Harvey Norman Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harvey Norman Bundle

Harvey Norman faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers posing substantial challenges. Understanding these dynamics is crucial for navigating the retail landscape. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Harvey Norman’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Harvey Norman sources products from a vast network of manufacturers, ranging from global electronics giants like Samsung and LG to numerous smaller furniture and bedding suppliers. This diversity means supplier power isn't uniform across its operations.

In categories like high-tech electronics, a few major brands hold significant sway due to their strong market presence and innovation. For instance, in 2023, global consumer electronics sales reached over $1.1 trillion, with brands like Samsung and LG commanding substantial market share, giving them leverage in negotiations.

However, the furniture sector, often characterized by a more fragmented supplier base, typically offers Harvey Norman greater bargaining power. This allows the retailer to negotiate more favorable terms with a larger number of smaller, less concentrated manufacturers.

Switching costs for Harvey Norman can be a significant factor in their bargaining power with suppliers. For specialized electronics or white goods where Harvey Norman has deeply integrated supply chains or relies on suppliers' proprietary technologies, the effort and expense to switch can be substantial. This might involve renegotiating contracts, reconfiguring logistics, and undertaking new marketing efforts, all of which add to the cost and potential disruption.

Many of Harvey Norman's crucial suppliers, particularly in the fast-moving consumer electronics sector, are increasingly leveraging their own robust online platforms to engage directly with customers. This direct-to-consumer (D2C) sales model significantly amplifies their bargaining power by diminishing their dependence on established retail partners like Harvey Norman, allowing them to retain a greater portion of the profit margin.

For instance, major electronics brands often have sophisticated e-commerce operations that can rival or even surpass the online presence of large retailers. This shift forces Harvey Norman to continuously innovate its in-store customer experience and value-added services to justify its role in the supply chain and retain customer loyalty against these direct channels.

Uniqueness of Supplier Offerings

Harvey Norman's bargaining power of suppliers is influenced by the uniqueness of their offerings. Suppliers providing highly differentiated or proprietary products, like exclusive electronics models or distinct furniture designs, hold significant sway. If these items are in high demand and difficult for competitors to replicate, Harvey Norman's dependence on these specific suppliers grows, potentially leading to less favorable terms to ensure product availability.

For instance, in the competitive Australian retail landscape of 2024, Harvey Norman's ability to secure exclusive distribution rights for certain high-demand appliance brands or cutting-edge tech gadgets directly impacts its supplier relationships. Suppliers with such unique product portfolios can command better pricing and terms, as Harvey Norman needs these differentiated products to attract and retain customers in a crowded market.

- Supplier Differentiation: Harvey Norman relies on suppliers for a wide range of goods, from electronics to home furnishings. When these suppliers offer unique, branded, or technologically advanced products that are not readily available elsewhere, their bargaining power increases significantly.

- Consumer Demand for Uniqueness: The demand from Australian consumers for the latest technology or exclusive home decor items means Harvey Norman must secure these unique products. This consumer pull strengthens the supplier's position.

- Impact on Terms: Suppliers of unique goods can negotiate better payment terms, minimum order quantities, or even pricing, as Harvey Norman's need to offer these sought-after items outweighs the ability to switch to alternative, less differentiated suppliers.

- Competitive Advantage: Harvey Norman's access to unique supplier offerings is a key factor in its ability to differentiate itself from competitors, making it willing to accept less favorable terms to maintain this competitive edge.

Volume of Purchases

Harvey Norman's substantial purchasing volumes across its diverse brands like Harvey Norman, Domayne, and Joyce Mayne, coupled with its international presence, grant it considerable leverage with suppliers. This scale allows for more favorable negotiations on pricing, payment terms, and other conditions, especially for popular consumer products. For instance, in fiscal year 2023, Harvey Norman reported total revenue of AUD 8.4 billion, indicating the significant scale of its operations and thus its purchasing power.

