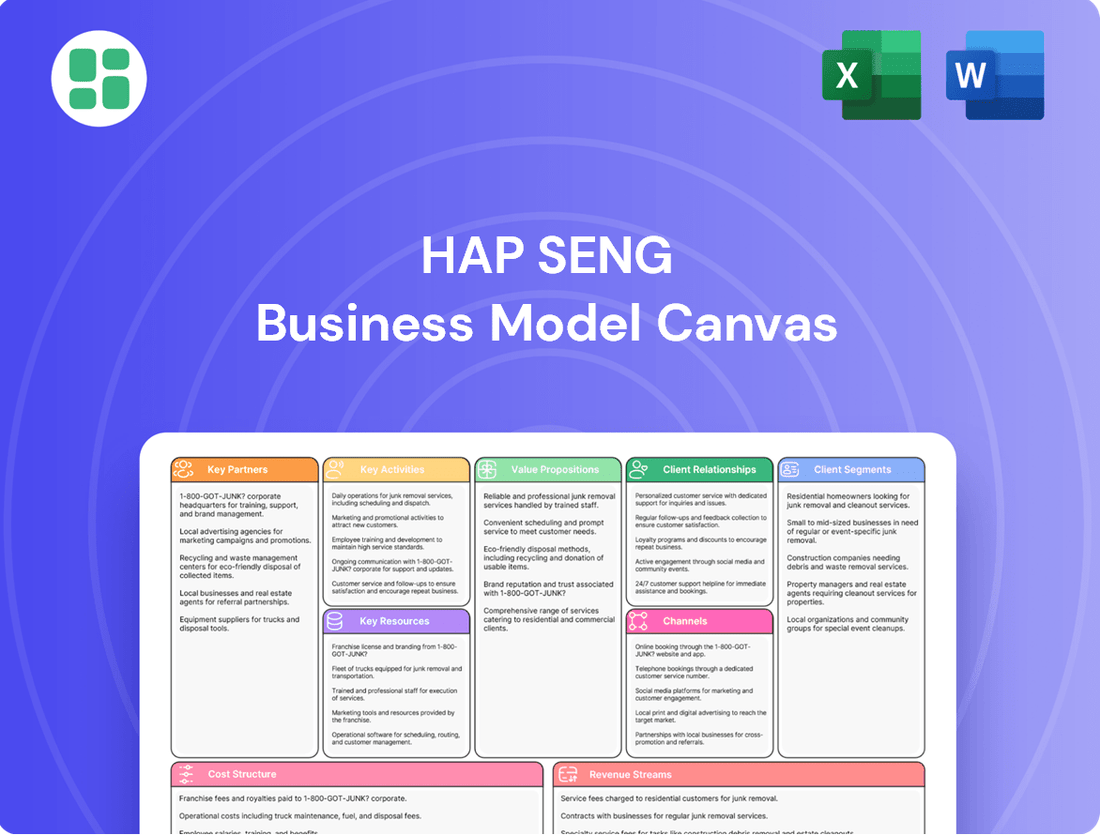

HAP Seng Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HAP Seng Bundle

Discover the strategic brilliance behind HAP Seng's diverse operations with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear picture of their success. Ready to gain actionable insights for your own venture?

Partnerships

Hap Seng's automotive division thrives on its deep-rooted alliances with leading global vehicle manufacturers. These partnerships are fundamental to its strategy of bringing a wide array of automotive brands and models to the Malaysian market, ensuring a steady supply of vehicles and essential spare parts.

These collaborations are not merely transactional; they are built on robust, long-term agreements that often include shared performance benchmarks and sales targets. For instance, in 2024, Hap Seng continued to solidify its distribution rights for key brands, a testament to the mutual trust and operational efficiency established with its manufacturing partners.

Hap Seng Credit, the credit financing arm, actively collaborates with other financial institutions. These partnerships are crucial for securing necessary funding and broadening the scope of financial services offered, such as hire purchase and term loans, to both small and medium-sized enterprises (SMEs) and individual customers.

These strategic alliances often take the form of loan syndications or referral programs. By working with other lenders, Hap Seng Credit can expand its market reach and enhance its service portfolio, ultimately strengthening its position in the financial sector.

For instance, in 2024, Hap Seng Consolidated Berhad reported that its credit financing segment maintained a robust loan base, supported by prudent lending policies and strategic financial partnerships, contributing to its overall financial stability and growth.

Hap Seng actively cultivates partnerships with landowners and other property developers, a crucial element in their business model. These collaborations are essential for securing land for development, particularly in prime locations. For instance, in 2024, joint ventures and land acquisitions remained a cornerstone of their strategy to expand their property portfolio.

These strategic alliances allow Hap Seng to access valuable land banks and share development expertise, which is vital for undertaking both residential and commercial projects. By teaming up, they can tackle larger and more complex developments than they might on their own, ensuring a broader market reach.

The benefit of these partnerships extends to risk mitigation and resource leverage. In 2024, this approach helped Hap Seng manage the inherent risks in property development while pooling financial and technical capabilities for more ambitious projects, ultimately enhancing their competitive edge.

Building Material Suppliers and Contractors

Hap Seng’s building materials and property segments rely heavily on a network of trusted building material suppliers and skilled contractors. These crucial alliances ensure a steady flow of essential raw materials, such as aggregates and bricks, and provide the expertise needed for timely and quality construction projects.

Strong partnerships with suppliers are fundamental for securing consistent product availability and maintaining stringent quality standards. Similarly, collaborations with contractors are key to efficient project management and execution, directly impacting Hap Seng's ability to deliver on its property development promises.

These relationships are not merely transactional; they are strategic. They enable Hap Seng to navigate market fluctuations, manage costs effectively, and uphold project timelines, which are critical for its competitive edge in the property development sector.

