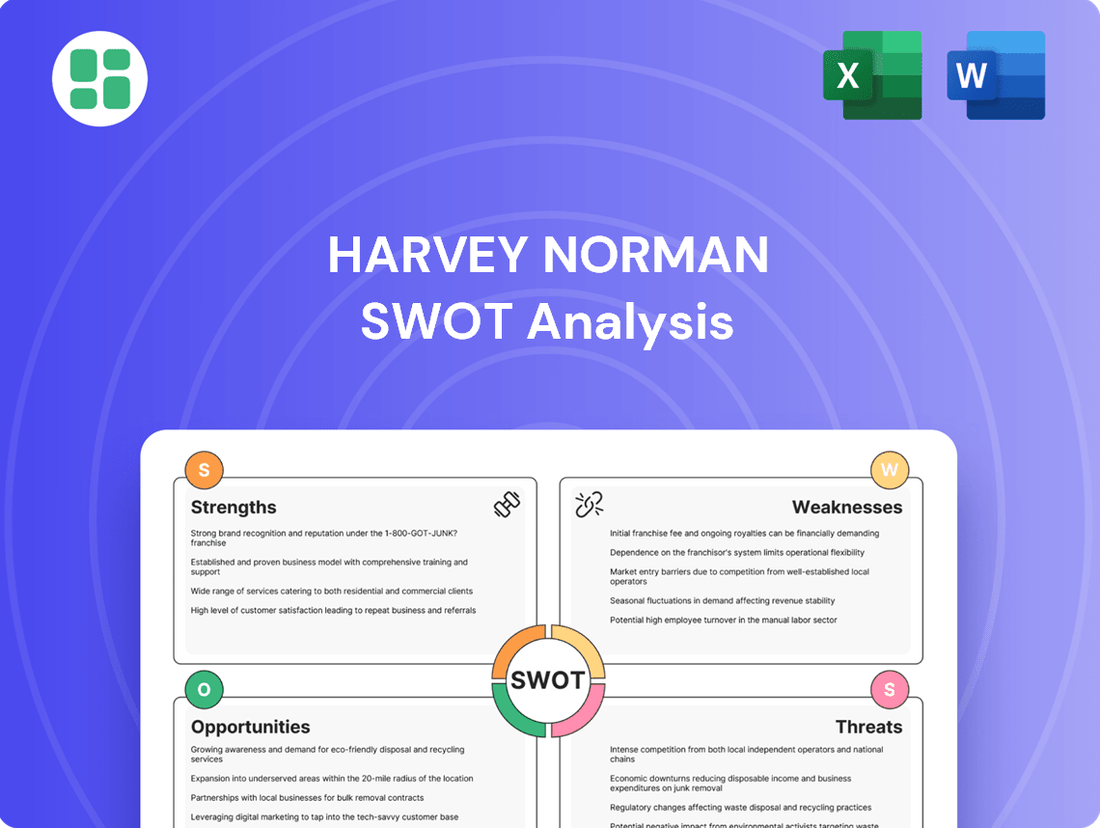

Harvey Norman SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harvey Norman Bundle

Harvey Norman leverages its strong brand recognition and extensive store network as key strengths, but faces challenges from increasing online competition and evolving consumer preferences. Understanding these dynamics is crucial for anyone looking to navigate the retail landscape.

Want the full story behind Harvey Norman's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Harvey Norman boasts extensive brand recognition, particularly in Australia, where it's a leading retailer for a broad range of products including electronics, furniture, and home appliances. This strong household name status translates into significant customer trust and loyalty, a crucial asset in the competitive retail landscape.

The company's market presence is further amplified by its operations across multiple international markets, including New Zealand, Singapore, Malaysia, Ireland, and Northern Ireland. This global footprint, built over years of consistent operation and marketing, provides a diversified revenue stream and mitigates risks associated with reliance on a single market.

Harvey Norman's strength lies in its exceptionally diversified product portfolio, spanning furniture, bedding, technology, and home appliances. This wide selection allows them to meet a broad spectrum of customer needs, from furnishing a home to equipping it with the latest electronics. In the fiscal year 2023, their diverse offerings contributed to a robust total revenue of AUD 8.65 billion, demonstrating their ability to capture market share across multiple retail categories.

Harvey Norman's franchise model is a significant strength, enabling local store owners to manage operations with entrepreneurial spirit. This decentralization can reduce the parent company's direct operational risk while fostering strong community ties.

The franchisor benefits from centralized branding, marketing, and supply chain efficiencies, creating a powerful synergy. For instance, in FY23, Harvey Norman Holdings reported a robust revenue of AUD 2.36 billion, showcasing the model's ability to drive consistent financial performance across its network.

