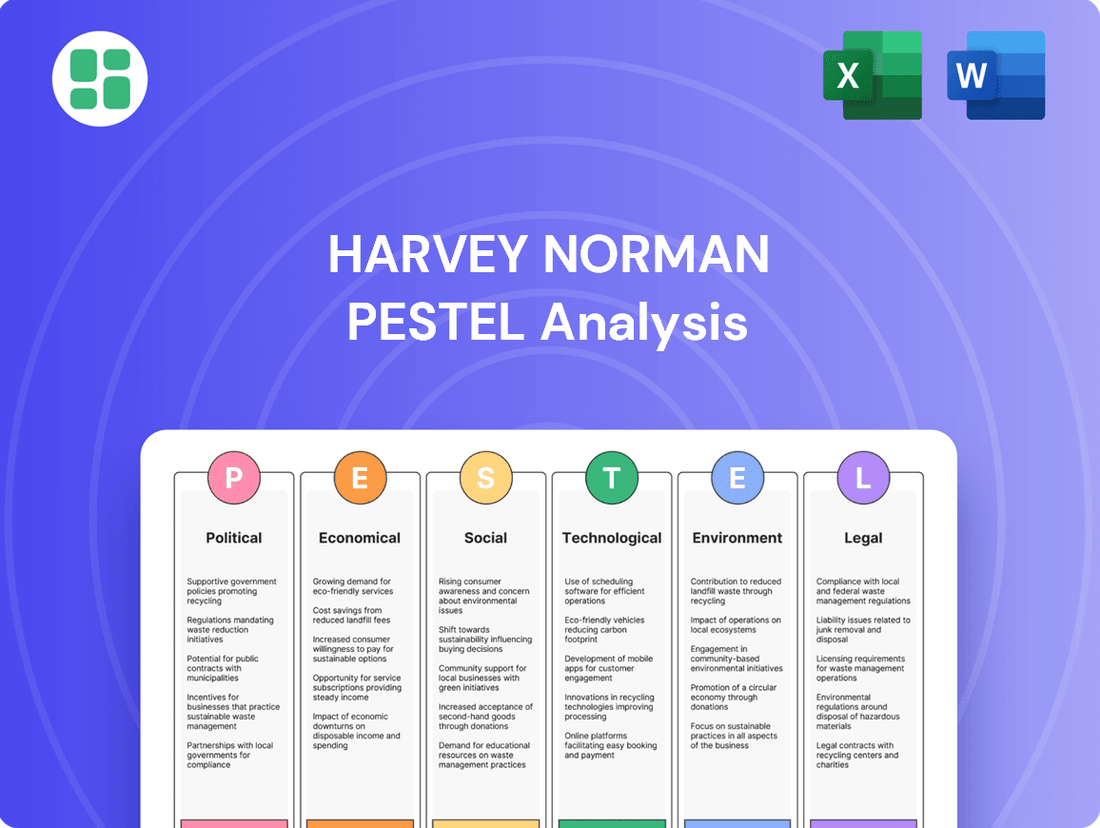

Harvey Norman PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Harvey Norman Bundle

Discover the intricate web of political, economic, social, technological, legal, and environmental factors shaping Harvey Norman's trajectory. Our meticulously researched PESTLE analysis offers a strategic roadmap, highlighting opportunities and potential challenges. Equip yourself with the knowledge to anticipate market shifts and make informed decisions. Download the full version now for actionable intelligence.

Political factors

Government policies, including shifts in taxation and import duties, directly influence Harvey Norman's operational expenses and competitive positioning. For instance, changes to GST or tariffs on imported electronics and appliances can significantly alter product pricing and profitability.

Retailers like Harvey Norman operate under the Australian Consumer Law (ACL), which mandates fair trading and robust consumer protection. Recent updates, such as those strengthening protections against unfair contract terms, require ongoing compliance efforts and can impact sales agreements and return policies.

The Australian Retailers Association (ARA), representing businesses including Harvey Norman, advocates for favorable policies. In 2024, the ARA has been particularly focused on addressing rising retail crime rates, which cost the sector an estimated $1.16 billion in 2022-2023, and enhancing cybersecurity measures to protect both businesses and consumers.

