Headlam Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Headlam Group Bundle

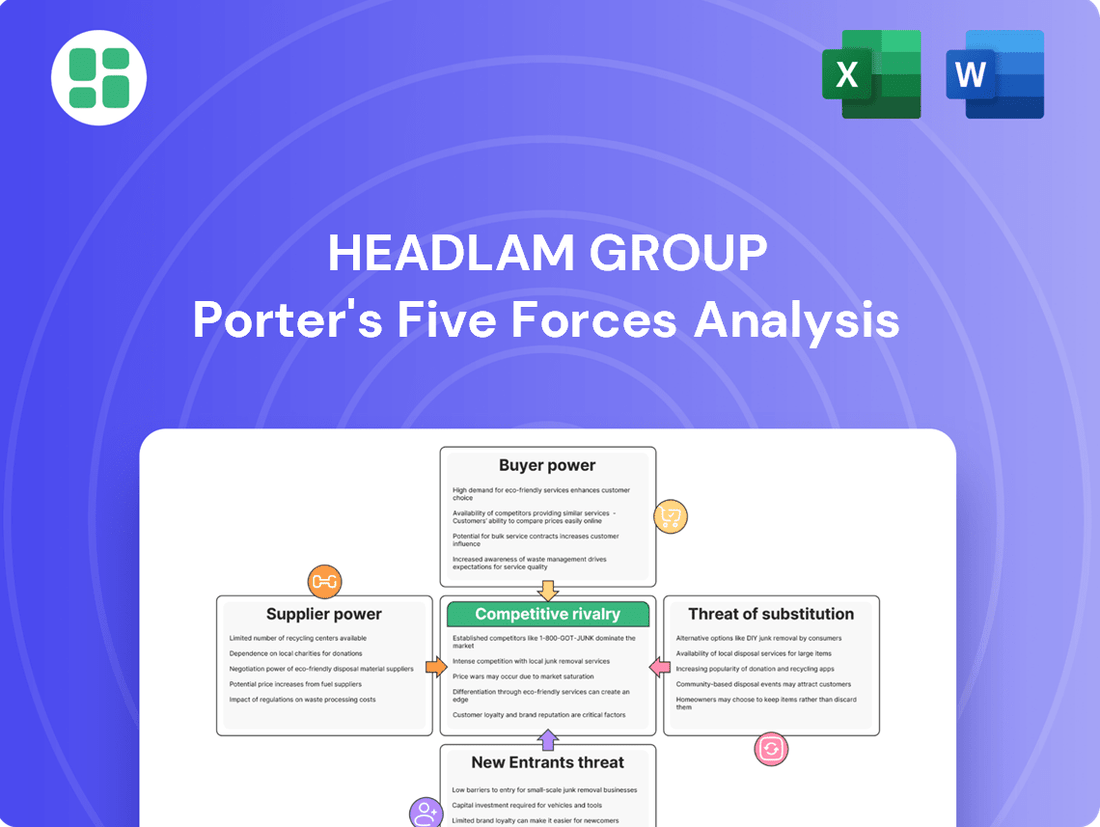

The Headlam Group operates within a competitive landscape shaped by several key forces. Understanding the bargaining power of buyers and the threat of substitutes is crucial for navigating this market. The intensity of rivalry among existing competitors and the influence of suppliers also play significant roles in Headlam's strategic positioning.

The complete report reveals the real forces shaping Headlam Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Headlam Group's extensive product portfolio, encompassing carpets, wood, laminate, and luxury vinyl tiles, points towards a diverse and likely fragmented supplier base. This broad product offering means Headlam isn't reliant on a single type of supplier, which inherently reduces the bargaining power of any individual supplier. For instance, in 2024, the flooring industry saw continued growth, with the global flooring market projected to reach over $500 billion, indicating a vast number of potential manufacturers and suppliers.

Suppliers' bargaining power is a key consideration for Headlam Group, particularly as raw material costs and overall inflation continue to rise. This increased cost pressure directly impacts Headlam's operational expenses and its ability to maintain healthy profit margins.

