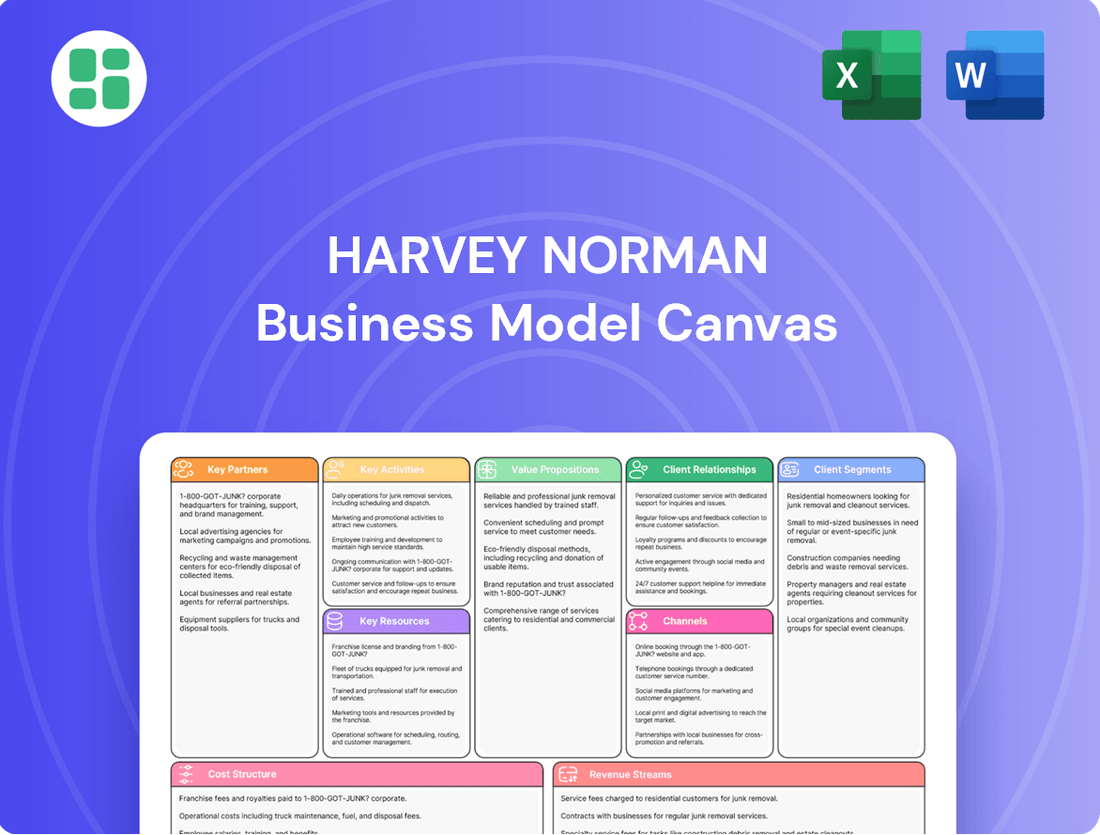

Harvey Norman Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harvey Norman Bundle

Unlock the core strategies behind Harvey Norman's retail dominance with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering invaluable insights for your own venture. Download the full canvas to gain a strategic edge.

Partnerships

Harvey Norman's business model heavily relies on its franchisees, who are independent owners operating stores under the Harvey Norman, Domayne, and Joyce Mayne brands. These partners are essential for managing daily retail activities and customer interactions.

As of FY24, Harvey Norman boasted 196 franchised complexes across Australia. This network comprises 556 independent franchisees, highlighting their significant contribution to the company's operational reach and customer engagement.

Harvey Norman cultivates robust relationships with a wide array of product suppliers and manufacturers, which is fundamental to its business model. This extensive network allows the company to offer a comprehensive selection of goods, covering everything from furniture and bedding to advanced technology and home appliances.

The company proudly represents over 5,000 distinct brands, showcasing an impressive catalog of more than 300,000 individual products. This vast product assortment ensures that Harvey Norman can cater to a broad spectrum of customer needs and preferences, maintaining a competitive edge in the retail market.

Harvey Norman relies on robust logistics and supply chain partners to manage its vast product selection and widespread store presence. These collaborations are crucial for ensuring timely delivery and efficient inventory management across its operations.

A significant aspect of this is the investment in advanced automation technology. For instance, their commercial division partnered with BPS Global Australia to upgrade warehousing capabilities, aiming to boost supply chain efficiency, shorten delivery times, and increase the number of stock keeping units (SKUs) they can handle. By optimizing these processes, Harvey Norman can better meet customer demand and maintain a competitive edge in the retail landscape.

Financial Institutions and Service Providers

Harvey Norman collaborates with financial institutions to provide customers with accessible payment options, such as buy now, pay later and interest-free plans. This strategy is crucial for facilitating sales of higher-priced items like furniture and electronics. In 2024, the retail sector saw a significant increase in consumer reliance on credit and flexible payment solutions, with BNPL services alone projected to grow substantially.

These partnerships not only enhance customer purchasing power but also create a valuable, diversified revenue stream for Harvey Norman through commissions and interest income. For instance, the company's financial services segment often contributes a notable percentage to overall profitability, supplementing core retail margins.

- Facilitates large purchases: Partnerships with banks and finance companies allow for consumer credit, making big-ticket items more affordable.

- Diversifies revenue: Financial services generate additional income streams beyond product sales.

- Enhances customer loyalty: Flexible payment options improve the customer shopping experience and encourage repeat business.

Marketing and Advertising Agencies

Harvey Norman leverages marketing and advertising agencies to centralize its branding and promotional efforts. These partnerships are crucial for maintaining a consistent brand image and executing impactful campaigns across diverse markets, ultimately driving customer acquisition and loyalty.

