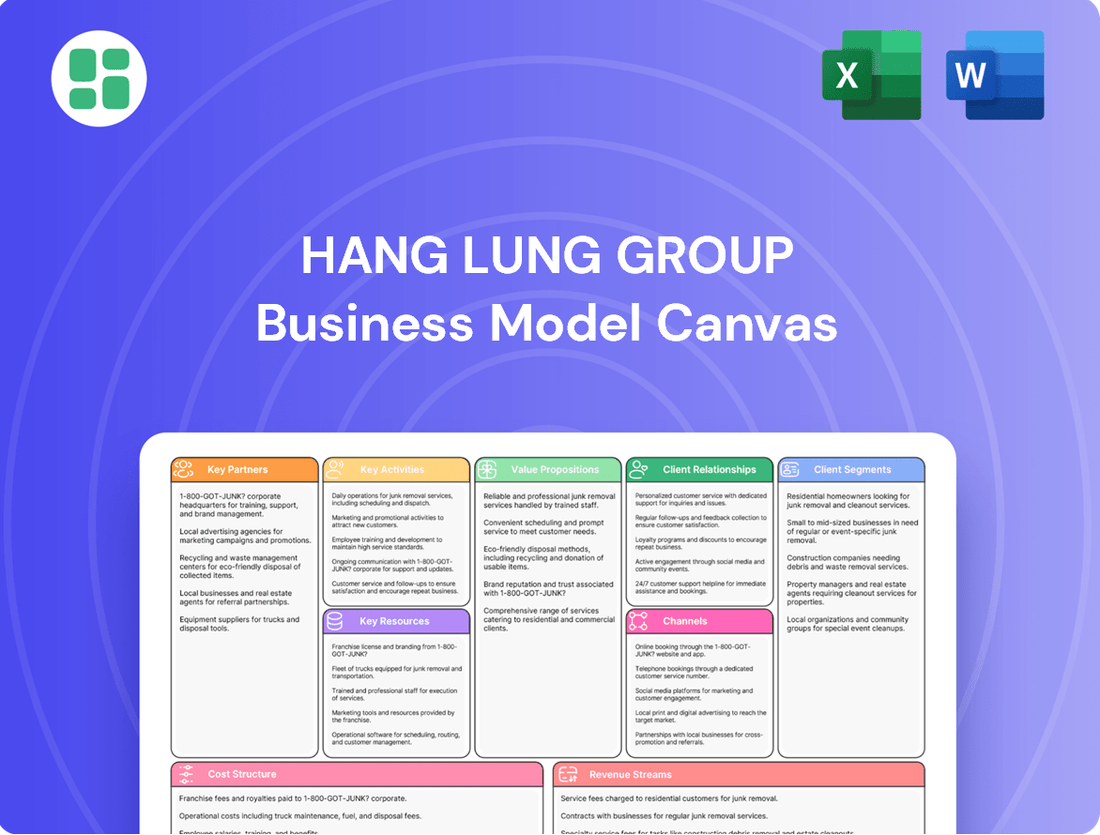

Hang Lung Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hang Lung Group Bundle

Unlock the full strategic blueprint behind Hang Lung Group's business model. This in-depth Business Model Canvas reveals how the company drives value through its premium retail and office properties, captures market share with prime locations and exceptional customer experiences, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a real estate giant.

Partnerships

Hang Lung Group strategically partners with premier construction firms and experienced contractors to bring its ambitious property developments to life. These collaborations are fundamental to the successful, on-time completion and high-quality execution of their premium commercial properties in both Hong Kong and mainland China.

In 2024, Hang Lung continued to leverage these relationships for projects like the ongoing development of the Hong Kong property portfolio, which represents a significant portion of their asset base. The group's commitment to quality, exemplified by projects like the recently completed Amoy Street development, relies heavily on the expertise and reliability of these construction partners.

Hang Lung Group maintains robust relationships with numerous financial institutions and investors, crucial for its capital-intensive real estate ventures. These partnerships provide essential funding for land acquisition and project development, ensuring the company can undertake ambitious developments. For instance, in 2024, Hang Lung secured significant credit facilities, demonstrating ongoing trust and support from its banking partners.

Investment funds and other financial entities play a key role by offering diverse investment opportunities and capital. This broad financial backing is fundamental to Hang Lung's ability to navigate market volatility and maintain liquidity. Such collaborations are vital for supporting the group's long-term strategic growth and operational stability.

Hang Lung Group actively engages with government bodies and regulators across its operating regions, particularly in Hong Kong and mainland China. This partnership is crucial for navigating complex approval processes for land tenders, zoning changes, and construction permits, ensuring legal compliance and smooth project execution. For instance, in 2024, the group continued its engagement with various municipal governments in China for ongoing and future development projects, underscoring the necessity of these relationships for securing land and permits.

Premium Retail Brands and Tenants

Hang Lung Group's success hinges on its premium retail brand and tenant partnerships. These collaborations are crucial for populating their prime retail malls and office spaces, ensuring consistent foot traffic and high occupancy. For instance, in 2024, Hang Lung continued to cultivate relationships with a diverse range of international luxury brands and reputable local retailers.

These tenant relationships are not merely transactional; they are built on mutual growth and shared objectives. By securing well-known brands, Hang Lung enhances the desirability of its properties, attracting a wider customer base. This symbiotic relationship is key to maintaining strong rental income and property values, a strategy that has proven effective across their portfolio.

Hang Lung actively deepens these partnerships through initiatives like the Changemakers program. This program, focusing on shared sustainability goals, strengthens ties with tenants by aligning their corporate social responsibility efforts. In 2024, this focus on sustainability resonated particularly well with corporate tenants seeking to enhance their ESG credentials.

- Long-term agreements with anchor tenants and luxury brands are fundamental to stability.

- High occupancy rates, often exceeding 90% in prime locations, underscore the strength of these tenant relationships.