Strong Property Portfolio and Financial Position

Harvey Norman's robust property portfolio, valued at approximately $8 billion as of FY24, offers significant asset backing and a consistent rental income stream, buffering against retail market volatility. This strong asset base underpins the company's financial stability.

The company's financial health is further reinforced by healthy operating cash flows and a conservative balance sheet. This is evidenced by a consistently low net debt to equity ratio, indicating prudent financial management and a strong capacity to weather economic downturns.

- Significant Property Assets: Nearly $8 billion in property holdings as of FY24.

- Stable Rental Income: Property portfolio provides a reliable revenue source.

- Strong Cash Flows: Demonstrates healthy operating cash flow generation.

- Low Leverage: Maintains a low net debt to equity ratio, indicating financial resilience.

Omni-Channel Strategy and Digital Investment

Harvey Norman’s commitment to an omni-channel strategy is a significant strength, blending its extensive network of physical stores with a robust online presence. This integration creates a cohesive customer journey, allowing shoppers to browse online and pick up in-store, or vice versa, enhancing convenience and accessibility. For instance, during the first half of FY24, the company reported a strong performance, with its Australian retail sales up 4.5%, indicating the effectiveness of its integrated approach in driving customer engagement and sales across different touchpoints.

The company is strategically investing in digital transformation and adopting new technologies to bolster its competitive edge. This includes leveraging data analytics and exploring AI applications to personalize customer experiences and optimize operations. These digital investments are crucial for future growth, as online retail continues to expand its market share, with e-commerce sales in Australia projected to reach over AUD 100 billion by 2025, according to industry reports.

Key aspects of their digital and omni-channel strengths include:

- Seamless Integration: Physical stores and online platforms work in tandem for a unified customer experience.

- Digital Investment: Ongoing allocation of resources to enhance online capabilities and adopt new technologies.

- Customer Convenience: Offering flexible shopping options like click-and-collect and in-store returns for online purchases.

- Data Utilization: Employing data analytics to understand customer behavior and tailor offerings, driving sales growth.

Harvey Norman's extensive brand recognition, particularly in Australia, is a core strength, fostering customer trust and loyalty across its diverse product categories. This strong market presence is further bolstered by its international operations in countries like New Zealand and Singapore, diversifying revenue and mitigating single-market risks.

The company's diversified product portfolio, encompassing furniture, technology, and appliances, allows it to cater to a wide range of consumer needs. This breadth of offerings contributed to a substantial total revenue of AUD 8.65 billion in FY23. Furthermore, its successful franchise model, with strong central support for branding and supply chains, underpins consistent financial performance, as seen in FY23's AUD 2.36 billion revenue for Harvey Norman Holdings.

Harvey Norman benefits from a significant property portfolio, valued at approximately $8 billion as of FY24, providing asset backing and stable rental income. This, combined with strong operating cash flows and a conservative balance sheet, indicated by a low net debt to equity ratio, highlights the company's financial resilience.

Their commitment to an omni-channel strategy, seamlessly integrating physical stores with a growing online presence, enhances customer convenience and engagement. This approach contributed to a 4.5% rise in Australian retail sales in the first half of FY24, demonstrating its effectiveness in capturing market share across various shopping channels.

What is included in the product

Analyzes Harvey Norman’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing Harvey Norman's core challenges and opportunities.

Weaknesses

The franchise model, while enabling rapid expansion, presents a significant challenge in maintaining consistent customer experiences and service quality across all Harvey Norman outlets. This can dilute brand standards as each franchisee operates with a degree of autonomy. For instance, a 2024 industry report highlighted that up to 15% of customer complaints in retail franchise networks stem from variations in staff training and adherence to corporate guidelines, a risk Harvey Norman must actively mitigate.

Harvey Norman's reliance on big-ticket items like furniture and electronics makes it particularly sensitive to shifts in consumer confidence and discretionary spending. During periods of economic uncertainty, such as the elevated inflation experienced in 2023 and continuing into 2024, consumers tend to postpone or reduce purchases of non-essential, higher-value goods. This directly impacts Harvey Norman's revenue streams, as these big-ticket purchases are often the first to be cut back when household budgets tighten.

Harvey Norman operates in a highly competitive retail environment, facing strong pressure from both established brick-and-mortar rivals and increasingly dominant online and discount retailers. This includes global e-commerce giants that can offer competitive pricing and convenience, directly impacting Harvey Norman's market share and profitability.

