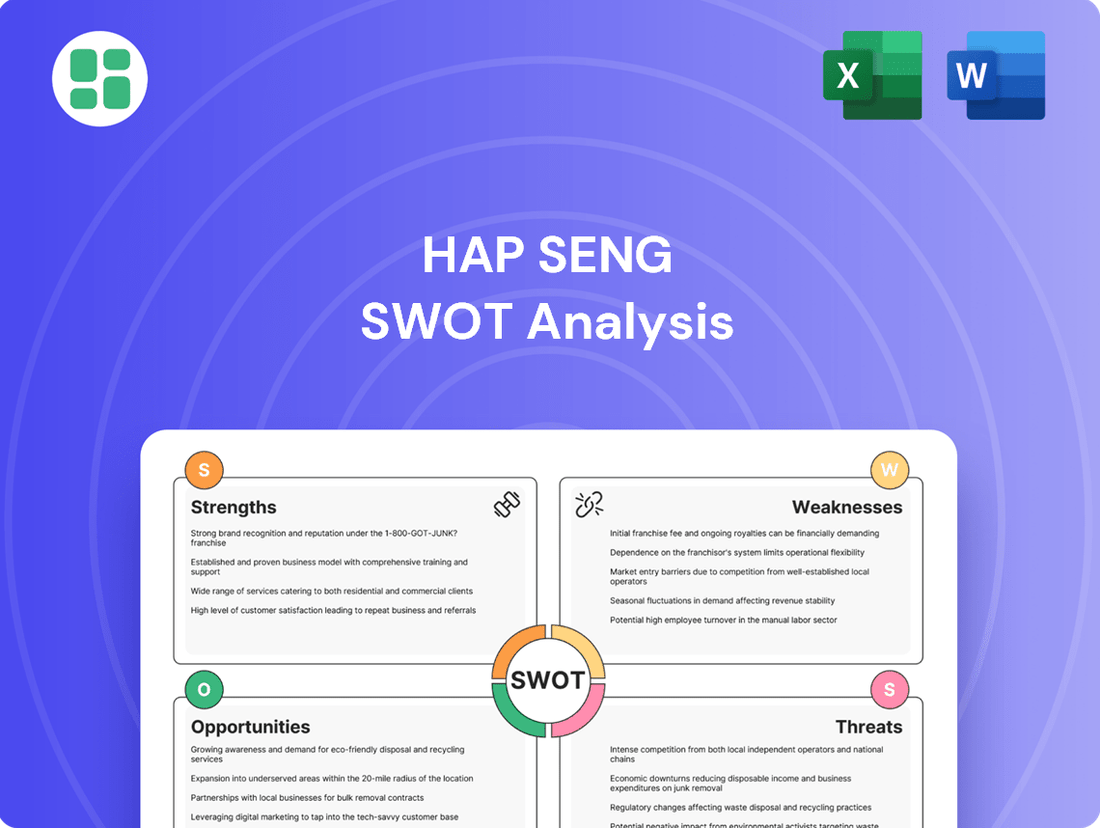

HAP Seng SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HAP Seng Bundle

Hap Seng's diversified business model presents significant strengths, but also exposes it to market volatility. Understanding its unique opportunities and potential threats is crucial for strategic decision-making.

Want the full story behind Hap Seng's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hap Seng Consolidated Berhad's strength lies in its remarkably diversified business portfolio. This includes significant operations in plantations, property development, credit financing, automotive sales, building materials, and trading.

This broad operational base acts as a powerful buffer against sector-specific downturns. For instance, even if one segment faces challenges, the resilience of others can maintain overall financial stability. In FY2024, this diversification proved beneficial, with the plantation, property, and building materials divisions showing robust performance, effectively offsetting weaker results in other areas and contributing positively to the group's revenue.

Hap Seng's plantation division experienced a strong FY2024, with revenue climbing due to higher average selling prices for palm products and an increase in sales volume. This segment’s resilience is a key strength, especially in a fluctuating commodity market.

