Hearst Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hearst Bundle

Understanding Hearst's competitive landscape through Porter's Five Forces reveals the intricate web of industry pressures it navigates. From the bargaining power of its suppliers to the ever-present threat of new entrants, each force plays a critical role in shaping its market position.

This snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hearst’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Hearst's reliance on a broad base of journalists and content creators means that for many, individual bargaining power is low. However, highly sought-after talent, particularly those with specialized expertise or a strong personal brand, can negotiate more favorable terms. For instance, a prominent investigative journalist with a proven track record of exclusive stories could leverage their unique skills to command higher fees or better contract conditions.

Technology and software providers hold a moderate level of bargaining power over Hearst. This is largely due to the significant switching costs associated with enterprise software, cloud services, and specialized media production tools that Hearst relies on for its diverse operations, from content creation to advertising. For instance, migrating complex content management systems or advertising platforms can be a costly and time-consuming endeavor.

The criticality of these technological offerings to Hearst's core business functions, including its digital ventures and business information services, further strengthens the suppliers' position. As of early 2024, major cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud continue to dominate the market, with companies like Hearst often entering into multi-year contracts for their services, reflecting the integrated nature of these partnerships.

Hearst's strategic response to mitigate this supplier power includes substantial investments in developing its own internal technology capabilities and expanding its digital businesses. This proactive approach aims to reduce reliance on external vendors for key technological infrastructure and software solutions, thereby potentially lowering future switching costs and enhancing negotiation leverage.

For Hearst's traditional magazine and newspaper operations, printing companies and paper suppliers hold significant sway. Their bargaining power is influenced by factors such as the cost of paper pulp, which saw significant volatility in 2024 due to global supply chain issues and demand shifts, and the degree of consolidation within the printing industry. Hearst's large order volumes can offer some negotiation leverage, but the overall trend towards digital media may be gradually reducing the suppliers' long-term power.

Distribution Networks (Digital and Physical)

Hearst's reliance on distribution networks, both digital and physical, significantly influences supplier bargaining power. For digital content, internet service providers (ISPs) and cloud infrastructure providers hold considerable sway. While the ISP market is somewhat fragmented, major players can exert influence over delivery costs and accessibility.

In the realm of print, the bargaining power of physical distribution networks can be substantial. Consolidation among logistics providers, particularly for local and regional delivery of newspapers and magazines, can lead to increased costs and reduced flexibility for publishers like Hearst. For instance, a 2023 industry report indicated that the top three logistics firms in several key US markets controlled over 70% of the print distribution capacity, giving them significant leverage.

- Digital Distribution: ISPs and cloud service providers possess high bargaining power due to essential infrastructure provision.

- Physical Distribution: Consolidation in logistics networks for print media grants suppliers significant leverage, impacting Hearst's operational costs.

- Market Concentration: In specific local markets, a limited number of print distributors can dictate terms, increasing supplier power.

Advertising Technology (AdTech) Providers

Advertising technology (AdTech) providers hold considerable bargaining power over Hearst, given the company's substantial reliance on advertising revenue. These platforms are crucial for effective ad targeting, delivery, and performance measurement in the digital landscape. As digital advertising becomes more sophisticated, with advancements in programmatic buying, data analytics, and AI, the leverage of AdTech firms increases.

The increasing demand for specialized AdTech solutions, such as those offering advanced audience segmentation or real-time bidding optimization, allows providers to command higher fees. For instance, the global AdTech market was valued at approximately $70 billion in 2023 and is projected to grow significantly, indicating strong demand and potential pricing power for key players. This trend means that companies like Hearst must navigate these relationships carefully to ensure cost-effectiveness and optimal campaign performance.

While AdTech providers possess strong leverage, Hearst actively works to mitigate this through strategic initiatives. The development of its own advertising platform, Aura, is a direct effort to bring more control and efficiency in-house. By investing in proprietary technology, Hearst aims to reduce its dependence on third-party AdTech solutions, thereby rebalancing the bargaining power dynamic and potentially capturing more value from its advertising operations.

- High reliance on AdTech: Hearst's significant advertising revenue necessitates dependence on AdTech for targeting, delivery, and measurement.

- Growing AdTech complexity and importance: Advancements in programmatic advertising, data analytics, and AI empower AdTech providers.

