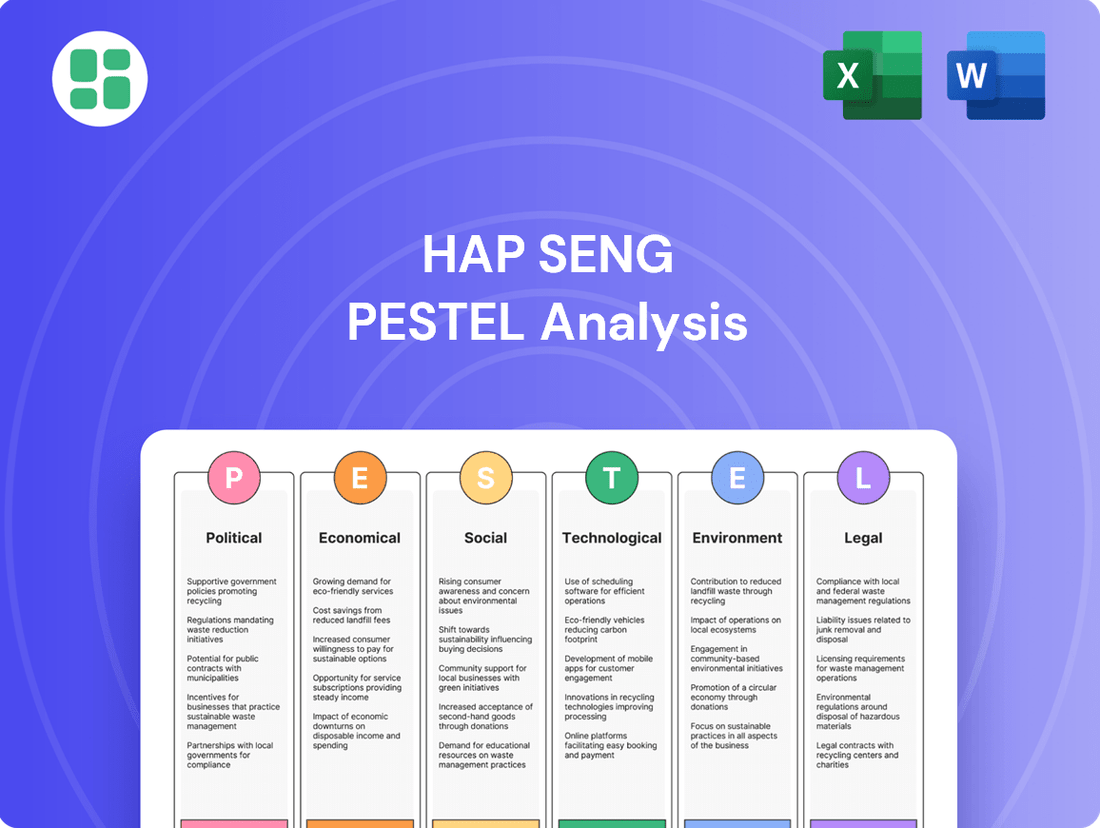

HAP Seng PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HAP Seng Bundle

Navigate the dynamic landscape impacting HAP Seng with our detailed PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its trajectory. Gain a competitive edge by leveraging these crucial insights to inform your strategy. Download the full PESTLE analysis now for actionable intelligence.

Political factors

The Malaysian government's strategic industrial policies directly shape Hap Seng's diverse business landscape. Budget 2025, for instance, prioritizes affordable housing and green building incentives, offering a significant tailwind for Hap Seng's property development arm.

In the crucial palm oil sector, government mandates are increasingly focused on sustainability. The push for wider adoption and stringent adherence to the Malaysian Sustainable Palm Oil (MSPO) certification scheme, a key focus for 2024 and beyond, directly impacts Hap Seng's plantation operations and market access.

Malaysia's trade policies and its relationships with key international partners, particularly the European Union and the United States, directly influence Hap Seng's export-dependent segments, such as its palm oil operations. The EU's decision to postpone the EU Deforestation Regulation (EUDR) enforcement to December 2025 offers a vital opportunity for Malaysian palm oil producers, including Hap Seng, to align their practices and secure continued market access. This delay is critical as Malaysia is a significant palm oil exporter, with exports to the EU accounting for a notable portion of its total trade.

