services over physical media, or a move towards minimalist lifestyles reducing the need for certain home goods, directly impacts the demand for Helen of Troy's product categories. In 2023, Nielsen data indicated that 73% of consumers globally would change their purchasing habits to reduce their environmental impact, a trend Helen of Troy needs to actively address.

Technological Advancements and New Solutions

Technological advancements present a significant threat of substitutes for Helen of Troy. Emerging technologies could introduce entirely new solutions that fulfill consumer needs in ways current products cannot. For instance, the burgeoning smart home ecosystem and personalized health technology sectors are rapidly developing alternatives that may prove more convenient or effective than traditional offerings.

Helen of Troy's defense against this threat lies in its commitment to innovation and product development. The company actively invests in research and development to anticipate and adapt to these shifts. For example, in fiscal year 2023, Helen of Troy reported approximately $100 million in R&D expenses, a testament to its focus on staying ahead of evolving technological landscapes.

The potential for substitutes to disrupt markets is substantial. Consider the rapid growth in the direct-to-consumer health tech market, which saw a global valuation of over $20 billion in 2023, offering personalized wellness solutions that could bypass traditional consumer health products.

To mitigate this threat, Helen of Troy must continue to:

- Monitor emerging technologies and consumer trends closely.

- Invest strategically in R&D to develop innovative and competitive products.

- Explore partnerships or acquisitions to integrate new technologies into their portfolio.

- Adapt their business models to incorporate digital solutions and personalized offerings.

Subscription Services or Rental Models

While not a widespread threat across Helen of Troy's diverse product portfolio, the growing popularity of subscription services and rental models for certain durable goods presents a potential long-term challenge. For instance, the increasing adoption of subscription boxes for personal care items or rental services for home appliances could shift consumer preference from outright ownership to access, potentially impacting traditional sales volumes for comparable products. This trend, though still developing in many consumer goods sectors, signifies a subtle but evolving shift in how consumers engage with and acquire goods.

The impact of these alternative models can be seen in broader consumer trends. In 2024, the subscription e-commerce market continued its expansion, with reports indicating sustained growth in sectors beyond digital content. For example, the home goods rental market, while niche, has seen increased interest from younger demographics seeking flexibility. This suggests that for certain categories Helen of Troy operates within, the perceived value of ownership might be challenged by the convenience and lower upfront cost of access-based services.

- Subscription Growth: The subscription e-commerce market has shown consistent year-over-year growth, indicating a consumer willingness to adopt recurring payment models for goods and services.

- Rental Market Expansion: While specific data for Helen of Troy's product categories is limited, the broader rental market for durable goods, including furniture and appliances, has seen increased activity, particularly among younger consumers.

- Consumer Preference Shift: A growing segment of consumers, especially millennials and Gen Z, express a preference for access over ownership, driven by factors like flexibility, cost-consciousness, and a desire to reduce clutter.

The threat of substitutes for Helen of Troy is significant, as consumers can opt for products fulfilling similar needs from different categories or through DIY methods. For instance, a 2024 survey revealed that 35% of consumers prefer multi-functional items, highlighting a demand that can be met by alternatives outside Helen of Troy's core offerings. This is further amplified by economic pressures, with 73% of consumers in 2023 indicating a willingness to alter purchasing habits for environmental reasons, favoring sustainable options that might bypass traditional products.

Technological advancements also introduce new solutions, such as the over $20 billion health tech market in 2023, offering personalized wellness that could displace conventional health products. Helen of Troy's investment of approximately $100 million in R&D for fiscal year 2023 demonstrates a strategic effort to counter these evolving threats by fostering innovation and staying competitive.

Entrants Threaten

Entering the consumer products arena, particularly a segment as broad as Helen of Troy's, demands substantial financial resources. Companies need significant capital for research and development, setting up manufacturing facilities, extensive marketing campaigns, and building robust distribution channels. This high upfront investment acts as a considerable hurdle for potential new competitors.

Helen of Troy's ongoing strategic initiatives, such as Project Pegasus and Elevate for Growth, underscore the continuous investment required to maintain and enhance market standing. These programs, which focus on improving operational efficiency and brand strength, highlight the capital-intensive nature of staying competitive in this sector. For instance, in fiscal year 2024, Helen of Troy reported net sales of $2.0 billion, demonstrating the scale of operations that new entrants would need to match.

Helen of Troy benefits significantly from strong brand loyalty, a key barrier to new entrants. Brands like OXO, known for its kitchen tools, and Hydro Flask, a leader in insulated drinkware, have cultivated deep consumer trust and recognition over many years. This established reputation makes it incredibly difficult for newcomers to gain market share.

