Hang Lung Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hang Lung Group Bundle

Hang Lung Group demonstrates significant strengths in its prime property portfolio and strong brand recognition, but faces opportunities in expanding its digital presence and potential threats from economic downturns. Understanding these dynamics is crucial for navigating the competitive real estate landscape.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hang Lung Group boasts an established presence in key markets, with a significant and long-standing footprint in both Hong Kong and major mainland Chinese cities. This deep market understanding, cultivated over more than 60 years of operations, provides a robust foundation for its business.

The company's strategic focus on prime locations in tier-one mainland Chinese cities, particularly under its '66' brand, has cemented its leadership in the luxury retail sector. For instance, as of early 2024, Hang Lung's portfolio in mainland China includes prominent properties like Plaza 66 in Shanghai and Forum 66 in Shenyang, which consistently demonstrate strong rental income and high occupancy rates, reflecting their prime positioning.

Hang Lung Group's strength lies in its meticulously curated portfolio of premium commercial properties, encompassing retail malls, office towers, and serviced apartments. This strategic focus on high-quality, well-maintained assets consistently attracts top-tier tenants and discerning customers. For instance, in the first half of 2024, their Hong Kong properties achieved a rental reversion rate of 5.1% for office leases, demonstrating the enduring appeal and value of their prime locations.

Hang Lung Group exhibits strong financial management, maintaining a solid liquidity position. This is highlighted by its successful acquisition of a HK$10 billion five-year syndicated term loan and revolving credit facility in January 2025, a testament to market confidence even amidst economic uncertainties.

This financial prudence ensures the company is well-positioned to navigate market fluctuations and pursue strategic growth opportunities. The ability to secure substantial funding demonstrates the market's trust in Hang Lung's financial stability and its capacity for future development.

Commitment to Sustainability and ESG Leadership

Hang Lung is solidifying its position as a leader in sustainability within the real estate industry, actively working towards ambitious goals in climate resilience, resource efficiency, occupant wellbeing, and sustainable business practices.

The company has already achieved a significant milestone, exceeding its 2025 renewable energy target for its Mainland China portfolio. As of May 2025, an impressive 80% of its operating properties are now powered by renewable energy sources.

This strong commitment to Environmental, Social, and Governance (ESG) principles not only bolsters Hang Lung's brand image but also resonates strongly with a growing segment of environmentally aware tenants and investors.

- Recognized ESG Leadership: Hang Lung is increasingly acknowledged for its proactive approach to sustainability in real estate.

- Renewable Energy Milestone: Surpassed 2025 target, with 80% of Mainland operating properties using renewable energy as of May 2025.

- Enhanced Brand Appeal: Commitment attracts environmentally conscious tenants and investors, strengthening market position.

Diversified Portfolio and Strategic Expansion

Hang Lung Group boasts a diversified property portfolio, encompassing retail, office, residential, and serviced apartments. This mix mitigates risk and captures value across different market segments. For instance, their Hong Kong and Mainland China properties generated substantial rental income, with the Mainland portfolio contributing significantly to the group's overall revenue.

Strategic expansion is a key strength, evident in ongoing projects like the Grand Hyatt Kunming and the anticipated Westlake 66 in Hangzhou. These developments are designed to integrate retail, office, and hospitality, creating synergistic environments. By 2024, the group continued to invest in these mixed-use projects, aiming to enhance customer experience and drive long-term value.

- Diversified Asset Mix: Retail, office, residential, and serviced apartments across key Chinese cities and Hong Kong.

- Strategic Development Pipeline: Ongoing investments in integrated, mixed-use projects like Westlake 66 in Hangzhou.

- Synergistic Value Creation: Blending retail, work, and hospitality to create attractive, self-sustaining destinations.

Hang Lung's established market presence, particularly in Hong Kong and prime mainland Chinese cities, is a significant advantage, built on over six decades of experience. Their strategic focus on high-quality, well-located commercial properties, such as Plaza 66 in Shanghai, consistently drives strong rental income and high occupancy rates.

