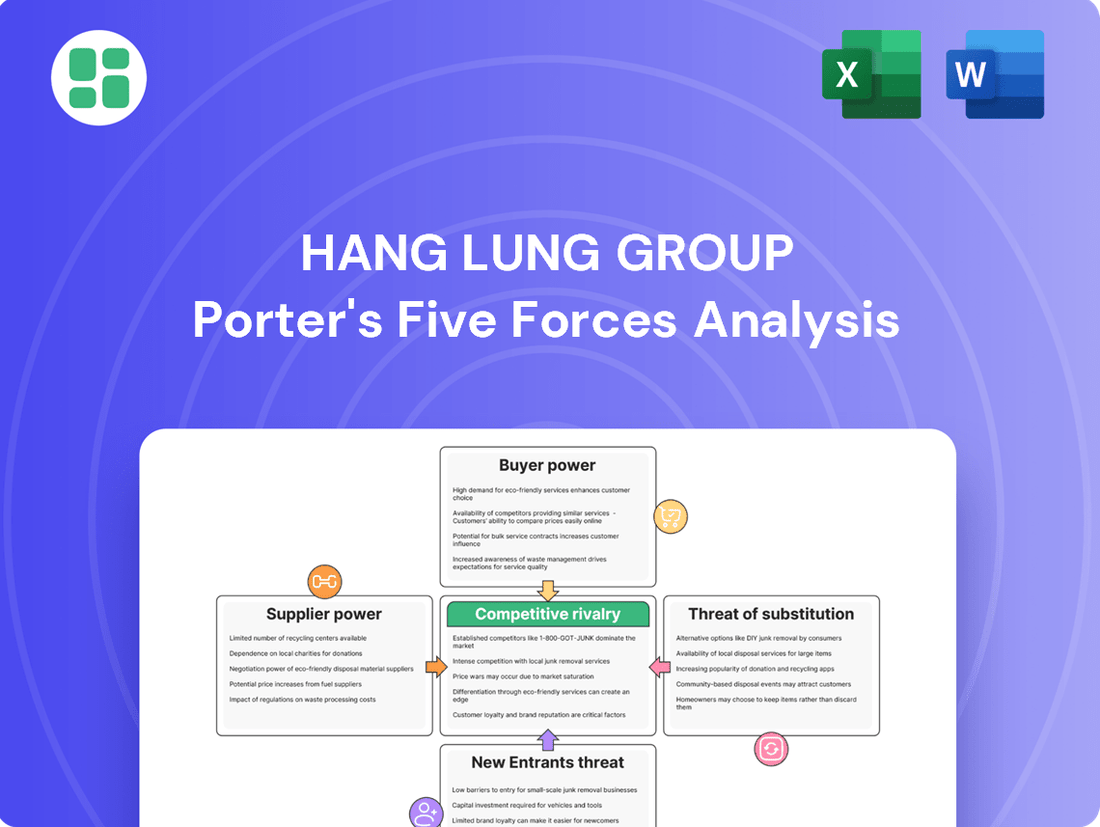

Hang Lung Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hang Lung Group Bundle

Hang Lung Group navigates a competitive retail landscape, facing moderate bargaining power from both buyers and suppliers. The threat of new entrants is a significant concern, while the intensity of rivalry among existing players demands constant innovation.

The complete report reveals the real forces shaping Hang Lung Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

In Hong Kong and mainland China, concentrated land ownership, often by government entities or major developers, grants these landowners significant bargaining power. This means Hang Lung Group may encounter higher acquisition costs and reduced negotiation flexibility when securing prime development sites.

The government's influence over land supply and its policy adjustments, such as streamlining land sale processes, directly amplify this supplier power. For instance, in 2024, land premiums in Hong Kong remained a significant factor in development costs, reflecting the controlled nature of land availability.

Suppliers of capital, such as banks, wield significant power in the property development sector due to its inherently capital-intensive nature. Hang Lung Group's financial disclosures for 2024 and projections into 2025 highlight increasing finance costs. This trend is a direct consequence of a less favorable interest rate environment and more stringent approval processes for commercial mortgage loans.

