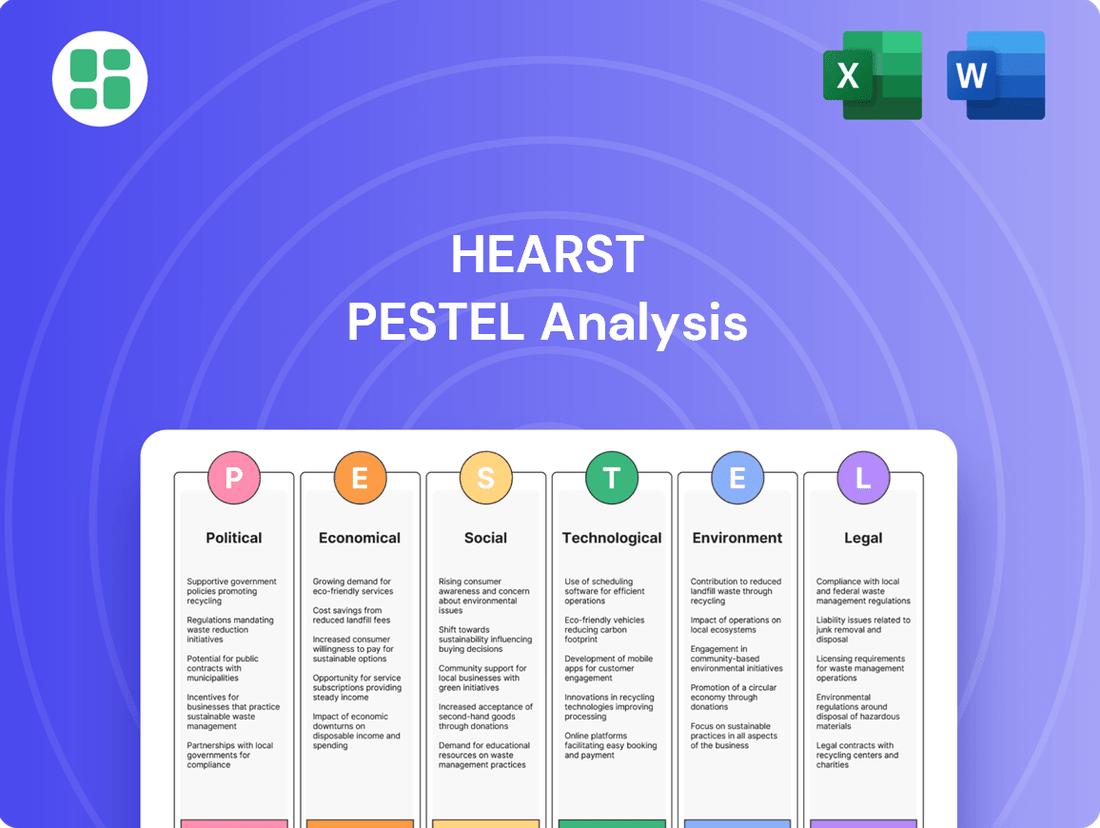

Hearst PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hearst Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Hearst's strategic landscape. Our PESTLE analysis provides a deep dive into these external forces, offering actionable insights for your own market strategy. Don't be left behind; download the full version now for a competitive edge.

Political factors

Hearst's operations are deeply intertwined with governmental regulations on media content and ownership, impacting its strategic decisions and market position. These rules dictate everything from how much of the media landscape a single company can control to the standards content must adhere to.

Changes in regulations, like those concerning local media consolidation or rules preventing cross-ownership, can directly affect Hearst's growth strategies, potentially forcing the company to sell off assets or limiting its ability to acquire new ones. For example, evolving anti-trust laws could reshape the competitive environment for diversified media conglomerates.

The European Media Freedom Act, set to be fully implemented by August 2025, is a significant development. This act is designed to bolster media pluralism and independence throughout the EU. It will likely introduce new transparency obligations regarding media ownership and establish safeguards against undue influence, which could impact Hearst's international media ventures by requiring greater disclosure and potentially limiting certain operational flexibilities.

The political landscape surrounding press freedom significantly impacts Hearst's core business of news and editorial content. When governments restrict journalistic independence or engage in censorship, Hearst's capacity to provide unbiased reporting is directly challenged, potentially affecting audience trust and market reach.

Emerging legislative frameworks, such as aspects of the European Media Freedom Act, are designed to bolster press freedom by safeguarding journalistic sources and ensuring editorial autonomy. These protections are vital for Hearst to maintain its operational integrity and the credibility of its publications.

