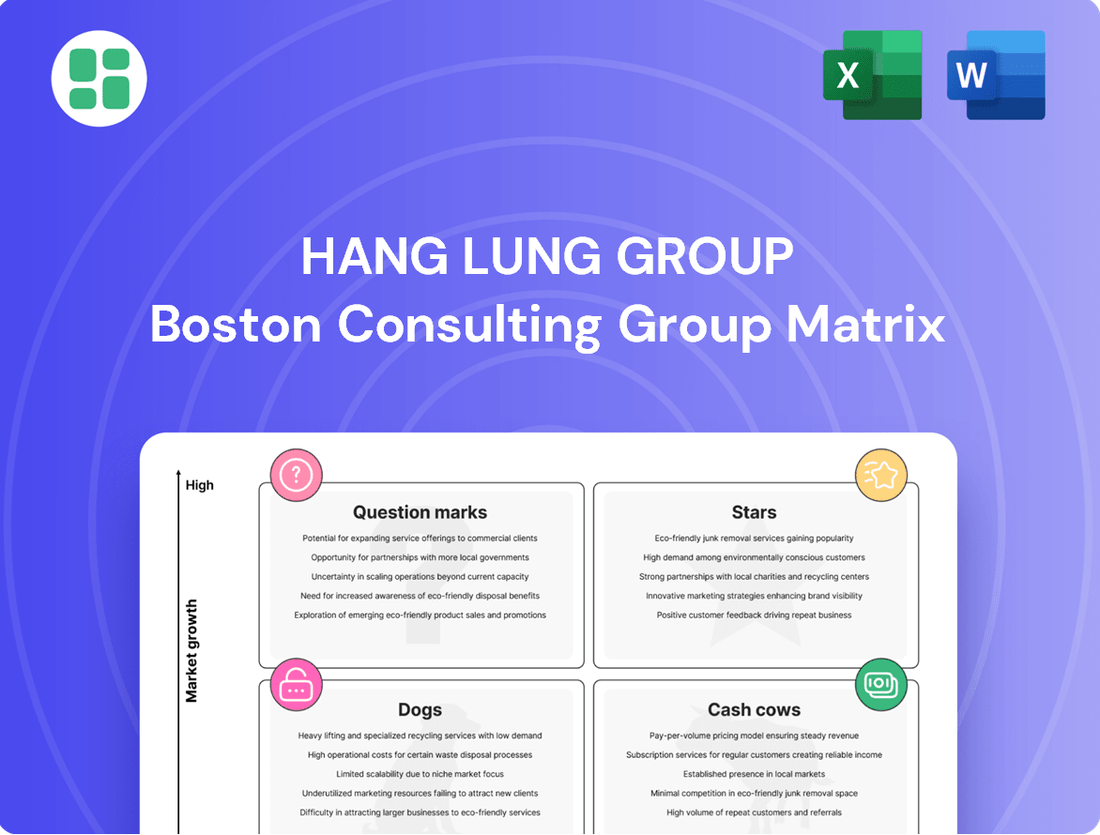

Hang Lung Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hang Lung Group Bundle

Curious about Hang Lung Group's strategic positioning? Our BCG Matrix analysis reveals which of their ventures are market leaders (Stars), reliable income generators (Cash Cows), resource drains (Dogs), or potential growth opportunities (Question Marks). Don't settle for a glimpse; purchase the full report for a comprehensive breakdown and actionable insights to guide your investment decisions.

Stars

Westlake 66 in Hangzhou is a standout Star for Hang Lung Group, set for phased completion from late 2025. This development is a comprehensive high-end commercial project, featuring a retail podium, premium Grade A office spaces, and a luxury Mandarin Oriental hotel. Its prime location in a rapidly expanding market, coupled with strong pre-leasing, positions it for significant future success and cash flow.

The project's robust pre-leasing is a key indicator of its Star status. Approximately 77% of the retail space is already secured, demonstrating considerable market demand and confidence. This high level of commitment suggests Westlake 66 will quickly become a cash-generating asset for Hang Lung Group upon opening.

The Grand Hyatt Kunming & Residences, launched in August 2024 as part of Hang Lung Group's Spring City 66 complex, is a prime example of a Star in the BCG Matrix. This luxury hotel and serviced apartment development is designed to complement the existing high-performing mall, aiming to draw in affluent customers and increase overall visitor engagement.

By integrating premium hospitality services into a well-established retail environment, the Grand Hyatt Kunming is poised to capture a significant market share in a growing region of China. This strategic move is expected to drive sustained growth and profitability, reinforcing its status as a Star asset for Hang Lung Group.