Malaysia's commitment to regulatory stability is a significant advantage for Hap Seng. For instance, the World Bank's Ease of Doing Business report, prior to its discontinuation in 2020, consistently ranked Malaysia favorably, indicating a generally predictable and supportive business landscape. This stability fosters confidence for continued investment and operational planning across Hap Seng's diverse portfolio.

However, any potential shifts in Malaysian business regulations, such as changes to foreign ownership rules or new environmental compliance standards, could introduce uncertainty. For a conglomerate like Hap Seng, operating in sectors like plantations and property development, such regulatory adjustments can directly influence profitability and necessitate swift strategic adjustments to maintain market competitiveness.

Political Stability and Governance

Malaysia's political stability is a cornerstone for investor confidence, directly influencing the operational environment for companies like Hap Seng. The government's dedication to robust governance and clear policy frameworks fosters a predictable landscape essential for Hap Seng's varied investments.

The administration's focus on anti-corruption initiatives and transparent policy-making is crucial. For instance, Malaysia's ranking in Transparency International's Corruption Perception Index for 2023 was 57th out of 180 countries, indicating a moderate but improving level of perceived corruption, which is a positive signal for foreign direct investment.

- Political Stability: The nation's political stability under the current administration is a key factor for long-term business planning.

- Governance and Policy: Government commitment to good governance and clear, consistent economic policies reduces operational risks for businesses.

- Investor Confidence: A stable political climate and effective anti-corruption measures directly correlate with increased foreign direct investment (FDI) inflows, vital for economic expansion.

- Regulatory Environment: Predictable regulatory changes, driven by stable governance, allow companies like Hap Seng to strategize effectively for growth.

Industry-Specific Government Support

The Malaysian government actively supports key sectors, which directly benefits Hap Seng. For example, in the property market, initiatives like affordable housing programs and tax incentives for buyers, such as stamp duty exemptions on properties valued up to RM500,000 for first-time homebuyers, were extended through 2024, aiming to stimulate demand.

Furthermore, the palm oil industry, a significant area for Hap Seng, is seeing focused government efforts to address environmental and social concerns. The implementation and promotion of Malaysian Sustainable Palm Oil (MSPO) 2.0 are crucial, aiming to bolster the industry's credibility and market access globally. This includes stricter guidelines and certifications to meet international sustainability standards, a move supported by government grants and technical assistance programs for producers.

- Affordable Housing Initiatives: Continued government focus on affordable housing projects, with an estimated RM1.8 billion allocated in the 2024 budget, provides a stable demand base for property developers like Hap Seng.

- Palm Oil Sustainability: MSPO certification targets, with a goal for 100% certified palm oil by 2025, drive demand for sustainable practices, benefiting companies like Hap Seng that align with these standards.

- Tax Incentives: Tax reliefs and exemptions in sectors like property and manufacturing continue to be reviewed and implemented, offering direct cost benefits to companies operating within these supported industries.

Malaysia's political stability is a significant positive for Hap Seng, fostering a predictable operating environment. The government's commitment to good governance and clear economic policies, as evidenced by Malaysia's 57th ranking in Transparency International's 2023 Corruption Perception Index, reduces operational risks.

Government initiatives, such as the RM1.8 billion allocated for affordable housing in the 2024 budget, directly support Hap Seng's property development segment. Similarly, the push for MSPO 2.0 certification in the palm oil sector, with a 2025 target for 100% certified oil, aligns with Hap Seng's sustainability efforts and enhances market access.

Trade policies, including the EU's postponement of the EU Deforestation Regulation to December 2025, provide crucial breathing room for Hap Seng's palm oil exports. This regulatory timeline allows for necessary adjustments to meet evolving international sustainability standards, crucial for maintaining market share.

The Malaysian government's supportive stance through tax incentives, such as stamp duty exemptions on properties up to RM500,000 for first-time homebuyers extended through 2024, directly benefits Hap Seng's property business by stimulating demand.