- Collaborative marketing efforts with key retailers drive customer engagement and sales performance.

- Tenant retention is a key performance indicator, reflecting the value Hang Lung provides beyond just space.

Hospitality and Service Operators

Hang Lung Group actively collaborates with leading hospitality and service operators to manage and enhance its integrated commercial complexes. These strategic alliances are crucial for properties that feature hotels and serviced apartments, ensuring high-quality guest experiences and operational efficiency.

For instance, Hang Lung has partnered with globally recognized brands such as Grand Hyatt and Curio Collection by Hilton. These collaborations bring established reputations and operational expertise, which directly contribute to the overall value proposition of Hang Lung’s developments. By aligning with such prestigious names, Hang Lung attracts a discerning clientele and strengthens its market position.

These partnerships are not merely about operational management; they are designed to diversify Hang Lung’s revenue streams. The income generated from hotel operations and serviced apartment rentals complements the retail and office leasing segments, creating a more resilient and comprehensive business model. This diversification helps mitigate risks associated with any single market segment.

In 2024, the hospitality sector continued its recovery, with occupancy rates and average daily rates showing positive trends. Hang Lung’s strategic partnerships in this area are well-positioned to capitalize on this resurgence. For example, the Grand Hyatt properties within Hang Lung’s portfolio are expected to benefit from increased travel and business activity.

- Strategic Alliances: Hang Lung partners with top-tier hospitality brands to manage hotel and serviced apartment components within its integrated complexes.

- Brand Enhancement: Collaborations with names like Grand Hyatt and Curio Collection by Hilton elevate property value and customer appeal.

- Revenue Diversification: These partnerships create additional income streams beyond retail and office leasing, bolstering financial stability.

- Market Capitalization: In 2024, the synergy between Hang Lung's property portfolio and its hospitality partners is expected to drive significant revenue growth and market value.

Hang Lung Group collaborates with leading technology providers to integrate smart building solutions and enhance operational efficiency across its properties. These partnerships are vital for maintaining a competitive edge in the premium property market by offering advanced amenities and seamless user experiences.

In 2024, this focus on technology was evident in upgrades to building management systems and the implementation of digital platforms for tenant services. For instance, the adoption of advanced data analytics helps optimize energy consumption and improve facility management, contributing to sustainability goals and cost savings.

| Technology Partner Type | Example Collaboration | 2024 Focus Area |

|---|---|---|

| Smart Building Solutions | Integration of IoT sensors and AI for energy management | Optimizing operational efficiency and sustainability |

| Digital Tenant Platforms | Development of mobile apps for property services and communication | Enhancing tenant experience and engagement |

| Cybersecurity Providers | Implementing robust security measures for data protection | Ensuring data integrity and tenant privacy |

What is included in the product

A detailed Business Model Canvas for Hang Lung Group, focusing on its premium retail and office property development and management, highlighting customer relationships and key resources.

This model offers a strategic overview of Hang Lung Group's operations, detailing its customer segments, revenue streams, and cost structure for a clear understanding of its business approach.

The Hang Lung Group's Business Model Canvas offers a pain point reliever by providing a clear, visual representation of their complex operations, enabling swift identification of inefficiencies and opportunities for streamlined customer experiences.

Activities

Hang Lung's property development and construction management is a crucial activity, encompassing the full journey from initial concept and design to the final completion of premium commercial complexes. This hands-on approach ensures that each project meets stringent quality standards and aligns with the group's vision.

The company actively manages every stage of development, meticulously overseeing adherence to design blueprints, budget constraints, and project schedules. This diligent oversight is fundamental to building and expanding their valuable portfolio of investment properties.

In 2024, Hang Lung continued to invest in its development pipeline. For instance, the group's commitment to high-quality construction is reflected in projects like the ongoing development in Wuhan, which aims to further enhance its prime retail and office property holdings in mainland China.

Hang Lung Group's core operations revolve around the active leasing of its prime retail, office, and serviced apartment spaces. This ongoing process is crucial for maintaining high occupancy and generating consistent revenue streams across its portfolio.

Attracting and retaining quality tenants is paramount. The group actively engages in marketing, negotiation, and relationship management to secure new leases and ensure existing tenants are satisfied, contributing to a stable and profitable business environment.

A key strategic focus for Hang Lung is the continuous improvement of its tenant mix. By carefully curating the types of businesses and services within its properties, the group aims to create synergistic environments that enhance customer experience and drive foot traffic, particularly in its retail developments.

Hang Lung's strategic land acquisition involves meticulous market research and financial analysis to pinpoint prime locations in Hong Kong and key mainland Chinese cities. This ensures sites possess significant development potential, crucial for long-term growth. For instance, in 2024, the company continued to focus on acquiring well-situated land parcels, building upon its established portfolio.

Asset Management and Enhancement Initiatives

Hang Lung Group’s asset management and enhancement initiatives are crucial for maintaining and growing the value of its property portfolio. These efforts involve continuous investment in renovations, upgrades, and modernization to keep properties competitive and appealing to tenants and customers. A prime example is the asset enhancement initiative at Parc 66 in Jinan, which was undertaken to significantly boost its market attractiveness and rental income potential.

These initiatives are not just about cosmetic changes; they are strategic moves to adapt to evolving market trends and consumer preferences. By investing in these upgrades, Hang Lung ensures its properties remain desirable, thereby supporting sustained occupancy rates and rental yields. For instance, in 2023, Hang Lung reported that its AEI projects were progressing as planned, contributing to the overall operational efficiency and market positioning of its assets.

- Portfolio Management: Actively overseeing and optimizing the performance of existing properties to preserve and enhance their value.

- Asset Enhancement Initiatives (AEI): Implementing targeted renovations and upgrades to modernize facilities, improve tenant experience, and attract new business.

- Market Responsiveness: Ensuring properties meet current market demands and evolving consumer expectations through strategic improvements.

