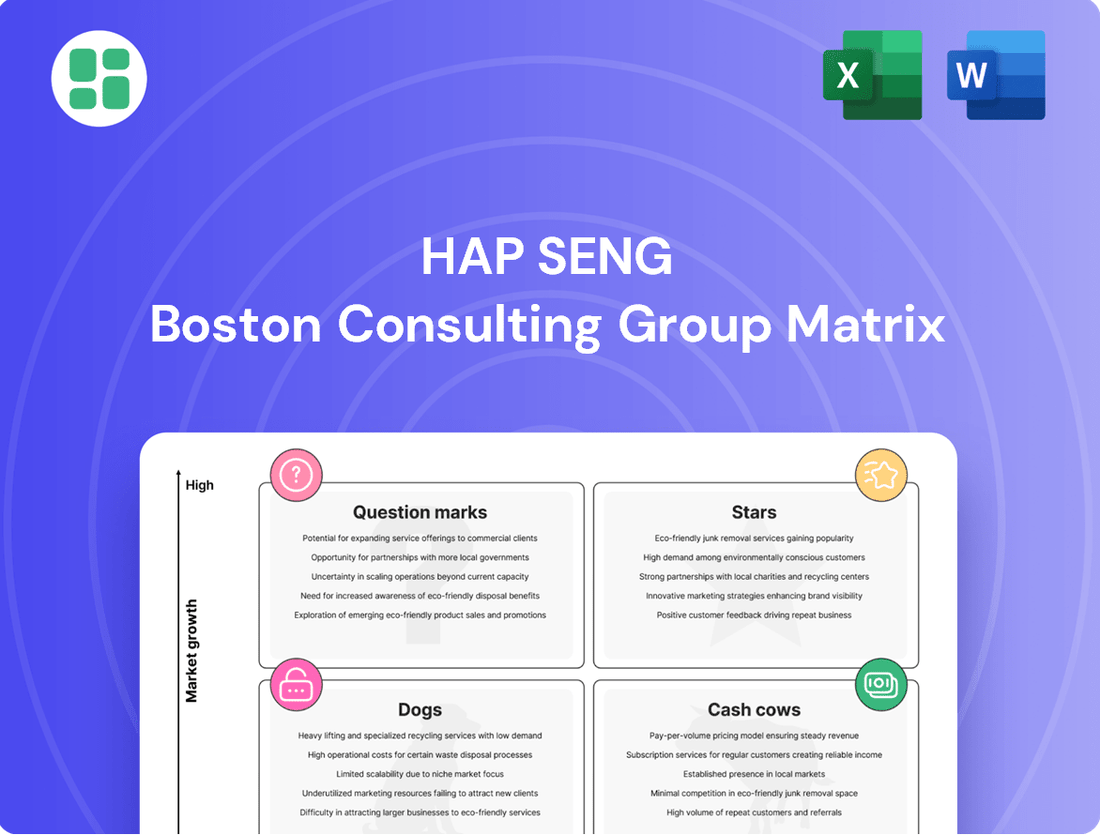

HAP Seng Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HAP Seng Bundle

Curious about HAP Seng's product portfolio and their market potential? This glimpse into their BCG Matrix highlights key areas, but the real strategic advantage lies in understanding the full picture. Discover which HAP Seng products are Stars, Cash Cows, Dogs, or Question Marks to make informed investment decisions.

Unlock the complete HAP Seng BCG Matrix to gain a comprehensive understanding of their strategic positioning. This detailed report provides quadrant-by-quadrant insights and actionable recommendations, empowering you to optimize your investments and product strategy for maximum impact.

Don't miss out on the full HAP Seng BCG Matrix analysis! Purchase the complete report to receive a detailed breakdown, including data-backed insights and tailored strategic moves. It's your essential guide to navigating HAP Seng's market landscape with confidence.

Stars

Hap Seng's strategic urban land development is a cornerstone of its success, consistently yielding substantial profits. The company's property division reported a strong performance in 4Q24, underscoring its ability to capitalize on prime urban land sales and its leading market position.

This segment thrives due to ongoing urbanization and the persistent demand for well-situated development land. Hap Seng's strategic land bank allows it to secure high returns in an expanding property market, demonstrating a clear advantage.