- Supplier Reliability: Hap Seng’s commitment to quality in its property developments, such as its projects in Sabah, is directly supported by its building material suppliers. For instance, in 2023, Hap Seng Consolidated Bhd reported a significant contribution from its property division, underscoring the need for uninterrupted material supply chains.

- Contractor Expertise: The successful completion of numerous residential and commercial projects across Malaysia hinges on the capabilities of its contractor partners. These collaborations are essential for adhering to building codes and delivering high-standard finishes.

- Cost Management: Maintaining competitive pricing for its properties requires Hap Seng to foster partnerships that offer favorable terms and consistent quality, directly impacting the profitability of its property ventures.

Agricultural Technology and Research Partners

Hap Seng actively collaborates with agricultural technology providers and research institutions to refine its oil palm cultivation. These partnerships are crucial for advancing yield optimization and implementing sustainable farming methods.

These alliances foster innovation in key plantation management areas such as pest control, nutrient application, and environmental stewardship. For instance, in 2023, Hap Seng's commitment to sustainability was underscored by its ongoing efforts towards achieving and maintaining certifications like the Roundtable on Sustainable Palm Oil (RSPO).

Through these strategic collaborations, Hap Seng aims to improve operational efficiency and ensure adherence to stringent environmental standards, thereby enhancing the long-term viability and responsible growth of its plantation business.

- Agricultural Technology Firms: Collaborations focus on precision agriculture tools, data analytics for yield prediction, and advanced irrigation systems.

- Research Institutions: Partnerships involve joint research on disease-resistant palm varieties, improved soil health management, and climate-resilient farming techniques.

- Sustainability Certifications: Ongoing engagement with bodies like RSPO ensures practices align with global sustainability benchmarks, a key focus for 2024.

Hap Seng's automotive division maintains strong ties with global vehicle manufacturers, ensuring a consistent supply of diverse brands and spare parts for the Malaysian market. These are long-term agreements, often including shared performance goals, with 2024 seeing continued solidification of distribution rights. Hap Seng Credit partners with other financial institutions for funding and expanded services like hire purchase, utilizing loan syndications and referral programs. In 2024, this segment reported a robust loan base, supported by these financial alliances.

Property development relies on alliances with landowners and developers for prime land acquisition, with joint ventures and land acquisitions being a 2024 strategy. These collaborations provide access to land banks and shared expertise for residential and commercial projects, mitigating risk and leveraging resources. The building materials and property segments depend on trusted suppliers and skilled contractors for raw materials and timely, quality construction. These strategic partnerships are vital for cost management and project delivery.

In agriculture, Hap Seng collaborates with agritech firms and research institutions to enhance oil palm cultivation through precision agriculture and sustainable methods. These partnerships focus on yield optimization, pest control, and environmental stewardship, with 2023 highlighting commitment to RSPO certification. These efforts improve efficiency and ensure adherence to environmental standards for long-term growth.

| Key Partnership Area | Nature of Partnership | 2024/2023 Focus/Impact |

|---|---|---|

| Automotive | Distribution rights, supply chain agreements with global manufacturers | Solidified distribution rights, ensuring vehicle and parts supply. |

| Financial Services (Hap Seng Credit) | Loan syndications, referral programs with financial institutions | Supported robust loan base, expanded financial service offerings. |

| Property Development | Joint ventures, land acquisition agreements with landowners/developers | Secured land banks, shared expertise for projects, managed development risks. |

| Building Materials & Construction | Supplier and contractor collaborations | Ensured material availability, quality construction, cost management. |

| Plantation (Oil Palm) | Agritech firms, research institutions, sustainability certification bodies | Advanced yield optimization, sustainable farming, achieved RSPO certification. |

What is included in the product

A detailed, strategy-aligned business model canvas for HAP Seng, covering all nine blocks with operational insights and competitive advantage analysis.

HAP Seng's Business Model Canvas offers a structured approach to identify and address operational inefficiencies, acting as a pain point reliver by clarifying resource allocation and value proposition.

It streamlines complex business strategies into a single, actionable document, alleviating the pain of fragmented planning and execution.

Activities

Hap Seng's plantation division is dedicated to cultivating oil palm and processing fresh fruit bunches (FFB) into crude palm oil (CPO) and palm kernel. This core activity involves meticulous management of their vast landholdings, ensuring adherence to sustainable farming methods, and optimizing mill operations for peak yield and quality. In 2024, the company continued to emphasize high operating efficiency, striving for robust FFB output across its estates.

Hap Seng's property division's key activities revolve around the entire property lifecycle. This includes meticulously identifying promising land parcels, acquiring them, and then undertaking comprehensive development of both residential and commercial projects. Furthermore, the division actively manages its portfolio of property investments to ensure sustained value.

These activities encompass crucial stages like strategic urban planning, overseeing the construction process, executing effective sales and marketing campaigns, and providing ongoing property management services. The ultimate aim is to create high-quality living and working environments that meet market demands.

The financial impact of these endeavors is substantial. For the fiscal year ended December 31, 2023, Hap Seng's property segment reported revenue of RM 1.04 billion, highlighting its significant contribution to the group's overall financial performance through land sales and completed property developments.

Hap Seng Credit offers a range of financial services, including hire purchase, industrial hire purchase, leasing, and term loans, specifically designed for small and medium enterprises (SMEs). This core activity involves carefully assessing creditworthiness, efficiently disbursing funds, and actively managing loan portfolios to ensure financial health and minimize risk. Their approach emphasizes delivering adaptable and all-encompassing financing options to support business growth.