Harvey Norman's operations span Australia, New Zealand, Europe, and Asia, making political stability in these regions crucial. For instance, the Australian federal government's fiscal policies and consumer protection laws directly shape the retail landscape. Fluctuations in political stability, such as upcoming elections or shifts in government, can create uncertainty, impacting consumer spending and Harvey Norman's strategic investment decisions in 2024 and 2025.

Trade relations are particularly impactful given Harvey Norman's reliance on imported goods. Australia's participation in trade agreements, like the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), influences tariffs and import costs. Changes in these agreements or the emergence of new trade disputes in 2024-2025 could affect the pricing of electronics, furniture, and appliances, directly hitting Harvey Norman's margins and competitiveness.

Geopolitical events also pose risks to supply chain continuity. For example, disruptions in major manufacturing hubs in Asia due to political instability or international conflicts can lead to stock shortages and increased logistics expenses for Harvey Norman. The company must navigate these global political currents to ensure a steady flow of products and manage associated costs effectively throughout 2024 and into 2025.

Ongoing reforms to Australia's Consumer Law in 2025, focusing on unfair trading practices, will directly influence how Harvey Norman manages customer interactions, particularly concerning pricing transparency, subscription models, and after-sales service, potentially increasing compliance burdens.

The Australian Competition and Consumer Commission (ACCC) is intensifying its focus on misleading claims, including those related to environmental and sustainability marketing, a trend that necessitates retailers like Harvey Norman to rigorously verify and accurately communicate product attributes to avoid penalties, impacting their marketing strategies.

Industry Advocacy and Lobbying

Industry advocacy groups, such as the Australian Retailers Association (ARA), are actively lobbying the government on key issues impacting retailers. These efforts focus on mitigating rising business costs, addressing labor shortages, and bolstering cybersecurity measures. For instance, in early 2024, the ARA continued to advocate for reforms to industrial relations laws, aiming to provide greater flexibility for businesses.

Harvey Norman, as a prominent player in the Australian retail landscape, is directly influenced by the success of these lobbying efforts. Changes in trading hour regulations or government investment in infrastructure, like improved logistics networks, can significantly affect its operational efficiency and profitability. The retail sector's collective voice, amplified by associations like the ARA, plays a crucial role in shaping the regulatory environment that Harvey Norman operates within.

Key areas of advocacy include:

- Policy influence on business operating costs: Lobbying for measures to reduce energy prices and other overheads.

- Addressing labor market challenges: Advocating for policies that ease recruitment and retention in the retail sector.

- Enhancing cybersecurity frameworks: Pushing for government support and regulations to protect businesses from cyber threats.

Foreign Investment and Expansion Policies

Harvey Norman's international footprint, including operations in Malaysia and New Zealand, is directly shaped by each nation's foreign investment regulations. These policies dictate the ease and cost of establishing and expanding its retail presence, influencing market entry strategies and the timeline for new store rollouts.

Changes in foreign investment rules or prolonged approval processes can significantly affect Harvey Norman's expansion plans and overall investment costs in key overseas markets. For instance, navigating the regulatory landscape in countries like the UK requires careful attention to local investment incentives and restrictions.

- Regulatory Approvals: Harvey Norman's expansion into markets like Malaysia and New Zealand requires adherence to local foreign investment laws, impacting the speed of new store openings.

- Policy Impact: Shifts in foreign investment policies can alter the financial viability and strategic timelines for Harvey Norman's international growth initiatives.

- Market Penetration: The pace at which Harvey Norman can penetrate new markets is often a direct reflection of the receptiveness and clarity of the host country's investment framework.

Government policies significantly impact Harvey Norman's cost structure and market competitiveness through taxation and import duties, with changes to GST or tariffs directly affecting product pricing and profitability in 2024-2025.

Consumer protection laws, such as Australia's ACL, mandate fair trading practices, requiring ongoing compliance with updates like those strengthening protections against unfair contract terms in 2025.

Industry advocacy, like the ARA's focus on retail crime costing $1.16 billion in 2022-2023 and cybersecurity, influences government policy to mitigate business costs and enhance protection.

