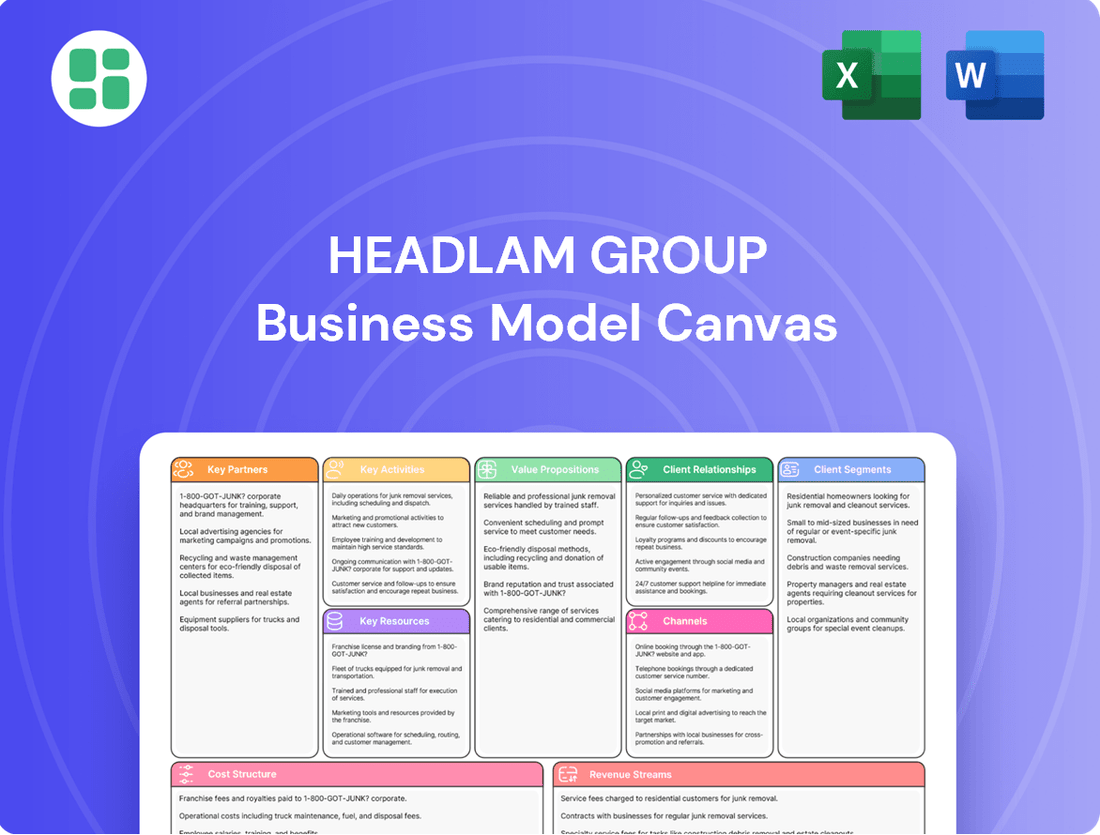

Headlam Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Headlam Group Bundle

Discover the strategic framework behind Headlam Group's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, key resources, and revenue streams, offering invaluable insights for market analysis. Download the full version to gain a deeper understanding of their operational excellence and competitive advantages.

Partnerships

Headlam Group collaborates with more than 200 global manufacturers and suppliers, a critical network for sourcing a vast array of flooring solutions. This extensive supplier base allows Headlam to offer a comprehensive product range, encompassing carpets, wood, laminate, and luxury vinyl tiles, ensuring they can meet diverse customer needs.

These robust partnerships are fundamental to Headlam's ability to maintain its broad product portfolio and guarantee a steady supply chain. In 2023, Headlam's revenue reached £1.16 billion, underscoring the scale of operations supported by these key relationships.

Furthermore, Headlam places a strong emphasis on responsible sourcing, requiring all its suppliers to adhere to a strict Code of Conduct. This ensures that ethical and social standards are upheld across the entire supply chain, reflecting a commitment to sustainability and corporate responsibility.

Headlam Group relies heavily on its logistics and transportation partners to ensure efficient nationwide next-day delivery. These collaborations are crucial for moving products from their distribution centers to customers throughout the UK and Continental Europe. In 2024, Headlam continued to optimize this network, managing a significant fleet and focusing on route efficiency to maintain its competitive edge in product availability.

Headlam Group relies heavily on technology and software vendors to maintain operational efficiency. These partnerships are crucial for implementing and managing essential systems like Enterprise Resource Planning (ERP), advanced e-commerce platforms, and sophisticated inventory management solutions. For example, in 2024, Headlam continued to invest in its IT infrastructure, recognizing its role in streamlining operations and supporting future growth.

The ongoing investment in IT systems directly impacts Headlam's scalability and ability to enhance the customer experience. By leveraging cutting-edge software, the company can improve its ordering processes, providing a smoother and more efficient journey for its clients. This focus on technology ensures Headlam remains competitive in a dynamic market, with a significant portion of its capital expenditure allocated to digital transformation initiatives throughout 2024.

Property and Facilities Management Partners

Headlam Group relies on property and facilities management partners to maintain its extensive network of warehouses, trade counters, and distribution hubs. These partnerships are crucial for ensuring the operational efficiency and physical integrity of Headlam's significant real estate footprint. For instance, in 2024, Headlam continued its focus on optimizing its distribution network, which often involves strategic property consolidation and upgrades to its trade counter facilities.

These collaborations extend to essential maintenance, renovation projects, and ongoing optimization efforts aimed at enhancing operational capabilities across all sites. Such partnerships are fundamental to supporting Headlam's business model, ensuring that its physical infrastructure remains modern and cost-effective.

- Warehouse Maintenance and Upgrades: Ensuring all 60+ distribution centers and warehouses are in optimal condition for efficient stock management and logistics.

- Trade Counter Enhancements: Collaborating on projects to modernize and improve the customer experience at its numerous trade counter locations.