The flooring market faced a challenging environment in 2024, with reports indicating a decline in both revenue and volume. This downturn put additional strain on companies like Headlam, forcing them to manage inventory effectively and navigate reduced supplier rebates, which further squeezed gross margins.

While Headlam Group offers a wide variety of flooring, the bargaining power of suppliers can increase significantly when it comes to niche or proprietary products. If Headlam relies on a limited number of suppliers for specific high-demand materials, these suppliers gain leverage to dictate terms and prices. For example, the European wood flooring market experienced a 5% contraction between 2023 and 2024, potentially concentrating demand for specific types of wood among fewer available suppliers.

Importance of Headlam to Suppliers

As Europe's largest distributor of floor coverings, Headlam Group's substantial purchasing volume inherently grants it considerable sway over its suppliers. This scale means Headlam likely accounts for a significant percentage of many suppliers' revenue, a fact that strengthens its negotiating position. For instance, if a supplier's sales to Headlam represent over 15% of their total turnover, Headlam can leverage this dependency to secure more favorable pricing and terms, thus diminishing the supplier's bargaining power.

Headlam's strategic focus on centralizing its buying and stock control systems further amplifies this advantage. By consolidating procurement, Headlam can achieve greater economies of scale, presenting a unified and powerful front to its supplier base. This centralization allows for more effective negotiation on behalf of the entire group, potentially leading to improved cost efficiencies and supply chain reliability for Headlam, while simultaneously reducing the individual bargaining power of suppliers.

- Significant Sales Volume: Headlam's position as Europe's largest distributor means it represents a substantial portion of many suppliers' sales.

- Negotiating Leverage: This large volume allows Headlam to negotiate for better prices, terms, and preferential supply, reducing supplier power.

- Centralized Procurement: The ongoing transformation plan to centralize buying and stock control enhances Headlam's purchasing power and negotiating strength.

- Supplier Dependency: Suppliers with a high percentage of their revenue tied to Headlam have less bargaining power due to their reliance on the distributor.

Switching Costs for Headlam

The bargaining power of suppliers for Headlam is significantly influenced by switching costs. If Headlam can easily move from one supplier to another for its flooring products and related services, supplier power is reduced. For instance, if many suppliers offer similar quality carpet tiles or adhesive products at competitive prices, Headlam has more leverage.

Headlam's strategic focus on simplifying its customer offer and streamlining its network could impact supplier relationships. This simplification might lead to fewer, but potentially more integrated, supplier partnerships. For example, in 2023, Headlam reported a focus on optimizing its product range, which could involve consolidating suppliers for certain categories. This consolidation, while potentially offering volume discounts, could also increase reliance on those fewer suppliers if alternatives are not readily available.

- Low switching costs for standard flooring materials like carpet tiles or vinyl, provided there are multiple comparable suppliers, would limit supplier bargaining power.

- Headlam's 2023 efforts to simplify its product offering might lead to fewer, but potentially more specialized, supplier relationships.

- The availability of alternative suppliers for essential components or services is a key factor in determining how much leverage suppliers have over Headlam.

Headlam's bargaining power with suppliers is substantial due to its market dominance and centralized procurement strategies. This allows Headlam to negotiate favorable terms, leveraging its significant sales volume to reduce supplier leverage. For example, in 2024, the company's focus on optimizing its supply chain aimed to consolidate purchasing power, potentially increasing supplier dependency on Headlam.

| Factor | Impact on Supplier Bargaining Power | Evidence/Data (2024 Focus) |

|---|---|---|

| Market Position | Low | Europe's largest floor covering distributor |

| Purchasing Volume | Low | Significant revenue contribution for many suppliers (e.g., >15% turnover dependency) |

| Procurement Strategy | Low | Centralized buying enhances economies of scale and negotiation strength |

| Product Diversity | Low | Broad portfolio reduces reliance on any single supplier type |

| Switching Costs | Low (for standard items) | Availability of multiple comparable suppliers for common materials |

What is included in the product

This analysis dissects the competitive forces impacting Headlam Group, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the flooring industry.