Political advertising is a critical revenue driver for Hearst, especially for its television and newspaper divisions during election cycles. In 2024, this segment likely saw substantial contributions, a trend that historically reverses sharply in non-election years. For instance, following the 2024 U.S. elections, a significant downturn in political ad spending is anticipated for 2025.

International Trade Policies and Global Presence

Hearst's extensive global presence means its operations are directly influenced by a complex web of international trade policies, tariffs, and evolving geopolitical landscapes. For example, shifts in trade agreements, such as potential changes to digital services taxes or data localization requirements in key markets, could significantly alter the cost and accessibility of Hearst's digital content and advertising services. The company's reliance on international markets for content distribution and revenue generation necessitates careful monitoring of these political factors to mitigate risks and capitalize on opportunities.

Increased protectionist measures in various countries could impact Hearst's ability to import and export content, affecting its diverse media portfolio, which includes newspapers, magazines, and digital platforms. Furthermore, such policies might influence the cost of raw materials for its print operations or create barriers for its digital service offerings. Hearst's strategic approach to navigating these international political dynamics is paramount for maintaining its global reach and ensuring continued growth across its various business segments.

Consider the following potential impacts:

- Trade Agreement Revisions: Changes to agreements like the EU-US Data Privacy Framework could affect data flow for digital services.

- Tariff Impositions: New tariffs on paper products or printing equipment could raise costs for Hearst's print divisions.

- Geopolitical Instability: Conflicts or political unrest in regions where Hearst operates or sources content could disrupt operations and revenue streams.

- Digital Service Taxes: The implementation of digital services taxes in countries like France or the UK directly impacts the profitability of Hearst's online advertising and subscription services.

Government Scrutiny of Digital Platforms and Data

Governments globally are intensifying their oversight of major digital companies, focusing on data privacy, content management, and fair competition. For Hearst, which operates and invests in digital ventures, this means navigating potential regulatory hurdles concerning user data collection, utilization, and security.

Regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States directly impact how Hearst must manage user information. These frameworks impose strict rules on consent, data access, and deletion, requiring significant investment in compliance infrastructure and data governance. As of early 2024, enforcement actions and fines under these regulations continue to be a significant concern for digital businesses. For instance, the EU has levied substantial fines against tech giants for privacy violations, underscoring the financial risks associated with non-compliance.

- GDPR fines: In 2023, Meta was fined €1.2 billion for transferring EU user data to the US.

- CCPA enforcement: California's Attorney General has been actively investigating and penalizing companies for data privacy breaches.

- Content moderation debates: Ongoing discussions about platform liability for user-generated content, particularly concerning misinformation and hate speech, could lead to new legislative requirements affecting digital publishers.

Political stability and government policies significantly shape Hearst's operating environment, influencing everything from media ownership rules to advertising revenue. The company must adapt to evolving regulations impacting its diverse portfolio, from traditional print to digital platforms.

In 2024, political advertising played a crucial role in Hearst's revenue, particularly for its broadcast and newspaper segments, with a notable slowdown expected in 2025 after the U.S. elections. Furthermore, international trade policies and geopolitical shifts present both risks and opportunities for Hearst's global content distribution and digital services.

The implementation of regulations like the EU's European Media Freedom Act by August 2025 will introduce new transparency requirements for media ownership and content, directly affecting Hearst's international operations and requiring careful navigation of compliance measures.

What is included in the product

This Hearst PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic planning.

It provides a comprehensive overview of external forces, highlighting key trends and their potential impact on Hearst's business environment.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for immediate strategic action.

Economic factors

Hearst's revenue is heavily influenced by advertising market spend, a critical component for both its traditional media like newspapers and magazines, and its growing digital platforms. The competitive landscape is shifting rapidly, with a notable move from traditional channels to digital, connected TV (CTV), and programmatic advertising.

Projections for 2025 indicate strong growth in digital advertising, particularly within social video and CTV segments, which could benefit Hearst's newer ventures. Conversely, traditional linear TV advertising is anticipated to experience a downturn, posing a challenge to Hearst's established revenue streams from legacy media.

Economic cycles significantly influence how consumers spend their money, especially on non-essential items like media. During economic downturns or periods of high inflation, people tend to cut back on discretionary spending, which can impact media subscriptions and engagement with ad-supported content. For instance, while many content subscriptions have remained resilient, some consumer groups, particularly younger demographics, are actively reducing their spending in this area as of early 2024.