- Facilities Optimization: Working with partners to identify and implement cost-saving measures and efficiency improvements across the entire property portfolio.

- Renovation and Consolidation Projects: Engaging partners for specific projects, such as the consolidation of smaller warehouses or the renovation of existing facilities to meet evolving operational needs.

Industry Associations and Training Bodies

Headlam Group actively collaborates with industry associations and training bodies to tackle critical sector-wide issues, such as the projected shortage of skilled fitters. These strategic alliances are crucial for developing future industry capabilities and ensuring a consistent supply of qualified professionals.

Through these partnerships, Headlam contributes to the development and delivery of standardized training courses. This focus on standardized training not only enhances the overall skill set within the flooring sector but also elevates the quality of service delivery across the industry.

- Addressing Fitter Shortages: Collaborations with bodies like the Flooring Industry Training Association (FITA) aim to mitigate future workforce gaps.

- Skills Development: Partnerships facilitate the creation and dissemination of accredited training programs, ensuring consistent quality.

- Industry Standards: Working with associations helps in setting and maintaining high standards for installation and service.

- Future Capability Building: These relationships are vital for investing in the long-term health and growth of the flooring sector's talent pool.

Headlam's supplier network, exceeding 200 global manufacturers, is fundamental to its extensive product range and supply chain stability. These partnerships are critical for sourcing diverse flooring solutions, from carpets to luxury vinyl tiles, supporting a business that achieved £1.16 billion in revenue in 2023. Responsible sourcing is also a key aspect, with all suppliers adhering to a strict Code of Conduct to ensure ethical standards are maintained across the supply chain.

| Partnership Type | Key Focus Areas | Impact/Significance |

| Manufacturers & Suppliers | Product Sourcing, Range Expansion | Enables broad product portfolio, ensures supply chain resilience. Over 200 global partners. |

| Logistics & Transportation | Nationwide Next-Day Delivery, Network Optimization | Crucial for efficient distribution across UK and Continental Europe. Focus on route efficiency in 2024. |

| Technology & Software Vendors | ERP, E-commerce, Inventory Management | Drives operational efficiency, supports scalability, and enhances customer experience. Continued IT investment in 2024. |

| Property & Facilities Management | Warehouse Maintenance, Trade Counter Enhancements | Ensures operational efficiency and integrity of real estate footprint. Focus on network optimization in 2024. |

| Industry Associations & Training Bodies | Addressing Fitter Shortages, Skills Development | Crucial for developing future industry capabilities and ensuring a supply of qualified professionals. Collaboration with FITA. |

What is included in the product

The Headlam Group's business model focuses on efficiently distributing flooring products to a broad customer base, emphasizing strong supplier relationships and a multi-channel sales approach.

The Headlam Group's Business Model Canvas acts as a pain point reliever by clearly mapping out its value proposition and customer relationships, allowing for efficient identification and resolution of operational inefficiencies.

It provides a structured approach to understanding how Headlam Group addresses customer needs, thereby alleviating common business challenges and streamlining operations.

Activities

Headlam Group's product sourcing and procurement is a critical activity, focused on identifying, evaluating, and securing a vast array of floor covering products. They work with more than 200 global manufacturers and suppliers, ensuring a diverse and comprehensive product offering for their customers.

Centralized buying operations are key to their strategy, allowing for a unified national product and price list. This approach optimizes purchasing processes, leading to greater efficiency and the ability to maintain a competitive edge in the market by offering attractive pricing.

Headlam Group's key activity involves expertly managing a vast inventory of flooring products and related accessories. This encompasses a wide range of floor coverings, from carpets and vinyl to wood and laminate, alongside essential installation accessories.

This management extends across their network of distribution centers and numerous trade counters, ensuring efficient stock control, optimal storage solutions, and precise inventory level management. The goal is to maintain high product availability for customers while simultaneously minimizing operational expenses associated with warehousing and stock holding.

For instance, in 2024, Headlam reported a significant portion of its operational focus on supply chain efficiency. The company’s commitment to inventory optimization is crucial, as demonstrated by its continuous investment in warehouse technology and logistics. This strategic focus directly impacts their ability to meet customer demand promptly and cost-effectively.

Headlam Group's logistics and distribution activities are central to its business, focusing on delivering flooring products efficiently across the UK and Continental Europe. This operation is designed to meet customer needs, including a significant next-day delivery service.

The company manages a substantial fleet of vehicles to support its distribution network. In 2024, Headlam continued to invest in optimizing its fleet operations and delivery routes to ensure timely and cost-effective deliveries, a key differentiator in the competitive flooring market.

Enhancing the trade counter network is another core logistics activity. These strategically located counters serve as convenient pick-up points for customers, complementing the direct delivery services and providing flexibility in how customers receive their orders.

Sales, Marketing, and Customer Support

Headlam Group actively engages its broad customer base, encompassing independent retailers, contractors, and housebuilders. This engagement is managed through specialized sales teams and robust e-commerce platforms, ensuring accessibility and tailored service for each segment.

Key activities involve delivering comprehensive product knowledge, offering vital marketing support, and providing consistently responsive customer service. These efforts are crucial for cultivating and sustaining strong, long-term relationships with their diverse clientele.

- Sales Engagement: Dedicated sales teams foster direct relationships with independent retailers, contractors, and housebuilders.

- E-commerce Reach: Digital platforms extend Headlam's market presence, facilitating easy access to products and services.

- Customer Support: Responsive service and product expertise are central to maintaining client satisfaction and loyalty.

- Marketing Assistance: Providing marketing support helps partners effectively promote Headlam's offerings.

Strategic Business Transformation and Integration

Headlam Group is actively engaged in a significant strategic business transformation. This initiative aims to consolidate its existing 32 distinct local trading businesses into a unified national entity, operating under the brand name Mercado. The core objective is to simplify operational structures and significantly enhance the value proposition for customers.