Quickly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

Headlam Group caters to a wide array of customers, from small independent retailers to larger contractors and housebuilders. This diversity means that while individual small customers have minimal impact, larger clients can significantly influence pricing and terms.

For instance, major housebuilders undertaking substantial projects represent a concentrated segment that can leverage their purchase volume to negotiate better deals. In 2023, the UK construction sector saw significant activity, with housing starts reaching approximately 200,000 units, highlighting the potential scale of these large customers.

Customers in the floor coverings market, particularly when the economy is struggling, are very focused on price. This heightened price sensitivity gives them more leverage when negotiating.

Headlam Group experienced a revenue drop of 9.7% in 2024, a direct result of a sluggish market and consumers cutting back due to inflation and elevated interest rates. This economic climate amplifies customer bargaining power as they actively search for more affordable choices.

The availability of alternative distributors significantly impacts the bargaining power of customers in the floor covering market. With numerous other floor covering distributors operating within the UK and Continental Europe, customers are not reliant on Headlam Group alone. This competitive landscape means if Headlam's pricing or service falls short, customers can easily switch to a competitor offering better value or a more appealing customer experience.

The UK floor covering market itself is characterized by a high degree of competition, with a substantial number of businesses vying for customer attention. For instance, in 2023, the UK flooring market was estimated to be worth approximately £3.5 billion, supporting a wide array of distributors and retailers. This vibrant market environment empowers customers, giving them the leverage to compare offers and seek out the most advantageous deals, thereby increasing their bargaining power against any single distributor like Headlam.

Customer Switching Costs

For Headlam Group's customers, the costs associated with switching distributors are generally quite low, especially when dealing with standard flooring products. This low barrier to switching means customers have more leverage, as they aren't deeply committed to a single supplier, which can put pressure on Headlam's pricing and service offerings.

Headlam combats this by emphasizing its vast product selection and reliable next-day delivery service. These factors are crucial in building customer loyalty and reducing the incentive to switch. For instance, in 2023, Headlam reported that its extensive product range, covering over 30,000 product lines, contributed to its market position.

- Low Switching Costs: Customers can easily move to competitors for standard flooring, increasing their bargaining power.

- Headlam's Retention Strategy: Focus on broad product offerings and efficient next-day delivery to lock in customers.

- Impact on Power: Ease of switching enhances customer ability to demand better terms or prices.

- 2023 Data: Headlam's extensive product range, exceeding 30,000 lines, is a key factor in customer retention.

Impact of Digital Tools and E-commerce

The increasing prevalence of digital tools and e-commerce in the flooring sector significantly amplifies customer bargaining power. With e-commerce for specialty retailers projected to grow at a robust 7.75% CAGR between 2025 and 2030, customers gain unprecedented ease in comparing prices across numerous suppliers. This digital accessibility also broadens their product choices and allows them to identify a wider array of distributors, all contributing to a more competitive landscape where customer demands hold greater sway.

- Enhanced Price Transparency: Customers can readily compare prices from multiple online vendors, forcing retailers to remain competitive.

- Wider Product Selection: Digital platforms offer access to a vast inventory, reducing reliance on single suppliers.

- Increased Distributor Options: E-commerce platforms connect buyers with a broader network of flooring distributors globally.

- Informed Purchasing Decisions: Online reviews and detailed product information empower customers to make more informed choices, shifting power towards them.

Headlam Group's customers possess considerable bargaining power, driven by low switching costs and a competitive market. The ease with which customers can move to alternative suppliers, especially for standard flooring products, forces Headlam to maintain competitive pricing and service levels. This is further amplified by the digital marketplace, where price comparison is readily available.

In 2024, Headlam's revenue declined by 9.7%, reflecting a market where price sensitivity is high due to economic pressures. This economic climate empowers customers to seek better value, directly impacting Headlam's ability to dictate terms.