The company's robust financial management, highlighted by securing a HK$10 billion syndicated loan in early 2025, underscores market confidence and provides a stable foundation for future growth. Furthermore, Hang Lung's commitment to sustainability, evidenced by powering 80% of its mainland China operating properties with renewable energy as of May 2025, enhances its brand appeal and attracts environmentally conscious stakeholders.

| Strength | Description | Supporting Data (as of early-mid 2025) |

|---|---|---|

| Market Presence & Experience | Long-standing operations in Hong Kong and major mainland Chinese cities. | Over 60 years of operational history. |

| Prime Property Portfolio | Focus on premium retail and office spaces in tier-one cities. | Properties like Plaza 66 (Shanghai) and Forum 66 (Shenyang) demonstrate high occupancy and rental performance. |

| Financial Stability | Strong liquidity and access to funding. | Secured HK$10 billion syndicated loan in January 2025. |

| ESG Leadership | Commitment to sustainability and renewable energy. | 80% of Mainland China operating properties powered by renewables (May 2025). |

What is included in the product

Explores the strategic advantages and threats impacting Hang Lung Group’s success by analyzing its strong brand, prime property portfolio, and potential for growth against market volatility and intensifying competition.

Provides a clear, actionable roadmap by identifying Hang Lung Group's key strengths and weaknesses, helping to address operational inefficiencies and market vulnerabilities.

Weaknesses

Hang Lung Group's significant concentration in property development and investment leaves it vulnerable to the inherent cyclicality of the real estate market, especially in its key regions of Hong Kong and mainland China. This sector-specific focus means that any downturn can have a pronounced impact on its financial health.

The company's recent financial reports underscore this vulnerability. For the first half of 2024, Hang Lung reported a notable decline in its underlying net profit, which fell by 11.7% to HK$2.18 billion. Similarly, operating profit saw a decrease of 10.5% to HK$2.38 billion, largely attributed to the sluggish performance of its retail and office rental segments.

This heavy reliance on the property sector exposes Hang Lung to substantial market risks, including the potential for significant revaluation losses on its extensive property portfolio should market conditions deteriorate further.

Hang Lung's substantial reliance on property leasing, particularly for its retail malls and office towers, has been a significant vulnerability. Weak economic sentiment across Hong Kong and mainland China, coupled with an oversupply in both markets, has directly impacted revenue streams from these core assets.

The office sector in Hong Kong, specifically, faces continued headwinds. Projections indicate a further decline in office rents for 2025, driven by persistent high vacancy rates and the influx of new developments. This environment directly challenges Hang Lung's ability to maintain and grow its rental income from its office portfolio.

This subdued demand environment for both retail and office spaces directly curtails the profitability of Hang Lung's primary leasing operations. The company's financial performance is therefore closely tied to the broader economic health and supply-demand dynamics within these specific property segments.

The ongoing depreciation of the Renminbi (RMB) against the Hong Kong Dollar (HKD) presents a notable weakness for Hang Lung Group. This currency movement directly impacts the reported rental income from its substantial property portfolio in mainland China. When the RMB weakens, the HKD equivalent of this revenue decreases, even if the actual RMB rental income remains stable.

For instance, during the first half of 2024, Hang Lung reported that foreign exchange headwinds, including RMB depreciation, negatively affected its financial performance. This currency fluctuation can effectively erode the value of profits earned in mainland China before they are translated into the group's reporting currency, thereby impacting overall financial results and potentially diluting earnings per share.

High Capital Expenditure for Development Projects

Hang Lung Group's ongoing development projects, like Westlake 66 in Hangzhou and the Plaza 66 Pavilion Extension in Shanghai, necessitate significant capital outlays. For instance, the group's capital expenditure was HKD 5.3 billion in 2023, a notable increase from HKD 3.9 billion in 2022, reflecting these investments.

While these expansions are crucial for future growth, they do tie up substantial capital. This can place pressure on short-term profitability and cash flow, particularly if market conditions lead to delayed returns on these large-scale developments.

- Substantial Capital Outlay: Ongoing projects like Westlake 66 and Plaza 66 Pavilion Extension require significant investment.

- Impact on Short-Term Finances: Large capital commitments can affect immediate profitability and cash flow.

- Dependency on Market Conditions: Project returns are sensitive to market fluctuations, potentially delaying payback periods.