What is included in the product

This HAP Seng PESTLE analysis meticulously examines the influence of political, economic, social, technological, environmental, and legal forces on the company's operations and strategic positioning.

It provides a comprehensive understanding of the macro-environmental landscape, enabling informed decision-making and proactive strategy development for HAP Seng.

Provides a concise version of the HAP Seng PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to quickly identify and address external challenges.

Economic factors

Malaysia's economic outlook for 2025 and 2026 projects a GDP growth rate between 4% and 4.8%. This expansion is anticipated to be fueled by robust domestic demand, a strong labor market, and a pickup in investment, creating a generally favorable environment for Hap Seng's varied business interests.

Hap Seng's financial services are sensitive to interest rate shifts. For instance, Bank Negara Malaysia's Monetary Policy Committee decisions directly influence lending rates. In early 2024, the Overnight Policy Rate (OPR) remained steady at 3.00%, a level that generally supports credit demand, but any upward adjustments could increase borrowing costs for Hap Seng's customers, potentially dampening loan growth and impacting the company's net interest margins.

Credit market liquidity is also crucial. Tight credit conditions, characterized by reduced availability of funds for lending, can constrain Hap Seng's ability to expand its financing portfolio. Conversely, ample liquidity, often seen when banks have excess reserves, can lower funding costs for Hap Seng and boost its lending capacity, directly affecting its profitability and market share in the Malaysian credit landscape.

Fluctuations in global commodity prices, especially for palm oil and construction materials like cement, directly impact Hap Seng's core businesses. For instance, the price of Crude Palm Oil (CPO) saw significant volatility in late 2023 and early 2024, influenced by global supply-demand dynamics and the ongoing expansion of biofuel mandates in key markets.

Higher CPO prices, as seen in periods of strong export demand, can significantly enhance the profitability of Hap Seng's plantation segment. Conversely, stable or declining prices for construction materials such as cement and aggregates directly influence the cost of production and the competitiveness of its manufacturing and trading divisions.

Inflation and Consumer Spending Power

Inflation is expected to remain moderate in 2025, with projections placing it between 1.5% and 2.3%. This level of inflation is generally beneficial for consumer spending, a vital component for Hap Seng's key business segments like property, automotive, and trading.

Sustained consumer confidence and healthy disposable incomes are critical for driving demand across Hap Seng's operations. For instance, a stable economic environment supports robust sales in the residential property market and the automotive sector, while also bolstering the performance of its general trading activities.

- Projected 2025 Inflation: 1.5% - 2.3%

- Impact on Consumer Spending: Moderate inflation generally supports spending.

- Key Drivers for Hap Seng: Consumer confidence and disposable income.

- Affected Divisions: Property, Automotive, and Trading.

Foreign Direct Investment (FDI) and Infrastructure Development

Malaysia's continued strong inflow of Foreign Direct Investment (FDI) is a significant economic driver. In the first quarter of 2024, approved investments reached RM 63.4 billion, with a substantial portion directed towards manufacturing and services sectors, which often rely on robust infrastructure. This sustained investment activity, coupled with ongoing progress in large-scale, multi-year infrastructure projects like the East Coast Rail Link (ECRL) and Pan Borneo Highway, directly benefits companies like Hap Seng.

The progress in these national infrastructure projects translates into increased construction demand. This surge in building activity naturally boosts the need for construction materials, a core business for Hap Seng. Furthermore, Hap Seng's property development arm stands to gain as improved infrastructure enhances connectivity and desirability of its developments, attracting both domestic and foreign buyers.

- RM 63.4 billion in approved investments in Malaysia during Q1 2024.

- Continued progress in major infrastructure projects like ECRL and Pan Borneo Highway.

- Increased demand for building materials due to heightened construction activity.

- Enhanced property values and marketability from improved infrastructure.