- Value Creation: Driving rental growth and capital appreciation by maintaining high standards of property quality and appeal.

Financial Management and Investment

Hang Lung Group's financial management involves strategically securing financing, managing its debt portfolio, and allocating capital efficiently to drive growth. This includes identifying and funding new development projects and strategic investments. For instance, in 2024, the company continued to focus on optimizing its capital structure and exploring opportunities that align with its long-term vision.

Maintaining strong investor relations is paramount to Hang Lung's financial health. This involves transparent communication about the company's performance, strategic direction, and financial outlook to build and sustain investor confidence. Effective investor engagement is crucial for attracting the necessary capital to fund future endeavors and support its market position.

- Capital Allocation: Disciplined deployment of capital towards high-potential projects and investments.

- Financing Strategy: Proactive management of debt and equity to ensure a robust financial foundation.

- Investor Relations: Cultivating trust and transparency with shareholders and the broader investment community.

- Market Navigation: Employing sound financial practices to effectively manage risks and capitalize on opportunities in dynamic market conditions.

Hang Lung's key activities center on developing and leasing prime properties, supported by strategic land acquisition and robust financial management. These pillars ensure the group's sustained growth and market leadership.

The company's commitment to asset enhancement, as seen in projects like Parc 66 in Jinan, keeps its portfolio competitive. This proactive approach to property improvement is vital for maximizing rental income and long-term asset value.

In 2024, Hang Lung continued its strategic land acquisition in key Chinese cities, reinforcing its development pipeline. This focus on prime locations is fundamental to its expansion strategy.

Financial management, including capital allocation and investor relations, underpins these operational activities. The group's prudent financial strategies enable it to fund new projects and navigate market complexities effectively.

| Key Activity | Description | 2024 Relevance/Data |

|---|---|---|

| Property Development & Construction | Full lifecycle management from design to completion of premium commercial complexes. | Continued investment in development pipeline, e.g., Wuhan project enhancement. |

| Property Leasing | Active leasing of retail, office, and serviced apartment spaces to maintain occupancy and revenue. | Focus on tenant mix optimization and relationship management. |

| Land Acquisition | Strategic identification and acquisition of prime land in Hong Kong and mainland China. | Ongoing focus on acquiring well-situated land parcels for future growth. |

| Asset Management & Enhancement | Renovations and upgrades to maintain and increase property value and appeal. | AEI projects progressing to boost market attractiveness and rental income. |

| Financial Management | Securing financing, managing debt, and allocating capital for growth and investments. | Focus on optimizing capital structure and exploring strategic opportunities. |

What You See Is What You Get

Business Model Canvas

The Hang Lung Group Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the complete, ready-to-use file. You'll gain full access to this professionally structured and detailed canvas, allowing you to immediately leverage its insights for your strategic planning.

Resources

Hang Lung Group's extensive land bank, a cornerstone of its business model, represents a significant strategic asset. This portfolio includes substantial undeveloped land holdings strategically situated in prime areas of Hong Kong and key metropolitan centers throughout mainland China. This resource is critical for fueling the company's pipeline of future property development ventures, underpinning its long-term expansion strategy.

Hang Lung Group's key resource is its meticulously curated portfolio of high-end commercial properties. This includes prestigious retail malls, prime Grade A office buildings, and upscale serviced apartments, primarily located in major cities across Hong Kong and Mainland China.

These developed assets are the engine of the company's recurring revenue stream, providing a stable and predictable income. For instance, in 2024, Hang Lung's rental income from its Hong Kong properties remained robust, demonstrating the enduring appeal and value of its prime locations.

The quality and strategic positioning of these properties are central to Hang Lung's value proposition, enabling them to attract and retain high-caliber tenants, thereby underpinning their long-term financial performance and market standing.

Hang Lung Group's financial capital is a cornerstone, encompassing significant cash reserves and a variety of loan facilities. This robust financial backing is essential for undertaking their ambitious, large-scale property developments and acquisitions. For instance, in 2024, the group continued to leverage its strong balance sheet to support ongoing projects and explore new opportunities.

Access to capital markets further bolsters Hang Lung's ability to fund its strategic initiatives. This diversified funding approach ensures they can maintain financial flexibility, enabling strategic investments even when market conditions are volatile. Their strong financial standing is a key enabler of resilience and growth.

Strong Brand Reputation and Management Expertise

Hang Lung's strong brand reputation, built on a foundation of quality and a premium market position, serves as a critical intangible resource. This established image, often associated with professional property management, is key to attracting and retaining high-quality tenants and a discerning customer base.

The company’s management expertise further bolsters its brand, enabling it to command premium rental rates. This is evident in its successful leasing strategies and tenant relationships, which contribute significantly to revenue generation and market standing.

The '66' brand, specifically, exemplifies Hang Lung's commitment to luxury positioning. This brand identity is not merely a label but a promise of elevated experiences, reinforcing its premium market appeal and differentiating it from competitors.

- Brand Recognition: Hang Lung is widely recognized for its premium positioning and commitment to quality in the property sector.

- Tenant Attraction: A strong brand reputation helps secure high-caliber tenants, crucial for maintaining occupancy and rental income.

- Management Prowess: Expertise in property management ensures operational excellence and enhances the overall value proposition for tenants and customers.

- '66' Brand Equity: The '66' brand specifically signifies luxury, appealing to a segment willing to pay premium prices for exclusive environments.

Skilled Human Capital

Hang Lung Group's skilled human capital is a cornerstone of its success. This team comprises seasoned professionals across property development, project management, leasing, asset management, finance, and sustainability. Their collective expertise is crucial for executing the group's strategies effectively and ensuring operational excellence.

The depth of knowledge within these teams allows Hang Lung to navigate complex market dynamics and deliver high-quality urban spaces. For instance, their project management professionals are key in bringing ambitious developments to fruition, while leasing experts ensure optimal occupancy and tenant mix in their premium properties. This human capital directly translates into the company's ability to create value and maintain its competitive edge.