These elevated financing costs underscore the necessity for Hang Lung Group to negotiate favorable terms with its lenders. The Group's ability to secure capital for new developments and its overall profitability are directly influenced by the bargaining power of these financial institutions.

While many construction materials are readily available, specialized components or advanced building techniques might be sourced from a limited number of key providers. This concentration of specialized suppliers can elevate their bargaining power, especially when Hang Lung Group requires unique or high-performance materials for its premium developments.

The availability of skilled labor and reputable contractors in Hong Kong and mainland China is also a factor. Scarcity in these areas can empower specialized construction and material providers, allowing them to negotiate more favorable terms. For instance, in 2023, the construction sector in Hong Kong faced challenges with labor shortages, potentially increasing the leverage of experienced contractors and specialized material suppliers.

Hang Lung's emphasis on quality and sustainability further influences supplier relationships. Their preference for specific, often higher-cost, suppliers who meet stringent environmental and performance standards can reduce the pool of viable alternatives, thereby strengthening the bargaining position of these chosen providers.

Limited Availability of Prime Locations

The scarcity of prime commercial and residential locations in major cities like Hong Kong and tier-one mainland Chinese cities significantly amplifies the bargaining power of landowners. Hang Lung Group's reliance on securing premium sites for its high-quality commercial complexes makes it particularly vulnerable to this dynamic, potentially increasing acquisition costs and development timelines.

- Limited prime land availability: Major cities often have fixed land supplies, making premium locations a scarce commodity.

- Increased land costs: In 2024, prime commercial land prices in Hong Kong continued to reflect this scarcity, with some transactions indicating sustained high per-square-foot costs.

- Supplier leverage: Landowners in these desirable areas can command higher prices and more favorable terms from developers like Hang Lung Group.

Talent and Expert Shortage

The property development and management sector, including companies like Hang Lung Group, relies heavily on specialized expertise. This demand for skilled professionals, ranging from architects and engineers to seasoned property managers, creates a tight labor market.

In 2024, the competition for top talent in both Hong Kong and mainland China remains intense. This scarcity empowers individuals and specialized consultancies, giving them considerable leverage. This can lead to increased labor costs and difficulties in retaining key personnel, potentially affecting project timelines and operational effectiveness.

- Talent Scarcity: The need for architects, engineers, and experienced property managers is high.

- Competitive Landscape: Fierce competition for talent exists in Hong Kong and mainland China.

- Supplier Power: Skilled professionals and consultancies hold significant bargaining power due to demand.

- Impact on Costs: This can drive up labor expenses and challenge talent retention for companies like Hang Lung Group.

Suppliers of capital, such as banks, wield significant power in the property development sector due to its inherently capital-intensive nature. Hang Lung Group's financial disclosures for 2024 and projections into 2025 highlight increasing finance costs. This trend is a direct consequence of a less favorable interest rate environment and more stringent approval processes for commercial mortgage loans.

The scarcity of prime commercial and residential locations in major cities like Hong Kong and tier-one mainland Chinese cities significantly amplifies the bargaining power of landowners. Hang Lung Group's reliance on securing premium sites for its high-quality commercial complexes makes it particularly vulnerable to this dynamic, potentially increasing acquisition costs and development timelines.

Suppliers of specialized construction materials or advanced building techniques can also possess considerable leverage, especially when Hang Lung requires unique or high-performance components. The scarcity of skilled labor in 2023 and 2024 further empowered experienced contractors and material providers, potentially increasing costs for developers.

| Supplier Type | Bargaining Power Factor | Impact on Hang Lung Group (2024/2025 Outlook) |

|---|---|---|

| Landowners | Concentrated ownership, prime location scarcity | Higher acquisition costs, reduced negotiation flexibility for premium sites. Land premiums in Hong Kong remained a significant cost factor in 2024. |

| Capital Providers (Banks) | Capital-intensive industry, interest rate environment | Increased finance costs due to higher interest rates and stricter loan approvals. |

| Specialized Material/Labor Providers | Limited suppliers for unique materials, skilled labor shortages | Potential for elevated costs for specialized components and construction services; challenges in talent retention. |

What is included in the product

This analysis of Hang Lung Group's competitive landscape reveals the intensity of rivalry among existing players and the bargaining power of its customers and suppliers.

