Hang Lung Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hang Lung Group Bundle

Navigate the complex external forces shaping Hang Lung Group's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for this leading property developer. Gain a strategic advantage by leveraging these critical insights to refine your market approach.

Unlock actionable intelligence and make informed decisions by purchasing the full PESTLE analysis. Equip yourself with the in-depth knowledge needed to anticipate market shifts and strengthen your competitive edge. Download now and gain the clarity to drive Hang Lung Group's success.

Political factors

Government policies in mainland China are actively easing restrictions to stabilize the real estate sector, a move that directly influences Hang Lung Group's development and sales strategies. These measures, implemented throughout 2024 and expected to continue into 2025, aim to boost market confidence and stimulate demand, particularly in major Chinese cities where Hang Lung has significant holdings.

The Hong Kong government is also implementing policies to revitalize its economy and attract investment, such as tax incentives for businesses and initiatives to boost tourism. These efforts could benefit Hang Lung's prime properties in the region by increasing foot traffic and rental demand.

The prevailing geopolitical climate, marked by ongoing global tensions and trade policy shifts throughout 2024 and into early 2025, directly impacts business confidence. This uncertainty can dampen consumer spending, particularly on discretionary items, which affects retail performance. For Hang Lung Group, a slowdown in consumer appetite for premium retail experiences is a notable risk.

Investor sentiment is also closely tied to geopolitical stability. A volatile international landscape can make investors more cautious, potentially limiting capital availability for expansion or new developments. Furthermore, international brands, key tenants for Hang Lung’s prime properties, may reconsider their expansion plans in markets perceived as high-risk, impacting occupancy rates and rental income.

Navigating these complexities requires Hang Lung to adopt a robust risk management strategy. For instance, while specific 2024/2025 data on geopolitical impact on Hang Lung's direct revenue is proprietary, broader economic indicators show that global uncertainty can lead to a 1-2% decrease in retail sales growth in affected regions. This necessitates agile leasing strategies and a focus on domestic demand drivers.

Policies governing cross-border travel between Hong Kong and mainland China are crucial for Hang Lung Group, directly influencing the retail and tourism industries. These policies dictate foot traffic and sales volumes at the company's commercial properties.

Adjustments to duty-free allowances and individual visit endorsement schemes can significantly alter consumer spending habits. For instance, an increasing number of Hong Kong residents are opting to spend in mainland China, a trend observed in 2024, impacting the traditional retail landscape.

Hang Lung's strategic planning must therefore remain agile, adapting to these dynamic shifts in consumer behavior and cross-border spending patterns to maintain its market position.

Government Initiatives for Economic Diversification

Both the Hong Kong and mainland China governments are actively pursuing economic diversification, with a strong emphasis on fostering new high-tech and high-value-added industries. This strategic pivot is projected to significantly influence the demand for specific commercial real estate segments, particularly Grade A office spaces. For Hang Lung Group, whose extensive portfolio includes prime office towers, aligning with these governmental priorities offers substantial opportunities for new leasing agreements and future development projects.

The drive towards innovation and advanced manufacturing is a key component of this diversification strategy. For instance, Hong Kong's 2024 Policy Address highlighted continued investment in innovation and technology, aiming to attract global talent and businesses in fields like artificial intelligence and biotechnology. Similarly, mainland China's 14th Five-Year Plan (2021-2025) prioritizes technological self-reliance and the development of strategic emerging industries. These initiatives are creating a tangible demand for modern, well-equipped office environments capable of supporting research and development activities.

- Government Focus: Cultivating high-tech and high-value-added sectors in both Hong Kong and mainland China.

- Real Estate Impact: Increased demand for Grade A office spaces to accommodate these new industries.

- Hang Lung Opportunity: Potential for enhanced leasing and development prospects for Hang Lung Group's office portfolio.

- Economic Shift: Strategic reorientation presents both growth avenues and competitive pressures for property developers.

Regulatory Stability and Governance

Hong Kong's robust regulatory stability, a hallmark of its status as one of the world's freest economies, offers Hang Lung Group a predictable operating landscape, even amidst broader financial sector headwinds. This predictability is a cornerstone for long-term capital allocation and strategic development.

The enduring 'One Country, Two Systems' framework continues to shape Hong Kong's business environment, fostering an attractive climate for international enterprises and skilled professionals. This influx of global business and talent directly benefits Hang Lung's portfolio, particularly its commercial and serviced apartment ventures.