However, this supplier bargaining power is not absolute. Major international suppliers often possess strong brand recognition and employ direct-to-consumer strategies, which can diminish Harvey Norman's influence. These suppliers may have alternative sales channels, reducing their reliance on Harvey Norman and thereby strengthening their own negotiating position.

- Significant Purchasing Volumes: Harvey Norman's extensive retail network and multi-brand strategy contribute to large order quantities, enhancing its negotiation power.

- Leverage in Negotiations: This scale enables Harvey Norman to negotiate better prices and terms with many suppliers, particularly for high-volume consumer goods.

- Counterbalancing Factors: The bargaining power of suppliers is tempered by the strong brand equity and direct sales efforts of major international manufacturers.

- Fiscal Year 2023 Performance: The company's AUD 8.4 billion in revenue highlights the substantial market presence that underpins its purchasing leverage.

Harvey Norman's bargaining power with suppliers is a mixed bag, heavily influenced by the nature of the products and the suppliers themselves. While its sheer scale of purchasing provides significant leverage, especially for common goods, this is often counterbalanced by the increasing independence and direct-to-consumer capabilities of major brands.

Suppliers of unique or highly demanded items, like exclusive electronics or distinctive furniture, can command stronger negotiating positions. This is because Harvey Norman needs these differentiated products to attract customers, making it more amenable to less favorable terms to secure these offerings. For instance, in 2024, securing exclusive tech gadgets is crucial for maintaining market appeal.

The rise of direct-to-consumer (D2C) models by major electronics manufacturers, such as Samsung and LG, significantly shifts the power dynamic. These brands, which saw global consumer electronics sales exceed $1.1 trillion in 2023, can reduce their reliance on retailers like Harvey Norman, thereby strengthening their own bargaining power and potentially impacting Harvey Norman's margins.

| Supplier Characteristic | Impact on Harvey Norman's Bargaining Power | Example/Data Point |

|---|---|---|

| Supplier Differentiation & Exclusivity | Increases Supplier Power | Exclusive electronics models or unique furniture designs sought after by consumers in 2024. |

| Supplier Brand Strength & D2C Capability | Increases Supplier Power | Major electronics brands with robust online platforms, reducing reliance on retailers. Global consumer electronics sales over $1.1 trillion in 2023. |

| Supplier Market Concentration | Increases Supplier Power (for concentrated markets) | Few major brands in high-tech electronics hold significant sway due to market presence. |

| Supplier Market Fragmentation | Decreases Supplier Power (for fragmented markets) | More fragmented furniture sector allows Harvey Norman greater negotiation flexibility. |

| Harvey Norman's Purchasing Volume | Increases Harvey Norman's Bargaining Power | AUD 8.4 billion in revenue (FY2023) signifies substantial scale and negotiation leverage. |

