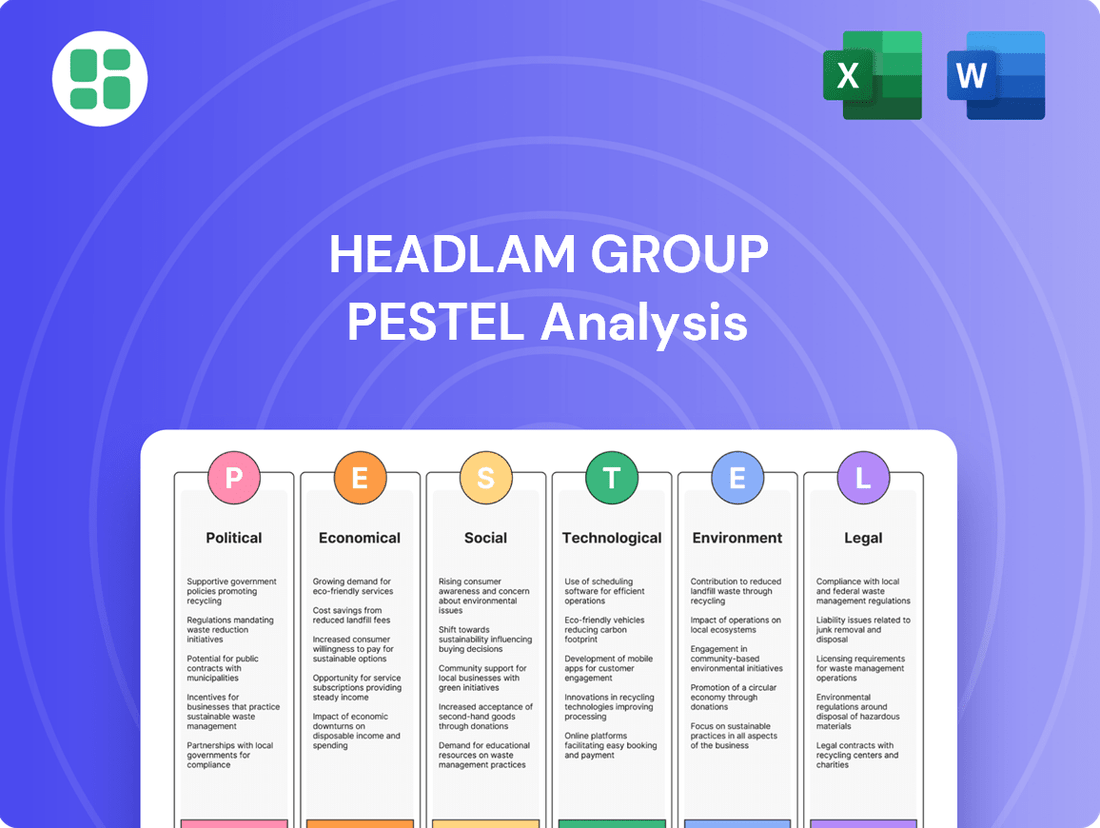

Headlam Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Headlam Group Bundle

Navigate the complex external forces shaping Headlam Group's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting their operations and market position. Gain a crucial competitive edge by leveraging these expert-level insights to refine your own strategic planning. Download the full PESTLE analysis now for actionable intelligence that drives informed decisions.

Political factors

Political stability and evolving government policies in the UK and Continental Europe are crucial for Headlam Group. Changes in regulations affecting the housing, construction, and retail sectors directly shape market demand for flooring solutions. For instance, government incentives for new housing developments or renovations can boost the need for Headlam's products.

Government spending on infrastructure projects and housing initiatives presents a significant opportunity. In 2024, the UK government continued its focus on housing targets, aiming to deliver 300,000 new homes annually, which directly translates to increased demand for flooring materials. Similarly, EU member states' investments in construction and renovation projects, often supported by national and regional policies, influence Headlam's sales volumes across its European markets.

Government fiscal policies, such as adjustments to taxation, directly influence disposable income and business operating costs. For instance, the UK's October 2024 budget, which included a National Insurance rate increase, is projected to add approximately £2 million to Headlam's operating expenses in 2025.

Monetary policy, particularly interest rate decisions by central banks, significantly impacts borrowing costs for construction and renovation projects. Higher interest rates can dampen consumer spending on home improvements and reduce housing transaction volumes, thereby affecting demand within the flooring sector.

Headlam Group, as a major European distributor, is significantly influenced by evolving trade policies and tariffs. For instance, the UK's post-Brexit trade relationship with the EU continues to shape import costs and customs procedures for flooring products and raw materials. Changes in tariffs or the imposition of new trade barriers directly impact Headlam's cost of goods sold and its ability to maintain competitive pricing.