Hap Seng's premium residential developments in growth corridors, such as Kuala Lumpur and Johor, are strategically positioned to capitalize on high demand. These projects tap into the sustained buyer interest and price appreciation characteristic of rapidly expanding urban centers.

By focusing on quality housing in these key areas, Hap Seng secures a significant market share. This segment is a major contributor to the group's overall revenue and profitability, reflecting strong market reception.

In 2024, the Malaysian property market, particularly for landed properties in prime locations, continued to show resilience. For instance, average prices for new residential launches in Kuala Lumpur saw an upward trend, with some prime developments reporting take-up rates exceeding 80% shortly after their release.

The industrial and logistics property sector is experiencing significant expansion in Malaysia, fueled by the substantial growth of e-commerce and the increasing demand for efficient supply chains. This trend is particularly evident in the demand for green-certified facilities, reflecting a broader market shift towards sustainability. Hap Seng's strategic focus on developing modern industrial and logistics properties has allowed it to capture a considerable market share in this high-growth, high-value segment.

In 2024, the Malaysian industrial property market continued its upward trajectory, with e-commerce penetration driving demand for warehousing and distribution centers. Hap Seng's commitment to developing state-of-the-art facilities, including those with green certifications, aligns perfectly with market needs. For instance, the group’s diversified property portfolio, which includes industrial assets, has consistently contributed to its revenue, demonstrating the strength of this sector. The ongoing digital transformation across industries further solidifies the long-term prospects for industrial and logistics property development.

Aggregates and Quarry Operations

Hap Seng's aggregates and quarry operations form a crucial part of its building materials division. These operations are foundational for the construction industry, supplying essential raw materials for infrastructure and property projects. Their established presence in this sector positions them to capitalize on market demand.

Malaysia's construction sector is projected for robust growth, with an estimated expansion from 2024 to 2033. This forecast indicates a sustained high demand for building materials, including aggregates and quarry products. Hap Seng's existing infrastructure and supply chain are well-suited to meet this increasing need.

- Market Share: Hap Seng holds a significant market share in the aggregates and quarry sector due to its extensive operations and established client base.

- Industry Growth: The Malaysian construction industry, a key market for Hap Seng's building materials, is expected to grow substantially in the coming decade. For instance, infrastructure spending in Malaysia was projected to reach RM100 billion in 2024.

- Strategic Importance: As a supplier of fundamental construction inputs, Hap Seng's quarry operations are vital for supporting national development and large-scale projects.

Specialized Green Building Materials

Specialized green building materials in Malaysia are experiencing a significant upswing, fueled by a growing emphasis on sustainability and supportive government policies. This sector is projected to grow substantially in the coming years.

If Hap Seng is involved in developing or distributing these advanced, eco-friendly materials, it positions them in a high-growth area. This strategic focus could lead to increased market share and robust future revenue streams for the company.

- Market Growth: The Malaysian green building materials market is expanding, with an estimated Compound Annual Growth Rate (CAGR) of 8.5% from 2023 to 2028, reaching an estimated value of RM 15 billion by 2028.

- Government Support: Initiatives like the Green Building Index (GBI) and tax incentives for green building projects encourage the adoption of specialized materials.

- Hap Seng's Potential: For Hap Seng, investing in or expanding its portfolio of specialized green building materials could capture a significant portion of this expanding market.

- Competitive Edge: Offering innovative and sustainable solutions can provide Hap Seng with a distinct competitive advantage in the construction sector.

Stars represent business units with high market share in high-growth markets. Hap Seng's premium residential developments in key urban areas like Kuala Lumpur and Johor exemplify this category. These projects benefit from sustained urbanization and buyer interest, leading to strong take-up rates, with some prime developments exceeding 80% in 2024.

The industrial and logistics property sector, driven by e-commerce growth, also positions Hap Seng's developments as Stars. The demand for modern, green-certified facilities is high, and Hap Seng's strategic focus here allows it to capture significant market share in a rapidly expanding segment.

