Hanes SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanes Bundle

Hanes boasts a strong brand recognition and efficient supply chain, but faces increasing competition and shifting consumer preferences. Understanding these dynamics is crucial for navigating the apparel market.

Want the full story behind Hanes' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hanesbrands boasts a powerful collection of popular brands like Hanes, Bonds, Maidenform, and Playtex. These names are widely recognized by consumers and hold substantial market share in essential apparel segments.

This strong brand recognition provides a significant edge over competitors, enabling the company to achieve premium pricing within its core product lines.

For instance, in fiscal year 2023, Hanesbrands reported net sales of $3.9 billion, with its innerwear segment, heavily reliant on these established brands, continuing to be a cornerstone of its revenue.

Hanes boasts a highly efficient, vertically integrated supply chain, a significant strength. The company produces roughly 75% of its apparel in its own factories, predominantly situated in Central America. This control over production minimizes reliance on third-party manufacturers and offers substantial cost savings.

This vertical integration translates into tangible financial benefits. By managing a large portion of its manufacturing internally, Hanes significantly reduces its exposure to the fluctuating tariffs and geopolitical risks often associated with sourcing from Asian countries. This strategic advantage contributes to more predictable costs and a stronger bottom line, with operational efficiency boosted by streamlined processes.

Hanesbrands is actively pursuing strategic transformation initiatives designed to boost efficiency and financial health. These plans are heavily focused on cutting costs, streamlining the supply chain, and paying down debt.

A key part of this transformation involves upgrading technology, including the use of AI for better sales predictions and inventory control. For example, in the first quarter of 2024, Hanesbrands reported a net sales increase of 1% to $3.76 billion, demonstrating early progress from these strategic shifts.

These modernization efforts are expected to improve operating margins and generate stronger cash flow. The company's commitment to these changes aims to create a more agile and profitable business model, as evidenced by their continued investment in these areas throughout 2024.

Commitment to Sustainability

HanesBrands demonstrates a strong commitment to sustainability, setting ambitious targets such as achieving zero waste across its operations by 2025 and sourcing 100% renewable electricity by 2030. This dedication is already yielding results, with the company reporting a 16% reduction in absolute Scope 1 and 2 greenhouse gas emissions in 2023 compared to its 2018 baseline. Furthermore, Hanes has increased its use of preferred materials, with 49% of its cotton sourced sustainably in 2023, up from 41% in 2022.

These sustainability initiatives are not just about environmental responsibility; they also resonate with a growing consumer base that prioritizes ethical and eco-conscious brands. This alignment can translate into increased market share and brand loyalty. Moreover, the pursuit of operational efficiencies, such as reducing waste and energy consumption, is projected to generate significant cost savings, enhancing profitability. For instance, their focus on renewable energy is expected to contribute to long-term operational cost stability.

Key aspects of Hanes' sustainability commitment include:

- Ambitious Goals: Targeting zero waste by 2025 and 100% renewable electricity by 2030.

- Progress in Emissions Reduction: Achieved a 16% reduction in Scope 1 and 2 GHG emissions by 2023 (vs. 2018 baseline).

- Sustainable Materials: Increased sustainable cotton sourcing to 49% in 2023.

- Consumer Alignment: Meeting growing consumer demand for ethically produced goods.

- Operational Savings: Driving cost efficiencies through waste and energy reduction efforts.

Market Leadership in Core Categories

Hanesbrands commands significant market leadership in foundational innerwear segments across several key global markets. For instance, its Hanes brand is a dominant force in North America, while Bonds enjoys a similar top-tier position in Australia and New Zealand.

This established leadership in replenishment-driven apparel categories, like basic t-shirts and underwear, creates a resilient and predictable revenue stream for the company. This stability is crucial, enabling Hanesbrands to navigate broader economic headwinds and focus on enhancing its financial performance.

- Market Dominance: Hanes is a top-three player in the US men's underwear market and holds a leading share in Australia with Bonds.

- Brand Strength: Key brands like Hanes, Champion, and Bonds benefit from strong consumer recognition and loyalty.

- Replenishment Focus: The company's strength in essential, frequently purchased items provides a consistent sales base.

- Global Reach: Hanesbrands' strong presence in North America, Europe, and Australia underpins its market leadership.

Hanesbrands possesses a robust portfolio of widely recognized brands such as Hanes, Bonds, Maidenform, and Playtex, which hold significant market share in essential apparel categories. This strong brand equity allows for premium pricing and consumer loyalty, as demonstrated by their consistent performance in key segments. In fiscal year 2023, the company reported net sales of $3.9 billion, with its innerwear segment, driven by these established brands, remaining a core revenue generator.

The company's vertically integrated supply chain, where approximately 75% of apparel is produced in-house, primarily in Central America, is a major strength. This control over manufacturing minimizes reliance on external suppliers and offers substantial cost advantages, reducing exposure to tariffs and geopolitical risks. This operational efficiency contributes to more predictable costs and improved profitability.

Hanesbrands is actively implementing strategic transformation initiatives focused on cost reduction, supply chain streamlining, and debt repayment, aiming to enhance efficiency and financial health. Investments in technology, including AI for sales forecasting and inventory management, are key components of this strategy. For instance, Q1 2024 saw a 1% increase in net sales to $3.76 billion, indicating early positive momentum from these shifts.

