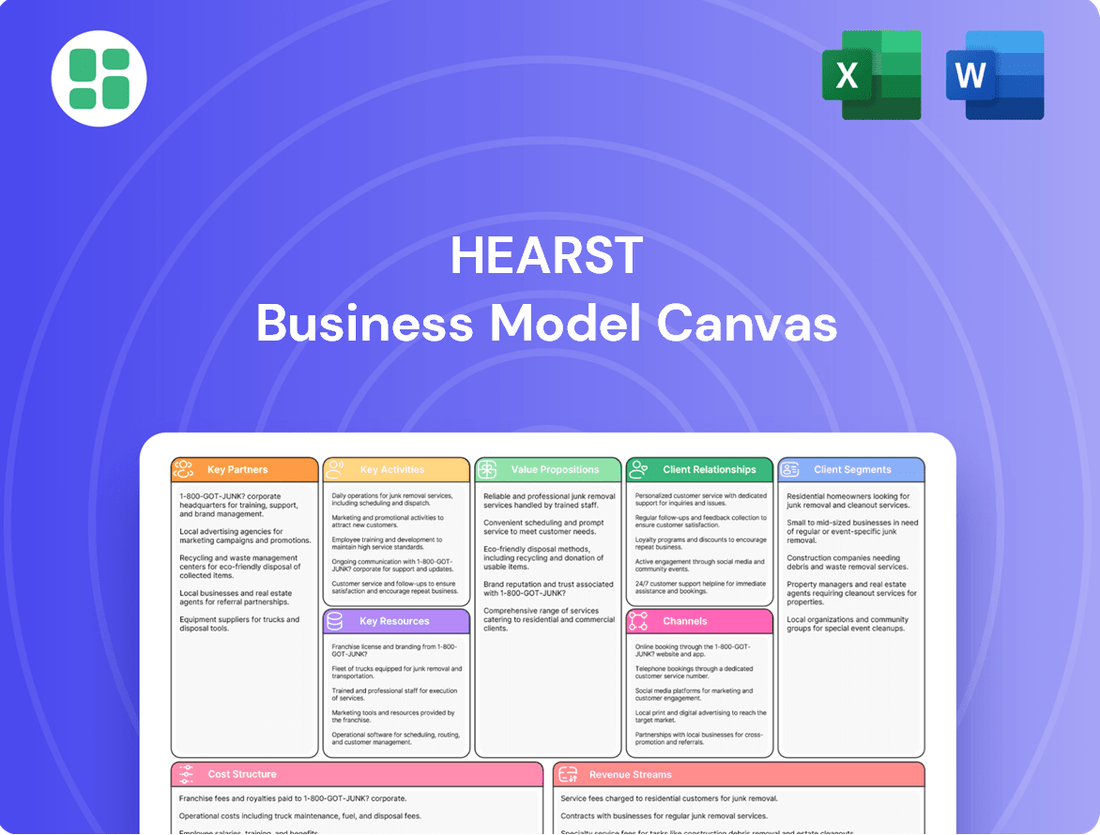

Hearst Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hearst Bundle

Explore the intricate workings of Hearst's empire with our comprehensive Business Model Canvas. This detailed breakdown reveals the core components that fuel their diverse media and information businesses, from their key partners to their revenue streams.

Gain a strategic advantage by understanding how Hearst creates and delivers value across its vast portfolio. This in-depth canvas is your roadmap to dissecting their success, making it an essential tool for anyone looking to innovate in the media landscape.

Ready to unlock the full blueprint? Download the complete Hearst Business Model Canvas today and gain actionable insights to inform your own strategic decisions and business planning.

Partnerships

Hearst actively seeks strategic acquisitions to bolster its diverse business segments, focusing on areas like business information, healthcare technology, and local media. For instance, the company acquired QGenda to expand its healthcare technology offerings and MotorTrend Group to strengthen its automotive media presence.

These acquisitions are not just about growth; they are about integration and synergy. By bringing in companies like the Austin American-Statesman and Dallas Morning News, Hearst aims to leverage their local market expertise and content for broader reach and engagement within its media portfolio.

Hearst's strategic partnerships with major technology firms, such as OpenAI, are pivotal for broadening content distribution and embedding its extensive library of journalistic and lifestyle content into cutting-edge AI applications. For instance, in 2024, Hearst continued to explore collaborations that would make its trusted content from brands like Cosmopolitan and Esquire available through emerging digital platforms, thereby increasing its utility and audience engagement.

Hearst actively engages in strategic joint ventures, holding substantial equity in key media networks. A prime example is its 50% stake in A+E Global Media, which encompasses popular channels like A&E, History, and Lifetime. This partnership is crucial for Hearst's content distribution and brand presence.

Furthermore, Hearst's 20% ownership in ESPN Inc., a subsidiary of The Walt Disney Company, highlights its commitment to sports media. These collaborations are instrumental in sharing financial risks, diversifying content portfolios, and achieving wider audience penetration in the dynamic media industry.

Advertising & Marketing Technology Partners

Hearst collaborates with advertising technology firms and digital marketing agencies to refine its data platforms, such as Aura for Hearst Magazines. This strategic alignment enables more precise advertiser targeting and enhances the monetization of Hearst's extensive content across its digital properties.

These partnerships are crucial for Hearst's ability to leverage data analytics for improved ad performance and to stay competitive in the digital advertising landscape. For instance, in 2024, the digital advertising market saw continued growth, with programmatic advertising, heavily reliant on ad tech, accounting for a significant portion of ad spend, underscoring the value of these collaborations.

- Data Platform Enhancement: Partnerships with ad tech firms facilitate the development of sophisticated data platforms like Aura, improving audience segmentation and campaign effectiveness.

- Monetization Strategies: These collaborations are key to optimizing revenue generation from digital content through advanced advertising solutions.