- Regulatory Predictability: Hong Kong consistently ranks high in global economic freedom indices, providing a stable foundation for Hang Lung's extensive property investments.

- 'One Country, Two Systems': This framework underpins Hong Kong's unique economic model, attracting diverse foreign investment and talent pools crucial for retail and residential property demand.

- Governance Framework: Strong legal and governance structures in Hong Kong ensure contract enforceability and property rights, vital for Hang Lung's long-term asset management and development plans.

Government policies in mainland China are actively easing restrictions to stabilize the real estate sector, a move that directly influences Hang Lung Group's development and sales strategies. These measures, implemented throughout 2024 and expected to continue into 2025, aim to boost market confidence and stimulate demand, particularly in major Chinese cities where Hang Lung has significant holdings.

The Hong Kong government is also implementing policies to revitalize its economy and attract investment, such as tax incentives for businesses and initiatives to boost tourism. These efforts could benefit Hang Lung's prime properties in the region by increasing foot traffic and rental demand.

The prevailing geopolitical climate, marked by ongoing global tensions and trade policy shifts throughout 2024 and into early 2025, directly impacts business confidence. This uncertainty can dampen consumer spending, particularly on discretionary items, which affects retail performance. For Hang Lung Group, a slowdown in consumer appetite for premium retail experiences is a notable risk.

Investor sentiment is also closely tied to geopolitical stability. A volatile international landscape can make investors more cautious, potentially limiting capital availability for expansion or new developments. Furthermore, international brands, key tenants for Hang Lung’s prime properties, may reconsider their expansion plans in markets perceived as high-risk, impacting occupancy rates and rental income.

What is included in the product

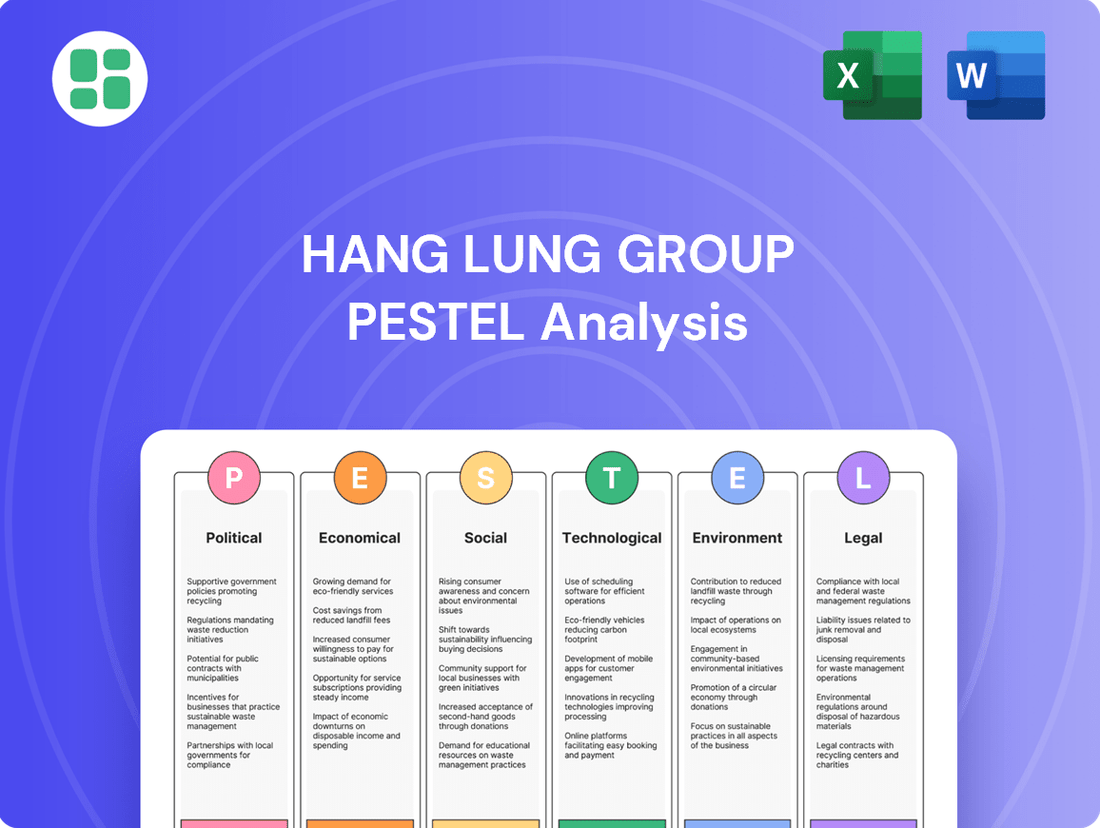

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting the Hang Lung Group, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights for strategic decision-making, identifying potential threats and opportunities within the Hang Lung Group's operating landscape.