- Market growth fuels provider power: The expanding AdTech market, valued in the tens of billions, suggests strong demand and pricing leverage for key providers.

- Hearst's counter-strategy: Development of proprietary platforms like Aura aims to reduce reliance and rebalance bargaining power.

Suppliers of essential content, like freelance journalists or specialized content agencies, can exert significant bargaining power, especially if they possess unique skills or a strong brand. For Hearst, this means that while many individual contributors have limited leverage, highly sought-after talent can negotiate better terms, impacting content acquisition costs.

The bargaining power of technology and software providers remains a key consideration for Hearst. The substantial investment and complexity involved in switching enterprise software, cloud services, and media production tools mean these suppliers hold considerable sway. For instance, major cloud providers like AWS and Microsoft Azure, which Hearst likely utilizes for its digital operations, often secure multi-year contracts, reflecting their integral role and the associated switching costs.

Printing and paper suppliers continue to influence Hearst's traditional media operations. The cost of raw materials, such as paper pulp, experienced volatility in 2024 due to global supply chain disruptions. While Hearst's large order volumes provide some negotiation leverage, the ongoing shift toward digital platforms may gradually diminish the long-term power of these suppliers.

Hearst's strategic response involves investing in internal technology development and expanding its digital businesses to reduce reliance on external vendors and mitigate supplier power.

What is included in the product

This analysis dissects the competitive forces shaping Hearst's industry, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors to inform strategic decision-making.

Instantly visualize competitive intensity with a dynamic, interactive dashboard, eliminating the guesswork in strategic planning.

Customers Bargaining Power

Advertisers, particularly major corporations and advertising agencies, hold considerable sway over media entities such as Hearst. This leverage stems from the sheer volume of advertising spend they control and their ability to shift budgets across a fragmented media landscape.

The advertising market in 2024 is characterized by intense competition, with digital platforms, social media, and even emerging generative AI solutions offering advertisers numerous channels to reach consumers. This abundance of choice empowers advertisers to negotiate more favorable terms, including lower ad rates and enhanced targeting capabilities, putting pressure on media companies to demonstrate clear ROI.

Individual subscribers to Hearst's publications, like magazines and newspapers, typically hold limited bargaining power. The cost of a single subscription is often modest, and the perceived value of the content from one subscriber's perspective is generally not enough to sway Hearst's pricing. For instance, a single digital subscription might range from $5 to $20 per month, a small amount in the grand scheme of household budgets.

However, this dynamic shifts when considering subscribers collectively. As consumers increasingly experience subscription fatigue and have access to a vast ocean of free online content, their combined influence grows. This trend forces companies like Hearst to be more strategic with their pricing, potentially offering bundled services or more flexible subscription tiers to retain customers. In 2024, the average consumer was subscribed to over 12 paid digital services, highlighting this growing saturation and the power of the collective consumer voice.

Hearst's significant stake in cable television networks and content syndication places large cable operators and other distributors in a powerful customer position. These distributors wield substantial bargaining power due to their immense scale, their capacity to bundle various services, and their direct connection to a vast subscriber base.

The increasing prevalence of cord-cutting, where consumers abandon traditional cable subscriptions for streaming services, further amplifies the leverage held by these distributors. As traditional TV viewership continues to shrink, cable operators become even more critical for content providers like Hearst, giving them greater negotiating strength in carriage agreements and content licensing.

For instance, in 2023, the number of U.S. households subscribing to traditional pay-TV services continued its downward trend, with estimates suggesting a decline of around 2.5 million households annually. This ongoing shift underscores the growing influence of distributors who can dictate terms more effectively in a shrinking market.

Businesses (for Business Information Services)

Hearst's substantial business information services, encompassing entities like Fitch Group and Hearst Health, cater to a business-to-business (B2B) clientele. These customers, frequently large corporations, wield moderate to significant bargaining power.

These B2B clients typically demand highly specialized, high-value data and sophisticated software solutions. Their procurement processes are often characterized by long-term commitments, but they are underpinned by rigorous evaluation and negotiation, heavily influenced by their expected return on investment and the competitive landscape of available solutions.

- Customer Concentration: Large enterprise clients, often few in number relative to the total customer base, can exert considerable influence due to the volume of their purchases.