Hap Seng's involvement with specialized green building materials further places it in a Star category. This market is experiencing substantial growth, projected at an 8.5% CAGR from 2023 to 2028, supported by government incentives.

| Hap Seng BCG Category | Market Growth | Market Share | Key Drivers | 2024 Data/Trends |

|---|---|---|---|---|

| Stars | High | High | Urbanization, E-commerce, Sustainability | Strong take-up rates for prime residential; increased demand for green industrial facilities. |

| Malaysian green building materials market CAGR 8.5% (2023-2028). | ||||

| Infrastructure spending projected at RM100 billion in Malaysia for 2024. |

What is included in the product

The HAP Seng BCG Matrix offers a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, highlighting units for growth, harvesting, or divestment.

HAP Seng's BCG Matrix provides a clear, one-page overview, instantly relieving the pain of complex portfolio analysis.

Cash Cows

Hap Seng's mature palm oil plantations are classic cash cows, consistently generating substantial profits for the group. This strong performance is driven by stable palm product prices and a notable increase in crude palm oil (CPO) sales volume in recent quarters.

Even within a mature global industry, Hap Seng's established plantations and commitment to sustainable practices allow them to maintain a significant market share. Their operations demonstrate high earnings sensitivity to CPO prices, ensuring a reliable and consistent generation of cash flow.

Hap Seng's established investment property portfolio, encompassing commercial and retail spaces, is a significant contributor to its recurring income. These assets, typically situated in prime locations, boast high occupancy rates and efficient rental yield management, solidifying their position as cash cows within the BCG framework.

This segment represents a substantial market share in a mature property market, ensuring consistent cash flow generation. While growth prospects are stable rather than explosive, the predictable income stream from these well-managed properties underpins Hap Seng's financial stability.

Traditional cement and basic building materials represent Hap Seng's established Cash Cows. These segments operate in mature markets characterized by high volumes but typically lower growth rates. Hap Seng's deep market penetration and extensive distribution networks in these core areas allow for consistent cash flow generation, providing a stable financial base for the group.

In 2024, the building materials sector in Malaysia, where Hap Seng has a significant presence, saw steady demand. While specific figures for Hap Seng's cement division are proprietary, the broader industry experienced a moderate uplift driven by ongoing infrastructure projects and residential development. This environment allows Hap Seng's Cash Cow segments to continue their role of reliably generating profits.

Existing Credit Financing Loan Portfolio

Hap Seng's credit financing division, while adopting a cautious stance on new loan origination and experiencing a slight contraction in its total loan book during fiscal year 2024, benefits from a substantial existing portfolio. This established base is a consistent generator of interest income, functioning as a dependable cash cow within a market characterized by moderate yet stable credit expansion.

The division’s ability to maintain this income stream is crucial, especially as overall credit growth remains subdued. For instance, in FY2024, the total loan portfolio saw a minor decrease, yet the underlying performance of the existing book provided a stable revenue foundation.

- Steady Income Generation: The existing loan portfolio continues to produce reliable interest income, serving as a primary cash flow contributor for Hap Seng.

- Market Stability: Despite moderate overall credit growth, the stability of the market allows this established portfolio to perform consistently.

- Conservative Growth Strategy: A deliberate conservative approach to new loan approvals in FY2024 underscores the focus on managing risk within the existing, profitable loan base.

Long-Standing Trading Operations

Hap Seng's long-standing trading operations, though facing some revenue headwinds in late 2024 and early 2025, are a foundational element of the group. These operations benefit from a deeply entrenched market position, likely commanding substantial market share within their specialized trading segments.

Despite a potentially slower growth trajectory, these established trading businesses continue to be a reliable source of cash flow for Hap Seng. This stability stems from their strong brand recognition and a loyal, long-term customer base that underpins consistent demand.

Key characteristics of these Cash Cow segments include:

- Established Market Presence: These operations have a history of consistent performance, indicating a strong foothold in their respective markets.

- Consistent Cash Generation: Even with moderate revenue shifts, the mature nature of these businesses ensures a steady inflow of cash, vital for funding other group initiatives.

- Resilience in Mature Markets: While growth might be limited, the established customer relationships and operational efficiencies make them resilient to market fluctuations.

