Harvey Norman Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harvey Norman Bundle

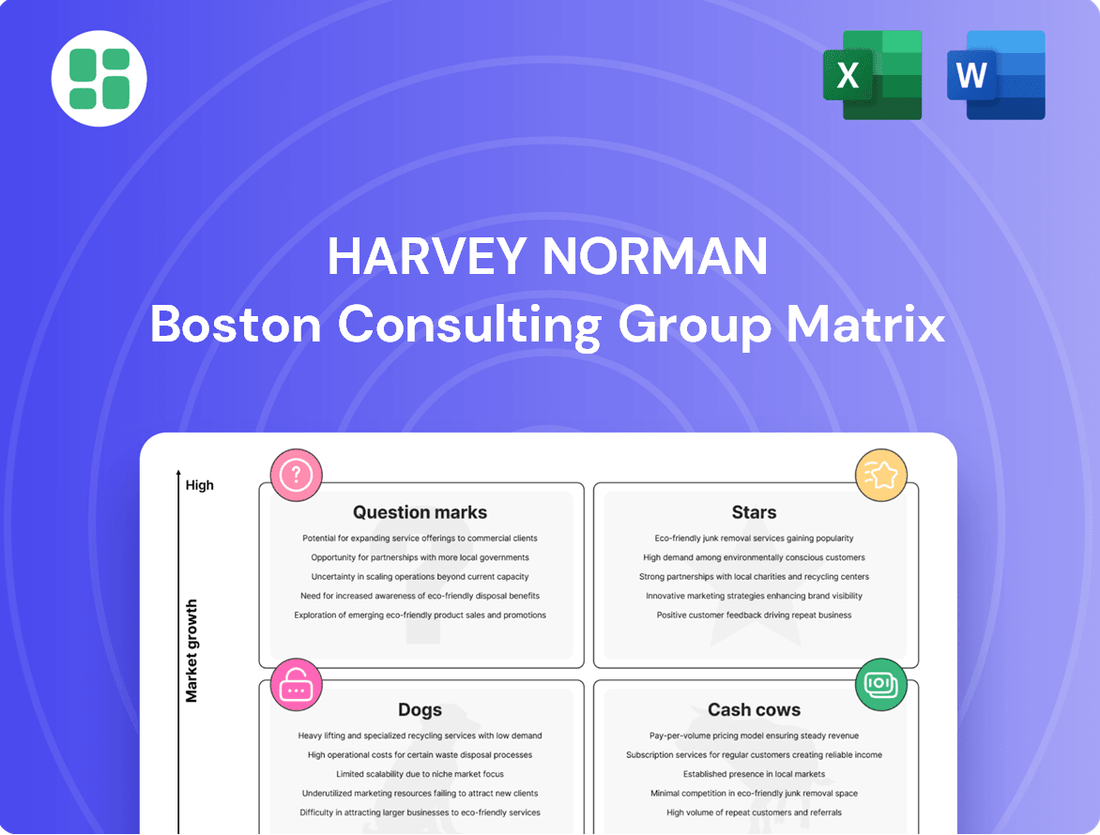

Curious about Harvey Norman's product portfolio performance? Our BCG Matrix preview highlights key categories, but to truly understand their strategic positioning—identifying Stars, Cash Cows, Dogs, and Question Marks—you need the full picture. Unlock actionable insights and a clear roadmap for investment decisions by purchasing the complete BCG Matrix.

Stars

Harvey Norman is strategically positioning itself in the burgeoning AI-PC and device market, anticipating these products will be a significant catalyst for sales expansion through 2025 and into the future. This segment is experiencing rapid growth, and Harvey Norman's proactive investments and commitment to cutting-edge technology are enabling it to capture a substantial portion of this expanding market. For instance, the global AI PC market is projected to reach $100 billion by 2027, with significant growth expected in 2024 and 2025 as more devices incorporate advanced AI capabilities.

Harvey Norman's Premium Gaming PCs & Peripherals are a clear Star in their BCG Matrix. The global gaming market was valued at approximately USD 200 billion in 2023 and is projected to grow substantially, with the PC gaming segment showing robust expansion. Harvey Norman's strong market share in this high-demand, high-margin category, driven by dedicated gamers investing in top-tier equipment, ensures consistent revenue generation and brand visibility.