- Switching Costs: While integration of specialized data and software can create switching costs, clients may still have alternatives or the ability to develop in-house solutions if pricing or service levels become unfavorable.

- Information Availability: B2B customers in this sector are generally well-informed about market offerings and pricing, enabling them to negotiate effectively.

- Price Sensitivity: The high cost of specialized information services means customers are often sensitive to price, especially when assessing the direct impact on their own profitability.

Digital Platforms and Aggregators

Major digital platforms and aggregators like Google News and social media have become gatekeepers for content consumption, significantly increasing their bargaining power over publishers. These platforms dictate terms for content visibility, revenue splits, and data utilization, impacting how companies like Hearst reach their audiences.

In 2024, digital advertising revenue continues to be heavily influenced by these platforms, with a substantial portion of ad spend flowing through them. For instance, Google and Meta (Facebook/Instagram) consistently capture over half of the global digital ad market. This concentration of audience access means publishers have limited leverage in negotiating favorable terms.

- Audience Concentration: Platforms control access to billions of users, making direct publisher-to-consumer relationships more challenging.

- Revenue Sharing Models: Aggregators often take a significant cut of advertising revenue generated from publisher content.

- Data Control: Platforms gather extensive user data, which they can leverage in negotiations and for their own advertising services.

- Content Syndication Terms: Publishers must often accept platform-defined terms for content syndication and display.

Hearst's strategic partnerships, including those with AI companies like OpenAI in 2024, underscore the necessity of adapting to this evolving digital landscape and finding new ways to monetize content amidst the dominance of these powerful intermediaries.

The bargaining power of customers is a critical factor in Hearst's operating environment, influencing pricing, content distribution, and advertising revenue. This power varies significantly across different customer segments, from large corporate advertisers to individual subscribers and major distributors.

Advertisers, especially large corporations, hold substantial leverage due to their significant advertising budgets and the availability of numerous media channels in 2024. This allows them to negotiate lower ad rates and better targeting, pressuring media companies to prove return on investment.

While individual subscribers have limited power alone, their collective influence is growing due to subscription fatigue and the abundance of free online content, forcing companies like Hearst to offer more flexible pricing and bundled services.

Major distributors of Hearst's content, such as cable operators, possess considerable bargaining power due to their scale and direct access to a vast subscriber base, further amplified by the ongoing trend of cord-cutting.

| Customer Segment | Bargaining Power | Key Factors Influencing Power | Impact on Hearst |

| Advertisers (Major Corporations) | High | Large ad spend volume, fragmented media landscape, demand for ROI | Pressure on ad rates, need for performance metrics |

| Subscribers (Individual) | Low (individually) / Moderate (collectively) | Subscription fatigue, availability of free content, price sensitivity | Need for competitive pricing, bundled offerings, retention strategies |

| Distributors (Cable Operators) | High | Scale, bundling capabilities, direct subscriber access, cord-cutting trend | Negotiation strength in carriage agreements, content licensing terms |

| B2B Clients (Business Information Services) | Moderate to High | Demand for specialized data, long-term commitments, rigorous evaluation, price sensitivity | Negotiation on pricing and service levels for data and software solutions |

| Digital Platforms/Aggregators | Very High | Audience concentration, revenue sharing models, data control, platform-defined terms | Limited leverage in content visibility, revenue splits, and data utilization |

