Headlam Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Headlam Group Bundle

The Headlam Group, a leader in the flooring industry, demonstrates significant strengths in its extensive distribution network and strong brand recognition, but also faces potential challenges from evolving market trends and competitive pressures. Understanding these dynamics is crucial for navigating its future success.

Want the full story behind Headlam's market position, its potential vulnerabilities, and its key growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Headlam Group stands as Europe's largest distributor of floor coverings, a position that grants it substantial market power and significant economies of scale. This dominant presence allows Headlam to negotiate highly favorable terms with its suppliers, a crucial advantage in maintaining a competitive edge.

The company's extensive scale translates into competitive pricing and superior product availability across a broad geographical footprint. This operational efficiency is further bolstered by an expansive distribution network, ensuring effective reach to a wide array of customer segments.

Headlam Group boasts an extensive distribution network, a significant strength that underpins its market reach. This network spans across the UK and into Continental Europe, allowing for broad penetration into various markets.

This widespread operational footprint is crucial for efficient delivery and fostering robust relationships with a diverse clientele, encompassing independent retailers, contractors, and housebuilders. For instance, in 2023, Headlam reported that its network facilitated sales to over 40,000 customers.

The strategic consolidation of 32 trading businesses into a unified national entity, known as Mercado, further enhances this strength. This move is designed to streamline operations and optimize the network, aiming for greater efficiency and responsiveness to market demands.

Headlam Group boasts a diverse product portfolio, distributing a comprehensive range of floor coverings. This includes carpets, wood, laminate, luxury vinyl tiles (LVT), and essential accessories, effectively catering to a broad spectrum of residential and commercial requirements. This breadth of offering mitigates risk by reducing dependence on any single product category, enhancing the company's agility in responding to shifting market trends.

Strengthened Balance Sheet and Cash Generation

Headlam Group demonstrated remarkable financial resilience in 2024, successfully transitioning its balance sheet from a net debt to a net cash position of £10.9 million. This significant achievement, despite a challenging trading environment, underscores the company's effective financial management.

The company's enhanced financial standing was a direct result of robust cash generation, primarily fueled by strategic improvements in working capital management. Furthermore, substantial proceeds from property disposals played a crucial role in bolstering the company's cash reserves.

- Net Cash Position: £10.9 million achieved in 2024, a marked improvement from previous net debt.

- Working Capital Optimization: Key driver for strong cash generation.

- Property Disposals: Contributed significantly to strengthening the balance sheet.

- Financial Flexibility: Enhanced capacity for future investments and strategic initiatives.

Strategic Growth Initiatives

Headlam Group's strategic growth initiatives are proving effective, particularly in expanding reach to larger customers and strengthening its trade counter network. This focus yielded positive results in 2024, with these segments demonstrating revenue growth even as the broader market faced challenges. These strategic moves are fundamental to Headlam's long-term vision for sustained profitability and market share expansion.

Key aspects of these strengths include:

- Targeted Segment Growth: Success in attracting and serving larger customers and growing the trade counter business in 2024, indicating strong execution of strategic priorities.

- Resilience in a Downturn: Revenue growth within these key segments during a period of overall market decline highlights their robustness and Headlam's ability to gain traction.

- Future Profitability Focus: These initiatives are designed to enhance long-term profitability by diversifying revenue streams and capturing a wider customer base.

- Strategic Market Penetration: The company is successfully broadening its appeal beyond traditional regional distribution channels, signaling effective market penetration strategies.

Headlam's extensive distribution network, covering the UK and Continental Europe, is a significant asset, facilitating sales to over 40,000 customers in 2023. The strategic integration of 32 businesses into the Mercado brand streamlines operations, enhancing efficiency and market responsiveness.

The company's broad product portfolio, including carpets, wood, laminate, and LVT, mitigates risk by reducing reliance on single categories, allowing for agile responses to market shifts. In 2024, Headlam achieved a net cash position of £10.9 million, a testament to strong cash generation driven by working capital improvements and property disposals.