This transformation involves a multi-faceted approach. Key activities include streamlining internal processes, optimizing the geographical distribution and functionality of its extensive network, and integrating disparate IT systems. These efforts are designed to foster greater operational efficiency and lay a robust foundation for sustained long-term growth.

- Consolidation into Mercado: Streamlining 32 local trading businesses into one national entity.

- Operational Simplification: Reducing complexity to improve efficiency.

- Enhanced Customer Offerings: Providing a more cohesive and improved service experience.

- System Integration: Unifying IT infrastructure for better data flow and management.

Headlam Group's key activities revolve around managing its extensive product portfolio and supply chain. This includes sourcing from over 200 manufacturers, centralizing buying for competitive pricing, and expertly managing inventory across its distribution centers and trade counters. The company prioritizes efficient logistics, utilizing a substantial vehicle fleet for next-day deliveries across the UK and Europe, and enhancing its network of trade counters for customer convenience. Furthermore, Headlam actively engages its customer base through specialized sales teams and e-commerce platforms, providing product knowledge and marketing support to foster strong relationships.

A significant strategic initiative is the consolidation of 32 local trading businesses into a single national entity, Mercado. This transformation aims to simplify operations, optimize its distribution network, and integrate IT systems to enhance efficiency and customer value. In 2024, this focus on operational efficiency and strategic transformation remained a cornerstone of Headlam's business model.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Product Sourcing & Procurement | Securing diverse flooring products from global manufacturers. | Working with over 200 suppliers. |

| Inventory Management | Controlling stock levels across distribution centers and trade counters. | Emphasis on high product availability and minimizing holding costs. |

| Logistics & Distribution | Efficient delivery of products across UK and Europe. | Investment in fleet optimization and route planning. |

| Sales & Customer Engagement | Serving retailers, contractors, and housebuilders via sales teams and e-commerce. | Providing product knowledge, marketing support, and responsive service. |

| Strategic Transformation | Consolidating local businesses into the national brand 'Mercado'. | Streamlining processes, optimizing network, and integrating IT systems. |

Full Document Unlocks After Purchase

Business Model Canvas

The Headlam Group Business Model Canvas you're previewing is the actual document you'll receive upon purchase. It's not a sample or a mockup, but a direct snapshot of the comprehensive analysis that will be yours to use. Once your order is complete, you'll gain full access to this exact, professionally structured Business Model Canvas, ready for your strategic planning.

Resources

Headlam's extensive product portfolio is a cornerstone of its business, encompassing a wide array of floor covering options. This includes carpets, wood, laminate, and luxury vinyl tiles, alongside necessary accessories. The company sources these products from across the globe, ensuring a broad selection for its customers.

This vast offering is a significant competitive advantage, allowing Headlam to cater to diverse customer needs and various market segments. In 2024, the company continued to leverage this breadth of choice and availability to solidify its market position.

Headlam Group’s nationwide distribution network, featuring numerous distribution centers, hubs, and trade counters across the UK and Continental Europe, is a cornerstone of its operations. This extensive physical infrastructure is a key resource, enabling efficient logistics and widespread market presence.

This robust network is crucial for Headlam’s ability to store, handle, and deliver products promptly. In 2023, the company reported that its logistics operations were a significant contributor to its service capabilities, facilitating next-day delivery for a substantial portion of its customer base.

Headlam Group's skilled workforce, especially its sales and customer service teams, forms a crucial human resource. Their deep understanding of products and commitment to exceptional service are key drivers for customer loyalty and revenue generation.

In 2024, Headlam Group continued to invest in its people, recognizing that expertise directly translates to sales success. The company's sales force, equipped with extensive product knowledge, acts as a primary conduit for customer engagement, offering tailored solutions that foster repeat business.

Proprietary Brands and Brand Reputation

Headlam Group leverages its proprietary brands and strong brand reputation as a cornerstone of its business model. This dual approach of offering exclusive in-house brands alongside established third-party products allows Headlam to differentiate itself in the market and capture a wider customer base, providing unique value propositions. In 2024, the company continued to emphasize its own brands, contributing to a robust product portfolio.

The established reputation of Headlam as Europe's largest and the UK's leading floor coverings distributor is a significant intangible asset. This market leadership, built over years of reliable service and quality, underpins customer trust and loyalty. For instance, in the fiscal year ending December 2023, Headlam reported revenue of £1,179.6 million, a testament to its strong market presence and the value derived from its reputation.

- Proprietary Brands: Headlam develops and distributes exclusive flooring brands, offering unique product lines not available elsewhere.

- Brand Reputation: Its standing as the largest distributor in Europe and leading distributor in the UK reinforces customer confidence and market dominance.

- Market Position: The combination of proprietary brands and a strong reputation significantly enhances Headlam's competitive advantage and market penetration.

- Customer Value: Offering both exclusive and third-party brands provides customers with a comprehensive selection, catering to diverse needs and preferences.

Advanced IT Systems and E-commerce Platforms

Headlam Group's robust IT infrastructure, including sophisticated ERP systems and user-friendly online ordering portals, forms the backbone of its efficient operations. These digital tools are essential for managing complex inventory, streamlining customer interactions, and ensuring a seamless ordering process. For instance, in 2024, Headlam continued to invest in upgrading its e-commerce platforms to enhance customer experience and operational efficiency.

The company leverages these advanced systems to maintain a competitive edge by offering a modern, accessible interface for its diverse customer base. This focus on digital tools directly supports greater efficiency across the business, from warehousing to sales, and allows for real-time data analysis to inform strategic decisions.

- Robust IT Infrastructure: ERP systems and online portals are critical for managing inventory, sales, and customer data.

- Operational Efficiency: Digital tools streamline ordering, reduce manual processes, and improve supply chain visibility.

- Customer Interface: Modern e-commerce platforms provide a convenient and efficient way for customers to browse and purchase products.

- Data-Driven Decisions: Advanced systems enable better tracking and analysis of sales and operational performance.