Malaysia's economic trajectory for 2025 is projected to see GDP growth between 4% and 4.8%, supported by domestic demand and a healthy labor market. Inflation is expected to remain moderate at 1.5% to 2.3%, which generally supports consumer spending vital for Hap Seng's property, automotive, and trading divisions. Foreign Direct Investment, with RM 63.4 billion approved in Q1 2024, fuels infrastructure development, directly benefiting Hap Seng's construction materials and property segments.

| Economic Factor | 2025 Projection/Status | Impact on Hap Seng |

|---|---|---|

| GDP Growth | 4% - 4.8% | Favorable environment for diverse business interests. |

| Inflation | 1.5% - 2.3% | Supports consumer spending in property, automotive, and trading. |

| Foreign Direct Investment (Q1 2024) | RM 63.4 billion approved | Boosts construction materials demand and property development. |

| Interest Rates (OPR) | Steady at 3.00% (early 2024) | Influences lending rates and net interest margins in financial services. |

Full Version Awaits

HAP Seng PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hap Seng covers political, economic, social, technological, legal, and environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the strategic landscape Hap Seng operates within.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed breakdown of external influences crucial for understanding Hap Seng's business environment.

Sociological factors

Malaysia's urbanization trend, with an estimated 77.6% of the population residing in urban areas as of 2024, directly fuels demand for property development, a key sector for Hap Seng. This increasing concentration of people in cities necessitates ongoing construction of both housing and commercial spaces.

Furthermore, demographic shifts, such as the growing segment of young professionals, are shaping consumer preferences. This influences demand not only for accessible housing options but also for specific vehicle types, impacting Hap Seng's diverse business interests.

Consumer preferences are shifting significantly, with a notable rise in demand for sustainable and eco-friendly housing solutions. This evolving taste directly impacts Hap Seng's property development, pushing for greener building materials and energy-efficient designs.

The growing emphasis on sustainability is particularly evident among younger demographics like millennials and Gen Z. This trend influences purchasing decisions across Hap Seng's diverse portfolio, from automotive choices favoring electric vehicles to trading divisions stocking environmentally conscious products.

The availability and cost of skilled labor in Malaysia are paramount for Hap Seng's varied businesses, including plantations, construction, and automotive services. For instance, in 2024, the construction sector faced persistent labor shortages, potentially delaying projects and increasing operational expenses.

Favorable labor market conditions, such as the declining unemployment rate in Malaysia, which stood at 3.4% in early 2024, bolster consumer spending and contribute to overall economic stability, indirectly benefiting Hap Seng's market reach.

Health and Safety Standards

Societal expectations and a growing regulatory emphasis on occupational health and safety standards are increasingly shaping business operations. Hap Seng's proactive approach to these demands is evident in its strategic initiatives. The company recognizes that maintaining high safety standards is not just a compliance issue but a core aspect of its social responsibility and employee well-being.

Hap Seng's commitment to employee welfare and adherence to international safety benchmarks is underscored by its pursuit of ISO 45001 certification for its palm oil mills. This certification is targeted for completion by 2025, demonstrating a clear timeline for enhancing safety protocols. Achieving this standard signifies a dedication to creating a safer working environment across its key operational sites.

- ISO 45001 Target: Hap Seng aims for ISO 45001 certification for its palm oil mills by 2025.

- Employee Welfare Focus: The certification reflects a strong commitment to employee health and safety.

- International Standards: Adherence to ISO 45001 aligns operations with global best practices in occupational safety.

Community Engagement and Social Responsibility

Hap Seng's commitment to community engagement and social responsibility significantly shapes its public image and its ability to operate. By actively participating in local development and upholding ethical practices, the company reinforces its social license to operate. This is crucial for maintaining trust with all stakeholders, from local communities to investors.

The company's contributions to education and community development are key components of its CSR strategy. For instance, Hap Seng's focus on improving educational infrastructure and supporting local initiatives demonstrates a tangible commitment to societal well-being. In 2024, the company continued its long-standing support for rural education, providing resources to over 50 schools.

Adherence to social responsibility criteria, particularly within its palm oil operations, is paramount. This includes ensuring fair labor practices and minimizing environmental impact. Hap Seng's palm oil division actively pursues certifications like Roundtable on Sustainable Palm Oil (RSPO), aiming for greater transparency and accountability in its supply chain. By 2025, the company targets 80% of its palm oil production to be certified sustainable.

- Community Investment: Hap Seng's CSR programs in 2024 focused on education and infrastructure, benefiting an estimated 10,000 individuals across its operational areas.