Harvey Norman's online sales channel has experienced robust growth, especially since the pandemic, reflecting a fundamental shift in consumer behavior towards digital purchasing. This surge has positioned the e-commerce platform as a key revenue driver for the company.

Significant investments in enhancing its digital infrastructure and supply chain capabilities have enabled Harvey Norman to capture a substantial market share within its online retail segments. This strategic focus on online presence has been crucial for maintaining competitiveness.

The company's online channel continues its upward trajectory, necessitating sustained capital allocation towards technological advancements and efficient fulfillment operations. This ongoing investment is vital for preserving its competitive advantage and continuing its strong sales performance in the digital marketplace.

High-End 4K/8K Televisions

High-end 4K/8K televisions represent a significant growth area within the broader, more mature television market. Consumers are increasingly seeking enhanced viewing experiences, driving demand for these premium products. In 2024, the global market for 8K TVs, while still nascent, is projected to see substantial year-over-year growth, with sales expected to reach millions of units, indicating a clear upward trend.

Harvey Norman holds a strong position in this high-value segment. Their strategy of showcasing these advanced televisions in physical showrooms, coupled with strong relationships with leading electronics brands, allows them to effectively reach and engage customers looking for the latest in home entertainment technology. This focus on a premium customer experience is crucial for selling these high-ticket items.

- Market Growth: The 4K TV segment continues to expand, with 8K technology emerging as a key driver of future growth, attracting consumers willing to invest in superior picture quality.

- Harvey Norman's Position: The retailer benefits from a high market share in this premium category, attributed to its effective showroom strategy and strategic brand partnerships.

- Financial Impact: These televisions, being high-value products, contribute significantly to revenue and attract a discerning customer base, justifying the investment in marketing and sales efforts.

- Category Status: Classified as a Star in the BCG Matrix, these products require ongoing investment (cash consumption) for marketing and promotion but are expected to yield substantial future returns due to their high growth and market share.

Strategic Global Store Expansion (e.g., UK & Croatia)

Harvey Norman's strategic global store expansion, including new ventures in the UK and continued growth in Croatia, positions these markets as Stars within the BCG Matrix. These initiatives, with new flagship stores opening in 2024 and 2025, target high-growth potential markets. While initial investment is substantial, these expansions are vital for long-term market share capture and future profitability.

- UK Expansion: Harvey Norman's entry into the UK market in 2024 signifies a significant investment in a developed, albeit competitive, retail landscape.

- Croatia Growth: Continued investment and store openings in Croatia reflect a strategy to solidify and expand market presence in a growing European economy.

- Market Share Capture: These new territories are viewed as key opportunities to gain substantial market share, driving future revenue growth.

- Investment for Future: The substantial upfront costs associated with these expansions are justified by their potential to become significant profit centers as market penetration increases.

Harvey Norman's AI-PC and device offerings are positioned as Stars, reflecting the rapid growth of this technology sector. The global AI PC market is projected to reach $100 billion by 2027, with significant expansion anticipated in 2024 and 2025 as AI integration becomes more widespread. Harvey Norman's investment in these cutting-edge products allows them to capture a substantial share of this expanding market.

Premium Gaming PCs and peripherals are another Star category for Harvey Norman. The global gaming market, valued at approximately USD 200 billion in 2023, continues its robust expansion, particularly within the PC gaming segment. Harvey Norman's strong market share in this high-demand, high-margin area, driven by dedicated gamers, ensures consistent revenue and brand visibility.

High-end 4K/8K televisions also fall into the Star category. The market for these premium televisions is experiencing significant growth, with consumers actively seeking enhanced viewing experiences. While the 8K TV market is still developing, sales are expected to reach millions of units in 2024, indicating a strong upward trend. Harvey Norman's showrooms and brand partnerships effectively cater to this demand for superior home entertainment technology.