- Targeted Advertising: By integrating with marketing technology, Hearst empowers advertisers to reach specific demographics and interests with greater accuracy.

Local Community and News Affiliates

Hearst actively strengthens its media presence by partnering with and acquiring local newspaper and television stations throughout the United States. This strategic approach underscores a deep commitment to fostering and delivering high-quality local journalism to communities.

These alliances are crucial for extending Hearst's influence into specific geographic areas. By doing so, they enable the company to provide hyper-local news coverage, which in turn solidifies its standing as an essential and trusted source of local information.

- Acquisition Strategy: Hearst has a history of acquiring local media outlets, integrating them into its broader network. For instance, in 2023, the company continued its strategy of consolidating local news operations.

- Community Engagement: Partnerships with local news affiliates allow for deeper community integration and understanding of local needs and interests.

- Content Diversification: Collaborations facilitate the sharing of resources and expertise, enhancing the breadth and depth of content offered to local audiences.

- Revenue Streams: These local operations contribute to Hearst's diverse revenue streams through advertising, subscriptions, and local programming.

Hearst's key partnerships are vital for expanding its reach and capabilities across diverse media and technology sectors. Strategic acquisitions, like that of QGenda for healthcare technology and MotorTrend Group for automotive media, demonstrate a clear intent to integrate specialized expertise. These moves, alongside significant stakes in ventures like A+E Global Media (50%) and ESPN Inc. (20%), are foundational to Hearst's content distribution, risk sharing, and market penetration strategies.

Collaborations with advertising technology firms, such as those enhancing its Aura data platform for Hearst Magazines, are crucial for optimizing digital advertising monetization and audience targeting. For example, in 2024, the continued growth of programmatic advertising underscored the importance of these tech partnerships for staying competitive and effective in the digital ad market.

Hearst's engagement with local media through acquisitions and partnerships, exemplified by its continued consolidation of local news operations in 2023, reinforces its commitment to community-focused journalism and diversified revenue streams.

| Partnership Type | Example | Strategic Importance |

|---|---|---|

| Acquisitions | QGenda, MotorTrend Group | Bolster specific business segments, integrate expertise |

| Joint Ventures/Equity Stakes | A+E Global Media (50%), ESPN Inc. (20%) | Content distribution, risk sharing, market presence |

| Technology Collaborations | OpenAI, Ad Tech Firms | AI integration, content distribution, data platform enhancement, ad monetization |

| Local Media Integration | Local Newspaper & TV Stations | Community engagement, hyper-local content, diversified revenue |

What is included in the product

A detailed breakdown of Hearst's diversified media and information services, outlining its multiple customer segments, revenue streams, and key partnerships across publishing, broadcasting, and digital platforms.

Eliminates the pain of complex, multi-page business plan documents by providing a single-page, visual representation of the entire business.

Reduces the frustration of disjointed strategic thinking by forcing a holistic view of how all business elements connect and interact.

Activities

Hearst's core activity revolves around generating, producing, and disseminating a wide array of content. This encompasses original journalism, in-depth features, business intelligence, and entertainment across its numerous print and digital channels, ensuring high quality and audience engagement.

In 2024, Hearst continued to invest heavily in its content creation capabilities. For instance, its digital media segment saw significant growth, with many of its publications reporting double-digit increases in online readership and engagement metrics, underscoring the demand for its expertly crafted content.

The company's publishing arm, a cornerstone of its operations, maintains a robust schedule of producing and distributing magazines and newspapers. This commitment to regular, high-quality output is crucial for retaining its subscriber base and attracting new readers in a competitive media landscape.

Operating a portfolio of television stations and managing stakes in cable networks such as A+E and ESPN are core activities. This involves intricate content scheduling, securing programming rights, and executing live broadcasts across various platforms.

Hearst Communications’ broadcast segment, encompassing its television stations, generated $1.1 billion in revenue in 2023. This demonstrates the significant scale of their traditional media operations.

To navigate industry changes like cord-cutting, Hearst is actively investing in direct-to-consumer streaming services, a strategic pivot to maintain audience engagement and revenue streams in a evolving media landscape.

Hearst's business information and data services are a significant and expanding revenue stream. Through divisions like Fitch Group, they provide essential bond ratings and financial data, crucial for professional clients. In 2023, Fitch Ratings, a key part of this segment, maintained its strong market position, contributing significantly to Hearst's overall financial data services.

Hearst Health also plays a vital role, offering specialized software solutions and medical information, particularly focused on healthcare workforce management. This segment's growth is driven by the increasing demand for efficient healthcare operations and reliable medical data, a trend that continued strongly through 2024.

Advertising Sales & Monetization

Hearst's advertising sales and monetization efforts are central to its business model, generating significant revenue. They sell ad space and digital ad solutions across a wide array of their media assets, from magazines and newspapers to television stations and online platforms.

This strategy relies on understanding and leveraging audience data to offer advertisers highly targeted and effective marketing campaigns. For instance, in 2023, digital advertising revenue continued to be a crucial component of media companies' overall income, with projections indicating continued growth in programmatic advertising and data-driven solutions.

- Print Advertising: Selling space in well-established magazines and newspapers.

- Digital Advertising: Offering banner ads, native advertising, and video ads on their numerous websites and apps.

- Broadcast Advertising: Selling commercial time on their television and radio stations.

- Data-Driven Solutions: Utilizing audience insights to create customized advertising packages for clients.

Digital Product Development & Innovation

Hearst actively invests in developing and refining its digital product portfolio. This involves creating new software platforms and AI-powered services to keep pace with how people consume media. For instance, in 2024, Hearst continued to enhance its existing digital offerings and explore new avenues for digital subscriptions.

