HAP Seng Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HAP Seng Bundle

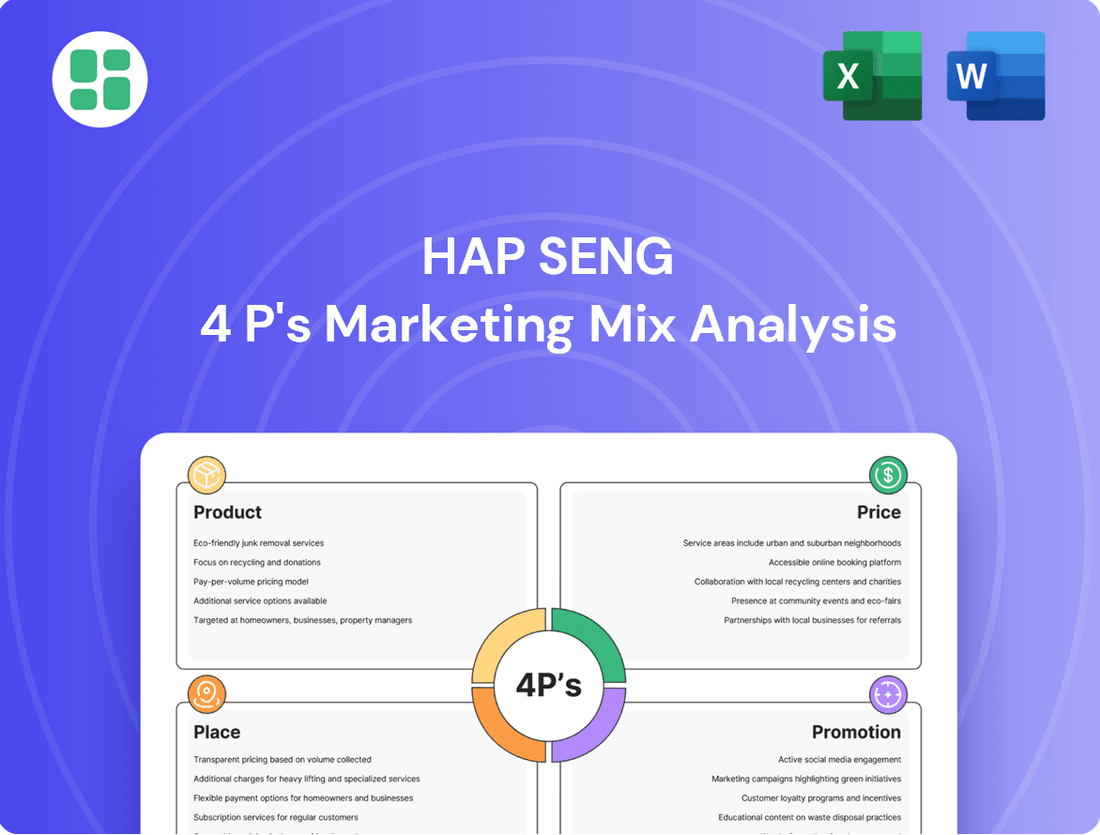

Discover how HAP Seng strategically leverages its product portfolio, pricing structures, distribution channels, and promotional efforts to dominate its market. This analysis goes beyond the surface, revealing the intricate interplay of their 4Ps.

Ready to unlock HAP Seng's marketing secrets? Get the full, in-depth 4Ps Marketing Mix Analysis, packed with actionable insights and ready for your strategic planning or academic research.

Product

Hap Seng's diverse business portfolio is a cornerstone of its strategy, encompassing oil palm cultivation, property development, credit financing, and automotive distribution. This broad reach across sectors like agriculture, real estate, finance, and retail allows the company to navigate economic fluctuations by not relying on a single industry. For instance, in 2024, the company continued to see robust performance from its plantations, contributing significantly to its overall earnings.

This diversification acts as a powerful risk mitigation tool, as a downturn in one segment can be offset by strength in another. Hap Seng is strategically positioned to capitalize on various market opportunities within Malaysia and its expanding regional presence. The company's property division, for example, has consistently delivered strong sales figures, particularly in its residential developments, demonstrating the appeal of its offerings to a wide customer base.