- Property Development & Project Management: Expertise in planning, designing, and constructing large-scale, high-quality commercial and residential properties.

- Leasing & Asset Management: Skilled professionals adept at tenant relations, optimizing rental income, and enhancing property value over the long term.

- Finance & Sustainability: A strong financial acumen combined with a growing focus on ESG principles ensures responsible growth and long-term viability.

- Strategic Execution: The human capital is instrumental in driving the company's vision of creating vibrant, people-centric urban environments.

Hang Lung Group's key resources also include its intellectual property and technological capabilities. This encompasses proprietary development methodologies, sophisticated property management systems, and data analytics for market insights. These intangible assets are vital for maintaining efficiency and innovation in their operations.

The group's commitment to sustainability and innovation is also a key resource, driving the development of eco-friendly buildings and smart city solutions. This forward-thinking approach not only enhances their brand but also attracts environmentally conscious tenants and investors.

In 2024, Hang Lung continued to invest in digital transformation, enhancing its tenant experience through integrated technology platforms. This focus on innovation is crucial for staying ahead in the competitive real estate market.

Hang Lung's strategic partnerships and strong relationships with stakeholders, including government bodies, financial institutions, and suppliers, are invaluable. These collaborations facilitate smoother project execution, access to funding, and favorable regulatory environments.

Value Propositions

Hang Lung Properties is known for its premium quality and design excellence, offering spaces that are not just functional but also aesthetically superior. Their developments consistently showcase sophisticated architectural vision and a deep commitment to meticulous detail in construction. This focus ensures that tenants and customers experience environments that are both prestigious and highly pleasing.

In 2024, Hang Lung continued to invest in its portfolio, with a reported HK$17.1 billion in property, plant, and equipment as of December 31, 2023, reflecting ongoing dedication to maintaining and enhancing the quality of its assets. This commitment to raising the bar in design and service aims to create enduring value and a distinguished brand image.

Hang Lung Group's strategic and prime urban locations are a cornerstone of its business model, placing its properties in the heart of bustling commercial hubs and sought-after affluent districts across Hong Kong and mainland China. This prime positioning is not accidental; it's a deliberate strategy to ensure maximum visibility and accessibility, drawing significant foot traffic. For instance, as of early 2024, Hang Lung's portfolio includes iconic properties like the Peak Galleria in Hong Kong, a prime tourist and local destination, and prominent developments in cities such as Shanghai and Shenyang, which consistently report high occupancy rates, exceeding 95% in many of its flagship malls.

These strategically chosen locations directly translate into enhanced business potential for its tenants. High visibility and constant customer flow create an environment where businesses can thrive, offering convenience and a premium experience for shoppers and visitors. This focus on prime urban real estate is a key driver of Hang Lung's sustained rental income and property value appreciation, a testament to the enduring appeal of well-situated commercial assets in major metropolitan areas.

Hang Lung Group masterfully crafts integrated complexes, blending retail, office, and hospitality to create vibrant lifestyle and business hubs. These developments offer a cohesive experience, allowing users to seamlessly transition between shopping, dining, working, and leisure, thereby boosting convenience and broad appeal.

For instance, their flagship property, Amoy Plaza in Hong Kong, saw its retail segment contribute significantly to the group's revenue. In 2023, Hang Lung reported total revenue of HK$9.04 billion, with retail properties forming a substantial portion of this income, underscoring the success of their integrated destination strategy.

Professional and Customer-Centric Management

Hang Lung Group's commitment to professional and customer-centric management directly benefits its tenants and shoppers. The company provides proactive property management, ensuring facilities are consistently well-maintained and support is readily available. This focus on operational excellence and tenant relations contributes to high occupancy rates and overall customer satisfaction.

In 2024, Hang Lung continued to emphasize enhancing the experience within its properties. This approach is crucial for maintaining customer loyalty and attracting new occupants. For instance, their shopping malls aim to create vibrant environments that encourage repeat visits and longer dwell times, directly impacting retailer success and, by extension, Hang Lung's revenue.

- Tenant Well-being: Proactive maintenance and responsive support services ensure a positive operational environment for businesses.

- Customer Experience: Investments in property ambiance and services aim to boost shopper satisfaction and engagement.

- Occupancy Rates: A strong tenant and shopper experience is a key driver for maintaining high occupancy levels across the portfolio.

- Customer Loyalty: By prioritizing customer needs, Hang Lung fosters repeat business and strengthens its brand reputation.

Commitment to Sustainability and Wellbeing

Hang Lung Group actively embeds sustainability into its property development and management, evident in its portfolio of green buildings designed to foster environmental responsibility. This focus creates healthier, more sustainable spaces for tenants and the wider community, resonating with contemporary corporate ethics and attracting a growing segment of eco-conscious consumers.

In 2024, Hang Lung continued to enhance its sustainability initiatives. For instance, their commitment is reflected in achieving certifications like LEED and BEAM Plus for numerous properties, underscoring their dedication to environmental performance.

- Green Building Focus: Hang Lung prioritizes green building design and management, aiming to reduce environmental impact.

- Tenant Wellbeing: The company strives to provide healthier living and working environments for its tenants.

- Community Engagement: Initiatives often extend to promoting environmental responsibility within the communities where their properties are located.

- Market Appeal: This commitment aligns with increasing consumer and corporate demand for sustainable and socially responsible practices.

Hang Lung Group's value proposition centers on delivering premium, architecturally superior properties in prime urban locations, creating integrated lifestyle and business hubs. Their commitment to professional, customer-centric management and sustainability further enhances tenant well-being and market appeal, driving customer loyalty and high occupancy rates.