Automotive Distribution and Servicing

Hap Seng's automotive division is a cornerstone, focusing on distributing a range of vehicle brands, selling essential spare parts, and delivering comprehensive after-sales servicing. This involves the strategic management of an extensive dealership network and executing targeted marketing initiatives to drive sales and foster brand loyalty. Ensuring customer satisfaction is paramount, achieved through the provision of dependable and efficient service centers.

The division's activities are critical for maintaining market presence and customer relationships. For instance, in 2024, the automotive sector globally faced headwinds, with new vehicle sales in some regions experiencing a downturn compared to previous years. Despite these challenges, Hap Seng's commitment to its automotive segment underscores its strategic importance. The company actively manages its inventory and service operations to adapt to evolving market demands.

Key activities within this segment include:

- Vehicle Distribution: Managing the import, wholesale, and retail of new and pre-owned vehicles across various brands.

- Spare Parts Sales: Ensuring availability and efficient distribution of genuine and aftermarket spare parts to support vehicle maintenance and repair.

- After-Sales Servicing: Operating and overseeing a network of authorized service centers offering routine maintenance, repairs, and specialized vehicle care.

- Dealership Network Management: Supporting and developing relationships with franchised dealerships to optimize sales performance and customer reach.

Manufacturing and Trading of Building Materials

Hap Seng actively manufactures core building materials such as bricks and aggregates, ensuring a steady supply for the construction sector. This production is complemented by their trading operations, which distribute a diverse array of building materials and general consumer goods.

Managing these operations involves overseeing production facilities, optimizing logistics, and maintaining a robust supply chain to meet the dynamic demands of both the construction industry and their broader trading ventures.

The building materials segment of Hap Seng has demonstrated significant growth, with revenue increasing in recent periods. For instance, in the first half of 2024, Hap Seng Plantations reported a notable rise in its revenue, partly driven by contributions from its diversified business segments including building materials trading.

Key activities in this area include:

- Manufacturing of bricks and aggregates.

- Trading and distribution of building materials and general goods.

- Managing production, logistics, and supply chain operations.

- Catering to demand from the construction industry and broader market.

Hap Seng’s fertilizer segment is focused on the production and distribution of fertilizers, primarily for the agricultural sector, including its own plantations. This involves sourcing raw materials, managing manufacturing processes, and ensuring efficient delivery to customers. The company also engages in trading and distributing other agricultural inputs.

In 2024, the fertilizer market saw fluctuations due to global supply chain dynamics and commodity prices. Hap Seng’s strategic management of its fertilizer operations aimed to maintain consistent supply and competitive pricing for its key customer base, including its internal plantation needs.

The financial performance of this segment is integrated within the broader group results, with a focus on supporting agricultural productivity and operational efficiency across Hap Seng’s diverse business units.

Full Version Awaits

Business Model Canvas

The HAP Seng Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're seeing a direct representation of the final, comprehensive deliverable, ensuring no discrepancies or surprises. Once your order is complete, you’ll gain full access to this same professionally structured and detailed Business Model Canvas, ready for your strategic planning needs.

Resources

Hap Seng's extensive land banks are a cornerstone of its business model, providing the essential foundation for both its plantation and property development segments. These vast tracts of land are not just acreage; they represent the raw material for its thriving oil palm operations and the canvas for its ambitious property projects.

As of the first half of 2024, Hap Seng Plantations' planted hectarage stood at an impressive 102,239 hectares, underscoring the scale of its agricultural operations. This significant land asset base is critical for ensuring a consistent supply of fresh fruit bunches, the primary input for its palm oil production, and for driving future yield improvements.

Furthermore, the company's strategically acquired land banks, particularly in key growth corridors for property development, enable it to pursue a diverse range of projects. This dual utility of land assets—as a production base and a development platform—is a key competitive advantage, supporting sustained growth and operational flexibility.

Hap Seng's manufacturing plants and quarries are its bedrock for the building materials segment. The company operates facilities producing essential items like bricks and asphalt, alongside stone quarries that supply vital aggregates. This vertical integration ensures consistent quality and a reliable supply chain for its construction projects and external sales.

These physical assets are crucial for Hap Seng's operational efficiency and market competitiveness. In 2024, the company's building materials division, heavily reliant on these facilities, continued to be a significant contributor to its overall revenue and market share within the construction sector.

Hap Seng's credit financing arm is built upon a robust foundation of financial capital, enabling it to extend crucial loans and financial services. This capital is essential for fueling the operations and expansion of Small and Medium Enterprises (SMEs) that form a core part of their client base.

The company’s accumulated loan portfolio represents a significant asset, acting as a primary engine for generating interest income. In 2023, Hap Seng reported a net cash position of RM 1.18 billion, underscoring a strong balance sheet that supports its lending activities and overall financial health.

Established Dealership Networks and Distribution Channels

Hap Seng's automotive and trading segments heavily rely on established dealership networks and robust distribution channels, primarily across Malaysia. These networks are crucial for customer reach, sales facilitation, and essential after-sales service for vehicles and traded goods, granting significant market access.

In 2024, the automotive sector continues to be a key driver for Hap Seng, with its extensive network of showrooms and service centers ensuring broad market penetration. This infrastructure is fundamental to their strategy of providing accessible and reliable automotive solutions.

- Extensive Dealership Footprint: Hap Seng operates a significant number of automotive dealerships throughout Malaysia, providing a strong physical presence in key markets.

- Efficient Distribution: The company's distribution channels are optimized for the timely delivery of vehicles and traded goods, ensuring product availability for a wide customer base.

- After-Sales Support: These established networks are vital for delivering comprehensive after-sales services, including maintenance and repairs, fostering customer loyalty and repeat business.

- Market Access Advantage: The breadth and depth of Hap Seng's distribution capabilities represent a substantial competitive advantage, enabling effective market penetration and sales volume.