New companies entering the market must overcome the substantial hurdle of building comparable brand equity and capturing consumer preference away from these trusted names. For instance, OXO has a long history of innovation and quality, which new kitchenware brands struggle to replicate in terms of consumer perception and loyalty.

Helen of Troy's ongoing investment in marketing and brand development is crucial for maintaining this competitive advantage. In 2023, the company reported net sales of approximately $2.05 billion, with a significant portion attributed to the strong performance of its core brands, demonstrating the power of their established market presence.

Newcomers face a tough time getting their products onto store shelves or online marketplaces. Major retailers like Walmart and Target, along with popular e-commerce sites, are key for reaching consumers, but they often demand significant volume commitments and established track records.

Helen of Troy benefits from long-standing relationships with these crucial distribution partners. Their ability to consistently supply and manage inventory, bolstered by investments like their new distribution center, makes it difficult for new brands to gain comparable access and shelf space.

For instance, in 2023, Helen of Troy reported net sales of $2.05 billion, demonstrating the scale of their operations and their established presence within these distribution networks. This existing infrastructure and market penetration act as a substantial barrier to entry for potential competitors.

Economies of Scale in Production and Sourcing

Helen of Troy's significant scale in production and sourcing creates a formidable barrier to entry. The company’s ability to spread fixed costs over a larger output volume results in lower per-unit production expenses. For example, in 2024, Helen of Troy's operational efficiency, bolstered by initiatives like Project Pegasus, allowed for optimized procurement of raw materials and components, securing more favorable pricing than emerging competitors could likely achieve.

These economies of scale translate directly into a competitive cost advantage, making it challenging for new entrants to match Helen of Troy's pricing strategies. A smaller new entrant would face higher per-unit costs for manufacturing, distribution, and marketing, hindering their ability to gain market share. This cost differential is a critical deterrent, as it requires substantial upfront investment for new players to even approach the cost efficiencies enjoyed by established leaders like Helen of Troy.

- Economies of Scale: Helen of Troy leverages its size for cost efficiencies in production, sourcing, and logistics.

- Cost Advantage: These efficiencies create a significant cost advantage that new entrants find difficult to overcome.

- Project Pegasus: This initiative further aims to optimize operational efficiencies, strengthening the cost barrier.

- Competitive Pricing: The scale advantage enables competitive pricing, a hurdle for smaller, newer market participants.

Regulatory Hurdles and Intellectual Property

New entrants into Helen of Troy's diverse product categories, such as health appliances or water filtration, often encounter significant regulatory hurdles. These can include stringent safety standards, product testing requirements, and the need for specific certifications, which demand substantial time and investment to navigate. For instance, in the water filtration market, compliance with NSF/ANSI standards is crucial for consumer trust and market access.

Intellectual property (IP) presents another formidable barrier. Helen of Troy's robust portfolio of existing patents, particularly in areas like air purification technology and personal care appliances, creates a moat that new competitors must either circumvent or challenge. The company's strategic acquisitions further bolster its IP position, integrating technologies and patents that would be costly and time-consuming for new entrants to replicate.

- Regulatory Approvals: Compliance with FDA, EPA, or UL standards can be a lengthy and expensive process for new entrants.

- Intellectual Property: Helen of Troy holds numerous patents, including those related to its Purifier and Brita brands, which protect its innovative technologies.

- Acquisition Strategy: The company has historically acquired businesses with established IP, such as the 2016 acquisition of Hydrofresh, which strengthened its water filtration capabilities and patent library.

- Brand Reputation: Existing brands like Honeywell (under license) and Brita benefit from established consumer trust, making it harder for new, unproven brands to gain traction.

The threat of new entrants for Helen of Troy is moderate. Significant capital investment is required for R&D, manufacturing, and marketing, creating a substantial financial barrier. For example, Helen of Troy's fiscal year 2024 net sales reached $2.0 billion, indicating the scale of operations new entrants must match.

Established brand loyalty, exemplified by brands like OXO and Hydro Flask, makes it difficult for newcomers to gain traction. Overcoming this requires considerable effort in building brand equity and consumer trust, a challenge for any new player entering the market.

Access to distribution channels is another key hurdle. Helen of Troy's long-standing relationships with major retailers and e-commerce platforms, supported by investments in logistics, make it challenging for new brands to secure shelf space and reach consumers effectively.

Economies of scale provide Helen of Troy with a cost advantage, as larger production volumes lead to lower per-unit costs. Initiatives like Project Pegasus aim to further enhance operational efficiencies, making it harder for new entrants to compete on price.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Helen of Troy is built upon a foundation of robust data, including the company's SEC filings, annual reports, and investor presentations. We also leverage industry-specific market research reports and trade publications to capture current market dynamics and competitive landscapes.