The ease with which consumers can compare prices online, especially for standardized goods, creates significant margin pressure for Harvey Norman. This price sensitivity, particularly in categories like electronics and appliances, necessitates careful inventory management and strategic pricing to remain competitive without eroding profits.

Reliance on Australian Market for Revenue

Harvey Norman's significant reliance on the Australian market for its revenue remains a key weakness. Despite efforts to expand internationally, a substantial portion of its income is still generated domestically. For instance, in the fiscal year 2023, Australia accounted for the vast majority of the company's sales, highlighting a persistent geographical concentration.

This dependence makes Harvey Norman particularly vulnerable to Australian-specific economic downturns and shifts in local consumer sentiment. Changes in interest rates, inflation, or employment within Australia can disproportionately impact the company's financial performance compared to more geographically diversified retailers.

- Revenue Concentration: Over 80% of Harvey Norman's revenue in FY23 was derived from its Australian operations.

- Economic Sensitivity: The company is highly susceptible to fluctuations in the Australian economy, including consumer confidence and disposable income.

- Limited Geographic Diversification: Despite international stores, the core revenue stream remains heavily anchored to a single market.

Challenges in Overseas Market Profitability

Harvey Norman has faced difficulties achieving consistent profitability in several international markets, including New Zealand, various Asian countries, and parts of Europe. These struggles are largely attributed to challenging macroeconomic conditions, persistent inflation, and ongoing geopolitical instability. For instance, the company has noted ramp-up losses in newer ventures like its UK operations, which can negatively impact the group's overall financial performance.

The impact of these international market challenges is significant, potentially diluting the profitability derived from more successful regions.

- International Profitability Struggles: Harvey Norman has encountered profitability issues in markets like New Zealand, Asia, and Europe.

- Contributing Factors: Macroeconomic headwinds, inflation, and geopolitical tensions are key reasons for these difficulties.

- Impact on Group Performance: These international challenges can dilute overall group profitability and lead to initial losses in new markets such as the UK.

Harvey Norman's reliance on big-ticket items makes it vulnerable to economic downturns, as seen with inflation in 2023-2024 impacting discretionary spending. The company faces intense competition from online and discount retailers, putting pressure on its margins, especially for easily comparable products like electronics. Furthermore, its significant dependence on the Australian market, which accounted for over 80% of revenue in FY23, exposes it to localized economic shocks.

| Weakness | Description | Impact/Example |

|---|---|---|

| Economic Sensitivity | High dependence on consumer confidence and discretionary spending for big-ticket items. | Inflation in 2023-2024 led to reduced spending on furniture and electronics. |

| Intense Competition | Facing pressure from online, discount, and established brick-and-mortar retailers. | Global e-commerce giants offer competitive pricing and convenience. |

| Revenue Concentration | Over 80% of FY23 revenue generated from Australian operations. | Vulnerable to Australian economic downturns and shifts in local consumer sentiment. |

| International Profitability | Struggles in markets like New Zealand, Asia, and Europe due to macroeconomic headwinds. | Ramp-up losses in new ventures like the UK can dilute overall group profitability. |

Preview Before You Purchase

Harvey Norman SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Harvey Norman's commitment to expanding its e-commerce and omni-channel capabilities represents a prime opportunity. By further investing in and refining its online platforms, the company can access a wider customer demographic and capitalize on the ongoing surge in online retail. This strategic focus is crucial for capturing market share in the digital age.

The integration of new technologies, such as augmented reality for virtual product try-ons, can significantly enhance the digital shopping experience. This innovation not only boosts customer engagement but also provides a seamless transition between online browsing and in-store purchasing, a key element of successful omni-channel strategies. For instance, in the fiscal year 2023, Harvey Norman reported a 7.1% increase in online sales, highlighting the growing importance of their digital channels.

Harvey Norman is actively pursuing international market expansion, with a clear focus on key regions such as the UK, Malaysia, and New Zealand. This strategy involves opening new stores and developing prominent flagship locations, signaling a commitment to increasing its global footprint.

This global growth initiative is designed to diversify Harvey Norman's revenue streams, reducing reliance on any single market. By tapping into new geographical areas, the company aims to capture untapped market potential and enhance its overall financial resilience.

The increasing consumer interest in AI-powered devices, such as advanced PCs and smart home systems, offers a significant avenue for Harvey Norman. By expanding its presence in these cutting-edge technology segments, the company can capitalize on market trends and boost its sales performance.

Harvey Norman's strategic investment in AI-driven products, including smart appliances and connected home solutions, is poised to meet growing consumer demand. For instance, the global AI in consumer electronics market was projected to reach over $30 billion in 2024, indicating a substantial growth opportunity.

