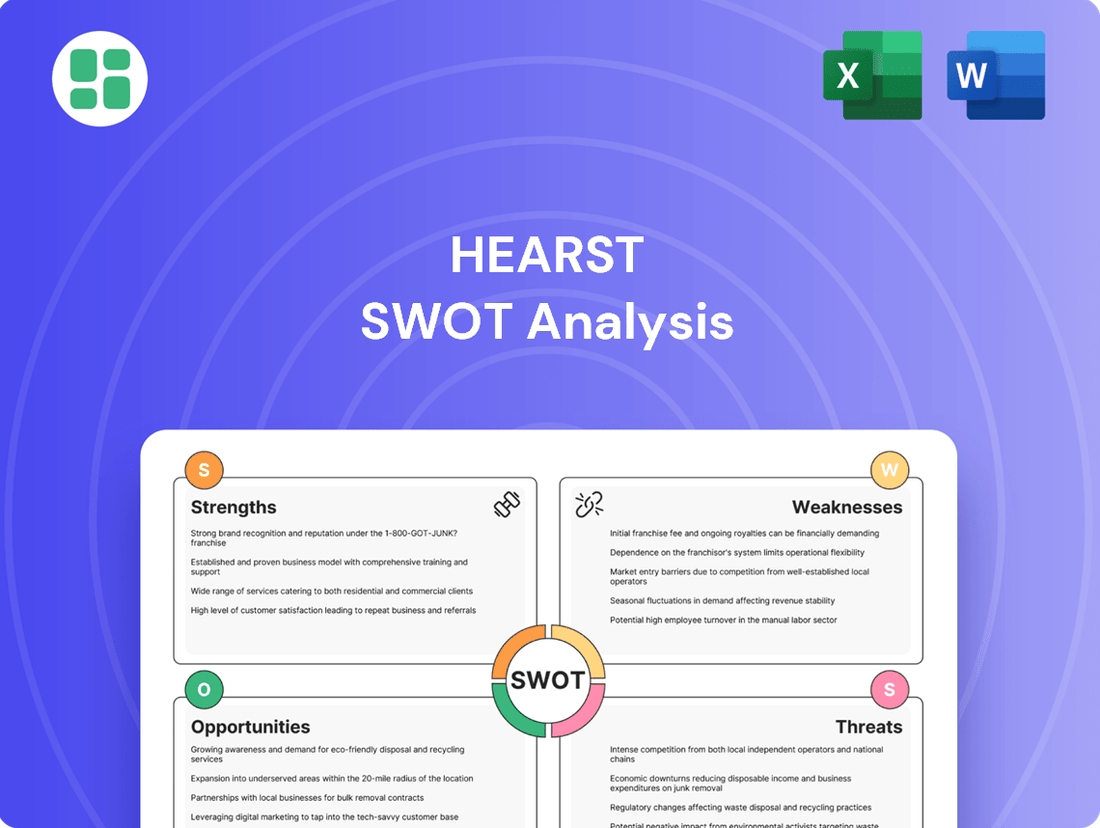

Hearst SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hearst Bundle

Hearst's media empire boasts significant brand recognition and a diversified portfolio, but faces evolving digital landscapes and intense competition. Understanding these internal capabilities and external market forces is crucial for navigating the future.

Want the full story behind Hearst's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hearst Communications boasts a robustly diversified business model, encompassing a wide array of sectors including magazines, newspapers, television, business information, and digital platforms. This strategic spread, which includes a substantial investment in Fitch Group and Hearst Health, proved instrumental in the company's record-breaking performance, with revenues and profits reaching $13 billion in 2024. Such diversification significantly reduces the company's vulnerability to downturns in any single industry.

The company's expansive global footprint is another key strength. With its magazines distributed in 47 countries, Hearst commands a significant international market presence. This worldwide reach not only broadens its customer base but also provides a crucial buffer against localized economic instability, enhancing overall business resilience.

Hearst's brand recognition is a significant strength, built on a portfolio of iconic publications and broadcast stations. Owning titles like Cosmopolitan, Esquire, and the Houston Chronicle grants the company substantial brand equity and a dedicated readership and viewership. This established trust and credibility are crucial advantages in the highly competitive media industry.