- Sustainable Palm Oil: The company aims to increase its RSPO-certified sustainable palm oil production to 80% by the end of 2025, up from 65% in 2023.

- Stakeholder Relations: Positive community engagement directly contributes to a stronger social license to operate, reducing operational risks and enhancing brand reputation.

- Employee Volunteerism: In 2024, Hap Seng employees dedicated over 5,000 volunteer hours to various community projects, reflecting a broad organizational commitment to social responsibility.

Societal attitudes towards corporate social responsibility (CSR) are increasingly influencing consumer and investor decisions, pushing companies like Hap Seng to embed ethical practices throughout their operations. This includes a heightened focus on fair labor, community welfare, and transparent supply chains, particularly in sectors like palm oil where sustainability is a major concern.

Hap Seng's commitment to employee well-being and adherence to international safety standards is crucial, with a target for ISO 45001 certification for its palm oil mills by 2025. This reflects a broader societal expectation for safe working environments.

The company's active community engagement, including support for education, reinforces its social license to operate. In 2024, Hap Seng continued its support for rural education, benefiting over 50 schools.

The push for sustainability in palm oil production, with a target of 80% RSPO certification by 2025, aligns with evolving consumer preferences and societal demands for environmentally responsible sourcing.

| Sociological Factor | Hap Seng's Response/Impact | Relevant Data (2024/2025) |

| Corporate Social Responsibility (CSR) | Emphasis on ethical practices, community welfare, and fair labor. | Continued support for rural education in 2024, benefiting over 50 schools. |

| Employee Health & Safety | Pursuit of international safety standards. | Targeting ISO 45001 certification for palm oil mills by 2025. |

| Sustainable Consumption | Alignment with consumer demand for eco-friendly products and practices. | Aiming for 80% RSPO-certified sustainable palm oil production by 2025. |

| Community Engagement | Building social license to operate through local development initiatives. | Over 5,000 employee volunteer hours dedicated to community projects in 2024. |

Technological factors

The financial services sector in Malaysia is undergoing a significant digital transformation, with a notable surge in digital payments and mobile banking adoption. This trend offers Hap Seng's credit financing division a chance to expand its customer base and streamline operations through advanced digital platforms and data analytics, improving efficiency and risk assessment.

By embracing these technological shifts, Hap Seng can tap into the growing digital economy, potentially increasing its market share. For instance, Bank Negara Malaysia reported that in 2023, e-payments transactions reached a substantial volume, indicating a strong consumer preference for digital financial services.

Technological advancements are significantly reshaping the construction sector, directly influencing Hap Seng's operations. The increasing integration of green technologies, such as solar panels and rainwater harvesting, alongside the use of energy-efficient building materials, is becoming standard. For instance, by 2024, global investment in green buildings was projected to reach over $1 trillion, highlighting a strong market trend.

Hap Seng's property and building materials segments are particularly impacted by these shifts. Embracing sustainable construction methods and materials not only boosts operational efficiency and minimizes environmental footprints but also aligns the company with growing consumer and regulatory preferences for eco-friendly solutions. This strategic adoption is crucial for meeting evolving market demands and maintaining a competitive edge.

Hap Seng's automotive arm, a distributor of various brands, is navigating a landscape increasingly shaped by technological advancements, most notably the global surge in electric vehicle (EV) adoption and the integration of advanced driver-assistance systems (ADAS). This shift is evident in their proactive installation of EV chargers across their Autohaus facilities, signaling a strategic adaptation to evolving consumer preferences and regulatory pressures pushing for greener transportation solutions.

The competitive premium passenger and commercial vehicle segments demand continuous technological innovation to maintain market share. For instance, in 2024, many premium automakers are rolling out new EV models with enhanced battery ranges and faster charging capabilities, alongside sophisticated ADAS features like Level 2 autonomous driving, directly impacting Hap Seng's product offerings and sales strategies.

Automation and Efficiency in Plantations

Hap Seng's palm oil operations are increasingly benefiting from technological advancements aimed at boosting efficiency. Automation in harvesting, for instance, is streamlining labor-intensive tasks, leading to quicker collection and reduced post-harvest losses. This adoption of new tech is crucial for maintaining competitiveness in a global market.