The Plaza 66 Pavilion Extension in Shanghai, slated for completion in mid-2026, represents a significant strategic move by Hang Lung Group. This expansion will increase the retail area of its premier luxury mall by 13%, directly tapping into China's robust and growing luxury consumer market.

With an emphasis on innovative retail, elevated dining, wellness, and lifestyle offerings, the extension aims to capture a larger share of this high-demand segment. Plaza 66 already boasts a strong market presence, and this development is poised to solidify its position as a future Star in the BCG Matrix, indicating high growth potential and market leadership.

Center Residences, Wuxi (Phase Two)

Center Residences, Wuxi (Phase Two) is positioned as a Star within Hang Lung Group's portfolio. This development, scheduled for pre-sale in the second half of 2025, includes residential towers and a Curio Collection by Hilton lifestyle hotel, enhancing the existing luxury mall at Center 66. Its strategic location and expansion into residential segments in a high-growth market suggest strong future potential.

The project benefits from Wuxi's economic dynamism. In 2024, Wuxi's GDP was projected to grow by approximately 5.5%, driven by its strong manufacturing base and increasing service sector. This economic environment supports the demand for premium residential properties like Center Residences.

- Project Type: High-rise residential towers and lifestyle hotel.

- Location: Wuxi, China, adjacent to Center 66 luxury mall.

- Pre-sale Timing: Latter half of 2025.

- Market Context: High-growth market with strong economic indicators.

Renewable Energy Initiatives for Mainland Portfolio

Hang Lung Group's ambitious renewable energy strategy for its mainland China properties is a clear indicator of a Star in the BCG Matrix. The company is targeting to power 80% of its mainland portfolio with renewable energy by May 2025, a goal that signifies a strong commitment to sustainability and operational efficiency.

This aggressive push not only aims to reduce operational expenses through lower energy costs but also strategically aligns Hang Lung with the escalating global demand for Environmental, Social, and Governance (ESG) compliant investments. By embracing green energy, Hang Lung is also bolstering its brand reputation, making its properties more attractive to a growing segment of environmentally conscious tenants and investors.

- Renewable Energy Target: 80% of mainland portfolio powered by renewables by May 2025.

- Cost Reduction: Anticipated decrease in operational expenses through sustainable energy sourcing.

- Market Attraction: Enhanced appeal to environmentally conscious tenants and investors.

- ESG Alignment: Strong positioning within the growing green investment market.

Hang Lung Group's Star assets are characterized by their strong market position and high growth potential, requiring significant investment to maintain their momentum. Westlake 66 in Hangzhou, with 77% retail pre-leasing, and the Grand Hyatt Kunming & Residences, launched in August 2024, exemplify this category. The upcoming Plaza 66 Pavilion Extension in Shanghai, set for mid-2026, also fits this profile, aiming to capture more of the luxury market.

| Asset | Location | Status/Key Feature | Projected Impact |

|---|---|---|---|

| Westlake 66 | Hangzhou | High-end commercial; 77% retail pre-leased | Strong future cash flow |

| Grand Hyatt Kunming & Residences | Kunming | Luxury hotel and residences; launched August 2024 | Enhanced visitor engagement and market share |

| Plaza 66 Pavilion Extension | Shanghai | Retail expansion; completion mid-2026 | Increased market share in luxury segment |

| Center Residences, Wuxi (Phase Two) | Wuxi | Residential towers & Hilton hotel; pre-sale H2 2025 | Leveraging Wuxi's economic growth |

| Renewable Energy Strategy | Mainland China Portfolio | 80% renewable energy by May 2025 | Reduced costs, enhanced ESG appeal |

What is included in the product

The Hang Lung Group BCG Matrix provides a framework for analyzing its diverse business units based on market share and growth potential.

It guides strategic decisions on investment, divestment, and resource allocation for each unit.

A clear BCG Matrix overview for Hang Lung Group eliminates the pain of indecision by visually guiding strategic resource allocation across business units.

Cash Cows

Plaza 66 in Shanghai is a prime example of a Cash Cow for Hang Lung Group. It consistently boasts near-full occupancy, solidifying its status as a leader in the luxury retail segment.

While tenant sales have seen some recent moderation due to wider economic trends, Plaza 66's strong luxury appeal and established brand presence, featuring numerous flagship stores, continue to drive substantial profit margins and reliable cash flow. This mature property demands minimal marketing expenditure, making it a consistent and significant income contributor.

Grand Gateway 66 in Shanghai stands as a prime example of a Cash Cow for Hang Lung Group. This established luxury mall consistently delivers strong rental revenue, bolstered by a high occupancy rate that demonstrates its enduring appeal in a mature market.