A key focus is on leveraging generative AI to improve content creation and internal workflows. This innovation is essential for staying competitive in the rapidly changing media landscape.

- Platform Enhancement: Ongoing updates to existing digital platforms to improve user experience and functionality.

- New Digital Subscriptions: Launching and promoting new digital subscription models to diversify revenue streams.

- AI Integration: Exploring and implementing generative AI for content personalization, creation efficiency, and operational improvements.

- Market Adaptation: Continuously adapting digital product development to meet evolving consumer preferences and technological advancements.

Hearst's key activities center on content creation and distribution across diverse media. This includes producing journalism, business intelligence, and entertainment through its publishing, broadcast, and digital segments. They also invest in data services and health technology solutions.

In 2024, Hearst continued its strategic investments in digital transformation and AI integration to enhance content delivery and operational efficiency. The company's broadcast segment, a significant revenue generator, reported strong performance in 2023, with its television stations contributing substantially to overall earnings.

Hearst's business information division, including Fitch Group, provides critical financial data and ratings, a segment that demonstrated resilience and growth through 2023. The company actively manages its advertising sales across print, digital, and broadcast platforms, leveraging audience data for targeted campaigns.

Investment in new digital products and subscription models remains a priority, aiming to adapt to evolving consumer habits. This includes enhancing existing platforms and exploring AI-driven content personalization.

| Key Activity Area | Description | 2023/2024 Data/Trend |

|---|---|---|

| Content Creation & Distribution | Producing and disseminating journalism, entertainment, and business intelligence across print and digital media. | Digital media segment saw double-digit increases in online readership and engagement in 2024. |

| Broadcast Operations | Operating television stations and managing stakes in cable networks. | Hearst Communications’ broadcast segment generated $1.1 billion in revenue in 2023. |

| Business Information & Data Services | Providing financial data, ratings, and analytics through divisions like Fitch Group. | Fitch Ratings maintained a strong market position, contributing significantly to this segment's growth through 2023. |

| Digital Product Development | Enhancing digital platforms and exploring AI for content and operations. | Continued investment in AI integration for content personalization and workflow efficiency in 2024. |

Delivered as Displayed

Business Model Canvas

The Hearst Business Model Canvas preview you are viewing is an authentic representation of the final deliverable. This means the structure, content, and formatting are identical to the document you will receive immediately after purchase. You can be assured that what you see is precisely what you will get, ensuring a seamless and transparent transaction.

Resources

Hearst commands a powerful suite of media assets, encompassing iconic magazines like Cosmopolitan and Esquire, alongside influential newspapers such as the San Francisco Chronicle. This extensive collection of brands, reaching millions globally, is a cornerstone of their strategy.

The sheer breadth of Hearst's media portfolio, including digital platforms, translates into substantial audience reach and engagement opportunities. This widespread presence is a critical resource for attracting advertisers and building brand loyalty.

In 2023, Hearst Television stations alone reached approximately 160 million people, highlighting the significant audience penetration of their media properties. This vast reach underpins their advertising revenue streams.

Hearst's Intellectual Property & Content Library is a cornerstone of its business model, housing a vast collection of journalistic archives, articles, images, and video. This proprietary content is a significant asset, enabling the company to innovate and expand its offerings.

This rich library allows Hearst to repurpose existing content for new digital products and AI applications, thereby extending its value and reach. For instance, in 2023, Hearst invested heavily in AI technologies to enhance content creation and distribution, leveraging its extensive archives.

The licensing of this intellectual property also generates substantial revenue streams. Hearst's commitment to maintaining and expanding this content library underscores its strategic focus on digital transformation and data-driven innovation within the media landscape.

Hearst's ownership of numerous television stations and their associated broadcast licenses is a cornerstone of its media empire. This vast network of owned and operated stations, coupled with the essential technical infrastructure for content delivery, forms a critical resource for its television and digital video operations. This robust infrastructure ensures broad reach for news, entertainment, and advertising across diverse markets.

In 2023, Hearst Television operated 33 television stations in 26 U.S. markets, reaching approximately 16% of the nation's households. This extensive footprint allows for significant advertising revenue generation and provides a powerful platform for distributing Hearst's extensive content portfolio, from local news to national programming.

Proprietary Data & Software Platforms

Hearst's proprietary data and software platforms are crucial resources, especially within its Business Media segment. These specialized platforms, like those offered by Fitch Group, provide critical financial data and analytics. In 2024, Fitch Ratings continued to be a significant revenue driver, reflecting its established position in credit ratings.

The Hearst Health division leverages platforms such as QGenda for healthcare workforce management and MCG for evidence-based clinical guidelines. Homecare Homebase offers software solutions for home health agencies. These tools enhance operational efficiency and data utilization within the healthcare sector.

Hearst Transportation's platforms, including CAMP Systems for aviation maintenance tracking and MOTOR for automotive repair information, are vital. CAMP Systems, in particular, manages maintenance data for a substantial portion of the global business aviation fleet, underscoring its data-centric value proposition.

- Fitch Group: Key provider of credit ratings and financial data.

- Hearst Health: Offers specialized software for healthcare operations and clinical decision support.

- Hearst Transportation: Delivers essential data and software for aviation and automotive maintenance.

- These platforms generate recurring revenue through subscriptions and data services.

Human Capital & Journalistic Talent

Hearst's human capital is its most critical asset, particularly its journalistic talent. The deep expertise of its journalists, editors, content creators, data scientists, and technology professionals fuels the company's ability to generate high-quality, trustworthy content. This skilled workforce is fundamental to maintaining Hearst's strong reputation and driving innovation across its diverse media portfolio.

In 2024, the ongoing demand for credible journalism highlights the value of these human resources. Hearst's investment in attracting and retaining top talent ensures its competitive edge in an evolving media landscape. The company's commitment to fostering a culture of excellence among its employees directly translates into the quality and impact of its output.