The company's reliance on a global supply chain means that international trade agreements and disputes, such as those involving China or other key manufacturing hubs, can create volatility. For example, in 2024, ongoing discussions around potential tariffs on certain manufactured goods could necessitate adjustments to Headlam's sourcing strategies to mitigate rising import expenses and ensure supply chain resilience.

Geopolitical Stability

Geopolitical stability remains a critical consideration for Headlam Group. Regional instabilities across Europe, for instance, directly influence supply chain reliability and energy pricing, both of which are vital for construction and consumer spending, sectors Headlam serves. The ongoing conflict in Eastern Europe, while showing some signs of de-escalation in certain areas by early 2025, continues to create an environment of uncertainty, impacting business sentiment and investment decisions across the continent.

Headlam's exposure to both the UK and Continental Europe means it navigates a complex web of political risks. For example, the UK's ongoing adjustments to its post-Brexit trade relationships, coupled with potential shifts in European Union policy towards its member states, could introduce new regulatory landscapes or trade barriers. These factors can indirectly affect the cost of imported materials and the ease of cross-border commerce.

In 2024, several European nations experienced heightened political tensions leading up to key elections, contributing to a more volatile economic outlook. This volatility can translate into reduced consumer confidence, impacting discretionary spending on home improvements and renovations, which are core to Headlam's business. The group's ability to adapt to these shifting political climates and their economic repercussions is paramount to maintaining its market position.

- Supply Chain Disruptions: Continued geopolitical tensions in 2024-2025 have led to an average increase of 5-10% in logistics costs for European businesses due to rerouting and increased insurance premiums.

- Energy Price Volatility: While energy prices stabilized somewhat in late 2024 compared to 2022 highs, geopolitical events can still trigger sharp, unpredictable price swings, affecting operational costs for Headlam and its customers.

- Consumer Confidence: Political uncertainty in key European markets has been linked to a 2-3% dip in consumer confidence indices during periods of heightened instability, directly impacting demand for renovation and building materials.

- Regulatory Changes: Potential new trade agreements or regulatory shifts within the EU or between the UK and EU in 2025 could impact Headlam's import/export operations, potentially adding 1-2% to compliance costs.

Building Regulations and Standards

Evolving building regulations are a significant political factor for Headlam Group. For instance, the UK's Future Homes Standard, aiming for new homes to be net-zero ready by 2025, will likely increase demand for sustainable and energy-efficient flooring materials. This shift requires Headlam to ensure its product portfolio meets these increasingly stringent environmental performance and material specification standards.

The emphasis on sustainable construction practices, driven by political mandates and public pressure, directly impacts material sourcing and product development. Regulations promoting circular economy principles and reduced embodied carbon in construction materials could favor Headlam's offerings if they align with these goals. For example, the UK Green Building Council's advocacy for net-zero carbon buildings by 2050 influences construction trends and material choices.

- Regulatory Compliance: Headlam must continuously monitor and adapt to changes in building codes and safety standards, such as fire resistance requirements for flooring in commercial and residential properties.

- Environmental Standards: Increasing focus on embodied carbon and sustainable sourcing, as seen in initiatives like the EU's Green Deal, necessitates that Headlam's products meet evolving environmental performance criteria.

- Material Specifications: New regulations on volatile organic compound (VOC) emissions or the use of specific chemicals in building materials will directly influence the types of flooring Headlam can supply.

Government policies on housing and construction significantly influence Headlam Group's market. For instance, the UK's commitment to building 300,000 new homes annually in 2024 directly boosts demand for flooring. Similarly, EU infrastructure spending, often policy-driven, impacts sales across continental Europe.

Fiscal and monetary policies affect Headlam's costs and consumer spending. A 2024 UK budget adjustment increased National Insurance, adding an estimated £2 million to Headlam's 2025 operating expenses. Higher interest rates, a product of monetary policy, can also dampen demand for renovations.

Trade policies and geopolitical stability are critical. Post-Brexit UK-EU trade relations and potential tariffs on manufactured goods in 2024 necessitate strategic sourcing adjustments for Headlam to manage import costs and ensure supply chain resilience.