Headlam's strategic focus on larger customers and its trade counter network yielded revenue growth in 2024, demonstrating resilience and effective market penetration even amidst broader market challenges. This strategic expansion is key to their long-term profitability goals.

| Strength | Description | Supporting Data |

|---|---|---|

| Market Dominance & Scale | Europe's largest floor covering distributor. | Negotiates favorable supplier terms; economies of scale. |

| Extensive Distribution Network | Broad geographical reach across UK and Europe. | Serves over 40,000 customers (2023); Mercado integration. |

| Diverse Product Portfolio | Comprehensive range of flooring solutions. | Carpets, wood, laminate, LVT, accessories; reduces category dependence. |

| Financial Strength | Transition to net cash position. | £10.9 million net cash (2024); driven by working capital and property disposals. |

| Strategic Growth Initiatives | Focus on larger customers and trade counters. | Revenue growth in these segments (2024) despite market downturn. |

What is included in the product

This analysis offers a comprehensive review of Headlam Group's internal strengths and weaknesses alongside external market opportunities and threats, providing a strategic roadmap for future growth and risk mitigation.

Identifies key internal weaknesses and external threats to proactively address potential operational disruptions.

Weaknesses

Headlam's reliance on the construction and housing sectors, especially residential, makes it vulnerable to economic cycles. This susceptibility was evident in 2024, when the company experienced a notable drop in revenue and posted an underlying loss before tax. These financial results were directly linked to the persistent weakness in the market and a decrease in consumer spending on home renovations.

Headlam Group faced significant financial headwinds in 2024, with revenue dropping by 9.7%. This downturn resulted in an underlying loss before tax of £34.3 million, a stark contrast to the prior year's profitability.

The challenges persisted into the early months of 2025. From January to February, the group's revenue saw a further 6% decrease, highlighting ongoing pressure on its top-line performance and financial health.

Headlam encountered significant cost inflation in 2024, with notable increases in employee pay directly impacting operational expenses. This surge in costs occurred concurrently with a subdued pricing environment in their primary distribution market, creating a dual challenge.

The lack of price inflation meant Headlam struggled to pass on their escalating costs to customers, leading to considerable pressure on their profit margins. This squeeze made it difficult to maintain profitability in the face of rising input prices.

Operational Complexity and Restructuring Costs

Headlam Group's extensive network of diverse businesses, while a strength, has historically presented significant operational complexity. Navigating this intricate web requires robust systems and efficient management, which can be challenging to maintain consistently across all divisions. This complexity can lead to inefficiencies and slower decision-making processes.

The company's ongoing strategic restructuring initiatives, while designed for long-term benefits, incur substantial one-off cash costs. These restructuring expenses directly impact short-term financial performance, potentially affecting profitability and cash flow. For instance, the transformation plan announced in 2023 involved significant investment in IT systems and process improvements, leading to increased capital expenditure.

- Operational Challenges: Managing a broad portfolio of businesses requires sophisticated operational oversight, which can be a source of inefficiency.

- Restructuring Costs: Strategic changes, such as the 2023 transformation plan, involve one-off cash outlays impacting immediate financial results.

- Integration Difficulties: Integrating acquisitions or streamlining diverse business units can be complex and time-consuming.

- Supply Chain Vulnerabilities: The scale of operations can expose Headlam to greater risks within its supply chain, especially during periods of disruption.

Reliance on Traditional Regional Distribution

Headlam Group's reliance on its traditional regional distribution model presents a notable weakness. This segment, a historical cornerstone of the business, felt the brunt of subdued market conditions, with revenues declining by 16% in 2024.

This downturn underscores the vulnerability of relying heavily on established sales channels when overall market demand weakens. The company must accelerate its pivot towards diversifying revenue streams and exploring less traditional avenues for growth to mitigate this risk.

- Vulnerability to Market Downturns: The 16% revenue drop in the Regional Distribution segment in 2024 clearly illustrates how traditional channels suffer when the market is soft.

- Need for Diversification: This reliance highlights the strategic imperative for Headlam to reduce its dependence on legacy distribution methods and embrace newer, more resilient sales strategies.

Headlam's significant exposure to the cyclical construction and housing markets, particularly the residential sector, remains a key vulnerability. This dependence was starkly highlighted in 2024, when the company reported a 9.7% revenue decline and an underlying loss before tax of £34.3 million, directly attributed to weak market conditions and reduced consumer spending on home improvements.

