Headlam Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Headlam Group Bundle

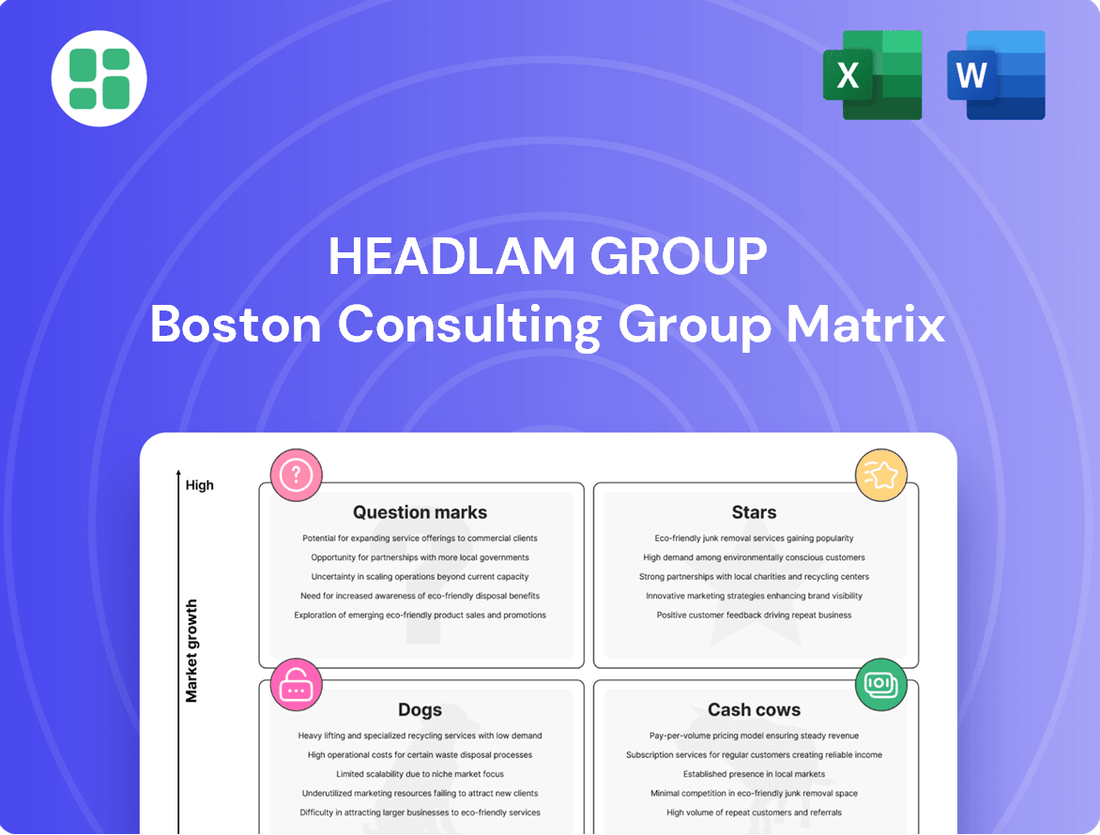

Curious about the Headlam Group's strategic positioning? This preview offers a glimpse into their BCG Matrix, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly understand their market performance and unlock actionable strategies, dive into the full report.

Gain a comprehensive understanding of the Headlam Group's product portfolio with our complete BCG Matrix. This detailed analysis will equip you with the insights needed to identify growth opportunities and optimize resource allocation. Purchase the full report for a definitive strategic roadmap.

Stars

Headlam Group's distribution of Luxury Vinyl Tile (LVT) is positioned as a Star within its business portfolio. The European LVT market is a high-growth sector, with projections indicating a Compound Annual Growth Rate (CAGR) between 8.2% and 9.9% from 2024 through 2031. This robust expansion is driven by LVT's inherent qualities, such as its resilience, diverse design options, and water-proof nature, making it a popular choice for homes and businesses alike.