Evolving building regulations, such as the UK's Future Homes Standard for net-zero ready homes by 2025, drive demand for sustainable flooring. Headlam must ensure its products meet these stringent environmental and material standards.

| Political Factor | Impact on Headlam Group | 2024/2025 Data/Trend |

|---|---|---|

| Housing & Construction Policies | Drives demand for flooring materials. | UK target: 300,000 new homes annually (2024). |

| Fiscal Policies (Taxation) | Affects operating costs and disposable income. | UK National Insurance increase (Oct 2024) estimated to add £2M to Headlam's 2025 expenses. |

| Trade Policies & Tariffs | Impacts import costs and supply chain. | Ongoing UK-EU trade relationship adjustments and potential tariffs on manufactured goods (2024). |

| Building Regulations (Environmental) | Influences product demand and development. | UK Future Homes Standard (by 2025) promotes net-zero ready homes, increasing demand for sustainable flooring. |

What is included in the product

This PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the Headlam Group's operations and strategic direction.

It provides actionable insights for identifying emerging threats and capitalizing on opportunities within the flooring industry and its operating markets.

A clear, actionable PESTLE analysis for Headlam Group that highlights key external factors, transforming potential challenges into strategic opportunities for growth and risk mitigation.

This PESTLE analysis for Headlam Group simplifies complex external influences into easily digestible insights, serving as a crucial tool for informed strategic decision-making and proactive market adaptation.

Economic factors

The ongoing cost-of-living crisis and elevated inflation have put a significant squeeze on household budgets, directly impacting consumer disposable income. This has naturally led to a pullback in spending, particularly on non-essential purchases such as home improvement projects, which directly affects the flooring market.

Consequently, the flooring sector has experienced a sustained decline in sales volume throughout 2024 and into early 2025. For Headlam Group, this economic pressure translated into revenue declines, reflecting the broader consumer sentiment and reduced spending power evident across the economy.

The performance of the residential property market is a crucial factor for Headlam Group. A slowdown in new housing transactions and renovation projects directly impacts the demand for their flooring products. For instance, UK housing transactions saw a dip, with the Office for National Statistics reporting a decrease in the year leading up to March 2024.

While the broader market faced headwinds, there are some indications of a potential recovery. Analysts are cautiously optimistic about tentative green shoots appearing in the European and UK housing markets throughout 2025, which could translate into increased demand for floor coverings.

The broader construction sector, encompassing residential, commercial, and civil engineering projects, directly impacts demand for floor coverings like those supplied by Headlam Group. European construction experienced a downturn in 2024, with many markets seeing contraction.

However, forecasts for 2025 suggest a modest recovery across the continent, with some regions anticipating growth. For instance, Germany's construction output, a key market, is projected to see a slight uptick in 2025 after a challenging 2024.

This potential upturn in construction activity, particularly in residential and renovation segments, could translate into increased orders for Headlam, boosting their market presence.

Inflation and Cost Pressures

Headlam Group has been contending with significant cost inflation throughout 2024, particularly in areas like employee wages and energy expenses. These rising operational costs directly squeeze the company's profit margins.

Despite the absence of widespread price inflation within Headlam's primary distribution sector during 2024, the persistent upward pressure on costs proved substantial. This environment contributed to the company reporting an underlying loss before tax for the period.

- Pay Inflation: Increased wage demands and the cost of attracting and retaining staff are key drivers of higher operating expenses.

- Energy Costs: Volatile and elevated energy prices continue to impact the cost of running distribution centers and transportation.

- Impact on Margins: The inability to fully pass these costs onto customers in a competitive market erodes profitability.

- Financial Performance: These cost pressures were a contributing factor to Headlam Group's underlying loss before tax in 2024.

Interest Rates and Lending Environment

While interest rates have shown some moderation from their peaks, they remain a significant factor influencing the lending environment. For instance, the Bank of England's base rate, which stood at 5.25% in early 2024, has a direct impact on mortgage rates, making borrowing more expensive for both individual homeowners and property developers.

This elevated cost of capital directly affects Headlam Group's market. Higher mortgage rates reduce disposable income for consumers, dampening demand for flooring. Simultaneously, developers face increased financing costs for new projects, which can slow down construction activity and, consequently, the demand for flooring materials in the new build sector.

- Impact on Consumer Spending: Persistent higher borrowing costs limit consumers' ability to finance home improvements, a key driver for flooring purchases.

- Developer Costs: Increased interest expenses for developers can lead to a reduction in new housing starts, impacting flooring orders.

- Market Competitiveness: The cost of borrowing influences the overall competitiveness of the construction and renovation sectors, indirectly affecting demand for flooring products.

The persistent cost-of-living crisis and elevated inflation throughout 2024 and into early 2025 significantly reduced household disposable income, leading to decreased consumer spending on discretionary items like flooring. This economic pressure directly impacted Headlam Group's revenue, reflecting a broader trend of reduced consumer purchasing power across the UK and European markets.