Hap Seng's palm oil division continues to be a steadfast cash cow, leveraging its mature plantations. In 2024, stable palm product prices and increased CPO sales volume contributed to robust profits, reinforcing its position as a reliable cash generator.

The investment property segment also acts as a significant cash cow, with prime locations and high occupancy rates ensuring consistent recurring income. This segment benefits from a substantial market share in a mature property market, providing predictable cash flow crucial for financial stability.

| Business Segment | BCG Category | Key Financial Characteristic | 2024 Context/Data Point |

|---|---|---|---|

| Palm Oil Plantations | Cash Cow | Stable profit generation, high earnings sensitivity to CPO prices | Increased CPO sales volume, stable palm product prices |

| Investment Properties | Cash Cow | Consistent recurring income, high occupancy rates | Prime locations, efficient rental yield management |

| Cement & Building Materials | Cash Cow | Consistent cash flow generation, deep market penetration | Steady demand in Malaysian market driven by infrastructure projects |

| Credit Financing | Cash Cow | Reliable interest income from existing portfolio | Substantial existing portfolio, cautious new loan origination in FY2024 |

| Trading Operations | Cash Cow | Steady cash flow, strong brand recognition | Established market position, loyal customer base |

What You’re Viewing Is Included

HAP Seng BCG Matrix

The HAP Seng BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks or demo content will be present in your downloaded file, ensuring you get a professional, analysis-ready document. You can confidently use this preview as a direct representation of the strategic insights and clear presentation that will be yours to implement instantly. It's designed for immediate application in your business planning and competitive analysis.

Dogs

Hap Seng's automotive division experienced a revenue dip in the fourth quarter of 2024 and the first quarter of 2025. This performance is particularly noteworthy as the broader Malaysian automotive market is anticipated to see only marginal growth or a slight contraction in 2025, following a period of record sales. This divergence indicates potential struggles within specific brands or vehicle segments under Hap Seng's umbrella, suggesting they might be facing challenges in gaining traction or maintaining market share in a competitive or softening market, thereby generating lower profits.

Hap Seng's trading division experienced a revenue decline in the fourth quarter of 2024 and the first quarter of 2025. This downturn is likely linked to commoditized product lines facing intense competition and price sensitivity. These segments, characterized by low differentiation, struggle to maintain market share and exhibit limited growth potential.

These specific trading product lines can be categorized as Dogs within the BCG Matrix framework. For instance, if Hap Seng trades basic agricultural commodities like palm oil, which saw price volatility and oversupply concerns in late 2024, this segment would fit the Dog profile. The average price of crude palm oil futures on the Bursa Malaysia Derivatives Exchange, for example, saw fluctuations, impacting trading volumes and profitability for such products.

Hap Seng's strategic divestment of subsidiaries in FY2023, impacting its FY2024 net profit, points to the shedding of non-core or underperforming assets. These divested units likely had low market share and limited growth prospects, tying up capital inefficiently. Such businesses are typically categorized as Dogs in the BCG Matrix, signifying their low growth and low market share status.

Specific Oversupplied Property Niches

While Malaysia's property market generally shows stability, specific segments can experience oversupply. For Hap Seng, exposure to these niche areas, where demand doesn't match available stock, can lead to reduced market share and stunted growth for those projects, fitting them into the 'Dogs' category of the BCG Matrix.

In 2024, reports indicated that certain high-rise residential segments in Klang Valley, for instance, were experiencing significant vacancy rates. This oversupply in specific urban niches can directly impact Hap Seng's performance in those particular developments.

- Oversupply in specific urban residential segments: High vacancy rates in certain high-rise developments in major cities.

- Low demand relative to supply: This imbalance directly impacts sales velocity and pricing power.

- Reduced market share and growth: Projects in these oversupplied niches struggle to capture significant market share and exhibit limited expansion potential.

- Impact on Hap Seng's portfolio: Identifying these 'Dog' properties is crucial for strategic resource allocation and portfolio management.

High-Cost, Low-Efficiency Operations

High-Cost, Low-Efficiency Operations, or 'Dogs' in the HAP Seng BCG Matrix, represent business units that consume significant resources while offering minimal returns. These are often legacy operations struggling in mature or declining markets. For instance, a segment of HAP Seng's plantation business that is reliant on older, less productive palm oil trees could fall into this category. In 2024, such an operation might see operating costs rise due to increased fertilizer and maintenance needs, while yields per hectare remain stagnant or decline, leading to a negative or very low profit margin.