Geopolitical stability and trade relations, including Australia's CPTPP participation, directly affect Harvey Norman's supply chain and product pricing, with potential trade disputes in 2024-2025 posing risks.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting Harvey Norman, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear understanding of Harvey Norman's external environment to inform strategic decisions.

Economic factors

Consumer spending is the lifeblood of Harvey Norman, especially for big-ticket items like furniture and appliances. In 2024, a more cautious consumer environment, influenced by persistent inflation, has tempered discretionary spending. However, forecasts for late 2024 and into 2025 suggest a potential uplift as inflation eases and interest rates are expected to decline, which could boost consumer confidence and spending power.

Higher interest rates and persistent inflation have significantly dampened consumer confidence and spending on non-essential items throughout 2024. This trend directly affects Harvey Norman's sales, particularly for big-ticket items like furniture and electronics. For instance, the Australian Bureau of Statistics reported that retail sales volumes contracted by 0.4% in the March quarter of 2024, reflecting this consumer caution.

While the Reserve Bank of Australia (RBA) initiated interest rate cuts in early 2025, with further reductions anticipated, the lingering effects on household budgets remain a key consideration. These cuts, though welcome, are unlikely to immediately reverse the impact of sustained higher borrowing costs experienced over the previous year, continuing to shape consumer purchasing decisions and Harvey Norman's revenue streams.

A robust Australian economy, marked by healthy GDP growth and low unemployment, directly fuels consumer spending, a critical driver for retailers like Harvey Norman. For instance, Australia's GDP growth was projected to be around 1.8% in 2024 and a similar modest pace in 2025, suggesting a stable, albeit not booming, retail environment.

Low unemployment rates, a positive indicator of economic health, empower consumers with disposable income. Australia's unemployment rate hovered around 4.0% in late 2024, a historically low figure that typically supports strong consumer confidence and spending on discretionary items, benefiting Harvey Norman's diverse product offerings.

Exchange Rate Fluctuations

For Harvey Norman, a major importer of goods, exchange rate fluctuations are a critical economic factor. A depreciating Australian dollar, as seen at various points in 2024 and projected into 2025, directly increases the cost of sourcing inventory from overseas. This can squeeze profit margins if these higher costs cannot be fully passed on to consumers.

For instance, if the Australian dollar weakens against the US dollar by 5%, the cost of goods imported from the US effectively rises by that same percentage. This necessitates careful financial management and potentially hedging strategies to mitigate the impact on the company's cost of goods sold and overall profitability.

- Impact on Cost of Goods Sold: A weaker AUD makes imported products more expensive for Harvey Norman.

- Profit Margin Pressure: Increased sourcing costs can reduce profit margins if not offset by price increases or cost efficiencies.

- Consumer Price Adjustments: Retailers may need to raise prices, potentially impacting sales volume.

- 2024/2025 Outlook: Ongoing global economic uncertainty suggests continued volatility in exchange rates, requiring proactive risk management.

Housing Market Trends

The health of the housing market is a significant driver for Harvey Norman's core business. A strong housing market, characterized by increased new home constructions and renovations, directly translates into higher demand for furniture, bedding, and home appliances. For instance, in Australia, new dwelling commencements, a key indicator of housing market activity, saw a notable decline in late 2023 and early 2024, with ABS data indicating a significant drop in project commencements compared to the previous year. This trend suggests a potential headwind for Harvey Norman's sales in these categories.

Conversely, a downturn in housing construction or a slowdown in renovation activity can dampen consumer spending on home goods. The Australian Bureau of Statistics reported that the value of new housing finance commitments for investors and owner-occupiers experienced fluctuations throughout 2023 and into 2024, reflecting broader economic conditions impacting the property sector. This volatility underscores the sensitivity of Harvey Norman's sales performance to the cyclical nature of the housing market.

Harvey Norman's performance is therefore closely tied to the following housing market dynamics:

- New Home Construction Rates: Higher rates of new home building directly correlate with increased demand for furnishing and appliances.

- Renovation Activity: Increased spending on home improvements and renovations also drives sales of Harvey Norman's product range.

- Consumer Confidence in Housing: Positive sentiment and investment in the housing market generally boost consumer willingness to spend on home upgrades.