Each business segment within Hap Seng operates with a distinct set of product and service offerings, meticulously tailored to meet the specific demands of its respective market. This targeted approach ensures relevance and competitiveness. In the automotive sector, Hap Seng's dealerships reported a notable increase in sales for premium vehicle brands in late 2024, reflecting successful product placement and market penetration strategies.

Hap Seng Star, a key part of Hap Seng's automotive division, stands as a premier authorized dealer for Mercedes-Benz in Malaysia. They provide a comprehensive selection of new and certified pre-owned passenger cars, trucks, and buses, alongside genuine spare parts. This focus on the luxury segment caters to customers seeking high performance and an elevated ownership experience.

The product portfolio consistently evolves, incorporating the newest Mercedes-Benz models, including their expanding range of electric vehicles. For instance, in 2024, Mercedes-Benz continued to push its EQ electric lineup, with models like the EQE and EQS seeing increased market presence and customer interest in Malaysia, reflecting Hap Seng Star's commitment to offering cutting-edge automotive technology.

Hap Seng Land's comprehensive property developments showcase a diverse range of residential and commercial projects, including high-rise apartments, corporate offices, and integrated townships. This strategy aims to cater to varied market needs, from individual homebuyers to large corporations. For instance, their portfolio features projects in strategic urban centers, reflecting a commitment to accessibility and growth potential.

The company prioritizes modern lifestyles and sustainability in its developments, creating attractive, high-value propositions. This focus on quality and forward-thinking design enhances the appeal of their properties. By integrating green building principles and contemporary amenities, Hap Seng Land aims to deliver enduring value to its customers and stakeholders.

Key ongoing and upcoming developments are situated in prime locations, such as Kuala Lumpur, a major economic hub. This strategic placement ensures strong market demand and capital appreciation potential for their projects. The company's commitment to urban regeneration and development underscores its role in shaping city landscapes.

Specialized Financial Services

Hap Seng Credit offers specialized financial services, focusing on industrial hire-purchase, leasing, and term loans. These solutions are specifically crafted for small and medium enterprises (SMEs) operating across diverse industries, aiming to support their working capital needs or investment goals with adaptable and economical terms.

The company's financial products are engineered for flexibility and affordability, recognizing the unique challenges faced by SMEs. For instance, in 2024, Hap Seng Credit continued to refine its loan structures to better align with the cash flow cycles of businesses in sectors like manufacturing and agriculture, which are crucial to the Malaysian economy.

Their commitment to risk management is evident through a carefully maintained prudent lending policy. This approach is vital in navigating the dynamic economic conditions of 2024 and 2025, ensuring the sustainability of their financing operations while supporting SME growth.

- Target Market: Primarily SMEs across various industrial sectors.

- Financial Products: Industrial hire-purchase, leasing, and term loans.

- Customer Benefit: Flexible and cost-effective solutions for working capital and investments.

- Risk Management: Adherence to a prudent lending policy to manage economic volatility.

Essential Building Materials and Trading

HAP Seng's Essential Building Materials and Trading segment is a cornerstone of its operations, providing critical inputs for both construction and agriculture. This division manufactures and trades essential building materials, including aggregates, and also participates in general trading, supplying vital products like fertilizers and agrochemicals. The company's commitment to these sectors is evident in its significant presence in both manufacturing and distribution.

Within building materials, HAP Seng operates quarry operations in Sabah, ensuring a steady supply of aggregates. Furthermore, its acquisition of Hafary Holdings Limited, a prominent building material supplier in Singapore, significantly expands its reach, offering a comprehensive range of tiles, stones, and interior fittings. This dual approach, combining upstream production with downstream retail, solidifies its market position.

The trading segment plays a crucial role in supporting key industries. By supplying fertilizers and agrochemicals, HAP Seng directly contributes to the productivity and growth of the agricultural sector. Simultaneously, its involvement in general trading ensures that the construction industry has access to necessary supplies, underscoring the segment's broad economic impact.

- Building Materials: Quarry operations in Sabah and Hafary Holdings Limited in Singapore (tiles, stones, interior fittings).

- General Trading: Fertilizers and agrochemicals supporting the agricultural sector.

- Market Reach: Strong presence in both manufacturing and distribution of essential goods.

- Industry Support: Vital supplies for both construction and agricultural industries.