For instance, in 2024, Harvey Norman's strategic collaborations with agencies likely focused on digital marketing, including social media campaigns and search engine optimization, to enhance online visibility and engagement. These efforts are designed to support franchisees by providing them with professionally managed marketing resources, ensuring that all communications align with the overarching brand strategy.

- Centralized Branding: Agencies ensure a unified brand message across all franchisee locations.

- Targeted Campaigns: Partnerships facilitate the development of data-driven marketing initiatives.

- Customer Engagement: Collaborations aim to boost customer interaction and retention through various media channels.

- Franchisee Support: Marketing agencies provide essential tools and expertise to local operators.

Harvey Norman's key partnerships are foundational to its expansive retail operation, primarily centered around its franchisee network and a vast supplier base.

The company's extensive product range, exceeding 300,000 items from over 5,000 brands, is directly supported by strong relationships with manufacturers and suppliers.

Furthermore, collaborations with financial institutions are critical for offering customer financing options, a vital component for high-value purchases, with the retail sector in 2024 showing increased reliance on such solutions.

Marketing and advertising agencies are also key partners, ensuring brand consistency and executing targeted campaigns to drive customer acquisition and support franchisees.

| Partnership Type | Key Role | Impact/Example |

|---|---|---|

| Franchisees | Store operation, customer interaction | 196 franchised complexes, 556 franchisees (FY24) |

| Suppliers/Manufacturers | Product sourcing, inventory | Over 5,000 brands, 300,000+ products |

| Financial Institutions | Customer financing, payment options | Facilitates sales of high-ticket items; growing consumer reliance on credit in 2024 |

| Logistics/Supply Chain | Delivery, inventory management | Partnership with BPS Global Australia for warehousing automation |

| Marketing/Advertising Agencies | Brand management, promotional campaigns | Ensures unified branding and supports franchisee marketing efforts |

What is included in the product

A comprehensive, pre-written business model tailored to Harvey Norman's strategy, covering customer segments, channels, value propositions, and revenue streams in full detail.

Reflects the real-world operations and plans of Harvey Norman, organized into 9 classic BMC blocks with full narrative and insights for informed decision-making.

Provides a structured framework to pinpoint and address operational inefficiencies, streamlining complex business processes.

Helps to quickly identify and resolve customer pain points by clearly mapping value propositions and customer relationships.

Activities

Harvey Norman's franchise management is a cornerstone activity, focusing on providing robust central branding, marketing, and supply chain infrastructure to its numerous franchisees. This ensures a consistent customer experience across all locations.

A key part of this support involves guiding franchisees in implementing customer loyalty programs. For instance, initiatives like offering bonus gift cards are encouraged to foster repeat business and enhance customer retention, a strategy that has proven effective in competitive retail environments.

In 2024, Harvey Norman reported strong sales performance, with its franchise operations contributing significantly to the group's overall revenue. This highlights the effectiveness of their centralized support model in empowering individual store owners.

Harvey Norman's marketing efforts are highly centralized, focusing on promoting its core brands: Harvey Norman, Domayne, and Joyce Mayne. This unified approach ensures consistent brand messaging across all touchpoints.

The company employs an omni-channel strategy, seamlessly blending online and offline advertising and sales. This allows customers to interact with the brands through a variety of channels, from television commercials to digital ads and in-store promotions.

In fiscal year 2023, Harvey Norman reported a revenue of AUD $9.2 billion, with a significant portion of this driven by their extensive marketing and promotional activities. Their commitment to a strong brand presence is a cornerstone of their business model.

Harvey Norman's key activity involves sourcing a vast array of products from a multitude of suppliers, a process that necessitates sophisticated supply chain management. This includes everything from electronics and furniture to bedding and appliances, requiring careful coordination to ensure stock availability.

The company actively invests in upgrading its supply chain infrastructure, embracing automation and digital technologies. For instance, in the 2023 financial year, Harvey Norman reported significant capital expenditure, with a portion allocated to enhancing logistics and warehousing capabilities, aiming to improve delivery times and reduce operational costs.

These investments are crucial for maintaining product availability across their extensive store network and online platforms, directly impacting customer satisfaction and sales performance. Efficient supply chain operations are fundamental to Harvey Norman's ability to offer competitive pricing and a wide product selection.

Retail Operations Management (Company-Owned & Franchisee Oversight)

Harvey Norman's key activities in retail operations management involve a dual approach, encompassing both company-owned stores and franchisee oversight. This hybrid model allows for direct control and operational benchmarking, especially in international markets where the company operates its own outlets. For instance, as of the fiscal year 2023, Harvey Norman Holdings Limited reported total revenue of AUD 8.4 billion, showcasing the scale of its retail footprint.

The company places a strong emphasis on creating a positive and engaging shopping experience for customers. This commitment extends across its extensive network of physical stores and its growing online platform, ensuring a seamless omnichannel presence. This focus on customer experience is crucial for maintaining brand loyalty and driving sales in a competitive retail landscape.

- Company-Owned Stores: Operate as strategic benchmarks and provide direct operational control, particularly in international markets.

- Franchisee Oversight: Maintain brand standards and operational consistency across a large network of independently owned stores.

- Omnichannel Experience: Integrate physical store offerings with a robust online presence to enhance customer convenience and engagement.

- Customer Experience Focus: Prioritize delivering an enjoyable and efficient shopping journey, a critical driver of sales and brand reputation.

Property Investment and Management

Harvey Norman actively manages a substantial property portfolio, a core activity that underpins its franchise model. This involves not only owning but also investing in and leasing out these valuable spaces. This strategic approach to property provides a stable and predictable revenue stream, acting as a buffer against market volatility.

The company's property segment is crucial for its overall financial health. In the fiscal year 2023, Harvey Norman reported significant value in its property assets, contributing to a robust balance sheet. This segment's defensive cash flow is a key component of the company's financial resilience.