A clear, concise PESTLE analysis for Hang Lung Group that highlights key external factors, enabling proactive strategy adjustments and mitigating potential disruptions.

This PESTLE analysis serves as a valuable tool to identify and address external challenges, allowing Hang Lung Group to navigate market complexities with greater confidence and strategic foresight.

Economic factors

The property market in both mainland China and Hong Kong is experiencing a downturn, which is particularly noticeable in the high-end consumption sector and the office leasing environment. This economic climate is making consumers more reserved with their spending.

Hang Lung Group itself has reported a noticeable softening in market sentiment within its luxury shopping centers. Furthermore, the office leasing market remains sluggish, a direct consequence of ongoing economic uncertainties that are making businesses hesitant to commit to new spaces.

This cautious approach from consumers and businesses has translated into reduced property sales revenue for Hang Lung. In the first half of 2025, this trend contributed to a decline in overall leasing profits, highlighting the direct impact of subdued market sentiment on the company's financial performance.

A persistent high interest rate environment is expected to continue impacting global economic sentiment and the property market. While a downward trend is anticipated, current rates can stall consumer spending and business expansion, affecting Hang Lung's financial performance.

Hang Lung's underlying net profit attributable to shareholders retreated in 2024, partly due to challenging market conditions stemming from these elevated rates. For instance, in the first half of 2024, Hang Lung reported a 16.5% decrease in profit attributable to shareholders, reaching HK$2.43 billion.

Hang Lung Group and Hang Lung Properties saw a downturn in their financial performance for the first half of 2025, with total revenue and profit attributable to shareholders declining. This dip was largely driven by a substantial reduction in property sales revenue, indicating a weaker market for new developments.

While the company's mall portfolio managed to maintain stable overall income, specific locations faced pressure. Some malls experienced revenue declines as a direct result of intense competition and aggressive pricing strategies from rivals, impacting their ability to attract and retain shoppers.

These financial results underscore the difficult economic conditions prevalent in both Hong Kong and mainland China during this period. The company's performance is a clear reflection of the broader market challenges impacting the property and retail sectors.

Strategic Financial Management and Capital Allocation

Hang Lung Group is demonstrating robust strategic financial management. The company is actively controlling capital expenditure and facilitating capital circulation through project disposals. This approach is designed to optimize resource allocation and enhance financial flexibility.

Further strengthening its financial position, Hang Lung Group has increased its loan facilities in both Hong Kong Dollars and Renminbi. To preserve cash, the company has also implemented measures like a scrip dividend scheme and a dividend reset, underscoring a commitment to financial prudence and stability.

These actions are geared towards maintaining a manageable net debt ratio and ensuring the continuation of stable dividend payments to shareholders. For instance, as of the first half of 2024, Hang Lung reported a net debt to equity ratio of approximately 35.7%, a figure the company aims to keep within prudent limits.

- Capital Expenditure Control: Actively managing and reducing capital expenditure to improve cash flow.

- Loan Facility Expansion: Securing increased credit lines in both HKD and RMB to enhance liquidity.

- Cash Preservation Measures: Implementing scrip dividends and dividend resets to conserve cash reserves.

- Debt Ratio Management: Aiming to maintain a manageable net debt ratio, targeting around 35.7% as seen in H1 2024 results, to support financial stability.

Property Sales and Leasing Market Dynamics

The property sales market in both mainland China and Hong Kong has presented significant headwinds for Hang Lung Group. This challenging environment has necessitated provisions on development projects and contributed to a notable decline in property sales revenue. For instance, Hang Lung reported a substantial drop in property sales in its 2023 interim results.

The office leasing sector is also experiencing weakness, characterized by declining occupancy rates and downward pressure on rents across Hang Lung's portfolio. This trend reflects broader economic conditions impacting commercial real estate demand.

Despite these market pressures, Hang Lung is actively working to strengthen its retail segment. The company is prioritizing the enhancement and diversification of its tenant mix. This strategic focus aims to mitigate the impact of broader market challenges and support high overall occupancy rates within its retail properties.