Headlam strategically counters this by offering an extensive product range, exceeding 30,000 lines as of 2023, and ensuring reliable next-day delivery. These value-added services aim to reduce customer churn and mitigate the impact of their inherent bargaining power.

| Factor | Impact on Headlam | Customer Leverage | 2023/2024 Data Point |

|---|---|---|---|

| Switching Costs | Pressure on pricing and service | High for standard products | Low barriers to switching suppliers |

| Market Competition | Need for competitive offerings | High due to numerous distributors | UK flooring market valued at £3.5 billion in 2023 |

| Economic Climate | Reduced sales volume | Increased price sensitivity | 9.7% revenue drop in 2024 |

| Digitalization | Need for online competitiveness | Enhanced price transparency and choice | E-commerce growth projected at 7.75% CAGR (2025-2030) |

Preview Before You Purchase

Headlam Group Porter's Five Forces Analysis

This preview shows the exact Headlam Group Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of competitive forces within the industry. You'll gain detailed insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This professionally formatted document is ready for your immediate use, providing a thorough understanding of the strategic landscape.

Rivalry Among Competitors

Headlam Group stands as Europe's largest flooring distributor, a testament to its significant market leadership. However, this prominent position doesn't negate the fierce competition. The flooring industry is actively consolidating, with projections indicating that by 2027, a smaller number of dominant players will command a substantial portion of the market. This trend intensifies the rivalry as major distributors vie for increased market share and strategic advantage.

The flooring market experienced significant headwinds in 2024, a challenging environment that directly fuels competitive rivalry. Headlam Group, a key player, saw its revenue drop by 9.7% during this period, underscoring the tough trading conditions. This contraction in overall market demand means companies are fighting harder for a smaller share of customer spending.

When the market shrinks, the intensity of competition naturally escalates. Companies are often forced to compete more aggressively on price to maintain sales volumes, which can erode profit margins for everyone involved. This dynamic puts pressure on all participants to differentiate their offerings and secure any available business, intensifying the rivalry among flooring suppliers.

While Headlam Group offers a broad selection of flooring, many products in the market are seen as quite similar. This often means competition heats up on price, how well they serve customers, and how quickly they can deliver. For instance, in 2024, the flooring sector continued to see intense price competition among distributors.

Headlam is actively working on a plan to streamline its product range and enhance its customer service. The goal is to stand out not just on price, but on superior service and operational efficiency, making them a more attractive partner for retailers.

Presence of Other Key Players

Headlam Group operates within a competitive landscape featuring other substantial players in the furnishings, fixtures, and appliances sector. For instance, Likewise Group presents a significant challenge with its own widespread distribution network spanning the UK and Europe, directly vying for market share.

The UK flooring market itself is a hotbed of activity, characterized by robust growth that naturally attracts and intensifies competition. This expanding market dynamic means Headlam must continuously innovate and maintain operational efficiency to stay ahead of rivals.

- Intense Rivalry: Headlam faces significant competition from established players like Likewise Group, which boasts an extensive UK and European distribution network.

- Market Growth Attracts Competitors: The strong growth trajectory of the UK flooring market is drawing in new entrants and intensifying competition from existing companies.

- Strategic Importance of Distribution: A key battleground for competitors is the development and maintenance of efficient and far-reaching distribution networks.

High Fixed Costs and Exit Barriers

Headlam Group operates in a distribution sector characterized by substantial fixed costs. These costs are primarily associated with maintaining a wide network of warehouses, managing complex logistics, and holding significant inventory levels. For instance, in 2024, the company’s investment in its distribution infrastructure remains a key operational expense, directly contributing to high overheads.

These elevated fixed costs can compel companies within the industry, including Headlam, to pursue aggressive pricing strategies to ensure sufficient sales volume and cover their operational expenses. This drive for volume often intensifies competitive rivalry as firms vie for market share, potentially leading to price wars. In 2023, the flooring distribution market saw continued pressure on margins due to these dynamics.