Preview the Actual Deliverable

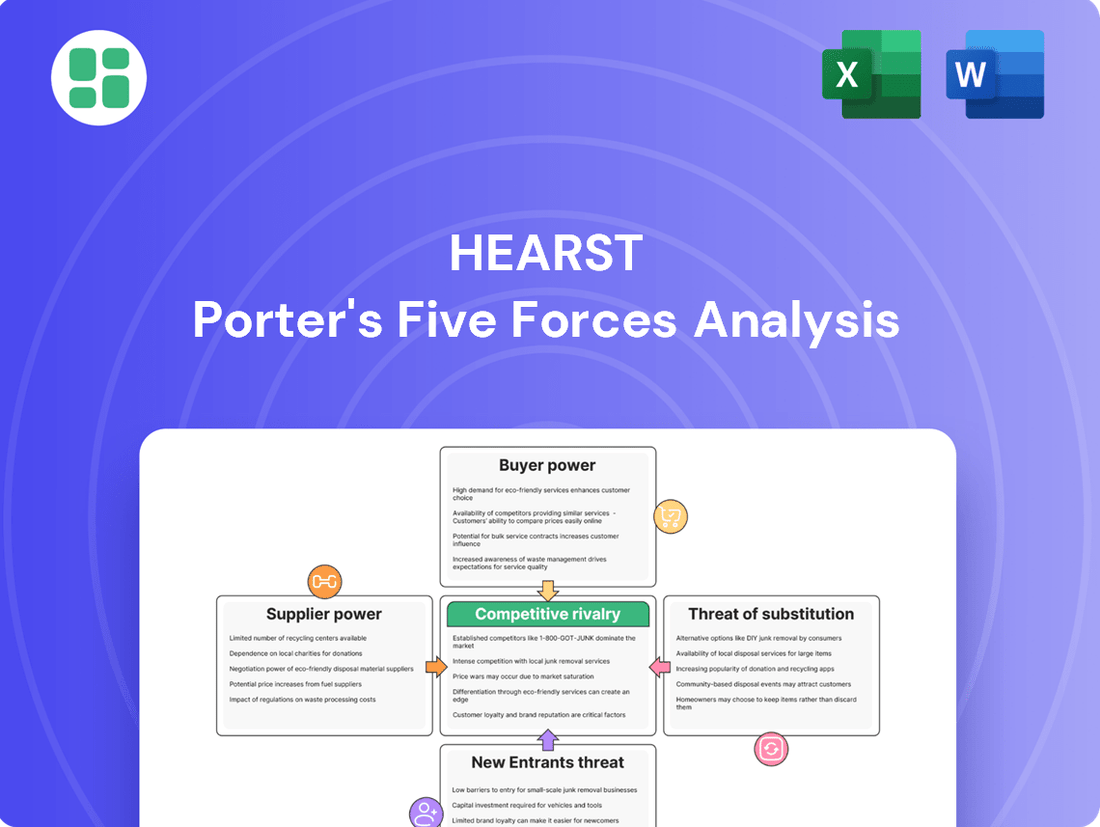

Hearst Porter's Five Forces Analysis

This preview showcases the exact Hearst Porter's Five Forces Analysis you will receive immediately after purchase, providing a comprehensive understanding of the competitive landscape. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within Hearst's industry. This meticulously prepared document is ready for your immediate use, offering actionable intelligence without any surprises or placeholders.

Rivalry Among Competitors

Hearst operates in a highly competitive landscape, facing significant rivalry from other major diversified media conglomerates such as Disney, Warner Bros. Discovery, and Paramount Global. These giants vie for market share across television, magazines, and digital media, frequently utilizing their vast content archives and synergistic promotional strategies to gain an edge.

The competition is particularly acute in securing advertising revenue and capturing audience engagement. For instance, in 2024, the advertising market continued to be a battleground, with these conglomerates investing heavily in content and distribution to attract both viewers and advertisers. Warner Bros. Discovery, for example, has been strategically integrating its various content platforms to enhance its appeal to advertisers and consumers alike.

Digital-first media companies and startups present a dynamic competitive force. These agile players, unburdened by legacy infrastructure, can quickly capture audience attention with specialized content and novel distribution methods. For instance, in 2024, the digital advertising market continues its robust growth, with global digital ad spending projected to reach over $700 billion, a significant portion of which is captured by these nimble competitors.

Their lower overheads allow for rapid adaptation to evolving consumer tastes, particularly among younger demographics. This agility directly challenges Hearst's established media properties, as these startups often excel at engaging audiences through social media platforms and personalized content delivery, areas where traditional media can sometimes lag.

Tech titans like Google, Meta, and Amazon represent intense competition for Hearst in the advertising sector, a crucial revenue source. These giants leverage massive user data and sophisticated targeting tools, offering unparalleled digital reach that directly challenges traditional media. For instance, Google's advertising revenue alone reached approximately $237.8 billion in 2023, highlighting the scale of their dominance.