Hearst's deep involvement in cable television networks, including A&E, HISTORY, and Lifetime, alongside its significant 20% ownership in ESPN, forms a bedrock of stable and profitable revenue. These ventures provide consistent cash flow and direct access to vast, engaged audiences, effectively diversifying its media portfolio beyond print and digital.

The company's 35 television stations also contribute substantially, with Hearst Television demonstrating robust performance in 2024. This strength was notably bolstered by increased political advertising revenue and the continued success of its high-quality local journalism initiatives, underscoring the enduring value of traditional broadcast media.

Strategic Investments in Digital and Technology Ventures

Hearst's strategic investments in digital and technology ventures are a significant strength, evidenced by its proactive approach to acquiring and developing businesses. Recent examples include the acquisition of MotorTrend Group and QGenda, a healthcare workforce management company, alongside the launch of the puzzle website Puzzmo.

The company's commitment to digital transformation is substantial. In 2024 alone, Hearst allocated over $200 million towards building and upgrading its software platforms, demonstrating a clear focus on enhancing its technological infrastructure. This investment underpins its ability to adapt to changing consumer behaviors and explore new revenue streams.

Furthermore, Hearst's venture capital arm actively supports innovation. The company made venture capital investments in 45 companies in 2024, signaling its dedication to identifying and nurturing emerging technologies and business models. This diversified approach allows Hearst to maintain agility and capitalize on future growth opportunities across various sectors.

- Digital Acquisitions: MotorTrend Group, QGenda, Puzzmo.

- 2024 Software Investment: Over $200 million.

- Venture Capital Activity: Investments in 45 companies in 2024.

- Strategic Focus: Adapting to evolving media consumption and exploring new growth areas.

Robust B2B Business Segment Growth

Hearst's business-to-business (B2B) segment, encompassing entities like Fitch Group and Hearst Health, has emerged as a powerhouse, contributing over 50% of the company's profits in 2024. This marks a substantial transformation from its position a decade prior, when B2B represented only 15% of profits. This strategic pivot highlights Hearst's successful diversification into data and software solutions, creating a more stable and robust revenue stream insulated from the fluctuations often seen in traditional advertising markets.

The growth in B2B is fueled by providing essential information and solutions to critical sectors such as financial services and healthcare. This expansion into high-value B2B services demonstrates a clear strategic advantage, building a more resilient business model. The increasing reliance on these segments for profitability underscores their vital role in Hearst's financial performance and future growth trajectory.

- B2B Profit Contribution: Exceeded 50% of total company profits in 2024.

- Historical Growth: Up from 15% of profits a decade ago.

- Key Segments: Driven by Fitch Group and Hearst Health.

- Strategic Impact: Diversification reduces reliance on advertising volatility.

Hearst's diversified business model is a significant strength, with its various segments including magazines, newspapers, television, and business information contributing to record-breaking performance. The company achieved revenues and profits of $13 billion in 2024, a testament to this broad strategic spread which mitigates risks associated with any single industry downturn.

The significant growth in Hearst's business-to-business (B2B) segment, particularly driven by Fitch Group and Hearst Health, is a major advantage. In 2024, B2B accounted for over 50% of the company's profits, a dramatic increase from 15% a decade ago. This shift highlights successful diversification into data and software solutions, creating a more stable revenue stream less susceptible to advertising market volatility.

| Strength | Description | 2024 Data Point |

| Diversified Business Model | Encompasses magazines, newspapers, TV, business information, and digital platforms. | $13 billion in revenues and profits. |

| B2B Segment Dominance | Fitch Group and Hearst Health drive profitability. | Over 50% of company profits. |

| Global Footprint | Magazines distributed in 47 countries. | Broad customer base and resilience against localized instability. |

| Brand Recognition | Portfolio of iconic publications and broadcast stations. | Strong brand equity and dedicated audiences. |

What is included in the product

Provides a strategic overview of Hearst’s internal strengths and weaknesses alongside external opportunities and threats.

Provides a clear, actionable framework to identify and address strategic challenges, transforming potential weaknesses into opportunities.

Weaknesses

Despite Hearst's efforts to diversify, its traditional media segments, including newspapers and magazines, along with its stake in A+E Networks, encountered significant headwinds in 2024. These legacy businesses, deeply ingrained in Hearst's identity, felt the pressure of a more challenging advertising landscape and the persistent trend of cord-cutting impacting broadcast revenue. The profitability of these core segments saw a decline, underscoring the ongoing need for strategic adaptation.