Harvey Norman's strategic global store expansion, particularly its entry into the UK in 2024 and continued growth in Croatia, also represents Star investments. These new ventures target high-growth markets, with new flagship stores opening in 2024 and 2025. Despite substantial initial investment, these expansions are crucial for capturing long-term market share and future profitability.

What is included in the product

This BCG Matrix overview details Harvey Norman's product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

It provides strategic recommendations for investment, holding, or divestment based on market growth and share.

A clear BCG Matrix visualizes Harvey Norman's portfolio, identifying Stars and Cash Cows to strategically allocate resources and alleviate financial strain.

Cash Cows

Traditional white goods, such as refrigerators and washing machines, are Harvey Norman's cash cows. These are essential items with steady demand, making them reliable revenue generators. In 2024, Harvey Norman continued to leverage its strong brand recognition and wide store presence to maintain a significant market share in this mature segment.

The consistent sales of these appliances provide a stable and substantial cash flow for the company. This financial stability allows Harvey Norman to allocate resources to other areas of its business, like investing in growth opportunities or managing operational costs effectively, without requiring significant marketing or innovation expenditure.

Standard Furniture & Bedding, encompassing brands like Domayne and Joyce Mayne, represents a classic Cash Cow for Harvey Norman. This sector benefits from a mature market with predictable replacement cycles, ensuring a steady demand.

Harvey Norman holds a substantial market share in furniture and bedding, leveraging its established brands and extensive retail footprint. This strong market position translates into consistent and significant cash flow, supported by efficient supply chains and a loyal customer base.

In 2024, the Australian furniture and bedding market continued its stable performance, with household spending on furnishings showing resilience. Harvey Norman's furniture division consistently contributes a significant portion of the company's overall revenue, underscoring its role as a reliable cash generator that requires minimal reinvestment for growth.

Core laptop and desktop computers, while not cutting-edge AI devices, represent a high-volume, mature segment in the computing market. Harvey Norman holds a significant market share here, serving a wide range of everyday consumer and business needs.

These foundational computing products are reliable cash cows for Harvey Norman. They consistently generate substantial cash flow with relatively low investment needs, primarily focused on inventory management and maintaining competitive pricing to ensure steady income.

Established Franchise Operations in Australia

Harvey Norman's established franchise operations in Australia represent a classic Cash Cow within its business portfolio. This segment is the bedrock of the company's financial strength, consistently delivering substantial aggregated sales revenue and profit from its franchising activities.

While the Australian retail market, and by extension its franchise network, is mature and not characterized by explosive growth, it offers a dependable source of significant cash flow. This reliability is crucial for funding other ventures and supporting the overall business structure.

The inherent efficiency of the franchising model means that once the initial investment is made to establish these operations, Harvey Norman can continue to generate sustained profitability with relatively lower ongoing direct investment. This operational leverage is a key driver of its Cash Cow status.

- 2024 Financial Performance: Harvey Norman's Australian franchise segment reported total sales of $7.03 billion in FY2024, contributing significantly to the group's overall revenue.

- Profitability: The franchising operations profit for the Australian segment stood at $393.9 million in FY2024, highlighting its consistent cash generation capabilities.

- Market Maturity: The Australian retail market, while competitive, provides a stable environment for these established franchises to operate and generate consistent returns.

- Strategic Importance: These Cash Cows provide the financial stability and capital necessary for Harvey Norman to invest in growth areas and navigate market fluctuations.

Freehold Property Portfolio

Harvey Norman's freehold property portfolio, valued at over $4 billion as of their 2024 financial reporting, functions as a significant cash cow. This mature, low-growth asset generates consistent rental income, contributing substantial and stable cash flow to the company's operations. The portfolio's consistent appreciation in value also bolsters the company's underlying asset base, providing a strong financial foundation.

This segment offers considerable financial flexibility and underpins a robust balance sheet for Harvey Norman. The stable income stream from these properties allows for reinvestment in other business areas or provides a buffer during economic downturns. It's a key element in maintaining the company's financial health and strategic options.

- Property Valuation: Exceeds $4 billion (2024).

- Income Generation: Stable rental revenues provide consistent cash flow.

- Asset Strength: Appreciating value enhances the company's balance sheet.