Intensified Competition in Luxury Retail and Office Segments

Hang Lung Group is navigating a challenging landscape in its core markets. The luxury retail and Grade A office segments, particularly in mainland China's tier-one cities, are experiencing heightened competition. This competitive pressure has led to instances where some of Hang Lung's shopping malls have seen a reduction in rental income, a direct consequence of rivals employing aggressive pricing strategies and extensive promotional activities.

Adding to these headwinds, the Hong Kong office market is also facing increased supply. This growing availability of new office spaces is tipping the scales in favor of tenants, creating a more competitive environment for landlords. Consequently, Hang Lung, like its peers, is experiencing pressure on its rental rates and occupancy levels as it works to retain and attract tenants in this evolving market.

- Intensified Competition: Luxury retail and Grade A office markets in tier-one Chinese cities are seeing aggressive pricing and promotions from competitors.

- Rental Income Pressure: Some Hang Lung malls have reported declining rental income due to this competitive environment.

- Hong Kong Office Market Dynamics: Increased new office supply in Hong Kong is creating a tenant-favorable market, impacting rents and occupancy.

Hang Lung Group's significant exposure to the cyclical property market, particularly in Hong Kong and mainland China, presents a key weakness. The company's heavy reliance on property leasing for its retail and office segments makes it susceptible to economic downturns and shifts in supply and demand. This concentration was evident in the first half of 2024, with underlying net profit falling 11.7% to HK$2.18 billion, driven by sluggish retail and office rental performance.

Furthermore, the ongoing depreciation of the Renminbi against the Hong Kong Dollar negatively impacts the reported rental income from its mainland China properties. This currency headwind effectively erodes the value of profits earned in RMB when translated into the group's reporting currency, as seen in the first half of 2024 results.

The company also faces intensified competition in its core markets. Aggressive pricing and promotional activities by rivals in the luxury retail and Grade A office segments, especially in tier-one Chinese cities, have led to pressure on rental income, with some malls reporting declines.

Additionally, substantial capital outlays for ongoing development projects, such as Westlake 66 in Hangzhou, tie up significant capital. In 2023, capital expenditure reached HK$5.3 billion, a considerable increase from HK$3.9 billion in 2022, which can strain short-term profitability and cash flow, especially if market conditions delay project returns.