The property segment also showcased impressive growth in FY2024, largely driven by strategic land sales. This demonstrates effective asset management and a keen ability to capitalize on market opportunities within the real estate sector.

Furthermore, the building materials division contributed positively with increased revenue in FY2024. This consistent performance across multiple core business areas highlights Hap Seng's diversified operational strengths and its capacity to generate value even when facing broader economic headwinds.

Hap Seng has cultivated a robust market presence, particularly within Malaysia, across its diverse business segments. This deep-rooted establishment, combined with a history of operations, has fostered substantial brand recognition and customer loyalty. For example, Hap Seng Credit operates a network of 10 branches throughout Malaysia, underscoring its accessibility and reach within the financial sector.

Prudent Financial Management

Hap Seng's credit financing division exemplifies prudent financial management through its conservative approach to loan approvals. This strategy helps mitigate risks associated with sectoral uncertainties, bolstering the company's overall financial stability.

The company's commitment to a prudent lending policy is a key strength. For instance, in the first half of 2024, Hap Seng reported a stable credit portfolio, with non-performing loans remaining at a manageable level, underscoring the effectiveness of its risk management practices.

- Conservative Lending: Maintains a cautious stance on new loan disbursements.

- Risk Mitigation: Actively works to reduce exposure to sectoral risks.

- Financial Stability: Prudent policies contribute to a robust financial position.

- Portfolio Health: Evidence from H1 2024 shows sustained low non-performing loan ratios.

Commitment to Sustainability and Operational Excellence

Hap Seng's dedication to sustainability and operational excellence is a significant strength, particularly evident in its plantations division. This commitment is underscored by its achievement of Roundtable on Sustainable Palm Oil (RSPO) certification, a testament to its adoption of best agricultural practices. For instance, in 2023, Hap Seng Plantations reported a strong performance, with its sustainability initiatives contributing to a more resilient supply chain and enhanced market appeal.

This focus on responsible value chains not only bolsters Hap Seng's reputation but also strategically positions it to capitalize on the increasing global consumer and investor preference for environmentally conscious products. By adhering to rigorous sustainability standards, the company is better equipped to navigate evolving regulatory landscapes and tap into premium markets that value ethical sourcing. This proactive approach to sustainability is projected to be a key differentiator in the competitive agribusiness sector through 2025.

- RSPO Certification: Demonstrates adherence to global sustainable palm oil standards.

- Value Creation: Commitment to operational excellence across all business segments.

- Market Alignment: Meets growing demand for sustainably sourced and produced goods.

- Reputational Enhancement: Builds trust and credibility with stakeholders and consumers.

Hap Seng's diversified business model is a core strength, providing resilience against sector-specific downturns. In FY2024, the company's plantation, property, and building materials segments demonstrated robust performance, effectively balancing out weaker results in other areas and contributing positively to overall revenue. This broad operational base ensures financial stability, as seen in the group's ability to maintain consistent revenue streams despite market fluctuations.

The company's strong market presence, particularly in Malaysia, across its various business segments is another significant advantage. This established footprint, coupled with years of operational experience, has cultivated substantial brand recognition and customer loyalty. For instance, Hap Seng Credit's network of 10 branches throughout Malaysia highlights its accessibility and extensive reach within the financial services sector.

Hap Seng's prudent financial management, especially within its credit financing division, is a key strength. The conservative approach to loan approvals effectively mitigates risks associated with sectoral uncertainties, thereby bolstering the company's overall financial stability. This is evidenced by a stable credit portfolio and manageable non-performing loan ratios reported in the first half of 2024, underscoring the effectiveness of its risk management strategies.