Furthermore, the integration of biogas plants presents a significant opportunity for Hap Seng to enhance sustainability and manage waste effectively. These plants convert palm oil mill effluent (POME) into renewable energy, thereby reducing the company's carbon footprint. In 2023, the palm oil industry globally saw continued investment in such green technologies, with reports indicating a 15% increase in facilities utilizing waste-to-energy solutions.

- Automation in harvesting: Reduces labor costs and improves speed of collection.

- Biogas plants: Convert POME into renewable energy, cutting emissions.

- Efficiency gains: Technologies contribute to lower operational costs and better resource utilization.

- Sustainability focus: Aligns with global trends towards environmentally responsible agriculture.

Data Analytics and Business Intelligence

Hap Seng's strategic advantage is amplified by its increasing adoption of data analytics and business intelligence. By leveraging these tools across its diverse sectors, the company can gain deeper insights into operational efficiencies, supply chain management, and customer behavior. This analytical capability is vital for making informed strategic decisions and identifying emerging market trends.

For instance, in 2024, Hap Seng Plantations reported a significant increase in yield optimization through data-driven farming techniques, contributing to its robust financial performance. The company's retail division also utilizes customer data analytics to personalize promotions and enhance the shopping experience, aiming to boost customer loyalty and sales volume. This focus on data intelligence allows Hap Seng to adapt swiftly to market shifts and maintain a competitive edge.

- Optimized Operations: Data analytics enables Hap Seng to fine-tune its manufacturing processes and logistics, leading to cost savings and improved efficiency.

- Enhanced Customer Engagement: By analyzing customer data, Hap Seng can tailor its product offerings and marketing strategies, fostering stronger customer relationships.

- Market Opportunity Identification: Business intelligence tools help uncover new market segments and growth opportunities within its existing and potential business ventures.

- Informed Strategic Planning: The insights derived from data analytics empower Hap Seng's leadership to make more accurate and effective long-term strategic decisions.

Technological advancements are a key driver for Hap Seng across its diverse operations. The company is leveraging digital platforms for its credit financing arm, mirroring a broader trend in Malaysia where e-payment transactions saw substantial growth in 2023. In construction, the adoption of green technologies is becoming standard, with global investment in green buildings projected to exceed $1 trillion by 2024, impacting Hap Seng's property and building materials segments. The automotive division is adapting to the EV surge and ADAS integration, with premium automakers in 2024 introducing new EV models with enhanced features.

| Sector | Technological Trend | Impact on Hap Seng | Relevant Data Point (2023/2024) |

|---|---|---|---|

| Financial Services | Digital Payments & Mobile Banking | Customer base expansion, operational streamlining | Malaysia's e-payments transactions volume substantial in 2023 |

| Construction | Green Building Technologies | Operational efficiency, alignment with eco-friendly preferences | Global green building investment >$1 trillion by 2024 |

| Automotive | Electric Vehicles (EVs) & ADAS | Product offering adaptation, sales strategy adjustments | Premium automakers launching new EV models with enhanced features in 2024 |

| Palm Oil | Automation & Biogas Plants | Efficiency gains, sustainability improvement | 15% increase in palm oil facilities using waste-to-energy in 2023 |

Legal factors

Hap Seng's extensive operations, especially in palm oil plantations and building materials, face rigorous environmental oversight in Malaysia. Compliance with evolving standards is paramount for sustained operations and market access.

Key to this is adherence to MSPO 2.0, which became mandatory in January 2025, alongside strict rules on wastewater discharge and carbon emissions. Navigating these requirements is essential for Hap Seng's long-term sustainability and reputation.

The current delay in the European Union's Deforestation Regulation (EUDR) implementation offers Hap Seng a valuable window to solidify its compliance frameworks, ensuring readiness for future international market demands.

HAP Seng's property development arm operates within a framework of intricate land use, zoning, and building code regulations. Adherence to these legal stipulations is paramount for project approval and successful execution.

Shifts in government policies, such as those concerning affordable housing mandates or land acquisition procedures, can directly influence project viability. For instance, a new policy in 2024 requiring a higher percentage of affordable units could reduce profit margins on certain developments.