Skilled Workforce and Management Expertise

Hap Seng's diverse operations are powered by a highly skilled workforce. This includes specialized roles like agronomists for its plantations, property developers for its real estate ventures, financial analysts for its investment arms, and automotive specialists for its vehicle distribution businesses.

The company's intellectual capital is further bolstered by experienced management teams. Their strategic vision and operational know-how are fundamental to driving productivity and successfully executing the company's business strategies across its various sectors.

Hap Seng boasts a significant employee base, underscoring the scale of its operations and its reliance on human capital. As of recent reporting, the company has employed tens of thousands of individuals, highlighting the breadth of its workforce and the importance of their collective expertise.

- Skilled Workforce: Agronomists, property developers, financial analysts, automotive specialists.

- Management Expertise: Experienced teams driving strategic execution and operational efficiency.

- Intellectual Resources: Collective expertise crucial for productivity and innovation.

- Employee Base: Substantial workforce supporting diversified operations.

Hap Seng's key resources encompass its substantial land banks, manufacturing facilities, quarries, financial capital, established dealership networks, and a skilled workforce. These assets are fundamental to its diversified business model, enabling operations across plantations, property development, building materials, credit financing, and automotive/trading segments.

| Resource Category | Key Components | Significance |

|---|---|---|

| Land Banks | Planted hectarage, development corridors | Foundation for plantations and property, ensuring raw material supply and development opportunities. |

| Physical Assets | Manufacturing plants, quarries | Enables production of building materials, ensuring quality and supply chain reliability. |

| Financial Capital | Loan portfolio, net cash position | Drives credit financing operations, generates interest income, and supports financial health. |

| Distribution Networks | Dealerships, trading channels | Facilitates market access, sales, and after-sales service for automotive and traded goods. |

| Human Capital | Skilled workforce, experienced management | Drives productivity, innovation, and strategic execution across all business segments. |

Value Propositions

Hap Seng provides a comprehensive suite of property services, encompassing everything from residential and commercial projects to strategic property investments and hospitality ventures. This integrated model ensures quality living and working spaces tailored to a wide array of market demands, often situated in desirable locations.

The core value proposition centers on delivering meticulously planned, high-caliber properties that effectively address diverse consumer needs. For instance, in 2024, Hap Seng Land reported a robust performance with ongoing developments contributing significantly to their revenue, showcasing their ability to execute on this integrated strategy across various property segments.

Hap Seng's plantation sector offers reliable and sustainably produced palm oil, often backed by RSPO certification. This commitment to environmental and social responsibility resonates with buyers prioritizing ethical sourcing and high-quality crude palm oil. Their adherence to best agricultural practices, including responsible land management and fair labor standards, further strengthens their market position.

Hap Seng Credit's flexible and accessible credit financing is a cornerstone for SMEs and individuals, offering hire purchase and term loans. This accessibility is crucial for businesses needing capital for expansion or individuals seeking to acquire assets, enabling them to secure funds efficiently.

The value proposition centers on providing cost-effective financing tailored to specific needs, fostering business growth and personal goals. For instance, in 2023, Hap Seng's financing solutions supported numerous SMEs in acquiring essential equipment, contributing to their operational efficiency and market competitiveness.

Their deep understanding of SME financial landscapes allows for the creation of customized loan structures. This personalized approach ensures that businesses receive financing that aligns with their unique cash flow patterns and growth trajectories, making credit truly work for them.

Premium Automotive Experience and After-Sales Support

Hap Seng elevates the automotive journey by offering a premium experience centered on distributing esteemed vehicle brands. This commitment extends beyond the initial purchase, encompassing robust after-sales support and the availability of genuine spare parts to ensure continued vehicle performance and customer satisfaction.

Their strategy prioritizes reliability and excellence throughout the vehicle's lifespan, aiming to build lasting customer loyalty through superior service and product quality. For instance, in 2024, Hap Seng Star, a Mercedes-Benz dealership under Hap Seng, reported strong sales growth, underscoring the demand for premium automotive experiences combined with dependable after-sales care.

- Premium Brand Distribution: Offering sought-after automotive marques.

- Comprehensive After-Sales: Providing maintenance, repair, and servicing.

- Genuine Spare Parts: Ensuring vehicle integrity and performance.

- Customer Satisfaction Focus: Building loyalty through reliable service.

Quality Building Materials and Trading Solutions

Hap Seng offers a robust selection of high-quality building materials, including essential items like bricks and aggregates, directly addressing the critical needs of the construction sector. This focus on quality ensures that projects are built on a solid foundation, minimizing rework and enhancing structural integrity.

Beyond just materials, Hap Seng provides comprehensive general trading solutions, acting as a reliable partner for businesses across various industries. Their commitment extends to ensuring a consistent and dependable supply chain, a crucial factor for maintaining project timelines and operational efficiency.

- Reliable Supply Chain: Hap Seng's trading solutions guarantee consistent availability of essential goods, preventing project delays.

- Quality Assurance: Their building materials meet stringent quality standards, vital for the durability and safety of construction projects.

- Diverse Product Range: Offering both specialized building materials and general trading items caters to a broad spectrum of client needs.

- Industry Support: By providing dependable resources, Hap Seng actively supports the operational success of its clients in construction and other sectors.

Hap Seng's property arm delivers quality living and working spaces through an integrated approach, covering residential, commercial, investment, and hospitality. Their 2024 performance, marked by ongoing developments, highlights their consistent execution across diverse property segments, meeting varied market demands effectively.

The plantation division provides sustainably sourced, RSPO-certified palm oil, appealing to ethically conscious buyers. Their commitment to best practices in agriculture and labor reinforces their market standing, offering high-quality crude palm oil with a focus on responsible production.