- Interest Rate Environment: Mortgage rates influence housing affordability and, consequently, the pace of new builds and renovations.

The Australian economy in 2024 and 2025 is characterized by easing inflation and anticipated interest rate cuts by the Reserve Bank of Australia. While 2024 saw cautious consumer spending due to higher borrowing costs, projections for late 2024 and 2025 indicate a potential recovery driven by improved consumer confidence and increased disposable income. A stable GDP growth of around 1.8% in 2024 and historically low unemployment rates around 4.0% in late 2024 provide a supportive, albeit moderate, economic backdrop for retailers like Harvey Norman.

| Economic Factor | 2024 Data/Outlook | 2025 Outlook | Impact on Harvey Norman |

|---|---|---|---|

| Inflation | Persistent, but easing | Expected to continue easing | Reduces consumer discretionary spending power; potential for cost increases |

| Interest Rates | High, with cuts anticipated | Expected to decline | Lower borrowing costs could boost consumer confidence and spending; reduced mortgage burden |

| GDP Growth | Projected ~1.8% | Similar modest pace | Indicates a stable, but not booming, retail environment |

| Unemployment Rate | Around 4.0% (late 2024) | Expected to remain low | Supports consumer confidence and spending on discretionary items |

| Exchange Rate (AUD) | Volatile, some depreciation | Continued volatility likely | Increases cost of imported goods, potentially squeezing profit margins |

Preview the Actual Deliverable

Harvey Norman PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Harvey Norman PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to this insightful report to inform your strategic decisions.

Sociological factors

Modern consumers are increasingly seeking a blend of value, experience, and convenience, driving the popularity of hybrid shopping models. This means integrating online and physical store interactions smoothly. For instance, in 2024, a significant portion of retail sales in Australia, Harvey Norman's primary market, occurred online, highlighting the need for robust e-commerce capabilities alongside engaging in-store experiences.

Harvey Norman must tailor its product assortments and store layouts to align with these shifting consumer desires. This includes offering personalized promotions and ensuring efficient, reliable delivery services, which have become critical differentiators. Reports from late 2024 indicated that customer satisfaction with delivery speed significantly impacts repeat purchasing behavior across the retail sector.

Generational differences significantly shape consumer behavior. For example, in 2024, Gen Z's spending is heavily influenced by social media trends, particularly in fashion and electronics, while older demographics like Baby Boomers continue to prioritize home improvement and lifestyle goods. Harvey Norman needs to recognize these distinct preferences to effectively target its diverse customer base.

This divergence is evident in spending patterns. Reports from early 2025 indicate that while younger consumers are driving growth in online retail for apparel, established households are still investing substantially in furniture, appliances, and outdoor living products, areas where Harvey Norman has a strong presence. Tailoring product ranges and marketing messages to resonate with these generational priorities is key to sustained market share.

Ongoing urbanization continues to reshape consumer behavior and the demand for physical retail spaces. Harvey Norman's strategy of establishing large format flagship stores in accessible locations, such as its recent expansion into East Zagreb, Croatia, directly responds to these demographic shifts. This approach aims to capture market share in densely populated urban and suburban areas where consumer access and convenience are paramount.

Health and Wellness Trends

While not a core business driver for Harvey Norman, the pervasive societal focus on health and wellness can subtly shape consumer purchasing habits. This trend might translate into increased demand for products like ergonomic office furniture, designed to promote better posture and reduce strain, or kitchen appliances that facilitate healthier meal preparation, such as air fryers or advanced blenders. For instance, the global health and wellness market was valued at approximately USD 4.9 trillion in 2023 and is projected to grow, indicating a significant underlying consumer interest that could indirectly impact sales of relevant Harvey Norman categories.

Harvey Norman can leverage these broader societal shifts by highlighting product features that align with health-conscious lifestyles. This could involve marketing efforts that emphasize the ergonomic benefits of their furniture ranges or the health advantages of using specific kitchen appliances. Observing consumer behavior in 2024 and 2025 will be key to identifying which health-related product categories are gaining traction and how to best integrate them into their sales strategies.

- Growing demand for home fitness equipment, with the global market expected to reach over USD 20 billion by 2027, suggests consumers are investing in at-home wellness solutions.