Furthermore, changes in development density allowances or environmental impact assessment requirements, potentially introduced in 2025, could necessitate costly project redesigns or limit the scale of future undertakings, impacting HAP Seng's strategic planning and financial projections.

Hap Seng's credit financing arm is heavily regulated by Bank Negara Malaysia, the nation's central bank. This oversight ensures adherence to robust financial services regulations, impacting everything from lending practices to customer data security.

Compliance with these rules, including stringent anti-money laundering (AML) and Know Your Customer (KYC) directives, is paramount. For instance, in 2024, financial institutions globally, including those in Malaysia, continued to face increased scrutiny and penalties for AML breaches, underscoring the critical need for robust compliance frameworks.

Labor Laws and Employment Standards

Hap Seng must strictly adhere to Malaysia's labor laws, encompassing minimum wage requirements, employee rights, and occupational safety and health standards across all its operations. For instance, as of February 2024, the national minimum wage in Malaysia is RM1,500 per month for employees in Peninsular Malaysia and RM1,700 per month for those in Sabah, Sarawak, and Labuan Federal Territory. Failure to comply can result in significant legal penalties, including fines and potential operational disruptions, alongside severe reputational damage.

Key legal considerations for Hap Seng include:

- Compliance with the Employment Act 1955: This act governs various aspects of employment, including working hours, overtime pay, and termination procedures.

- Adherence to Occupational Safety and Health Act 1994 (OSHA): Ensuring safe working environments and implementing preventative measures against workplace accidents is paramount.

- Minimum Wage Regulations: Staying updated with and implementing the latest minimum wage rates as mandated by the government is essential.

- Contractual Obligations: Upholding all terms and conditions stipulated in employment contracts and collective bargaining agreements.

Trade and Import/Export Regulations

Hap Seng's trading and automotive sectors are significantly influenced by import and export regulations, tariffs, and prevailing trade agreements. These external factors directly shape the cost of goods and affect market competitiveness.

For instance, any shifts in trade policies, such as the introduction of new tariffs by major trading partners on Malaysian exports, could increase operational expenses for Hap Seng. This could potentially reduce profit margins or necessitate price adjustments, impacting their standing in the market.

In 2024, global trade dynamics continue to evolve, with ongoing negotiations and potential adjustments to existing trade pacts. For a company like Hap Seng, staying abreast of these changes is crucial for strategic planning and mitigating risks associated with international trade.

- Impact on Automotive: Import duties on vehicle components or finished vehicles can directly affect Hap Seng's automotive division, influencing pricing and sales volumes.

- Impact on Trading: Export tariffs imposed by destination countries can make Hap Seng's traded goods less attractive, potentially leading to reduced demand.

- Trade Agreements: Favorable trade agreements, like those within ASEAN, can reduce barriers and create opportunities for expanded trade volumes and market access.

- Regulatory Compliance: Adherence to import/export documentation, licensing, and customs procedures is essential to avoid delays and penalties, ensuring smooth operations.

Hap Seng's operations are subject to a complex web of Malaysian laws, from environmental regulations for its plantations to building codes for property development. Compliance with these legal frameworks, including labor laws with a minimum wage of RM1,500 to RM1,700 as of early 2024, is critical to avoid penalties and maintain operational continuity.

Environmental factors

Hap Seng acknowledges climate change as a major risk, actively working to lower its carbon footprint. A key initiative involves investing in renewable energy sources and enhancing energy efficiency throughout its business segments. For instance, in 2023, the company reported a 5% increase in energy efficiency across its plantation operations, contributing to emission reductions.

The company is also implementing biogas plants at its palm oil mills, a strategy designed to capture methane, a potent greenhouse gas, and transform it into usable electricity. This not only mitigates emissions but also provides a sustainable energy source, aligning with their commitment to environmental stewardship and reducing reliance on fossil fuels.

Hap Seng Plantations, a significant palm oil producer, faces increasing pressure concerning deforestation and biodiversity impact. The company's commitment to no-deforestation policies and the protection of high conservation value (HCV) areas is crucial, especially as global awareness of environmental sustainability grows.