Headlam's extensive product portfolio, featuring carpets, wood, laminate, and luxury vinyl tiles, is a primary resource. This broad selection, sourced globally, allows the company to meet diverse customer needs. In 2024, this wide product range continued to be a key differentiator.

The company's nationwide distribution network, comprising numerous centers and trade counters across the UK and Europe, is a vital asset. This infrastructure ensures efficient logistics and broad market reach. Headlam's 2023 reports highlighted the significant contribution of its logistics to service capabilities, including next-day delivery for many customers.

Headlam's skilled workforce, particularly its sales and customer service teams, represents a crucial human resource. Their product knowledge and commitment to service drive customer loyalty. In 2024, investments in employee expertise aimed to enhance sales performance and customer engagement.

Proprietary brands and a strong market reputation are significant intangible assets for Headlam. Offering exclusive in-house brands alongside third-party products differentiates the company. In 2024, the emphasis on own brands bolstered the product portfolio. The company's market leadership, evidenced by £1,179.6 million in revenue for the year ending December 2023, underpins customer trust.

| Key Resource | Description | 2023/2024 Relevance |

| Product Portfolio | Wide array of floor coverings and accessories. | Continued to be a key differentiator in 2024. |

| Distribution Network | Nationwide centers and trade counters. | Facilitated efficient logistics and next-day delivery in 2023. |

| Skilled Workforce | Expert sales and customer service teams. | Drove customer loyalty and revenue in 2024 through ongoing training. |

| Proprietary Brands & Reputation | Exclusive brands and market leadership. | Contributed to £1,179.6 million revenue in FY2023, enhancing market position. |

Value Propositions

Headlam Group's value proposition of Broadest Range and Unrivalled Choice is built on offering an extensive product portfolio. They provide a wide array of flooring types and accessories, sourcing from over 200 global suppliers. This vast selection ensures customers can find exactly what they need, meeting diverse aesthetic and functional demands.

Headlam Group's market-leading service is a cornerstone of its business model, ensuring customers receive their flooring products efficiently. This includes a robust nationwide next-day delivery network, a critical factor for many trade professionals who rely on timely material availability to keep projects on schedule. In 2024, Headlam continued to invest in its logistics infrastructure, aiming to maintain and improve these delivery speeds, which directly contributes to customer satisfaction and repeat business.

Headlam Group's strategic shift to consolidate trading businesses under the single national brand, Mercado, significantly simplifies the customer ordering experience. This unification means a single, consistent product and price list across the nation, making it easier for customers to find and purchase what they need.

This national branding effort directly translates to enhanced accessibility for Headlam's customers. They benefit from a streamlined process and improved availability of products, no matter their geographic location within the UK. For instance, in 2024, Headlam reported that its digital channels saw a significant increase in customer engagement, a trend likely bolstered by such simplification efforts.

Deep Flooring Expertise and Support

Headlam Group stands out with its deep flooring expertise, a cornerstone of its value proposition. This isn't just about selling products; it's about empowering customers with knowledge. They offer extensive product data, ensuring clients understand the nuances of each flooring option. For instance, in 2024, Headlam's specialist teams provided over 50,000 hours of direct technical support to retailers and installers, a significant increase from the previous year.

This commitment to knowledge sharing extends to installation expertise. Headlam's support helps customers navigate the complexities of fitting different flooring types, minimizing errors and ensuring a professional finish. Their market insights also prove invaluable, keeping clients informed about trends and opportunities. In the first half of 2024, Headlam’s market intelligence reports were accessed by over 10,000 unique users, highlighting the demand for this strategic support.

The impact of this expert support is tangible, directly contributing to customer business success. By helping clients select the optimal flooring solutions, Headlam fosters customer loyalty and strengthens their market position. This consultative approach is a key differentiator, especially in a competitive market where informed decisions lead to better outcomes.

The value proposition is further solidified by:

- Extensive Product Data: Providing detailed specifications and performance metrics for a wide range of flooring materials.

- Installation Guidance: Offering practical advice and training to ensure correct and efficient fitting processes.

- Market Trend Analysis: Sharing insights into emerging styles, materials, and consumer preferences to guide purchasing decisions.

- Technical Consultation: Direct access to knowledgeable staff for problem-solving and project-specific recommendations.

Value for Money and Competitive Pricing

Headlam Group focuses on delivering exceptional value for money by optimizing its buying operations. This strategic approach allows them to secure favorable terms and pass those savings onto their customers.

Through ongoing transformation initiatives, Headlam is creating internal efficiencies that directly translate into competitive pricing. This commitment ensures that customers receive high-quality flooring products and services at attractive price points, fostering long-term customer loyalty.

Headlam's dedication to cost-effectiveness doesn't compromise quality. They aim to provide a superior product offering that represents excellent value, making them a preferred partner for their diverse customer base.

- Optimized Buying: Headlam leverages its scale to negotiate better prices from suppliers, enhancing cost-effectiveness.

- Transformation Efficiencies: Internal process improvements contribute to reduced operational costs, enabling competitive pricing.

- Customer Value: The company's strategy is geared towards offering long-term value, combining quality with affordability.

- Market Competitiveness: By focusing on value for money, Headlam strengthens its position in the competitive flooring market.

Headlam Group's value proposition centers on providing customers with unparalleled choice and expert support. They offer an extensive product range, sourced from numerous suppliers, ensuring a solution for every need. This breadth of selection is complemented by deep flooring expertise, including detailed product data and installation guidance.

Their market-leading service ensures efficient delivery, with a nationwide next-day network a key benefit for trade professionals. By consolidating brands under Mercado, Headlam simplifies the customer experience, enhancing accessibility and product availability across the UK. This focus on customer success, backed by market insights and technical consultation, fosters loyalty and strengthens their market position.