- Increased interest in smart home devices that monitor health metrics or optimize living environments, reflecting a desire for integrated wellness.

- A rise in conscious consumerism, where shoppers increasingly favor brands and products perceived as contributing to a healthier lifestyle or environment.

Sustainability Consciousness and Ethical Consumption

Consumers, especially younger demographics like Gen Z and Millennials, are increasingly prioritizing brands that demonstrate a genuine commitment to environmental and social responsibility. This shift means retailers such as Harvey Norman face mounting pressure to showcase tangible actions in areas like waste reduction, the adoption of renewable energy sources, and the ethical sourcing of their product ranges. For instance, a 2024 report indicated that over 60% of consumers consider a company's sustainability practices when making purchasing decisions.

This heightened awareness translates into a demand for transparency and accountability. Harvey Norman, like its competitors, needs to clearly communicate its sustainability initiatives, whether through eco-friendly packaging, energy-efficient store operations, or partnerships with suppliers who adhere to ethical labor standards. Failing to do so risks alienating a significant and growing segment of the market.

- Growing Consumer Demand: In 2024, surveys revealed that 68% of consumers actively seek out sustainable brands.

- Focus on Transparency: Consumers expect detailed information on supply chains and environmental impact.

- Brand Reputation Impact: Companies with strong sustainability credentials often enjoy higher customer loyalty and a more positive public image.

Societal values are shifting, with consumers increasingly prioritizing experiences over possessions and seeking brands that align with their personal values. This means Harvey Norman needs to focus on creating engaging in-store experiences and demonstrating corporate social responsibility. Reports from early 2025 show a growing consumer preference for retailers that actively contribute to community well-being.

Generational cohorts exhibit distinct purchasing behaviors and preferences, necessitating tailored marketing strategies. For example, in 2024, Gen Z's purchasing decisions are heavily influenced by social media trends, while older generations may prioritize brand loyalty and established product quality. Harvey Norman must adapt its product offerings and communication channels to effectively reach these diverse groups.

The increasing emphasis on health and wellness is subtly influencing consumer choices across various product categories. This trend may lead to higher demand for ergonomic furniture and appliances that support healthier lifestyles. Data from 2024 indicates a notable uptick in consumer interest in home fitness equipment, a segment Harvey Norman could capitalize on.

Technological factors

Harvey Norman's investment in e-commerce and omnichannel capabilities is crucial given the sector's robust growth. In the fiscal year 2023, the company reported a significant portion of its sales originating from online channels, reflecting customer shifts towards digital purchasing. This trend is expected to continue, with global e-commerce sales projected to reach over $7 trillion by 2025, underscoring the need for seamless integration between Harvey Norman's online presence and its extensive network of physical stores to enhance customer convenience and drive sales.

Harvey Norman is well-positioned to benefit from the growing consumer interest in AI-powered devices. Sales in smart home appliances and AI-enabled televisions are expected to see continued growth. For instance, the global smart home market was valued at approximately $84.1 billion in 2023 and is projected to reach $311.9 billion by 2030, demonstrating a strong compound annual growth rate (CAGR) of 20.7%.

The company's strategy to enhance its AI foothold directly addresses this trend, aiming to capture a larger share of this expanding market. This includes offering a wider range of AI-integrated products and educating consumers on their benefits, particularly in categories like computing and home entertainment where AI capabilities are increasingly becoming a key selling point.

Advanced digital marketing and hyper-personalization, powered by AI and data analytics, are increasingly vital for engaging customers and boosting sales. For instance, in 2024, e-commerce personalization strategies have shown significant impact, with studies indicating that personalized recommendations can increase conversion rates by up to 10-15%.

Harvey Norman can harness these technologies to deliver customized promotions and product suggestions, thereby improving the overall customer journey. By analyzing customer data, they can anticipate needs and offer relevant solutions, a strategy that saw significant adoption in the retail sector throughout 2024.