Headlam Group's 'Strategic Larger Customer Accounts' are positioned as stars in their BCG Matrix, demonstrating robust revenue growth even as the broader market experienced a downturn in 2024. This segment's performance, with reported revenue growth of 5% in fiscal year 2024 despite a challenging economic climate, highlights Headlam's strong penetration and increasing share within these key relationships.

The consistent expansion of business from these larger accounts underscores their potential as significant drivers of future growth for Headlam. This strategic focus is paying off, as these relationships are not only resilient but actively contributing to the company's top line, suggesting a high degree of customer loyalty and a successful strategy in managing key accounts.

Headlam Group's expanded trade counter network is a key driver in its transformation strategy, targeting revenue growth and profitability from 2026. This initiative focuses on increasing customer access and service across local and regional markets.

The company is actively investing in this high-growth area, with a plan to have the network fully rolled out by mid-2025. This expansion is expected to capture a larger share of the distribution market.

Commercial Sector Flooring Solutions

The commercial sector flooring solutions offered by Headlam Group represent a significant growth opportunity. The European floor covering market within the commercial building segment is anticipated to expand at a compound annual growth rate (CAGR) of 5.15% up to 2030, signaling a robust and expanding market.

Headlam has actively secured new contracts and projects within this commercial space, demonstrating a solid and increasing foothold. This success is underpinned by their broad product portfolio and established distribution network, which are crucial for capitalizing on the growing demand across various commercial environments.

- Market Growth: European commercial floor covering market projected to grow at a 5.15% CAGR through 2030.

- Headlam's Performance: Winning new contracts and projects in the commercial sector.

- Competitive Advantage: Extensive product range and strong distribution capabilities.

- Target Segments: Well-positioned to serve offices, healthcare, and retail spaces.

E-commerce Distribution Channels

E-commerce is a rapidly expanding avenue for floor covering sales across Europe, with projections indicating a 7.75% compound annual growth rate between 2025 and 2030. This upward trend highlights e-commerce as a significant growth driver within the sector.

Headlam Group is actively investing in its digital capabilities, notably through the re-platforming of its Mercado online ordering system and a broader enhancement of its digital services. This strategic move underscores the company's commitment to capitalizing on the growing online market.

The company plans to utilize its extensive product range and nationwide operational reach via a unified digital platform. This approach is designed to secure a greater market share as consumer purchasing habits increasingly shift towards online channels.

- E-commerce Growth: European floor covering e-commerce expected to grow at 7.75% CAGR (2025-2030).

- Digital Investment: Headlam is re-platforming Mercado and improving digital offerings.

- Strategic Advantage: Leveraging product breadth and national scale online.

- Market Capture: Aiming to increase share in the digitally driven market.

Headlam Group's Luxury Vinyl Tile (LVT) distribution is a prime example of a Star in the BCG Matrix. The European LVT market is experiencing significant growth, projected at an 8.2% to 9.9% CAGR from 2024 to 2031, fueled by LVT's durability and design versatility.

The company's strategic focus on "Strategic Larger Customer Accounts" also positions them as Stars. These accounts demonstrated a 5% revenue growth in fiscal year 2024, outperforming a challenging market, indicating strong penetration and customer loyalty.

Furthermore, Headlam's investment in its expanded trade counter network and its growing presence in the commercial sector flooring solutions are also considered Stars. The commercial floor covering market is expected to grow at a 5.15% CAGR through 2030, and Headlam's secured contracts reflect their successful market penetration.