The ongoing challenges were further underscored in early 2025, with a 6% revenue decrease from January to February, indicating persistent top-line pressure. This reliance on traditional regional distribution channels also proved problematic, with revenues in this segment falling by 16% in 2024.

| Weakness | Impact | 2024 Data |

| Market Cyclicality | Vulnerability to construction/housing downturns | Revenue down 9.7%; Underlying loss before tax £34.3m |

| Regional Distribution Reliance | Exposure to soft market conditions | Regional Distribution revenue down 16% |

| Cost Inflation vs. Pricing | Margin pressure due to rising employee pay and subdued pricing | Employee pay increases impacting operational expenses |

Full Version Awaits

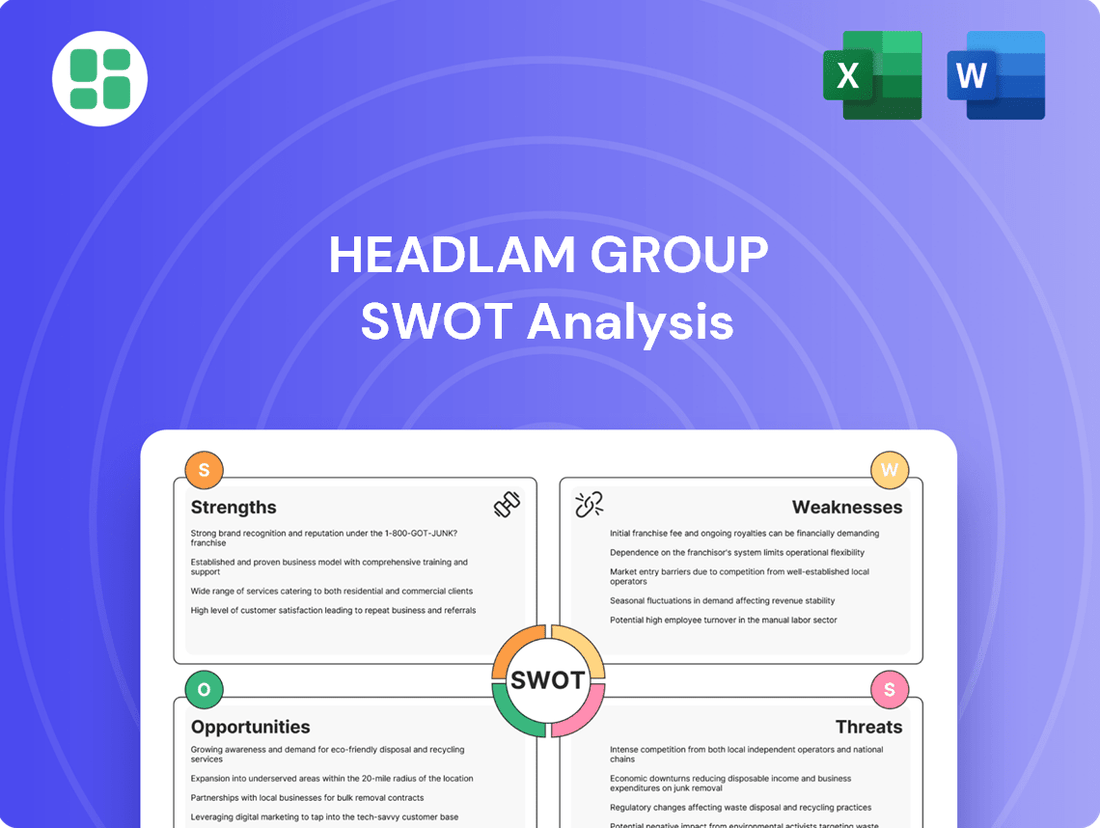

Headlam Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the Headlam Group's Strengths, Weaknesses, Opportunities, and Threats, offering actionable insights for strategic planning.

Opportunities

External forecasts suggest the flooring and related markets are poised for a modest recovery in 2025, after a period of contraction. This expected upturn is a significant opportunity for Headlam Group.

An anticipated rise in consumer confidence, coupled with increased housing transactions and disposable incomes, is likely to fuel greater spending on home improvements. This trend directly translates to higher sales volumes for Headlam's extensive product range.

For instance, market analysis from firms like GlobalData projected a gradual rebound in the UK construction sector, with residential building expected to see a 2.5% growth in 2025. This positive economic environment provides a fertile ground for Headlam to capitalize on renewed consumer demand.

The market for sustainable and eco-friendly flooring is experiencing significant expansion, with consumers increasingly prioritizing environmentally conscious choices. This trend is particularly evident in the demand for materials like luxury vinyl tiles (LVT) and laminate, which offer both durability and aesthetic appeal. For instance, the global LVT market was valued at approximately USD 15.6 billion in 2023 and is projected to grow substantially in the coming years, driven by these consumer preferences.

Headlam Group is strategically positioned to benefit from this burgeoning market. With its extensive product portfolio, the company can readily enhance its offerings in sustainable and resilient flooring segments. By focusing on expanding its range of LVT and laminate products and implementing targeted marketing campaigns, Headlam can effectively tap into these high-growth areas, meeting the evolving demands of its customer base.