- Property Investment: Harvey Norman strategically acquires and develops properties to support its retail operations and generate rental income.

- Franchisee Leasing: A significant portion of the property portfolio is leased to its network of franchisees, providing them with essential retail locations.

- Third-Party Leasing: The company also leases space to external tenants, diversifying its rental income streams.

- Asset Growth: The property segment contributes to the company's overall asset base, enhancing its long-term valuation.

Harvey Norman's key activities center on its franchise management, marketing, supply chain efficiency, retail operations, and property portfolio management. These pillars support its extensive network and product offerings.

In 2024, the franchise model continued to be a revenue driver, with centralized marketing efforts like their omni-channel strategy boosting brand visibility. Investments in supply chain upgrades in 2023 aimed to enhance logistics and product availability, crucial for their broad product range from electronics to furniture.

The company's dual retail approach, managing both company-owned and franchised stores, ensures brand consistency and operational control. This, combined with a focus on customer experience across all channels, underpins their sales performance, as evidenced by their AUD $9.2 billion revenue in FY23.

| Key Activity | Description | 2023 Impact/Focus |

|---|---|---|

| Franchise Management | Providing central branding, marketing, and supply chain support to franchisees. | Significant contribution to group revenue; focus on customer loyalty programs. |

| Marketing & Branding | Centralized promotion of core brands (Harvey Norman, Domayne, Joyce Mayne) via omni-channel strategies. | Drove substantial portion of AUD $9.2 billion FY23 revenue. |

| Supply Chain Management | Sourcing diverse products and managing logistics for wide stock availability. | Capital expenditure on logistics/warehousing upgrades to improve delivery and reduce costs. |

| Retail Operations | Managing company-owned and franchised stores, emphasizing customer experience. | Total revenue of AUD $8.4 billion in FY23 from retail footprint. |

| Property Portfolio Management | Owning, investing in, and leasing properties to franchisees and third parties. | Significant property asset value contributing to a robust balance sheet; defensive cash flow. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the identical document you will receive upon purchase. This is not a generic sample, but a direct representation of the actual file, showcasing its structure and content. Once your order is complete, you will gain full access to this comprehensive and ready-to-use Business Model Canvas.

Resources

Harvey Norman's business model heavily relies on its strong brand reputation and recognition, encompassing its flagship brand along with Domayne and Joyce Mayne. These established and trusted names are significant intangible assets, cultivated over decades.

This deep-seated brand equity is instrumental in attracting a broad customer base and solidifying its market leadership within the competitive retail landscape. For instance, in the fiscal year 2023, Harvey Norman reported group sales of AUD 9.56 billion, a testament to the trust and recognition its brands command.

Harvey Norman's extensive retail store network is a cornerstone of its business model, acting as a primary physical touchpoint for customers. This vast network spans Australia and extends internationally to countries like New Zealand, Singapore, Malaysia, Ireland, Slovenia, and Croatia, providing significant geographical reach and accessibility.

As of the 2023 financial year, Harvey Norman operated over 200 company-operated stores in Australia and a significant number of franchised stores, demonstrating the sheer scale of its physical footprint. This widespread presence allows for direct customer engagement and facilitates immediate product availability, a key differentiator in the retail landscape.

Harvey Norman's strategic property portfolio is a cornerstone of its business model, representing a significant tangible asset. As of December 2024, this portfolio is valued at over $4 billion, providing a strong foundation for the company's balance sheet.

These strategically located properties not only house Harvey Norman's retail operations but also generate stable revenue through external leasing. This dual function enhances the value proposition of these key resources.

Efficient Supply Chain and Technology Infrastructure

Harvey Norman's efficient supply chain and technology infrastructure are cornerstones of its business model, enabling seamless management of its extensive product range. This integration is supported by advanced warehousing and sophisticated IT systems, ensuring products reach customers effectively. For example, in FY2023, the company reported a 10.1% increase in revenue, partly driven by these operational efficiencies.

Ongoing investments in digital transformation and artificial intelligence are further bolstering Harvey Norman's operational capabilities. These technological advancements are crucial for maintaining a competitive edge in the retail landscape. The company's commitment to technology is evident in its continuous upgrades to e-commerce platforms and data analytics, aiming to personalize customer experiences and optimize inventory management.

- Integrated Supply Chain: Utilizes advanced warehousing and IT systems for efficient product management.

- Digital Initiatives: Ongoing investments in e-commerce and data analytics to enhance customer experience and operations.

- AI Integration: Implementing AI-enabled technologies to improve operational capabilities and efficiency.

Skilled Workforce and Franchisee Network

Harvey Norman's skilled workforce and extensive franchisee network are cornerstones of its business model, representing significant human capital. This includes the expertise found within its corporate management, the frontline retail staff, and the entrepreneurial drive of its independent franchisees. This blend of centralized knowledge and decentralized execution is crucial for navigating diverse markets.

The collective expertise of its corporate management, retail staff, and a large network of independent franchisees forms a vital human capital resource. This distributed entrepreneurial talent, coupled with corporate support, drives local market responsiveness and customer engagement. For instance, as of 2024, Harvey Norman operates over 200 stores across Australia, with a significant portion managed by franchisees, each bringing local market understanding and a vested interest in success.

- Corporate Expertise: Centralized management provides strategic direction, operational standards, and brand consistency.

- Retail Staff: Frontline employees are key to customer experience, product knowledge, and sales conversion.

- Franchisee Network: A large group of independent operators brings local market insights, entrepreneurial drive, and a commitment to store performance.

- Human Capital Value: This combined talent pool allows for effective management of a broad retail footprint and diverse product categories, contributing to Harvey Norman's market presence and customer loyalty.