Finally, Headlam's e-commerce initiatives, including the Mercado platform upgrade, are positioned as Stars. The European floor covering e-commerce market is projected for a 7.75% CAGR between 2025 and 2030, a trend Headlam is actively leveraging with its digital investments.

| Business Unit | BCG Category | Market Growth Rate | Headlam's Performance Indicator | Key Driver |

|---|---|---|---|---|

| Luxury Vinyl Tile (LVT) Distribution | Star | 8.2%-9.9% CAGR (2024-2031) | High demand due to LVT's attributes | Resilience, design options, water-proof nature |

| Strategic Larger Customer Accounts | Star | N/A (segment specific) | 5% revenue growth (FY24) | Strong penetration, customer loyalty |

| Commercial Sector Flooring Solutions | Star | 5.15% CAGR (through 2030) | Secured new contracts and projects | Broad product portfolio, established distribution |

| E-commerce Operations | Star | 7.75% CAGR (2025-2030) | Digital platform enhancements | Investment in Mercado, digital service improvement |

What is included in the product

This BCG Matrix analysis highlights Headlam Group's business units, identifying Stars for growth, Cash Cows for funding, Question Marks for evaluation, and Dogs for divestment.

Provides a clear, visual roadmap to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

Headlam's core UK regional distribution of carpets represents a classic Cash Cow within its BCG Matrix. This mature segment, while experiencing overall market weakness in 2024, continues to be a significant contributor to the company's revenue and profitability.

Despite a challenging market, Headlam has successfully defended its market share in this traditional distribution channel. The company's established network and dominant position as the UK's leading carpet distributor ensure a steady generation of cash flow from this segment.

Investment in this area is strategically focused on maintaining operational efficiency and optimizing costs, rather than pursuing aggressive expansion. This approach is typical for Cash Cows, where the goal is to maximize returns from a stable, high-market-share business.

Headlam Group's established laminate flooring distribution is a classic Cash Cow. This segment benefits from laminate flooring's mature and stable status in the European market, prized for its durability and cost-effectiveness. In 2023, the flooring sector, which includes laminate, saw continued demand, with Headlam Group reporting overall revenue growth.

Leveraging its significant market share, Headlam's laminate distribution likely generates consistent, robust cash flow. This is achieved with minimal investment in marketing and development, as the product category is well-established. The strategy here is to efficiently manage this strong performer, ensuring reliable supply and upholding product quality to maintain its dominant position.

General Wood Flooring is a cornerstone for Headlam Group, functioning as a Cash Cow. Despite a 5% contraction in the European wood flooring market in 2024, this segment remains robust due to its established nature. Headlam's extensive distribution network allows it to maintain a significant market share, ensuring steady revenue and cash flow, appealing to consumers who favor natural materials.

The consistent demand for wood flooring, driven by its aesthetic appeal, provides a stable financial base for Headlam. Projections indicate a potential market recovery with increased construction activity anticipated in late 2025, which should further bolster this segment's performance and cash-generating capabilities.

Extensive UK Logistics and Warehousing Network

Headlam's extensive UK logistics and warehousing network is a prime example of a cash cow within its BCG Matrix. This mature, highly efficient operational backbone underpins the distribution of all its product lines, consistently generating significant cash flow due to its sheer scale and optimized operations.

The company's ongoing transformation plan is focused on further streamlining this network, aiming to boost profitability and reduce the capital tied up in its infrastructure. For example, in 2023, Headlam reported that its logistics and warehousing operations were instrumental in maintaining efficient stock availability and timely deliveries, contributing to a stable revenue stream.

- Mature Operational Backbone: Headlam's established logistics and warehousing infrastructure across the UK reliably supports product distribution.

- Cash Flow Generation: The scale and efficiency of this network are key drivers of substantial cash flow.

- Optimization Focus: Transformation plans are in place to further simplify and enhance the profitability of the logistics network.

- 2023 Performance: The network played a crucial role in ensuring stock availability and timely deliveries, supporting consistent revenue.

Standard Flooring Accessories Distribution

Standard flooring accessories, such as underlays, adhesives, and installation tools, are a consistent source of high profit margins for Headlam Group. Their essential role in flooring projects ensures a steady and reliable cash flow.

This segment operates within a mature, low-growth market, yet it benefits from consistent demand across all flooring types, making it a stable revenue generator. Headlam's strong market share, bolstered by its extensive distribution network, allows it to maintain this position with minimal marketing expenditure.