Furthermore, the substantial capital investment tied up in physical assets and established distribution networks creates significant exit barriers. Companies that find themselves underperforming may struggle to divest these assets without incurring substantial losses, effectively locking them into the market and perpetuating the intense competition.

- High Fixed Costs: Warehousing, logistics, and inventory management represent significant ongoing expenses for Headlam Group.

- Aggressive Pricing: To cover fixed costs, firms may engage in price competition, impacting profitability.

- Exit Barriers: Substantial investments in infrastructure make it difficult for underperforming companies to leave the market.

- Intensified Rivalry: The combination of high costs and exit barriers fuels a highly competitive landscape.

Headlam Group faces intense competition from rivals like Likewise Group, which possesses a strong distribution network across the UK and Europe. The UK flooring market's robust growth in 2024 attracted new entrants and intensified competition from existing players, forcing companies to innovate and maintain efficiency. This rivalry is further fueled by the industry's high fixed costs, such as warehousing and logistics, which in 2024 remained significant operational expenses for Headlam, pushing firms towards aggressive pricing to cover overheads and maintain sales volumes.

| Competitor | Distribution Network Scope | 2024 Market Impact |

|---|---|---|

| Likewise Group | UK and Europe | Significant challenge to Headlam's market share |

| Other Distributors | Varies (UK focused to European) | Intensified price competition and service demands |

| New Entrants | Emerging | Increased market fragmentation and innovation pressure |

SSubstitutes Threaten

The threat of substitutes for flooring materials, particularly for Headlam Group, is significant. Customers often have readily available alternatives to traditional options like carpet, wood, laminate, and luxury vinyl tile (LVT). For instance, in commercial spaces, polished concrete or durable epoxy coatings offer a functional and often cost-effective substitute.

Emerging technologies in resin flooring also present a growing alternative, providing aesthetic and performance benefits that can sway customer choice. In 2023, the global flooring market was valued at approximately $370 billion, with a substantial portion of this driven by non-traditional materials like engineered wood and resilient flooring, indicating a clear shift away from some of Headlam's core offerings.

The flooring market is seeing a significant rise in sustainable and innovative alternatives that can challenge Headlam Group's traditional products. Think about materials like bamboo and cork, which are gaining traction due to their eco-friendly nature. These aren't just niche products anymore; consumer preference for sustainability is a powerful driver.

Furthermore, "smart flooring" systems, integrating technology for heating or data collection, represent another frontier. While Headlam focuses on established materials, these new trends offer distinct advantages in terms of environmental impact and functionality, potentially diverting customer interest and spending away from conventional carpet and vinyl offerings.

Luxury Vinyl Plank (LVP) and Luxury Vinyl Tile (LVT) present a significant threat of substitution within the flooring market. While Headlam Group distributes these products, they also compete directly with more premium natural materials such as hardwood and stone. LVP and LVT offer compelling advantages in terms of durability and water resistance, often at a considerably lower price point, making them an attractive alternative for cost-conscious consumers and businesses.

The growing consumer preference for LVT, in particular, directly challenges the market share of traditional flooring options like carpet and solid wood. This shift is driven by LVT's aesthetic versatility, ease of maintenance, and resilience, which appeal to a broad range of customers. For instance, the global LVT market was valued at approximately $23.6 billion in 2023 and is projected to grow substantially, indicating a clear trend away from older, more expensive materials.

Changing Consumer Preferences and DIY Trends

Consumer preferences are increasingly leaning towards hard surface flooring, such as LVT and wood, moving away from traditional carpeting. This shift is driven by concerns over moisture, mold, and a growing preference for contemporary interior design. For instance, in 2024, the global LVT market alone was projected to reach over $25 billion, indicating a substantial move towards these alternatives.

The rise of the do-it-yourself (DIY) movement also presents a threat. Consumers are more inclined to undertake flooring installations themselves, favoring products with user-friendly installation systems like click-and-lock mechanisms. This trend can bypass traditional distribution channels and professional installation services, potentially impacting demand for Headlam Group's core offerings.