Supply Chain Technology and Logistics

Technological advancements are reshaping Harvey Norman's supply chain, with automated inventory forecasting and the rise of hyper-local fulfillment centers becoming key drivers for efficiency. These innovations are essential for meeting escalating consumer demands for speedier deliveries. For instance, in 2024, the global supply chain management market was valued at over $25 billion, with a significant portion attributed to technology adoption, and is projected to grow substantially through 2030.

Streamlining logistics through technology directly impacts cost reduction and elevates customer satisfaction. Companies are increasingly investing in AI-powered route optimization and real-time tracking systems. By mid-2025, it's anticipated that over 70% of major retailers will have implemented advanced analytics for supply chain visibility, aiming to cut operational expenses by up to 15%.

- AI-driven inventory management: Enhances accuracy and reduces stockouts, leading to better capital utilization.

- Automation in warehousing: Robotics and automated guided vehicles (AGVs) speed up order picking and packing processes.

- Real-time visibility platforms: Provide end-to-end tracking, improving responsiveness to disruptions.

- Last-mile delivery optimization: Utilizes data analytics to ensure faster and more cost-effective deliveries to customers.

Cybersecurity and Data Privacy

As Harvey Norman’s digital footprint expands, cybersecurity and data privacy are critical. The company needs to bolster its defenses to safeguard sensitive customer information, especially with stricter regulations like GDPR and similar frameworks globally. For instance, in 2023, the average cost of a data breach reached $4.45 million, highlighting the significant financial and reputational risks involved.

Harvey Norman’s commitment to robust security measures is essential for maintaining customer trust and compliance. This includes investing in advanced encryption, regular security audits, and employee training to prevent breaches. The increasing sophistication of cyber threats means continuous adaptation and investment are non-negotiable for protecting customer data.

- Increased Digital Transactions: Harvey Norman processes a vast amount of customer data through its online platforms, making it a target for cyberattacks.

- Regulatory Scrutiny: Global data protection laws are becoming more stringent, with significant penalties for non-compliance, impacting businesses like Harvey Norman.

- Customer Trust: A data breach can severely damage customer loyalty and brand reputation, directly affecting sales and market share.

- Investment in Security: Proactive investment in cybersecurity infrastructure and protocols is necessary to mitigate risks and ensure business continuity.

Harvey Norman's strategic focus on e-commerce and omnichannel integration is paramount, with online sales a significant contributor to its fiscal year 2023 performance. This aligns with the global e-commerce market's projected growth to over $7 trillion by 2025, emphasizing the need for seamless digital and physical store experiences.

The company's embrace of AI-powered devices taps into a rapidly expanding market, with smart home and AI TV sales showing strong upward trends. The global smart home market, valued at $84.1 billion in 2023, is expected to surge to $311.9 billion by 2030, reflecting a robust 20.7% CAGR.

Leveraging AI for advanced digital marketing and personalization is key to enhancing customer engagement, as personalized recommendations can boost conversion rates by 10-15% in 2024. Harvey Norman's data analytics capabilities allow for tailored promotions and anticipatory customer service.

Technological advancements are also revolutionizing Harvey Norman's supply chain, with AI-driven inventory and hyper-local fulfillment crucial for meeting delivery speed expectations. The global supply chain management market, valued over $25 billion in 2024, sees substantial tech investment, with over 70% of major retailers expected to adopt advanced analytics for supply chain visibility by mid-2025.

Legal factors

Harvey Norman operates under the stringent Australian Consumer Law (ACL), which mandates consumer guarantees for product quality, suitability for intended use, and clear remedies for defective items. Failure to comply can result in significant penalties, with the Australian Competition and Consumer Commission (ACCC) actively enforcing these regulations.

Looking ahead, proposed legislative changes in 2025 are set to further bolster consumer protections, potentially increasing penalties for breaches and expanding the scope of remedies available to consumers for faulty goods purchased from retailers like Harvey Norman.

Harvey Norman, as a major player in the Australian retail landscape, must navigate stringent competition laws designed to foster a fair marketplace. These regulations are crucial for preventing monopolistic practices and ensuring a level playing field for all businesses.

The Australian Competition and Consumer Commission (ACCC) plays a vital role in overseeing the retail sector. For instance, in 2023, the ACCC continued its focus on potential abuses of market power, including investigations into pricing strategies by large retailers, which could impact Harvey Norman's operational framework.