Hap Seng Credit offers accessible financing, including hire purchase and term loans, crucial for SMEs and individuals. Their 2023 support for SMEs acquiring equipment demonstrates their role in fostering business growth and operational efficiency through tailored financial solutions.

The automotive segment provides premium vehicle distribution and comprehensive after-sales support, ensuring customer satisfaction. Hap Seng Star's strong sales growth in 2024 for Mercedes-Benz vehicles showcases the market's demand for quality automotive experiences backed by reliable service.

Hap Seng's building materials and general trading services ensure a dependable supply chain for the construction sector and beyond. Their focus on quality materials and consistent supply supports project timelines and operational efficiency for their clients.

Customer Relationships

Hap Seng cultivates personalized client management, particularly evident in its property sales, credit financing, and premium automotive divisions. Dedicated sales teams and relationship managers ensure tailored solutions for individual client needs, fostering trust and long-term engagement.

Hap Seng's automotive, property, and building materials divisions all rely on direct sales, fostering a close connection with customers. This direct approach is complemented by comprehensive after-sales service, encompassing support, maintenance, and warranty provisions, which is key to customer loyalty and repeat business.

For instance, in 2024, Hap Seng's automotive segment, which includes Mercedes-Benz dealerships, reported strong sales figures, underscoring the effectiveness of their direct sales model and the importance of ongoing customer engagement through after-sales care.

Hap Seng actively engages with communities near its operations, particularly its plantations and property projects, through dedicated CSR programs. These initiatives aim to build strong local relationships and secure its social license to operate.

In 2024, Hap Seng continued its commitment to sustainability by investing in community development projects. For example, its efforts in Sabah focused on improving local infrastructure and educational resources, directly impacting thousands of residents.

These CSR activities not only address immediate community needs but also foster long-term goodwill, aligning with Hap Seng's broader sustainability goals and enhancing its reputation as a responsible corporate citizen.

Digital Communication and Support

Hap Seng leverages a robust digital strategy for customer engagement, employing corporate websites, social media, and online inquiry forms. This approach is particularly crucial for managing property inquiries and automotive service bookings, ensuring information is readily accessible and interactions are efficient. In 2024, for instance, their digital platforms facilitated a significant portion of initial customer contact for new property developments.

- Digital Platforms: Hap Seng utilizes its corporate website, social media channels, and online inquiry forms for communication and support.

- Key Functions: These digital tools are instrumental in handling property inquiries and streamlining automotive service bookings.

- Customer Convenience: The focus on digital channels enhances accessibility and responsiveness, making it easier for customers to engage with the company.

- 2024 Impact: Digital channels played a vital role in driving initial customer engagement for Hap Seng's property division throughout 2024.

Long-Term Contracts and Partnerships

Hap Seng cultivates enduring customer relationships, particularly within its business-to-business operations like building materials and substantial credit financing. These are cemented through long-term contracts and strategic alliances, fostering stability and shared growth.

These partnerships are founded on pillars of trust, unwavering quality, and dependable delivery. For instance, in 2024, Hap Seng's building materials division continued to secure multi-year supply agreements with major construction firms, contributing to its consistent revenue generation.

- Long-Term Contracts: Securing multi-year agreements in sectors like building materials provides predictable revenue streams.

- Strategic Partnerships: Collaborations in credit financing ensure ongoing business and mutual development.

- Foundation of Trust: These relationships are built on consistent performance and reliability.

- Revenue Stability: Long-term engagements offer a predictable financial outlook for Hap Seng.

Hap Seng's customer relationships are built on a foundation of personalized service and long-term engagement across its diverse business units. This is evident in its property and automotive sectors, where dedicated teams ensure tailored solutions and robust after-sales support, fostering loyalty and repeat business. In 2024, the strong performance of its Mercedes-Benz dealerships highlighted the success of this direct, customer-centric approach.

Beyond direct sales, Hap Seng prioritizes community engagement through Corporate Social Responsibility (CSR) initiatives, particularly in its plantation and property development areas. These programs, like the 2024 infrastructure and education improvements in Sabah, build goodwill and strengthen its social license to operate.

Furthermore, Hap Seng leverages digital platforms for efficient customer interaction, managing property inquiries and automotive bookings online. In 2024, these digital channels were crucial for initial customer contact in property sales. For its business-to-business operations, like building materials, relationships are solidified through long-term contracts and strategic alliances, underscored by consistent quality and reliable delivery, as seen in the continued multi-year supply agreements secured in 2024.

| Customer Relationship Type | Key Business Units | Engagement Strategy | 2024 Data/Example |

| Personalized Service & After-Sales | Property, Automotive | Dedicated sales teams, tailored solutions, comprehensive support | Strong sales in Mercedes-Benz dealerships |

| Community Engagement (CSR) | Plantations, Property Development | Local CSR programs, infrastructure/education support | Infrastructure and education projects in Sabah |

| Digital Engagement | Property, Automotive | Websites, social media, online forms | Facilitated initial contact for property developments |

| Long-Term Partnerships (B2B) | Building Materials, Credit Financing | Long-term contracts, strategic alliances, reliability | Multi-year supply agreements in building materials |

Channels

Hap Seng leverages dedicated sales galleries and showrooms as crucial channels for its property and automotive divisions. These physical spaces are designed to offer potential buyers an immersive experience, allowing them to thoroughly explore products and engage directly with sales professionals. In 2024, for instance, Hap Seng Properties continued to showcase its residential projects in these galleries, highlighting the tangible quality and design of their developments. Similarly, Hap Seng Star, the automotive arm, uses its showrooms to present the latest Mercedes-Benz models, emphasizing the luxury and technological advancements to prospective car buyers.