| Financial Metric (H1 2024) | Value (HK$ billion) | Change vs. H1 2023 |

|---|---|---|

| Underlying Net Profit | 2.18 | -11.7% |

| Operating Profit | 2.38 | -10.5% |

| Capital Expenditure (FY 2023) | 5.3 | +35.9% (vs. FY 2022) |

Preview Before You Purchase

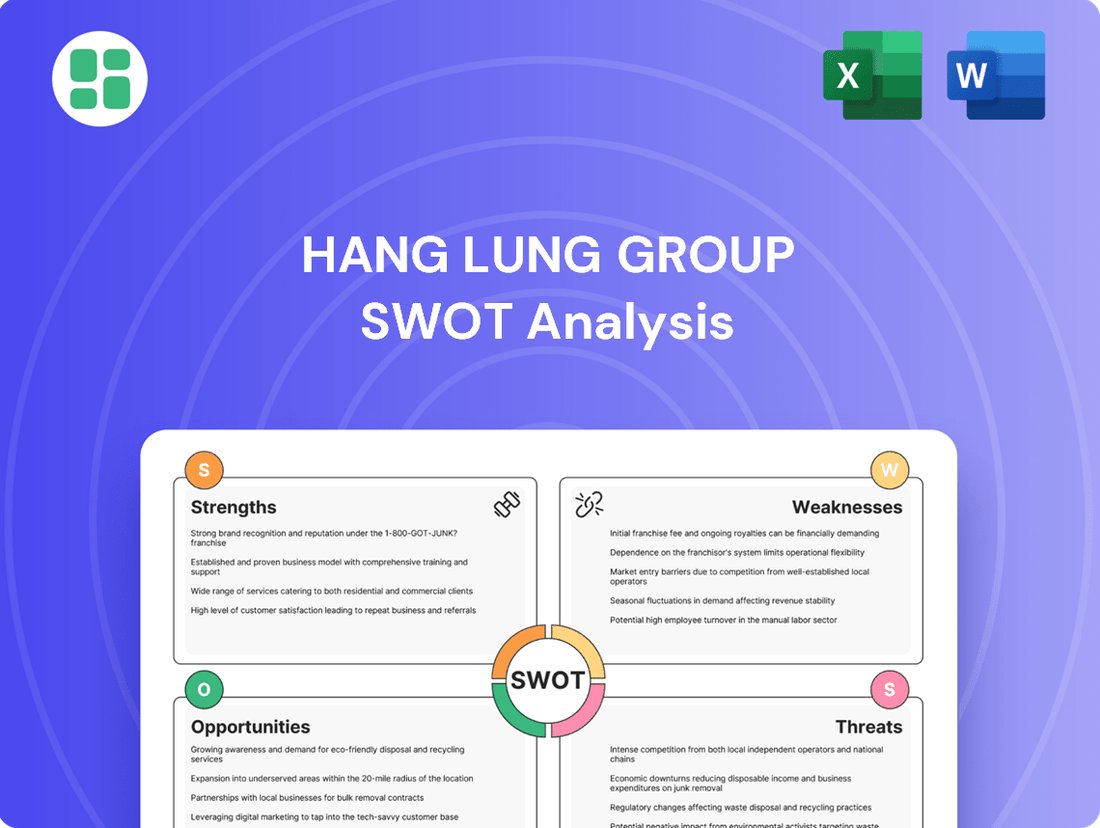

Hang Lung Group SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This comprehensive analysis of the Hang Lung Group's Strengths, Weaknesses, Opportunities, and Threats is ready for your strategic planning needs.

Opportunities

Hang Lung Group is well-positioned to capitalize on the ongoing urbanization trend in mainland China. Continued economic growth in Tier-1 cities like Shanghai and Beijing, which saw retail sales increase by 8.5% and 7.2% respectively in 2024, offers significant opportunities for expanding its premium retail and office portfolio. This demographic shift fuels demand for high-quality, modern urban infrastructure.

Emerging cities, experiencing rapid population growth and rising disposable incomes, present further avenues for expansion. For instance, cities like Chengdu, with its projected GDP growth of 6.5% in 2025, are becoming increasingly attractive for businesses and consumers, aligning with Hang Lung’s strategy of developing prime commercial assets in dynamic urban centers.

Government initiatives in mainland China, such as liquidity injections and relaxed mortgage terms, are designed to stabilize the property market. The expansion of infrastructure REITs also signals a more supportive policy environment. These measures could directly benefit Hang Lung by stimulating housing transactions and improving overall market sentiment.

Hang Lung Group can significantly boost its retail performance by strategically curating its tenant mix and focusing on customer engagement. By identifying and onboarding brands that resonate with current consumer trends, particularly in the luxury and sub-luxury segments, the group can attract a broader customer base and encourage higher spending.

Implementing innovative retail formats, offering diverse experiential zones, and investing in strong placemaking initiatives are key to drawing in shoppers and fostering lasting loyalty. For instance, successful pop-up events or unique in-mall services can create buzz and encourage repeat visits, directly impacting footfall and sales.

This proactive approach to tenant mix and customer experience is crucial for maintaining robust occupancy rates and ensuring stable rental income. In 2023, Hang Lung reported a slight increase in overall occupancy rates across its mainland China properties, demonstrating the positive impact of such strategies.

Expansion of Serviced Apartments and Hospitality Segments

Hang Lung Group's residential and serviced apartments have seen a notable uptick in occupancy and revenue, with some of this growth attributed to government initiatives aimed at attracting skilled professionals. This trend highlights a strong demand for flexible living arrangements.

The group's strategic push into expanding its hospitality offerings, exemplified by new hotel developments, presents a significant opportunity. This diversification into hotels can bolster revenue streams and foster the creation of comprehensive lifestyle hubs within their existing commercial properties.

This expansion into hospitality and serviced apartments is particularly advantageous in markets that are experiencing growth in international tourism and attracting a global talent pool. For instance, in 2024, Hong Kong's tourism sector saw a significant recovery, with visitor numbers reaching 65 million, up from 28.9 million in 2023, indicating a favorable environment for hospitality investments.