Despite facing some market competition, Grand Gateway 66's robust brand equity and strategic marketing efforts ensure a stable and predictable cash flow. Its position as a market leader with limited growth potential solidifies its Cash Cow status within Hang Lung's portfolio.

Spring City 66 in Kunming operates as a strong Cash Cow for Hang Lung Group. Its impressive 99% occupancy rate as of mid-2025 highlights its stability and consistent revenue generation. This premier mall in Southwestern China, despite a slight dip in tenant sales, remains a reliable cash generator in a well-established market.

The mall's enduring appeal is further bolstered by its integration with the Grand Hyatt Kunming, enhancing its value proposition as a key retail and lifestyle hub. This strategic move solidifies its position as a mature asset contributing significantly to the group's overall financial performance.

Parc 66, Jinan

Parc 66 in Jinan, a key property within the Hang Lung Group portfolio, exemplifies a Cash Cow. In 2024, it maintained a robust occupancy rate of 93% and saw a steady revenue increase of 1%.

This consistent performance indicates a mature asset generating reliable income. The ongoing Asset Enhancement Initiative (AEI) at Parc 66 is designed to refresh its offerings and maintain its competitive edge, ensuring continued profitability.

The strategy here is to sustain cash flow with targeted investments rather than aggressive growth, a hallmark of a successful Cash Cow.

- Asset: Parc 66, Jinan

- Category: Cash Cow

- 2024 Occupancy: 93%

- 2024 Revenue Growth: 1%

- Strategic Focus: Asset Enhancement Initiative (AEI) for sustained profitability

Hong Kong Central Office Portfolio

Hang Lung Group's Hong Kong Central office portfolio, featuring prime assets such as the Standard Chartered Bank Building, acts as a steadfast cash cow, generating consistent rental income.

Even with a subdued office leasing environment characterized by elevated vacancy rates, this portfolio has demonstrated resilience, maintaining strong occupancy and rental earnings. This success is attributed to proactive tenant retention efforts and superior property management, underscoring its status as a reliable income generator.

- Stable Rental Income: Properties like the Standard Chartered Bank Building consistently contribute to Hang Lung's revenue.

- High Occupancy: Despite market headwinds, the portfolio has maintained impressive occupancy levels.

- Premium Management: Proactive tenant retention and high-quality property management are key drivers of sustained performance.

- Resilience in Challenging Markets: The portfolio's ability to weather a difficult office leasing market highlights its cash cow status.

Cash Cows within Hang Lung Group's portfolio represent mature, high-performing assets that generate substantial and stable cash flow with minimal investment. These properties, like Plaza 66 and Grand Gateway 66 in Shanghai, consistently achieve high occupancy rates and command strong rental income, solidifying their role as reliable profit contributors. Their established market position and brand recognition allow for sustained performance even amidst broader economic fluctuations.

| Asset | Location | 2024 Occupancy | 2024 Revenue Growth | Category |

|---|---|---|---|---|

| Plaza 66 | Shanghai | Near Full | Stable | Cash Cow |

| Grand Gateway 66 | Shanghai | High | Stable | Cash Cow |

| Spring City 66 | Kunming | 99% (mid-2025) | Steady | Cash Cow |

| Parc 66 | Jinan | 93% | 1% | Cash Cow |

| Central Office Portfolio | Hong Kong | High | Consistent | Cash Cow |

What You See Is What You Get

Hang Lung Group BCG Matrix

The Hang Lung Group BCG Matrix preview you're examining is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis, crafted by industry experts, is ready for immediate strategic application without any watermarks or sample content. You can confidently use this preview as a direct representation of the high-quality, actionable insights contained within the complete Hang Lung Group BCG Matrix report.

Dogs

The Heartland 66 Office Tower in Wuhan, part of Hang Lung Group's portfolio, is exhibiting traits of a Dog in the BCG Matrix. By mid-2025, its revenue saw a 2% decrease, and occupancy fell to 63%, a five-point drop.

This performance is attributed to a difficult market environment and intense competition, signaling both a low market share and limited growth potential for the asset.

Such underperforming properties can immobilize capital, offering minimal returns, and therefore warrant a strategic evaluation for potential divestment or repositioning.

Forum 66 Mall in Shenyang, part of Hang Lung Group, is currently positioned as a Dog in the BCG Matrix. In 2024, it saw a 16% revenue decline and a 25% drop in tenant sales, with occupancy at 87%.