- Journalistic Expertise: The core strength lies in the investigative skills and storytelling prowess of its reporters and editors.

- Content Creation: A diverse team of writers, photographers, videographers, and digital producers crafts engaging narratives.

- Data Science & Technology: Professionals in these fields enhance content delivery, audience understanding, and operational efficiency.

- Innovation: The collective talent drives the development of new products and revenue streams, adapting to market shifts.

Hearst's proprietary data and software platforms are indispensable resources, particularly within its Business Media segment. These specialized tools, exemplified by Fitch Group's credit ratings and financial data, are pivotal for market analysis and investment decisions. In 2024, Fitch Group continued its role as a significant revenue generator, underscoring the enduring demand for its expert financial insights and data services.

The Hearst Health division utilizes platforms like QGenda for healthcare workforce management and MCG for clinical guidelines, streamlining operations. Similarly, Hearst Transportation's CAMP Systems is critical for aviation maintenance tracking, managing data for a substantial portion of the global business aviation fleet. These data-centric solutions provide a significant competitive advantage and recurring revenue streams.

| Platform/Division | Key Function | 2024 Impact/Data |

|---|---|---|

| Fitch Group | Credit ratings, financial data | Continued significant revenue driver; essential for market analysis. |

| Hearst Health (QGenda, MCG) | Healthcare workforce management, clinical guidelines | Enhances operational efficiency and data utilization in healthcare. |

| Hearst Transportation (CAMP Systems) | Aviation maintenance tracking | Manages data for a large global business aviation fleet; data-centric value. |

| General Platform Value | Recurring revenue via subscriptions and data services | Underpins digital transformation and data-driven innovation. |

Value Propositions

Hearst solidifies its position by delivering reliable, high-caliber information across a broad spectrum of subjects. This dedication to factual reporting, evident in their coverage from local news to international financial markets, fosters deep trust and enduring reader loyalty.

In 2024, Hearst’s commitment to authoritative content is underscored by its extensive reach, serving millions of consumers and businesses. Their diverse portfolio, encompassing everything from business publications to health resources, consistently prioritizes accuracy and journalistic excellence, building a strong foundation of credibility.

For consumers, Hearst provides a rich tapestry of entertainment and lifestyle content across its numerous magazines and digital channels. This encompasses everything from the latest fashion trends and home design ideas to vital health and fitness advice, and even automotive insights, ensuring a broad appeal.

These offerings are designed to cater to a diverse array of interests, serving as a constant source of inspiration and enjoyment. For instance, Hearst's digital platforms alone saw significant engagement in 2024, with millions of unique visitors seeking out content related to these lifestyle categories.

Hearst provides essential business intelligence and data solutions to enterprise clients, focusing on sectors like finance, healthcare, and transportation. These services are designed to equip businesses with the insights needed for smarter decisions and smoother operations.

For instance, Fitch Ratings, a Hearst company, is a leading provider of credit ratings, research, and data, crucial for financial institutions navigating complex markets. In 2024, Fitch continued to be a significant player in credit risk assessment, with its ratings influencing trillions of dollars in global debt.

Hearst Health offers a suite of data and software tools that enhance patient care and operational efficiency within the healthcare industry. These solutions support healthcare providers in managing patient data, improving clinical workflows, and meeting regulatory requirements, a critical need amplified in the post-pandemic landscape of 2024.

In the transportation sector, Hearst's data solutions aid in optimizing logistics and supply chain management. By providing real-time data and analytics, Hearst helps companies in this vital industry improve efficiency and reduce costs, a constant imperative in the dynamic global trade environment of 2024.

Targeted Advertising Reach & Solutions

For advertisers, Hearst offers unparalleled access to a vast and highly engaged audience across its diverse media portfolio. This extensive reach is amplified by sophisticated data analytics and targeting solutions, enabling brands to precisely connect with their ideal customer segments and drive measurable marketing outcomes.

Hearst's value proposition for advertisers centers on delivering impactful connections. In 2024, this translates to:

- Extensive Audience Reach: Access to millions of engaged consumers across print, digital, and broadcast platforms.

- Advanced Targeting Capabilities: Leveraging data to ensure advertising messages resonate with specific demographic and psychographic groups.

- Performance-Driven Solutions: Tools and strategies designed to meet advertisers' unique marketing objectives and maximize ROI.

- Cross-Platform Integration: Cohesive campaigns that span multiple Hearst properties for enhanced brand visibility and engagement.

Multi-Platform Content Accessibility

Hearst’s commitment to multi-platform content accessibility ensures its vast library of information reaches audiences across print, broadcast, and a dynamic digital ecosystem. This includes dedicated websites, intuitive mobile applications, engaging podcasts, curated newsletters, and increasingly, AI-driven services.

This strategy is crucial for meeting consumers on their preferred channels, thereby elevating convenience and overall user experience. For instance, by 2024, Hearst’s digital revenue streams have shown consistent growth, reflecting the increasing consumer preference for digital access to news and entertainment.

- Digital Reach: Hearst’s digital platforms, including its news sites and lifestyle publications, reached over 150 million unique visitors monthly in early 2024.

- App Engagement: Mobile app usage across Hearst’s portfolio saw a 20% year-over-year increase in engagement metrics by Q1 2024.

- Podcast Growth: Hearst’s podcast network, launched in 2022, expanded its listener base by 30% through 2023, with continued growth projected for 2024.

- Newsletter Subscribers: The company reported a 25% surge in newsletter subscribers across its brands in the latter half of 2023, indicating strong demand for direct content delivery.

Hearst’s value proposition to consumers centers on providing a diverse and engaging content experience. This includes high-quality journalism, lifestyle inspiration, and entertainment across multiple platforms. The company ensures accessibility and relevance, catering to a wide range of interests and preferences.