Hearst's strategic diversification offers a crucial advantage in navigating these economic fluctuations. By maintaining a strong presence in business-to-business (B2B) sectors, such as Fitch Group and Hearst Health, the company can offset potential volatility in its consumer-facing media businesses. This approach provides a more stable revenue stream, demonstrating resilience in the face of changing consumer spending habits driven by economic conditions.

The prevailing interest rate environment directly impacts Hearst's cost of capital for both acquisitions and internal development projects. Higher interest rates, such as those seen in late 2023 and continuing into 2024, can make borrowing more expensive for companies looking to finance growth initiatives.

Hearst's strategy involves significant investment in upgrading its software platforms and physical infrastructure, alongside a history of strategic acquisitions. Elevated borrowing costs due to higher interest rates could therefore put pressure on the profitability of these investments.

However, Hearst's robust financial position, notably its lack of net debt as of its latest reports, offers substantial flexibility. This strong cash position allows the company to pursue growth opportunities without being overly constrained by rising interest rate environments.

Inflationary Pressures on Operational Costs

Inflationary pressures directly impact Hearst's operational costs, driving up expenses for essential inputs like paper for its print media and energy for its digital infrastructure and broadcasting operations. For instance, the Producer Price Index for printing and related support activities saw a notable increase throughout 2023 and into early 2024, reflecting these rising material costs. Labor costs also contribute, with wage growth continuing to be a factor in maintaining a skilled workforce across the company's diverse media and information services segments.

Managing these escalating costs is paramount for Hearst to safeguard its profit margins across its varied business units, from media and entertainment to data services. The company's strategic investments in efficiency and technological advancements, such as the integration of AI for content creation and operational optimization, are key strategies to counteract these inflationary headwinds.

Specific cost impacts can be observed in:

- Paper Costs: Fluctuations in pulp and paper prices, influenced by global supply chains and energy costs, directly affect the profitability of Hearst's print publications.

- Energy Expenses: Increased electricity and fuel prices impact the cost of running data centers, broadcast facilities, and powering digital platforms.

- Labor Wages: Competitive labor markets and general inflation contribute to higher payroll expenses across all Hearst divisions.

Global Economic Conditions and Diversification

Hearst's extensive global reach means that shifts in international economic climates directly influence its performance. For instance, a slowdown in a key advertising market in Europe could temper revenue growth, even if other regions are performing well.

The company's strategic pivot towards B2B data and software services has been a game-changer. This diversification was instrumental in Hearst achieving record profits in 2024, a testament to its ability to navigate the volatile consumer media landscape by leaning into more stable, recurring revenue streams.

This strategic diversification offers significant protection against localized economic downturns. By not being solely reliant on consumer advertising or subscription models, Hearst can absorb shocks more effectively, as demonstrated by its 2024 financial results where new ventures bolstered overall profitability.

- 2024 Record Profits: Hearst reported record profits in 2024, largely driven by its B2B data and software segments.

- Global Economic Sensitivity: Performance is influenced by economic conditions in North America, Europe, and Asia, where Hearst has significant operations.

- Resilience Through Diversification: The shift to B2B services has provided a buffer against downturns in traditional media markets.

Economic factors significantly shape Hearst's revenue streams, with advertising spend remaining a critical driver, especially as the market shifts towards digital and CTV. While consumer spending on discretionary media may dip during economic slowdowns, Hearst's diversification into B2B sectors like data and software has proven resilient, contributing to record profits in 2024.

Interest rates directly influence Hearst's cost of capital for growth initiatives, though its debt-free status provides considerable financial flexibility. Inflationary pressures increase operational costs across print, energy, and labor, necessitating strategic investments in efficiency and technology to maintain profit margins.

Hearst's global operations mean its performance is sensitive to varying international economic conditions, but its strategic diversification has demonstrably bolstered overall profitability and resilience.

| Economic Factor | Impact on Hearst | Supporting Data/Observation |

|---|---|---|

| Advertising Spend | Influences revenue for both traditional and digital media. | Shift towards digital and CTV expected to grow; linear TV advertising projected to decline. |

| Consumer Spending | Affects subscription and ad-supported content revenue. | Some consumer segments reducing discretionary media spending as of early 2024. |

| Interest Rates | Impacts cost of capital for investments and acquisitions. | Late 2023/2024 rates make borrowing more expensive, but Hearst's lack of net debt offers flexibility. |

| Inflation | Increases operational costs for materials, energy, and labor. | Producer Price Index for printing services increased in 2023-2024; AI integration is a cost-management strategy. |

| Global Economic Climate | Affects performance across international markets. | Record profits in 2024 driven by B2B diversification, demonstrating resilience against market volatility. |

Same Document Delivered

Hearst PESTLE Analysis

The preview shown here is the exact Hearst PESTLE analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive PESTLE breakdown of Hearst.