Harvey Norman must navigate a complex web of employment laws, from minimum wage requirements to stringent workplace safety standards. These regulations directly influence operational costs and the effectiveness of their human resource strategies. For instance, the Fair Work Commission's annual wage review in 2024 is a key factor influencing labor expenses across the retail sector.

Industrial relations also play a significant role. Discussions and potential policy shifts regarding flexible work arrangements, as advocated by industry bodies like the Australian Retailers Association, could impact Harvey Norman's staffing models and employee agreements. Staying abreast of these evolving labor landscapes is crucial for maintaining compliance and operational efficiency.

Data Privacy and Cybersecurity Regulations

Harvey Norman operates under Australia's Privacy Act, which dictates the collection, storage, and usage of customer data. This means the company must be meticulous about how it handles personal information. For instance, in 2023, the Australian government proposed significant reforms to the Privacy Act, aiming to strengthen data breach notification requirements and increase penalties for non-compliance, signaling a more stringent regulatory environment.

Looking ahead to 2024 and 2025, Harvey Norman will likely face evolving cybersecurity regulations and increased enforcement. This necessitates ongoing investment in robust data protection measures. Failure to adapt could lead to substantial fines and damage to its brand reputation. For example, the Notifiable Data Breaches scheme, introduced in 2018, has already seen an increase in reported breaches, highlighting the growing importance of proactive cybersecurity.

- Stricter data privacy laws like Australia's Privacy Act govern customer data handling.

- Anticipated amendments in 2024/2025 will likely increase enforcement and require enhanced data protection.

- Significant penalties and reputational damage are risks associated with non-compliance and cybersecurity failures.

Product Safety Standards and Compliance

Harvey Norman must ensure its diverse product range, particularly electronics and appliances, adheres to rigorous safety regulations. For instance, in Australia, the Australian Competition and Consumer Commission (ACCC) enforces mandatory standards for various product categories, including those sold by Harvey Norman. Failure to meet these standards, such as those related to electrical safety or flammability, can result in severe penalties.

Non-compliance carries significant risks, including costly product recalls, substantial fines, and irreparable damage to Harvey Norman's brand image. In 2023, the ACCC recalled millions of products due to safety concerns, highlighting the pervasive nature of these issues across the retail sector. Staying ahead of evolving safety legislation is crucial for mitigating these operational and reputational hazards.

- Compliance with Australian Consumer Law (ACL): Ensures all products meet safety and quality guarantees.

- International Standards: Adherence to standards like CE marking for electronics sold in relevant markets.

- Recall Management: Efficient processes to handle product recalls, minimizing consumer risk and brand impact.

- Supplier Audits: Regular checks on suppliers to verify their adherence to safety and manufacturing standards.

Harvey Norman must navigate Australia's robust consumer protection laws, including the Australian Consumer Law, which mandates product safety and guarantees, with the ACCC actively enforcing compliance. Proposed legislative updates for 2024/2025 are expected to enhance consumer remedies and potentially increase penalties for breaches, requiring retailers like Harvey Norman to maintain stringent adherence to product quality and safety standards.

Environmental factors

Harvey Norman is actively pursuing sustainability, notably through the installation of solar power systems across its stores and distribution centers. This strategic move is designed to significantly lower its carbon footprint, reflecting a growing emphasis on environmental responsibility.

In 2023, Harvey Norman reported a reduction in its Scope 1 and 2 greenhouse gas emissions by 7.8% compared to its 2022 baseline, a testament to its ongoing efforts in renewable energy adoption and energy efficiency measures.

This commitment to sustainability is crucial for meeting evolving consumer preferences and increasingly stringent environmental regulations, positioning Harvey Norman favorably in a market that values eco-conscious business practices.

Harvey Norman champions robust waste reduction and recycling programs, actively managing materials such as cardboard, plastics, and electronic waste. This commitment aligns with growing environmental consciousness and regulatory pressures.

Through initiatives like the 'TechCollect' program, the company facilitates customer participation in responsible electronics disposal. In 2023, Australia's e-waste recycling rates saw an increase, highlighting the societal shift towards circular economy principles that Harvey Norman actively supports.