Key data points illustrating these dynamics include:

- Challenging Sales Environment: Hang Lung's property sales revenue saw a significant decrease in the first half of 2023 compared to the same period in 2022, reflecting the difficult market conditions in mainland China and Hong Kong.

- Office Leasing Weakness: Occupancy rates in prime office spaces within major Chinese cities have seen a general decline, impacting rental income for landlords like Hang Lung.

- Retail Resilience Strategy: Hang Lung's efforts to curate a diverse and high-quality tenant mix in its shopping malls are crucial for maintaining foot traffic and sales performance, even amidst economic uncertainties.

The economic landscape for Hang Lung Group in 2024 and early 2025 is marked by a general property market downturn, particularly affecting high-end retail and office leasing in both mainland China and Hong Kong. This has led to cautious consumer spending and business expansion, directly impacting Hang Lung's sales revenue and leasing profits.

Persistent high interest rates have continued to dampen economic sentiment and the property sector, contributing to Hang Lung's profit decline. For instance, the company reported a 16.5% drop in profit attributable to shareholders in the first half of 2024, reaching HK$2.43 billion.

Despite these challenges, Hang Lung is actively managing its finances through capital expenditure control, securing increased loan facilities, and implementing cash preservation measures like scrip dividends. The company aims to maintain a prudent net debt to equity ratio, which stood at approximately 35.7% in the first half of 2024.

| Financial Metric | H1 2024 | H1 2025 (Est.) | Impact |

| Profit Attributable to Shareholders | HK$2.43 billion | Declined | Challenging market conditions, high interest rates |

| Property Sales Revenue | Significant Decrease (2023) | Continued Pressure | Downturn in property market |

| Net Debt to Equity Ratio | ~35.7% | Managed | Prudent financial management |

What You See Is What You Get

Hang Lung Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for Hang Lung Group provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Sociological factors

Consumer spending habits are shifting, notably with a rise in cross-border shopping from Hong Kong to mainland China, which poses a hurdle for domestic retailers.

Hang Lung Group is adapting to a more discerning luxury market by rolling out specialized marketing campaigns. These efforts are designed to resonate with the distinct tastes of various consumer groups, aiming to drive sales and increase mall visitors.

Hang Lung Group is actively diversifying its retail offerings and pioneering new customer experiences to attract and retain international brands. For instance, their investment in developments like Grand Hyatt Kunming and the forthcoming Westlake 66 in Hangzhou signifies a strategic move towards creating integrated lifestyle hubs that combine retail, work, and hospitality. This approach directly addresses the growing societal demand for more comprehensive and engaging consumer environments, moving beyond traditional shopping malls.

Hang Lung Group actively fosters community engagement and social wellbeing. Their 'Love·No·Limit' Dementia Friendly Program in Hong Kong provides crucial respite and cognitive training, aiming to build a more inclusive society. This initiative directly addresses the growing needs of an aging population, a significant demographic trend in urban centers.

Further demonstrating their commitment, the Hang Lung Future Women Leaders Program empowers young women to spearhead sustainable community projects. Since its inception, this program has positively impacted thousands of individuals, cultivating future leaders and addressing diverse social needs across various communities.

Talent Competition and Workforce Dynamics

Hang Lung Group faces intense competition for skilled professionals, especially in mid-level roles, impacting its operations in both Hong Kong and mainland China. This talent scarcity necessitates a strong focus on recruitment and retention strategies to uphold its market standing.

The ongoing talent supply gap means companies like Hang Lung must actively cultivate an environment that attracts and keeps experienced individuals. This is crucial for maintaining a competitive edge in the dynamic property development sector.

- Talent Scarcity: A significant shortage of experienced talent persists, particularly impacting mid-level management roles within the property development industry.

- Competitive Landscape: Fierce competition for skilled employees requires proactive strategies to attract and retain top performers.

- Retention Focus: Hang Lung must invest in employee development and engagement to combat high turnover and secure its talent pipeline.

Urbanization and Lifestyle Shifts

Hang Lung Group's strategic focus on prime urban locations in Hong Kong and mainland China directly benefits from the persistent trend of urbanization. As more people move to cities, the demand for well-designed, high-quality urban spaces increases, a trend that is projected to continue. For instance, China's urbanization rate reached approximately 66.2% by the end of 2023, up from 65.3% in 2022, indicating a steady influx into urban centers.