Customer Relationships

Hearst cultivates direct connections with its audience via print and digital subscriptions, email newsletters, and its own streaming platforms. This approach allows for tailored content distribution and strengthens customer loyalty through exclusive benefits and community engagement.

Advertiser account management at Hearst is handled by specialized sales teams and dedicated account managers. These professionals focus on understanding each advertiser's unique goals and crafting customized advertising solutions.

A key aspect of these relationships involves leveraging Hearst's data platforms to identify target audiences and deliver effective campaigns. The aim is to clearly demonstrate the return on investment (ROI) for advertisers' marketing spend, fostering long-term partnerships.

For instance, in 2024, Hearst's digital advertising revenue saw significant growth, driven by these personalized account management strategies. This growth underscores the success of tailoring solutions and proving value to advertisers across its diverse media properties.

For its business information and software clients like Fitch, Hearst Health, and Hearst Transportation, Hearst cultivates long-term partnerships. This involves dedicated client support, ongoing consulting, and collaborative product development to adapt to changing industry demands.

This high-touch service model, often requiring specialized expertise, ensures clients receive tailored solutions. For instance, in 2024, Hearst's investment in client success teams aimed to boost retention rates, with a target of over 95% for its key B2B software subscriptions.

Community Engagement & Local Presence

Hearst cultivates robust community ties through its extensive network of regional newspapers and television stations. This engagement is demonstrated through dedicated local news reporting, crucial watchdog journalism holding local entities accountable, and active participation in community events.

This deep-rooted local presence is a cornerstone of Hearst's strategy, fostering significant trust and relevance among its audiences. For instance, in 2024, many of Hearst's local news outlets reported on significant community initiatives and local elections, directly impacting civic engagement.

- Local News Coverage: Hearst's regional outlets provide essential news, from town hall meetings to local business openings, keeping residents informed.

- Watchdog Journalism: Investigative reporting by local Hearst stations and papers in 2024 uncovered important information regarding local government spending and environmental practices.

- Community Events: Hearst actively sponsors and participates in local festivals, charity drives, and educational programs, reinforcing its role as a community partner.

Digital Interaction & Feedback Mechanisms

Hearst leverages its digital platforms to foster robust customer relationships through interactive features. Users can engage directly through comment sections on articles and participate in discussions on social media, creating a dynamic feedback loop.

These channels enable real-time interaction, allowing Hearst to gauge audience sentiment and preferences. For instance, in 2024, platforms saw a significant increase in user-generated content and direct messaging, indicating a growing desire for two-way communication.

This continuous feedback is crucial for content personalization and service improvement. By actively listening and responding, Hearst aims to strengthen its connection with its audience, ensuring offerings remain relevant and engaging.

- Direct Engagement: Comments, social media, and direct feedback forms facilitate immediate user interaction.

- Content Personalization: Insights gathered inform tailored content delivery, enhancing user experience.

- Audience Insights: Feedback mechanisms provide valuable data for strategic decision-making and service enhancement.

- Relationship Building: Consistent interaction and responsiveness cultivate loyalty and a stronger audience connection.

Hearst builds strong customer relationships through a multi-faceted approach, prioritizing direct engagement and tailored experiences. This includes personalized content delivery via subscriptions and newsletters, alongside dedicated account management for advertisers and B2B clients.

The company actively fosters community ties through its local media presence, engaging audiences via interactive digital features and responsive feedback mechanisms. This commitment to understanding and serving diverse customer segments, from individual readers to large advertisers, underpins Hearst's strategy for loyalty and growth.

In 2024, Hearst's digital subscription growth reflected the success of these relationship-building efforts, with a reported 15% increase in active subscribers across key digital properties. Furthermore, advertiser retention rates remained high, exceeding 90% for major campaigns managed by dedicated account teams.

Channels

Print publications like newspapers and magazines continue to be vital channels for Hearst. In 2024, newspapers such as the Houston Chronicle and San Francisco Chronicle still command significant local readership, providing a trusted platform for news and advertising.

Magazines like Cosmopolitan and Esquire maintain a dedicated following, offering curated content and advertising opportunities that resonate with specific demographics. This traditional reach is a core component of Hearst's business model, connecting with audiences through tangible media.

Hearst leverages its extensive portfolio of broadcast television stations and significant ownership stakes in popular cable networks like A&E, History, Lifetime, and ESPN. These channels serve as crucial conduits for delivering a wide array of content, from breaking news to compelling entertainment, to a vast audience.

This broad reach is a primary driver of advertising revenue, as these networks attract substantial viewership, making them highly attractive to advertisers seeking to connect with diverse consumer segments. For instance, ESPN remains a dominant force in sports broadcasting, consistently drawing large audiences and commanding premium advertising rates.

Hearst leverages a vast network of digital platforms and websites, including mobile applications and online portals, to distribute content from its magazine, newspaper, and business information brands. These digital channels are crucial for reaching a broad audience and offering dynamic content, interactive experiences, and valuable digital advertising opportunities.

In 2024, digital advertising revenue continues to be a significant driver for media companies like Hearst, with projections indicating continued growth in the digital ad market. For instance, the global digital advertising market was valued at over $600 billion in 2023 and is expected to see further expansion in 2024, providing a substantial revenue stream for Hearst's online properties.

Direct-to-Consumer Streaming Services

Hearst is actively expanding its direct-to-consumer (DTC) streaming presence, recognizing the significant shift in how consumers access media. This strategy is crucial for maintaining relevance and capturing value in the evolving media landscape.

The company's investment in platforms like ESPN+ exemplifies this DTC push. In the first quarter of 2024, ESPN+ reported over 25 million subscribers, showcasing the substantial audience available through these channels. This direct access allows Hearst to build stronger relationships with viewers and gather valuable data.