What is included in the product

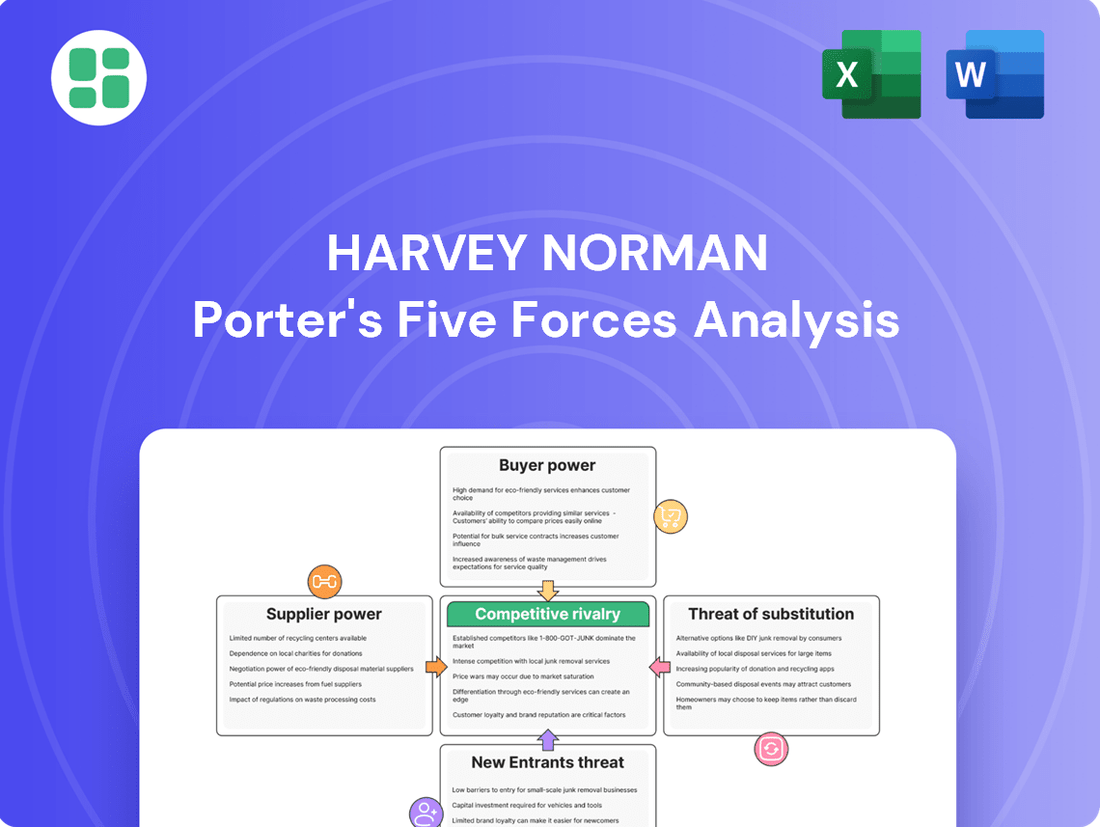

This analysis dissects the competitive landscape for Harvey Norman, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Instantly visualize competitive intensity with a dynamic Porter's Five Forces analysis, highlighting Harvey Norman's strategic position and potential pain points.

Customers Bargaining Power

Customers in the electronics, appliance, and furniture sectors are keenly aware of price. With so many options available online, comparing prices is incredibly simple, making them less likely to overpay. For instance, a 2024 report indicated that over 70% of consumers research products online before making a purchase, often comparing prices across multiple retailers.

The digital age has armed consumers with a wealth of information. They can easily access product reviews, detailed specifications, and, crucially, competitor pricing. This transparency significantly boosts their leverage, compelling Harvey Norman to maintain competitive pricing strategies and focus on delivering added value beyond just the product itself.

The cost for a customer to switch from Harvey Norman to another retailer is generally low. This means consumers can easily move to a competitor if they find better deals or service elsewhere.

With many online and physical stores offering comparable products, consumers have ample choice. For example, in 2024, the Australian retail market saw continued growth in online sales, with consumers increasingly accustomed to comparing prices and switching between platforms and providers with minimal friction.

The surge in e-commerce, with online retail sales in Australia projected to reach $70 billion in 2024, has dramatically shifted bargaining power towards consumers. This digital landscape offers unprecedented convenience, a vast array of choices, and often more competitive pricing, forcing retailers like Harvey Norman to adapt.

Australian consumers are increasingly demanding an omnichannel experience, seamlessly blending online research with physical store interactions. For instance, a 2024 report indicated that over 60% of Australian online shoppers utilize physical stores for product discovery before purchasing online, highlighting the need for integrated strategies.

Harvey Norman's ability to effectively merge its online and brick-and-mortar operations is crucial for retaining customer loyalty and competitive positioning. Failing to provide a cohesive omnichannel journey risks alienating a significant portion of the market, as customers can easily switch to competitors offering a more integrated experience.