Hap Seng's product strategy is deeply integrated with its diversified business model, offering tailored solutions across its key segments. In automotive, Hap Seng Star provides a full spectrum of Mercedes-Benz vehicles, including the expanding EQ electric lineup, which saw growing customer interest in Malaysia in 2024.

Hap Seng Land's property division offers a wide array of residential and commercial projects, emphasizing modern living and sustainability, with key developments in prime locations like Kuala Lumpur. Hap Seng Credit focuses on flexible financial products like industrial hire-purchase and leasing, specifically designed for SMEs, with loan structures refined in 2024 to match business cash flows.

The Building Materials and Trading segment is crucial, supplying aggregates from Sabah operations and a broad range of interior fittings through its Singapore-based Hafary Holdings, alongside vital fertilizers and agrochemicals for the agricultural sector.

| Segment | Key Products/Services | Target Market | 2024/2025 Highlights |

|---|---|---|---|

| Automotive | New & Certified Pre-owned Mercedes-Benz vehicles, trucks, buses, spare parts | Premium vehicle buyers | Increased interest in EQ electric models |

| Property Development | Residential apartments, corporate offices, townships | Homebuyers, corporations | Developments in strategic urban centers |

| Credit Financing | Industrial hire-purchase, leasing, term loans | SMEs | Refined loan structures for cash flow alignment |

| Building Materials & Trading | Aggregates, tiles, stones, interior fittings, fertilizers, agrochemicals | Construction industry, agricultural sector | Expansion via Hafary Holdings; support for agriculture |

What is included in the product

This analysis provides a comprehensive breakdown of HAP Seng's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

It delves into HAP Seng's actual market practices and competitive positioning, making it an invaluable resource for marketers and consultants seeking to understand their approach.

Simplifies complex marketing strategies by clearly outlining HAP Seng's Product, Price, Place, and Promotion, alleviating the pain of strategic ambiguity.

Provides a clear, actionable framework for understanding HAP Seng's market positioning, relieving the burden of scattered or unclear marketing plans.

Place

Hap Seng boasts an extensive Malaysian network, a cornerstone of its marketing mix. This robust physical presence spans automotive showrooms and service centers, property sales galleries, and credit financing branches across the nation. For instance, as of early 2024, Hap Seng Consolidated Berhad operates over 150 automotive touchpoints nationwide, ensuring broad accessibility.

Hap Seng leverages direct sales for its property and automotive segments, complemented by strategically located showrooms and sales galleries. These physical touchpoints are crucial for high-value items, enabling customers to engage directly with products and receive personalized guidance from sales professionals. For instance, the Hap Seng Auto Fest aims to drive traffic to these venues, fostering immediate customer interaction and sales opportunities.

Hap Seng's industrial and commercial distribution strategy centers on its building materials and trading products. This includes essential items like aggregates, bricks, and fertilizers, which are channeled directly to key industries. For the fiscal year ending December 31, 2023, Hap Seng Consolidated Berhad reported revenue from its trading and manufacturing segment, which encompasses these activities, reaching RM 1.17 billion.

The distribution network is robust, relying on direct sales to construction firms and agricultural enterprises. Furthermore, Hap Seng leverages an extensive network of warehouses and branches to ensure efficient product availability. This multi-pronged approach allows for broad market reach and accessibility for its diverse product range.

The fertilizer trading arm of Hap Seng demonstrates significant international reach, extending its operations across Malaysia and Indonesia. Its global footprint is further solidified through MML (Shanghai) Trading Co., Ltd., facilitating worldwide distribution. In 2023, the group's fertilizer sales contributed significantly to its overall trading performance.

Digital and Online Presence

HAP Seng strategically leverages its digital and online presence to complement its physical operations, focusing on information dissemination and initial customer engagement. Corporate websites serve as crucial hubs for investor relations, detailed product information, and facilitating inquiries for services such as credit financing and property viewings. This digital outreach is vital for expanding market reach and enhancing customer convenience.

The company’s digital footprint is designed to provide accessible information and streamline customer interactions across its diverse business segments. By maintaining informative websites and potentially utilizing social media for broader engagement, HAP Seng ensures potential customers can easily access details about their offerings and initiate contact, thereby supporting wider market penetration and customer acquisition efforts.

- Corporate Websites: HAP Seng operates dedicated websites for its various divisions, offering comprehensive information on products, services, and investor relations.