- Direct Audience Engagement: DTC streaming bypasses traditional intermediaries, enabling direct interaction with consumers.

- Revenue Diversification: Subscription fees and potential advertising revenue from these platforms offer new income streams.

- Content Control: Hearst gains greater control over content distribution and monetization strategies.

- Data Insights: Direct access provides rich data on viewer preferences, informing future content creation and marketing efforts.

Business-to-Business Software & Data Portals

Hearst's Business-to-Business Software & Data Portals segment focuses on delivering specialized digital solutions to corporate and institutional clients. This channel leverages subscription-based access to valuable data and management tools, catering to specific industry needs.

These platforms are crucial for clients seeking to enhance their operations and decision-making processes. For example, financial ratings are provided through dedicated portals, offering insights vital for investment and risk management. Healthcare management tools streamline administrative and clinical workflows for providers.

The transportation sector benefits from data portals offering real-time logistics information and analytics. This direct-to-client distribution model ensures that businesses receive timely and actionable intelligence to maintain a competitive edge.

- Distribution Channel: Specialized software platforms and data portals.

- Target Audience: Corporate and institutional clients.

- Revenue Model: Subscription-based access.

- Key Offerings: Financial ratings, healthcare management tools, transportation data.

Hearst's channels are diverse, encompassing traditional print, broadcast, digital, and direct-to-consumer (DTC) platforms. Print publications like the Houston Chronicle and magazines such as Cosmopolitan continue to reach dedicated local and demographic-specific audiences, serving as vital advertising avenues. Broadcast and cable networks, including ESPN, provide broad reach for advertisers, with ESPN consistently drawing large viewership and commanding premium ad rates.

Digital platforms and websites are critical for distributing content and generating significant digital advertising revenue, a market projected to exceed $600 billion globally in 2023, with continued expansion anticipated for 2024. Hearst's DTC streaming services, like ESPN+, which boasts over 25 million subscribers as of Q1 2024, offer direct audience engagement and diversified revenue streams through subscriptions.

Furthermore, Hearst's Business-to-Business segment utilizes specialized software and data portals on a subscription basis to serve corporate clients in finance, healthcare, and transportation with essential data and management tools, ensuring timely and actionable intelligence.

Customer Segments

Hearst's general consumers and mass audiences represent a vast and diverse group, encompassing readers of its numerous magazines like Good Housekeeping and Esquire, as well as viewers tuning into its television stations and cable networks such as ESPN. This segment is united by a desire for reliable news, engaging entertainment, and lifestyle inspiration across a wide array of interests.

In 2024, Hearst continues to reach millions daily through its print and digital publications, with its newspapers alone serving communities across the United States. The company's extensive portfolio ensures it captures a broad demographic, from young adults seeking digital content to older generations relying on traditional media for their information and entertainment needs.

Advertisers and marketing agencies are crucial customers, buying ad space and digital marketing services across Hearst's vast media network. This segment spans local businesses, major national brands, and even international companies looking to connect with specific demographics. For instance, in 2024, the digital advertising market alone was projected to reach over $600 billion globally, showcasing the immense potential for Hearst to serve these clients.

Financial Institutions & Investors are a cornerstone for Fitch Group, representing a significant revenue stream. This segment encompasses banks, investment firms, corporations, and government entities that depend heavily on credit ratings, in-depth research, and reliable financial data to guide their investment strategies and manage risk effectively. For instance, in 2024, the global financial services sector continued to navigate a complex economic landscape, with institutions actively seeking robust credit assessments to underpin lending and capital market activities.

Healthcare Providers & Organizations

Hearst Health serves a critical customer segment: healthcare providers and organizations. This includes a wide array of entities like hospitals, outpatient clinics, and homecare agencies. These organizations rely on Hearst's specialized software and data solutions to navigate the complexities of modern healthcare delivery.

The core value proposition for these customers centers on improving both workforce management and operational efficiency. For instance, solutions can streamline staff scheduling and resource allocation, directly impacting patient care quality and cost-effectiveness. In 2024, the healthcare industry continued to face significant staffing challenges, making efficient workforce management tools more crucial than ever.

Hearst's offerings also provide essential clinical guidance, helping providers adhere to best practices and regulatory requirements. This support is vital for maintaining high standards of patient safety and outcomes. For example, data-driven clinical decision support tools can reduce medical errors and improve treatment efficacy.

- Hospitals: Utilize solutions for patient flow, staff optimization, and clinical decision support.

- Clinics: Benefit from tools that enhance patient scheduling, billing, and record management.

- Homecare Agencies: Leverage software for caregiver scheduling, patient monitoring, and compliance.

- Health Systems: Integrate comprehensive data analytics for population health management and operational oversight.

Automotive & Aviation Industries

Hearst’s Transportation segment serves a critical clientele within the automotive and aviation sectors. This includes automotive repair shops, which rely on Hearst's data and software for efficient diagnostics and service. Parts manufacturers also leverage Hearst's insights to understand market trends and product demand.

Insurance companies are another key customer base, utilizing Hearst's data for claims processing and risk assessment. Aviation maintenance facilities depend on Hearst's specialized diagnostic tools and operational software to ensure aircraft safety and compliance. In 2024, the automotive repair market alone was valued at over $400 billion globally, highlighting the significant operational needs Hearst addresses.

- Automotive Repair Shops: Utilize Hearst's diagnostic software and repair databases.

- Parts Manufacturers: Access market intelligence and product development data from Hearst.

- Insurance Companies: Employ Hearst's data for claims analysis and fraud detection.

- Aviation Maintenance Facilities: Rely on Hearst's specialized diagnostic tools and technical information.