These units typically exhibit characteristics that make them unattractive investments. They require substantial capital for upkeep or modernization but have limited growth potential and a weak competitive position. Such a situation could be seen if HAP Seng had a particular manufacturing plant that, despite ongoing investment, faced intense competition from newer, more efficient facilities both domestically and internationally, resulting in low market share and high per-unit production costs.

- Legacy Plantation Assets: Older palm oil estates with declining yields and increasing input costs, potentially contributing to a higher cost per metric ton of CPO compared to newer plantations.

- Underperforming Manufacturing Units: Facilities with outdated technology or inefficient processes that lead to higher operational expenses and a weaker competitive pricing strategy.

- Low Market Share Segments: Business lines within HAP Seng that have failed to capture significant market share in their respective industries, making it difficult to achieve economies of scale and absorb high fixed costs.

Dogs in the HAP Seng BCG Matrix are business units with low market share and low growth potential. These segments often consume more resources than they generate, representing a drain on the company's overall performance. For HAP Seng, this could manifest in older plantation assets with declining yields or specific trading lines facing intense price competition.

These 'Dog' segments require careful management, often involving divestment or significant restructuring to improve efficiency. The company's strategic divestments in FY2023, impacting FY2024 net profit, likely targeted such underperforming units, freeing up capital for more promising ventures.

Identifying and addressing these 'Dog' segments is crucial for optimizing HAP Seng's resource allocation and improving overall profitability. For example, a specific property development facing oversupply in a niche urban area, evidenced by high vacancy rates in late 2024, would be a prime candidate for such a classification.

The automotive division's recent revenue dip, especially against a backdrop of marginal growth in the broader Malaysian market for 2025, suggests certain brands or segments within HAP Seng's automotive portfolio might be performing as Dogs.

Question Marks

New property development ventures in untapped markets would likely be classified as Question Marks in the HAP Seng BCG Matrix. These initiatives, potentially in emerging Malaysian regions or new territories, represent opportunities for high growth but carry substantial risk due to limited market presence and significant upfront investment requirements. For instance, HAP Seng's 2024 focus on expanding its property footprint could see such ventures, requiring careful market analysis to mitigate the inherent uncertainty of customer adoption and future market share.

Hap Seng has signaled intentions to expand beyond its Malaysian base, a move that aligns with the 'Question Marks' category of the BCG matrix. This strategic pivot into new geographic markets, while promising significant growth opportunities, inherently starts with a nascent market share.

Entering these new territories necessitates considerable investment. This capital will be directed towards establishing brand presence, building operational infrastructure, and executing market penetration strategies to effectively compete and capture the anticipated growth. For instance, in 2024, many companies exploring international expansion are allocating significant portions of their R&D and marketing budgets to these new ventures, often seeing initial negative cash flows as a result.

Hap Seng's credit financing division, even with its typically cautious approach, might explore financing for nascent, high-growth sectors like advanced AI development or sustainable energy infrastructure. These innovative ventures, by their very nature, would begin with a limited market share, placing them in the question mark category of the BCG matrix.

These new financing products would demand substantial capital infusions and strategic planning to cultivate market presence and achieve leadership. For instance, a commitment to financing the burgeoning electric vehicle charging network sector in Malaysia, a market projected to grow significantly by 2025, would exemplify such a strategic move, requiring considerable upfront investment to establish Hap Seng as a key player.

Adoption of Advanced Green Building Technologies

Hap Seng's investment in advanced green building technologies, such as high-performance insulation or smart energy management systems, would likely place them in the Question Mark category of the BCG matrix. The global green building materials market was projected to reach USD 268.7 billion in 2024, indicating strong underlying growth. However, the adoption of truly cutting-edge, high-cost technologies within this market can be slow initially, presenting a scenario of low market share but high growth potential.