- Consistent Profitability: Accessories are essential, driving high margins.

- Stable Demand: Consistent need across all flooring types.

- Mature Market: Low growth but reliable revenue.

- Strong Market Position: Headlam's network ensures high share with low investment.

Headlam's established UK regional distribution of carpets is a prime Cash Cow. Despite a generally weak market in 2024, this segment remains a significant revenue and profit contributor due to Headlam's dominant position as the UK's leading carpet distributor.

The company's strategy focuses on maintaining operational efficiency and cost optimization within this mature, high-market-share business, ensuring steady cash flow generation without aggressive expansion.

Similarly, Headlam's general wood flooring distribution, despite a 5% contraction in the European market in 2024, continues to be a Cash Cow. Its established nature and Headlam's extensive network ensure a significant market share, providing a stable financial base, with projections of market recovery anticipated in late 2025.

Headlam's laminate flooring distribution also functions as a Cash Cow, benefiting from the product's mature and stable status in the European market. The company leverages its significant market share to generate consistent, robust cash flow with minimal investment.

| Segment | BCG Category | Key Characteristics | 2024/2025 Outlook |

|---|---|---|---|

| UK Regional Carpet Distribution | Cash Cow | Dominant market share, mature, stable cash flow. Focus on efficiency. | Market weakness in 2024, but stable contribution. |

| General Wood Flooring Distribution | Cash Cow | Established, aesthetic appeal, consistent demand. | Market contraction in 2024, but robust due to established nature. Potential recovery in late 2025. |

| Laminate Flooring Distribution | Cash Cow | Mature product, cost-effective, consistent demand. | Stable demand, robust cash flow generation with minimal investment. |

Delivered as Shown

Headlam Group BCG Matrix

The Headlam Group BCG Matrix preview you are viewing is the complete, final document you will receive upon purchase, offering an unwatermarked and fully formatted strategic analysis. This is not a demo; it's the actual, professionally designed report ready for immediate use in your business planning and competitive strategy discussions. Once purchased, you will gain instant access to this comprehensive BCG Matrix, enabling you to leverage its insights without any further modifications or delays. The preview accurately represents the quality and detail of the full document, ensuring you know exactly what strategic asset you are acquiring.

Dogs

Headlam's Continental Europe revenue saw a sharp decline of 14.9% in 2024. This underperformance highlights a low market share in a region experiencing tougher market conditions than the UK.

These operations are likely cash consumers, not generating sufficient returns, suggesting a need for strategic review or divestment if market share improvements are not feasible.

The group's strategy to simplify its network may lead to consolidation or exits from these underperforming European distribution channels.

Headlam Group's portfolio might include older residential vinyl flooring products, distinct from the popular Luxury Vinyl Tile (LVT) category. These items cater to specific, often shrinking, market segments and are likely facing reduced consumer interest.

These products would likely exhibit a low market share within a market that is either stagnant or in decline. Such offerings can become cash traps, consuming resources that could be more effectively deployed in growth areas like LVT.

Headlam Group’s legacy regional distribution centers are currently categorized as dogs within its BCG Matrix. The company's strategic transformation includes consolidating its distribution network, evidenced by the sale of sites like the Tamworth distribution center through a leaseback agreement. This move suggests that some of these older facilities were likely underperforming, burdened by high operational costs relative to their market share and returns.

Highly Commoditized, Low-Margin Carpet Ranges

Within Headlam Group's portfolio, certain highly commoditized carpet ranges, especially those lacking strong brand identity, often find themselves in a challenging position. These segments typically exhibit both low market share and limited growth potential.

These products can become 'cash traps,' tying up valuable inventory and operational resources without delivering substantial returns. For instance, in 2024, the broader UK flooring market saw intense price competition, particularly in entry-level carpet segments, impacting margins across the industry. Headlam's strategy here would involve reducing investment in these areas or finding ways to differentiate their offerings.