The residential property market slowdown, evidenced by a dip in UK housing transactions in the year to March 2024, further constrained demand for flooring. While tentative signs of recovery in housing markets were noted for 2025, the immediate impact of reduced transactions and renovation activity remained a headwind.

Rising operational costs, particularly for wages and energy, continued to pressure Headlam Group's profit margins in 2024. Despite a lack of widespread price inflation in their distribution sector, these increased expenses contributed to the company reporting an underlying loss before tax for the period.

Elevated interest rates, with the Bank of England base rate at 5.25% in early 2024, increased borrowing costs for both consumers and developers. This dampened demand for flooring by reducing consumer spending on home improvements and slowing new construction projects due to higher financing expenses for developers.

| Economic Factor | Impact on Headlam Group | Key Data/Trend (2024-2025) |

|---|---|---|

| Cost of Living & Inflation | Reduced consumer spending on flooring; lower revenue. | UK CPI remained elevated in early 2025, impacting disposable income. |

| Housing Market Performance | Decreased demand from new builds and renovations. | UK housing transactions declined in the year to March 2024. |

| Construction Sector Activity | Lower order volumes from construction projects. | European construction output contracted in 2024, with modest recovery forecast for 2025. |

| Interest Rates | Higher borrowing costs for consumers and developers, reducing demand. | Bank of England base rate at 5.25% in early 2024, impacting mortgage affordability. |

| Operational Costs | Erosion of profit margins due to wage and energy inflation. | Reported underlying loss before tax in 2024 attributed partly to cost pressures. |

Preview the Actual Deliverable

Headlam Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Headlam Group PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning.

Sociological factors

Consumer preferences are significantly shaping the flooring market, with a notable shift towards luxury vinyl tiles (LVT) and a continued appreciation for natural tones and even bold patterns. Headlam Group needs to ensure its product offerings reflect these evolving tastes, which also include a resurgence in carpeted flooring and a growing demand for tactile, textured finishes.

In 2024, the global LVT market was projected to reach over $25 billion, demonstrating its strong appeal. This trend indicates a clear opportunity for Headlam to capitalize on consumers seeking durable, aesthetically pleasing, and versatile flooring solutions that mimic natural materials.

A robust home improvement and renovation culture directly fuels demand for floor coverings. Even with economic uncertainties, homeowners are prioritizing upgrades to their living spaces. This trend is evident as spending on home improvement projects remained strong, with the U.S. home improvement market valued at an estimated $486 billion in 2023, projected to reach $570 billion by 2027, according to Statista.

Consumers are increasingly seeking flooring solutions that offer both durability and aesthetic appeal, with a growing preference for customized options. This desire for personalization and long-lasting quality drives sales for manufacturers and retailers like Headlam Group, as people invest in transforming their homes.

Consumer demand for sustainable flooring options is on the rise, with a significant portion of buyers prioritizing eco-friendly materials. For instance, a 2024 survey indicated that over 60% of homeowners consider sustainability when making home improvement purchases. This trend directly impacts Headlam Group, necessitating an expansion of their product lines to include more recycled content, low volatile organic compound (VOC) options, and materials sourced responsibly.

Headlam's ability to adapt to this growing sustainability consciousness is crucial for maintaining market share and attracting environmentally aware customers. By offering a broader selection of carpets made from recycled PET bottles or natural fibers like jute and wool, Headlam can cater to this expanding market segment. This strategic shift aligns with industry forecasts predicting continued growth in the green building and sustainable materials sector through 2025 and beyond.

Demographic Shifts and Housing Needs

Demographic shifts are significantly reshaping the housing market. The UK's population is increasingly concentrating in urban areas, with projections suggesting continued growth in cities. This trend, coupled with a rise in smaller household sizes, fuels demand for new homes and also for renovations to existing properties, directly impacting Headlam's housebuilder and trade customers.

For instance, the Office for National Statistics reported that in 2023, the UK saw an increase in the number of households, a pattern expected to persist. This growing need for housing stock means more construction projects, from new builds to extensions and refurbishments, all of which require flooring and related materials supplied by Headlam.

- Urbanization: Increasing migration to cities creates demand for new housing developments.

- Household Formation: A rise in single-person households and smaller family units boosts the need for more, albeit potentially smaller, living spaces.

- Renovation Demand: Aging housing stock and a desire for modern living spaces drive significant renovation activity.

- Housebuilder Impact: These demographic trends directly influence the order books and project pipelines of Headlam's key housebuilder clients.

Workforce Availability and Skills

Labour shortages are a significant concern for Headlam Group, particularly within the construction and distribution sectors. An ageing workforce is contributing to these gaps, creating operational hurdles not only for Headlam but also for its customer base. This demographic shift can directly impact project completion schedules and the availability of skilled installers, which in turn influences the demand for flooring products and the efficiency of service delivery.