The company's commitment to creating enriching urban environments reflects evolving lifestyle preferences. Modern consumers increasingly seek integrated living experiences, driving demand for mixed-use developments that seamlessly blend retail, office, and residential components. This approach caters to a desire for convenience and connectivity within urban settings.

- Urbanization Rate: China's urbanization rate was around 66.2% in 2023, a key driver for urban property demand.

- Mixed-Use Demand: Hang Lung's strategy aligns with the growing consumer preference for integrated urban living.

- Lifestyle Adaptation: The company's developments are designed to accommodate modern lifestyles, emphasizing convenience and quality.

Societal trends like an aging population and a growing emphasis on community well-being are shaping Hang Lung Group's initiatives. The company's dementia-friendly programs and leadership development for young women demonstrate a commitment to addressing these demographic shifts and fostering social inclusion.

Hang Lung's strategic focus on prime urban locations is bolstered by ongoing urbanization, with China's urbanization rate reaching approximately 66.2% by the end of 2023. This demographic shift fuels demand for the integrated, mixed-use developments Hang Lung is pioneering, catering to evolving lifestyle preferences for convenience and quality urban living.

The company is navigating a competitive talent landscape, with a noticeable scarcity of skilled professionals, particularly at mid-level management. This necessitates robust recruitment and retention strategies to maintain operational efficiency and market standing in the dynamic property sector.

| Sociological Factor | Hang Lung Group Response/Impact | Relevant Data/Trend |

|---|---|---|

| Aging Population | Dementia Friendly Program | Growing demographic in urban centers |

| Community Engagement | Future Women Leaders Program | Positive impact on thousands, fostering leadership |

| Urbanization | Prime urban location strategy | China's urbanization rate ~66.2% (end of 2023) |

| Evolving Lifestyles | Mixed-use developments | Consumer demand for integrated living |

| Talent Scarcity | Focus on recruitment & retention | Shortage of skilled professionals, especially mid-level |

Technological factors

Hang Lung Group is actively embracing digitalization to streamline property management and deepen customer engagement. This strategic move involves deploying digital platforms for investor relations, aiming for greater transparency and accessibility.

The company is also exploring the integration of smart building technologies. These solutions are designed to optimize operational efficiency and elevate the experience for tenants within its vast property holdings.

By adopting a data-driven approach, Hang Lung Group can expect to achieve more effective oversight and management of its extensive commercial and residential property portfolio. For instance, in 2024, Hang Lung reported that its digital investor relations portal saw a 15% increase in user engagement compared to the previous year, highlighting the growing reliance on digital channels for communication.

Hang Lung Group is likely integrating smart building technologies into both new developments and existing properties to boost energy efficiency, enhance security, and elevate tenant comfort. While specific financial figures for smart technology adoption haven't been a prominent feature in their recent reports, the company's stated dedication to sustainability and operational excellence strongly implies the implementation of advanced building management systems. This focus on technological advancement helps create desirable, contemporary urban environments.

Hang Lung Group is actively embracing technological advancements to refine its customer engagement and marketing strategies, particularly as consumer preferences shift. The company is leveraging digital tools to create highly targeted marketing campaigns and foster stronger customer relationships. These digital platforms are essential for segmenting their customer base and personalizing experiences to drive increased foot traffic and revenue at their commercial properties.

A prime example of this technological integration was seen during Hang Lung's 65th-anniversary celebrations. The group deployed various marketing activities, powered by digital channels, to significantly enhance customer loyalty and engagement across its nationwide portfolio. This strategic use of technology underscores their commitment to adapting to the modern retail landscape.

Data Analytics for Market Insights

Hang Lung Group leverages data analytics to dissect market trends and performance, a crucial step in refining its business strategies. This includes dynamically adjusting tenant mixes and rental pricing to align with prevailing market conditions, ensuring optimal property performance.

The company utilizes data analytics to gain a deep understanding of key operational metrics. This encompasses tracking occupancy rates, analyzing rental income streams, and interpreting consumer behavior patterns, all of which are vital for making well-informed decisions regarding property leasing and future development projects.

- Occupancy Rate Focus: In the first half of 2024, Hang Lung Group reported an average occupancy rate of 89.7% across its mainland China portfolio, highlighting the importance of data-driven tenant management.

- Rental Income Analysis: The group's rental income from mainland properties reached HK$3.56 billion in H1 2024, with data analytics helping to identify segments contributing most significantly to this revenue.