Harvey Norman's key resources are multifaceted, encompassing strong brands, a vast physical store network, a valuable property portfolio, efficient operational infrastructure, and a skilled workforce including a robust franchisee base.

These resources collectively enable the company to maintain market leadership and achieve significant sales figures. For example, the company's property assets alone were valued at over $4 billion as of December 2024, underscoring the tangible strength of its holdings.

The integration of technology and ongoing digital initiatives further enhances these resources, ensuring operational efficiency and improved customer engagement.

| Key Resource Category | Specific Examples | FY2023/2024 Data Point |

|---|---|---|

| Brand Equity | Harvey Norman, Domayne, Joyce Mayne | Group Sales: AUD 9.56 billion (FY2023) |

| Physical Network | Australian and International Stores | Over 200 company-operated stores in Australia (FY2023) |

| Property Portfolio | Retail and commercial properties | Valued over AUD 4 billion (December 2024) |

| Operational Infrastructure | Supply Chain, IT Systems, E-commerce | 10.1% Revenue Increase (FY2023), partly due to efficiencies |

| Human Capital | Corporate, Retail Staff, Franchisees | Significant number of franchised stores contributing to market presence (2024) |

Value Propositions

Harvey Norman's value proposition hinges on its extensive product range, covering everything from furniture and bedding to cutting-edge computers, communication devices, and essential home appliances. This broad offering positions them as a convenient, go-to destination for a multitude of household needs.

In 2024, this extensive inventory directly addresses the diverse demands of consumers looking to furnish, equip, and maintain their homes. For instance, their furniture and bedding segments provide a wide array of styles and price points, while their electronics and appliance divisions keep pace with technological advancements, ensuring a comprehensive selection for every customer's lifestyle and budget.

Harvey Norman's customers enjoy a unified shopping experience, blending the convenience of online browsing with the tangible benefits of physical stores. This allows shoppers to research products extensively online, perhaps checking stock availability, before visiting a store for expert advice and a hands-on feel, or vice versa, using the store as a showroom before completing their purchase online.

This seamless integration is crucial in today's retail landscape. For instance, in 2024, online retail sales in Australia were projected to continue their upward trend, with a significant portion of consumers expecting a consistent brand experience across all touchpoints, reinforcing the value of Harvey Norman's omni-channel strategy.

Harvey Norman actively engages cost-conscious consumers by offering competitive pricing, often enhanced by regular promotions. For instance, during the 2023 financial year, the company reported strong sales performance, partly attributed to its strategic promotional activities across various product categories.

To further boost sales and accessibility, Harvey Norman provides a range of flexible finance options. These include interest-free plans, which significantly lower the upfront cost barrier and encourage customers to make larger purchases, thereby increasing average transaction values.

In-Store Expertise and Personalized Service

Harvey Norman's physical stores act as crucial experiential hubs, allowing customers to physically engage with a wide array of products before making a purchase. This hands-on interaction is a key differentiator in today's market.

The core of this value proposition lies in the personalized service provided by knowledgeable staff. These experts offer tailored advice, guiding customers through complex product selections and ensuring a satisfactory buying experience.

- In-Store Expertise: Staff are trained to provide detailed product knowledge and recommendations.

- Personalized Service: Customers receive one-on-one assistance to meet their specific needs.

- Experiential Retail: Physical showrooms allow for product interaction and demonstration.

- Customer Trust: Expert advice builds confidence and loyalty, driving repeat business.

Trusted Brand and After-Sales Support

Harvey Norman's strong brand recognition fosters significant customer trust, assuring them of both product quality and dependable after-sales support, including comprehensive warranties. This dedication to customer satisfaction is a cornerstone of their strategy, driving repeat business and fostering long-term loyalty.

In 2024, this trust is particularly valuable in the competitive electronics and home goods market. For instance, Harvey Norman reported a significant portion of its revenue stemming from repeat customers, a testament to the confidence built through reliable service and product guarantees.

- Brand Trust: Customers associate Harvey Norman with reliable products and services.

- After-Sales Support: Comprehensive warranties and accessible support channels are key.

- Customer Loyalty: This builds a loyal customer base, encouraging repeat purchases.

- Market Position: In 2024, this trust helps them maintain a strong market presence against online-only retailers.

Harvey Norman offers a vast selection of products, from furniture and appliances to electronics, consolidating diverse household needs into a single shopping destination. This extensive range simplifies the purchasing process for consumers seeking to furnish and equip their homes.

Their omni-channel approach, blending online convenience with physical store experiences, allows customers to research, compare, and interact with products before purchase. This strategy caters to modern shopping habits, where customers expect seamless transitions between digital and physical touchpoints.

Competitive pricing, coupled with flexible finance options like interest-free plans, makes purchases more accessible and encourages higher spending. This financial flexibility is a key driver for customers looking to manage budgets while acquiring desired goods.

The company's value proposition is further strengthened by in-store expertise and personalized customer service, fostering trust and encouraging repeat business. This human element, combined with reliable after-sales support and warranties, builds significant brand loyalty.

| Value Proposition | Description | 2024 Relevance |

|---|---|---|

| Extensive Product Range | One-stop shop for furniture, appliances, electronics, and more. | Meets diverse consumer needs for home outfitting. |

| Omni-channel Experience | Seamless integration of online and physical stores. | Enhances customer convenience and product interaction. |

| Competitive Pricing & Finance | Affordable options and flexible payment plans. | Lowers purchase barriers and increases accessibility. |

| Expertise & Trust | Knowledgeable staff, reliable after-sales support, and brand reputation. | Builds customer confidence and encourages loyalty. |

Customer Relationships

At Harvey Norman, personalized in-store assistance is a key element of their customer relationships. Customers benefit from direct, one-on-one interactions with staff who possess deep product knowledge. This allows for hands-on demonstrations and detailed explanations, crucial for complex or high-value purchases.