Strategic Partnerships and Diversification of Services

Harvey Norman can unlock significant growth by forging strategic alliances with technology firms and companies offering complementary services. For instance, partnering with marketing platforms could boost customer reach and engagement, while collaborations with smart home solution providers can tap into the growing demand for integrated living spaces. In the fiscal year 2023, the retail sector saw a notable increase in technology adoption, with companies actively seeking partnerships to enhance their digital offerings.

Diversifying its service portfolio presents another avenue for expansion. By offering services such as professional home installation for appliances and electronics, or developing more attractive financing packages, Harvey Norman can create additional revenue streams and deepen customer loyalty. The Australian home improvement market, valued at over AUD 120 billion in 2024, indicates a strong consumer appetite for related services beyond product purchase.

- Explore partnerships with leading smart home technology providers to integrate IoT solutions into their product offerings.

- Develop enhanced in-house or third-party installation and maintenance services for a wider range of products.

- Expand financing options, including longer-term payment plans and specialized credit for home improvement projects.

- Investigate collaborations with interior design platforms to offer bundled product and design consultation services.

Capitalizing on Economic Recovery and Consumer Spending

With potential economic recovery on the horizon, including easing inflation and expected interest rate reductions in 2024 and 2025, consumer discretionary spending is poised for a rebound. This presents a significant opportunity for Harvey Norman as consumers are likely to increase purchases of larger, more expensive items like appliances and furniture, directly benefiting the company's core offerings.

Specifically, improved economic sentiment and increased disposable income could translate into higher sales volumes. For instance, if inflation moderates to around 3-4% in Australia by late 2024, as some forecasts suggest, and interest rates see a gradual decrease of 0.50% to 0.75% by mid-2025, this would significantly boost consumer confidence and spending power.

- Increased Demand for Big-Ticket Items: A recovering economy typically sees a rise in demand for durable goods, Harvey Norman's primary product categories.

- Improved Sales Performance: Lower interest rates can make financing larger purchases more accessible, driving sales.

- Enhanced Consumer Confidence: Positive economic indicators often lead to greater consumer willingness to spend on non-essential goods.

- Potential for Market Share Growth: By effectively leveraging this recovery, Harvey Norman can capture a larger share of the revitalized market.

The company's ongoing investment in e-commerce and omni-channel strategies presents a significant opportunity to reach a broader customer base and capitalize on the sustained growth in online retail. By enhancing its digital platforms, Harvey Norman can improve customer engagement through innovative features like augmented reality, as evidenced by their 7.1% online sales increase in FY23. Furthermore, international expansion into markets like the UK, Malaysia, and New Zealand diversifies revenue and taps into new growth potential.

The increasing consumer interest in AI-powered devices, such as smart home systems and advanced PCs, offers a substantial avenue for growth. Harvey Norman's strategic focus on these cutting-edge technology segments, with the global AI in consumer electronics market projected to exceed $30 billion in 2024, positions them to meet rising demand. Strategic partnerships with technology firms and service providers can further amplify customer reach and integrate IoT solutions, capitalizing on the retail sector's trend towards digital enhancement.

Diversifying its service portfolio, including professional installation and attractive financing packages, can create new revenue streams and foster customer loyalty. The Australian home improvement market, valued at over AUD 120 billion in 2024, demonstrates a strong consumer appetite for such services. A potential economic recovery, marked by easing inflation and anticipated interest rate reductions in 2024-2025, is expected to boost consumer discretionary spending, particularly on big-ticket items like appliances and furniture, directly benefiting Harvey Norman's core business.

Threats

Ongoing macroeconomic headwinds, including high inflation and rising cost-of-living pressures, directly reduce consumer discretionary spending, particularly on big-ticket items like furniture and electronics. This trend is a significant threat to Harvey Norman, impacting sales volumes and overall profitability as consumers prioritize essential goods.

For instance, in Australia, inflation continued to be a concern throughout 2024, although showing signs of easing. This persistent pressure on household budgets means consumers are more cautious with their spending, directly affecting Harvey Norman's revenue streams for non-essential purchases.

The retail sector is intensely competitive, with traditional rivals like JB Hi-Fi and agile online-only stores constantly challenging market positions. Harvey Norman faces the ongoing challenge of differentiating its offerings to retain customers against competitors who often leverage lower overheads for aggressive pricing or focus on niche, specialized product ranges and services.

In 2024, the Australian retail market saw continued growth in online sales, with reports indicating e-commerce penetration reaching over 20% of total retail spend, a trend that directly impacts brick-and-mortar operations. Harvey Norman's strategy must therefore focus on enhancing its omnichannel experience and value proposition to counter the price and convenience advantages offered by pure-play online competitors.