- Shifting Material Preferences: Growing consumer demand for hard surface flooring over carpets due to hygiene and aesthetic reasons.

- DIY Installation Trend: Increased consumer interest in self-installation of flooring, favoring easy-fit products.

- Market Impact: Potential reduction in demand for professionally distributed and installed flooring solutions.

Technological Advancements in Functionality

Technological advancements are rapidly expanding the definition of flooring beyond mere aesthetics and durability. Innovations like smart flooring, which can integrate sensors for climate control or even detect falls, offer functionalities that traditional floor coverings cannot match. For instance, in 2024, the smart home technology market continued its robust growth, with an increasing consumer appetite for integrated home solutions.

These advanced features, such as moisture-resistant carpets or antimicrobial surfaces, provide added value that can directly substitute for conventional flooring. This means a homeowner might opt for a specialized, high-tech solution that addresses specific needs, bypassing standard carpet or tile options. The market for smart home devices, including those related to home infrastructure, is projected to see significant expansion through 2025, indicating a growing acceptance of such technologically enhanced products.

The threat of substitutes is amplified as these functional innovations become more accessible and integrated into mainstream building practices. Consider the potential for smart textiles in flooring to offer dynamic temperature regulation, reducing reliance on separate heating systems. This shift highlights how technological evolution can redefine product categories and present compelling alternatives to established market offerings.

- Smart flooring offers integrated sensors for temperature control and fall detection.

- Moisture-resistant carpets provide enhanced functionality beyond traditional floor coverings.

- The smart home technology market is experiencing significant growth, indicating consumer interest in advanced home features.

- Technological evolution in flooring can create new product categories and competitive substitutes.

The threat of substitutes for Headlam Group is substantial, as consumers increasingly opt for alternative materials and technologies. Hard surface flooring, particularly Luxury Vinyl Plank (LVP) and Luxury Vinyl Tile (LVT), directly competes with traditional offerings like carpet and wood. These resilient options provide durability, water resistance, and aesthetic versatility at competitive price points, appealing to a broad market segment. For example, the global LVT market was valued at approximately $23.6 billion in 2023, showcasing a significant consumer shift towards these alternatives.

Beyond material changes, technological advancements are introducing entirely new categories of flooring. Smart flooring systems, incorporating features like climate control or integrated sensors, offer enhanced functionality that traditional materials cannot match. This trend is supported by the robust growth of the smart home technology market, with consumer appetite for integrated solutions on the rise. For instance, in 2024, the smart home market continued its upward trajectory, indicating a growing acceptance of technologically advanced home infrastructure.

The DIY movement also contributes to the threat of substitutes by empowering consumers to undertake flooring installations themselves. Products with user-friendly, click-and-lock mechanisms bypass traditional distribution channels and professional installation services, potentially impacting Headlam's business model. This trend, coupled with a growing preference for sustainable materials like bamboo and cork, diversifies the competitive landscape and presents compelling alternatives to Headlam's core product lines.

| Substitute Category | Key Characteristics | Market Relevance (2023/2024 Data) | Impact on Headlam Group |

|---|---|---|---|

| Luxury Vinyl Tile (LVT) | Durability, water resistance, aesthetic versatility, lower cost | Global LVT market valued at ~$23.6 billion (2023) | Direct competition with carpet and wood; potential market share erosion |

| Smart Flooring | Integrated sensors, climate control, enhanced functionality | Robust growth in smart home technology market (2024) | Functional substitution, offering benefits beyond traditional flooring |

| Sustainable Materials (Bamboo, Cork) | Eco-friendly, unique aesthetics | Growing consumer preference for sustainable options | Diversifies material choices, potentially diverting demand from conventional products |

| DIY-Friendly Flooring | Easy installation (e.g., click-and-lock) | Increasing DIY trend | Bypasses traditional distribution and installation services |

Entrants Threaten

Headlam Group, Europe's largest distributor, operates 67 businesses and trade brands across the UK and Continental Europe, leveraging significant economies of scale. This extensive network makes it incredibly difficult for new entrants to compete on cost and reach.