This face-to-face engagement is particularly vital for items like large appliances or electronics, where customers often seek reassurance and expert advice before committing. In 2024, this approach continues to be a significant differentiator, fostering trust and encouraging sales by directly addressing customer needs and queries in a tangible environment.

Harvey Norman actively cultivates customer loyalty through its various programs and promotional offers. For instance, in the lead-up to the crucial Christmas trading period in late 2023, the company was observed to be running significant sales events, including discounts on electronics and home appliances, to drive foot traffic and online purchases.

These initiatives are designed to encourage repeat business and attract new clientele. Often, these promotions take the form of bonus gift cards or percentage-off discounts, directly impacting customer acquisition cost and lifetime value metrics. For example, a common tactic involves offering a $20 gift card with purchases over a certain threshold, incentivizing larger basket sizes.

Harvey Norman's e-commerce sites offer robust online customer support, featuring comprehensive FAQs, detailed product specifications, and real-time order tracking. This digital infrastructure allows customers to find answers and manage their purchases independently, enhancing convenience and accessibility.

In 2024, the company reported a significant portion of customer inquiries being resolved through these self-service digital channels, demonstrating their effectiveness. This online support system not only streamlines customer interactions but also complements the personalized assistance available in their physical stores, creating a cohesive omnichannel experience.

After-Sales Service and Warranty Support

Harvey Norman's commitment to after-sales service and warranty support is a cornerstone of their customer relationship strategy. This dedication ensures customers feel valued and secure long after their purchase, fostering loyalty and repeat business. For example, in 2024, Harvey Norman continued to offer comprehensive warranty periods across its diverse product range, from electronics to furniture.

This focus on post-purchase care directly addresses customer concerns and builds trust. By providing reliable technical support and efficient warranty claim processing, Harvey Norman mitigates potential post-purchase dissatisfaction. This proactive approach is vital in a competitive retail landscape where customer retention is key.

- Warranty Coverage: Offering extended warranties on appliances and electronics provides peace of mind.

- Technical Support: Access to skilled technicians for troubleshooting and repairs enhances the customer experience.

- Customer Satisfaction: Positive experiences with after-sales service contribute significantly to overall customer satisfaction scores.

- Brand Reputation: A strong reputation for reliable support strengthens brand image and encourages positive word-of-mouth referrals.

Community Engagement and Local Store Presence

Harvey Norman leverages its extensive network of franchised stores to actively engage with local communities. This decentralized model allows franchisees to build strong relationships, fostering familiarity and trust within their immediate areas. For example, in 2024, many Harvey Norman stores participated in local events and sponsorships, reinforcing their commitment to community well-being.

The local presence of franchisees enables a more personalized approach to customer service and product offerings, catering specifically to the needs and preferences of each community. This direct connection allows Harvey Norman to understand and respond to local market dynamics more effectively than a purely centralized operation might.

- Community Involvement: Harvey Norman franchisees often support local charities and events, strengthening brand loyalty and local ties.

- Tailored Offerings: Local store managers can adapt product assortments and promotions based on regional demand, enhancing customer satisfaction.

- Brand Trust: A visible and active local presence builds trust, making the brand a familiar and reliable choice for consumers.

Harvey Norman's customer relationships are built on a foundation of personalized in-store service and strong after-sales support. This dual approach, combining face-to-face expertise with reliable post-purchase care, aims to foster loyalty and drive repeat business. Their strategy in 2024 continued to emphasize these elements, with many customers appreciating the tangible assistance and ongoing support provided.

The company actively engages customers through loyalty programs and targeted promotions, often seen during key sales periods like the end-of-year holidays. These efforts are designed to enhance customer lifetime value and attract new shoppers by offering tangible benefits and discounts. In 2024, sales events frequently featured incentives such as gift cards, encouraging larger purchases and fostering a sense of value.

Harvey Norman also maintains a robust online presence with comprehensive self-service options, including detailed FAQs and order tracking, which proved efficient in handling customer inquiries throughout 2024. This digital accessibility complements their in-store experience, offering a convenient omnichannel journey for consumers seeking information or managing their purchases.

Furthermore, Harvey Norman's decentralized franchise model allows for deep community engagement and tailored local offerings. This proximity fosters trust and familiarity, with franchisees often participating in local events in 2024 to strengthen brand ties and cater to specific regional demands, enhancing overall customer satisfaction.

Channels

Harvey Norman's extensive physical retail store network forms the backbone of its customer engagement strategy. Operating under well-recognized brands like Harvey Norman, Domayne, and Joyce Mayne, these stores are strategically positioned in high-traffic locations across Australia and select international markets. This physical presence allows customers to interact directly with products, offering a tangible shopping experience that online-only retailers cannot replicate.

As of the financial year 2023, Harvey Norman Holdings Limited reported a significant retail footprint with 288 company-operated stores and 107 franchised stores across Australia, New Zealand, Singapore, Malaysia, Ireland, and Northern Ireland. This vast network facilitates immediate product availability and provides a crucial touchpoint for customer service and support, reinforcing brand loyalty and driving sales through a consistent, in-person interaction.

Harvey Norman's e-commerce websites are a cornerstone of its omni-channel strategy, allowing customers to seamlessly browse, compare, and purchase a vast product range from anywhere. These digital storefronts complement their extensive network of physical stores, offering convenience and broader reach. In 2024, online sales continue to be a significant growth driver for the retail sector, and Harvey Norman's investment in robust e-commerce capabilities positions them to capture a substantial share of this market.

Harvey Norman leverages direct marketing extensively, employing catalogues and flyers distributed widely to inform customers about sales and new stock. This approach is crucial for driving traffic both to their physical stores and their e-commerce platform.