It further assesses the threat of new entrants and the availability of substitute products or services, providing a comprehensive view of Hang Lung Group's market position.

A clear, one-sheet summary of all five forces—perfect for quick decision-making and identifying strategic vulnerabilities.

Instantly understand strategic pressure with a powerful spider/radar chart, highlighting areas needing immediate attention and resource allocation.

Customers Bargaining Power

The bargaining power of customers for Hang Lung Group's office and retail properties, particularly in Hong Kong, is substantial. Businesses and brands, acting as tenants, can leverage market conditions to their advantage.

In the office sector, high vacancy rates, exceeding 6% in prime Hong Kong locations by early 2024, and significant new supply have tilted the scales. This has resulted in downward pressure on rents, with landlords increasingly offering concessions and attractive rental packages to secure and retain tenants.

The retail segment mirrors this trend, with declining sales and rents evident throughout 2023 and into 2024. To combat tenant attrition and maintain occupancy, retail landlords like Hang Lung are compelled to negotiate lower rental rates and provide enhanced tenant support, directly impacting their revenue streams.

The availability of numerous alternatives significantly bolsters the bargaining power of customers for Hang Lung Group. In Hong Kong's office market, a substantial influx of new Grade A office spaces in 2024 has created a tenant's market, driving a flight-to-quality and enabling tenants to negotiate favorable lease terms or relocate to superior buildings. This abundance of choice directly pressures landlords like Hang Lung to offer competitive rents and incentives.

Similarly, in the retail segment, customers are spoiled for choice with alternatives ranging from competing shopping malls and independent high street retailers to the ever-expanding reach of e-commerce. This broad spectrum of options empowers consumers to seek out the best value, forcing retailers and mall operators to be more accommodating with pricing and tenant terms to retain foot traffic and sales.

Both retail and office tenants in mainland China and Hong Kong are demonstrating significant price sensitivity. This is largely driven by a prevailing weak economic sentiment and a widespread focus on cost-containment strategies among businesses. Consequently, customers are increasingly reluctant to commit to premium rental rates, directly impacting landlords.

Hang Lung Group's financial performance for 2024 and projections for 2025 illustrate this trend, with reported declines in property leasing revenue. This downturn underscores the pressure on landlords to adapt their pricing models and offer more attractive incentives to secure and retain tenants in the current market environment.

Shifting Consumption Patterns

Shifting consumption patterns significantly influence the bargaining power of customers for Hang Lung Group. For instance, the surge in northbound travel from Hong Kong, a key market for many retailers, directly affects the sales performance of tenants within Hang Lung's malls. This means tenants are more sensitive to foot traffic and sales volume, giving them more leverage when negotiating lease terms.

The escalating prominence of e-commerce further amplifies customer bargaining power. As consumers increasingly opt for online shopping, brick-and-mortar retailers face greater pressure to offer unique experiences and value propositions. This forces Hang Lung's retail tenants to adapt their strategies, and consequently, puts pressure on Hang Lung to invest in creating more attractive and engaging physical retail environments to retain and attract shoppers.

- Increased Northbound Travel: In 2023, Hong Kong saw a notable increase in outbound tourism, with many residents traveling to mainland China, impacting local retail spending.

- E-commerce Growth: Global e-commerce sales are projected to reach $7.4 trillion by 2025, indicating a continued shift in consumer spending away from physical retail.

- Tenant Adaptability: Retail tenants experiencing fluctuating sales due to these shifts have greater leverage in lease negotiations, demanding more favorable terms from mall operators like Hang Lung.