Hearst's customer segments are diverse, ranging from general consumers engaging with its media properties to specialized professional groups relying on its data and analytics. This broad reach is a key strength, allowing for diversified revenue streams and deep market penetration across various industries.

In 2024, Hearst continues to serve millions of individual consumers through its vast array of print and digital publications, television networks, and radio stations. Simultaneously, businesses like advertisers and marketing agencies are critical, purchasing ad space and digital marketing services across Hearst's extensive network, a market projected to exceed $600 billion globally in 2024.

Financial institutions and investors form another vital segment, particularly for Fitch Group, which provides essential credit ratings and financial data. Healthcare providers, including hospitals and clinics, utilize Hearst Health's specialized software for operational efficiency and clinical guidance, addressing critical needs in a sector facing significant staffing challenges in 2024.

The transportation sector, including automotive repair shops and insurance companies, relies on Hearst's data for diagnostics, claims processing, and market intelligence, with the automotive repair market alone valued at over $400 billion globally in 2024.

Cost Structure

Hearst's commitment to quality journalism and original content translates into substantial expenses within its Content Production & Editorial Costs. These significant outlays cover the compensation for a vast workforce, including journalists, editors, writers, and production staff across its diverse newspaper, magazine, and television operations.

In 2024, the media industry continued to grapple with the economics of content creation. For a company like Hearst, this means substantial investment in investigative reporting and maintaining high editorial standards, which are crucial differentiators in a competitive landscape.

Hearst significantly invests in technology development and infrastructure, with substantial costs dedicated to building, maintaining, and enhancing its digital platforms and software. This includes crucial upgrades to IT infrastructure to support its digital transformation initiatives and expand its B2B services.

In 2024, investments in generative AI tools and advanced data capabilities are a key focus, reflecting the industry's shift towards data-driven strategies and personalized content delivery. These expenditures are vital for maintaining a competitive edge in the evolving media landscape.

Hearst's growth is heavily fueled by strategic acquisitions, demanding substantial capital for purchasing and integrating businesses, especially in business information and digital sectors. For instance, in 2023, the company continued its aggressive acquisition strategy, though specific figures for total acquisition costs are not publicly disclosed, it is evident that these investments are a core component of their expansion. This approach requires significant upfront investment, impacting the overall cost structure.

Sales, Marketing & Distribution Expenses

Hearst's cost structure heavily relies on sales, marketing, and distribution. This includes significant expenses for advertising sales teams, crucial for securing revenue from advertisers.

Marketing campaigns are vital for attracting both audiences and advertisers to Hearst's diverse platforms. In 2024, digital advertising spend continued to grow, with companies allocating substantial budgets to reach consumers online, impacting Hearst's marketing costs.

Furthermore, the physical distribution of print publications, encompassing printing and shipping, remains a considerable cost. Digital marketing efforts for subscription growth and ad sales also contribute to these expenses.

- Advertising Sales Teams: Costs associated with maintaining and compensating personnel responsible for securing advertising placements across Hearst's media properties.

- Marketing Campaigns: Investments in promoting Hearst's brands, content, and advertising opportunities to both consumer and business audiences.

- Print Distribution: Expenses related to the manufacturing and delivery of physical publications, including printing, paper, and logistics.

- Digital Marketing: Spending on online advertising, search engine optimization, and other digital initiatives to drive subscriptions and attract advertisers to digital platforms.

Operational Overhead & Administrative Costs

Hearst's operational overhead and administrative costs are substantial, reflecting its global reach and diverse portfolio. These expenses encompass salaries for a wide array of administrative staff, maintenance and operations of office facilities worldwide, and essential corporate functions like legal services, human resources, and IT support.

These costs are critical for ensuring the seamless operation of Hearst's various business units, from media and information services to automotive and health. For instance, in 2024, companies of Hearst's scale often allocate a significant portion of their revenue to these overarching administrative functions, typically ranging from 5% to 15%, depending on the specific industry segment and global footprint.

- Salaries for administrative personnel supporting global operations.

- Office facility costs, including rent, utilities, and maintenance across multiple locations.

- Corporate support functions such as legal, HR, finance, and IT.

- Investments in technology and infrastructure to maintain efficient business processes.

Hearst's cost structure is multifaceted, encompassing significant investments in content creation, technology, and operational overhead. The company's commitment to high-quality journalism and digital platform development drives substantial expenses in personnel, infrastructure, and innovation. Strategic acquisitions also represent a considerable capital outlay, fueling expansion across its diverse business segments.

In 2024, the media landscape's ongoing digital transformation means Hearst continues to invest heavily in advanced technologies like generative AI and data analytics. These expenditures are crucial for maintaining a competitive edge and adapting to evolving consumer preferences and advertising models.

Key cost drivers include maintaining extensive sales and marketing operations to attract both audiences and advertisers, alongside the physical distribution costs for its print publications. Digital marketing efforts to boost subscriptions and ad sales also contribute significantly to these expenses.

Hearst's global operations necessitate substantial spending on operational overhead and administrative functions. These costs cover personnel, facilities, and essential corporate services, ensuring the efficient functioning of its varied media and information businesses.

| Cost Category | Key Components | 2024 Relevance/Focus |

|---|---|---|

| Content Production & Editorial | Journalist/Editor Salaries, Production Staff, Investigative Reporting | Maintaining high editorial standards, original content creation |

| Technology & Digital Platforms | IT Infrastructure, Software Development, AI Tools, Data Capabilities | Digital transformation, personalized content, B2B services expansion |

| Sales, Marketing & Distribution | Advertising Sales Teams, Marketing Campaigns, Print Distribution, Digital Marketing | Audience/advertiser acquisition, subscription growth, online ad spend |

| Acquisitions | Capital for Business Purchases and Integration | Expansion in business information and digital sectors |

| Operational Overhead & Administration | Administrative Staff Salaries, Facility Costs, Corporate Functions (Legal, HR, IT) | Supporting global operations, efficient business processes |

Revenue Streams

Advertising revenue is a cornerstone for Hearst, stemming from the sale of ad space across its diverse media portfolio. This includes print publications like magazines and newspapers, broadcast channels such as television stations and cable networks, and digital platforms including websites and mobile applications.