- Consumer Behavior Insights: By analyzing foot traffic and spending patterns, Hang Lung can tailor retail offerings and promotional activities, as evidenced by the 15% year-on-year increase in retail sales across its mainland malls in H1 2024.

Development of Co-working Spaces

Hang Lung Group is actively adapting to evolving work trends by launching NET•WORK, a co-working space in Hong Kong. This initiative directly addresses the growing demand for flexible office solutions, aligning with technological shifts that are reshaping the workspace environment and creating new growth avenues for the company.

This strategic move into co-working spaces reflects a broader trend observed globally. For instance, the global flexible workspace market was valued at approximately USD 14.2 billion in 2023 and is projected to reach USD 31.7 billion by 2030, growing at a CAGR of 12.1% during the forecast period. This expansion by Hang Lung Group positions them to capitalize on this significant market growth.

- Adaptation to Modern Work Trends: Hang Lung's NET•WORK project caters to the increasing preference for flexible and collaborative work environments.

- Embracing Technological Shifts: The development signifies an understanding of how technology is influencing office design and utilization.

- New Growth Driver: Co-working spaces represent a strategic diversification for Hang Lung Group, tapping into a dynamic sector.

Hang Lung Group is leveraging technology for enhanced investor relations and operational efficiency, as seen with a 15% user engagement increase on its digital investor relations portal in 2024. The company is also integrating smart building technologies to optimize energy use and tenant experience. Data analytics plays a key role, with the group using it to manage occupancy rates, which stood at 89.7% in mainland China properties in H1 2024, and to analyze rental income, which reached HK$3.56 billion from mainland China in the same period.

| Key Technology Initiatives | 2024/2025 Data/Projections | Impact |

| Digital Investor Relations Portal Engagement | 15% year-on-year increase in user engagement (2024) | Improved transparency and accessibility for investors |

| Smart Building Technology Integration | Ongoing implementation across portfolio | Optimized operational efficiency, enhanced tenant experience, improved energy efficiency |

| Data Analytics for Property Management | 89.7% average occupancy rate (Mainland China, H1 2024) | Informed decisions on tenant mix, rental pricing, and property performance |

| Rental Income Analysis (Mainland China) | HK$3.56 billion (H1 2024) | Identification of key revenue-generating segments |

| Co-working Space Development (NET•WORK) | Expansion into flexible workspace market | Capitalizing on evolving work trends and technological shifts |

Legal factors

Hang Lung Group rigorously adheres to Hong Kong Financial Reporting Standards (HKFRSs), a cornerstone of its financial transparency. This commitment ensures that its financial statements accurately reflect its performance and financial position, fostering trust among stakeholders.

The company actively monitors and implements amendments to HKFRSs as they become effective, demonstrating a proactive approach to regulatory compliance. For instance, the adoption of new standards or interpretations in 2024 and 2025 ensures ongoing alignment with evolving best practices in financial reporting.

Hang Lung Group's property development in Hong Kong and mainland China operates under strict land use and zoning laws. Navigating these regulations is key to obtaining development permits and keeping projects on schedule. For instance, in 2023, Hong Kong's Town Planning Board approved several new development projects, highlighting the ongoing need for developers to align with evolving urban planning strategies.

Hang Lung Properties demonstrates a strong commitment to sustainable finance, with a substantial portion of its debt and facilities sourced through green financing instruments. This strategic approach reflects the company's proactive stance in complying with evolving sustainable finance regulations and principles, particularly as they gain traction globally.

The company's comprehensive sustainability reports are a testament to its dedication to transparency, detailing its environmental, social, and governance (ESG) performance. This aligns directly with the escalating regulatory demands for robust and clear ESG disclosures from businesses worldwide, ensuring stakeholders have access to critical performance data.

Corporate Governance and Shareholder Regulations

Hang Lung Properties operates under stringent corporate governance and shareholder regulations, ensuring transparency and accountability. The company's commitment is visible in its annual general meeting agendas, which typically feature the review of audited financial statements, dividend declarations, and director re-elections. For example, in its 2024 AGM, key resolutions included the approval of the final dividend and the reappointment of auditors.

Shareholder value is often enhanced through strategic maneuvers like share buybacks and new share issuances, all of which are subject to rigorous regulatory approvals. These actions demonstrate Hang Lung's adherence to legal frameworks designed to protect investor interests and maintain market integrity. In 2023, the company completed a significant share repurchase program, signaling confidence in its valuation and a commitment to returning capital to shareholders.