Strong Bargaining from Anchor Tenants

Large retail brands, often referred to as anchor tenants, wield significant bargaining power due to their ability to attract substantial customer traffic. Their presence is a cornerstone for a shopping mall's success, enabling them to negotiate advantageous lease agreements, including favorable rental rates and significant fit-out allowances. For instance, in 2024, major department stores and flagship brands continued to demand prime locations and flexible lease terms, impacting Hang Lung's rental income strategies.

Hang Lung Group, like other mall operators, must carefully navigate these demands. Balancing the need to secure these high-profile tenants, which are critical for the overall appeal and footfall of their properties, with the imperative to maintain healthy profit margins presents a continuous challenge. This dynamic influences Hang Lung's ability to optimize its revenue streams and overall financial performance.

- Anchor tenants drive significant foot traffic, making their presence crucial for mall success.

- These tenants often negotiate favorable lease terms, impacting rental income.

- Hang Lung must balance tenant needs with profitability in lease negotiations.

Hang Lung Group faces considerable customer bargaining power, especially from large retail brands acting as anchor tenants. These key tenants can negotiate favorable lease terms due to their ability to drive significant foot traffic, directly impacting Hang Lung's rental income and overall financial strategy.

The increasing prevalence of e-commerce and shifting consumption patterns further empower customers. With global e-commerce sales projected to reach $7.4 trillion by 2025, physical retailers, and by extension their landlords like Hang Lung, must offer compelling experiences to retain shopper engagement. This necessitates greater flexibility and investment from Hang Lung to maintain occupancy and appeal.

| Factor | Impact on Hang Lung | Supporting Data (2023-2025) |

|---|---|---|

| Anchor Tenant Power | Negotiate favorable leases, impacting rental income | Major department stores and flagship brands demand prime locations and flexible terms in 2024. |

| E-commerce Growth | Pressure on physical retail, need for enhanced experiences | Global e-commerce sales to reach $7.4 trillion by 2025. |

| Shifting Consumption | Tenants sensitive to foot traffic, seek better lease terms | Northbound travel impacts Hong Kong retail spending; tenants leverage fluctuating sales for negotiation. |

Preview Before You Purchase

Hang Lung Group Porter's Five Forces Analysis

This preview showcases the complete Hang Lung Group Porter's Five Forces Analysis, detailing the competitive landscape of the real estate industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. The document you see here is the exact, professionally formatted analysis you'll receive immediately after purchase, ready for your strategic decision-making.

Rivalry Among Competitors

The property development and investment sectors in both Hong Kong and mainland China are characterized by a crowded field of established participants, making competitive rivalry a significant force. In Hong Kong specifically, major developers such as CK Asset Holdings, Sun Hung Kai Properties, and Henderson Land are consistently introducing new projects, which directly escalates the intensity of competition.

This highly fragmented market structure compels Hang Lung Group to continuously seek ways to distinguish its properties and service offerings. For instance, in 2024, the Hong Kong property market saw ongoing new project launches, with developers actively competing for market share and tenant acquisition, putting pressure on rental yields and property values.

The property markets in Hong Kong and mainland China are experiencing a slow recovery, with high vacancy rates and substantial new supply, especially in office and retail spaces. This oversupply coupled with weak demand heightens competition among property owners and developers aiming to secure and keep tenants.

In 2023, Hong Kong's overall vacancy rate for Grade-A office space reached approximately 9.5%, a notable increase from previous years. Similarly, mainland China's major cities saw office vacancy rates averaging around 15% in the first half of 2024, putting downward pressure on rents and increasing the rivalry for occupants.

Hang Lung Group's leasing revenue for the first half of 2024 saw a decrease of 5.2% year-on-year, directly reflecting these adverse market conditions. The intense competition to attract and retain tenants in a market with more available space than demand is a significant factor contributing to this revenue decline.

Hang Lung Group, like many in property development, faces intense rivalry stemming from high fixed costs. These include significant outlays for land acquisition, construction, and continuous upkeep of its extensive investment properties. For instance, the company's substantial portfolio requires ongoing capital allocation, making it difficult to scale back operations quickly.