- Low Market Share: These carpets struggle to capture significant customer preference due to their undifferentiated nature.

- Low Growth Prospects: The overall market for these specific, unbranded carpet types is not expanding.

- Minimal Profitability: Thin margins mean that even high sales volumes contribute little to overall profitability.

- Potential Cash Traps: Holding large stocks of these products can tie up capital that could be better utilized elsewhere.

Non-Strategic, Legacy Product Brands

Headlam Group's strategic shift towards consolidating its operations under the Mercado brand signifies a move away from a fragmented customer offer. This consolidation, aiming to streamline 32 trading businesses into a single national entity, naturally categorizes certain legacy product brands as potential 'dogs' within the BCG matrix.

These brands, often representing smaller, acquired entities or those with a niche, non-strategic focus, are likely to exhibit low market share and limited growth potential. Their continued existence may not align with the simplified, national approach of Mercado. For instance, if a legacy brand serves a very specific, declining segment of the market, its contribution to the overall group's growth would be negligible.

- Low Market Share: Brands not fitting the national Mercado strategy likely hold a small percentage of their respective markets.

- Low Growth Potential: These legacy offerings are unlikely to experience significant expansion in demand.

- Strategic Disconnect: They may not align with Headlam's core business priorities or customer value proposition.

- Potential Divestment/Integration: Such brands might be phased out or absorbed into the Mercado portfolio to focus resources.

Within Headlam Group's portfolio, certain legacy regional distribution centers, such as those potentially underperforming or with high operational costs relative to their market share, are categorized as dogs. The sale of sites like the Tamworth distribution center through a leaseback agreement in 2024 exemplifies the group's strategy to consolidate its network, suggesting these older facilities may have been cash consumers.

Highly commoditized carpet ranges, particularly those lacking strong brand identity, also fall into the dog category. In 2024, intense price competition in entry-level UK carpet segments impacted margins, making these undifferentiated products with low market share and limited growth potential potential cash traps.

Legacy brands from acquired entities or those with a niche, non-strategic focus are likely dogs within the Mercado consolidation strategy. These brands, exhibiting low market share and limited growth potential, may not align with Headlam's simplified national approach and could be phased out or absorbed.

Question Marks

The market for advanced sustainable and eco-friendly flooring is a significant growth area, fueled by both consumer awareness and stricter environmental regulations. Headlam Group's involvement in this space, while growing, may see its share in truly cutting-edge, next-generation materials still developing. These innovative products represent potential stars, but currently require substantial investment in supply chain development, marketing, and consumer education to capture a leading market position.

Specialized high-performance commercial flooring, such as that used in demanding healthcare, sports, or industrial settings, represents a high-growth niche for Headlam Group. While Headlam may hold a smaller market share in these specialized areas compared to its general commercial flooring business, these segments are prime candidates for the question mark category in a BCG matrix.

These niche applications require specific product development, rigorous certifications, and dedicated sales expertise. For example, the global healthcare flooring market was valued at approximately $10.5 billion in 2023 and is projected to grow at a CAGR of 5.8% through 2030, according to Grand View Research. Similarly, the sports flooring market is experiencing robust growth, driven by increased investment in athletic facilities.

Investing in these specialized segments could unlock significant future returns for Headlam. By focusing resources on tailoring products, obtaining necessary industry accreditations, and building specialized sales teams, Headlam can effectively capture market share in these lucrative, high-demand niches. This strategic focus is key to transforming these question marks into future stars.

Headlam Group's investment in re-platforming its Mercado online portal and developing a new ERP system highlights a strategic push into advanced digital capabilities. This foundational work is crucial for future growth.

Within the BCG matrix, new digital customer engagement and design visualization tools represent potential question marks for Headlam. While e-commerce is expanding, these innovative areas, such as virtual showrooms or augmented reality design tools, are high-growth segments where Headlam's current market penetration or adoption may be limited.

Significant investment is needed to foster market understanding and drive adoption of these advanced digital tools. The goal is to nurture these question marks into future stars by building a strong competitive position in these emerging digital customer experience areas.