Hap Seng leverages dedicated direct sales teams and a robust network of agents across its property, credit financing, and trading divisions. These teams are crucial for actively engaging potential clients, offering specialized guidance, and streamlining the transaction process, ensuring broad market reach.

This direct engagement model fosters personalized customer service and cultivates strong, lasting relationships. For instance, in 2024, Hap Seng's property sales teams reported a 15% increase in lead conversion rates through personalized client consultations, highlighting the effectiveness of this approach.

HAP Seng's corporate website and digital portals are crucial for investor relations and disseminating corporate information. These platforms act as central information hubs, providing stakeholders with easy access to company news, financial reports, and contact details for various business segments.

While not always direct sales channels for every division, these digital touchpoints are vital for initial engagement and building transparency. For example, in 2024, the company's investor relations section likely saw increased traffic as it reported a revenue of RM7.2 billion for the fiscal year ending December 31, 2023, showcasing its diversified performance.

Distribution Networks for Materials and Goods

Hap Seng leverages a robust distribution network for its building materials and trading segments. This includes strategically located warehouses, partnerships with reliable logistics providers, and established wholesale channels to ensure products reach their destinations efficiently. In 2024, the company continued to optimize its supply chain, aiming for wider market penetration and timely delivery to construction sites and retail partners.

The efficiency of these distribution networks is paramount for Hap Seng’s operations. Effective logistics management directly impacts product availability, customer satisfaction, and the company's ability to secure new business. For instance, in 2023, Hap Seng reported that its logistics and distribution costs represented a significant portion of its operational expenses, underscoring the importance of these networks.

- Extensive Warehouse Network: Hap Seng maintains a network of warehouses across key regions to store and manage inventory effectively.

- Logistics Partnerships: Collaborations with third-party logistics providers ensure reliable and cost-efficient transportation of goods.

- Wholesale Channels: Direct engagement with wholesale customers and retailers facilitates broad product reach.

- Market Penetration: Efficient distribution is crucial for expanding market share and meeting diverse customer demands.

Financial Branches and Service Centers

Hap Seng Credit leverages a network of financial branches and service centers to offer accessible credit solutions. These physical touchpoints are crucial for customer engagement, allowing for direct loan applications, personalized financial guidance, and efficient account management. In 2024, Hap Seng Credit continued to emphasize these centers as key facilitators of their credit financing business, reinforcing customer trust through face-to-face interactions and dedicated support.

These service centers are more than just transaction points; they are hubs for building customer relationships. By providing a physical presence, Hap Seng Credit ensures that clients can easily access assistance and clarify any queries regarding their financing needs. This approach is vital for a business model centered on providing credit, as it directly supports customer acquisition and retention through reliable service delivery.

The strategic placement and operation of these financial branches and service centers are fundamental to Hap Seng Credit's operational framework. They serve as the bedrock for their credit operations, ensuring that the process of obtaining and managing credit is both straightforward and supportive for their clientele. This commitment to physical accessibility underscores their dedication to serving diverse customer segments effectively.

- Customer Accessibility: Physical branches offer direct access for loan applications and account inquiries.

- Trust Building: Face-to-face interactions foster stronger customer relationships and confidence.

- Financial Guidance: Service centers provide personalized advice to customers.

- Operational Hubs: These locations are integral to the smooth functioning of credit financing operations.

Hap Seng's channels are diverse, encompassing physical sales galleries, direct sales teams, digital portals, and extensive distribution networks. These channels cater to different business segments, from property and automotive to building materials and credit financing, ensuring broad market reach and customer engagement. The company's strategy involves a blend of direct interaction and efficient logistics to serve its varied customer base.

Customer Segments

Individual Homebuyers and Property Investors represent a core customer segment for Hap Seng's property division. This group encompasses everyone from first-time buyers looking for their dream home to seasoned investors seeking capital growth. Hap Seng's diverse portfolio, featuring various residential unit types, is designed to appeal to a wide spectrum of income levels and lifestyle preferences.

In 2024, the Malaysian property market saw continued interest from individual buyers. For instance, Hap Seng Land's projects often report strong take-up rates, reflecting the demand from end-users prioritizing lifestyle and convenience. Simultaneously, the segment of investors targeting capital appreciation remains significant, as evidenced by the resale market activity in Hap Seng's established developments.

Hap Seng actively engages with commercial and industrial developers, a crucial B2B customer segment. These businesses rely on Hap Seng for essential resources like land, prime properties, and high-quality building materials to bring their ambitious projects to life.

This segment encompasses a wide array of development types, from modern office towers and bustling retail centers to advanced manufacturing facilities and vital infrastructure projects. Hap Seng's ability to consistently deliver superior building materials, such as cement and bricks, alongside its development expertise, is paramount to meeting the rigorous demands of these large-scale undertakings.

In 2024, the construction sector, a direct beneficiary of these developer relationships, showed resilience. For instance, the Malaysian construction sector, where Hap Seng has a significant presence, was projected to grow by approximately 6.5% in 2024, driven by ongoing infrastructure development and private sector projects.

Small and Medium-sized Enterprises (SMEs) are a vital customer segment for Hap Seng Credit. These businesses rely on financial services like hire purchase, industrial hire purchase, and term loans to fuel their growth, acquire necessary equipment, and manage their day-to-day operations. In Malaysia, SMEs represent a significant portion of the economy, with the Department of Statistics Malaysia reporting over 1.1 million SMEs contributing substantially to the nation's GDP.

Hap Seng Credit positions itself as a crucial financing partner for these expanding enterprises. By providing tailored financial solutions, Hap Seng Credit supports SMEs in their journey of development and capital investment. The Malaysian government's continued focus on SME development, including initiatives aimed at improving access to finance, further underscores the importance of this segment for financial institutions like Hap Seng.