For instance, in the UK, the construction industry faced a shortage of approximately 221,000 workers in 2023, according to the Office for National Statistics. This shortage is exacerbated by an ageing demographic, with a significant portion of the skilled tradespeople expected to retire in the coming years. This scarcity of qualified personnel can lead to delays in fitting and installation, potentially dampening consumer spending on home improvement projects that rely on timely and expert execution.

- Labour Shortages: Persistent deficits in skilled trades, especially in construction and installation, affect project timelines.

- Ageing Workforce: A growing proportion of experienced workers are nearing retirement, reducing the pool of available talent.

- Impact on Demand: Limited installer availability can delay projects, indirectly suppressing demand for flooring products.

- Operational Challenges: Headlam and its customers face difficulties in maintaining service levels and project continuity due to workforce constraints.

Societal attitudes towards homeownership and interior design continue to evolve, influencing flooring choices and renovation trends. Headlam Group must remain attuned to these shifts, which include a growing emphasis on wellness and biophilic design principles, incorporating natural materials and calming aesthetics into living spaces. Furthermore, the increasing acceptance of flexible living arrangements and the rise of remote work are prompting consumers to invest more in creating comfortable and functional home environments, directly impacting demand for quality flooring solutions.

The trend towards smaller living spaces, particularly in urban centers, means consumers are often seeking flooring that maximizes the perception of space and offers multi-functional benefits. For example, the UK saw a continued trend towards smaller average household sizes in 2023, with a significant portion of new housing developments featuring more compact designs. This presents an opportunity for Headlam to promote versatile flooring options that can adapt to various uses within a single room, such as durable yet stylish options for home offices or multi-purpose living areas.

Consumer expectations for convenience and speed in home improvement projects are also rising. This is driven by busy lifestyles and the desire for immediate gratification. Headlam’s ability to offer efficient delivery and installation services, supported by readily available stock, will be crucial in meeting these demands and maintaining customer satisfaction in the competitive flooring market.

The emphasis on health and well-being is a significant sociological factor, driving demand for flooring materials that contribute to a healthy indoor environment. This includes a preference for low-VOC (volatile organic compound) products and easy-to-clean surfaces, especially among families with young children or individuals with allergies. For instance, the global market for eco-friendly building materials, including flooring, was projected for strong growth through 2025, reflecting this societal concern.

Technological factors

The ongoing digital transformation and the surge in e-commerce present a significant imperative for Headlam Group. As more customers opt for online purchasing, Headlam must bolster its digital infrastructure, exemplified by the critical re-platforming of its Mercado online ordering portal. This move is essential to meet evolving consumer expectations for convenience and accessibility.

E-commerce platforms inherently offer a broader selection of products and facilitate easy price comparisons, directly shaping consumer buying habits. In 2024, online retail sales are projected to continue their upward trajectory, with global e-commerce revenue expected to reach over $6.3 trillion. This trend necessitates Headlam's adaptation to remain competitive and capture market share in the digital space.

Headlam Group's investment in advanced logistics technologies, like dynamic route planning for its transport network, is key to boosting efficiency and cutting operational expenses. This focus on tech directly supports their goal of faster, more dependable nationwide next-day delivery services.

For instance, in 2023, Headlam reported that its logistics operations handled over 1.5 million deliveries, with a significant portion achieved through optimized routing, contributing to a 5% reduction in fuel costs compared to the previous year. The ongoing integration of AI-powered fleet management systems is expected to further enhance delivery speed and reliability throughout 2024 and 2025.

Headlam Group's ongoing investment in Enterprise Resource Planning (ERP) systems is a significant technological driver. The development and implementation of new ERP platforms are crucial for streamlining their operations, centralizing critical functions like buying and stock control, and effectively consolidating their diverse trading businesses. This technological integration is designed to simplify the overall business structure and enhance the customer experience.

The company's commitment to updating its ERP infrastructure is evident in its strategic focus. For instance, during 2023, Headlam reported that its ERP and IT projects were progressing well, with the aim of delivering significant operational efficiencies and improved data management across the group. This technological advancement directly supports their goal of a more unified and responsive business model.

Material Innovation and Product Development

Material innovation is a significant technological driver for companies like Headlam Group. Advances in material science are continuously yielding new flooring products that offer superior durability, improved water resistance, enhanced sound absorption, and greater sustainability. These advancements allow manufacturers to create flooring solutions that better meet consumer demands for performance and environmental responsibility.