This intense rivalry forces companies like Hearst to continuously enhance their advertising products and strategies to remain competitive. The sheer volume of advertising spending captured by these platforms, estimated to be over 60% of the US digital ad market in 2024, underscores the pressure on legacy media to innovate and demonstrate unique value to advertisers.

Local and Niche Media Outlets

While Hearst boasts a substantial portfolio of local newspapers and television stations, it contends with robust competition from smaller, independent local news organizations. These entities often possess stronger community connections and can be more agile in responding to local needs, presenting a direct challenge to Hearst's market share in specific geographic areas.

Furthermore, highly specialized niche media outlets represent another significant competitive force. These outlets cater to very specific interests, cultivating dedicated audiences that may be less receptive to the broader content offered by Hearst's generalist local media. For instance, a local business journal focusing exclusively on the tech startup scene in a particular city could draw away a valuable segment of Hearst's readership.

- Community Focus: Independent local outlets often leverage deep community ties, fostering loyalty that larger corporations may struggle to replicate.

- Niche Specialization: Highly specialized media capture dedicated audiences by catering to specific interests, fragmenting the broader media market.

- Agility: Smaller competitors can often adapt more quickly to changing local market dynamics and reader preferences than larger, more established organizations.

Content Streaming and Social Media Platforms

The competitive rivalry in content streaming and social media is intense, directly siphoning consumer attention away from traditional media like Hearst's television and digital properties. Services such as Netflix, Disney+, and Max, alongside social platforms like TikTok and YouTube, are vying for finite viewer hours. This dynamic forces companies like Hearst to adapt by significantly investing in their own streaming and digital content creation to remain relevant.

In 2024, the streaming wars continue to heat up, with major players investing billions in original content. For instance, Netflix reported spending over $17 billion on content in 2023, a figure expected to remain robust in 2024. Similarly, social media platforms are increasingly sophisticated in their content delivery and user engagement strategies. TikTok, for example, saw its global user base surpass 1.5 billion active users by early 2024, demonstrating its powerful draw on audience attention.

- Audience Fragmentation: Consumers now have an overwhelming number of choices for entertainment, diluting the audience for any single provider.

- Content Investment: Streaming services and social media platforms consistently outspend traditional media on content creation and acquisition.

- User Engagement: Social media platforms excel at capturing and retaining user attention through interactive and personalized experiences.

- Digital Dominance: The shift towards digital consumption means that companies not prioritizing their digital and streaming offerings risk losing market share.

Hearst faces intense competition from established media giants like Disney and Warner Bros. Discovery, who leverage extensive content libraries and integrated platforms to capture audience and advertising revenue. Digital-first companies and agile startups also pose a significant threat, quickly adapting to consumer preferences with specialized content and efficient digital strategies, as evidenced by the projected over $700 billion global digital ad spending in 2024.

Tech titans such as Google and Meta dominate the digital advertising space, commanding a substantial share of ad budgets with their data-driven targeting capabilities, with Google's 2023 ad revenue alone reaching approximately $237.8 billion. Furthermore, streaming services like Netflix, investing billions in content, and social media platforms like TikTok, with over 1.5 billion users by early 2024, fragment audience attention and compel traditional media to significantly enhance their digital and streaming offerings.

| Competitor Type | Key Strengths | Impact on Hearst |

|---|---|---|

| Diversified Media Conglomerates | Vast content archives, synergistic promotion | Direct competition for audience and advertising |

| Digital-First Companies & Startups | Agility, specialized content, lower overheads | Capture niche audiences, challenge legacy models |

| Tech Titans (Google, Meta) | Massive user data, sophisticated targeting | Dominance in digital advertising revenue |

| Streaming Services & Social Media | High content investment, user engagement | Audience fragmentation, demand for digital innovation |

SSubstitutes Threaten

The proliferation of free online content, including user-generated media on platforms like YouTube and TikTok, presents a substantial threat of substitutes for traditional media outlets. Consumers can readily access news, entertainment, and information without incurring costs, directly impacting the willingness to pay for premium content. For instance, in 2024, the average daily time spent on YouTube by users globally exceeded 30 minutes, showcasing the immense reach of free video content.

Social media platforms are now a dominant force for news and entertainment, particularly among younger generations. This shift directly impacts traditional media like Hearst, as users increasingly favor the personalized and interactive nature of platforms like TikTok and Instagram. In 2024, a significant portion of Gen Z and Millennials reported social media as their primary news source, diverting advertising revenue that historically supported print and broadcast media.