This continued reliance on traditional media platforms leaves Hearst susceptible to further market disruptions and demands substantial, sustained investment in digital innovation to counteract revenue erosion. The company's historical strength in these areas, while foundational, now presents a clear vulnerability as consumer habits and advertising spend continue to migrate online.

Hearst's reliance on advertising revenue, especially within its consumer media and cable network divisions, makes it vulnerable to economic slowdowns that often reduce ad spending. For instance, the company anticipates a significant decline in political advertising in 2025 compared to election years, which directly impacts revenue streams.

Furthermore, the ongoing trend of cord-cutting continues to affect A+E Networks, a key part of Hearst's cable portfolio. This shift in consumer behavior away from traditional cable subscriptions poses an ongoing challenge to subscriber-based revenue and necessitates adaptation in content delivery and monetization strategies.

Operating extensive traditional media assets, such as print publications and broadcast stations, inherently involves significant fixed costs. These include expenses related to printing, distribution networks, and the upkeep of physical infrastructure, which can be substantial.

While Hearst continues to invest in modernizing its software platforms and physical infrastructure, these legacy costs remain a drag on profit margins. This is particularly true as revenues from these traditional segments face increasing pressure from digital competition and evolving consumer preferences.

For instance, the print segment, a core part of Hearst's historical operations, saw its revenue decline by approximately 5% year-over-year in the first half of 2024, according to internal financial reports, highlighting the ongoing challenge of high operational costs in a shifting media landscape.

Intense Competition in Digital Media and Tech Ventures

Hearst's digital ventures operate in a highly competitive landscape, contending with established pure-play digital media firms, dominant social media platforms, and tech giants. This intense rivalry for user engagement and advertising revenue is a significant hurdle. For instance, in 2024, the global digital advertising market is projected to reach over $700 billion, with a substantial portion dominated by a few major players, making it difficult for Hearst to capture significant market share.

The digital advertising arena is particularly crowded, with streaming services and social networks leveraging vast amounts of user data to offer sophisticated advertising solutions. This puts pressure on Hearst to innovate and differentiate its offerings to remain competitive and attract advertisers. Maintaining profitability in these saturated digital markets requires continuous investment in technology and content, alongside strategic partnerships.

- Intense Competition: Hearst competes with major tech companies and digital-native media outlets for audience attention and advertising revenue.

- Digital Ad Market Saturation: The digital advertising space is increasingly crowded, with platforms like Google and Meta commanding a significant share.

- Data-Driven Rivals: Streaming platforms and social media giants offer data-rich advertising solutions, creating a competitive disadvantage for less data-intensive players.

- Profitability Challenges: Achieving and sustaining profitability in the fast-evolving and competitive digital media sector remains a significant challenge for Hearst.

Challenges in Digital Traffic and Generative AI Competition

Hearst's traditional media segments, particularly its newspaper and magazine divisions, are facing headwinds from declining search-related traffic. This shift in user behavior directly impacts a key channel for content discovery and advertising revenue. For instance, the ongoing evolution of search algorithms and the rise of alternative information sources continue to challenge established digital traffic patterns for legacy publishers.

The emergence of generative AI presents a dual-edged sword for Hearst. While the company is actively exploring AI for internal efficiency and productivity enhancements, the broader implications for content creation and distribution are significant. Generative AI's ability to produce content at scale and potentially leverage existing proprietary material without direct compensation poses a substantial threat to traditional monetization models, impacting revenue streams that have sustained the business for decades.

- Declining Search Traffic: Newspaper and magazine groups are experiencing a reduction in search-driven audience engagement, a critical component of their digital strategy.

- Generative AI Impact: Competition from generative AI technologies is directly affecting profitability, creating new challenges for content creators and distributors.

- Content Monetization Threats: The potential for AI models to utilize Hearst's proprietary content for their own outputs raises concerns about copyright and the future of paid content models.

- AI as Opportunity and Threat: While Hearst aims to leverage AI for productivity, the disruptive nature of AI in content creation and distribution creates both significant risks and potential avenues for innovation.

Hearst's significant investment in legacy media assets, such as newspapers and magazines, continues to be a drag on profitability. These traditional segments face declining advertising revenue and readership, exacerbated by high operational costs. For example, the print division's revenue dropped approximately 5% year-over-year in the first half of 2024, a trend that persists due to ongoing digital migration.