- Financial Flexibility: Supports strategic decision-making and stability.

Harvey Norman's established franchise operations in Australia are a prime example of a Cash Cow. This segment is the financial backbone, consistently delivering substantial sales revenue and profit from franchising activities. While the Australian retail market is mature, these franchises offer a dependable source of significant cash flow, crucial for funding other ventures and supporting the overall business.

The efficiency of the franchising model allows Harvey Norman to generate sustained profitability with relatively lower ongoing direct investment. This operational leverage is a key driver of its Cash Cow status, providing financial stability and capital for growth areas.

In 2024, Harvey Norman's Australian franchise segment reported total sales of $7.03 billion, with a profit of $393.9 million. These figures underscore the segment's consistent cash generation capabilities in a stable, albeit competitive, market.

| Segment | FY2024 Sales (AUD) | FY2024 Profit (AUD) | Market Maturity | Cash Flow Contribution |

| Australian Franchises | $7.03 billion | $393.9 million | Mature | High & Stable |

What You’re Viewing Is Included

Harvey Norman BCG Matrix

The Harvey Norman BCG Matrix preview you're seeing is the identical, fully finalized document you will receive immediately after your purchase. This means you get a complete, professionally formatted analysis ready for strategic decision-making, with no watermarks or demo content. It’s the exact report designed to provide clear insights into Harvey Norman's product portfolio, enabling you to leverage its strategic value without any further editing or revisions needed.

Dogs

Legacy home theatre components, such as standalone DVD and Blu-ray players, are firmly in the Dogs category of the BCG Matrix. The market for these physical media players has experienced a dramatic downturn, largely driven by the widespread adoption of streaming platforms and digital content delivery. For instance, global sales of Blu-ray players saw a substantial decrease in recent years, reflecting this shift in consumer preference.

Harvey Norman, like many retailers, likely holds a minimal market share in this declining segment, with sales figures consistently trending downwards. These products represent an inefficient use of valuable retail space and tie up capital that could be better allocated to more profitable or growing product lines. The minimal profit generated further solidifies their position as candidates for strategic divestment or a significant reduction in inventory.

The market for basic DSLR and compact digital cameras has been significantly impacted by the rise of sophisticated smartphone cameras. In 2024, it's estimated that over 1.5 billion smartphones were sold globally, many featuring advanced photographic capabilities that meet the needs of the average consumer.

Harvey Norman's sales of these older camera types are likely very low, indicating a small slice of a shrinking pie. This means they represent a low market share within a declining industry segment.

These products contribute minimal revenue while still incurring costs for holding inventory. Therefore, it makes strategic sense for Harvey Norman to reduce their focus on these items, allowing resources to be redirected towards more promising product categories.

Corded telephones and answering machines are firmly in the 'dog' quadrant of the BCG matrix for Harvey Norman. The market for these products has shrunk dramatically, with mobile phones and internet-based calling services dominating consumer communication. Sales in this category for Harvey Norman are minimal, reflecting a tiny market share in a declining sector.

Given the near-complete obsolescence of corded phones and standalone answering machines, Harvey Norman's strategic focus should be on phasing out these products. Continued investment in this area yields no significant returns and detracts from resources that could be allocated to more promising product lines.

Underperforming International Company-Operated Stores

Harvey Norman's international company-operated stores, particularly those in New Zealand and parts of Europe, represent a segment that could be classified as Dogs in the BCG Matrix. These operations are often characterized by low market share in mature or declining markets experiencing significant macroeconomic challenges.

For instance, while Harvey Norman's overall revenue for the fiscal year 2023 reached AUD 10.3 billion, specific international segments have faced profitability pressures. In New Zealand, the retail environment has been impacted by inflation and reduced consumer spending, leading to a slowdown in sales growth for some of their outlets.

- Declining Profitability: Some overseas company-operated stores, especially in markets like New Zealand and Europe, have experienced a downturn in profits due to economic headwinds.

- Low Market Share: These underperforming units often hold a small share of their respective challenging markets.

- Cash Consumption: They may consume valuable company resources without generating substantial returns, impacting overall cash flow.