The content and structure shown in the preview is the same Hearst PESTLE analysis document you’ll download after payment, offering valuable strategic insights.

Sociological factors

Consumer media consumption is undergoing a dramatic transformation, with traditional television viewership declining and print newspaper readership shrinking. For instance, Nielsen data from early 2024 indicated that broadcast and cable TV viewing hours continued to fall, while digital streaming services saw substantial growth.

There's a pronounced pivot towards digital platforms, with consumers increasingly favoring on-demand content, short-form videos, and social media. This trend is evident in the surging popularity of platforms like TikTok and YouTube, which command billions of user hours monthly.

Hearst, to remain competitive, must strategically adapt its content creation and distribution models. This involves a greater emphasis on multi-platform delivery, ensuring content is accessible and engaging across various digital channels to capture new and younger demographics.

Demographic shifts significantly influence how Hearst reaches its audience. Younger generations, particularly Gen Z and millennials, are heavily invested in digital and social media platforms for their content consumption. For instance, a significant portion of Gen Z actively uses platforms like TikTok and Instagram for news and entertainment, while their spending on traditional print media continues to decline.

This divergence necessitates a strategic approach for Hearst to tailor its content and advertising. While younger demographics are embracing digital subscriptions and streaming services, older audiences may still retain preferences for certain traditional media formats, though their overall consumption is also evolving. Understanding these distinct patterns is crucial for effective audience segmentation and resource allocation in 2024 and 2025.

Public trust in media is a cornerstone for organizations like Hearst, particularly as misinformation campaigns proliferate. A 2024 Edelman Trust Barometer report indicated that while trust in media saw a slight global increase to 50%, it remains a significant challenge, especially with the rise of deepfakes and AI-generated content impacting authenticity.

Hearst’s stated commitment to trusted investigative reporting and accurate storytelling directly addresses this sociological factor. In a media environment where 59% of global respondents in the same Edelman report believe journalists and news organizations are trying to do the right thing, maintaining this reputation is paramount for audience retention and brand loyalty.

Influence of Social Media and User-Generated Content

Social media platforms are now primary hubs for content, with social video advertising seeing substantial growth. In 2024, global social media ad spending is projected to reach over $200 billion, highlighting its importance for media companies like Hearst.

The increasing influence of user-generated content and nano-influencers is reshaping brand-consumer interactions. For instance, campaigns featuring micro and nano-influencers often achieve higher engagement rates than those with macro-influencers, demonstrating a shift in audience trust and preference.

Hearst must strategically utilize social media for content dissemination, audience connection, and advertising. Adapting to emerging trends such as shoppable content and the dominance of short-form video formats, like TikTok and Instagram Reels, is crucial for maintaining relevance and driving revenue.

- Global social media ad spending forecast to exceed $200 billion in 2024.

- User-generated content and nano-influencers drive higher engagement rates.

- Adaptation to shoppable content and short-form video is essential for media companies.

Demand for Personalized and Interactive Content

Consumers now actively seek out content tailored specifically to their interests and preferences, moving away from one-size-fits-all media. This shift is driven by the pervasive influence of digital platforms and the increasing sophistication of user data analysis.

Artificial intelligence is at the forefront of this trend, enabling platforms to offer highly personalized content recommendations. For instance, by mid-2024, streaming services were leveraging AI to analyze viewing habits, with studies indicating that personalized recommendations can increase user engagement by up to 30%.

Interactive content formats are also gaining significant traction, transforming passive consumption into active participation. Augmented reality (AR) experiences and shoppable media, which allow direct purchasing within content, are becoming key differentiators. By early 2025, the global AR market is projected to reach over $100 billion, highlighting the growing consumer appetite for immersive and functional digital interactions.

- Personalization Growth: AI-driven personalization is expected to see continued growth, with an estimated 80% of consumers more likely to purchase from brands that offer personalized experiences by 2025.

- Interactive Media Adoption: Shoppable media formats are projected to grow significantly, with e-commerce integration into video content potentially boosting sales by 15-20% for participating brands in 2024-2025.

- Audience Engagement: Platforms investing in interactive features like polls, quizzes, and AR filters are seeing higher user retention rates, with some reporting a 25% increase in session duration.

- Content Customization: The demand for user-generated content integration and customizable news feeds reflects a broader societal desire for control and relevance in media consumption.