The long development timelines and the inherent illiquidity of real estate assets create formidable exit barriers. This means companies such as Hang Lung are compelled to remain active and competitive even during economic downturns, primarily to ensure they can cover their substantial fixed costs and maintain high occupancy rates across their properties. This pressure often translates into aggressive pricing to drive sales and leasing velocity.

In 2024, the commercial property market, particularly in key Asian cities where Hang Lung operates, continued to grapple with evolving demand patterns. While specific figures for Hang Lung's cost structure are proprietary, industry benchmarks show that development costs can represent a significant portion of a project's total value, often exceeding 70% before considering ongoing operational expenses.

Product Differentiation and Placemaking

Hang Lung Group faces intense rivalry, even within its niche of high-quality commercial complexes. To stand out, continuous innovation in property design, the selection of tenants, and the overall customer experience is paramount. This differentiation is key to attracting and retaining shoppers and businesses in a crowded marketplace.

The company's strategy heavily relies on placemaking – transforming properties into desirable urban destinations. These initiatives are vital for drawing consistent foot traffic and boosting tenant sales, particularly as consumers today have abundant choices for their retail and leisure activities.

- Innovation Drive: Hang Lung's commitment to differentiating its properties is evident in its ongoing investment in modern design and curated tenant mixes.

- Placemaking Impact: Successful placemaking efforts directly correlate with increased visitor numbers and enhanced tenant performance, as seen in the sustained appeal of its flagship properties.

- Competitive Landscape: The retail and commercial real estate sectors are highly competitive, necessitating proactive strategies to maintain market share and desirability.

Geographic Concentration and Regional Competition

Hang Lung Group's competitive landscape is significantly shaped by its geographic concentration in Hong Kong and key mainland Chinese cities. This focus intensifies rivalry within these specific markets, as local dynamics and the presence of strong regional players demand tailored strategies. Competition for prime real estate and desirable tenants is particularly acute in these concentrated areas.

In 2024, the Hong Kong retail property market, a key area for Hang Lung, continued to face headwinds. While there were signs of recovery, vacancy rates in prime districts remained a concern, with some reports indicating average vacancy rates in Central and Causeway Bay hovering around 5-7% for prime retail spaces, putting pressure on rental yields and increasing competition among landlords to attract and retain tenants. Mainland China's tier-one cities, such as Shanghai and Guangzhou, also present a highly competitive environment. For instance, Shanghai's retail property market saw new supply entering the market in 2024, with several large-scale developments opening, increasing the overall inventory and intensifying the battle for market share among established and new entrants.

- Geographic Focus: Hang Lung's core operations are centered in Hong Kong and major mainland Chinese cities, creating concentrated competitive arenas.

- Regional Rivalry: Local market conditions, regulatory shifts, and the strength of regional competitors are critical factors influencing Hang Lung's performance in these concentrated markets.

- Asset Competition: The battle for prime properties and high-quality tenants is particularly fierce in these key urban centers, impacting Hang Lung's leasing strategies and revenue generation.

Competitive rivalry is a significant force for Hang Lung Group, stemming from a crowded property market in Hong Kong and mainland China. Established developers constantly launch new projects, intensifying competition for market share and tenants, particularly in office and retail spaces. This is exacerbated by high vacancy rates and new supply, leading to downward pressure on rents and increased competition to secure occupants.

Hang Lung faces intense rivalry from well-capitalized competitors and the need for continuous innovation in property design and tenant selection to differentiate its offerings. The company's placemaking strategy is crucial for attracting foot traffic and boosting tenant sales in a market with abundant consumer choices.

The company's geographic concentration in Hong Kong and key mainland Chinese cities intensifies rivalry within these specific markets. In 2024, Hong Kong's prime retail vacancy rates were around 5-7%, while Shanghai saw new retail supply entering the market, increasing competition for market share.

| Market Segment | 2024 Vacancy Rate (Approx.) | Competitive Pressure Factor |

|---|---|---|

| Hong Kong Grade-A Office | ~9.5% (2023) | High new supply, weak demand |

| Mainland China Tier-1 Office | ~15% (H1 2024) | Oversupply, tenant retention focus |

| Hong Kong Prime Retail | 5-7% (2024) | Headwinds, competition for tenants |

| Shanghai Retail | Increasing inventory | New developments, market share battle |

SSubstitutes Threaten

The most significant threat to Hang Lung Group's retail malls comes from the escalating growth of e-commerce, notably from dominant players like Alibaba and JD.com. These platforms are increasingly making inroads into the Hong Kong market, offering competitive pricing and streamlined delivery services that directly challenge brick-and-mortar retail.