- Corporate Governance: Adherence to best practices, including transparent financial reporting and director accountability, as demonstrated in annual general meeting proceedings.

- Shareholder Rights: Regulations governing share buybacks and issuances ensure that strategic capital management actions are conducted within legal parameters to protect shareholder value.

- Regulatory Oversight: All significant corporate actions, such as share repurchases or new equity offerings, require explicit approval from relevant regulatory bodies, underscoring compliance.

- Dividend Policy: The declaration and payment of dividends are subject to shareholder approval and regulatory guidelines, reflecting a structured approach to profit distribution.

Contractual Agreements and Tenant Laws

Hang Lung Group's operations are heavily influenced by contractual agreements with its diverse tenant base across retail, office, and serviced apartment sectors. These contracts are meticulously crafted to comply with the specific landlord-tenant laws and commercial leasing regulations in both Hong Kong and mainland China. For instance, in Hong Kong, lease agreements must adhere to ordinances like the Landlord and Tenant (Consolidation) Ordinance, ensuring fair practices and dispute resolution mechanisms.

Navigating these legal frameworks is crucial for maintaining smooth tenant relationships and ensuring operational stability. In mainland China, commercial property leasing is governed by a complex set of national and local regulations, including the Contract Law of the People's Republic of China, which dictates terms for rent, lease duration, and property use. Compliance ensures the validity of agreements and protects Hang Lung Group from potential legal challenges.

The group's commitment to legal compliance is evident in its proactive approach to understanding and adapting to evolving property laws. For example, recent updates to commercial lease regulations in certain Chinese cities might impact renewal terms or rent review clauses, requiring careful contract renegotiation and adherence. Such diligence is fundamental to Hang Lung Group's reputation as a reliable property manager and landlord.

- Contractual Frameworks: Hang Lung Group relies on legally sound lease agreements for all its properties, covering retail, office, and residential spaces.

- Jurisdictional Compliance: Operations in Hong Kong and mainland China necessitate strict adherence to distinct landlord-tenant laws and commercial leasing regulations.

- Regulatory Evolution: The company must stay abreast of changes in property law, such as potential revisions to rent control or lease renewal stipulations in key markets.

- Legal Risk Mitigation: Robust contractual agreements and diligent legal compliance are essential for minimizing disputes and safeguarding the company's interests.

Hang Lung Group's adherence to Hong Kong Financial Reporting Standards (HKFRSs) ensures financial transparency, with ongoing adaptation to new standards in 2024 and 2025. The company's property development is governed by strict land use and zoning laws, requiring alignment with evolving urban planning, such as the Town Planning Board approvals in Hong Kong in 2023.

The group's commitment to sustainable finance is reflected in its use of green financing instruments, aligning with growing global regulations for ESG disclosures. Corporate governance and shareholder regulations are strictly followed, with actions like dividend approvals and director re-elections highlighted in its 2024 AGM.

Legal frameworks for lease agreements are critical, complying with Hong Kong ordinances and mainland China's Contract Law. Staying updated on property law changes, like potential rent control revisions in Chinese cities, is vital for risk mitigation and maintaining strong tenant relationships.

Environmental factors

Hang Lung Group is actively pursuing ambitious renewable energy goals, demonstrating a strong commitment to environmental sustainability. In 2023, the company achieved a significant milestone by exceeding its 2025 renewable energy target for its Mainland China portfolio, sourcing 18.9% of its electricity demand from renewable sources.

This achievement underscores Hang Lung's dedication to reducing its carbon footprint, with plans to surpass its initial 25% renewable energy target. Such proactive measures position the company favorably in an evolving regulatory landscape and growing investor focus on ESG performance.

Hang Lung Group has made significant strides in reducing its environmental footprint, achieving a notable 41% reduction in Scope 1 and 2 Greenhouse Gas (GHG) emissions intensity. This accomplishment is measured against their 2018 baseline, demonstrating a clear commitment to sustainability.

Further reinforcing this commitment, Hang Lung is actively incorporating low-carbon concrete and steel into its development projects. This strategic adoption targets the reduction of embodied carbon emissions, a crucial step in aligning with global initiatives aimed at mitigating climate change.