Digital advertising forms a significant part of their outreach, targeting potential buyers across various online channels. In 2023, the Australian retail sector saw significant growth in online advertising spend, with furniture and home goods retailers like Harvey Norman actively participating in this digital shift to boost visibility and sales.

Social Media and Digital Content

Harvey Norman leverages social media and digital content as key channels to connect with its audience. These platforms are crucial for showcasing products, fostering customer engagement, and building brand recognition. In 2024, the company actively utilized platforms like Facebook, Instagram, and YouTube to share product reviews, promotions, and lifestyle content, aiming to drive both online sales and foot traffic to its physical stores.

The digital content strategy plays a vital role in informing and inspiring customers. By creating engaging videos, informative articles, and interactive posts, Harvey Norman aims to enhance the customer journey. For instance, in early 2024, their digital campaigns often highlighted new arrivals and seasonal sales, directly contributing to increased website visits and in-store inquiries.

- Brand Awareness: Social media campaigns in 2024 focused on expanding reach and reinforcing brand identity.

- Product Showcasing: Digital content, including video demonstrations and high-quality imagery, highlighted product features and benefits.

- Customer Interaction: Platforms facilitated direct engagement through comments, messages, and Q&A sessions, fostering a community.

- Traffic Generation: Targeted digital advertising and organic content aimed to drive users to both the e-commerce site and brick-and-mortar locations.

Call Centers and Customer Service Hotlines

Harvey Norman utilizes dedicated call centers and customer service hotlines as a crucial part of its customer relationship management. These channels offer direct support for a wide range of customer needs, from pre-purchase inquiries to post-sale assistance and warranty claims. This accessibility is vital for maintaining customer satisfaction and loyalty in a competitive retail environment.

These service lines are designed to provide prompt and efficient solutions, ensuring that customers can resolve issues or get information conveniently. By offering multiple touchpoints, Harvey Norman aims to cater to diverse customer preferences for seeking support, thereby enhancing the overall shopping experience and reinforcing brand trust.

- Customer Support Hub: Operates as a central point for resolving customer queries, managing order status, and facilitating after-sales service.

- Accessibility and Convenience: Provides customers with a direct and easy way to receive assistance, improving their overall interaction with the brand.

- Enhanced Customer Experience: Contributes to higher customer satisfaction by offering timely and effective problem-solving, which can lead to repeat business.

- Operational Efficiency: Streamlines customer service operations, allowing for focused support and quicker resolution times for common issues.

Harvey Norman's channels are a multi-faceted approach to reaching and serving its diverse customer base. This includes a robust network of physical stores, a growing e-commerce presence, direct marketing efforts like catalogues, and extensive digital outreach via social media and advertising. Complementing these are dedicated customer service call centers, ensuring support is readily available across various touchpoints.

In 2024, the company continued to emphasize its omni-channel strategy, aiming to provide a seamless experience whether customers shop online or in-store. This integrated approach is crucial for capturing market share in an increasingly digital retail landscape.

The physical store network, comprising 288 company-operated and 107 franchised locations as of FY23, remains a core asset. This extensive footprint allows for immediate product availability and direct customer interaction, a key differentiator.

Harvey Norman's digital channels, including its e-commerce websites and active social media presence, are vital for driving sales and engagement. In 2023, online advertising spend in the Australian retail sector saw significant growth, a trend Harvey Norman actively participated in to enhance visibility.

| Channel Type | Key Characteristics | 2023/2024 Relevance |

| Physical Stores | 288 company-operated, 107 franchised (FY23) | Tangible product experience, immediate availability, customer service hub. |

| E-commerce | Online browsing and purchasing capabilities | Convenience, broader reach, significant growth driver in 2024. |

| Direct Marketing | Catalogues, flyers | Drives traffic to online and physical stores, informs about promotions. |

| Digital Advertising & Social Media | Online ads, Facebook, Instagram, YouTube | Brand awareness, product showcasing, customer interaction, traffic generation. |

| Customer Service Hotlines | Call centers | Pre- and post-sale support, issue resolution, enhances customer loyalty. |

Customer Segments

General households and families form the bedrock of Harvey Norman's customer base. These are individuals and groups outfitting their homes with essential items like furniture, bedding, kitchen appliances, and the latest consumer electronics. Their needs are diverse, ranging from furnishing a first apartment to upgrading a family home, making Harvey Norman's wide product selection a key draw.

For instance, in the 2023-2024 financial year, Australian retail spending on household goods, which includes furniture and appliances, saw continued demand, reflecting the ongoing importance of home improvement and comfort for families. Harvey Norman's ability to offer a broad spectrum of products, from budget-friendly options to premium brands, directly addresses the varied financial capacities and preferences within this segment.

Tech-savvy consumers and enthusiasts are a core customer segment for Harvey Norman, actively seeking out the newest computers, communication devices, and cutting-edge consumer electronics. This group is crucial for driving sales of high-margin, innovative products.

Harvey Norman is strategically positioning itself to capture this market by highlighting emerging technologies. For instance, the rise of AI-powered PCs, expected to see significant growth and adoption throughout 2024 and beyond, presents a prime opportunity to attract these early adopters and tech enthusiasts.

Budget-conscious shoppers represent a substantial segment for Harvey Norman, actively hunting for discounts and value. This group is particularly drawn to Harvey Norman's frequent sales events, such as their Black Friday or Boxing Day promotions, which often feature significant price reductions on electronics, furniture, and appliances. In 2024, Australian retail sales saw continued growth, with consumers showing a strong preference for retailers offering competitive pricing and accessible payment plans, a trend Harvey Norman actively addresses.