The commitment to sustainability and operational excellence, particularly in its plantations, is a notable strength. Hap Seng's achievement of RSPO certification signifies adherence to best agricultural practices, contributing to a resilient supply chain and enhanced market appeal. This focus on responsible value chains positions the company favorably to meet the growing global demand for environmentally conscious products.

| Business Segment | FY2024 Performance Highlight | Key Strength Factor |

|---|---|---|

| Plantations | Strong revenue growth due to higher average selling prices and increased sales volume. | Resilience in commodity markets, sustainability certifications (RSPO). |

| Property Development | Impressive growth driven by strategic land sales. | Effective asset management, ability to capitalize on market opportunities. |

| Building Materials | Positive contribution with increased revenue. | Consistent performance across core business areas. |

| Credit Financing | Stable credit portfolio with manageable non-performing loans. | Prudent lending policies, effective risk mitigation. |

What is included in the product

Delivers a strategic overview of HAP Seng’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

HAP Seng's SWOT analysis offers a clear, structured framework to identify and address critical business challenges, transforming potential weaknesses into actionable strategies for growth.

Weaknesses

Hap Seng's significant reliance on its plantation division makes it vulnerable to swings in crude palm oil (CPO) and palm kernel prices. While the company saw a benefit from higher CPO prices in the fourth quarter of fiscal year 2024, management anticipates that these elevated prices may not persist.

The expectation of lower CPO prices in the second half of fiscal year 2025 presents a clear risk, potentially impacting the company's profitability. This commodity price volatility is a key weakness that could affect earnings stability.

Hap Seng's financial performance in FY2024 revealed revenue downturns in key areas. The credit financing segment, for instance, witnessed a shrinking loan portfolio, a direct consequence of the company's more cautious lending strategy.

Adding to this, the automotive and trading divisions also contributed less to the overall revenue picture during the same period. This dip in performance across multiple segments highlights a significant challenge for the group.

Hap Seng operates across many different industries, meaning it faces strong rivals in each area. For example, its automotive segment contends with persistent competition, which can affect how many cars it sells and how much profit it makes. This necessitates ongoing strategic shifts and capital injections to hold onto its market position.

Reliance on Malaysian Market

Hap Seng's significant reliance on the Malaysian market presents a notable weakness. While the company has made some inroads into other regions, its core operations and the bulk of its revenue generation remain firmly rooted in Malaysia. This geographical concentration means Hap Seng is particularly susceptible to the economic fluctuations, regulatory changes, and political landscape specific to Malaysia.

This concentration can limit growth potential when compared to competitors with broader international diversification. For instance, a downturn in the Malaysian property sector, a key area for Hap Seng, could disproportionately impact its overall financial performance. In 2023, Hap Seng's Malaysian operations accounted for the vast majority of its revenue, highlighting this dependency.

- Geographical Concentration: Over 90% of Hap Seng's revenue is generated within Malaysia, increasing vulnerability to domestic economic and political shifts.

- Limited Diversification Benefits: The lack of significant international presence restricts opportunities to offset regional downturns with growth in other markets.

- Exposure to Malaysian-Specific Risks: Economic slowdowns, regulatory changes, or political instability within Malaysia directly and significantly impact Hap Seng's performance.

Impact of Past Disposals on Financial Comparatives

Hap Seng's financial comparatives for FY2024 are impacted by past disposals. The company's net profit in FY2024 decreased compared to FY2023, primarily due to a significant gain from subsidiary disposals recognized in the prior year. This situation complicates direct year-on-year financial comparisons, potentially obscuring the true operational performance without meticulous scrutiny.

The gain on disposal of subsidiaries in FY2023 created an anomaly, making the FY2024 net profit appear lower in comparison. For instance, if FY2023 included a substantial one-off gain, the underlying business performance in FY2024 might be stronger than a simple net profit comparison suggests. Investors and analysts need to adjust for these non-recurring items to accurately assess the company's ongoing business health.

- FY2024 Net Profit Impact: Disposals in prior periods distort year-on-year net profit comparisons.

- Operational Performance Masking: One-off gains can make current operational trends harder to discern.

- Analytical Adjustment Needed: Investors must account for non-recurring items for accurate performance assessment.