- Digital Engagement: These platforms facilitate online inquiries for services like credit financing and property viewings, improving customer accessibility.

- Market Reach: Digital channels are essential for extending HAP Seng's market reach beyond physical locations, catering to a broader customer base.

- Information Dissemination: Websites provide up-to-date details on company performance and offerings, crucial for informed decision-making by stakeholders.

Strategic Regional Expansion

Hap Seng's strategic regional expansion extends its influence beyond Malaysia. Its trading arm actively operates in Indonesia and China, focusing on fertilizer distribution, while the building materials subsidiary, Hafary, has established a presence in Singapore. This geographical diversification is key to accessing new customer bases and bolstering revenue streams.

The company's strategic maneuvers also include a focused approach to its core markets. For instance, the divestment of its Peninsular Malaysia quarry operations in April 2024 signals a deliberate concentration on specific regional strengths and potentially more profitable ventures within its operational footprint.

This outward growth is supported by tangible market engagement:

- Indonesia and China: Key markets for Hap Seng's fertilizer trading operations, contributing to international sales.

- Singapore: The base for Hafary's building materials business, leveraging a robust regional construction sector.

- April 2024 Divestment: The sale of Peninsular Malaysia quarry operations highlights a refined strategy, emphasizing core competencies and potentially higher-margin activities in other regions.

Hap Seng's place strategy is deeply rooted in its extensive physical network across Malaysia, encompassing over 150 automotive touchpoints as of early 2024. This widespread presence ensures accessibility for its property, automotive, and credit financing services. The company also strategically utilizes digital platforms to disseminate information and facilitate initial customer engagement, complementing its brick-and-mortar operations.

| Business Segment | Key Locations/Reach | Distribution Strategy |

|---|---|---|

| Automotive | Over 150 nationwide touchpoints (early 2024) | Direct sales via showrooms and service centers |

| Property | Nationwide sales galleries | Direct sales, physical engagement |

| Building Materials & Trading | Malaysia, Indonesia, China, Singapore | Direct to industries, warehouses, branches, international distribution (MML Shanghai) |

| Fertilizer Trading | Malaysia, Indonesia | Global distribution via MML (Shanghai) |

Same Document Delivered

HAP Seng 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive HAP Seng 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

Hap Seng strategically deploys brand-specific marketing campaigns, exemplified by the 'Hap Seng Star Raya Bonanza' for its Mercedes-Benz automotive division. This approach allows for deep resonance with distinct customer segments by emphasizing tailored product features, benefits, and promotions.

These focused campaigns are designed not only to stimulate immediate sales but also to cultivate stronger brand loyalty and recognition within each specific market segment. For instance, in 2024, automotive sales, a key area for such promotions, saw a notable uptick during festive seasons, driven by targeted marketing efforts.

Hap Seng strategically leverages digital channels for engagement, utilizing online advertising to connect with its tech-savvy audience. Its corporate website serves as a vital hub for investor relations and comprehensive business information.

The company's digital footprint extends to platforms like social media and search engine marketing, particularly for targeted campaigns around product launches and significant events. In 2024, digital advertising spending globally was projected to reach over $678 billion, highlighting the critical role these channels play in broad awareness and lead generation for businesses like Hap Seng.

Hap Seng actively manages its corporate image and disseminates crucial business updates, financial performance, and sustainability efforts through public relations. For instance, its consistent reporting of financial results, such as the 2023 financial year where it achieved a revenue of RM9.5 billion, demonstrates transparency.

Regular announcements on Bursa Malaysia, coupled with proactive engagement with financial news channels, are key to fostering investor trust and maintaining its standing as a robust, diversified conglomerate. This approach underpins its strategy of reinforcing its reputation in the market.

Sales s and Incentives

Hap Seng consistently leverages sales promotions and incentives to boost demand, especially within its automotive and property divisions. These often take the form of rebates, attractive financing packages, or added value services like complimentary maintenance, making their offerings more appealing to buyers.

These tactical sales efforts are crucial for achieving higher sales volumes and effectively managing inventory levels. For instance, in the automotive sector, Hap Seng might offer special year-end discounts to clear out the previous year's models, a common strategy in 2024 to make way for new inventory.

- Automotive Promotions: Hap Seng's automotive arm frequently provides discounts and financing deals on new vehicle purchases.