This evolving consumer preference towards online shopping demonstrably affects physical retail sales volumes and the crucial foot traffic within malls. Consequently, mall operators like Hang Lung face mounting pressure to adapt by enhancing the in-store experience and offering unique, engaging activities to maintain their appeal and relevance in the face of digital alternatives.

The rise of remote and hybrid work models presents a significant threat of substitution for Hang Lung Group's office towers. Many employees and companies now favor flexible arrangements, reducing the need for traditional, centralized office spaces. For instance, a 2024 survey in Hong Kong revealed that over 60% of respondents preferred a hybrid work setup, directly impacting the demand for physical office footprints.

For Hang Lung's serviced apartments, the threat of substitutes is significant. Traditional residential leases offer long-term stability, while hotels cater to shorter stays with varying service levels. Platforms like Airbnb provide flexible, often more affordable, short-term rental options.

Despite the government's talent admission regime boosting demand for serviced apartments, the sheer variety of housing choices means customers can easily pivot. For instance, in 2024, Hong Kong's overall residential rental market saw fluctuations, with some areas experiencing modest increases, potentially making traditional leases more attractive for longer commitments.

Digitalization of Services and Experiences

The increasing digitalization of services and experiences presents a significant threat of substitutes for traditional physical commercial spaces. Beyond simple e-commerce, the rise of virtual reality, online entertainment platforms, and digital social interactions directly competes with the need for consumers to visit brick-and-mortar retail locations or attend physical events. For instance, the global virtual reality market was valued at approximately USD 28.07 billion in 2023 and is projected to grow substantially, indicating a shift in how people engage with entertainment and experiences.

This trend means that activities previously driving foot traffic to malls or office buildings, such as shopping, socializing, or even attending concerts, can now be fulfilled digitally. Property developers like Hang Lung Group must therefore consider how to offer unique, technology-integrated, and experiential value within their physical spaces to remain competitive. The continued expansion of online streaming services and digital event platforms, which saw significant growth during the pandemic, further solidifies this threat.

- Digital Alternatives: Virtual experiences and online events directly substitute for in-person retail and entertainment activities.

- Market Growth: The virtual reality market's projected growth highlights a consumer shift towards digital engagement.

- Developer Response: Property developers need to innovate by integrating technology and unique experiences into physical spaces.

- Pandemic Impact: The accelerated adoption of digital services during recent years has permanently altered consumer behavior.

Shifting Consumer Spending Priorities

Economic uncertainties, particularly those impacting global and domestic markets in 2024, can significantly alter consumer spending habits. When faced with inflation or recessionary fears, individuals tend to reallocate their budgets, favoring necessities over discretionary purchases.

This shift directly impacts sectors like high-end retail and entertainment. For instance, a decline in consumer confidence, as observed in various economic reports throughout 2024, often correlates with reduced spending on luxury goods and experiences. Consumers might opt for more affordable entertainment options or delay purchases of non-essential items.

- Consumer Prioritization: Economic headwinds in 2024 have pushed consumers to prioritize essential goods and services over discretionary spending.

- Substitution Effect: Budget-friendly alternatives, such as online discount retailers or home entertainment, become more attractive substitutes for premium mall experiences.

- Reduced Discretionary Spending: Reports in early 2024 indicated a noticeable dip in spending on non-essential items, directly affecting sectors relying on discretionary income.

The threat of substitutes for Hang Lung Group's diverse property portfolio is multifaceted, stemming from both digital advancements and evolving consumer behaviors. For its retail malls, the relentless growth of e-commerce platforms like Alibaba and JD.com presents a direct challenge, offering convenience and competitive pricing that diverts shoppers from physical stores.