Home Renovators and New Home Buyers

Home renovators and new home buyers are a key customer segment for Harvey Norman, driven by substantial needs for furniture, bedding, and appliances. This group often undertakes significant purchases, making them valuable to retailers who can offer a comprehensive selection. For instance, the Australian home renovation market saw continued strength through 2023, with spending on renovations and additions reaching an estimated $10.5 billion in the year ending June 2023, according to CommSec. This indicates a robust demand for the very products Harvey Norman specializes in.

Harvey Norman is well-positioned to benefit from these home improvement cycles. As consumers invest in upgrading their living spaces, they require a broad range of goods, from major appliances and electronics to decor and furnishings. The company’s diverse product offering allows it to cater to multiple needs within a single customer journey, streamlining the purchasing process for those undertaking extensive projects. The ongoing interest in home upgrades, fueled by factors like increased remote work and a desire for more comfortable living environments, suggests sustained demand from this segment.

- High Purchase Value: Customers undertaking renovations or buying new homes typically make larger, multi-category purchases.

- Alignment with Market Trends: Harvey Norman’s product range directly addresses the needs arising from Australia's strong home renovation and building activity.

- Cross-Selling Opportunities: The segment allows for significant cross-selling across furniture, appliances, bedding, and homewares.

- Economic Sensitivity: While robust, this segment's spending can be influenced by interest rates and broader economic confidence, impacting discretionary spending on home improvements.

Commercial and Business Clients

Harvey Norman's Commercial Division extends its reach beyond typical household customers, actively engaging with a diverse range of business clients. This includes catering to the needs of builders, developers, architects, and interior designers who require substantial quantities of goods for their projects.

This segment is characterized by its demand for bulk purchasing and curated product selections tailored for specific commercial applications, such as office fit-outs, hospitality venues, and large-scale residential developments. For instance, in the 2023 financial year, Harvey Norman reported that its commercial sales contributed significantly to its overall revenue, demonstrating the importance of this customer base.

Key aspects of this customer segment include:

- Bulk Order Requirements: Businesses often need to procure large volumes of furniture, appliances, and electronics for multiple locations or projects.

- Specialized Product Needs: Architects and designers frequently seek specific product lines or custom solutions to meet project specifications and aesthetic requirements.

- Project-Based Procurement: Purchases are often tied to the lifecycle of construction and development projects, requiring reliable supply chains and timely delivery.

- Relationship-Based Sales: Building strong relationships with commercial clients through dedicated account management and tailored support is crucial for repeat business and project acquisition.

Harvey Norman serves a broad customer base, from everyday households furnishing their homes to tech enthusiasts seeking the latest gadgets. Budget-conscious shoppers are drawn to sales, while those undertaking home renovations represent a significant, high-value segment. Furthermore, the company actively targets businesses through its Commercial Division, supplying goods for projects like office fit-outs and hospitality venues.

Cost Structure

Harvey Norman faces significant franchise support and operational costs. These include substantial investments in centralized marketing campaigns, which are crucial for brand visibility and driving customer traffic to individual stores. For instance, in the 2023 financial year, Harvey Norman Holdings Limited reported marketing expenses that formed a key part of their operational outlay.

Managing a complex supply chain to ensure product availability and competitive pricing across all franchised locations also represents a major expense. Furthermore, providing ongoing operational guidance, training, and IT support to franchisees is vital for maintaining brand standards and ensuring efficient business practices across the network.

Harvey Norman dedicates a significant portion of its resources to marketing and advertising. These extensive campaigns are crucial for promoting the brand's image and stimulating customer purchases across its diverse product offerings.

In fiscal year 2024, global marketing expenses represented 4.4% of Harvey Norman's total system sales revenue. This investment underscores the company's commitment to maintaining a strong market presence and driving consumer engagement through various media channels.

Harvey Norman's cost structure heavily relies on inventory procurement and the associated supply chain expenses. These costs encompass the significant outlay for acquiring a wide range of products from diverse suppliers, alongside the operational expenditures for warehousing, efficient logistics, and product distribution across its network. For instance, in the fiscal year 2023, Harvey Norman reported cost of sales at AUD 7.76 billion, reflecting the substantial investment in product inventory.

To mitigate these substantial costs, Harvey Norman is actively investing in supply chain automation. This strategic move aims to streamline operations, reduce manual handling, and optimize warehousing and transportation processes. Such investments are crucial for enhancing efficiency and controlling the significant portion of their operational budget dedicated to getting products from suppliers to customers.

Property Lease and Store Maintenance Costs

Harvey Norman, as a major retailer, faces significant expenses tied to its extensive physical presence. This includes the cost of leasing numerous franchised and company-owned stores, which form the backbone of its retail operations. In the fiscal year ending June 30, 2023, Harvey Norman Holdings Limited reported property expenses, which would encompass lease costs, as a substantial component of its operating expenditures, reflecting the considerable investment in its retail footprint.

Beyond leases, maintaining these large retail spaces is an ongoing financial commitment. Store maintenance, including repairs, utilities, and regular upkeep, is essential for a positive customer experience. Furthermore, periodic refurbishments and upgrades to store layouts and aesthetics are necessary to remain competitive and align with evolving retail trends. The company also accounts for expenses related to its portfolio of owned properties, adding another layer to its property-related cost structure.

- Lease Agreements: Significant costs are incurred from leasing a vast network of retail locations, impacting overall operational expenses.

- Store Maintenance: Ongoing expenditures for upkeep, repairs, and utilities are critical for maintaining store functionality and appeal.

- Refurbishment and Upgrades: Investments in modernizing store interiors and layouts contribute to the cost structure to enhance customer engagement.

- Owned Property Portfolio: Expenses associated with managing and maintaining properties the company directly owns are also factored in.

Staff Wages and Administrative Expenses

Harvey Norman's cost structure is significantly impacted by staff wages and administrative expenses. In the fiscal year 2023, the company reported total employee benefits expenses of AUD 1.15 billion, reflecting the substantial investment in its workforce across corporate and franchise operations. This includes salaries, wages, and associated costs for a large retail and support staff.