Sociological factors significantly shape media consumption, with a clear shift towards digital and personalized content. Younger demographics, especially Gen Z and millennials, overwhelmingly favor platforms like TikTok and Instagram, driving a decline in traditional media engagement. This necessitates Hearst's strategic adaptation to multi-platform delivery and tailored content to capture these evolving audiences.

Public trust in media remains a critical concern, exacerbated by misinformation and AI-generated content. Hearst's commitment to accurate reporting is vital for maintaining audience loyalty, especially as global trust in media hovers around 50%. The rise of user-generated content and nano-influencers also highlights a growing preference for authentic, relatable brand interactions.

Consumers increasingly demand personalized experiences, with AI-driven recommendations enhancing engagement. Interactive content, such as shoppable media and AR, is also gaining traction, offering immersive and functional digital interactions. By early 2025, the global AR market is projected to exceed $100 billion, underscoring this trend.

| Trend | Impact on Media Consumption | Hearst's Strategic Imperative |

|---|---|---|

| Digital Dominance | Decline in traditional TV and print viewership; rise of streaming and social media. | Invest in digital platforms, multi-platform content strategy. |

| Personalization | Demand for tailored content and recommendations, driven by AI. | Leverage data analytics for personalized content delivery and advertising. |

| Trust & Authenticity | Skepticism towards misinformation; preference for trusted sources and user-generated content. | Reinforce commitment to investigative journalism; explore authentic influencer collaborations. |

| Interactivity | Growing interest in AR, shoppable content, and engaging formats. | Develop immersive and interactive content experiences. |

Technological factors

The media landscape is rapidly evolving, with digital transformation and Artificial Intelligence (AI) at its forefront. AI is no longer a futuristic concept but a present-day reality, revolutionizing how content is conceived, produced, and delivered.

AI is proving invaluable in content creation, automating tasks from initial idea generation to personalized content delivery and ad targeting. This allows for greater efficiency and more tailored experiences for audiences.

Hearst is demonstrating its commitment to this technological shift by investing in AI and upskilling its workforce. For instance, Hearst has been actively training employees on generative AI tools, aiming to boost productivity and enhance content quality across its diverse portfolio.

The broadcasting industry is undergoing a seismic shift, driven by the proliferation of digital streaming and Connected TV (CTV) platforms. This trend has led to a noticeable decline in traditional linear TV viewership, with a corresponding migration of advertising revenue towards these digital avenues. For instance, by the end of 2024, CTV ad spending in the US was projected to reach approximately $25 billion, a significant increase from previous years.

Hearst's television and cable network operations are directly impacted by this evolving media consumption. To remain competitive, Hearst must actively explore and implement new revenue streams. This includes embracing models such as advertising-supported video-on-demand (AVOD) and developing proprietary direct-to-consumer streaming services to capture a share of the growing digital video market.

Technological advancements in data analytics are fundamentally reshaping how companies like Hearst understand and engage with their audiences. Sophisticated analytical tools allow for the deep dissection of consumer behavior, preferences, and trends, paving the way for hyper-personalization in everything from advertising to content recommendations. For instance, in 2024, the digital advertising market is increasingly driven by AI-powered analytics, with platforms leveraging machine learning to predict user intent and deliver highly relevant ads.

Hearst can harness these capabilities to craft more precise marketing campaigns, leading to higher engagement rates and improved monetization. By analyzing vast datasets, the company can identify niche audience segments and tailor content and advertising messages accordingly. This data-driven approach is particularly critical as the digital marketing landscape evolves, with a growing emphasis on first-party and zero-party data, which provides more direct and reliable insights into consumer interests.

Cybersecurity and Data Privacy Technologies

As Hearst continues to grow its digital footprint, cybersecurity and data privacy are critical. The company handles extensive user data, making robust protection essential. Global data privacy regulations, like GDPR and CCPA, are tightening, requiring advanced technological solutions to safeguard sensitive information and preserve consumer trust. This directly influences how Hearst designs and manages its digital infrastructure and services.

The evolving landscape of cyber threats demands continuous investment in sophisticated security technologies. For instance, the global cybersecurity market size was projected to reach over $230 billion in 2023 and is expected to grow significantly in the coming years, reflecting the increasing importance of these solutions. Hearst must stay ahead of these threats to protect its assets and reputation.

- Data Breach Costs: The average cost of a data breach globally reached $4.45 million in 2023, underscoring the financial imperative for strong cybersecurity.

- Regulatory Fines: Non-compliance with data privacy laws can result in substantial penalties; for example, GDPR fines can reach up to 4% of annual global revenue or €20 million, whichever is higher.