- Strategic Review: Management is likely evaluating these segments for potential restructuring, cost-cutting measures, or even divestiture to reallocate capital to more promising growth areas.

Niche or Unpopular Furniture Styles

Niche or unpopular furniture styles, like Victorian revival or extremely ornate baroque pieces, often fall into the Dogs category of the BCG Matrix. These styles cater to a very small, specific customer base, leading to minimal sales volume. For instance, a 2024 retail analysis might show that these specific styles represent less than 0.5% of total furniture sales for a large retailer, despite occupying significant display space.

These items tie up capital in inventory and showroom space that could be used for more popular, higher-turnover products. Their low market share in a stagnant or declining market segment means they are unlikely to generate substantial future growth. A furniture store might find that a particular niche style hasn't sold a single unit in over six months, even with promotional pricing.

- Low Sales Volume: Niche styles like Art Nouveau or specific mid-century modern sub-genres often see very few transactions annually.

- High Inventory Costs: Holding stock of unpopular items incurs storage and potential depreciation costs without commensurate revenue.

- Poor ROI: The capital invested in these furniture lines yields negligible returns, dragging down overall profitability.

- Opportunity Cost: The showroom floor space occupied by these items could be utilized for best-selling or emerging trends, increasing overall sales potential.

Products classified as Dogs in the BCG Matrix, like outdated electronics or niche furniture, represent a significant challenge for retailers such as Harvey Norman. These items typically have low market share in declining industries, leading to minimal sales and profitability.

The strategic implication for Harvey Norman is to minimize investment in these categories, focusing instead on products with higher growth potential. This often involves reducing inventory, discontinuing lines, or exploring divestment opportunities to free up capital and retail space.

For example, the decline in physical media sales means DVD players are Dogs. In 2024, streaming services dominate, making dedicated players a relic. Harvey Norman’s sales of these are likely minimal, consuming resources without significant return.

Similarly, niche furniture styles occupy valuable showroom space with little customer demand. A 2024 market analysis might show these specific styles account for less than 0.5% of total furniture sales, highlighting their Dog status.

| Product Category | BCG Classification | Market Trend | Harvey Norman's Position | Strategic Recommendation |

| DVD/Blu-ray Players | Dog | Declining | Low market share, minimal sales | Reduce inventory, consider discontinuation |

| Basic Digital Cameras | Dog | Declining | Low sales volume in a shrinking market | Phase out, focus on higher-end or mirrorless |

| Corded Telephones | Dog | Rapidly Declining | Negligible sales, largely obsolete | Cease stocking, minimal inventory management |

| Niche Furniture Styles | Dog | Stagnant/Declining | Very low sales volume, high inventory cost | Reduce display space, clear existing stock |

Question Marks

Virtual Reality and Augmented Reality headsets represent a potential Star for Harvey Norman. The market is booming, with global AR/VR market size projected to reach $300 billion by 2027, showing substantial growth. Harvey Norman's current market share is likely modest given the category's newness and competition from specialized electronics stores.

Significant investment in marketing and product demonstration is crucial for these devices to capture consumer attention and build a stronger foothold. Without this, they risk becoming a Dog if adoption rates don't meet expectations, despite the overall market's upward trajectory.

The market for advanced home robotics, extending beyond simple vacuums to personal assistants and sophisticated cleaning units, is showing strong growth potential. This emerging sector represents a high-growth area, with projections indicating significant expansion in the coming years as technology matures and consumer interest rises.

Harvey Norman's current penetration in this advanced robotics segment is likely minimal, given its nascent stage and the specialized nature of the products. As a new frontier, the company is still establishing its presence and market share in this innovative space.

While stocking and marketing these high-end robots present considerable costs, their potential to become substantial revenue generators is undeniable. Increased consumer adoption, driven by technological advancements and falling price points, necessitates strategic investment to capitalize on this future growth. In 2024, the global market for service robots, which includes advanced home robots, was valued at approximately $30 billion, with a projected compound annual growth rate (CAGR) of over 20% through 2030.