Discretionary Spending Under Pressure

During periods of economic strain, like the cost-of-living challenges experienced in 2024, consumers become more hesitant to spend on non-essential, high-value items such as furniture and electronics. This heightened consumer prudence directly amplifies their bargaining power.

This shift means customers are more likely to delay purchases or actively seek out deals and discounts, putting pressure on retailers like Harvey Norman to offer competitive pricing. The focus on value becomes paramount as consumers scrutinize their spending more closely.

- Consumer spending on durable goods often declines during economic downturns.

- In 2024, many households faced increased inflation, impacting discretionary budgets.

- Retailers observed a trend towards prioritizing essential purchases over large discretionary items.

- Customers are more inclined to compare prices and wait for sales events.

Customer Loyalty and Personalisation

While price remains a significant factor, customers increasingly seek value through loyalty programs and personalized interactions. Harvey Norman's efforts to build strong customer relationships via bespoke promotions, superior after-sales support, and an engaging in-store atmosphere can effectively counter customer bargaining power. For instance, in 2024, retailers are investing heavily in CRM systems to better understand and cater to individual customer preferences, moving beyond generic discount schemes.

The effectiveness of loyalty initiatives hinges on their depth and relevance. Generic reward points often fall flat, prompting a shift towards more meaningful customer engagement strategies. Retailers are exploring data analytics to offer truly personalized recommendations and exclusive experiences, thereby fostering deeper loyalty and reducing price sensitivity.

- Customer Loyalty Drivers: Price, personalized offers, and excellent after-sales service are key.

- Harvey Norman's Strategy: Fostering strong relationships through tailored experiences mitigates customer power.

- Loyalty Program Effectiveness: Generic schemes are less impactful; meaningful engagement is crucial.

- Industry Trend: Retailers are enhancing CRM and data analytics for personalized customer journeys in 2024.

Customers possess significant bargaining power due to the ease of price comparison, particularly online, and low switching costs. In 2024, over 70% of consumers researched products online before purchasing, often comparing prices across multiple retailers. This transparency compels Harvey Norman to maintain competitive pricing and focus on added value, as consumers can easily shift to competitors offering better deals or integrated omnichannel experiences.

| Factor | Impact on Harvey Norman | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity | High; customers easily compare prices online. | Over 70% of consumers research online before purchase. |

| Switching Costs | Low; customers can easily move to competitors. | Continued growth in online sales makes switching frictionless. |

| Information Availability | High; customers access reviews, specs, and competitor pricing. | Digital transparency significantly boosts consumer leverage. |

| Omnichannel Expectations | Increasingly important; customers expect seamless online/offline integration. | Over 60% of Australian online shoppers use physical stores for discovery. |

What You See Is What You Get

Harvey Norman Porter's Five Forces Analysis

This preview shows the exact Harvey Norman Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive breakdown of competitive forces within the retail sector. You'll gain immediate access to this fully formatted document, providing actionable insights into industry attractiveness and strategic positioning. No surprises, no placeholders—just the complete, ready-to-use analysis for your business needs.

Rivalry Among Competitors

Harvey Norman operates in a crowded Australian retail environment for electronics, appliances, and furniture. This market includes major players like JB Hi-Fi and The Good Guys, alongside burgeoning online retailers such as Kogan.com and the significant presence of Amazon Australia.

The competitive set also extends to department stores and specialized furniture shops, creating a multifaceted challenge. For instance, JB Hi-Fi reported a 6.2% increase in total sales to AUD 10.1 billion for the fiscal year ending June 30, 2023, highlighting the scale of established rivals.

This broad range of competitors, from national chains to digital-first businesses, intensifies rivalry. The presence of global giants like Amazon further escalates price pressures and innovation demands within the sector.

Harvey Norman faces intense rivalry, especially in categories like consumer electronics and major appliances, where products are often identical regardless of the retailer. This lack of differentiation forces a focus on price as a key competitive factor.