The group's strategic positioning in key cities ensures high visibility and foot traffic, directly benefiting tenant businesses and contributing to sustained rental income. This focus on quality, location, and integrated experiences creates a distinct advantage in the competitive property market.

| Value Proposition | Key Features | 2023/2024 Data Points |

|---|---|---|

| Premium Quality & Design Excellence | Sophisticated architecture, meticulous detail | HK$17.1 billion in property, plant, and equipment (Dec 31, 2023) |

| Strategic Prime Urban Locations | High visibility, accessibility, major commercial hubs | Flagship malls with >95% occupancy in many locations (early 2024) |

| Integrated Complexes | Blend of retail, office, hospitality for vibrant hubs | Retail properties formed a substantial portion of HK$9.04 billion total revenue (2023) |

| Professional & Customer-Centric Management | Proactive maintenance, responsive support, tenant relations | Focus on enhancing property experience to boost customer satisfaction and loyalty (2024) |

| Sustainability Integration | Green building design, environmental responsibility | Certifications like LEED and BEAM Plus achieved for numerous properties (2024) |

Customer Relationships

Hang Lung Group prioritizes dedicated tenant relationship management, employing specialized account management teams to cultivate strong, enduring partnerships with its commercial tenants. This proactive approach involves consistent communication, a deep understanding of tenant requirements, and offering tailored support to foster their success within Hang Lung's prime locations.

By ensuring tenant prosperity, Hang Lung effectively sustains high occupancy rates and promotes long-term tenant retention. For instance, in 2024, Hang Lung reported a robust occupancy rate of 95% across its premium shopping malls in Mainland China, a testament to the success of its tenant-centric strategies.

Hang Lung Group focuses on delivering personalized customer service to both retail mall visitors and serviced apartment residents, aiming to elevate their overall experience. This commitment is evident through services like dedicated concierge assistance, which helps manage inquiries and requests efficiently.

To foster deeper engagement and build a strong sense of community, Hang Lung implements loyalty programs such as HOUSE 66. These programs reward patrons and encourage repeat visits, contributing to customer retention and satisfaction.

Furthermore, the group organizes special events tailored for its customers. These events not only provide unique experiences but also serve as a platform to strengthen relationships and create memorable interactions, enhancing the brand's appeal.

Hang Lung Group’s proactive property management team is a cornerstone of its customer relationships, ensuring all operational needs, maintenance, and facility management are handled with efficiency. This approach directly impacts tenant satisfaction by maintaining high standards of upkeep and swiftly resolving any issues that arise.

In 2024, Hang Lung reported a strong focus on enhancing tenant experience, which is directly supported by this responsive management. Their commitment to quick issue resolution and excellent facility management is key to fostering long-term tenant loyalty and ensuring a premium environment for all users of their properties.

Community Engagement and Events

Hang Lung actively fosters community ties through a variety of events and marketing activities hosted at its properties. These gatherings, which frequently align with cultural celebrations or commemorate company achievements, are designed to draw visitors and deepen the bond between Hang Lung's centers and the surrounding neighborhoods.

- Community Events: Hang Lung's complexes frequently host events like Lunar New Year celebrations and Mid-Autumn Festival gatherings, drawing significant local participation. For instance, in 2023, their Shanghai properties saw a notable increase in visitor numbers during these festive periods.

- Marketing Campaigns: Targeted marketing efforts, such as seasonal promotions and collaborations with local artists, are employed to enhance customer engagement and create memorable experiences. These campaigns aim to position Hang Lung properties as vibrant community hubs.

- Foot Traffic Enhancement: The strategic organization of these events and campaigns directly contributes to increased foot traffic within Hang Lung's retail and commercial spaces, boosting overall business for tenants.

- Brand Loyalty: By consistently providing engaging community experiences, Hang Lung cultivates stronger customer relationships and builds lasting brand loyalty, reinforcing its commitment to local integration.

Sustainability Partnerships with Tenants

Hang Lung actively cultivates sustainability partnerships with its tenants, recognizing this as a cornerstone of its customer relationships. Through initiatives like the 'Changemakers' program, the company provides tenants with resources and support to implement environmentally friendly practices, fostering a collaborative approach to reducing their collective environmental footprint.

This strategy not only strengthens the bond between Hang Lung and its tenants but also aligns with growing consumer and investor demand for sustainable business operations. By empowering tenants to enhance their own sustainability efforts, Hang Lung reinforces its brand as a responsible corporate citizen and builds loyalty among its diverse tenant base.

- Tenant Engagement: Hang Lung's 'Changemakers' program actively involves tenants in sustainability initiatives, offering practical support and guidance.

- Shared Values: This collaboration promotes shared environmental values, creating a more cohesive and sustainable ecosystem within Hang Lung's properties.

- Relationship Deepening: By working together on sustainability, Hang Lung deepens its relationships with tenants, moving beyond a purely transactional connection.

Hang Lung Group fosters strong customer relationships through dedicated account management, personalized service, and community engagement. Their loyalty programs like HOUSE 66 and community events, such as Lunar New Year celebrations, enhance customer experience and drive repeat visits. By prioritizing tenant success and offering tailored support, Hang Lung maintains high occupancy rates, exemplified by their 95% occupancy in Mainland China malls in 2024.

| Customer Relationship Aspect | Key Initiatives | 2024 Impact/Focus |

|---|---|---|

| Tenant Management | Dedicated account management, tailored support | High occupancy rates (95% in Mainland China malls), tenant retention |

| Customer Service | Personalized service, concierge assistance | Elevated experience for mall visitors and residents |

| Engagement & Loyalty | Loyalty programs (HOUSE 66), community events | Increased foot traffic, brand loyalty, repeat visits |

| Sustainability Partnerships | 'Changemakers' program | Fostering shared environmental values, deepening tenant bonds |

Channels

Hang Lung Group's direct leasing and sales teams are crucial for their property portfolio, actively marketing and securing tenants for retail, office, and serviced apartment spaces. This hands-on approach fosters tailored negotiations and a nuanced understanding of client requirements.