- Increased Occupancy: Serviced apartments and residential units are experiencing higher occupancy rates, driven by demand from talent admission programs.

- Revenue Diversification: Expanding into the hotel sector offers a new and potentially lucrative revenue stream.

- Integrated Lifestyle Hubs: New hotel developments can complement existing retail and commercial spaces, creating attractive destinations.

- Market Alignment: Growth opportunities align with increasing international tourism and the influx of global talent in key markets.

Adoption of Smart Building and Sustainable Technologies

Hang Lung Group's investment in smart building and sustainable technologies presents a significant opportunity. By enhancing operational efficiency and reducing costs through these advancements, the company can boost its property appeal. For instance, their commitment to ESG, including the use of low-carbon materials and renewable energy, positions them favorably in a market increasingly valuing environmental responsibility.

This strategic focus on sustainability directly addresses tenant demand, as businesses increasingly prioritize eco-friendly workspaces. Hang Lung's proactive approach in this area, evidenced by their pioneering efforts, strengthens their market position. For example, their 2024 sustainability report highlighted a 5% reduction in energy consumption across their portfolio due to smart technology integration.

- Enhanced Operational Efficiency: Smart building technologies can automate building management systems, leading to better resource allocation and reduced waste.

- Cost Reduction: Lower energy consumption and optimized maintenance schedules directly translate to decreased operating expenses.

- Increased Property Attractiveness: Properties equipped with modern, sustainable features are more appealing to a broader range of tenants, particularly those with strong ESG mandates.

- Strengthened Market Position: Aligning with global sustainability trends and tenant preferences reinforces Hang Lung's brand reputation and competitive edge.

Hang Lung Group is poised to benefit from ongoing urbanization in mainland China, particularly in Tier-1 cities like Shanghai and Beijing, where retail sales saw robust growth in 2024. This expansion into emerging cities with growing economies and populations, such as Chengdu, further strengthens its market reach. Supportive government policies, including property market stabilization measures and the growth of infrastructure REITs, create a favorable environment for the group's development projects.

The company can enhance its retail segment by strategically curating its tenant mix to align with current consumer trends, focusing on luxury and sub-luxury brands to drive higher spending. Implementing innovative retail formats and experiential zones, like pop-up events, will boost footfall and customer loyalty, as evidenced by the slight increase in overall occupancy rates in 2023 across its mainland China properties.

Hang Lung's expansion into hospitality and serviced apartments is well-timed, capitalizing on increased demand from skilled professionals and the recovery of international tourism, as seen in Hong Kong's visitor numbers in 2024. This diversification into hotels offers new revenue streams and the potential to create integrated lifestyle hubs within its existing commercial properties.

Investing in smart building and sustainable technologies presents a key opportunity for Hang Lung to improve operational efficiency and reduce costs. This focus on ESG principles, including reduced energy consumption by 5% in 2024 through smart technology, appeals to tenants prioritizing environmental responsibility and strengthens the group's market position.

Threats

The ongoing economic deceleration in mainland China and Hong Kong presents a substantial challenge. This prolonged slowdown dampens consumer sentiment, curtails retail expenditure, and reduces the demand for commercial office spaces, directly impacting Hang Lung's core business segments.

Consequently, Hang Lung faces sluggishness in its retail and office leasing sectors. This translates to diminished rental income and potential write-downs on property values, ultimately exerting downward pressure on the group's financial performance and profitability.

For instance, China's GDP growth, projected to be around 5% for 2024, reflects a continued moderation compared to previous years, and Hong Kong's economic outlook also faces headwinds. This environment directly impacts Hang Lung's revenue streams from its extensive property portfolio in these key markets.

Both Hong Kong and mainland China are grappling with a significant oversupply in their commercial real estate sectors, with the office segment being particularly affected. This surplus space is a notable threat to companies like Hang Lung Group.

The consequence of this excess supply is a rise in vacancy rates and a downward trend in rental prices. Landlords are compelled to offer concessions, such as rent-free periods or fit-out contributions, to attract and retain tenants, thereby increasing competition and eroding profitability. For instance, Hong Kong's overall office vacancy rate hovered around 6.1% in Q1 2024, a slight increase from the previous year, while certain prime areas in mainland China also reported elevated vacancy levels.