Hap Seng's substantial dependence on its plantation segment exposes it to the volatile pricing of crude palm oil (CPO) and palm kernel. Management anticipates that the elevated CPO prices experienced in late fiscal year 2024 may not continue, with expectations of lower prices in the latter half of fiscal year 2025, posing a risk to earnings stability.

The company's FY2024 financial results showed revenue declines in critical areas. Specifically, the credit financing division saw its loan portfolio shrink due to a more conservative lending approach, while the automotive and trading segments also contributed less to overall revenue, indicating challenges across multiple business lines.

Hap Seng faces intense competition across its diverse industry operations, impacting sales and profitability, particularly in its automotive division. This necessitates continuous strategic adjustments and capital investment to maintain market share.

Geographical concentration remains a significant weakness, with over 90% of Hap Seng's revenue generated in Malaysia. This heavy reliance on a single market makes the company highly susceptible to domestic economic downturns, regulatory shifts, and political instability, limiting its ability to offset regional weaknesses with international growth.

FY2024 financial comparisons are complicated by past disposals. The reported net profit for FY2024 was lower than FY2023, largely because the prior year included a substantial gain from subsidiary sales, making it crucial for investors to adjust for these one-off events to gauge underlying operational performance accurately.

| Weakness | Impact | Supporting Data |

|---|---|---|

| Commodity Price Volatility (CPO) | Reduced profitability and earnings instability | Anticipated lower CPO prices in H2 FY2025 |

| Revenue Declines in Key Segments | Overall financial performance challenges | Shrinking loan portfolio in credit financing; lower contributions from automotive and trading in FY2024 |

| Intense Competition | Pressure on sales and profitability | Persistent competition in the automotive segment |

| Geographical Concentration (Malaysia) | Vulnerability to domestic economic/political factors | Over 90% of revenue from Malaysia; limited international diversification |

| Distorted Financial Comparisons | Difficulty in assessing underlying operational trends | FY2023 net profit boosted by significant gains from subsidiary disposals |

What You See Is What You Get

HAP Seng SWOT Analysis

The preview below is taken directly from the full HAP Seng SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive understanding of the company's strategic position.

This is a real excerpt from the complete HAP Seng SWOT analysis document. Once purchased, you’ll receive the full, editable version, allowing for further customization and integration into your business planning.

You’re viewing a live preview of the actual HAP Seng SWOT analysis file. The complete version becomes available after checkout, providing all the detailed insights you need.

Opportunities

Hap Seng's property division is a significant growth driver, with its land sales contributing positively to performance. The company anticipates continued strength in its investment properties segment. For instance, in the first half of 2024, Hap Seng reported robust property sales, underscoring the segment's resilience.

Further expansion opportunities lie in initiating new property development projects, tapping into market demand. Optimizing occupancy rates and enhancing rental yields across its existing investment property portfolio also presents a clear path for increased revenue and profitability. This strategic focus is expected to bolster the company's overall financial health.

Hap Seng Plantations' commitment to sustainable palm oil, evidenced by its RSPO certification, aligns perfectly with the growing global demand for ethically sourced products. This strategic advantage is crucial as many major consumer markets, particularly in Europe and North America, are increasingly scrutinizing supply chains for environmental and social compliance.

The company's focus on sustainability can unlock premium pricing opportunities. For instance, market reports from 2024 indicate that RSPO-certified palm oil can fetch prices 5-10% higher than conventional oil, a significant factor for a commodity-driven business. This premium can directly boost Hap Seng's revenue and profitability.

Furthermore, this sustainable approach is a magnet for environmentally conscious investors and financial institutions that prioritize ESG (Environmental, Social, and Governance) factors in their portfolios. As of early 2025, ESG-focused funds are projected to manage trillions of dollars globally, making Hap Seng's sustainable practices a key differentiator in attracting capital and fostering long-term financial stability.

Hap Seng can leverage its diversified business model to pursue strategic acquisitions and partnerships. This strategy allows for strengthening its foothold in existing sectors like plantations and property development, or venturing into new, synergistic areas. For instance, acquiring a technology firm could bolster its digital transformation efforts across all divisions.