Furthermore, the increasing adoption of remote and hybrid work models significantly impacts the demand for Hang Lung's office towers, as companies reassess their need for traditional office spaces. A 2024 survey in Hong Kong highlighted that over 60% of respondents favored hybrid work, underscoring this shift.

For serviced apartments, alternatives like traditional leases and short-term rentals via platforms such as Airbnb provide flexible options that can substitute for Hang Lung's offerings, despite government initiatives aimed at boosting demand.

The digitalization of experiences, including virtual reality and online entertainment, also poses a threat by offering digital alternatives to physical retail and social activities, a trend accelerated by recent global events.

Economic uncertainties in 2024, including inflation and recessionary fears, further exacerbate this threat by influencing consumer spending habits, pushing individuals towards more budget-friendly substitutes for discretionary purchases.

| Property Segment | Primary Substitutes | Key Driver of Substitution | 2024 Data/Trend |

|---|---|---|---|

| Retail Malls | E-commerce (Alibaba, JD.com) | Convenience, Price Competition | Continued e-commerce growth impacting physical retail footfall. |

| Office Towers | Remote/Hybrid Work Models | Flexibility, Cost Savings | Over 60% of HK respondents preferred hybrid work in 2024. |

| Serviced Apartments | Traditional Leases, Airbnb | Long-term stability, Flexible short-term rentals | Fluctuations in HK rental market impacting lease attractiveness. |

| General Commercial Spaces | Digital Experiences (VR, Online Entertainment) | Digital engagement, Virtual fulfillment | Global VR market valued at USD 28.07 billion in 2023, showing strong digital shift. |

Entrants Threaten

The property development sector, particularly for substantial commercial and mixed-use ventures akin to Hang Lung Group's portfolio, demands colossal capital outlays. These include the costs of acquiring prime real estate, undertaking extensive construction, and navigating lengthy development timelines.

This substantial financial hurdle significantly impedes new players from entering the market at a comparable scale. For instance, in 2024, major urban regeneration projects in Tier 1 cities often require initial investments exceeding billions of dollars, making it a daunting prospect for less capitalized entities.

Securing prime land in Hong Kong and major mainland Chinese cities presents a substantial barrier to entry for new developers. Established players like Hang Lung Group benefit from long-standing relationships with government bodies and deep expertise in land bidding processes and urban planning, giving them a distinct advantage in acquiring desirable locations.

The scarcity of prime plots, especially in sought-after urban centers, makes it increasingly difficult for newcomers to acquire the necessary assets to build a competitive portfolio. For instance, in 2024, the average price per square foot for prime commercial land in Hong Kong’s Central district continued to be among the highest globally, reflecting this intense competition and limited availability.

Stringent regulatory and permitting processes act as a significant deterrent to new entrants in the property development sector, particularly for Hang Lung Group operating in Hong Kong and mainland China. These markets enforce complex and time-consuming approval pathways, including zoning laws and various permits. For instance, in 2024, the average approval time for major construction projects in Hong Kong remained a considerable hurdle, often extending beyond 18 months, demanding substantial upfront investment in compliance and expert consultation.

Brand Reputation and Trust

Hang Lung Group has established a powerful brand reputation, particularly with its luxury '66' brand, built on decades of developing and managing high-quality properties. This strong image, coupled with a deep commitment to customer service, creates a significant barrier for newcomers aiming to attract premium tenants and build comparable trust. For instance, in 2024, Hang Lung continued to invest in enhancing its customer experience, which directly supports its brand equity and makes it challenging for new entrants to replicate this level of established goodwill.

The time and resources required to cultivate a brand synonymous with quality and reliability are immense, posing a substantial threat to potential new entrants. Building a reputation that commands premium pricing and tenant loyalty, as Hang Lung has done, is a long-term endeavor. New players would face an uphill battle in convincing discerning customers and high-value tenants to switch from a trusted, established brand.

