Hearst Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hearst Bundle

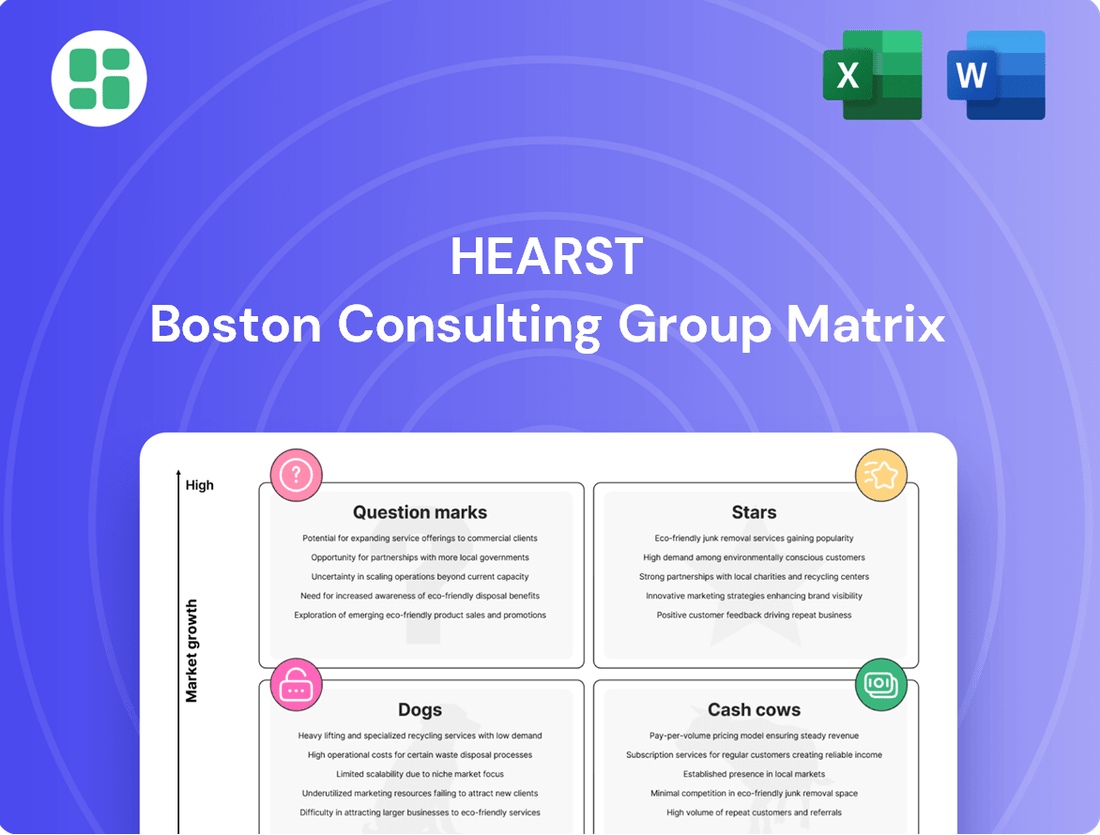

Curious about the strategic positioning of this company's product portfolio? Our preview offers a glimpse into the BCG Matrix, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To unlock a comprehensive understanding of each product's market share and growth rate, along with actionable recommendations for optimizing your investments, purchase the full BCG Matrix report today.

Stars

Hearst Health acquired QGenda in August 2024, a significant move into the rapidly expanding healthcare IT sector. This acquisition of a leading healthcare workforce management software provider is a strategic play to capitalize on the high demand for specialized solutions in this market. The deal is anticipated to fuel substantial growth for Hearst Health in 2025.

Hearst Transportation, notably through its digital auction platform Bring a Trailer, showcased robust performance in 2024, fueling consistent profit expansion for the division. Bring a Trailer thrives in the burgeoning market for classic and collectible car digital auctions, likely commanding a substantial market share thanks to its strong brand recognition and engaged user community.

This digital powerhouse acts as a star asset, adeptly capitalizing on the value generated by a dedicated and active online following. In 2024, Bring a Trailer facilitated the sale of over 30,000 vehicles, with average sale prices exceeding $50,000, underscoring its significant revenue generation and market dominance in this niche.

Hearst is making a significant push into digital subscriptions, aiming to capture a larger share of the growing digital content market. For instance, Hearst UK saw a strong 25% increase in digital subscriptions during 2024, highlighting the effectiveness of their strategy.