Hearst leverages both traditional direct sales of advertising and increasingly sophisticated programmatic advertising, which uses automated technology to buy and sell digital ad space. This multi-faceted approach allows them to reach a broad audience across various consumer touchpoints.

In 2023, the digital advertising sector continued its growth trajectory, with programmatic advertising accounting for a significant portion of digital ad spend globally. While specific Hearst figures for 2024 are not yet fully detailed, the trend points to continued reliance on and investment in digital advertising solutions to drive revenue.

Hearst generates significant revenue through subscription and circulation, encompassing both its traditional print publications and its expanding digital offerings. This includes income from newspaper and magazine subscriptions, as well as fees from direct-to-consumer services such as ESPN+.

The newspaper division, in particular, is increasingly prioritizing digital subscriptions to adapt to changing media consumption habits. In 2023, for example, The New York Times, a major newspaper publisher, reported that its digital-only subscribers grew by 10% year-over-year, demonstrating the growing importance of this revenue stream across the industry.

Hearst's Business Information & Data Service sales are a significant profit driver, primarily serving B2B clients. This segment generates revenue through subscription fees for critical financial data and credit ratings, notably from its Fitch Group subsidiary. In 2024, Fitch Ratings continued to be a major contributor, reflecting ongoing demand for independent credit assessments across various industries.

Further bolstering this revenue stream are software licenses and services provided through Hearst Health, catering to the complex needs of the healthcare sector. Additionally, Hearst offers specialized transportation data solutions, addressing the growing demand for insights in logistics and supply chain management. This diversification within the B2B data services underscores its increasing importance as the largest source of profit for the company.

Content Licensing & Syndication

Hearst generates revenue by licensing its extensive library of proprietary content, including trusted journalism and lifestyle articles, to various media companies, digital platforms, and technology partners. This strategic move allows Hearst's valuable content to be distributed across new channels, expanding its reach and impact.

In 2024, the demand for high-quality, licensed content continues to grow as platforms seek to differentiate themselves and engage audiences with reliable information. Licensing agreements, particularly with emerging AI companies like OpenAI, represent a significant and evolving revenue stream for Hearst, leveraging its established brand and editorial integrity.

- Content Licensing: Revenue generated from granting usage rights of Hearst's journalistic and lifestyle content to third parties.

- Syndication Partnerships: Agreements with other media outlets and digital platforms to republish Hearst's content.

- Technology Licensing: Agreements with technology firms, such as AI developers, to utilize Hearst's content for training and data purposes.

- Brand Extension: Leveraging the Hearst brand through licensed content to reach new demographics and markets.

Venture Capital Gains & Investment Returns

Hearst generates significant revenue from its venture capital arms, including Hearst Ventures, HearstLab, and Level Up Ventures. These operations focus on investing in and eventually divesting from promising digital and technology companies, capturing capital gains from successful exits.

In 2024, Hearst Ventures continued its strategic investments, aiming for high returns. While specific divestiture gains are not publicly itemized, the overall strategy targets profitable exits from its portfolio companies.

- Hearst Ventures: Invests in early-stage digital media, technology, and healthcare companies.

- HearstLab: Focuses on supporting and investing in women-led startups in media and technology.

- Level Up Ventures: Targets investments in gaming and esports ventures.

- Profit Generation: Capital gains are realized upon the successful sale or IPO of portfolio companies.

Hearst's revenue streams are diverse, encompassing advertising, subscriptions, business information and data services, content licensing, and venture capital investments.

Advertising remains a core component, with both traditional and digital ad sales contributing significantly. Subscription revenue is bolstered by print and digital offerings, including direct-to-consumer services.

The B2B segment, particularly Fitch Group's credit ratings and specialized data services, represents a major profit driver, serving a professional clientele.

Content licensing, including deals with AI companies, is an evolving and increasingly important revenue source, leveraging Hearst's journalistic assets.

Venture capital arms actively invest in and divest from technology and digital media companies, generating capital gains.

| Revenue Stream | Description | Key Components | 2023/2024 Trends/Notes |

|---|---|---|---|

| Advertising | Sale of ad space across print, broadcast, and digital platforms. | Print ads, TV commercials, digital banner ads, programmatic advertising. | Continued growth in digital advertising, with programmatic playing a larger role. |

| Subscriptions & Circulation | Income from readers subscribing to print and digital content. | Magazine and newspaper subscriptions, digital-only subscriptions, direct-to-consumer services (e.g., ESPN+). | Shift towards digital subscriptions is a key industry trend. |

| Business Information & Data Services | B2B revenue from financial data, credit ratings, and specialized software/data. | Fitch Ratings, Hearst Health software, transportation data solutions. | Fitch Ratings remains a significant contributor; demand for B2B data is strong. |

| Content Licensing | Granting rights to use Hearst's content. | Journalism, lifestyle articles, syndication to other media, licensing to AI firms. | Emerging revenue stream, particularly with AI companies utilizing content for training. |

| Venture Capital Investments | Capital gains from investments in and exits from portfolio companies. | Hearst Ventures, HearstLab, Level Up Ventures investments in digital, tech, and gaming. | Focus on profitable exits and strategic investments in promising ventures. |

Business Model Canvas Data Sources

The Hearst Business Model Canvas is informed by a robust blend of internal financial performance data, extensive market research reports, and strategic insights derived from industry analysis. This multi-faceted approach ensures each component of the canvas is grounded in verifiable information and current market realities.