The rise of direct-to-consumer (DTC) streaming services like Netflix, Disney+, and Max presents a significant threat to Hearst's traditional television and cable network businesses, such as A+E Networks and ESPN. These platforms offer consumers a compelling alternative to linear TV by providing on-demand content, often with flexible subscription models.

Consumers are increasingly opting for streaming, a trend known as cord-cutting, which directly impacts Hearst's revenue streams from traditional broadcast and cable advertising and subscriptions. In 2023, the number of U.S. households that had cut the cord on traditional pay TV reached approximately 60 million, highlighting a substantial shift in viewing habits.

AI-Generated Content and Personalized Feeds

The increasing sophistication of generative AI presents a significant threat by enabling the creation of text, images, and videos, often at a reduced cost and accelerated pace compared to traditional methods. This capability directly challenges established content creation workflows.

AI-powered personalized content feeds and aggregators are emerging as potent substitutes for traditional, curated media. These platforms can tailor content delivery to individual user preferences, potentially diminishing the perceived value of professionally edited and fact-checked journalism, a core offering of companies like Hearst.

This shift could erode Hearst's position as a trusted source, as AI-generated content, while potentially less nuanced, can be produced at scale and with high personalization. For instance, in 2024, the generative AI market saw substantial growth, with investments pouring into platforms capable of creating various media formats, indicating a clear trend towards AI-driven content production.

- AI Content Generation: Generative AI can produce diverse media, potentially at lower costs than human creators.

- Personalized Feeds: AI-driven aggregation offers tailored content, competing with curated media.

- Challenge to Authority: These AI capabilities could devalue traditional journalism and established media brands.

- Market Growth: The generative AI sector experienced significant investment and expansion throughout 2024.

Alternative Business Information Sources

In Hearst's B2B segments, such as Fitch Group and Hearst Health, the threat of substitutes is a significant consideration. Businesses can opt for developing their own in-house research departments, engaging specialized consulting firms, or leveraging readily available open-source data as alternatives to Hearst's premium information services.

While Hearst's offerings are distinguished by deep industry expertise and proprietary data sets, the cost-effectiveness and perceived value proposition are critical. If these diminish, companies might pivot to less expensive or more tailored solutions. For instance, in 2024, the global market for business intelligence software, a potential substitute for some of Hearst's data products, was projected to reach over $30 billion, indicating a robust competitive landscape.

- In-house Research: Companies may build internal teams to gather and analyze data, reducing reliance on external providers.

- Specialized Consulting Firms: Niche consultants can offer bespoke analysis and insights, sometimes at a more competitive price point for specific needs.

- Open-Source Data: The increasing availability and quality of free data sources present a low-cost alternative for basic information gathering.

- Cost-Benefit Analysis: Businesses regularly weigh the expense of Hearst's services against the tangible benefits derived, especially when budget constraints are present.

The threat of substitutes for Hearst is substantial, driven by the widespread availability of free digital content and evolving consumer behaviors. Platforms offering user-generated content and social media channels now serve as primary sources for news and entertainment, directly competing with traditional media outlets. This shift diverts advertising revenue and audience attention, impacting Hearst's established business models.

Entrants Threaten

The digital content landscape presents a significant threat of new entrants due to remarkably low barriers to entry. Startups can leverage readily available online publishing tools and social media platforms, requiring minimal upfront capital to launch and distribute content. This ease of access allows new players to quickly emerge and vie for audience attention and advertising dollars, especially within specialized or niche markets.

Tech giants like Apple, Amazon, and Google represent a significant threat to traditional media companies. These companies possess immense financial muscle, with Apple alone reporting over $383 billion in revenue for fiscal year 2023, and established user bases that can be leveraged for new media ventures.

Their ability to invest heavily in content creation and distribution, coupled with sophisticated technological infrastructure, allows them to quickly capture market share. For instance, Amazon's Prime Video has rapidly become a major player in streaming, challenging incumbents.

The burgeoning creator economy presents a significant threat of new entrants for traditional media companies. Independent content creators, from YouTubers to podcasters, can now build substantial audiences and monetize their platforms directly, often bypassing established media channels entirely.