Hearst Ventures' Portfolio Companies

Hearst Ventures strategically invests in early-stage companies poised for significant growth, particularly within sectors like AI, e-commerce, and mobility. A prime example of this is their investment in tvScientific in February 2025, highlighting their focus on emerging category leaders. These companies, while not directly owned, represent crucial indirect stars within Hearst's broader portfolio, offering exposure to dynamic and expanding markets.

These strategic investments are designed to foster future growth for Hearst. As these portfolio companies mature and solidify their market positions, they enhance the overall value and potential of Hearst's investment holdings. This approach allows Hearst to tap into innovation and capture upside from disruptive technologies and business models.

- tvScientific: A recent investment in February 2025, underscoring Hearst Ventures' focus on early-stage leaders in high-growth sectors.

- AI Tools: Hearst Ventures actively seeks out and invests in companies developing cutting-edge artificial intelligence solutions.

- E-commerce: The venture arm targets innovative e-commerce platforms and technologies that are shaping the future of retail.

- Mobility: Investments extend to companies revolutionizing transportation and mobility services, aligning with evolving consumer needs.

New Local Newspaper Digital Dominance Strategy (e.g., Austin American-Statesman)

Hearst's acquisition of the Austin American-Statesman in December 2024 exemplifies a strategic move to secure digital dominance in promising local markets. This investment targets communities with robust growth, aiming to leverage digital platforms for expanded readership and revenue. The strategy prioritizes transforming these acquired newspapers into high-growth digital entities by injecting capital into enhanced digital journalism and storytelling capabilities.

This approach positions the Austin American-Statesman as a potential 'Star' within Hearst's portfolio, reflecting a belief in its ability to achieve significant digital market share. The newspaper industry, while generally facing print challenges, presents opportunities in specific locales where digital engagement can be cultivated. Hearst's commitment to digital transformation aims to capitalize on these localized growth potentials.

- Investment Focus: Hearst is channeling resources into digital infrastructure and talent to bolster the Austin American-Statesman's online presence.

- Market Potential: Austin's dynamic economic and population growth provides a fertile ground for expanding digital subscriptions and advertising.

- Digital Transformation: The strategy involves a comprehensive overhaul of content delivery, user experience, and data analytics to drive digital engagement.

- Revenue Diversification: Beyond traditional advertising, Hearst likely seeks to develop new digital revenue streams, such as premium content or e-commerce integrations.

Stars in the BCG Matrix represent high-growth, high-market-share business units or products. These are often the most promising assets in a company's portfolio, demanding significant investment to maintain their growth trajectory and competitive advantage. Their success fuels overall company growth and profitability.

Bring a Trailer, with its strong brand and active user base in the collectible car market, is a prime example of a Star for Hearst. Hearst Health's acquisition of QGenda positions it to capitalize on the growing healthcare IT sector, making it another potential Star. Hearst Ventures' investments in companies like tvScientific, focusing on AI and e-commerce, also represent emerging Stars with high growth potential.

These Star assets require ongoing investment to defend their market positions and capitalize on growth opportunities. Their high market share in growing industries suggests they are well-positioned for future success and significant returns.

| Business Unit/Investment | Market Growth | Market Share | Strategic Importance | 2024/2025 Outlook |

|---|---|---|---|---|

| Bring a Trailer | High (Collectible Cars) | High | Digital revenue driver, strong brand | Continued profit expansion |

| Hearst Health (QGenda) | High (Healthcare IT) | Growing | Strategic expansion into tech | Anticipated substantial growth |

| Hearst Ventures (tvScientific) | High (AI, E-commerce) | Emerging | Exposure to future tech leaders | Potential for significant upside |

What is included in the product

The Hearst BCG Matrix analyzes Hearst's portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs to guide strategic decisions.

Provides a clear, visual overview of your portfolio, reducing the complexity of strategic decision-making.

Cash Cows

Fitch Group stands as a prime example of a cash cow within Hearst's portfolio. As their global bond rating and data arm, it consistently delivers top-tier performance and represents the largest single source of profit for the parent company. In 2024, Fitch significantly bolstered Hearst's record-breaking revenues, underscoring its robust financial contribution.

Operating within the financial services sector, a market that is mature yet indispensable, Fitch enjoys a commanding market share. This strong position is further amplified by the favorable conditions within the bond market, which translates into substantial and dependable cash flow for Hearst. The company's ongoing commitment to enhancing its data capabilities and operational efficiency reinforces its status as a reliable cash generator.

Hearst Television Stations are a prime example of a cash cow within the Hearst conglomerate. Despite the ongoing trend of cord-cutting, these local broadcast stations demonstrated remarkable resilience, contributing significantly to Hearst's record profits in 2024. Their ability to consistently generate substantial revenue, even in a maturing market, underscores their cash cow status.