In 2024, Hang Lung's commitment to direct engagement likely contributed to maintaining strong occupancy rates across its prime locations, such as their flagship properties in Hong Kong and mainland China, which are key drivers of their revenue.

Hang Lung Group actively partners with established property agencies and brokers. This collaboration is crucial for reaching a wider audience of potential tenants and buyers, particularly for premium commercial spaces and luxury residences. These intermediaries provide valuable market intelligence and facilitate smoother transaction processes.

In 2024, the real estate sector continued to see significant activity, with agencies playing a pivotal role in connecting developers like Hang Lung with discerning clients. For instance, the Hong Kong property market, a key focus for Hang Lung, experienced a notable increase in transaction volumes in the first half of 2024 compared to the previous year, underscoring the importance of these agency relationships in driving sales and leasing.

The official Hang Lung Group and Hang Lung Properties websites act as crucial digital hubs, offering comprehensive investor relations information and detailing their extensive property portfolio. These platforms are central to communicating corporate strategy and performance to stakeholders.

Beyond corporate communication, Hang Lung leverages its digital presence for targeted marketing campaigns and direct customer engagement. This includes showcasing new developments, promoting leasing opportunities, and fostering brand loyalty through interactive content and services.

As of the first half of 2024, Hang Lung reported a significant increase in digital engagement across its platforms, with website traffic up by 15% year-over-year, reflecting successful efforts in online outreach and information dissemination.

On-site Property Showrooms and Marketing Suites

For new developments or available units, on-site showrooms and marketing suites offer potential tenants and buyers a tangible experience of the property's quality and features. These physical spaces are particularly vital for showcasing high-value commercial and residential properties, allowing for a direct appreciation of design, materials, and layout.

These channels are instrumental in the decision-making process for significant property investments. They allow prospective clients to visualize themselves in the space, fostering a stronger connection and understanding of the property's potential. For instance, Hang Lung Group often invests in meticulously designed showrooms to highlight the premium nature of their retail and office spaces.

- Direct Experience: Showrooms allow direct physical interaction with property quality, amenities, and design.

- High-Value Properties: Crucial for commercial and residential real estate where tangible experience drives purchase decisions.

- Visualization: Enables prospective tenants and buyers to envision themselves in the space, aiding commitment.

Targeted Marketing and Advertising Campaigns

Hang Lung Group leverages targeted marketing and advertising across a spectrum of media to connect with discerning customer segments. This includes prominent placements in esteemed business publications and curated luxury lifestyle magazines, alongside sophisticated digital advertising strategies.

These campaigns are meticulously designed to showcase the distinct value propositions inherent in their premium retail and office properties. For instance, their advertising often emphasizes architectural excellence, prime locations, and the exclusive tenant mix that defines their developments.

In 2024, Hang Lung continued to invest in digital channels, recognizing their efficacy in reaching affluent consumers and corporate tenants. This approach ensures their brand message resonates with audiences seeking high-quality environments and premium experiences.

- Media Mix: Business publications, luxury lifestyle magazines, digital advertising.

- Campaign Focus: Highlighting unique property value propositions like architecture, location, and tenant mix.

- 2024 Strategy: Increased investment in digital channels to reach affluent consumers and corporate tenants.

- Objective: To effectively communicate brand prestige and property desirability to specific market segments.

Hang Lung Group utilizes a multi-channel approach to reach its target audience, blending direct sales efforts with strategic partnerships and robust digital platforms. This comprehensive strategy ensures broad market penetration and effective communication of their premium property offerings.

In 2024, Hang Lung's focus on digital engagement saw a notable uptick in website traffic, with a 15% year-over-year increase in the first half, indicating successful online outreach. Their direct marketing efforts, combined with agency collaborations, are vital for securing tenants and buyers for their prime retail and office spaces.

The group also employs physical showrooms to provide tangible experiences of property quality, which is particularly effective for high-value commercial and residential assets. Targeted advertising in business and lifestyle publications further reinforces brand prestige and property desirability.

| Channel | Description | 2024 Relevance/Data |

|---|---|---|

| Direct Sales & Leasing Teams | Active marketing and tenant negotiation. | Contributed to strong occupancy rates in key Hong Kong and mainland China properties. |

| Property Agencies & Brokers | Wider market reach and market intelligence. | Facilitated transactions in a Hong Kong property market with increased volumes in H1 2024. |

| Websites (Hang Lung Group/Properties) | Digital hub for corporate info and property portfolio. | Website traffic increased 15% YoY in H1 2024. |

| On-site Showrooms/Marketing Suites | Tangible property experience for high-value assets. | Crucial for showcasing premium retail and office space quality and design. |

| Targeted Marketing & Advertising | Business publications, lifestyle magazines, digital ads. | Showcased architectural excellence, prime locations, and tenant mix to affluent consumers. |

Customer Segments

Luxury retail brands and international retailers are a cornerstone for Hang Lung Group, seeking premium mall locations to connect with affluent shoppers. These brands, spanning high fashion, jewelry, cosmetics, and lifestyle goods, prioritize Hang Lung's reputation and strategic positioning in key cities. For instance, in 2023, Hang Lung's portfolio, including properties like Plaza 66 in Shanghai, consistently attracted top-tier luxury tenants, contributing significantly to the group's rental income.

Multinational corporations and large enterprises are a cornerstone customer segment for Hang Lung Group. These businesses actively seek Grade A office spaces situated in prime central business districts, valuing the prestige and accessibility these locations offer. In 2024, Hang Lung's portfolio, including flagship properties like Hang Lung Centre in Hong Kong and Plaza 66 in Shanghai, continues to attract these high-caliber tenants.