Despite ongoing repositioning efforts to improve its offerings, the mall's performance reflects a low market share within a slow-growing market segment. This situation, compounded by a competitive environment, suggests it may become a cash trap if significant improvements are not realized.

Certain older retail properties in Hong Kong, particularly those not integrated into prime lifestyle hubs, may be categorized as Dogs in the Hang Lung Group's BCG Matrix. These assets could be experiencing declining foot traffic and sales, exacerbated by shifting consumer preferences and a competitive retail landscape.

In 2024, Hong Kong's retail sector faced ongoing challenges, with overall retail sales volume seeing fluctuations. Properties that are older and lack modern amenities or prime locations are likely to be disproportionately affected, struggling to attract shoppers and maintain rental income.

Specific Underperforming Office Spaces in Mainland China

Certain office properties in mainland China, specifically those experiencing a surge in new supply and heightened tenant sensitivity to costs, are showing characteristics of question marks within the Hang Lung Group's BCG Matrix. These assets are caught in a low-growth segment, grappling with reduced occupancy rates and falling revenues.

For instance, the Grade A office building located at Shanghai Plaza 66 contributed substantially to the overall decline in office revenue during the first half of 2025. This downturn was attributed to tenant departures and shifts in market demand. Such properties are now facing challenges that place them in a precarious market position.

- Low Occupancy Rates: Properties like the Shanghai Plaza 66 Grade A office building are experiencing a dip in their occupancy levels.

- Declining Revenue: The financial performance of these specific office assets is negatively impacted by reduced rental income.

- Market Saturation: Increased new office supply in mainland China is intensifying competition and putting pressure on existing properties.

- Tenant Cost-Consciousness: Businesses are becoming more mindful of their expenditure, leading to a more selective approach to office leasing.

Divested Non-Core or Stagnant Development Land Banks

Divested non-core or stagnant development land banks represent assets that are not contributing to Hang Lung Group's strategic growth objectives. These might include undeveloped parcels or projects with minimal progress in markets experiencing slow economic expansion. Such holdings can immobilize significant capital, hindering the group's ability to reinvest in more promising ventures.

For instance, if a particular land bank in a region with a projected GDP growth of only 1.5% annually (as per 2024 economic forecasts) has remained undeveloped for over five years, it would fit this category. The opportunity cost of holding such an asset, especially when compared to potential returns from active development or alternative investments, makes divestiture a logical consideration.

- Stagnant Assets: Land banks or development projects with little to no progress in low-growth regions.

- Capital Immobilization: These assets tie up financial resources that could be deployed more effectively.

- Questionable Viability: Long-term usefulness and profitability become uncertain, prompting divestment.

- Strategic Realignment: Selling these allows Hang Lung Group to focus on core, high-potential developments.

Properties like the Heartland 66 Office Tower in Wuhan and the Forum 66 Mall in Shenyang are categorized as Dogs within Hang Lung Group's portfolio. These assets are characterized by low market share and limited growth prospects, evidenced by declining revenues and occupancy rates. For instance, Heartland 66 saw a 2% revenue decrease and a 5% drop in occupancy by mid-2025, while Forum 66 experienced a 16% revenue decline in 2024. Such underperformers can tie up capital, necessitating strategic review for divestment or repositioning.

| Asset | BCG Category | 2024/2025 Performance Indicators | Market Context |

|---|---|---|---|

| Heartland 66 Office Tower, Wuhan | Dog | Revenue down 2% (mid-2025), Occupancy at 63% (down 5 points) | Difficult market, intense competition |

| Forum 66 Mall, Shenyang | Dog | Revenue down 16% (2024), Tenant sales down 25% (2024), Occupancy at 87% | Slow-growing segment, competitive environment |

| Older HK Retail Properties | Dog | Declining foot traffic and sales (estimated) | Shifting consumer preferences, competitive retail landscape |

Question Marks

Westlake 66 in Hangzhou, while a Star in Hang Lung Group's portfolio due to its high-growth market potential, initially presents as a Question Mark. This is because its early operational stages require substantial investment and successful execution to solidify its market position and long-term profitability.

The project's sheer scale means it demands significant capital outlay during its initial phases, impacting cash flow. As of the first half of 2024, Hang Lung Group reported that Westlake 66 was still in its ramp-up period, with occupancy rates and rental income gradually increasing, indicating ongoing investment needs.

Center Residences in Wuxi, a new residential development by Hang Lung Group, is positioned as a Question Mark within the BCG framework. With pre-sales slated for late 2025, its future market performance is uncertain, despite its strategic location next to a thriving mall.