These stations command strong positions in their local markets, collectively reaching an impressive 19% of all U.S. viewers. This broad reach, coupled with a loyal audience base and a commitment to high-quality local journalism, ensures a steady and reliable stream of cash flow for the company.

Hearst's 20% stake in ESPN is a standout performer, proving to be its most lucrative major media venture in 2023, with ESPN+ notably reaching profitability. This significant ownership in a dominant sports broadcaster continues to be a substantial cash generator for Hearst, even amidst evolving media consumption trends.

Despite headwinds in traditional cable, ESPN's commanding market share in sports broadcasting solidifies its position as a cash cow. The substantial passive income derived from this mature, high-share asset remains a key financial strength for Hearst, underscoring its enduring value in the media landscape.

Established Hearst Magazine Brands (e.g., Good Housekeeping UK)

Established Hearst magazine brands, such as Good Housekeeping UK, are prime examples of Cash Cows in the BCG Matrix. These titles consistently lead their respective categories, evidenced by steady sales of actively purchased editions and notable subscription growth throughout 2024.

Despite operating in a mature industry, these brands capitalize on their significant brand equity and dedicated readership to secure and maintain a commanding market share. Their financial strength is further bolstered by a diversified revenue model, incorporating digital memberships and e-commerce initiatives.

- Market Leadership: Good Housekeeping UK maintains a leading position in the home and lifestyle magazine sector.

- Revenue Diversification: Income streams include print subscriptions, newsstand sales, digital subscriptions, and affiliate marketing through its e-commerce platform.

- Brand Loyalty: The brand benefits from decades of trust and recognition, fostering a loyal subscriber base.

- Financial Stability: These brands generate consistent, predictable cash flow, requiring minimal investment to sustain their market position.

Hearst Business Media (Beyond Fitch, e.g., MCG, First Databank)

Hearst's Business Media group, which includes entities like MCG and First Databank, is a significant profit driver for the company. In 2024, this segment contributed over 50% of Hearst's total profits, a testament to its sustained performance and decades of growth.

These businesses thrive in established, high-value business-to-business markets, where they often command substantial market shares. Their strength lies in providing specialized information and critical services that are essential for their clientele.

As a result, these ventures function as vital cash cows. They generate reliable and considerable profits, which in turn help to balance out any difficulties encountered in Hearst's other media divisions.

- Hearst Business Media's Profit Contribution: Exceeded 50% of total company profits in 2024.

- Market Position: Operates in mature, high-value B2B markets with significant market share.

- Financial Role: Serves as a crucial cash cow, providing stable and substantial profits.

- Strategic Importance: Offsets challenges in other media segments, ensuring overall financial stability.

Cash cows, under the BCG Matrix framework, represent established businesses with high market share in mature industries, generating more cash than they consume. Hearst's Fitch Group, Hearst Television Stations, its stake in ESPN, established magazine brands, and the Business Media group all exemplify this category. These units consistently deliver strong, reliable profits, often contributing the largest share of revenue and enabling investment in other parts of the business.

| Business Unit | Market Position | 2024 Financial Impact | BCG Category |

| Fitch Group | Global leader in bond ratings | Record revenue contributor | Cash Cow |

| Hearst Television Stations | Strong local market presence (19% US viewership) | Significant profit driver | Cash Cow |

| ESPN (20% Stake) | Dominant sports broadcaster | Most lucrative media venture (2023), ESPN+ profitable | Cash Cow |

| Established Magazine Brands (e.g., Good Housekeeping UK) | Category leaders with loyal readership | Steady sales and subscription growth | Cash Cow |

| Hearst Business Media (MCG, First Databank) | High market share in B2B sectors | Over 50% of total company profits (2024) | Cash Cow |

What You See Is What You Get

Hearst BCG Matrix

The Hearst BCG Matrix preview you are currently viewing is the complete, unedited document you will receive upon purchase. This means you can confidently assess the strategic insights and professional formatting before committing, knowing that no watermarks or demo elements will be present in your final download. The file is ready for immediate application to your business strategy discussions and planning sessions. You are seeing the exact, high-quality analysis that will be yours to utilize immediately after completing your purchase.

Dogs

The U.S. newspaper print circulation saw a significant decline of 12.7% for top papers in 2024, underscoring a challenging environment for traditional print media.

Certain Hearst print editions, especially those in less robust markets or with lower digital engagement, are likely experiencing diminishing market share and limited growth potential. These publications may represent cash traps, necessitating strategic evaluations for divestiture or substantial operational overhauls to ensure future viability.