The commodity nature of many of its offerings means that Harvey Norman must engage in constant price wars. For instance, during the 2023 holiday season, major electronics retailers, including those competing with Harvey Norman, heavily discounted popular items like televisions and laptops, with some deals offering savings of over 30%.

This environment demands aggressive promotional strategies and a keen eye on competitor pricing to remain competitive. Harvey Norman's reliance on sales events and discounts reflects this pressure, aiming to attract price-sensitive consumers in a crowded market.

Operating vast retail spaces like Harvey Norman's, filled with extensive product ranges, inherently carries substantial fixed costs. These include rent, utilities, and staffing, which must be covered regardless of sales performance.

This cost structure places immense pressure on Harvey Norman to achieve and sustain high sales volumes. To meet these targets and remain profitable, the company often engages in aggressive promotional activities and price reductions to draw in customers and clear inventory.

For instance, in the 2023 financial year, Harvey Norman reported total revenue of AUD 8.4 billion, underscoring the sheer scale of sales required to manage its operational footprint. The imperative to move stock efficiently can lead to heightened competitive responses, such as price wars, as businesses vie for market share.

Market Growth Rate

While the Australian retail sector experienced headwinds in 2024, a projected gradual improvement in consumer spending, especially in discretionary areas like electronics and home furnishings, is anticipated for mid-to-late 2025. This moderate market growth means competition for market share intensifies as businesses vie for a larger portion of the expanding market. For instance, the Australian Bureau of Statistics reported retail turnover increased by 1.3% in the March quarter of 2024, indicating a slow but positive trend.

In such a scenario, companies like Harvey Norman face heightened rivalry as they compete for customers in a market that isn't experiencing explosive growth. This dynamic forces businesses to differentiate themselves through pricing, product innovation, customer service, and marketing efforts to capture and retain market share. The intensity of this rivalry is a direct consequence of the market's growth trajectory.

- Projected Consumer Spending: Gradual improvement expected in discretionary categories by mid-to-late 2025.

- Market Growth: Moderate growth rate leads to increased competition for market share.

- Retail Turnover: Australian retail turnover saw a 1.3% increase in Q1 2024.

- Competitive Impact: Businesses must innovate and differentiate to gain an edge.

Online vs. Brick-and-Mortar Competition

The competitive rivalry for retailers like Harvey Norman is intensely shaped by the accelerating shift towards online retail. Pure-play online businesses often boast lower overheads, enabling them to offer more competitive pricing, which directly challenges traditional brick-and-mortar establishments.

This dynamic forces established retailers to adopt robust omnichannel strategies. The goal is to create a seamless experience for customers, blending the convenience of online shopping with the tangible benefits of physical stores.

- Online Retail Growth: Global e-commerce sales are projected to reach $7.4 trillion by 2025, highlighting the significant market share online players command.

- Price Sensitivity: Consumers often compare prices across channels, with online platforms frequently offering discounts that pressure physical retailers' margins.

- Omnichannel Imperative: Retailers investing in click-and-collect services and integrated inventory management systems report higher customer retention rates.

- Harvey Norman's Strategy: In 2024, Harvey Norman continued to emphasize its online presence and in-store experience integration, aiming to capture market share across both channels.

Harvey Norman faces fierce competition from a wide array of players, including large chains like JB Hi-Fi, online specialists such as Kogan.com, and global giants like Amazon. This intense rivalry is particularly acute in product categories where differentiation is minimal, forcing a strong reliance on price as a competitive lever.

The need to manage substantial fixed costs associated with its extensive physical store network puts Harvey Norman under constant pressure to achieve high sales volumes. This often translates into aggressive promotional activities and price reductions to attract customers and move inventory efficiently.