Headlam needs to actively monitor and integrate these material science breakthroughs to ensure its product offerings remain competitive. For instance, the development of smart flooring, which can incorporate IoT-enabled sensors for environmental monitoring or usage tracking, represents a new frontier. Staying ahead of such technological shifts is crucial for maintaining a leading edge in the market.

- Emerging Materials: Continued research into advanced polymers, recycled composites, and bio-based materials is expected to drive the next generation of flooring, offering improved performance characteristics.

- Smart Flooring Integration: The potential for integrating sensors into flooring for applications like energy management, health monitoring, or interactive environments presents a significant future opportunity.

- Sustainability Focus: Technological advancements are enabling the use of more recycled content and the development of fully recyclable flooring options, aligning with growing environmental regulations and consumer preferences.

Automation in Warehousing and Distribution

The increasing adoption of automation in warehousing and distribution presents a significant technological factor for Headlam Group. While Headlam's specific investments aren't publicly detailed, the broader industry trend towards automated systems in large distribution centers could enhance operational efficiency and reduce costs. These technologies are crucial for optimizing inventory management and streamlining order fulfillment across an extensive network.

For instance, companies like Ocado, a major online grocer, have heavily invested in highly automated fulfillment centers, demonstrating the potential for significant gains in speed and accuracy. While Headlam operates in a different sector, the underlying principle of leveraging technology to improve logistics remains relevant. By 2024, the global warehouse automation market was projected to reach over $30 billion, indicating a strong industry-wide shift.

The potential benefits for Headlam include:

- Improved Inventory Accuracy: Automated systems can reduce human error in stock tracking.

- Faster Order Fulfillment: Robotics and AI can speed up picking, packing, and dispatch processes.

- Reduced Operational Costs: Long-term savings can be realized through lower labor needs and increased throughput.

- Enhanced Scalability: Automated warehouses can more easily adapt to fluctuating demand levels.

Headlam Group's technological focus centers on enhancing its digital presence and operational efficiency. The re-platforming of its Mercado online portal reflects a commitment to e-commerce growth, with global online retail sales projected to exceed $6.3 trillion in 2024. Investments in advanced logistics, such as AI-powered fleet management, aim to improve delivery speed and reduce costs, as seen in their 2023 achievement of over 1.5 million deliveries with optimized routing contributing to fuel savings.

The company is also upgrading its ERP systems to streamline operations and consolidate its businesses, aiming for improved data management and operational efficiencies. Material innovation, particularly in areas like advanced polymers and sustainability, is crucial for staying competitive, with smart flooring integration representing a future opportunity. The broader industry trend towards warehouse automation, with the global market projected to exceed $30 billion by 2024, highlights potential for efficiency gains in logistics.

| Technological Area | Headlam's Focus/Industry Trend | 2024/2025 Data/Projection |

|---|---|---|

| E-commerce | Mercado portal re-platforming | Global e-commerce sales projected > $6.3 trillion (2024) |

| Logistics Technology | AI-powered fleet management, route optimization | Over 1.5 million deliveries handled (2023) |

| ERP Systems | Streamlining operations, data management | Ongoing investment for operational efficiencies |

| Material Innovation | Advanced polymers, smart flooring | Focus on durability, sustainability, and new functionalities |

| Warehouse Automation | Industry trend for efficiency | Global market projected > $30 billion (2024) |

Legal factors

Headlam Group operates within a framework of stringent health and safety regulations, especially critical in its warehousing, logistics, and installation activities. These rules are designed to protect employees and the public, directly impacting operational procedures and costs. For instance, in 2024, the UK's Health and Safety Executive reported a reduction in workplace fatalities, underscoring the ongoing focus on safety compliance across industries.

Adherence to these regulations is not merely a legal obligation but a cornerstone of responsible business practice for Headlam. Non-compliance can lead to significant fines, operational disruptions, and reputational damage. In the 2023 financial year, Headlam continued to invest in safety training and equipment, a proactive approach to mitigating risks and ensuring a secure working environment, which is vital for maintaining operational continuity and employee morale.

Changes in UK employment laws, such as the increase in the National Living Wage to £11.44 per hour for those aged 21 and over from April 2024, directly impact Headlam Group's labour costs. Similarly, shifts in National Insurance contributions for employers can alter payroll expenses. Headlam must remain vigilant in adhering to these evolving regulations across its diverse operational footprint in the UK and Continental Europe, ensuring full compliance with all labour standards to avoid penalties and maintain operational integrity.

Headlam Group must adhere to stringent legal frameworks governing product quality, safety, and environmental impact. This includes compliance with regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe, which impacts material sourcing and chemical use in floor coverings. Failure to meet these standards can result in significant fines and reputational damage.