The global health and wellness device market, encompassing advanced fitness trackers and smart scales, is experiencing robust growth, projected to reach over $100 billion by 2027, with a compound annual growth rate of approximately 15%. Harvey Norman's presence in this segment, while present, may not yet command a significant market share compared to specialized health technology retailers.

These smart health and wellness devices represent potential question marks for Harvey Norman. While they align with increasing consumer health consciousness, their success hinges on strategic investment.

To elevate these products from question marks to stars, Harvey Norman could focus on expanding its product range and implementing targeted marketing campaigns that highlight the advanced features and health benefits of these connected devices.

Subscription-Based Tech Support & Services

The retail landscape is increasingly embracing recurring revenue models, and subscription-based tech support and services are a prime example of this high-growth service area. Harvey Norman, like many retailers, is likely exploring or has introduced such offerings, meaning their current market share in this specific segment is probably low.

These services require upfront investment in infrastructure and skilled personnel, but they hold the promise of becoming significant Stars in the BCG Matrix if they achieve widespread customer adoption. For instance, in 2024, the global IT support market was projected to reach over $100 billion, highlighting the substantial opportunity.

- Market Shift: Retailers are moving towards subscription services for tech support, cloud storage, and device protection.

- Harvey Norman's Position: Likely a low market share in this emerging service area, indicating potential for growth.

- Investment & Potential: Initial investment is needed, but these services can become Stars if customer adoption is high.

- Market Size: The global IT support market demonstrated significant value in 2024, underscoring the opportunity.

New Store Formats or Niche Retail Concepts

Harvey Norman's exploration into new store formats or niche retail concepts positions these initiatives as potential question marks within the BCG matrix. These ventures, targeting specific product categories or customer segments, operate in growing markets but begin with a low market share due to their unproven nature.

Significant investment is necessary to scale these formats and achieve market traction. For instance, a new concept store focusing on smart home technology, a rapidly expanding sector, might require substantial capital for inventory, specialized staff training, and marketing to build brand awareness. In 2024, the smart home market was projected to reach over $150 billion globally, indicating a strong growth potential for such niche concepts.

- Potential for Growth: These new formats tap into expanding market segments, offering a chance to capture emerging consumer demand.

- High Investment Needs: Scaling these concepts requires significant capital outlay for infrastructure, inventory, and marketing.

- Uncertain Market Share: Initial market share is low as these are unproven models, facing established competitors.

- Strategic Importance: Success could transform them into Stars, while failure might relegate them to Dogs, impacting overall portfolio performance.

Smart health and wellness devices, such as advanced fitness trackers and smart scales, represent question marks for Harvey Norman. While the broader health and wellness market is growing rapidly, with global projections exceeding $100 billion by 2027 and a CAGR of around 15%, Harvey Norman's share in this specific niche is likely modest compared to specialized retailers.

These products require strategic investment in marketing and product range expansion to transition from question marks to stars. Success hinges on effectively communicating the advanced features and health benefits of these connected devices to consumers.

The subscription-based tech support and services sector is another area Harvey Norman is likely exploring, positioning it as a question mark. This segment, with the global IT support market valued at over $100 billion in 2024, offers significant growth potential if widespread customer adoption is achieved.

New store formats or niche retail concepts also fall into the question mark category. These ventures target expanding markets, like the smart home sector projected to exceed $150 billion globally in 2024, but begin with low market share and require substantial investment to gain traction.

| Category | Market Growth | Harvey Norman's Position | Investment Need | Potential |

|---|---|---|---|---|

| Smart Health & Wellness Devices | High (>$100B by 2027, ~15% CAGR) | Low Market Share | High (Marketing, Product Range) | Star |

| Subscription Tech Support/Services | High (>$100B IT Support Market in 2024) | Low Market Share | High (Infrastructure, Personnel) | Star |

| New Store Formats/Niche Concepts | High (e.g., Smart Home >$150B in 2024) | Low Market Share | High (Capital, Training, Marketing) | Star |

BCG Matrix Data Sources

Our Harvey Norman BCG Matrix is built on verified market intelligence, combining financial data from annual reports, industry research, and competitor benchmarks to ensure reliable, high-impact insights.