The residential market's inherent volatility means Center Residences faces potential challenges in initial adoption. Significant investment in marketing and sales will be crucial to establish market share and determine its long-term success, especially considering the competitive landscape.

New hospitality ventures like the Curio Collection by Hilton in Wuxi and the Mandarin Oriental Hangzhou represent significant investments for the Hang Lung Group, aiming to enhance mall traffic and attract premium tenants. These projects, slated for completion in the coming years, are positioned as potential stars in the BCG matrix, assuming they can overcome the challenges of a saturated hospitality market and shifting travel dynamics. For instance, in 2023, China's hospitality sector saw a strong rebound, with hotel occupancy rates in major cities reaching an average of 70%, according to STR data, indicating a healthy demand but also intense competition.

'Net-Work by Hang Lung' Co-working Facilities

Hang Lung Group's 'Net-Work by Hang Lung' in Hong Kong is currently a Question Mark in the BCG Matrix. This premium co-working facility is entering a rapidly expanding market for flexible workspaces, a sector that saw significant growth in 2024 with the demand for hybrid work models increasing. However, it's a new undertaking for Hang Lung, and its potential to capture substantial market share from established competitors remains uncertain, necessitating strategic investment to foster growth and achieve profitability.

The success of 'Net-Work by Hang Lung' hinges on its ability to differentiate itself and attract a consistent client base. By 2024, the flexible workspace market in Asia Pacific was projected to continue its upward trajectory, with Hong Kong being a key hub. Despite this favorable market trend, the venture's future performance is not guaranteed, requiring careful management and marketing efforts.

- Market Position: New entrant in a growing but competitive co-working market.

- Investment Need: Requires significant capital for market penetration and brand building.

- Future Potential: High growth potential if it can secure a strong market foothold against established players.

- Risk Factor: Uncertainty regarding profitability and market share acquisition in the short to medium term.

Future Redevelopment Projects in Hong Kong

Hang Lung Group's strategic positioning, particularly concerning its Hong Kong portfolio, involves navigating the complexities of future redevelopment projects. These initiatives are crucial for revitalizing older assets and introducing new concepts within a demanding market landscape.

The company's approach to these projects is characterized by a keen awareness of the challenges ahead. These include significant market uncertainties, substantial capital expenditure requirements, and the imperative to capture new market share in a mature and highly competitive environment.

- Revitalization of Older Assets: Hang Lung is likely to focus on redeveloping its existing properties in Hong Kong to enhance their appeal and functionality, thereby increasing their value and rental yields.

- Introduction of New Concepts: The group may explore innovative retail or commercial concepts to differentiate its offerings and attract a wider customer base, especially in response to evolving consumer preferences.

- Market Challenges: Redevelopment projects in Hong Kong, particularly those initiated in 2024 and beyond, face headwinds such as rising construction costs, potential interest rate fluctuations, and slower economic growth impacting consumer spending.

- Capital Investment and ROI: Significant upfront investment is required for these projects, and Hang Lung will need to carefully project return on investment, considering the long gestation periods and market volatility.

Question Marks in Hang Lung Group's portfolio represent new ventures or underdeveloped projects with high growth potential but uncertain market acceptance. These require significant investment to determine their future success, often facing intense competition and market volatility.

Westlake 66 in Hangzhou and Center Residences in Wuxi are prime examples, demanding substantial capital and strategic execution to establish their market presence. Similarly, 'Net-Work by Hang Lung' in Hong Kong enters a competitive co-working space, needing careful differentiation to capture market share.

These ventures, while promising, carry inherent risks due to their nascent stages and the need to overcome market entry barriers. Their classification as Question Marks highlights the critical juncture they are in, where strategic investment and performance will dictate their transition to Stars or potential divestment.

| Project Name | Location | BCG Category | Key Considerations | Investment Status (as of early 2024) |

| Westlake 66 | Hangzhou | Question Mark | High growth potential, requires substantial investment for market penetration and profitability. | Ramp-up period, occupancy and rental income gradually increasing, ongoing investment needed. |

| Center Residences | Wuxi | Question Mark | New residential development, uncertain market performance due to pre-sales in late 2025 and market volatility. | Pre-sales slated for late 2025, requiring significant marketing and sales investment. |

| 'Net-Work by Hang Lung' | Hong Kong | Question Mark | Entering a competitive co-working market, needs differentiation and client base acquisition. | Requires strategic investment for market penetration and brand building; future profitability uncertain. |

BCG Matrix Data Sources

Our Hang Lung Group BCG Matrix is built upon a foundation of robust financial disclosures, comprehensive market analytics, and insightful industry research to deliver strategic clarity.