Hang Lung Group is actively managing its environmental footprint through robust resource management and waste reduction initiatives. In 2023, the company demonstrated significant progress by achieving a 14% reduction in electricity intensity and an 8% reduction in water intensity when measured against a 2018 baseline.

Further underscoring its commitment, Hang Lung reported a 66% waste diversion rate in 2023. This high diversion rate highlights the company's success in minimizing waste sent to landfills, thereby reducing its overall environmental impact and promoting a more circular approach to resource utilization.

Climate Resilience and Adaptation

Hang Lung Group is actively addressing climate resilience, a crucial environmental factor for real estate developers. The company has undertaken comprehensive climate adaptation technical analyses, demonstrating a commitment to safeguarding its portfolio against the physical risks of climate change.

This proactive stance is supported by concrete data reflecting their progress:

- Climate Adaptation Analysis Completion: Hang Lung has completed climate adaptation technical analysis for 94% of its existing properties.

- Development Project Coverage: Furthermore, 83% of its development projects have undergone similar climate adaptation assessments.

- Risk Mitigation: This extensive analysis ensures that Hang Lung's assets are better prepared for potential climate impacts, thereby protecting their long-term value.

- Operational Continuity: By integrating adaptation strategies, the company aims to maintain operational continuity even amidst evolving environmental conditions.

Sustainable Procurement and Tenant Partnerships

Hang Lung Group prioritizes environmental responsibility through its sustainable procurement policies, actively favoring suppliers who demonstrate strong Environmental, Social, and Governance (ESG) performance and hold relevant certifications. This approach ensures that its supply chain aligns with its commitment to sustainability.

The company's 'Changemakers: Tenant Partnerships on Sustainability' program highlights a proactive strategy to engage tenants in addressing environmental challenges. This initiative encourages collaboration to reduce carbon emissions, minimize waste generation, and promote circular economy principles throughout Hang Lung's properties.

In 2024, Hang Lung reported that over 70% of its new leasing agreements incorporated sustainability clauses, a significant increase from previous years. The Changemakers program has seen participation from over 150 tenants, collectively achieving a 10% reduction in energy consumption across their leased spaces by the end of 2024.

- Supplier ESG Screening: Hang Lung's procurement process includes a mandatory ESG assessment for all new suppliers, with over 85% of key suppliers meeting their sustainability criteria as of early 2025.

- Tenant Sustainability Program: The Changemakers program recognized 30 tenants in 2024 for outstanding contributions to waste reduction and circularity initiatives.

- Carbon Emission Reduction Targets: Through tenant partnerships, Hang Lung aims to achieve a 15% reduction in Scope 3 emissions related to tenant operations by 2026.

- Circular Economy Initiatives: The group has implemented waste recycling programs in 90% of its shopping malls, diverting over 5,000 tonnes of waste from landfills in 2024.

Hang Lung Group demonstrates a strong commitment to environmental stewardship, exceeding renewable energy targets and significantly reducing greenhouse gas emissions. The company actively integrates sustainable materials in development projects and manages resource efficiency through robust waste reduction and water conservation efforts.

Furthermore, Hang Lung prioritizes climate resilience by conducting thorough adaptation analyses for its properties and development projects. Its sustainable procurement policies and tenant engagement programs, like Changemakers, underscore a holistic approach to environmental responsibility and carbon footprint reduction.

| Environmental Metric | 2023 Performance | 2024 Progress/Targets |

|---|---|---|

| Renewable Energy Sourcing (Mainland China) | 18.9% | Targeting >25% |

| Scope 1 & 2 GHG Emissions Intensity Reduction | 41% (vs. 2018 baseline) | Ongoing reduction efforts |

| Electricity Intensity Reduction | 14% (vs. 2018 baseline) | Ongoing reduction efforts |

| Water Intensity Reduction | 8% (vs. 2018 baseline) | Ongoing reduction efforts |

| Waste Diversion Rate | 66% | Aiming for higher diversion |

| Climate Adaptation Analysis Coverage (Existing Properties) | 94% completed | Maintaining coverage |

| Sustainability Clauses in New Leasing Agreements | Over 70% | Increasing adoption |

| Key Supplier Sustainability Criteria Met | Over 85% (early 2025) | Maintaining high standards |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Hang Lung Group is built on a robust foundation of data from official government publications, international financial institutions like the IMF and World Bank, and leading market research firms. We incorporate insights from reputable industry reports and economic trend analyses to ensure comprehensive coverage of all PESTLE factors.