Digital Transformation and Technology Adoption

HAP Seng has a significant opportunity to leverage digital transformation across its varied business segments. By implementing advanced technologies, the company can streamline operations, reduce costs, and improve customer engagement. For instance, smart property solutions in real estate can enhance tenant experiences and building management. In plantations, precision agriculture can optimize yields and resource utilization, a critical factor given the ongoing focus on sustainable practices in agriculture.

The company can also bolster its credit financing and automotive divisions with robust digital platforms. This would enable more efficient customer onboarding, faster transaction processing, and personalized service offerings. Such technological integration is key to staying competitive and capturing market share in an increasingly digital-first economy. For example, by mid-2024, many financial institutions reported significant gains in operational efficiency and customer satisfaction through digital channel adoption.

Key opportunities include:

- Enhanced operational efficiency through automation and data analytics in all business units.

- Improved customer experience via digital platforms offering seamless service and personalized interactions.

- Cost reduction by optimizing resource allocation and streamlining processes with technology.

- New revenue streams from innovative digital products and services tailored to evolving market demands.

Growing Demand in Specific Malaysian Sectors

Malaysia's continued economic expansion and ongoing infrastructure projects offer a fertile ground for Hap Seng's building materials segment. This growth is further bolstered by a healthy mix of domestic construction needs and increasing international interest in Malaysian development projects.

Specific sectors within Malaysia present significant growth prospects. The push for affordable housing initiatives, for instance, directly translates to increased demand for construction materials. Furthermore, the burgeoning automotive market, particularly with the anticipated rise of electric vehicles (EVs), could open new avenues for Hap Seng's automotive-related businesses.

- Infrastructure Development: Malaysia's commitment to projects like the East Coast Rail Link (ECRL) and various urban renewal schemes supports demand for building materials.

- Affordable Housing: Government targets for affordable housing, aiming to deliver hundreds of thousands of units, directly benefit construction-related businesses.

- EV Market Growth: Projections indicate a substantial increase in EV adoption in Malaysia, potentially driving demand for automotive components and services.

Hap Seng's property division benefits from ongoing land sales and a strong investment property portfolio, with robust sales reported in H1 2024. The company can further capitalize on this by developing new projects and optimizing existing ones for higher rental yields.

The company's commitment to RSPO-certified sustainable palm oil positions it well to meet growing global demand for ethically sourced products, potentially commanding premium prices of 5-10% as seen in 2024 market reports.

Leveraging its diversified model, Hap Seng can pursue strategic acquisitions and digital transformation across all segments to enhance efficiency, customer experience, and create new revenue streams.

Malaysia's economic growth, infrastructure projects like the ECRL, and affordable housing initiatives provide a strong market for Hap Seng's building materials, while the expanding EV sector presents opportunities for its automotive division.

Threats

Global economic headwinds and domestic uncertainties present a substantial threat to Hap Seng's operations, potentially dampening consumer spending and reducing demand for property. Increased loan defaults could also arise from a challenging economic climate.

Despite these broader economic challenges, Hap Seng's board has expressed cautious optimism regarding the company's performance for the fiscal year 2025, indicating a strategic focus on navigating these market volatilities.

Fluctuations in Crude Palm Oil (CPO) prices pose a significant threat to HAP Seng's plantation segment. While CPO prices have seen recent improvements, the outlook for the latter half of 2025 suggests potential downward pressure. This is primarily driven by anticipated higher palm oil production globally and a trend among major importing countries to shift towards more cost-effective vegetable oils.

Hap Seng faces formidable rivalry in every sector it operates, from plantations to automotive and property. For instance, the automotive segment contends with established global brands and aggressive local players, while the property division navigates a landscape shaped by numerous developers and fluctuating market demand. This pervasive competition necessitates substantial ongoing investment in product development and marketing to maintain market share and profitability.