The company's reliance on advertising revenue, particularly in consumer media and cable networks, makes it vulnerable to economic downturns. The anticipated significant decline in political advertising in 2025, following election cycles, directly impacts revenue streams. Furthermore, cord-cutting continues to erode A+E Networks' subscriber-based income, necessitating costly adaptations.

Hearst faces intense competition in the digital space from tech giants and digital-native firms, making it difficult to capture substantial market share in a saturated advertising market. The rise of generative AI also poses a threat, potentially devaluing proprietary content and challenging traditional monetization models.

Preview Before You Purchase

Hearst SWOT Analysis

The preview you see is the actual Hearst SWOT analysis document you'll receive upon purchase. This ensures you know exactly what you're getting—a comprehensive and professionally structured report. Unlock the full, detailed analysis immediately after completing your purchase.

Opportunities

Hearst can capitalize on consumers' increasing demand for premium digital content. Hearst UK's impressive 25% year-on-year digital subscription growth in 2024 highlights this trend. This demonstrates a clear market appetite for paid digital offerings.

The company's strategic investment in new direct-to-consumer streaming products, like ESPN's planned 2025 service, is a key opportunity to build more stable, recurring revenue. This move aligns with the broader industry shift towards subscription-based models.

Hearst's newspaper division already showcases the success of digital transformation, with digital subscriptions now comprising almost 40% of its revenue. This existing success provides a strong foundation and proven strategy for further expansion into digital subscriptions across other divisions.

Hearst is making significant strides by investing in and training its workforce on generative AI, aiming to boost productivity across various departments including software programming, sales, marketing, data assembly, and HR. Early reports indicate "significant productivity gains," signaling a strong return on this technological investment.

Future growth hinges on leveraging AI for enhanced customer satisfaction and streamlined onboarding processes within its B2B operations. Furthermore, AI presents a prime opportunity to refine subscription offers for its newspaper segments, ensuring more effective customer acquisition and retention.

The strategic deployment of advanced data analytics and AI is key to delivering personalized content, which in turn, can significantly improve user engagement. This enhanced engagement directly translates to a better return on investment for advertisers, creating a virtuous cycle of growth.

Hearst actively seeks strategic acquisitions to bolster its B2B offerings and expand into burgeoning markets. Notable examples from 2024 include the acquisition of QGenda, a leader in healthcare workforce management, and the MotorTrend Group, significantly enhancing its automotive media presence. Looking ahead to 2025, the acquisition of the Dallas Morning News further solidifies its media footprint.

Beyond acquisitions, Hearst leverages strategic partnerships to unlock new revenue streams and broaden content reach. A key 2024 collaboration with OpenAI for content integration exemplifies this approach, aiming to enhance content delivery and explore innovative applications.

Global Market Expansion for Business Information Services

Hearst's strong performance in its B2B segments, especially Fitch Group and Hearst Health, presents a significant opportunity for global market expansion. These specialized services have proven highly profitable domestically, and their proven success suggests considerable potential in untapped international markets.

Fitch Group, in particular, has demonstrated a capacity for global market share gains, fueled by strategic investments in its teams and data capabilities. This track record indicates a fertile ground for continued international growth in both financial and healthcare information services.

- Fitch Group's Global Reach: Continued expansion into new international markets for financial data and analytics services.

- Hearst Health Internationalization: Leveraging the success of Hearst Health to offer specialized healthcare information solutions globally.

- B2B Segment Growth: Capitalizing on the established profitability of existing B2B segments for further international revenue generation.

- Data and Team Investment: Replicating successful investment strategies in global teams and data infrastructure to support expansion.

Monetization of Niche Content and Communities through Multi-Platform Strategies

Hearst possesses a treasure trove of niche publications and content verticals, ripe for enhanced monetization. By developing specialized events, offering premium content tiers, and employing multi-platform strategies, Hearst can tap into these dedicated audiences for new revenue streams beyond traditional advertising. For example, MotorTrend's successful engagement through events and community building demonstrates a clear path to unlocking these untapped opportunities.

The strategic expansion of Hearst Global Solutions is designed to cater more effectively to the evolving global advertising landscape. This initiative aims to leverage Hearst's extensive reach across its 260 magazine editions and 200 websites to provide advertisers with integrated solutions. This focus on global advertiser needs directly supports the monetization of niche content by creating a more robust and attractive advertising ecosystem.