Certain niche traditional magazine titles within Hearst's portfolio, particularly those heavily dependent on print advertising, may be categorized as dogs in the BCG matrix. These publications often struggle with low market share and stagnant or declining growth, both in print and digital realms.

A prime example illustrating this challenge is House Beautiful UK, which experienced a -3% year-over-year decline in its ABC print circulation figures for 2024. This indicates a contraction in its readership base, a key indicator for a publication's market position and growth potential.

A+E Networks, in which Hearst holds a 50% stake, faced considerable headwinds in 2024. The advertising landscape proved intensely competitive, further exacerbated by the persistent migration of viewers away from traditional cable subscriptions, commonly known as cord-cutting.

The linear cable television sector itself is characterized by low growth. If A+E Networks is losing ground in this shrinking market, its position for Hearst can be likened to a 'dog' in the BCG matrix. This classification suggests it demands resources but offers limited potential for future expansion or significant returns.

Legacy Digital Service Businesses with Stagnant Growth

Some of Hearst's legacy digital service businesses, like iCrossing, might be categorized as Dogs in the BCG Matrix if they've struggled to keep pace with evolving market demands. These established digital agencies, once prominent, could now possess a small market share within a mature or contracting industry segment. This situation typically leads to modest revenue generation and limited profitability.

These businesses often face challenges such as:

- Failure to innovate: A lack of investment in new technologies or service offerings can lead to obsolescence.

- Intense competition: Newer, more agile competitors can erode market share.

- Changing client needs: Digital marketing landscapes shift rapidly, requiring constant adaptation.

In 2024, the digital marketing agency sector continues to be highly competitive, with specialized firms often outperforming larger, more generalized ones. Agencies that haven't diversified their service portfolios beyond traditional digital advertising may find themselves in a stagnant growth phase, mirroring the characteristics of a Dog in the BCG matrix.

Non-Strategic or Unsuccessful 'Bolt-On' Acquisitions

When smaller acquisitions, often called bolt-ons, don't work out as planned for Hearst, they can end up in the 'dog' quadrant of the BCG matrix. This happens if they don't integrate well with existing businesses or fail to deliver the expected cost savings and revenue boosts.

These underperforming bolt-ons are characterized by a low market share in industries that aren't growing much. For example, if Hearst acquired a small local newspaper that couldn't adapt to digital trends, it might become a dog. Such an acquisition ties up valuable capital without generating significant profits or contributing to the company's overall growth strategy.

- Low Market Share: The acquired entity struggles to capture a significant portion of its target market.

- Low Market Growth: The industry or segment in which the acquired entity operates is experiencing minimal or no expansion.

- Failure to Integrate: Operational or cultural challenges prevent the successful merging of the acquisition into Hearst's existing structure.

- Unrealized Synergies: The anticipated benefits, such as cost reductions or revenue enhancements, from the acquisition are not achieved.

Dogs in the BCG matrix represent business units or products with low market share in low-growth industries. For Hearst, this could include legacy print publications struggling against digital media or certain acquired businesses that failed to integrate or achieve expected returns. These entities often consume resources without offering substantial future growth prospects.

The U.S. newspaper industry's continued circulation decline, with top papers down 12.7% in 2024, exemplifies the challenging environment for print media. Publications like House Beautiful UK, showing a 3% print circulation drop in 2024, illustrate the characteristics of a dog, possessing low market share in a contracting market.

Similarly, linear cable television, a sector with inherently low growth, can house 'dog' assets if performance lags. A+E Networks, facing intense advertising competition and cord-cutting trends in 2024, could be viewed as a dog if its market position weakens within this shrinking landscape.

Underperforming acquisitions, particularly those failing to integrate or deliver expected synergies, also fall into the dog category. These businesses are characterized by their low market share and operation within stagnant or declining market segments, tying up capital without significant profit generation.

| Hearst Business Unit Example | BCG Category | Rationale |

|---|---|---|

| Niche Traditional Magazine (e.g., House Beautiful UK) | Dog | Low print circulation (e.g., -3% YoY in 2024), declining readership in a mature/contracting market. |

| Linear Cable TV Stake (e.g., A+E Networks) | Dog (Potential) | Operating in a low-growth sector, facing competitive pressures and cord-cutting trends in 2024. |

| Underperforming Digital Acquisition | Dog | Low market share in a mature digital segment, failure to integrate or achieve expected synergies. |

Question Marks

Puzzmo, acquired by Hearst in December 2023, represents a strategic move into the high-growth digital entertainment and casual gaming sector. As a recent addition, its current market share within the expansive gaming industry is expected to be minimal.