- Consumer Trust: A 2023 survey indicated that over 70% of consumers are more likely to trust companies that are transparent about their data privacy practices.

- Investment in AI Security: Companies are increasingly investing in AI-powered security solutions to detect and respond to sophisticated cyberattacks more effectively.

Emergence of New Content Creation Technologies

Beyond the buzz around Artificial Intelligence, new technologies like Augmented Reality (AR) and Virtual Reality (VR) are rapidly evolving, offering novel avenues for immersive content creation and groundbreaking advertising experiences. These immersive technologies are not just for entertainment; they are becoming powerful tools for storytelling and engagement. For instance, by 2025, the global AR/VR market is projected to reach hundreds of billions of dollars, indicating a significant shift in how content is consumed and monetized.

Furthermore, the rise of voice search and voice commerce necessitates a strategic pivot towards optimizing content for natural language processing. This means adapting content strategies to cater to conversational queries, making information more accessible and discoverable through spoken commands. By 2024, it's estimated that over half of all internet searches will be conducted via voice, highlighting the urgency of this adaptation.

- AR/VR Adoption: Continued investment in AR/VR content creation tools and platforms is crucial for Hearst's digital ventures to capitalize on the growing immersive media market.

- Voice Optimization: Implementing natural language processing (NLP) techniques for content creation and search engine optimization is essential to capture the increasing voice search traffic.

- Emerging Ad Formats: Exploring and integrating innovative advertising formats within AR/VR environments can unlock new revenue streams and enhance audience engagement.

- Cross-Platform Integration: Ensuring seamless integration of AR/VR and voice-enabled content across Hearst's diverse digital properties will be key to maintaining a competitive edge.

Technological advancements, particularly in AI and data analytics, are fundamentally reshaping content creation and audience engagement strategies. Hearst's investment in AI training for its employees underscores a commitment to leveraging these tools for enhanced productivity and personalized content delivery.

The shift towards Connected TV (CTV) and streaming platforms is significantly impacting traditional broadcasting, necessitating new revenue models like AVOD and direct-to-consumer services. By 2024, US CTV ad spending was projected to reach $25 billion, highlighting this digital migration.

Sophisticated data analytics enable hyper-personalization, with AI-driven insights guiding marketing campaigns for improved engagement. The digital advertising market in 2024 is heavily reliant on machine learning for predicting user intent and delivering relevant ads.

Cybersecurity and data privacy are paramount, especially with increasing global data regulations and the rising cost of data breaches, which averaged $4.45 million in 2023. Hearst must invest in advanced security to protect its extensive user data.

| Technology Area | Impact on Hearst | Key Data/Projections |

|---|---|---|

| Artificial Intelligence (AI) | Content creation, personalization, ad targeting, productivity enhancement | Hearst actively training employees on generative AI tools. AI-powered analytics driving digital advertising in 2024. |

| Streaming & CTV | Shift in viewership, advertising revenue migration | US CTV ad spending projected at ~$25 billion by end of 2024. Need for AVOD and D2C services. |

| Data Analytics | Audience understanding, hyper-personalization, precise marketing | Digital advertising market increasingly driven by AI analytics. Focus on first-party data. |

| Cybersecurity | Data protection, consumer trust, regulatory compliance | Average global data breach cost: $4.45 million (2023). GDPR fines up to 4% of global revenue. |

| AR/VR & Voice | Immersive content, new advertising avenues, voice search optimization | Global AR/VR market projected to reach hundreds of billions by 2025. Over 50% of internet searches by voice by 2024. |

Legal factors

Copyright and intellectual property (IP) laws are fundamental to Hearst's operations, given its extensive content creation across magazines, newspapers, television, and digital media. These laws safeguard Hearst's creative assets, preventing unauthorized duplication and distribution, which is crucial for maintaining its competitive edge and revenue generation through licensing and syndication. For instance, in 2023, the U.S. Copyright Office reported over 500,000 copyright registrations, underscoring the vast landscape of protected works that companies like Hearst navigate.

Any shifts in IP legislation or the efficacy of its enforcement directly influence the valuation and economic potential of Hearst's substantial content portfolio. The digital age presents ongoing challenges, with evolving interpretations of fair use and the increasing prevalence of AI-generated content, which may necessitate adjustments to how copyright is applied and protected. In 2024, discussions around AI and copyright are intensifying, with potential implications for how content is created, owned, and monetized across the media industry.

Hearst's digital operations necessitate strict adherence to data privacy regulations like GDPR and CCPA. These laws govern personal data handling, impacting advertising and user experience. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, underscoring the financial risk of non-compliance.