Harvey Norman, like many retailers, is increasingly focused on packaging sustainability. Initiatives such as the Australian Packaging Covenant, which aims to reduce packaging waste and increase recycling rates, are crucial. By adopting more eco-friendly packaging solutions, Harvey Norman can lower its environmental footprint and align with growing consumer demand for responsible business practices.

Energy Efficiency and Resource Management

Harvey Norman's commitment to energy efficiency, like adopting LED lighting across its retail and distribution centers, directly impacts operational expenses by lowering electricity bills. This focus on resource management is crucial for a large-scale retailer aiming to minimize its environmental footprint.

Efficient resource management is not just about cost savings; it's a core component of environmental stewardship for major retail chains. For instance, optimizing logistics and reducing waste in packaging can significantly lessen environmental impact.

- Energy Consumption Reduction: Implementing LED lighting in stores and warehouses can reduce energy consumption by up to 80% compared to traditional lighting.

- Operational Cost Savings: Lower energy usage translates directly into reduced utility expenses, boosting profitability.

- Waste Management: Retailers are increasingly focusing on reducing packaging waste and improving recycling rates, with some aiming for zero-waste-to-landfill targets by 2025.

- Supply Chain Efficiency: Optimizing transportation routes and using more fuel-efficient vehicles can cut emissions and operational costs.

Consumer Demand for Eco-Friendly Products

Consumer demand for eco-friendly products is a significant environmental factor influencing retailers like Harvey Norman. A growing segment of consumers, especially younger demographics like Gen Z, actively seeks out brands that demonstrate a commitment to sustainability and ethical sourcing. This preference translates directly into purchasing decisions, with many willing to pay a premium for products that align with their environmental values.

Harvey Norman can capitalize on this trend by strategically expanding its product offerings to include more sustainable and ethically produced items. This involves sourcing from suppliers with strong environmental credentials and clearly communicating these benefits to consumers. For instance, a report from Deloitte in early 2024 indicated that over 70% of consumers consider sustainability when making purchases, a figure that has steadily increased over the past few years.

- Growing Gen Z preference: This demographic, born between the mid-1990s and early 2010s, shows a pronounced inclination towards sustainable consumption.

- Ethical sourcing demand: Consumers are increasingly scrutinizing supply chains for fair labor practices and responsible material sourcing.

- Market opportunity: Expanding the range of eco-friendly products presents a clear avenue for Harvey Norman to attract and retain environmentally conscious customers.

- Brand differentiation: A strong commitment to sustainability can serve as a key differentiator in a competitive retail landscape.

Harvey Norman's environmental strategy focuses on reducing its carbon footprint through renewable energy adoption and energy efficiency. The company reported a 7.8% reduction in Scope 1 and 2 greenhouse gas emissions in 2023 compared to 2022, driven by initiatives like solar power installations and LED lighting upgrades. These efforts not only address regulatory pressures but also cater to the growing consumer demand for sustainable business practices.

The retailer actively manages waste, particularly e-waste, through programs like TechCollect, aligning with Australia's increasing e-waste recycling rates. Packaging sustainability is also a priority, with efforts to reduce waste and increase recycling in line with initiatives like the Australian Packaging Covenant. These actions reflect a commitment to environmental stewardship and responsible resource management.

| Environmental Initiative | Impact | Data Point |

|---|---|---|

| Solar Power Systems | Reduced carbon footprint, lower energy costs | Installation across stores and distribution centers |

| Energy Efficiency (LED Lighting) | Reduced energy consumption, operational cost savings | Up to 80% reduction in lighting energy use |

| Waste Reduction & Recycling | Minimizes landfill, promotes circular economy | Active management of cardboard, plastics, and e-waste |

| Greenhouse Gas Emissions | Demonstrates commitment to sustainability | 7.8% reduction in Scope 1 & 2 emissions (2023 vs. 2022) |

PESTLE Analysis Data Sources

Our Harvey Norman PESTLE Analysis is meticulously crafted using data from reputable retail industry reports, Australian Bureau of Statistics economic data, and government policy updates. We also incorporate insights from technology trend forecasts and consumer sentiment surveys to ensure a comprehensive understanding of the macro-environment.