Expansion into New High-Growth Geographic Regions within Europe

Headlam Group's expansion into new, high-growth geographic regions within Europe represents a classic 'question mark' in the BCG matrix. While the company has a solid presence in the UK and established operations in Continental Europe, identifying and entering nascent, rapidly expanding construction markets presents a significant opportunity. These markets, characterized by low current market share for Headlam but high potential growth, demand strategic investment to build a presence.

Such an expansion would necessitate significant capital allocation. For instance, entering a new market like Poland, which saw a construction output growth of approximately 8% in 2024 according to Euroconstruct data, would require building new distribution networks and forging local partnerships. This investment is crucial for establishing brand recognition and operational capacity in territories where Headlam currently has minimal penetration.

- Market Identification: Targeting European countries with projected construction sector growth rates exceeding 5% annually, such as Germany or the Netherlands, where Headlam's current market share is under 3%.

- Investment Requirements: Allocating an estimated €5-€10 million per target region for establishing sales offices, warehousing, and initial marketing campaigns.

- Strategic Partnerships: Collaborating with local distributors or construction firms to leverage existing networks and reduce market entry friction.

- Growth Potential: Aiming to capture a 5-10% market share within these new regions within the first five years of operation, capitalizing on strong economic tailwinds.

'Smart' Flooring and Integrated Technologies

The development of 'smart' flooring, embedding sensors for climate control, energy management, and health tracking, signifies a rapidly expanding market with transformative potential. Headlam Group's current presence in this innovative sector is likely minimal, classifying it as a question mark within its business portfolio.

This emerging technology requires substantial investment in research and development, along with collaborations with technology firms, to harness its future promise. For instance, the global smart flooring market was valued at approximately $1.2 billion in 2023 and is projected to reach over $3.5 billion by 2030, indicating a compound annual growth rate of over 17%.

- Nascent Market: 'Smart' flooring represents a new frontier in building technology.

- High Growth Potential: Forecasts suggest significant expansion in this sector.

- Low Current Share: Headlam's involvement is likely in its early stages.

- Investment Needs: Significant R&D and strategic partnerships are crucial for success.

Question marks for Headlam Group represent emerging opportunities with high growth potential but currently low market share. These areas require careful investment to develop into stars or could become dogs if they fail to gain traction. Strategic focus and resource allocation are key to navigating these uncertain but potentially lucrative segments.

The company's foray into specialized commercial flooring, such as for healthcare or sports facilities, fits this category. While these niches are growing rapidly, Headlam's current market penetration is limited, necessitating investment in product development and dedicated sales efforts. Similarly, advancements in digital customer engagement tools like augmented reality design visualization are new frontiers where Headlam's market share is nascent, demanding investment to build a competitive edge.

Geographic expansion into new European markets with strong construction growth, like Poland, also falls under question marks. These regions offer high potential but require substantial investment in infrastructure and partnerships to establish a foothold. Finally, the development of 'smart' flooring, embedding technology for energy and health management, is a nascent market with significant future promise, but requires considerable R&D and strategic alliances for Headlam to capitalize on its potential.

| BCG Category | Market Growth | Market Share | Headlam's Position | Strategic Implication |

|---|---|---|---|---|

| Question Marks | High | Low | Developing/Nascent | Invest for growth or divest if potential is not realized |

| Specialized Commercial Flooring | High (e.g., Healthcare CAGR 5.8%) | Low | Emerging | Requires targeted product development and sales expertise |

| Digital Customer Engagement Tools | High (E-commerce growth) | Low | Early Stage | Investment in R&D and adoption drives needed |

| New Geographic Markets | High (e.g., Poland construction +8% in 2024) | Low | Minimal Penetration | Significant capital for market entry and partnerships |

| Smart Flooring | Very High (CAGR >17%) | Very Low | Nascent | Substantial R&D and tech partnerships are critical |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.