- Property Incentives: In real estate, buyers might see early bird discounts, subsidized renovation packages, or flexible payment schemes.

- Inventory Management: Promotions are key to moving stock, particularly for seasonal or model year changes.

- Demand Stimulation: These offers directly aim to attract customers and encourage immediate purchasing decisions.

Investor Relations and Analyst Briefings

Hap Seng actively manages its investor relations by providing comprehensive quarterly earnings reports, detailed annual reports, and insightful corporate presentations. This commitment ensures the investment community, including individual investors and financial professionals, has access to critical performance data. For instance, in the first quarter of 2024, Hap Seng's revenue reached RM 1.8 billion, a 5% increase year-on-year, demonstrating consistent operational performance.

The company proactively engages with financial analysts and leading research houses, offering them in-depth insights into Hap Seng's financial performance and future strategic direction. This engagement is crucial for shaping market perception and influencing investment decisions. For example, analysts from CIMB Research maintained their 'Add' recommendation for Hap Seng in May 2024, citing strong plantation segment growth and strategic expansion plans.

This transparent and consistent communication strategy directly impacts the investment community's understanding and confidence in Hap Seng. It influences analyst ratings and, consequently, guides investor decisions regarding their portfolios. The company's focus on clear communication aims to foster long-term investor relationships and support its valuation in the market.

- Investor Communications: Hap Seng releases quarterly earnings, annual reports, and corporate presentations.

- Analyst Engagement: Proactive interaction with financial analysts and research firms to share performance insights and outlook.

- Market Influence: This transparency aims to inform analyst ratings and investor decision-making processes.

- Financial Performance Highlight: Q1 2024 revenue of RM 1.8 billion, up 5% YoY, underscores operational strength.

Hap Seng's promotional activities are multifaceted, aiming to drive sales and enhance brand perception across its diverse business units. These efforts often involve direct incentives for consumers and strategic communication with the investment community.

The company utilizes targeted sales promotions, such as discounts and financing packages in its automotive and property divisions, to stimulate demand and manage inventory effectively. For instance, year-end model clearance sales are a common strategy in the automotive sector to make way for new stock.

Furthermore, Hap Seng prioritizes robust investor relations through consistent financial reporting and proactive engagement with analysts. This transparency, exemplified by its Q1 2024 revenue of RM 1.8 billion, up 5% year-on-year, aims to build investor confidence and positively influence market perception.

| Promotion Type | Target Segment | Example/Objective | 2024/2025 Data/Trend |

|---|---|---|---|

| Sales Promotions | Automotive & Property Buyers | Discounts, financing deals, added services | Increased sales volume, inventory clearance |

| Digital Marketing | Tech-savvy Consumers | Online ads, social media campaigns | Enhanced brand awareness, lead generation |

| Investor Relations | Investors, Financial Professionals | Quarterly reports, analyst briefings | RM 1.8bn Q1 2024 revenue, analyst 'Add' ratings |

Price

For high-value offerings like Mercedes-Benz vehicles and premium property developments, Hap Seng likely utilizes a value-based pricing strategy. This approach aligns prices with the perceived quality, brand prestige, and exclusive features customers associate with these products.

This strategy allows Hap Seng to set higher price points by highlighting luxury, sophisticated design, and an elevated customer experience. For instance, in 2024, the average selling price for premium sedans in Malaysia, a segment Hap Seng actively participates in, remained robust, reflecting sustained demand for high-quality automotive products.

The pricing decisions are informed by the target demographic's willingness to pay for superior offerings. Hap Seng's premium property projects, for example, are often situated in prime locations and offer amenities that justify their premium pricing, catering to affluent buyers who prioritize exclusivity and lifestyle.

HAP Seng's plantation division prices its palm oil products based on prevailing market conditions. This means the price of crude palm oil (CPO) and palm kernel (PK) isn't set by the company but by global supply and demand, along with broader economic factors.

These fluctuations directly affect HAP Seng's revenue and profitability. For instance, CPO prices saw significant volatility in early 2024, influenced by weather patterns and demand from key importing nations, impacting earnings for producers.

The company actively monitors CPO price ranges and future forecasts. This data is crucial for making informed strategic decisions, such as managing inventory levels and planning planting cycles to optimize yield and profitability.