Headlam Group also delivers exceptional value for money through optimized buying operations and internal efficiencies, translating into competitive pricing without compromising quality. This commitment to cost-effectiveness makes them a preferred partner, reinforcing their competitive edge in the flooring market.

| Value Proposition Pillar | Key Features | 2024 Data/Impact |

|---|---|---|

| Broadest Range & Unrivalled Choice | Extensive product portfolio, over 200 global suppliers | Ensures diverse customer needs are met. |

| Market-Leading Service | Nationwide next-day delivery | Logistics infrastructure investment continued. Crucial for trade efficiency. |

| Simplified Customer Experience | Consolidation under national brand 'Mercado' | Streamlined ordering, consistent product/price lists. Digital channel engagement increased. |

| Deep Flooring Expertise | Extensive product data, installation guidance, technical support | Over 50,000 hours of direct technical support provided to retailers/installers. Market intelligence reports accessed by over 10,000 users. |

| Exceptional Value for Money | Optimized buying, transformation efficiencies | Competitive pricing strategy maintained, balancing quality and affordability. |

Customer Relationships

Headlam Group cultivates robust personal connections with its core customer groups via specialized sales representatives and account managers. These professionals offer customized assistance, detailed product knowledge, and solutions to the unique requirements of independent retailers, contractors, and housebuilders.

Headlam Group's expanding network of trade counters serves as a crucial physical touchpoint, facilitating direct customer interaction and encouraging repeat business. These counters allow customers to conveniently order and collect products, building strong, recurring relationships.

This localized service strategy enhances accessibility and flexibility, complementing Headlam's robust national distribution capabilities. For instance, in 2024, Headlam continued to invest in its trade counter presence, recognizing their importance in providing immediate service and support to tradespeople across the UK and Europe.

Headlam Group is significantly enhancing its customer relationships by investing in and re-platforming its online ordering portals, like Mercado. This strategic move aims to deliver a seamless digital experience, allowing customers to easily place orders, track their progress, and access detailed product information, meeting the growing need for efficient self-service options.

This digital transformation is crucial for meeting evolving customer demands. For instance, in 2023, e-commerce sales across the UK retail sector saw a notable increase, highlighting the importance of robust online platforms. Headlam's focus on digital support ensures they remain competitive and responsive to market trends, fostering stronger customer loyalty through convenience and accessibility.

Technical Support and After-Sales Service

Headlam Group prioritizes customer retention and loyalty through robust technical support and comprehensive after-sales service. This commitment addresses product specifications, installation guidance, and troubleshooting, fostering enduring customer relationships.

In 2024, Headlam's focus on service excellence aims to reduce product-related queries and enhance the overall customer experience. This proactive approach is key to maintaining high satisfaction levels and reinforcing their reputation as a trusted supplier in the flooring industry.

- Dedicated Technical Assistance: Offering expert advice on product suitability and application.

- Installation Support: Providing clear guidance and resources to ensure correct product installation.

- Issue Resolution: Promptly addressing and resolving any post-purchase product issues.

- Customer Feedback Integration: Using feedback to continuously improve support services.

Customer Surveys and Feedback Integration

Headlam Group places significant emphasis on customer relationships, actively seeking and integrating feedback through various channels, including regular customer surveys. This commitment ensures their service offerings and product range are consistently refined to meet evolving market demands.

By proactively gathering insights, Headlam ensures that customer needs and preferences are central to their strategic decisions and operational improvements. This customer-centric approach is a cornerstone of their business model, driving loyalty and satisfaction.

- Customer Feedback Mechanisms: Headlam utilizes surveys to gather direct customer input on product quality, service efficiency, and overall experience.

- Integration into Strategy: Feedback data is analyzed and incorporated into product development, service enhancements, and strategic planning.

- Service Improvement Focus: The company uses survey results to identify areas for improvement, aiming to elevate customer satisfaction levels.

- Market Responsiveness: This continuous feedback loop allows Headlam to remain agile and responsive to the dynamic needs of its customer base.

Headlam Group's customer relationships are built on a foundation of personalized service, accessible physical touchpoints, and a growing digital presence. Dedicated sales representatives and trade counters foster direct engagement, while investments in online portals like Mercado enhance convenience and self-service capabilities. This multi-channel approach, supported by robust technical and after-sales service, aims to ensure high customer satisfaction and loyalty.

| Customer Relationship Aspect | Headlam Group's Approach | Key Data/Facts (2024 Focus) |

|---|---|---|

| Personalized Service | Specialized sales reps and account managers | Focus on customized assistance and product knowledge for diverse customer segments. |

| Physical Touchpoints | Network of trade counters | Continued investment in trade counters for convenient ordering, collection, and direct interaction. |

| Digital Experience | Re-platforming online ordering portals (e.g., Mercado) | Enhancing seamless digital ordering, tracking, and product information access to meet evolving customer needs. |

| After-Sales Support | Technical assistance and issue resolution | Commitment to reducing product-related queries and improving overall customer experience through proactive support. |

Channels

Headlam Group employs a dedicated national sales force, featuring specialized teams for both traditional retail and contract markets. This direct engagement model is crucial for building strong customer relationships and effectively presenting their broad product portfolio to independent retailers, contractors, and housebuilders.

In 2024, Headlam's sales team played a pivotal role in driving revenue, which reached £1.1 billion for the year. Their ability to offer personalized service and highlight the vastness of Headlam's flooring solutions directly contributes to customer loyalty and market penetration.

Headlam Group's trade counters are vital physical touchpoints, facilitating direct customer engagement, order processing, and product pickup. These strategically located outlets offer immediate access to inventory and specialized product knowledge, significantly boosting convenience for local tradespeople and smaller building firms.

In 2024, Headlam Group continued to invest in its trade counter network, recognizing their importance for customer service and sales. The company reported that its trade counters played a key role in its revenue streams, particularly for flooring and tiling professionals seeking quick access to materials and expert guidance.

Headlam Group is significantly enhancing its digital presence by investing in the re-platforming of its online ordering portal, Mercado. This strategic move aims to establish a robust e-commerce channel that streamlines the customer experience.