These advanced technologies require significant capital investment to develop, market, and scale. For instance, developing and implementing a new type of self-healing concrete, while potentially revolutionary, would demand substantial R&D and early-stage marketing efforts to educate the market and build demand. The challenge lies in converting this high growth potential into market leadership without becoming a cash drain.

- Market Growth: The global green building materials market is experiencing robust growth, with projections suggesting continued expansion driven by sustainability mandates and consumer preference.

- Investment Needs: Adoption of advanced green building technologies necessitates significant upfront investment in research, development, and market education.

- Market Adoption: While the overall green building sector is expanding, the uptake of highly innovative and costly technologies can be gradual, creating a classic Question Mark scenario.

- Strategic Focus: Hap Seng must carefully evaluate which of these emerging technologies offer the most promising long-term market potential to justify continued investment and potential future success.

New Automotive Mobility Solutions

Hap Seng's venture into new automotive mobility solutions, such as EV charging and subscription services, positions them in a nascent but high-growth sector within Malaysia's evolving automotive landscape. The Malaysian government's target of having 10,000 EV charging stations by 2025 underscores the significant infrastructure development needed, presenting a prime opportunity for Hap Seng to establish a strong market presence early on.

These new mobility offerings, including integrated platforms and vehicle subscription models, align with global shifts towards flexible transportation and could tap into a burgeoning demand that is currently underserved by traditional dealership models. For instance, the projected growth of Battery Electric Vehicles (BEVs) in Malaysia, with sales expected to significantly increase in the coming years, indicates a strong underlying market for related services.

- EV Charging Infrastructure: Investment in charging stations addresses a critical bottleneck for BEV adoption.

- Integrated Mobility Platforms: These can offer a one-stop solution for various transportation needs, including ride-sharing and car-sharing.

- Vehicle Subscription Models: Providing flexible access to vehicles, catering to changing consumer preferences away from outright ownership.

- Market Potential: Malaysia's automotive market is ripe for disruption, with BEV sales projected to grow substantially, creating substantial revenue streams for innovative mobility providers.

New property development ventures in untapped markets would likely be classified as Question Marks in the HAP Seng BCG Matrix. These initiatives, potentially in emerging Malaysian regions or new territories, represent opportunities for high growth but carry substantial risk due to limited market presence and significant upfront investment requirements. For instance, HAP Seng's 2024 focus on expanding its property footprint could see such ventures, requiring careful market analysis to mitigate the inherent uncertainty of customer adoption and future market share.

Hap Seng's venture into new automotive mobility solutions, such as EV charging and subscription services, positions them in a nascent but high-growth sector within Malaysia's evolving automotive landscape. The Malaysian government's target of having 10,000 EV charging stations by 2025 underscores the significant infrastructure development needed, presenting a prime opportunity for Hap Seng to establish a strong market presence early on.

These new mobility offerings, including integrated platforms and vehicle subscription models, align with global shifts towards flexible transportation and could tap into a burgeoning demand that is currently underserved by traditional dealership models. For instance, the projected growth of Battery Electric Vehicles (BEVs) in Malaysia, with sales expected to significantly increase in the coming years, indicates a strong underlying market for related services.

Hap Seng's investment in advanced green building technologies, such as high-performance insulation or smart energy management systems, would likely place them in the Question Mark category of the BCG matrix. The global green building materials market was projected to reach USD 268.7 billion in 2024, indicating strong underlying growth. However, the adoption of truly cutting-edge, high-cost technologies within this market can be slow initially, presenting a scenario of low market share but high growth potential.

| HAP Seng Business Unit | BCG Category | Rationale | 2024 Market Context |

|---|---|---|---|

| New Property Development (Untapped Markets) | Question Mark | High growth potential, low market share, high investment needs. | Expansion into emerging Malaysian regions or new territories. |

| EV Charging & Subscription Services | Question Mark | Nascent but high-growth sector, requires significant infrastructure investment. | Malaysia aims for 10,000 EV charging stations by 2025; BEV sales projected to rise. |

| Advanced Green Building Technologies | Question Mark | High potential in a growing market, but slow initial adoption of cutting-edge tech. | Global green building market projected at USD 268.7 billion in 2024. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial disclosures, industry growth rates, and competitor analysis, to provide a clear strategic overview.