Hearst's aggressive acquisition strategy, exemplified by recent deals like the purchase of MotorTrend Group and the Austin American-Statesman, faces significant hurdles from antitrust laws and media ownership regulations. These regulations are designed to prevent market monopolies and foster a diverse media landscape, ensuring a variety of voices and viewpoints. For instance, in the US, the Federal Communications Commission (FCC) enforces media ownership rules, limiting the number of broadcast stations and newspapers a single entity can own in a given market.

Regulatory bodies meticulously scrutinize proposed mergers and acquisitions to gauge their potential impact on market competition and editorial independence. This scrutiny can lead to conditions being imposed on deals or, in some cases, outright rejection. For Hearst, this means that future acquisition opportunities, particularly in consolidating media markets, will be carefully evaluated against these legal frameworks, potentially shaping the company's growth trajectory and the scope of its media empire.

Broadcasting Licenses and Retransmission Consent

Hearst's television stations rely on broadcasting licenses, a critical legal factor. These licenses are subject to renewal and compliance with Federal Communications Commission (FCC) regulations. The FCC's oversight directly influences how Hearst operates its local broadcast services.

Retransmission consent negotiations are another key legal area. Hearst must secure agreements with cable and satellite operators to allow them to carry its broadcast signals. The revenue generated from these carriage agreements is substantial, making successful negotiations vital for financial performance.

Regulatory actions, such as those concerning signal blackouts due to failed retransmission consent talks, can significantly impact Hearst's operations. For example, FCC rules mandate reporting of such blackouts, which can lead to subscriber dissatisfaction and financial losses. In 2024, the ongoing complexities of these negotiations continue to shape the media landscape.

- Broadcasting Licenses: Essential for operating local TV stations, subject to FCC oversight and renewal.

- Retransmission Consent: Legal agreements with pay-TV providers for carrying Hearst's signals, a key revenue source.

- Regulatory Compliance: Adherence to FCC rules on signal carriage and blackout reporting is mandatory.

- Negotiation Impact: Failures in retransmission consent talks can lead to service disruptions and revenue loss.

Content Liability and Defamation Laws

Hearst, operating as a major publisher and broadcaster, navigates significant legal risks tied to content liability. This includes potential lawsuits for defamation, libel, and even incitement, particularly as its digital platforms host user-generated content and rapidly disseminate news. The legal landscape surrounding content responsibility is continually shifting, demanding constant vigilance.

The complexity is amplified by the sheer volume and speed of digital information flow. Hearst's news divisions rely heavily on legal frameworks that protect journalistic sources and uphold editorial independence. For instance, the European Media Freedom Act, enacted in 2024, aims to bolster these protections, which are crucial for maintaining the integrity of its reporting and broadcasting operations.

- Defamation Risks: Hearst must manage the potential for legal challenges arising from factual inaccuracies or unfair commentary in its publications and broadcasts.

- Evolving Digital Laws: The legal environment for online content is dynamic, requiring Hearst to adapt to new regulations concerning user-generated content and online speech.

- Source Protection: Laws safeguarding journalistic sources, like those reinforced by the European Media Freedom Act, are critical for Hearst's investigative journalism and reporting integrity.

Hearst's operations are significantly shaped by legal frameworks governing intellectual property, data privacy, and antitrust concerns. The company's vast content library is protected by copyright laws, with ongoing debates in 2024 around AI's impact on ownership. Adherence to data privacy regulations like GDPR and CCPA is critical, with substantial fines for non-compliance, potentially reaching 4% of global annual revenue.

Environmental factors

Hearst's paper sourcing and production for its media outlets are significantly impacted by environmental concerns. The push for sustainable forestry, with a growing number of companies adopting Forest Stewardship Council (FSC) certification, aims to ensure responsible land management. For instance, in 2023, FSC-certified forest area globally reached over 200 million hectares, indicating a strong industry trend towards eco-friendly sourcing.

Recycled content mandates are also a key environmental factor, influencing both supply chain costs and product quality. As of early 2024, many regions are implementing or strengthening regulations requiring a minimum percentage of post-consumer recycled fiber in paper products, which can affect the availability and price of raw materials for Hearst's printing operations.

Responsible disposal of printing by-products, such as ink and paper waste, is crucial for minimizing environmental impact. The industry is seeing increased investment in recycling technologies and waste-to-energy solutions. For example, the European Union's waste framework directive sets ambitious recycling targets, pushing businesses to adopt more circular economy principles in their production processes by 2030.