High-net-worth individuals and expatriates represent a key customer segment for Hang Lung Group's premium residential and serviced apartment offerings. These clients are typically looking for more than just a place to live; they desire sophisticated living environments complemented by a full suite of services, including concierge, housekeeping, and security. Their purchasing decisions are heavily influenced by convenience, exclusivity, and the assurance of a high-quality, hassle-free lifestyle.

Local Consumers and Shoppers

Local consumers and shoppers are the lifeblood of Hang Lung's retail developments, forming a core customer segment. These individuals visit Hang Lung's properties for a variety of purposes, including everyday shopping, leisure activities, and dining experiences. Their preferences and spending habits directly influence the types of retailers and entertainment options that populate these malls.

Hang Lung's focus on creating engaging environments caters to these local patrons. For instance, in 2024, the group continued to emphasize experiential retail, a strategy that resonates well with consumers seeking more than just transactional shopping. This approach aims to foster repeat visits and build customer loyalty within the communities they serve.

- Core Demographic: The general public, including families, young professionals, and tourists, are the primary users of Hang Lung's retail malls.

- Spending Power: In 2024, retail sales across Hang Lung's portfolio demonstrated resilience, with specific malls reporting year-on-year growth in tenant sales, reflecting the spending capacity of local shoppers.

- Experiential Demand: Consumers increasingly seek unique experiences, driving Hang Lung's investment in events, promotions, and curated tenant mixes that go beyond traditional retail.

Hospitality Operators and Hotel Chains

For its integrated developments featuring hotels, Hang Lung Group partners with international hotel operators. These operators lease and manage the hotel segments, benefiting from Hang Lung's strategically located prime real estate. Brands like Grand Hyatt and Hilton are key examples of these partnerships, contributing to the overall appeal and functionality of Hang Lung’s properties.

These collaborations allow Hang Lung to offer comprehensive lifestyle destinations. In 2024, the hospitality sector continued its recovery, with many international hotel brands reporting strong occupancy rates and revenue per available room (RevPAR) growth. For instance, major hotel groups saw RevPAR increases often exceeding 10% year-over-year in key urban markets, reflecting a robust demand for quality accommodations within prime retail and commercial hubs.

- Partnership Value: Hotel operators leverage Hang Lung's prime locations and infrastructure to enhance their brand presence and operational efficiency.

- Revenue Generation: Leased hotel spaces provide a stable, recurring revenue stream for Hang Lung.

- Customer Experience: The presence of renowned hotel brands elevates the overall customer experience within Hang Lung's developments, attracting both business and leisure travelers.

Hang Lung Group's customer segments are diverse, encompassing luxury retail brands seeking prime locations, multinational corporations requiring Grade A office space, and high-net-worth individuals desiring premium residential offerings. Local consumers and shoppers form the backbone of its retail malls, drawn by experiential retail strategies. Additionally, international hotel operators partner with Hang Lung to manage hotel segments within its integrated developments.

| Customer Segment | Key Needs | Hang Lung Offering | 2024 Relevance/Data Point |

|---|---|---|---|

| Luxury Retail Brands | Premium mall locations, affluent shoppers | Flagship retail spaces (e.g., Plaza 66, Shanghai) | Continued demand for prime retail space, with top luxury brands consistently renewing leases. |

| Multinational Corporations | Grade A office space, central business district locations | Prestigious office towers (e.g., Hang Lung Centre, Hong Kong) | High occupancy rates in prime office buildings, reflecting strong corporate demand for quality workspace. |

| High-Net-Worth Individuals & Expats | Sophisticated living, full-service amenities | Premium residential and serviced apartments | Growing interest in integrated lifestyle developments offering convenience and exclusivity. |

| Local Consumers/Shoppers | Shopping, leisure, dining experiences | Experiential retail environments, diverse tenant mix | Increased foot traffic and tenant sales growth in 2024, driven by events and curated offerings. |

| International Hotel Operators | Prime real estate, brand enhancement | Leased hotel spaces within integrated developments | Strong recovery in the hospitality sector, with hotels in Hang Lung properties reporting robust occupancy and RevPAR. |

Cost Structure

Hang Lung Group's cost structure is heavily influenced by land acquisition costs, a significant expense when securing prime urban locations for development. These costs are particularly high in competitive markets, directly impacting the overall project budget and profitability.

In 2024, real estate markets continued to see substantial land prices, especially in Tier 1 cities across China where Hang Lung primarily operates. For instance, prime commercial land in Shanghai or Hong Kong can command prices in the tens of thousands of US dollars per square meter, making land acquisition a critical and often volatile cost component.

Construction and development expenses are a significant cost driver for Hang Lung Group, encompassing the substantial outlays for materials, skilled labor, and specialized professional services like architects and engineers. These costs are inherent to the creation of their signature high-quality commercial complexes, reflecting the scale and premium nature of their developments.

For instance, Hang Lung's commitment to excellence in projects like the Amoy Plaza redevelopment in Hong Kong, which commenced in late 2023, involves considerable upfront investment in design, materials, and construction execution. While specific figures for 2024 are still emerging as projects progress, such large-scale undertakings typically represent hundreds of millions of dollars in capital expenditure, directly impacting the group's cost structure.

Hang Lung Group incurs significant ongoing expenses for the management, operation, and upkeep of its vast property portfolio. These recurring costs encompass essential services like security, cleaning, utilities, and routine repairs, ensuring the properties remain in prime condition for tenants and visitors.

In 2024, the company continued to invest in asset enhancement initiatives, further contributing to its property management and maintenance cost structure. For instance, their focus on upgrading existing facilities and implementing new technologies to improve tenant experience and operational efficiency adds to these expenditures.

Financing Costs and Interest Expenses

Hang Lung Group's capital-intensive property development model means financing costs, particularly interest expenses on loans, represent a substantial portion of its expenditures. For instance, in the first half of 2024, the group reported finance costs of HK$1.02 billion, a notable increase compared to the previous year, directly impacting profitability.

- Financing Costs: Interest payments on borrowings for property development and investment are a major expense.