- Monetization Potential: Hearst's diverse portfolio of niche content, including titles like Car and Driver and Delish, offers significant opportunities for generating revenue through specialized events and premium subscription models.

- Global Reach: With over 260 magazine editions and 200 websites globally, Hearst Global Solutions is positioned to attract international advertisers seeking to reach specific, engaged demographics within these niche communities.

- Brand Extension: Brands like HGTV Magazine and Food Network Magazine can extend their reach beyond print and digital by hosting branded events, workshops, and online courses, creating new revenue streams and deepening community engagement.

- Digital Growth: In 2023, Hearst's digital advertising revenue saw continued growth, reflecting the increasing effectiveness of multi-platform strategies in monetizing content across various digital touchpoints.

Hearst is well-positioned to leverage the growing consumer demand for premium digital content, as evidenced by Hearst UK's 25% year-on-year digital subscription growth in 2024. The company's strategic investments in direct-to-consumer streaming, such as ESPN's planned 2025 service, aim to build stable, recurring revenue streams, aligning with industry shifts. Furthermore, Hearst's newspaper division, where digital subscriptions now account for nearly 40% of revenue, provides a proven model for digital expansion across its portfolio.

The company's proactive investment in generative AI training across departments like programming, sales, and marketing is yielding significant productivity gains, signaling a strong return on technology adoption. This AI integration is expected to enhance customer satisfaction and streamline onboarding in B2B operations, while also refining subscription offers for newspaper segments to improve acquisition and retention. By deploying advanced data analytics and AI, Hearst can deliver personalized content, boosting user engagement and advertiser ROI.

Hearst's strategic acquisition strategy continues to strengthen its B2B offerings and expand into new markets, with notable 2024 acquisitions including QGenda and the MotorTrend Group, followed by the Dallas Morning News acquisition in 2025. These moves, coupled with strategic partnerships like the 2024 collaboration with OpenAI, aim to unlock new revenue streams and broaden content reach. The company's strong B2B segments, Fitch Group and Hearst Health, are prime candidates for global market expansion, building on their proven domestic profitability and capacity for international growth.

Hearst's diverse portfolio of niche publications offers substantial opportunities for enhanced monetization through specialized events, premium content tiers, and multi-platform strategies, as demonstrated by MotorTrend's successful community engagement. Hearst Global Solutions is expanding to cater to the evolving global advertising landscape, leveraging its extensive reach across 260 magazine editions and 200 websites to offer integrated solutions to advertisers. This focus directly supports the monetization of niche content by creating a more robust advertising ecosystem.

| Opportunity Area | Key Initiative/Data Point | Projected Impact |

|---|---|---|

| Digital Content Demand | Hearst UK: 25% YoY digital subscription growth (2024) | Increased recurring revenue from premium digital offerings. |

| Direct-to-Consumer Streaming | ESPN Service Launch (2025) | Expansion into stable, subscription-based revenue models. |

| AI Integration | Reported "significant productivity gains" in early AI adoption | Enhanced operational efficiency and improved customer engagement. |

| Strategic Acquisitions | Acquisition of QGenda (2024), MotorTrend Group (2024), Dallas Morning News (2025) | Strengthened B2B offerings and expanded market presence. |

| Niche Content Monetization | MotorTrend's event and community engagement success | New revenue streams via specialized events and premium content. |

Threats

The persistent migration of consumers away from print publications and scheduled television programming towards digital and on-demand content presents a significant challenge for Hearst. This trend, often termed cord-cutting, directly impacts revenue for segments like A+E Networks, forcing a continuous pivot towards digital engagement and content creation.

In 2024, the decline in traditional media consumption is a well-documented reality. For instance, print advertising revenue for many media companies has seen consistent year-over-year decreases, with some reporting drops exceeding 10% annually. This secular shift demands substantial and ongoing investment in Hearst's digital infrastructure and content strategies to offset potential revenue erosion.

Hearst faces a significant threat from digital-first companies and tech giants like Google and Meta, which increasingly capture audience attention and advertising budgets. These agile players often operate with leaner cost structures and faster innovation cycles, putting pressure on traditional media companies.

In 2024, the digital advertising market, where Hearst competes fiercely, is projected to reach over $680 billion globally, a substantial portion of which is concentrated among a few major tech platforms. This intense competition can compress Hearst's profit margins as they strive to maintain market share and attract advertisers in a crowded digital space.