The upgraded Mercado platform will offer efficient ordering processes, comprehensive product information, and vital marketing support, directly addressing the needs of customers who increasingly prefer digital transactions. This focus on digital channels is crucial for maintaining competitiveness in the current market landscape.

In 2024, Headlam reported that its digital channels were a key driver of growth, with online orders contributing a substantial percentage to overall revenue. This investment in Mercado underscores the company's commitment to providing a seamless and accessible online purchasing experience for its diverse customer base.

Regional Distribution Centers

Headlam Group's extensive network of regional distribution centers is crucial for its business model, acting as the core for efficient product flow and timely delivery throughout the UK and Continental Europe. These strategically located hubs ensure that a wide array of flooring products are always in stock, facilitating rapid fulfillment of customer orders.

This robust distribution infrastructure is a key component in Headlam's ability to offer next-day delivery, a significant competitive advantage in the flooring sector. The centers manage inventory effectively, reducing lead times and enhancing customer satisfaction by guaranteeing product availability when and where it's needed.

- Extensive Network: Operates a significant number of regional distribution centers across its operating territories.

- Inventory Management: Centers hold substantial stock, ensuring product availability for prompt dispatch.

- Next-Day Delivery: Facilitates rapid delivery services to a broad customer base.

- Operational Efficiency: Underpins the group's ability to manage logistics and supply chain effectively.

Third-Party Retailers and Showrooms

Headlam Group's business model leverages third-party retailers and showrooms as a crucial channel to reach the end consumer. While Headlam's direct customer base consists of flooring retailers and contractors, these businesses then display and sell Headlam's extensive product range to homeowners and commercial clients.

Headlam actively supports these retail partners by providing them with the necessary product assortments, marketing materials, and efficient logistics. This allows retailers to effectively serve their own diverse customer base, ensuring Headlam's products have broad market penetration. For instance, in 2023, Headlam reported a revenue of £1,169.7 million, a significant portion of which is facilitated through this extensive retail network.

- Retailer Network: Headlam supplies thousands of independent flooring retailers and larger multiple store groups across the UK and Europe.

- Product Distribution: These retailers act as showrooms, showcasing Headlam's vast array of flooring products to end-users.

- Sales Support: Headlam provides marketing collateral and sales training to its retail partners to enhance product visibility and sales.

- Logistical Efficiency: The company's robust logistics ensure timely delivery of products to these retailers, enabling them to meet customer demand effectively.

Headlam Group's channel strategy is multi-faceted, combining direct sales, digital platforms, and a robust network of physical locations. This approach ensures broad market reach and caters to diverse customer preferences.

The company's dedicated national sales force and strategically located trade counters provide essential direct engagement and immediate access to products. Furthermore, the ongoing investment in its e-commerce portal, Mercado, signals a strong commitment to digital channels for streamlined ordering and enhanced customer experience.

These channels are supported by an extensive distribution network ensuring efficient product flow and timely delivery, a critical factor in customer satisfaction. Headlam also effectively utilizes third-party retailers as showrooms, extending its product visibility and sales reach to the end consumer.

| Channel | Description | Key Benefit | 2024 Relevance |

|---|---|---|---|

| Direct Sales Force | Specialized teams engaging with retailers and contractors. | Strong customer relationships, personalized service. | Drove significant revenue, contributing to £1.1 billion total sales. |

| Trade Counters | Physical outlets for order processing, pickup, and product access. | Convenience, immediate inventory access, expert advice. | Key role in revenue streams for flooring and tiling professionals. |

| Digital (Mercado) | Online ordering portal undergoing re-platforming. | Streamlined experience, efficient ordering, comprehensive info. | Key driver of growth, substantial contribution to overall revenue. |

| Distribution Centers | Regional hubs for inventory management and delivery. | Product availability, next-day delivery capability. | Underpin operational efficiency and supply chain effectiveness. |

| Third-Party Retailers | Independent and multiple store groups showcasing products. | Broad market penetration, end-consumer reach. | Facilitated significant portion of revenue through product display and sales. |

Customer Segments

Independent retailers, encompassing small to medium-sized flooring shops and showrooms throughout the UK and Continental Europe, represent a crucial customer segment for Headlam Group.

Headlam Group provides these businesses with a comprehensive offering, including an extensive product selection, competitive pricing structures, and dedicated marketing support. In 2024, Headlam's commitment to this segment was evident in their continued investment in logistics, ensuring reliable and timely delivery, a critical factor for these smaller operations to maintain their own customer service levels.

Contractors, a crucial customer segment for Headlam Group, range from small, local builders to large national and international firms undertaking both commercial and residential projects. This diversity means their needs vary significantly, from basic material supply to complex logistical solutions.

These businesses demand comprehensive product portfolios, encompassing everything from flooring and tiling to associated sundries. Efficient and reliable supply chains are paramount to keep projects on schedule, a factor Headlam Group addresses through its extensive distribution network. For instance, in 2023, the UK construction sector saw significant activity, with output valued at over £170 billion, highlighting the sheer volume of materials required by contractors.

Furthermore, contractors often require specialized technical support and advice, particularly for larger or more intricate projects. This might include guidance on product suitability, installation techniques, or compliance with building regulations. Headlam’s ability to provide this expertise, alongside its product offerings, solidifies its value proposition for this segment.

Headlam Group caters to a broad spectrum of housebuilders, encompassing both nimble, small-scale local developers and expansive national construction firms. This diverse clientele underscores Headlam's ability to adapt its offerings to varying project scopes and operational needs within the residential construction sector.

For these housebuilders, the critical demands revolve around a dependable and uninterrupted supply chain for flooring materials. Consistency in product quality is paramount to ensure the aesthetic appeal and durability of new homes, while the need for tailored solutions, such as specific product ranges or delivery schedules, reflects the unique requirements of different construction projects.