This market imbalance directly impacts rental income and can lead to a devaluation of property assets. If this trend persists, it will continue to put pressure on Hang Lung Group's revenue streams and the overall valuation of its commercial property portfolio.

Geopolitical tensions and evolving regulatory landscapes, particularly within mainland China's property sector, present a significant threat. Potential shifts in government policy, even with current supportive measures, could disrupt Hang Lung's development, financing, and overall market operations.

The ongoing property crisis in China, marked by developer liquidations, underscores systemic risks that could indirectly affect Hang Lung. For instance, in 2023, the property sector's contribution to China's GDP saw a notable decline, creating a more challenging operating environment.

Rising Interest Rates and Finance Costs

While there's talk of interest rates potentially easing, the reality of fluctuating rates and elevated finance costs has already impacted Hang Lung Group. For instance, in the first half of 2024, the company reported a decline in its underlying net profit, partly due to these increased borrowing expenses. This trend directly squeezes profit margins, a significant concern for a business heavily reliant on property development and investment.

Higher borrowing costs can also cast a shadow over the feasibility of future ventures. The increased expense of financing new projects could make them less attractive or even unviable, potentially slowing down expansion and growth for Hang Lung.

- Rising Interest Rates: Hang Lung's finance costs have been a drag on profitability, contributing to a dip in underlying net profit in early 2024.

- Eroding Margins: Increased borrowing expenses directly reduce the profit margins on property development and investment activities.

- Project Viability: Higher finance costs can jeopardize the financial sense of undertaking new capital-intensive projects.

Shifts in Work and Consumption Patterns

The ongoing shift towards remote and hybrid work models presents a significant threat to traditional office leasing. For instance, in 2024, many companies continued to evaluate their office space needs, with some reporting a reduction in required square footage. This trend could lead to decreased long-term demand for prime office properties, impacting rental income for landlords like Hang Lung Group.

Evolving consumer behavior, particularly among Hong Kong residents, also poses a challenge. An increase in outbound travel and a preference for online shopping could dampen local retail sales. Data from 2024 indicated a rebound in tourism, with residents increasingly spending on experiences abroad, potentially diverting spending away from domestic retail environments.

These behavioral shifts necessitate a strategic re-evaluation of Hang Lung Group's property portfolio and leasing strategies. The traditional model of relying solely on long-term office leases and physical retail spaces may no longer be sufficient. Adapting to these evolving work and consumption patterns is crucial for sustained success.

- Reduced Demand for Office Space: Continued adoption of hybrid work models may shrink the overall need for traditional office environments.

- Impact on Retail Sales: Increased outbound travel and evolving consumer spending habits can negatively affect local retail performance.

- Business Model Adaptation Required: Property leasing companies must innovate to address changing tenant and consumer preferences.

The persistent economic slowdown in mainland China and Hong Kong directly impacts Hang Lung's revenue through reduced consumer spending and lower demand for office spaces. This economic deceleration, with China's GDP growth around 5% for 2024, translates to diminished rental income and potential property value declines, pressuring the group's financial performance.

A significant oversupply in commercial real estate, particularly offices, in both key markets is driving up vacancy rates and pushing down rental prices. For example, Hong Kong's office vacancy rate was around 6.1% in Q1 2024, a slight increase, which forces landlords to offer concessions, thereby eroding profitability.

Geopolitical risks and evolving regulatory environments in China, coupled with the ongoing property sector crisis, create systemic uncertainties. Elevated finance costs, as seen with a decline in Hang Lung's underlying net profit in H1 2024 due to increased borrowing expenses, also threaten project viability and squeeze profit margins.

The continued adoption of remote and hybrid work models poses a threat to office leasing demand, with companies re-evaluating space needs in 2024. Simultaneously, changing consumer habits, like increased outbound travel and online shopping, could negatively affect local retail sales, necessitating strategic portfolio adjustments.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry commentary to provide a robust and accurate assessment of Hang Lung Group's strategic position.