This shift is fueled by accessible technology and social media platforms, allowing individuals to become media entities. For instance, in 2024, the global creator economy was projected to reach hundreds of billions of dollars, with platforms like Patreon and Substack enabling creators to earn millions through direct fan support, diverting advertising and subscription revenue that once flowed to legacy media.

Niche Streaming and Hyper-local Platforms

New entrants are increasingly targeting niche streaming services and hyper-local platforms, carving out distinct market segments. These specialized players can offer highly curated content, appealing to specific audience interests that broader platforms might not fully address. For instance, niche sports streaming services or platforms focused on regional news and culture can build strong, loyal communities.

This trend presents a significant threat as these smaller, agile competitors can attract dedicated user bases. By focusing on underserved niches, they can achieve profitability without needing the massive scale of established players. For a company like Hearst, which operates across various media segments, this means facing competition not just from other large entities but also from a growing number of highly specialized digital-native companies.

- Niche Focus: New entrants can target specific content genres (e.g., documentaries, indie films, specific sports) or demographic groups, offering a more tailored experience than generalist platforms.

- Hyper-local Appeal: Platforms focusing on local news, events, and culture can build strong community ties, attracting users who seek relevant, geographically specific content.

- Community Building: Specialized platforms often foster strong user engagement through interactive features, forums, and exclusive content, creating a loyal subscriber base.

- Agility and Innovation: Smaller entrants can often adapt more quickly to changing consumer preferences and technological advancements compared to larger, more bureaucratic organizations.

AI-Powered Content Generation Platforms

The emergence of sophisticated AI-powered content generation platforms presents a significant threat of new entrants within the media industry. These platforms can democratize content creation, allowing individuals or smaller entities to produce professional-grade media at a fraction of the traditional cost and time. For example, generative AI models are rapidly advancing, with companies like OpenAI and Google investing heavily in their development, potentially lowering the barrier to entry for content production.

This influx of easily generated content could lead to a commoditization of traditional media, forcing established players to re-evaluate their production workflows and business models. The market may see a shift towards AI-driven media services, where the emphasis is on curation, distribution, and unique human insight rather than solely on original content creation. By 2024, the AI content generation market is projected to grow substantially, indicating the increasing viability of these new entrants.

- AI's Content Creation Capability: AI can now generate text, images, and even video, enabling rapid and low-cost media production.

- Market Flooding Risk: The ease of creation by AI could lead to an oversupply of content, diminishing the value of traditional media.

- Disruption of Workflows: Established media companies may face pressure to adopt AI to remain competitive, altering existing production processes.

- New Business Models: Opportunities may arise for services that leverage AI for content personalization, optimization, or unique interactive experiences.

The threat of new entrants in the digital content space remains high due to accessible technology and the rise of the creator economy. Independent creators, leveraging platforms like YouTube and TikTok, can build substantial audiences and monetize directly, bypassing traditional media. In 2024, the global creator economy was projected to be worth hundreds of billions of dollars, with platforms like Patreon and Substack enabling creators to earn millions, directly impacting revenue streams for established companies.

Tech giants like Apple and Amazon also pose a significant threat. Apple's fiscal year 2023 revenue exceeded $383 billion, and their established user bases and financial capacity allow for rapid market capture in new media ventures, as seen with Amazon's Prime Video challenging streaming incumbents.

Furthermore, AI-powered content generation is lowering production costs and barriers to entry. Companies are investing heavily in generative AI, potentially leading to a commoditization of traditional media and a shift towards AI-driven services by 2024.

| New Entrant Type | Key Advantage | Impact on Traditional Media | Example/Data Point |

|---|---|---|---|

| Independent Creators | Direct audience engagement, niche appeal | Revenue diversion, audience fragmentation | Creator economy projected to reach hundreds of billions in 2024 |

| Tech Giants (e.g., Apple, Amazon) | Vast financial resources, existing user base | Market disruption, increased competition | Apple's FY2023 revenue: over $383 billion |

| AI Content Platforms | Low-cost, rapid content creation | Content commoditization, workflow disruption | Significant investment in generative AI development |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating financial statements, industry-specific market research reports, and publicly available competitor disclosures to provide a comprehensive view of the competitive landscape.