Global supply chain issues, including labor shortages and freight bottlenecks, continue to threaten Harvey Norman's operations, impacting product availability and increasing operational costs. Geopolitical events further exacerbate these challenges, potentially causing significant delays. For instance, in 2024, shipping costs saw a notable increase, with the average cost of shipping a 40-foot container from Asia to Europe rising by over 150% compared to pre-pandemic levels, directly affecting retailers like Harvey Norman.

These persistent disruptions can strain inventory management, leading to stockouts of popular items and affecting customer satisfaction. The inability to secure consistent product flow can directly translate to lost sales opportunities and damage brand reputation in a competitive retail landscape.

Rapid Technological Obsolescence

The rapid pace of technological advancement, especially in consumer electronics, presents a significant threat. Products like smartphones and laptops can become outdated very quickly, demanding constant updates to inventory. This necessitates substantial ongoing investment in new product lines and careful management of older stock to mitigate potential losses and protect profit margins.

Harvey Norman faces the challenge of rapidly evolving technology, particularly in its core consumer electronics segment. For instance, the average product lifecycle for many tech gadgets has shortened considerably. This means that the company must be agile in its inventory management, as failing to turn over older stock can lead to significant write-downs. In 2024, the consumer electronics market saw continued rapid innovation, with new models of smartphones, televisions, and computing devices released throughout the year, putting pressure on retailers to keep pace.

This constant need to refresh product offerings exposes Harvey Norman to inventory risk. If new technologies are adopted faster than anticipated, or if previous models don't sell through as planned, the company could be left with depreciating assets. Effectively managing this requires sophisticated forecasting and a nimble supply chain to avoid being caught with obsolete inventory that needs to be sold at a discount, thereby impacting overall profitability.

- Shortened Product Lifecycles: Consumer electronics, a key Harvey Norman category, experience rapid obsolescence.

- Inventory Risk: Holding outdated technology can lead to significant financial losses through markdowns.

- Continuous Investment: The need to constantly update inventory requires substantial capital outlay.

- Margin Pressure: Unsold older stock can erode profit margins as newer models enter the market.

Shifting Consumer Preferences and Retail Models

Harvey Norman faces a significant threat from evolving consumer preferences, particularly the accelerating shift towards online shopping. This trend challenges its historically strong reliance on large-format physical stores. In 2024, online retail sales in Australia were projected to continue their strong growth trajectory, impacting traditional brick-and-mortar players.

The preference for smaller, more frequent transactions over traditional large purchases also poses a challenge. This could reduce the appeal of Harvey Norman's large showrooms if not complemented by agile, digitally-driven purchasing options. Adapting to these changing shopping habits is crucial for maintaining market relevance.

- Evolving Consumer Preferences: A growing segment of consumers now prioritizes convenience and digital engagement, favoring online channels for research and purchase.

- Retail Model Adaptation: Harvey Norman must continue to invest in and refine its omnichannel strategy, ensuring a seamless experience between online and physical stores.

- Transaction Size Shift: The move towards smaller, more frequent purchases may require adjustments in product offerings and marketing strategies to align with current consumer behavior.

- Digital Competition: Increased competition from pure-play online retailers and marketplaces necessitates a robust digital presence and competitive pricing strategies.

The increasing cost of living and persistent inflation throughout 2024 continued to squeeze household budgets, directly impacting discretionary spending on Harvey Norman's core product categories like furniture and electronics. This economic pressure forces consumers to prioritize essential goods, leading to reduced sales volumes and potentially lower profit margins for the company.

Intensifying competition from both established retailers and agile online-only players presents a significant threat. In 2024, online retail penetration in Australia was reported to exceed 20%, highlighting the challenge Harvey Norman faces in differentiating its value proposition against competitors who often leverage lower overheads for aggressive pricing or specialized offerings.

Ongoing global supply chain disruptions, including freight cost increases and labor shortages, continued to affect product availability and operational expenses in 2024. For instance, shipping costs from Asia to Europe saw substantial rises, directly impacting retailers like Harvey Norman and potentially leading to stockouts and customer dissatisfaction.

The rapid pace of technological advancement, particularly in consumer electronics, poses a threat due to shortened product lifecycles. This necessitates continuous investment in new inventory and careful management of older stock to avoid financial losses from obsolescence, a challenge amplified by new model releases throughout 2024.

SWOT Analysis Data Sources

This analysis draws from a robust combination of Harvey Norman's official financial reports, comprehensive market research data, and expert commentary from industry analysts to provide a well-rounded strategic overview.