Regulatory and Policy Changes

Hap Seng faces potential headwinds from evolving regulatory landscapes. Changes in Malaysian government policies, such as the expanded scope of Service Tax effective July 1, 2025, could impact its diverse operations. For instance, new property development regulations or adjustments to land use policies for its extensive plantation business could directly affect profitability and operational flexibility across its various segments.

These policy shifts can create uncertainty and necessitate costly adaptations. For example, stricter environmental regulations for palm oil production or changes in housing development approval processes could increase compliance costs or slow down project timelines. Furthermore, any adverse shifts in taxation policies within Malaysia or its other operating regions could directly reduce net income and cash flows, impacting overall financial performance.

• Potential for increased compliance costs due to new regulations.

• Risk of slower project approvals or operational disruptions in property and plantations.

• Negative impact on profitability from changes in tax structures.

• Uncertainty stemming from evolving policy frameworks across diverse business units.

Supply Chain Disruptions and Geopolitical Risks

Hap Seng's diversified operations, particularly in trading and automotive sectors with international reach, expose it to significant risks from global supply chain disruptions. Events like the ongoing semiconductor shortage, which impacted vehicle production throughout 2023 and into 2024, directly affect its automotive segment. Trade tensions and geopolitical instability can further exacerbate these issues, leading to increased logistics costs and potential shortages of critical components or finished goods.

These external factors can directly impact Hap Seng's operational efficiency and profitability. For instance, rising shipping costs observed in late 2024, driven by rerouting due to regional conflicts, could inflate the cost of imported goods for its trading division. Furthermore, shifts in global demand, influenced by economic uncertainty stemming from geopolitical events, could dampen sales volumes across its various business units.

- Global supply chain vulnerabilities: The automotive sector, a key area for Hap Seng, continues to grapple with component availability issues, as seen with persistent semiconductor shortages extending into early 2024.

- Geopolitical impact on trade: Escalating trade disputes and regional conflicts in 2023-2024 have led to increased shipping costs and potential disruptions for imported goods, affecting Hap Seng's trading operations.

- Commodity price volatility: Fluctuations in global commodity prices, influenced by geopolitical events and supply chain pressures, can impact the cost of raw materials for manufacturing and the profitability of trading activities.

- Consumer demand sensitivity: Economic uncertainty linked to geopolitical risks can reduce consumer spending power, negatively affecting demand for automotive products and other discretionary goods sold by Hap Seng.

Hap Seng faces significant threats from a volatile global economic climate, with potential for reduced consumer spending and increased loan defaults. The plantation segment is vulnerable to fluctuating Crude Palm Oil (CPO) prices, with projections indicating downward pressure in late 2025 due to increased global production and a shift towards cheaper vegetable oils.

Intense competition across all its business segments, from automotive to property and plantations, demands continuous investment to maintain market share. Additionally, evolving regulatory landscapes and potential policy changes in Malaysia, such as expanded Service Tax effective July 1, 2025, could increase compliance costs and operational disruptions.

Global supply chain disruptions, exemplified by persistent semiconductor shortages affecting the automotive sector through early 2024, pose a considerable risk. Geopolitical instability and trade tensions have already driven up shipping costs in late 2024, impacting the trading division and overall operational efficiency.

| Threat Category | Specific Risk | Impact on Hap Seng | Example/Data Point |

|---|---|---|---|

| Economic Headwinds | Reduced Consumer Spending | Lower demand for property and automotive sales. | Global economic slowdown projections for 2025. |

| Commodity Price Volatility | CPO Price Decline | Reduced profitability in the plantation segment. | Forecasted downward pressure on CPO prices in H2 2025. |

| Competition | Market Saturation | Pressure on profit margins across all divisions. | Intense rivalry from established global and local brands. |

| Regulatory Changes | Policy Shifts | Increased compliance costs and operational delays. | Expanded Service Tax effective July 1, 2025. |

| Supply Chain Disruptions | Component Shortages | Production delays and increased costs in automotive. | Persistent semiconductor shortages through early 2024. |

SWOT Analysis Data Sources

This HAP Seng SWOT analysis is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded perspective.