Hap Seng strategically positions its building materials with competitive pricing, a vital tactic in its crowded market. By diligently tracking competitor rates for key products like aggregates, bricks, and fertilizers, the company aims to secure market share and appeal to large-volume buyers. This approach is underpinned by a focus on cost efficiencies to sustain profitability while offering attractive prices.

Interest-Rate Based Pricing for Financing

Hap Seng Credit structures its financing pricing around prevailing interest rates, loan durations, and any applicable fees. These rates are dynamic, adjusting with market conditions and the company's assessment of borrower risk. For instance, in early 2024, benchmark lending rates in Malaysia, such as the Base Rate, were hovering around 3.00% to 3.50%, providing a foundational element for their pricing models.

They provide adaptable financing packages designed to meet the diverse requirements of Small and Medium Enterprises (SMEs). This approach aims to offer competitive interest rates while maintaining sound lending practices to effectively manage credit exposure. For example, Hap Seng Credit might offer SME loan packages with interest rates ranging from 7% to 12% per annum, depending on the loan amount, tenure, and the specific risk profile of the business.

- Interest Rate Benchmarks: Hap Seng Credit's pricing is influenced by Malaysia's Base Rate, which, as of Q1 2024, was approximately 3.00% - 3.50%, forming the floor for their lending rates.

- SME Loan Rate Ranges: Typical SME financing rates offered by institutions like Hap Seng Credit in 2024 often fall between 7% and 12% annually, reflecting risk and loan terms.

- Fee Structures: Beyond interest, financing may include processing fees, late payment charges, and other administrative costs, contributing to the overall cost of capital for SMEs.

- Risk Mitigation: The company carefully monitors its loan portfolio and approval processes to navigate sectoral economic uncertainties and minimize potential losses.

Promotional and Discounted Pricing

Hap Seng strategically employs promotional and discounted pricing across its diverse business segments to boost sales and market penetration. This approach is particularly evident in their property and automotive divisions, where limited-time offers, attractive bundle deals, and cash rebates are common tactics. For instance, during key sales periods in 2024, Hap Seng Land might have offered early-bird discounts on new property launches, while Hap Seng Star, their automotive arm, could have provided special financing rates or service packages for specific Mercedes-Benz models.

These pricing strategies are designed to achieve several objectives:

- Stimulate immediate sales volume, especially during periods of slower demand or to clear inventory.

- Attract price-sensitive customer segments, broadening the appeal of their products and services.

- Enhance brand visibility and customer engagement through attractive, time-bound offers.

- Drive traffic and generate leads for higher-margin products or future sales.

Hap Seng's pricing strategy is multifaceted, adapting to the distinct market dynamics of each division. For its premium offerings like Mercedes-Benz vehicles and high-end properties, value-based pricing is key, reflecting brand prestige and quality. In contrast, the plantation division adheres to market-driven pricing for commodities like crude palm oil, with prices fluctuating based on global supply and demand. Building materials are priced competitively to capture market share, while financial services pricing is benchmarked against interest rates and borrower risk, with specific rates for SME loans often falling between 7% and 12% annually in 2024.

| Division | Pricing Strategy | Key Considerations | 2024/2025 Data Point |

|---|---|---|---|

| Automotive & Property (Premium) | Value-Based Pricing | Brand prestige, perceived quality, exclusivity | Robust average selling prices for premium sedans in Malaysia. |

| Plantations | Market-Driven Pricing | Global supply and demand, economic factors | Volatility in CPO prices influenced by weather and import demand. |

| Building Materials | Competitive Pricing | Competitor rates, cost efficiencies, volume buyers | Focus on cost efficiencies to maintain profitability amidst competitive rates. |

| Financial Services (Hap Seng Credit) | Interest Rate & Risk-Based Pricing | Benchmark rates (e.g., Base Rate ~3.00%-3.50% in Q1 2024), loan duration, borrower risk | SME loan rates typically 7%-12% per annum. |

4P's Marketing Mix Analysis Data Sources

Our HAP Seng 4P's Marketing Mix Analysis is meticulously constructed using a blend of official company disclosures, such as annual reports and investor presentations, alongside proprietary market research and competitor analysis. We also leverage data from industry publications and relevant trade journals to ensure a comprehensive and up-to-date understanding of their strategies.