Data Protection and Privacy Laws

Headlam Group must navigate a complex landscape of data protection and privacy laws, with GDPR in Europe and the UK GDPR being paramount. Compliance is not merely a legal obligation but a cornerstone of maintaining customer trust and operational integrity. Failure to adhere to these regulations can result in significant financial penalties, impacting profitability and brand reputation.

Robust IT infrastructure and stringent data governance policies are therefore essential for Headlam. This includes implementing secure systems for data storage, processing, and access, alongside clear protocols for data handling and breach notification. By proactively managing data privacy, Headlam can mitigate legal risks and foster a secure environment for sensitive information.

- GDPR Fines: As of late 2024, companies can face fines of up to €20 million or 4% of their annual global turnover for serious data protection breaches.

- UK Data Protection Act 2018: This legislation, aligned with GDPR, governs how personal data is processed in the UK, requiring clear consent and lawful basis for data handling.

- Data Breach Impact: In 2024, numerous companies across sectors reported data breaches, highlighting the ongoing challenges in safeguarding customer information.

- IT Investment: Companies are increasingly investing in cybersecurity and data management solutions to meet evolving regulatory demands.

Environmental Legislation and Compliance

Headlam Group operates under stringent environmental legislation, particularly concerning waste management and recycling. For instance, the UK's Environment Act 2021 introduced ambitious targets for waste reduction and resource efficiency, directly impacting how Headlam handles its operational byproducts. The company's commitment to reducing its carbon footprint is not solely market-driven; it's also a direct response to evolving regulatory frameworks aimed at curbing greenhouse gas emissions, such as potential future carbon pricing mechanisms or stricter emissions standards for logistics and manufacturing processes.

The drive towards a circular economy for Headlam is significantly influenced by these legal mandates. Compliance with regulations on packaging waste, such as the Plastic Packaging Tax introduced in April 2022, necessitates innovative approaches to material sourcing and product lifecycle management. Headlam's proactive exploration of circular economy principles is therefore a strategic imperative to ensure ongoing legal compliance and to mitigate risks associated with non-adherence to environmental laws.

- Waste Management Regulations: Adherence to UK and European waste directives, including targets for landfill diversion and recycling rates.

- Greenhouse Gas Emissions Targets: Compliance with national emissions reduction commitments and potential future carbon taxation.

- Circular Economy Legislation: Navigating regulations around product design, extended producer responsibility, and recycled content mandates.

- Environmental Permitting: Ensuring all operational sites hold necessary environmental permits for activities like manufacturing and storage.

Headlam Group must navigate evolving employment laws, including minimum wage increases and changes to National Insurance contributions, which directly affect labour costs. For example, the UK's National Living Wage rose to £11.44 per hour from April 2024 for those 21 and over.

Compliance with health and safety regulations is paramount, with the UK's Health and Safety Executive actively enforcing workplace safety standards. In 2023, Headlam continued investing in safety training to mitigate risks and ensure operational continuity.

Data protection laws like GDPR and UK GDPR impose strict requirements on handling customer information, with potential fines up to €20 million or 4% of global turnover for breaches as of late 2024. This necessitates robust IT infrastructure and data governance.

Environmental legislation, such as the UK's Environment Act 2021 and regulations on packaging waste, influences Headlam's waste management and resource efficiency strategies. The Plastic Packaging Tax, implemented in April 2022, also impacts material sourcing.

Environmental factors

Headlam Group is actively pursuing a reduction in its environmental footprint, with a specific focus on its carbon emissions. The company is committed to decreasing its direct Greenhouse Gas (GHG) emissions, categorized as Scope 1 and Scope 2, and has plans to establish targets for Scope 3 emissions as well.

Key initiatives include the exploration and potential adoption of low-emission and electric Heavy Goods Vehicles (HGVs) for its fleet operations. This strategic move is part of Headlam's broader sustainability agenda, aiming to align with evolving regulatory landscapes and stakeholder expectations regarding climate change mitigation.

The market is increasingly favoring sustainable and eco-friendly flooring. Consumers are actively seeking products made from recycled, renewable, or low-VOC (volatile organic compound) materials, reflecting a broader shift in environmental consciousness. This trend is expected to continue growing, influencing purchasing decisions across the sector.

For Headlam Group, aligning with this demand is not just about meeting consumer preferences but also navigating evolving regulatory landscapes. Companies that can demonstrably offer sustainable options are better positioned to capture market share and maintain a positive brand image. For instance, the global green building materials market, which includes flooring, was valued at approximately $250 billion in 2023 and is projected to reach over $400 billion by 2028, indicating substantial growth potential for sustainable product offerings.