Evolving regulations concerning data privacy and content moderation, coupled with potential antitrust actions against major media and tech entities, present significant challenges. These shifts could lead to increased compliance expenses and limitations on Hearst's capacity to gather and leverage user data, impacting its advertising revenue streams and digital expansion plans.

Navigating this increasingly complex legal landscape is crucial, especially as global data protection laws like GDPR and CCPA continue to shape digital operations. For instance, the ongoing scrutiny of Big Tech's market dominance by regulators in the US and EU could set precedents affecting all digital platforms, including Hearst's online properties.

Economic Downturns and Advertising Market Volatility

Hearst's significant reliance on advertising revenue exposes it to the direct impact of economic downturns. When the economy falters, businesses often slash marketing budgets, which directly translates to reduced ad spending on Hearst's platforms. This vulnerability was underscored by a warning from the CEO regarding a projected 'massive drop off' in political advertising in 2025, alongside expectations of a generally more challenging advertising market.

The volatility in the advertising market, exacerbated by economic instability, poses a substantial threat to Hearst's financial performance. A slowdown in ad spending can lead to immediate revenue declines, impacting profitability. For instance, a general economic contraction could see a significant pullback in corporate advertising, a key revenue stream for many media companies.

- Economic Downturn Impact: Reduced consumer spending and business investment during recessions typically lead to decreased advertising expenditures across all sectors.

- Political Advertising Fluctuation: The cyclical nature of political campaigns means that years with fewer major elections, like post-2024, can see sharp declines in this high-value advertising segment.

- Market Sensitivity: Hearst's diverse media portfolio, from magazines to digital platforms, means it's susceptible to shifts in advertiser sentiment driven by broader economic indicators.

Technological Disruption from Generative AI and Content Monetization Challenges

Hearst faces a significant threat from the rapid advancement of generative AI, particularly in content creation and distribution. While Hearst is exploring AI for internal productivity, the external impact on its core businesses is a concern. For instance, the potential for AI-generated content to displace human-created content in search results could lead to substantial losses in traffic, impacting advertising revenue. As of early 2024, industry analysts project that AI could disrupt search engine results pages, potentially shifting user behavior away from traditional publisher websites.

A major challenge for Hearst is the difficulty in securing fair compensation for its vast library of proprietary content, which is increasingly being used to train generative AI models. This raises questions about intellectual property rights and the sustainability of content monetization strategies in an AI-driven landscape. Without clear frameworks for content licensing and usage, Hearst risks seeing its valuable assets devalued or exploited without adequate return. The ongoing debate around AI training data and copyright is expected to intensify throughout 2024 and 2025.

- Search Traffic Erosion: Generative AI's ability to provide direct answers could reduce click-through rates to publisher sites, impacting Hearst's digital advertising revenue.

- Content Monetization Gap: The lack of established models for compensating content used in AI training poses a financial risk to Hearst's intellectual property.

- Business Model Obsolescence: Existing Hearst business models, reliant on traditional content distribution and advertising, could be undermined by AI-driven alternatives.

- Competitive Landscape Shift: New AI-native platforms could emerge as significant competitors, challenging Hearst's established market position.

Hearst faces intense competition from agile digital-first companies and tech giants like Google and Meta, which increasingly dominate audience attention and advertising spend. In 2024, the global digital advertising market, projected to exceed $680 billion, is largely captured by a few major tech platforms, intensifying competition and potentially compressing Hearst's profit margins.

The company's substantial reliance on advertising revenue makes it vulnerable to economic downturns, with businesses often cutting marketing budgets during recessions. A projected significant drop in political advertising in 2025, alongside a generally challenging advertising market, underscores this threat.

The rapid advancement of generative AI presents a dual threat: AI-generated content could erode search traffic to Hearst's sites, impacting ad revenue, while the use of Hearst's proprietary content to train AI models without fair compensation raises concerns about intellectual property and future monetization.

Evolving data privacy regulations and potential antitrust actions could increase compliance costs and limit Hearst's ability to leverage user data, impacting its digital expansion and advertising revenue streams.

SWOT Analysis Data Sources

This analysis draws from a robust blend of sources, including Hearst's official financial filings, comprehensive market research reports, and expert industry commentary to provide a well-rounded and accurate strategic overview.