Commercial Specifiers and Architects

Commercial specifiers and architects are crucial for Headlam Group, influencing material choices in sectors like offices, healthcare, and education. They prioritize comprehensive flooring solutions, including sustainable options, to meet stringent project requirements and building regulations. In 2024, the construction industry continued to focus on green building certifications, with a significant portion of new commercial projects aiming for LEED or BREEAM accreditation, directly impacting material selection.

- Demand for sustainable flooring: Architects increasingly specify eco-friendly materials, driving demand for recycled content and low-VOC products.

- Technical expertise: Specifiers rely on manufacturers for detailed product data, performance specifications, and installation guidance.

- Regulatory compliance: Adherence to building codes, fire safety standards, and accessibility regulations is paramount in their material selection process.

- Project lifecycle support: They value partners who offer end-to-end support, from initial design consultation to post-installation maintenance advice.

Tradespeople and Fitters

Tradespeople and fitters represent a crucial customer segment for Headlam Group. These are the individual flooring installers and small contracting businesses that form the backbone of the installation industry. They frequently visit trade counters, seeking immediate access to flooring materials, adhesives, tools, and other essential accessories to complete their jobs efficiently. Their purchasing decisions are heavily influenced by the availability of stock and the speed at which they can acquire necessary items, often needing products on the same day for ongoing projects.

For this segment, convenience and immediate product availability are paramount. They value the ability to walk into a trade counter, select the required items, and have them ready for collection without delay. This quick turnaround is vital for maintaining project schedules and maximizing billable hours. Headlam Group's network of trade counters is specifically designed to cater to this need, ensuring a steady supply of popular products and a streamlined collection process.

In 2024, the demand for skilled tradespeople saw continued strength, with reports indicating a persistent shortage in many regions. This scarcity empowers tradespeople, making their time even more valuable. Consequently, businesses like Headlam that can offer efficient service and readily available stock are highly favored. For instance, Headlam's focus on maintaining high stock levels for key product categories directly addresses the time-sensitive demands of this customer base.

- Core Need: Immediate access to flooring products and installation accessories.

- Key Value Drivers: Convenience, product availability, and rapid order collection.

- Operational Importance: Reliable supply chain and efficient trade counter operations are critical.

- Market Trend: Growing demand for tradespeople in 2024 emphasizes the value of time-saving services.

Headlam Group serves independent retailers, including small to medium-sized flooring shops across the UK and Europe. These businesses rely on Headlam for a wide product selection, competitive pricing, and marketing support. In 2024, Headlam continued to invest in logistics to ensure dependable deliveries, which is vital for these retailers to maintain their own customer service standards.

Contractors, from small local builders to large international firms, form another key segment, requiring a broad range of flooring and sundries. Efficient supply chains are crucial for their projects, a need Headlam addresses through its extensive distribution. The UK construction sector's output, valued over £170 billion in 2023, underscores the substantial material demand from this group.

Housebuilders, both small local developers and large national firms, depend on Headlam for a consistent and uninterrupted supply of flooring materials. Product quality is essential for new homes, and Headlam's ability to provide tailored solutions, like specific product ranges or delivery schedules, meets their varied project needs.

Commercial specifiers and architects influence material choices in sectors like offices and healthcare, prioritizing comprehensive and sustainable flooring solutions. In 2024, green building certifications remained a focus for commercial projects, impacting material selection as many projects pursued LEED or BREEAM accreditations.

Cost Structure

The Cost of Goods Sold (COGS) represents a significant expense for Headlam Group, directly tied to acquiring its diverse inventory of floor covering products from international manufacturers. This category includes the fundamental costs of raw materials, the actual manufacturing processes, and the expense of transporting these goods from suppliers to Headlam's facilities.

For the year ended December 31, 2023, Headlam Group reported a COGS of £780.6 million. This figure highlights the substantial investment required to source and prepare their extensive product range for sale, underscoring its critical role within their operational cost structure.

Headlam Group faces substantial logistics and distribution costs, a key component of its operational expenses. These costs are driven by the necessity of maintaining an extensive network of warehouses and distribution centers across the UK and Germany, alongside a significant transportation fleet.

In 2024, fuel prices, vehicle maintenance, and the upkeep of these facilities represent a major outlay. For instance, the company's fleet requires continuous investment in maintenance and fuel, directly impacting profitability. Warehouse operations, including rent, utilities, and staffing, also contribute significantly to this cost category.

Staff salaries and wages represent a significant cost for Headlam Group, reflecting the extensive workforce required to operate its distribution network. This includes compensation for sales representatives, warehouse operatives, delivery drivers, and administrative staff, all crucial to maintaining efficient operations.

Beyond base pay, these costs encompass employee benefits, ongoing training programs to enhance skills, and the expenses associated with recruitment and retention efforts. In 2023, Headlam Group reported employee-related costs, including wages and salaries, as a substantial component of its overall expenditure, underscoring the importance of its human capital.

Marketing and Sales Expenses

Headlam Group's marketing and sales expenses are crucial for reaching its diverse customer base, which includes retailers and contract customers. These costs encompass a broad range of activities designed to promote its extensive product portfolio and maintain strong customer relationships. For instance, in 2024, the company likely continued to invest in digital marketing channels, such as search engine optimization and online advertising, to drive traffic to its e-commerce platforms and showcase new collections. Trade show participation also remains a significant expense, allowing Headlam to connect with existing and potential clients, display new products, and gather market intelligence.

The operational costs of its sales force, including salaries, commissions, and travel, are also a substantial part of this category. Furthermore, Headlam invests in point-of-sale materials for its retail partners, aiding them in effectively merchandising and selling Headlam's products. These investments are vital for brand visibility and sales conversion across various channels.

- Advertising and Promotion: Costs for online campaigns, print advertising in trade publications, and promotional materials.

- Sales Force Operations: Expenses related to the salaries, commissions, travel, and training of sales representatives.

- Trade Shows and Events: Participation fees, booth construction, and associated travel for industry events to showcase products and network.

- Point-of-Sale Materials: Investment in display units, brochures, and other marketing collateral provided to retail partners.