The ongoing shift to online retail further intensifies competition, as digital-native businesses typically operate with lower overheads, allowing for more aggressive pricing. Harvey Norman's strategy in 2024 focused on integrating its online and in-store experiences to remain competitive across all channels.

| Competitor | Key Offerings | 2023 Sales (AUD) |

|---|---|---|

| JB Hi-Fi | Electronics, Appliances, Music, Movies | 10.1 billion (6.2% increase) |

| Kogan.com | Electronics, Home Goods, Lifestyle Products | Not specified, but significant online presence |

| Amazon Australia | Vast range of products across all categories | Not specified, but a major global player |

SSubstitutes Threaten

The most significant threat of substitution for Harvey Norman comes from online-only retailers and major e-commerce marketplaces like Amazon and Kogan.com. These platforms provide an extensive range of products, often at more competitive prices, and the sheer convenience of online shopping makes them a direct alternative to traditional brick-and-mortar purchases.

In 2024, online retail continues its strong growth trajectory, with e-commerce sales in Australia projected to reach approximately AUD 70 billion, a substantial portion of which directly competes with the categories Harvey Norman operates in. This trend highlights how easily consumers can bypass physical stores entirely for their purchasing needs.

The burgeoning second-hand and refurbished market poses a significant threat to traditional retailers like Harvey Norman. A growing consumer focus on sustainability and affordability is driving demand for pre-owned electronics and furniture. For instance, the global refurbished electronics market was valued at approximately USD 57.1 billion in 2023 and is projected to reach USD 125.1 billion by 2030, indicating a strong growth trajectory.

This trend directly impacts Harvey Norman by offering consumers a viable, often cheaper, alternative to purchasing new goods. Price-sensitive customers, in particular, may divert their spending towards these pre-owned items, especially for categories like appliances and computers where functional differences between new and refurbished can be minimal. This can erode Harvey Norman's market share and pressure its pricing strategies.

For high-value items like appliances and IT equipment, rental and leasing services offer a compelling alternative to outright purchase. This approach is particularly attractive to consumers and businesses seeking to avoid significant upfront capital expenditure or requiring the flexibility to upgrade technology regularly. For instance, the Australian equipment rental market, which includes IT and office equipment, saw steady growth leading up to 2024, indicating a sustained demand for these flexible consumption models.

Direct-to-Consumer (D2C) from Manufacturers

The rise of direct-to-consumer (D2C) sales by manufacturers poses a significant threat to traditional retailers like Harvey Norman. Many electronics and appliance brands now operate their own online stores, allowing them to bypass intermediaries and connect directly with customers. This trend means consumers have more options to purchase goods without going through a physical store or a multi-brand online platform.

This shift is particularly evident in sectors where brand loyalty is strong and product differentiation can be easily communicated online. For example, in 2024, many major electronics manufacturers reported substantial growth in their D2C channels, capturing a larger share of online sales. This direct engagement allows manufacturers to control the customer experience and gather valuable data, potentially leading to more competitive pricing or exclusive offerings that divert customers from retailers.

- Increased Manufacturer D2C Sales: Many electronics and appliance manufacturers are expanding their direct online sales presence.

- Bypassing Traditional Retailers: This D2C model allows brands to sell directly, cutting out intermediaries like Harvey Norman.

- Consumer Choice and Potential Savings: Consumers gain direct access to brands, potentially finding exclusive products or better deals.

- Data Control and Customer Experience: Manufacturers can leverage D2C to manage customer relationships and gather insights directly.

Shifting Consumer Priorities and Lifestyles

Changes in consumer lifestyles, such as a growing preference for minimalism or smaller living spaces, can directly impact the demand for home furnishings and appliances. This shift means fewer purchases of large items, reducing the need for Harvey Norman's core offerings. For instance, a trend towards decluttering and owning fewer possessions means consumers might delay or forgo buying new furniture.

Furthermore, the rise of services that extend product lifespans or offer alternatives to outright ownership presents a significant threat. Repair services can keep existing appliances running longer, while sharing economy models for furniture or tools reduce the necessity of purchasing these items outright. In 2024, the global market for home repair and maintenance services continued its upward trajectory, indicating a growing consumer willingness to invest in extending the life of their current possessions rather than replacing them.