Headlam Group has a prime opportunity to boost revenue by further developing its larger customer accounts and expanding its network of trade counters. This strategic focus can broaden its customer reach, making the business less dependent on its weaker regional distribution channels.

By continuing to invest in these growth areas, such as opening new trade counter locations and improving online ordering systems, Headlam can unlock significant potential. For instance, in the first half of 2024, the company saw positive contributions from its trade segment, indicating strong customer demand.

Leveraging Digital Transformation and E-commerce

The European floor covering market is experiencing a notable shift towards e-commerce, with projections indicating substantial growth in online sales. Headlam has a clear opportunity to capitalize on this trend by bolstering its digital infrastructure.

Specifically, Headlam can significantly improve its customer engagement and operational efficiency by re-platforming its online ordering portal. This, coupled with the development of new Enterprise Resource Planning (ERP) systems, will streamline processes and enhance the overall customer experience. Such advancements are crucial for capturing a larger share of the expanding online market.

The digital transformation presents a strategic avenue for growth. For instance, e-commerce sales in the European home improvement sector, which includes flooring, were estimated to reach over €50 billion in 2023, with continued double-digit growth anticipated through 2025. Headlam's investment in digital capabilities directly addresses this evolving market dynamic.

- Enhanced Online Presence: Re-platforming the existing online ordering portal to offer a more intuitive and efficient customer journey.

- Streamlined Operations: Implementing new ERP systems to integrate sales, inventory, and logistics, leading to improved efficiency and reduced costs.

- Market Share Growth: Capturing a greater portion of the burgeoning European e-commerce floor covering market, which is expected to see continued expansion.

Strategic Acquisitions and Market Consolidation

Headlam Group's robust financial standing, including its net cash position, presents a significant opportunity for strategic acquisitions. This financial strength allows the company to actively seek out smaller distributors or businesses that offer complementary products or services, thereby driving market consolidation.

Such acquisitions can bolster Headlam's market leadership and extend its geographical footprint. For instance, by acquiring regional players, Headlam can gain access to new customer bases and distribution networks, especially as the market shows signs of recovery in 2024 and anticipates further growth in 2025.

These strategic moves also offer the chance to enhance Headlam's product capabilities. Integrating new product lines or technologies through acquisition can broaden the company's appeal and competitive edge.

- Financial Strength: Headlam's net cash position provides the firepower for acquisitions.

- Market Consolidation: Opportunities exist to acquire smaller competitors, increasing market share.

- Geographic Expansion: Acquisitions can open doors to new regions and customer segments.

- Capability Enhancement: Buying businesses with complementary products can broaden Headlam's offering.

The flooring market is showing signs of recovery, with projections for a modest upturn in 2025, presenting a prime opportunity for Headlam Group to capitalize on renewed consumer spending. An anticipated increase in consumer confidence and housing transactions is expected to drive demand for home improvements, directly benefiting Headlam's product sales.

The growing consumer preference for sustainable and eco-friendly flooring, particularly LVT and laminate, offers a significant growth avenue. Headlam is well-positioned to expand its offerings in these high-demand segments, meeting evolving customer needs and capturing market share.

Expanding its network of trade counters and focusing on larger customer accounts presents a clear path for Headlam to increase revenue and reduce reliance on weaker distribution channels. Investment in these areas, supported by positive early contributions from the trade segment in H1 2024, indicates strong customer demand.

The increasing shift towards e-commerce in the European floor covering market provides Headlam with a substantial opportunity to enhance its digital infrastructure. Re-platforming its online ordering portal and implementing new ERP systems can streamline operations, improve customer engagement, and capture a larger share of the expanding online market.

Headlam's strong net cash position enables strategic acquisitions, allowing for market consolidation and expansion. Acquiring smaller distributors or complementary businesses can bolster market leadership, extend geographical reach, and enhance product capabilities, especially as the market anticipates growth in 2025.

| Opportunity Area | Key Driver | Headlam's Action | Projected Impact |

|---|---|---|---|

| Market Recovery | Modest economic upturn, increased consumer confidence | Capitalize on renewed demand for home improvements | Increased sales volumes, revenue growth |

| Sustainable Flooring | Growing consumer preference for eco-friendly products | Expand LVT and laminate offerings | Tap into high-growth market segments |

| Trade Counters & Key Accounts | Demand for accessible B2B services | Develop larger customer accounts, expand trade counter network | Broader customer reach, reduced channel dependency |

| E-commerce Growth | Shift towards online purchasing in floor coverings | Enhance digital infrastructure, re-platform online portal | Capture larger share of expanding online market |

| Strategic Acquisitions | Strong net cash position, market consolidation potential | Acquire complementary businesses | Market leadership, geographic expansion, capability enhancement |