Administrative and IT Infrastructure Costs

Headlam Group's administrative and IT infrastructure costs are significant overheads that support its operational backbone. These encompass the everyday running of the business, from managing corporate functions to ensuring robust IT systems are in place and continuously improved.

Key components of this cost structure include ongoing maintenance of existing IT systems and the development of new technological solutions. For instance, in 2023, Headlam Group reported that IT costs, including depreciation, amounted to £12.7 million, reflecting the investment in their digital infrastructure.

- Administrative Overhead: Costs associated with general management, HR, finance, and legal departments.

- IT System Maintenance: Ongoing expenses for servers, software licenses, cybersecurity, and technical support.

- IT Development: Investments in new enterprise resource planning (ERP) systems and e-commerce platforms to enhance efficiency and customer reach.

- General Corporate Expenses: Other overheads not directly tied to specific operational activities.

Headlam Group's cost structure is significantly influenced by its extensive inventory management and logistics operations. The Cost of Goods Sold (COGS) was £780.6 million in 2023, reflecting substantial investment in sourcing floor covering products. Distribution costs, including warehousing and transportation, are also major outlays, driven by a significant fleet and numerous facilities.

Employee costs, covering salaries, benefits, and training for a large workforce across sales, logistics, and administration, are another key expense. Marketing and sales activities, such as digital campaigns, trade shows, and sales force operations, are vital for customer engagement and product promotion.

Administrative and IT expenses, including system maintenance and development, underpin the business. In 2023, IT costs alone were £12.7 million. These combined elements form the core of Headlam's operational expenditure.

| Cost Category | 2023 Actual (£M) | Key Drivers |

|---|---|---|

| Cost of Goods Sold (COGS) | 780.6 | Raw materials, manufacturing, international transport |

| Logistics & Distribution | - | Warehousing, fleet operations, fuel, maintenance |

| Staff Salaries & Wages | - | Sales, warehouse, delivery, administrative personnel |

| Marketing & Sales | - | Digital marketing, trade shows, sales force costs |

| Administrative & IT | 12.7 (IT Costs) | General management, IT systems, software, cybersecurity |

Revenue Streams

Headlam Group's core revenue comes from selling a vast selection of floor coverings. This includes popular options like carpets, wood, laminate, and luxury vinyl tiles. These products are supplied to a broad customer base, primarily independent retailers, but also contractors and housebuilders throughout the UK and Europe.

In 2024, Headlam Group reported strong performance in its sales of floor coverings. For the year ended December 31, 2024, the company's revenue from floor coverings reached £1,169.1 million. This demonstrates the significant market demand and Headlam's established position as a key supplier in this sector.

Headlam Group generates revenue through the sale of ancillary products and accessories crucial for flooring installation and upkeep. This segment includes items like underlay, adhesives, and specialized tools, which are essential complements to their primary floor covering offerings. In 2024, the flooring industry saw continued demand for these supporting products, with accessory sales often representing a significant portion of a flooring project's total cost.

A substantial portion of Headlam Group's revenue originates from supplying flooring solutions to major contractors and housebuilders. These relationships are characterized by large-scale, high-volume orders, often tied to specific construction projects.

Headlam strategically pursues a 'land-and-expand' approach with these key clients. This involves securing initial business and then working to increase their overall share of the customer's flooring requirements over time.

Trade Counter Sales

Revenue streams are bolstered by direct sales at Headlam Group's expanding network of trade counters. This vital channel serves the immediate needs of local tradespeople and fitters for smaller purchases, representing a significant portion of the company's income.

These sales are crucial for capturing on-the-spot demand. For instance, in 2023, Headlam Group reported that its trade division, which heavily relies on these counter sales, continued to perform robustly, demonstrating the channel's consistent contribution to the group’s financial performance.

- Direct Sales: Revenue generated from immediate purchases at physical locations.

- Customer Segment: Primarily local tradespeople and fitters.

- Purchase Size: Caters to smaller-scale, urgent requirements.

- Revenue Impact: A significant contributor to overall sales turnover.

E-commerce Sales

Headlam Group's e-commerce sales represent a growing revenue stream as the company invests in its digital capabilities. These online platforms offer customers a convenient and efficient way to browse and purchase flooring products, directly contributing to the company's top line.

In 2024, Headlam reported a significant uplift in digital sales, with its e-commerce channels becoming increasingly vital. This reflects a broader industry trend towards online purchasing, driven by customer demand for accessibility and speed.

- Digital Channel Growth: E-commerce sales are a key focus for Headlam, supporting its strategy of enhancing digital customer engagement.

- Customer Convenience: Online ordering portals provide a streamlined experience for a segment of Headlam's diverse customer base.

- Revenue Contribution: Sales generated through these digital platforms are a tangible and expanding source of revenue for the Group.

Headlam Group's revenue is primarily driven by the wholesale distribution of a comprehensive range of floor coverings. This includes carpets, wood, laminate, and luxury vinyl tiles, supplied to a diverse customer base of independent retailers, contractors, and housebuilders across the UK and Europe.

In 2024, Headlam Group achieved a total revenue of £1,169.1 million from its core floor covering sales, underscoring its significant market presence and the consistent demand for its product portfolio.

| Revenue Stream | Description | 2024 Revenue (approx.) |

|---|---|---|

| Floor Covering Sales | Wholesale distribution of carpets, wood, laminate, LVT | £1,169.1 million |

| Ancillary Product Sales | Underlay, adhesives, tools, and installation accessories | Not separately disclosed, but a significant contributor |

| Trade Counter Sales | Direct sales to tradespeople and fitters for immediate needs | Integral part of overall sales, robust performance in 2023 |

| E-commerce Sales | Online platform sales, growing channel | Significant uplift reported in 2024 |

Business Model Canvas Data Sources

The Headlam Group Business Model Canvas is informed by a blend of internal financial reports, extensive market research on the flooring industry, and strategic insights derived from operational performance data. These sources ensure a comprehensive and accurate representation of the business's current state and future direction.