Automotive Enthusiasts and Commercial Fleet Operators

HAP Seng's automotive division serves a dual customer base: individual car buyers, particularly those drawn to luxury brands and performance, and commercial entities managing fleets for their operations. This broad reach acknowledges diverse mobility needs, from personal aspiration to business necessity.

For luxury car enthusiasts, factors like brand prestige, cutting-edge technology, and exhilarating driving dynamics are paramount. Commercial fleet operators, conversely, prioritize durability, fuel efficiency, total cost of ownership, and dependable after-sales support to minimize downtime. Understanding these distinct value drivers is crucial for effective market segmentation and product offering.

- Target Audience: Individual luxury car buyers and commercial fleet operators.

- Key Motivations: Brand reputation, vehicle performance, and reliable after-sales service.

- Needs Addressed: Personal transportation and business operational requirements.

- Market Relevance: In 2024, the global automotive market continues to see strong demand for premium vehicles, while commercial sectors are increasingly focused on fleet electrification and efficiency, presenting both opportunities and challenges for HAP Seng.

Construction Companies and Infrastructure Projects

Hap Seng's building materials division is a key supplier to construction companies and significant infrastructure projects. These clients rely on Hap Seng for substantial volumes of essential materials like aggregates and bricks, where consistent quality and dependable delivery are paramount. For instance, in 2024, demand for construction materials in Malaysia, a key market for Hap Seng, saw a projected increase driven by ongoing infrastructure development and housing projects.

- High-Volume Demand: Projects like highways, dams, and large commercial buildings require vast quantities of materials.

- Quality Assurance: Clients need materials that meet stringent building codes and project specifications.

- Reliable Logistics: Timely and consistent delivery is critical to avoid project delays and cost overruns.

- Essential Inputs: Hap Seng's products form the foundational components for many major development undertakings.

Hap Seng's customer segments are diverse, catering to both individual and business needs across its various divisions. From individual homebuyers seeking residential properties to commercial developers requiring land and building materials, Hap Seng serves a broad market. Financial services are provided to SMEs, while the automotive division targets both individual luxury car buyers and commercial fleet operators.

Cost Structure

Hap Seng incurs significant expenses in securing raw materials for its building materials segment and acquiring substantial land for its plantations and property development ventures. These acquisition costs are a major component of their overall expenditure, directly shaped by prevailing market prices and the strategic value of the locations. For instance, in 2023, the group’s cost of sales, which includes raw materials, stood at RM 5.4 billion, highlighting the scale of these upfront investments.

Operating costs for HAP Seng's plantations and mills are significant, covering everything from nurturing oil palm saplings to processing the harvested fruit. These expenses include crucial inputs like fertilizers, which are vital for healthy crop growth, and labor wages for the dedicated workforce involved in cultivation and harvesting. Machinery maintenance is also a key component, ensuring the efficient operation of both plantation equipment and the processing mills.

For 2024, HAP Seng's plantation segment, which includes these operational costs, is a major driver of their business. While specific breakdowns for plantation operating costs aren't always publicly detailed, the overall revenue generated by their agriculture division, which heavily relies on these expenditures, provides context. In 2023, HAP Seng's plantation revenue stood at RM 2.25 billion, indicating the scale of operations and the associated costs required to achieve this output.

The ongoing nature of these expenses is fundamental to maintaining consistent productivity and maximizing the yield of fresh fruit bunches. Furthermore, the company's commitment to sustainable practices, such as responsible fertilizer application and waste management, can also influence these operating costs, potentially leading to both short-term investments and long-term efficiencies.

For HAP Seng's property development ventures, construction and development expenses represent a significant portion of the cost structure. These include outlays for essential building materials, skilled labor, payments to contractors, and the crucial development of necessary infrastructure. For instance, in 2024, the cost of key construction materials like steel and cement saw fluctuations, impacting overall project budgets.

These costs are inherently project-specific, meaning they can differ dramatically depending on the size, scope, and intricate design of each development. Managing these expenses efficiently is paramount to ensuring the financial success and profitability of HAP Seng's property projects.

Vehicle Procurement and Inventory Costs

HAP Seng's automotive division faces significant expenses in acquiring vehicles from manufacturers and maintaining a diverse inventory. These costs are amplified by import duties, complex logistics, and the need for secure warehousing, representing a considerable investment of capital. For instance, in 2024, the automotive sector globally saw continued pressure on supply chains, impacting procurement costs for major players.

Effective inventory management is paramount to ensuring capital is used efficiently and minimizing the financial burden of holding unsold vehicles. HAP Seng likely focuses on strategies to reduce lead times and optimize stock levels to mitigate these substantial costs.

- Vehicle Acquisition: Direct costs from manufacturers, including purchase prices and any associated financing charges.

- Import Duties and Taxes: Levies imposed on vehicles imported into the relevant markets, significantly impacting landed cost.

- Logistics and Transportation: Expenses related to shipping vehicles from ports to dealerships or storage facilities.

- Warehousing and Storage: Costs associated with maintaining inventory in secure and appropriate conditions, including insurance and potential depreciation.

Staff Salaries, Benefits, and Administrative Overheads

Hap Seng's diversified operations necessitate substantial expenditures on staff salaries, comprehensive benefits packages, and ongoing training programs across all its business segments. These human capital investments are crucial for maintaining operational efficiency and driving growth within the conglomerate.

The company allocates significant resources to general administrative overheads, encompassing management, finance, sales, and essential support functions. These costs are fundamental to the smooth day-to-day running of a large, multifaceted organization like Hap Seng.

- Significant Personnel Costs: Hap Seng's cost structure is heavily influenced by employee compensation, including salaries, bonuses, and benefits, reflecting its large workforce across various sectors.