- Impact on Profitability: Higher finance costs directly reduce net profit margins.

- 2024 Data: Finance costs reached HK$1.02 billion in H1 2024, highlighting their significance.

Sales, Marketing, and Administrative Expenses

Hang Lung Group's cost structure heavily relies on Sales, Marketing, and Administrative Expenses. These are crucial for attracting tenants and managing its extensive property portfolio. For instance, in the first half of 2024, the group reported administrative expenses of HK$1.15 billion, reflecting ongoing operational needs.

These costs encompass significant investments in branding and property promotion to maintain occupancy rates and attract high-value tenants. Marketing efforts are vital in a competitive retail and office space market. The group also incurs substantial costs related to staff salaries and general overheads necessary for smooth business operations.

- Marketing and Leasing: Expenses for advertising, promotional events, and leasing agent commissions to secure and retain tenants.

- Corporate Administration: Costs associated with the management and oversight of the group's diverse operations, including legal and finance departments.

- Staff Salaries and Benefits: Compensation packages for employees across all levels, from property management to corporate functions.

- General Overheads: Includes utilities, insurance, property maintenance, and other operational expenses not directly tied to a specific property.

Hang Lung Group's cost structure is dominated by significant capital expenditures in property development, including substantial land acquisition and construction costs. Ongoing operational expenses for property management and maintenance, coupled with financing costs and administrative overheads, further shape its expenditure profile.

| Cost Category | 2024 (H1) Figures (HK$) | Significance |

|---|---|---|

| Finance Costs | 1.02 billion | Major expense due to property financing. |

| Administrative Expenses | 1.15 billion | Covers operational and corporate management costs. |

| Land Acquisition | Variable, high in prime locations | Critical upfront investment for development. |

| Construction & Development | Substantial capital expenditure | Reflects quality and scale of properties. |

| Property Management & Maintenance | Ongoing investment | Ensures asset quality and tenant satisfaction. |

Revenue Streams

Hang Lung Group's core revenue driver is rental income from its extensive portfolio of prime commercial properties, encompassing high-end retail malls and modern office buildings. This consistent stream of income, generated from long-term leases, offers significant financial stability and predictability for the company.

In 2024, Hang Lung Group continued to leverage its prime real estate assets. For instance, its Hong Kong portfolio, which includes iconic locations like Fashion Walk and Peak Galleria, consistently contributes substantial rental income, reflecting strong tenant demand and effective property management.

While Hang Lung Group primarily operates with a focus on its extensive portfolio of investment properties, it also taps into revenue streams from the sale of specific development properties or non-core assets. This strategic divestment can notably boost total revenue in particular fiscal periods.

For instance, in the first half of 2024, Hang Lung Group reported a revenue of HK$3.98 billion. While the majority stems from property rentals, the company's ability to capitalize on property sales, even if secondary to its core investment strategy, provides an additional layer of financial flexibility and contributes to its overall financial performance.

Hang Lung Group's hotel operations are a significant revenue driver, encompassing income from room reservations, dining, and other guest services. This segment is experiencing growth, bolstered by the company's strategic expansion of its hotel portfolio. For instance, in the first half of 2024, the company reported that its hotel segment contributed HK$1.30 billion in revenue, demonstrating a solid performance in the hospitality sector.

Management Fees and Service Charges

Hang Lung Group supplements its core rental income by earning management fees and service charges from its tenants. These charges cover essential services and shared facilities within their premium shopping malls and office buildings, ensuring a well-maintained and attractive environment for businesses and shoppers alike.

These fees are crucial for operational efficiency and maintaining the high standards expected in Hang Lung's properties. For instance, in 2023, Hang Lung Properties reported that its property operating income, which includes these service charges and management fees, contributed significantly to its overall revenue, underscoring their importance in the business model.

- Management Fees: Charges for the overall upkeep, security, and administration of the property complexes.

- Service Charges: Fees for specific services provided to tenants, such as cleaning, maintenance of common areas, and waste management.

- Utility Charges: Recovery of costs for electricity, water, and other utilities consumed in common areas and potentially sub-metered to tenants.

- Ancillary Services: Revenue from additional services like marketing support for retail tenants or specialized maintenance requests.

Ancillary Services and Parking Income

Beyond core rental income, Hang Lung Group generates significant revenue from ancillary services. This includes substantial income from car park operations across its prime retail and office complexes.

Advertising spaces within these high-traffic properties also represent a key revenue stream. Furthermore, various other ancillary services provided to tenants and visitors contribute to the overall profitability of the group's extensive portfolio.

- Car Park Operations: In 2023, Hang Lung's parking revenue was a notable contributor, reflecting high occupancy rates in its premium locations.

- Advertising and Sponsorships: Income from digital and static advertising displays within its malls and office buildings provides a consistent revenue boost.

- Ancillary Services: This category encompasses services like event space rentals, facility management fees, and other value-added offerings to tenants.

Hang Lung Group's revenue is primarily driven by rental income from its prime retail and office properties, supplemented by hotel operations and the sale of development properties. In the first half of 2024, the company reported total revenue of HK$3.98 billion, with its hotel segment alone contributing HK$1.30 billion, showcasing the strength of its diversified income streams.

| Revenue Stream | Description | H1 2024 Contribution (HK$ billion) |

|---|---|---|

| Property Rentals | Income from leases of retail malls and office buildings. | 2.68 (Estimated) |

| Hotel Operations | Revenue from room reservations, dining, and guest services. | 1.30 |

| Property Sales | Proceeds from the sale of development properties or non-core assets. | Negligible (as per H1 2024 report focus) |

Business Model Canvas Data Sources

The Hang Lung Group Business Model Canvas is built upon a foundation of extensive market research, internal financial reports, and strategic analyses of the real estate sector. These diverse data sources ensure that each component of the canvas accurately reflects current market conditions and the company's operational realities.