This acquisition positions Puzzmo as a question mark in the BCG matrix, a category characterized by low market share in a high-growth industry. Significant investment in development and marketing will be crucial to increase user acquisition and market penetration.

The success of Puzzmo hinges on its ability to capture a substantial portion of the casual gaming market, which in 2024 continues to see robust growth, with global mobile gaming revenue projected to reach over $90 billion.

ESPN's upcoming direct-to-consumer streaming product, slated for a 2025 launch, enters a fiercely competitive landscape. As a new player, it will begin with a modest market share, necessitating significant outlays for content acquisition, platform development, and subscriber acquisition campaigns. The venture's outcome remains uncertain, positioning it as a question mark within the BCG matrix.

This new service represents a substantial investment for Disney, ESPN's parent company. While the streaming market continues to grow, with global revenues projected to reach over $200 billion by 2027, ESPN faces established giants like Netflix and Amazon Prime Video. The success of this product hinges on its ability to differentiate itself and attract a critical mass of subscribers, potentially transforming it into a future star if successful, or a dog if it falters.

HearstLab and Level Up Ventures actively deployed capital in 2024, backing 45 early-stage companies. These ventures, positioned within high-growth sectors like emerging technology and digital innovation, represent classic question marks in the BCG matrix.

While these investments exhibit significant potential for future market dominance, they currently possess low market share and are cash-intensive. The success of these 45 companies hinges on their ability to scale effectively and achieve widespread market adoption, with the potential to transition into stars or, conversely, to falter.

AI Integration in Content Creation and Monetization

Hearst is actively exploring and investing in generative AI for content creation and monetization, aiming to boost efficiency across various departments. This includes content programming, sales, marketing, and data assembly, signaling a strategic push into AI-driven operations.

While AI represents a significant growth area, its direct revenue contribution within Hearst's current media operations is likely minimal, placing it in the question mark category of the BCG matrix. These applications are probably in early development or adoption phases, meaning they have low market share in terms of immediate financial returns.

These AI integration efforts require ongoing investment to unlock their full potential for operational efficiencies and to develop new monetization avenues. Hearst's 2024 strategy likely involves continued experimentation and resource allocation to nurture these nascent AI capabilities.

- AI Investment Focus: Hearst is directing resources into generative AI for content programming, sales, marketing, and data assembly.

- Market Position: AI applications within Hearst's media operations are likely in early stages, resulting in low current market share for direct revenue.

- Strategic Outlook: These initiatives are considered question marks, necessitating sustained investment to achieve efficiency gains and new monetization opportunities.

- 2024 Priority: Continued exploration and development of AI tools are key to Hearst's forward-looking strategy for operational enhancement and revenue diversification.

Digital Expansion of Recently Acquired Local Newspapers (beyond Austin/Dallas)

Following the recent acquisitions of the Austin American-Statesman and the Dallas Morning News, Hearst is strategically targeting further digital expansion in promising local markets. These new ventures, while entering a growing digital journalism sector, will initially hold a modest market share in their respective communities.

These initiatives represent question marks within Hearst's portfolio, requiring focused investment and operational expertise to cultivate them into leading local digital news sources. For instance, the digital transformation of local news outlets is a key trend; by mid-2024, over 70% of local news consumers reported engaging with news content on digital platforms at least weekly.

- Strategic Focus: Expanding digital reach in underserved or high-potential local markets beyond Austin and Dallas.

- Market Position: Starting with low market share in these new digital ventures.

- Investment Rationale: Positioning these as future growth engines in the digital journalism space.

- Key Challenge: Achieving significant market penetration and audience engagement to transition from question marks to stars.

Question marks represent business units or products with low market share in high-growth industries. These require careful consideration regarding future investment.

Hearst's Puzzmo acquisition and its new ESPN streaming service are prime examples, needing significant capital to gain traction.

Similarly, early-stage AI investments and new digital local news ventures are question marks, demanding ongoing support to potentially become stars.

| Hearst Business Unit/Initiative | Industry Growth | Current Market Share | BCG Matrix Classification | Investment Strategy |

|---|---|---|---|---|

| Puzzmo (Digital Entertainment) | High | Low (as of acquisition) | Question Mark | Invest for growth, user acquisition |

| ESPN Direct-to-Consumer Streaming | High | Low (new launch) | Question Mark | Significant investment in content, platform, marketing |

| Generative AI Initiatives | High | Low (early stage) | Question Mark | Continued experimentation and resource allocation |

| New Digital Local News Ventures | Moderate to High | Low (new markets) | Question Mark | Focused investment, operational expertise for market penetration |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.