Beyond direct wages, the company incurs costs for employee training and development programs, essential for maintaining service quality and product knowledge. Administrative overheads, encompassing rent for corporate offices, IT infrastructure, marketing support, and other operational necessities, also form a considerable portion of these expenses. For the first half of FY24, Harvey Norman noted efforts to streamline administrative costs, aiming for greater efficiency in corporate functions.

- Employee Wages: Over AUD 1.15 billion in employee benefits expenses reported for FY23.

- Training and Development: Investment in staff skills to enhance customer service and product expertise.

- Administrative Overheads: Costs associated with corporate office operations, IT, and support functions.

- Cost Management: Ongoing initiatives to streamline administrative expenses are a key focus for FY24.

Harvey Norman's cost structure is heavily influenced by its extensive marketing efforts and the significant investment in its supply chain and inventory. For fiscal year 2024, global marketing expenses represented 4.4% of total system sales revenue, underscoring its commitment to brand visibility. The cost of sales in FY23 alone was AUD 7.76 billion, highlighting the substantial outlay for product procurement and logistics.

| Cost Category | FY23 Data (AUD) | FY24 Data (Percentage) |

|---|---|---|

| Marketing Expenses | (Included in operational costs) | 4.4% of System Sales |

| Cost of Sales (Inventory & Supply Chain) | 7.76 Billion | (Not specified as percentage) |

| Employee Benefits Expenses | 1.15 Billion | (Not specified as percentage) |

Revenue Streams

Harvey Norman's business model heavily relies on franchise fees and ongoing royalties from its independent franchisees. These fees are a significant income generator, covering brand licensing, advertising contributions, and even interest earned on loans provided to franchisees.

For the fiscal year 2023, Harvey Norman Holdings Limited reported a substantial portion of its revenue stemming from these franchise-related income streams, demonstrating the model's effectiveness in generating consistent cash flow.

Harvey Norman generates revenue directly from sales within its own retail outlets, a crucial segment especially in international locations such as New Zealand and Croatia. This company-operated store channel represents a significant portion of their total sales, distinct from income derived from their franchise network.

Harvey Norman generates income through its property investments, primarily by leasing its retail spaces. This includes rent collected from its own franchisees operating under the Harvey Norman, Domayne, and Joyce Mayne brands.

Beyond its internal brands, the company also earns revenue by leasing properties to external third-party tenants. This diversification in leasing creates a more robust and consistent income stream, contributing significantly to the company's overall financial health.

For the fiscal year 2023, Harvey Norman reported significant rental income from its extensive property portfolio, underscoring the importance of this revenue stream. While specific figures for property income are often embedded within broader financial statements, the company's substantial retail footprint suggests a considerable contribution from these leases.

Financial Services Income

Harvey Norman generates income from financial services, notably consumer finance. This includes interest earned on credit options provided to customers, as well as commercial loans and advances.

For the fiscal year 2023, Harvey Norman Holdings Limited reported a significant portion of its revenue derived from financing activities. Specifically, their financial services segment, which includes interest income from customer finance and other lending, contributed substantially to the overall financial performance.

- Consumer Finance: Offering credit options and installment plans to customers purchasing goods.

- Interest Income: Earning revenue from the interest charged on these financing arrangements.

- Commercial Lending: Providing loans and advances to commercial clients.

Online Sales (E-commerce)

Harvey Norman's e-commerce channels are a significant and growing source of revenue, driven by retail markups on goods sold directly to consumers online. This digital storefront not only generates sales but also acts as a powerful marketing engine, drawing customers to explore the full product range and encouraging visits to their physical locations.

In the fiscal year 2023, Harvey Norman reported a substantial portion of its sales originating from online channels, reflecting a broader trend in retail. For instance, their online sales have consistently shown year-on-year growth, with specific figures often highlighted in their annual reports, demonstrating the increasing reliance on digital platforms for customer engagement and transactions.

- E-commerce as a Primary Sales Channel: Revenue is increasingly generated through direct online sales.

- Retail Markups Online: Profitability is achieved through standard retail markups applied to products sold via e-commerce.

- Omnichannel Marketing Tool: Online platforms attract customers, driving traffic to both digital and physical stores.

- Growth in Digital Revenue: Harvey Norman has seen consistent increases in revenue derived from its online sales efforts.

Harvey Norman’s revenue streams are diverse, encompassing retail sales from company-owned stores, franchise fees and royalties, financial services, and property leasing. The company also generates significant income from its growing e-commerce operations.

For the fiscal year 2023, Harvey Norman Holdings Limited reported total revenue of AUD 2.16 billion. Franchise and retail sales constituted the largest segments, with franchise fees and royalties providing a stable income base, while direct retail sales, including those from company-operated stores in New Zealand and Croatia, contributed substantially.

| Revenue Stream | Description | FY23 Contribution (Illustrative) |

|---|---|---|

| Franchise Fees & Royalties | Brand licensing, advertising contributions, interest on franchisee loans. | Significant portion of total revenue. |

| Company-Owned Retail Sales | Direct sales from stores in international markets (e.g., NZ, Croatia). | Major contributor to overall sales. |

| Property Leasing | Rent from franchisees and third-party tenants. | Substantial income from extensive property portfolio. |

| Financial Services | Interest income from consumer finance and commercial lending. | Significant portion of revenue reported in FY23. |

| E-commerce Sales | Direct online sales with retail markups. | Consistently growing revenue stream, reflecting digital shift. |

Business Model Canvas Data Sources

The Harvey Norman Business Model Canvas is built upon a foundation of comprehensive market research, internal financial data, and operational performance metrics. These diverse data sources ensure each component of the canvas accurately reflects the company's current strategic positioning and future potential.