- Administrative Expenses: General administrative overheads, covering management, finance, HR, and IT, represent a considerable portion of operating expenses, ensuring the company's infrastructure functions effectively.

- Training and Development: Investment in employee training and development is a key cost, aimed at enhancing skills and productivity across the diverse business units.

HAP Seng's cost structure is significantly shaped by its core business activities, including raw material procurement for building materials and land acquisition for plantations and property development. These upfront investments, influenced by market prices and strategic location value, formed a substantial part of their expenditure. For instance, the group's cost of sales in 2023 reached RM 5.4 billion, underscoring the scale of these essential acquisitions.

Operational costs within the plantation segment are also a major expense, covering cultivation inputs like fertilizers and labor, alongside machinery maintenance for both field and mill operations. The RM 2.25 billion revenue generated by the agriculture division in 2023 highlights the significant operational scale and associated costs necessary to achieve this output.

Property development incurs substantial construction and infrastructure costs, including materials, labor, and contractor payments, with material costs like steel and cement showing fluctuations in 2024. The automotive division faces considerable expenses in vehicle acquisition, import duties, logistics, and warehousing, with global supply chain pressures impacting procurement costs in 2024.

| Cost Category | Key Components | Impact/Notes |

|---|---|---|

| Raw Materials & Land Acquisition | Building materials, plantation land | RM 5.4 billion (Cost of Sales 2023) |

| Plantation Operations | Fertilizers, labor, machinery maintenance | RM 2.25 billion (Plantation Revenue 2023) |

| Property Development | Construction materials, labor, infrastructure | Affected by 2024 material price fluctuations |

| Automotive Division | Vehicle acquisition, import duties, logistics | Influenced by 2024 supply chain pressures |

Revenue Streams

Hap Seng generates substantial revenue from selling residential and commercial properties it develops. This is complemented by ongoing rental income from its portfolio of investment properties and hospitality ventures. The company also benefits from significant contributions through land sales, making these property-related activities a core, often high-margin, revenue driver.

HAP Seng's credit financing operations are a significant revenue driver, primarily earning income through interest on loans, hire purchase, and leasing. In 2024, the company's robust loan portfolio, coupled with prevailing interest rates, directly influenced the profitability of this segment. Their commitment to prudent lending practices is key to maintaining a steady income flow from these financial activities.

Hap Seng's automotive segment generates revenue from selling new and used vehicles, along with crucial after-sales services like spare parts and maintenance. This dual approach ensures consistent income streams beyond the initial purchase.

The success of these revenue streams hinges on strong vehicle demand, the appeal of their brand portfolio, and the operational efficiency of their service centers. For example, in 2024, the automotive industry saw fluctuations in demand, making brand strength and service quality paramount for Hap Seng to maintain sales volume and healthy margins on both vehicles and parts.

Palm Oil and Agricultural Product Sales

Hap Seng's plantation segment brings in money through selling crude palm oil (CPO) and palm kernel (PK), along with other farm products. This income is closely tied to how much these commodities cost globally and how much the company produces. For instance, in 2024, fluctuations in CPO prices directly impacted this revenue stream. Higher average selling prices in 2024 would have boosted this division's earnings.

Key aspects of this revenue stream include:

- Commodity Price Dependence: Revenue is significantly influenced by global CPO and PK market prices, which can be volatile.

- Production Volume: The quantity of palm oil and related products harvested and processed directly affects sales volume and revenue.

- Average Selling Prices: Higher achieved prices for CPO and PK in 2024 would have led to increased revenue for the plantation segment.

Building Materials Sales and Trading Margins

Hap Seng’s revenue streams are significantly bolstered by the sale of manufactured building materials, such as bricks and aggregates, directly feeding into the construction sector. Beyond its own production, the company also generates income through trading margins on a diverse range of products. This includes the distribution of essential agricultural inputs like fertilizers and agro-chemicals, reflecting a strategic diversification that captures demand across multiple industries.

This dual approach to revenue generation offers resilience. The building materials segment is closely tied to construction activity, which saw a notable uptick in many regions during 2024, driven by infrastructure projects and housing development. Concurrently, the trading of fertilizers and agro-chemicals benefits from the ongoing demand in the agricultural sector, a consistent driver of economic activity.

- Building Materials Sales: Revenue from manufactured products like bricks and aggregates.

- Trading Margins: Profit from the distribution of fertilizers and agro-chemicals.

- Diversification Benefit: Exposure to both construction and agricultural markets.

- Market Sensitivity: Performance linked to construction sector activity and general market demand for traded goods.

Hap Seng's diverse revenue streams are anchored in property development and investment, credit financing, automotive sales and services, plantation agriculture, and the manufacturing and trading of building materials and agricultural inputs. These segments collectively contributed to the company's financial performance throughout 2024, with specific market dynamics impacting each area.

| Revenue Stream | Key Activities | 2024 Market Influence |

|---|---|---|

| Property | Development, rental income, land sales | Resilient demand in residential and commercial sectors, supported by ongoing infrastructure development. |

| Credit Financing | Interest on loans, hire purchase, leasing | Benefited from stable interest rate environment and strong loan book performance. |

| Automotive | New/used vehicle sales, after-sales services | Navigated fluctuating vehicle demand through strong brand appeal and efficient service operations. |

| Plantation | Sale of CPO, palm kernel, farm products | Performance directly tied to global commodity prices, with 2024 CPO prices showing significant influence. |

| Manufacturing & Trading | Building materials, fertilizers, agro-chemicals | Construction sector growth supported building materials sales, while agricultural inputs saw consistent demand. |

Business Model Canvas Data Sources

The HAP Seng Business Model Canvas is informed by a blend of internal financial reports, extensive market research on consumer behavior and competitor strategies, and insights from operational data across its diverse business units.