- Minimalist Lifestyles: A growing segment of consumers prioritizes fewer possessions, directly reducing demand for new home furnishings.

- Experience Economy: Increased spending on travel and experiences over material goods can divert consumer budgets away from appliance and furniture purchases.

- Product Lifespan Extension: The popularity of repair services and DIY maintenance means consumers are less likely to replace functional but older items.

- Sharing Economy Models: Rental or sharing platforms for furniture and appliances offer a viable alternative to ownership, especially for temporary needs.

The threat of substitutes for Harvey Norman is substantial, driven by online retail, the refurbished market, rental services, and direct-to-consumer (D2C) sales by manufacturers. Consumers increasingly opt for convenience and value, easily accessing alternatives that bypass traditional brick-and-mortar stores.

Online-only retailers and marketplaces like Amazon offer vast product selections and competitive pricing, directly challenging Harvey Norman's market share. By 2024, Australian e-commerce sales were projected to near AUD 70 billion, a significant portion of which directly competes with Harvey Norman's product categories.

The growing demand for refurbished goods, fueled by sustainability and affordability concerns, presents another key substitute. The global refurbished electronics market, valued at approximately USD 57.1 billion in 2023, is expected to reach USD 125.1 billion by 2030, indicating a strong shift towards pre-owned items.

Furthermore, rental and leasing options for appliances and IT equipment provide alternatives to outright purchase, particularly for those seeking flexibility or avoiding large upfront costs. The Australian equipment rental market has shown consistent growth, reflecting this trend.

| Substitute Type | Key Characteristics | Impact on Harvey Norman | 2024 Relevance/Data |

| Online-Only Retailers | Price competitiveness, convenience, wide selection | Direct competition, potential market share erosion | Australian e-commerce sales projected near AUD 70 billion |

| Refurbished Market | Affordability, sustainability focus | Diverts price-sensitive customers, pressures pricing | Global refurbished electronics market: USD 57.1 billion (2023) to USD 125.1 billion (2030) |

| Rental/Leasing Services | Flexibility, lower upfront cost, access to newer technology | Reduces outright purchase demand for high-value items | Steady growth in Australian equipment rental market |

| Manufacturer D2C Sales | Direct customer relationship, potential for exclusive offers | Bypasses traditional retail channels, controls customer experience | Growth in manufacturer D2C channels reported in electronics sector |

Entrants Threaten

Launching a large-format retail operation akin to Harvey Norman demands significant upfront capital. This includes acquiring prime real estate, constructing expansive stores, stocking a vast array of goods, and establishing robust supply chain and logistics networks. For instance, the cost of developing a single hypermarket can run into tens of millions of dollars.

This substantial financial outlay acts as a formidable barrier, effectively deterring many potential new entrants who may not possess the requisite funding. Consequently, the threat of new competitors entering the physical retail segment remains relatively low due to these high initial investment requirements.

Harvey Norman, like many established retailers, leverages decades of brand recognition and customer loyalty. This makes it difficult for new entrants to gain traction.

Building brand awareness and trust requires significant investment. For instance, in the 2023 financial year, Harvey Norman invested approximately AUD 160 million in marketing and advertising, a figure new competitors would need to match or exceed to even begin to compete.

This established loyalty translates into repeat business and a reduced need for constant customer acquisition efforts, a hurdle new players must overcome with substantial upfront costs and a long-term strategy.

Existing large retailers like Harvey Norman leverage significant economies of scale in purchasing, marketing, and distribution, giving them a substantial cost advantage. For instance, in 2024, major retailers often negotiate bulk discounts that smaller competitors simply cannot access, impacting their ability to compete on price. This established infrastructure and supplier network creates a formidable barrier for newcomers.