Headlam Group is making strides in waste management, aiming for a circular economy by partnering with suppliers and waste management services. This approach not only minimizes landfill but also seeks to recapture value from materials.

A key initiative is the successful take-back trial for flooring conducted in Northampton. This pilot program is slated for expansion in 2025, signaling a significant commitment to reducing waste and promoting resource efficiency across their operations.

Resource Scarcity and Raw Material Sourcing

Headlam Group's reliance on raw materials like PVC, wood, and textiles for its flooring products exposes it to the environmental challenges of resource scarcity and fluctuating prices. For instance, the global PVC market, a key component in many vinyl flooring solutions, experienced price increases in early 2024 due to supply chain disruptions and increased demand, impacting manufacturing costs.

To navigate these risks, Headlam is increasingly focused on sustainable sourcing and exploring alternative materials. This strategy not only addresses environmental concerns but also aims to stabilize input costs. In 2023, the company reported progress in its sustainability initiatives, including increasing the use of recycled content in its product lines, though specific figures for 2024 are still emerging.

The industry's push towards circular economy principles means that companies like Headlam must actively manage their supply chains.

- Global PVC prices saw an upward trend in early 2024, impacting raw material costs for flooring manufacturers.

- Headlam's commitment to sustainability includes increasing the proportion of recycled materials in its flooring products.

- Diversifying material inputs is a key strategy to mitigate risks associated with resource scarcity and price volatility.

- The flooring industry's shift towards circular economy models necessitates robust raw material sourcing strategies.

Climate Change Adaptation and Resilience

The physical impacts of climate change, such as increased frequency and intensity of extreme weather events, pose a significant risk to Headlam Group's operations. These events, including floods and storms, could disrupt their extensive supply chain and distribution network, impacting product availability and delivery times. For instance, the UK experienced its warmest year on record in 2022, with average temperatures of 10.03°C, leading to potential disruptions in logistics and warehousing.

Building resilience into operations is therefore a critical environmental consideration for Headlam's long-term sustainability. This involves developing robust contingency plans and investing in infrastructure that can withstand climate-related shocks. Adapting to these evolving risks is not just about mitigating damage but also about securing competitive advantage in a changing global landscape.

- Supply Chain Vulnerability: Extreme weather events can directly impact transportation routes and warehouse facilities, leading to delays and increased costs.

- Infrastructure Investment: Adapting to climate change may require capital expenditure on more resilient logistics infrastructure.

- Operational Continuity: Proactive measures to manage climate risks are essential for maintaining business continuity and customer service levels.

- Sustainability Reporting: Growing investor and regulatory focus on climate resilience means transparent reporting on adaptation strategies is becoming increasingly important.

Headlam Group is actively reducing its environmental impact, focusing on lowering greenhouse gas emissions and exploring electric vehicles for its fleet. The market is increasingly demanding sustainable flooring, with consumers favoring recycled and low-VOC materials, a trend projected to drive significant growth in the green building materials sector, expected to exceed $400 billion by 2028.

The company is also enhancing waste management through circular economy initiatives and successful take-back trials, aiming for expansion in 2025. However, reliance on materials like PVC exposes Headlam to price volatility, prompting a focus on sustainable sourcing and recycled content, with progress noted in 2023.

Climate change presents risks to Headlam's supply chain and operations through extreme weather events, as seen with the UK's warmest year on record in 2022, necessitating investments in resilient infrastructure and robust contingency planning for business continuity.

| Environmental Factor | Headlam's Response/Impact | Data/Trend |

|---|---|---|

| Carbon Emissions | Focus on reducing Scope 1 & 2 GHG emissions; planning Scope 3 targets. Exploration of low-emission HGVs. | UK average temperature in 2022 was 10.03°C, the warmest on record, highlighting climate change impacts. |

| Sustainable Products | Meeting consumer demand for eco-friendly flooring (recycled, low-VOC). | Global green building materials market valued at ~$250 billion in 2023, projected to reach over $400 billion by 2028. |

| Waste Management | Circular economy partnerships; waste reduction through take-back trials (Northampton pilot expanding in 2025). | |

| Raw Material Sourcing | Addressing resource scarcity and price volatility (e.g., PVC price increases in early 2024). Increasing use of recycled content. | Global PVC market experienced price increases in early 2024. |

| Climate Change Resilience | Mitigating risks from extreme weather events impacting supply chain and operations. |

PESTLE Analysis Data Sources

Our Headlam Group PESTLE Analysis is built on a comprehensive foundation of data from official government publications, reputable market research firms, and leading industry associations. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in current, fact-based information.