The company actively monitors fire incidents, a key indicator of deforestation risks, and its operations are guided by the updated MSPO 2.0 standards. These standards incorporate more rigorous requirements for safeguarding HCV areas, reflecting a commitment to more responsible land management practices in line with evolving environmental expectations.

Hap Seng's plantation and manufacturing activities are heavily reliant on effective water management. The company actively monitors wastewater quality to meet environmental standards, a critical aspect given the increasing global focus on water resource preservation.

Implementing rainwater harvesting systems is a key strategy for Hap Seng to ensure a sustainable water supply, particularly in regions facing potential scarcity. This approach not only supports operational continuity but also demonstrates a commitment to responsible resource utilization.

Waste Management and Circular Economy Practices

Hap Seng is actively integrating robust waste management systems throughout its operations, emphasizing reuse and recycling to enhance resource efficiency and minimize waste. This commitment is evident in their efforts to divert recyclable materials from landfills, a crucial step in reducing their environmental footprint.

The company is also exploring the adoption of circular economy principles, particularly within its building materials division. This forward-thinking approach aims to create more sustainable product lifecycles, aligning with global trends towards resource conservation and waste reduction.

For instance, in 2023, the construction industry globally generated approximately 2.2 billion tonnes of construction and demolition waste, highlighting the critical need for companies like Hap Seng to pioneer effective waste management solutions. Their initiatives in promoting reuse and recycling are therefore not only environmentally responsible but also strategically positioned to benefit from a growing market demand for sustainable practices.

- Waste Diversion: Hap Seng's focus on diverting recyclable waste from landfills directly addresses the global challenge of landfill overflow.

- Circular Economy Exploration: The company's engagement with circular economy principles in building materials positions them to capitalize on the increasing demand for sustainable construction.

- Resource Optimization: By promoting reuse and recycling, Hap Seng aims to optimize its consumption of raw materials, leading to cost efficiencies and reduced environmental impact.

Sustainable Sourcing and Green Building Materials

Hap Seng's property and building materials segments are prioritizing sustainable sourcing and the adoption of green building materials. This strategic shift is driven by increasing consumer preference for environmentally conscious residences and government support for sustainable construction, exemplified by programs such as the Green Building Index.

The company has made a commitment that all new investment properties developed from 2025 onwards will achieve recognized green building certifications. This proactive approach positions Hap Seng to capitalize on the growing market for sustainable real estate. For instance, the global green building materials market was valued at approximately USD 296.5 billion in 2023 and is projected to reach USD 658.3 billion by 2030, indicating a significant growth trajectory.

- Growing Market Demand: Consumer interest in eco-friendly homes is a key driver for sustainable sourcing.

- Government Incentives: Initiatives like the Green Building Index encourage green development practices.

- Future Certification: Hap Seng aims for all new properties from 2025 to hold green building certifications.

- Market Growth: The global green building materials market is expected to more than double by 2030, highlighting a substantial opportunity.

Environmental factors significantly influence Hap Seng's operations, particularly its plantation and property divisions. The company is actively addressing climate change by investing in renewable energy and improving energy efficiency, noting a 5% boost in plantation energy efficiency in 2023. Furthermore, Hap Seng is committed to sustainable land management, adhering to no-deforestation policies and protecting high conservation value areas, especially as global awareness of environmental impact intensifies.

Hap Seng's commitment to sustainable practices extends to water and waste management, with initiatives like rainwater harvesting and robust waste diversion programs. The company is also embracing circular economy principles within its building materials sector, recognizing the global challenge of construction waste, which reached approximately 2.2 billion tonnes in 2023.

The property and building materials segments are increasingly focusing on sustainable sourcing and green building materials, driven by consumer demand and government support. Hap Seng's pledge for all new investment properties from 2025 onwards to achieve green building certifications positions it to benefit from the rapidly expanding global green building materials market, projected to grow significantly by 2030.

PESTLE Analysis Data Sources

Our HAP Seng PESTLE analysis is meticulously constructed using a blend of public and proprietary data sources. We leverage official government reports, reputable financial news outlets, and market research databases to ensure a comprehensive understanding of the macro-environment.