Threats

Persistent inflation and elevated interest rates, exemplified by the Bank of England maintaining its base rate at 5.25% through early 2024, continue to cast a shadow over the UK economy. This economic backdrop directly impacts consumer confidence and disposable income, potentially leading to reduced spending on home furnishings and flooring, a key market for Headlam Group. Furthermore, ongoing geopolitical tensions contribute to supply chain fragilities and cost volatility, creating an unpredictable operating environment.

The European flooring market is seeing growing competition, with big global players and smaller, nimble regional companies vying for market share. This often results in price wars, squeezing profit margins, particularly when the market is already slow and demand is weak.

For instance, in 2023, the overall European flooring market experienced a slowdown, with some segments seeing price erosion as companies fought to maintain volume. Headlam Group, operating within this environment, faces the direct impact of these competitive pressures on its revenue and profitability.

Global supply chain vulnerabilities, exacerbated by geopolitical tensions like the Red Sea crisis, are driving up container costs and freight charges. These increased shipping expenses directly impact Headlam's import costs, potentially squeezing profit margins and creating inventory management difficulties, particularly for suppliers of vinyl and LVT products.

Shifting Consumer Preferences

Consumer tastes are evolving, and a notable trend is the ongoing move away from traditional carpets towards hard flooring solutions like luxury vinyl tile (LVT) and wood. This shift could affect various parts of Headlam's product range.

For example, if this preference for hard flooring continues to accelerate, Headlam might need to quickly adjust its stock levels and promotional efforts to match the changing demand. This requires agility in responding to market signals.

- Market Data: Reports from 2024 indicate that the global LVT market is projected to grow significantly, with some forecasts suggesting a compound annual growth rate (CAGR) of over 6% through 2028, highlighting the increasing consumer adoption of this flooring type.

- Impact on Portfolio: While Headlam has a broad offering, a substantial pivot to hard flooring necessitates strategic inventory management and potentially increased investment in marketing hard flooring options to maintain market share.

- Adaptation Strategy: The company's ability to quickly adapt its product mix and marketing strategies will be crucial in mitigating the impact of these shifting consumer preferences and capitalizing on growth areas within the flooring sector.

Regulatory Changes and Compliance Costs

Stricter regulations in Europe, particularly concerning sustainability and indoor air quality, are a significant threat. This trend is fueling demand for products with low volatile organic compounds (VOCs) and those made from recycled materials. For Headlam Group, adapting to these evolving environmental standards and implementing more sustainable operational practices may lead to increased compliance costs.

For instance, the EU's Green Deal aims to make the EU climate-neutral by 2050, which will undoubtedly translate into more stringent product and operational requirements across various sectors, including building materials and furnishings. Companies like Headlam will need to invest in research and development for eco-friendly alternatives and potentially retool manufacturing processes. This could impact profit margins if these costs cannot be fully passed on to consumers or offset by increased sales of sustainable products.

- Increased Compliance Burden: Evolving environmental regulations in Europe necessitate significant investment in compliant products and processes.

- Operational Cost Increases: Adopting sustainable practices and materials may raise production and operational expenses for Headlam Group.

- Market Access Risks: Failure to meet new regulatory standards could limit access to key European markets.

Intensifying competition within the European flooring market, characterized by aggressive pricing strategies from both global and regional players, poses a significant threat to Headlam Group's profitability. This competitive pressure is amplified during periods of economic slowdown, as seen in market reports from 2023 indicating price erosion in certain segments. Furthermore, ongoing global supply chain disruptions, such as those stemming from geopolitical events like the Red Sea crisis, are increasing freight costs and impacting inventory management, directly affecting import expenses for products like LVT.

The accelerating consumer shift towards hard flooring solutions like LVT and wood, away from traditional carpets, presents a challenge to Headlam's established product mix. This trend, supported by market data projecting over 6% CAGR for the global LVT market through 2028, necessitates agile adaptation in inventory and marketing strategies. Stricter European environmental regulations, driven by initiatives like the EU's Green Deal, also pose a threat by increasing compliance costs and potentially limiting market access if not met, impacting operational expenses and the need for investment in sustainable alternatives.

SWOT Analysis Data Sources

This Headlam Group SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial reports, comprehensive industry market research, and expert commentary from reputable financial analysts and trade publications.