- Brand Legacy: Hang Lung's '66' brand represents a long-standing commitment to luxury and quality, developed over many years.

- Customer Trust: Decades of consistent delivery have fostered deep trust among premium customers and tenants.

- High Entry Cost: Replicating Hang Lung's brand reputation requires substantial, long-term investment in property development, marketing, and customer service.

- Competitive Disadvantage: New entrants will struggle to match Hang Lung's established market presence and customer loyalty in the near to medium term.

Economic Downturn and Market Volatility

The current economic downturn and market volatility significantly deter new entrants into Hang Lung Group's operating markets. High vacancy rates, declining rents, and a property crisis marked by developer liquidations in Hong Kong and mainland China create a highly challenging environment. For instance, Hong Kong's retail property vacancy rate stood at 5.1% in Q1 2024, impacting rental income. This inherent risk and uncertain recovery outlook make substantial new investments in the sector unattractive for potential competitors.

The financial strain on existing developers and the overall market sentiment further solidify this barrier. With many developers facing liquidity issues, the capital requirements and perceived risk for new entrants are exceptionally high. This situation naturally discourages companies from entering a market where established players are struggling, effectively reducing the threat of new competition.

- Deterrent Market Conditions: High vacancy rates and declining rents in key markets like Hong Kong (5.1% retail vacancy in Q1 2024) discourage new real estate investment.

- Property Crisis Impact: Developer liquidations and broader market uncertainty amplify the risks for potential new entrants.

- Reduced Investment Appeal: The uncertain recovery outlook makes the sector less attractive for significant capital deployment by new players.

The threat of new entrants for Hang Lung Group is currently moderate to low, primarily due to the immense capital required for prime property development and acquisition. The significant financial outlay for land, construction, and lengthy development cycles acts as a substantial deterrent. For example, in 2024, major urban projects in Tier 1 cities continued to demand initial investments in the billions of dollars, making it a formidable barrier for less capitalized firms.

Furthermore, securing prime land in sought-after locations like Hong Kong and major mainland Chinese cities is exceptionally difficult. Hang Lung benefits from established relationships and expertise in land bidding, giving it an edge. The scarcity and high cost of prime plots, with Hong Kong's Central district land prices remaining among the world's highest in 2024, further limit opportunities for newcomers.

Stringent regulatory environments and complex permitting processes in Hong Kong and mainland China also pose significant hurdles. The time and resources needed for compliance, often exceeding 18 months for major projects in 2024, demand substantial upfront investment and specialized knowledge, which new entrants may lack.

Hang Lung's strong brand reputation, particularly its luxury '66' brand, built on decades of quality development and service, creates another barrier. Replicating this level of trust and customer loyalty requires considerable long-term investment, making it challenging for new players to compete for premium tenants and customers in 2024.

Current market conditions, including economic downturns and property sector volatility, further dampen the threat of new entrants. High vacancy rates, declining rents, and developer financial distress in markets like Hong Kong, which saw a 5.1% retail vacancy rate in Q1 2024, make the sector unattractive for new, substantial investments.

| Barrier | Description | Impact on New Entrants (2024) |

|---|---|---|

| Capital Requirements | High costs for land acquisition, construction, and development timelines. | Formidable obstacle, requiring billions for major projects. |

| Land Scarcity & Cost | Limited prime plots in key urban centers, with extremely high prices. | Difficult to acquire competitive locations; Hong Kong's Central district remains exceptionally expensive. |

| Regulatory Hurdles | Complex and time-consuming permitting and zoning laws. | Projects can take over 18 months for approvals, demanding significant upfront investment in compliance. |

| Brand Reputation & Trust | Established luxury brands require long-term investment to build. | Challenging to replicate Hang Lung's established goodwill and customer loyalty. |

| Market Conditions | Economic downturn, high vacancies, and developer distress. | Reduced investment appeal due to sector volatility and uncertain recovery outlook. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hang Lung Group leverages data from their annual reports, investor presentations, and public filings. We also incorporate industry research reports from reputable sources and macroeconomic data to understand the broader market landscape.