Replicating Headlam's established distribution and logistics infrastructure would demand massive capital investment and considerable time, presenting a formidable barrier to entry for any new player in the market.

Entering the floor coverings distribution sector, especially at a scale that rivals Headlam Group, necessitates a significant upfront capital commitment. This includes substantial investments in warehousing facilities, maintaining extensive inventory levels across various product lines, and establishing a robust transportation and logistics network. These considerable financial barriers act as a powerful deterrent for many potential new competitors.

Headlam Group, for instance, demonstrates its financial strength through a solid balance sheet, which includes significant holdings in property assets. As of their latest reporting period, the value of their property, plant, and equipment underscores the scale of physical infrastructure required to operate effectively in this industry, further highlighting the entry barriers.

Headlam Group benefits from over 30 years of deeply entrenched relationships with both global suppliers and a broad spectrum of trade customers. This extensive network is not easily replicated by newcomers.

New entrants face a significant hurdle in building the same level of trust and securing comparable supply agreements. Furthermore, Headlam's established customer loyalty, fostered by expert knowledge and marketing support, creates a formidable barrier.

Market Maturity and Consolidation

The European floor covering market, including segments relevant to Headlam Group, is characterized by its maturity, leading to a trend of consolidation. Challenging market conditions in 2024 have put pressure on profitability for existing players. This environment makes the sector less appealing for new entrants, as capturing market share and achieving growth becomes significantly more difficult amidst established competition and potentially declining overall market revenues.

The threat of new entrants is therefore considered low. Established brands and distribution networks present high barriers to entry. For instance, in 2023, the UK flooring market, a key territory for Headlam, saw a continuation of these trends, with companies focusing on efficiency and market consolidation rather than rapid expansion.

- Mature Market Dynamics: The European floor covering market is mature, with limited organic growth opportunities.

- Consolidation Trend: Ongoing consolidation among existing players increases barriers to entry.

- Profitability Pressures: Challenging market conditions in 2024 negatively impact profitability, deterring new investment.

- High Barriers: Established brands, extensive distribution networks, and significant capital requirements act as deterrents for potential new entrants.

Regulatory and Compliance Burdens

The EU's Construction Products Regulation (CPR) imposes stringent performance standards on flooring, covering aspects like mechanical strength, fire safety, and environmental impact. Meeting these requirements necessitates extensive testing and detailed documentation, significantly raising the barrier to entry.

These regulatory complexities translate into higher upfront costs and substantial administrative overhead, particularly challenging for smaller, emerging businesses aiming to compete with established players like Headlam Group.

- EU Construction Products Regulation (CPR): Mandates performance criteria for flooring products.

- Rigorous Testing & Documentation: Essential for compliance, increasing new entrant costs.

- Increased Costs & Administrative Burden: Particularly impacts smaller businesses.

The threat of new entrants for Headlam Group is low due to substantial barriers. These include the immense capital needed for infrastructure, established supplier and customer relationships, and the complexities of regulatory compliance like the EU's Construction Products Regulation. In 2024, market consolidation and profitability pressures further discourage new players.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Significant investment in warehousing, inventory, and logistics. | High; deters smaller entrants. |

| Economies of Scale | Headlam's extensive network (67 businesses) offers cost advantages. | High; difficult to match pricing. |

| Brand Loyalty & Relationships | Over 30 years of entrenched supplier and customer ties. | High; trust and supply agreements are hard to replicate. |

| Regulatory Compliance | EU CPR mandates stringent performance standards and testing. | High; increases costs and administrative burden. |

| Market Maturity & Consolidation | Mature European market with ongoing consolidation. | High; limited growth and increased competition. |

Porter's Five Forces Analysis Data Sources

Our Headlam Group Porter's Five Forces analysis is built upon a foundation of verified data, including Headlam's annual reports, industry-specific market research from firms like IBISWorld, and relevant trade publications. This ensures a comprehensive understanding of the competitive landscape.