Hearst's increasing reliance on digital infrastructure, including data centers and cloud services for its media and information businesses, directly correlates with substantial energy consumption. The global digital economy's energy demand is a growing concern, with data centers alone accounting for an estimated 1-1.5% of global electricity use. This trend necessitates Hearst to actively manage its carbon footprint.

To address this, Hearst should prioritize investments in renewable energy sources, such as solar and wind power, to offset the energy demands of its digital operations. Exploring and implementing energy-efficient technologies within its data centers and IT infrastructure can also significantly reduce consumption, aligning with broader sustainability objectives and potentially mitigating rising energy costs in the 2024-2025 period.

Stakeholder and public expectations for corporate social responsibility are intensifying, placing Hearst's environmental stewardship under a magnifying glass. This pressure means that how Hearst addresses its environmental impact, from waste management to energy consumption, is increasingly important for its public image.

Effective environmental initiatives, such as those focused on waste reduction or energy efficiency, can significantly boost Hearst's brand reputation. For instance, companies that demonstrate strong sustainability practices often see increased appeal among environmentally aware consumers and investors, a trend that was evident in the growing ESG investment market, which saw significant inflows in 2024.

Climate Change Impact on Operations and Supply Chains

Climate change presents a significant environmental challenge for Hearst, potentially disrupting operations through extreme weather events. These events can impact physical infrastructure, such as printing facilities or offices, and also affect distribution networks crucial for Hearst's print media. For instance, in 2024, several major hurricanes and floods caused widespread damage to logistics and transportation in North America, highlighting the vulnerability of supply chains to climate-related disruptions.

Developing resilient operations and supply chains is a long-term environmental consideration for Hearst. This involves proactive measures to mitigate the impact of potential climate-related disruptions. The increasing frequency and intensity of extreme weather events, as noted by the World Meteorological Organization's 2024 report indicating a 10% increase in weather-related disasters compared to the previous decade, underscore the urgency of this strategic imperative.

- Increased operational costs: Extreme weather events can lead to higher insurance premiums and repair expenses for damaged infrastructure.

- Supply chain vulnerabilities: Disruptions to transportation and resource availability can impact print production and timely delivery of publications.

- Resource scarcity: Changes in climate can affect the availability and cost of raw materials used in printing, such as paper.

- Reputational risk: Inability to deliver products or services due to climate impacts can damage Hearst's brand image and customer trust.

Regulatory Pressure for Environmental Reporting

Governments worldwide are intensifying mandates for corporate environmental accountability. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD), fully applicable from 2024 for many companies, requires extensive disclosure on environmental impacts. Hearst, as a global media and content company, will likely face increased scrutiny and demands for transparency regarding its carbon footprint, waste management, and supply chain sustainability, potentially impacting its operational strategies and capital allocation towards eco-friendly initiatives.

This regulatory shift means that companies like Hearst must invest in robust data collection and reporting systems to meet evolving disclosure standards. Failure to comply could result in penalties and reputational damage. By proactively addressing these requirements, Hearst can not only mitigate risks but also identify opportunities for efficiency gains and innovation in its environmental performance.

- Increased Disclosure Requirements: Expect more stringent reporting on Scope 1, 2, and 3 emissions, water usage, and biodiversity impact.

- Investor Scrutiny: Investors are increasingly using ESG (Environmental, Social, and Governance) data to inform investment decisions, pushing companies towards better environmental performance.

- Operational Adjustments: Hearst may need to re-evaluate its energy consumption, digital infrastructure's environmental impact, and paper sourcing for its print publications.

- Technological Investment: Adopting greener technologies, such as renewable energy sources for data centers and more sustainable printing processes, will become crucial.

Hearst's environmental considerations span from sustainable sourcing for its print media to the energy demands of its digital platforms. The global push for eco-friendly practices, such as the over 200 million hectares of FSC-certified forest area globally as of 2023, influences raw material procurement.

Increased regulatory scrutiny, exemplified by the EU's CSRD fully applicable from 2024, mandates detailed environmental reporting. This necessitates investment in robust data systems and potentially drives operational adjustments towards greener technologies and energy efficiency, especially given the significant energy consumption of data centers, which are estimated to use 1-1.5% of global electricity.

Climate change also poses risks, with extreme weather events in 2024 impacting logistics and highlighting supply chain vulnerabilities, as noted by a 10% increase in weather-related disasters compared to the previous decade. Proactive mitigation strategies and resilient operations are therefore critical for Hearst's long-term stability and reputation.

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from official government publications, reputable international organizations, and leading market research firms. We ensure every insight into political, economic, social, technological, legal, and environmental factors is supported by credible and current information.