Regulatory and Compliance Hurdles

The retail landscape in Australia presents significant regulatory and compliance challenges for prospective new entrants. These include navigating stringent consumer protection laws, managing import duties on goods, and adhering to evolving environmental standards. For instance, the Australian Competition and Consumer Commission (ACCC) actively enforces consumer guarantees, requiring substantial investment in compliance infrastructure and training.

These complexities translate into considerable time and financial outlays for new businesses seeking to establish a foothold. Successfully meeting these requirements can add a substantial layer of difficulty and cost to market entry, acting as a deterrent.

- Consumer Protection Laws: New entrants must comply with the Australian Consumer Law, ensuring fair trading practices and product safety.

- Import Duties and Tariffs: Navigating customs regulations and paying applicable duties can significantly impact the cost of goods for retailers.

- Environmental Regulations: Compliance with waste management, packaging, and carbon emission standards adds operational complexity and cost.

- Licensing and Permits: Obtaining necessary business licenses and permits can be a bureaucratic and time-consuming process.

Market Saturation and Intense Existing Competition

The Australian retail landscape for household goods and electronics is already a crowded space, with many segments reaching maturity. This high level of market saturation presents a significant barrier for any new companies looking to enter. They would need to find a way to steal customers from well-established brands like Harvey Norman, which is often achieved through radical innovation or sharp price reductions, both carrying substantial risk.

For instance, in 2024, the Australian retail sector continued to experience strong competition, with major players like Harvey Norman, JB Hi-Fi, and The Good Guys vying for consumer spending. New entrants would face immediate pressure to differentiate themselves, potentially through niche offerings or aggressive promotional strategies. Companies like Kogan.com have demonstrated that online-first models can disrupt traditional retail, but the capital investment and brand building required remain considerable hurdles.

- Market Saturation: The Australian market for electronics and home appliances is well-served by numerous established retailers.

- Intense Competition: New entrants must contend with significant brand loyalty and existing market share held by incumbents.

- High Barrier to Entry: Disruptive innovation or aggressive pricing is often necessary for new players to gain traction, increasing risk.

- Established Player Strength: Retailers like Harvey Norman have extensive store networks and strong supply chain relationships, making it difficult for newcomers to compete on scale and efficiency.

The threat of new entrants for Harvey Norman is generally low due to significant barriers. High capital requirements for physical stores, extensive inventory, and supply chain development demand substantial investment, often in the tens of millions of dollars per hypermarket. Furthermore, established brands benefit from decades of customer loyalty and brand recognition, requiring new players to spend heavily on marketing, potentially mirroring Harvey Norman's AUD 160 million marketing investment in FY23, to gain any market share.

Economies of scale enjoyed by incumbents like Harvey Norman, giving them purchasing and distribution advantages, also deter new entrants. Navigating complex Australian regulations, including consumer protection laws and import duties, adds further cost and time. The market for electronics and home goods is already saturated, meaning newcomers must differentiate through innovation or aggressive pricing, which carries significant risk.

| Barrier Type | Description | Example/Data Point |

|---|---|---|

| Capital Requirements | High upfront investment for physical retail operations. | Tens of millions of dollars to develop a single hypermarket. |

| Brand Loyalty & Recognition | Established customer trust and preference. | Harvey Norman's FY23 marketing spend of AUD 160 million to maintain brand presence. |

| Economies of Scale | Cost advantages from large-scale operations. | Negotiating bulk discounts unavailable to smaller competitors. |

| Regulatory Hurdles | Compliance with consumer laws, import duties, environmental standards. | Adherence to Australian Consumer Law enforced by the ACCC. |

| Market Saturation | Crowded market with established players. | Intense competition from retailers like JB Hi-Fi and The Good Guys. |

Porter's Five Forces Analysis Data Sources

Our Harvey Norman Porter's Five Forces analysis is built upon a foundation of robust data, drawing from the company's annual reports, investor presentations, and publicly available financial statements. We supplement this with insights from reputable industry analysis firms and market research reports to capture a comprehensive view of the retail landscape.