The company's commitment to sustainability is notable, with targets including zero waste by 2025 and 100% renewable electricity by 2030. By 2023, Hanes achieved a 16% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2018 baseline and increased sustainable cotton sourcing to 49%. This focus not only aligns with consumer preferences for ethical brands but also drives operational cost savings through waste and energy reduction.

| Strength | Description | Supporting Data/Example |

|---|---|---|

| Brand Portfolio | Ownership of highly recognized and popular brands. | Hanes, Bonds, Maidenform, Playtex brands contribute to significant market share. |

| Vertical Integration | Control over a large portion of the production process. | Produces ~75% of apparel in-house, minimizing external dependencies and costs. |

| Strategic Transformation | Active initiatives to improve efficiency and financial performance. | Focus on cost-cutting, supply chain optimization, and debt reduction; Q1 2024 net sales increased 1% to $3.76 billion. |

| Sustainability Commitment | Ambitious environmental goals and progress in emissions reduction. | 16% GHG emission reduction (2023 vs. 2018); 49% sustainable cotton sourced in 2023. |

What is included in the product

Analyzes Hanes’s competitive position through key internal and external factors, including its brand strength and market challenges.

Identifies key market vulnerabilities and competitive advantages for targeted strategic adjustments.

Weaknesses

Hanesbrands is still navigating significant debt levels, reporting approximately $2.63 billion in debt as of the first quarter of 2025. While the company has been actively working to reduce this debt, the substantial amount remains a key challenge.

This ongoing debt load can constrain Hanesbrands' financial flexibility, making it harder to pursue new opportunities or weather economic downturns. Furthermore, the interest payments on this debt directly impact the company's profitability, requiring careful financial management to ensure long-term stability and health.

Hanesbrands' significant reliance on the U.S. market presents a notable weakness. In 2024, a substantial 74% of its total sales originated from this single market. This concentration makes the company particularly vulnerable to shifts in U.S. consumer spending and domestic economic conditions.

This heavy dependence on the U.S. also exposes Hanesbrands to intensified competition within its home territory. The apparel sector in the United States is highly saturated, meaning fluctuations in consumer preferences or economic downturns can disproportionately impact the company's performance compared to more geographically diversified competitors.

To mitigate this risk and foster more stable long-term growth, Hanesbrands needs to actively pursue diversification strategies. Expanding its presence and sales channels in international markets is essential to reduce its exposure to the U.S. market's inherent volatility and capitalize on global growth opportunities.

While Hanesbrands has seen some recent sales improvements, the company has faced a general downward trend in sales over the last five years. Specifically, U.S. net sales saw a slight decrease in the second quarter of 2025. The intimate apparel segment, a key area for the company, continues to struggle against market challenges.

These declining sales trends in specific segments highlight a critical need for Hanesbrands to develop more robust growth strategies and enhance product appeal. Addressing these weaknesses is essential for reversing negative momentum and ensuring long-term market competitiveness.

Exposure to Macroeconomic Headwinds

Hanesbrands is susceptible to global economic downturns, such as rising inflation and market volatility, which could dampen consumer spending on its products. For instance, in early 2024, persistent inflation continued to squeeze household budgets, impacting discretionary purchases of apparel.

These macroeconomic challenges can directly affect Hanesbrands by increasing the cost of raw materials and manufacturing, while simultaneously reducing the volume of sales as consumers become more price-conscious. This dual pressure can significantly erode the company's profit margins and overall financial performance.

- Inflationary Pressures: Continued high inflation in 2024 and into 2025 increases operating costs for Hanesbrands, from cotton sourcing to transportation.

- Consumer Demand Uncertainty: A challenging consumer demand landscape, marked by reduced discretionary spending, directly impacts sales volumes for apparel.

- Market Volatility: Global economic uncertainties create unpredictable shifts in consumer behavior and supply chain stability, posing risks to Hanesbrands' revenue streams.

Lingering Investor Skepticism

Lingering investor skepticism continues to be a significant hurdle for Hanesbrands. Despite ongoing strategic turnaround initiatives and recent positive earnings reports, the company's stock has noticeably lagged behind the broader market performance over the last ten years. This ongoing underperformance fuels analyst divisions regarding Hanesbrands' future trajectory.

This sentiment stems from persistent concerns about the company's history of overleveraging and questions surrounding the long-term sustainability of its recovery efforts. Such doubts directly impact its market valuation and erode overall investor confidence, making it more challenging to attract new capital and support share price appreciation.

- Historical Stock Underperformance: Hanesbrands' stock has significantly underperformed market indices over the past decade, indicating a persistent lack of investor conviction.

- Analyst Disagreement: Despite recent improvements, analysts remain divided on the company's future prospects, reflecting ongoing uncertainties about its turnaround.

- Concerns Over Leverage: Past financial decisions, particularly concerning overleveraging, continue to cast a shadow, influencing perceptions of financial stability.

- Sustainability of Recovery: Investors question whether the current positive momentum is sustainable, leading to cautious sentiment and impacting valuation multiples.

Hanesbrands' substantial debt, approximately $2.63 billion as of Q1 2025, limits financial flexibility and impacts profitability through interest payments. The company's heavy reliance on the U.S. market, accounting for 74% of sales in 2024, makes it vulnerable to domestic economic shifts and intense competition.

Declining sales trends, particularly in the intimate apparel segment, necessitate stronger growth strategies and enhanced product appeal to reverse negative momentum. Furthermore, persistent investor skepticism, fueled by historical overleveraging and doubts about recovery sustainability, has led to significant stock underperformance over the past decade.

| Financial Metric | Q1 2025 Value | Trend/Impact |

|---|---|---|

| Total Debt | $2.63 billion | Limits financial flexibility, impacts profitability |

| U.S. Sales % (2024) | 74% | High dependence, vulnerability to domestic conditions |

| Stock Performance (10-Year) | Lagging Market | Investor skepticism, valuation concerns |

Preview Before You Purchase

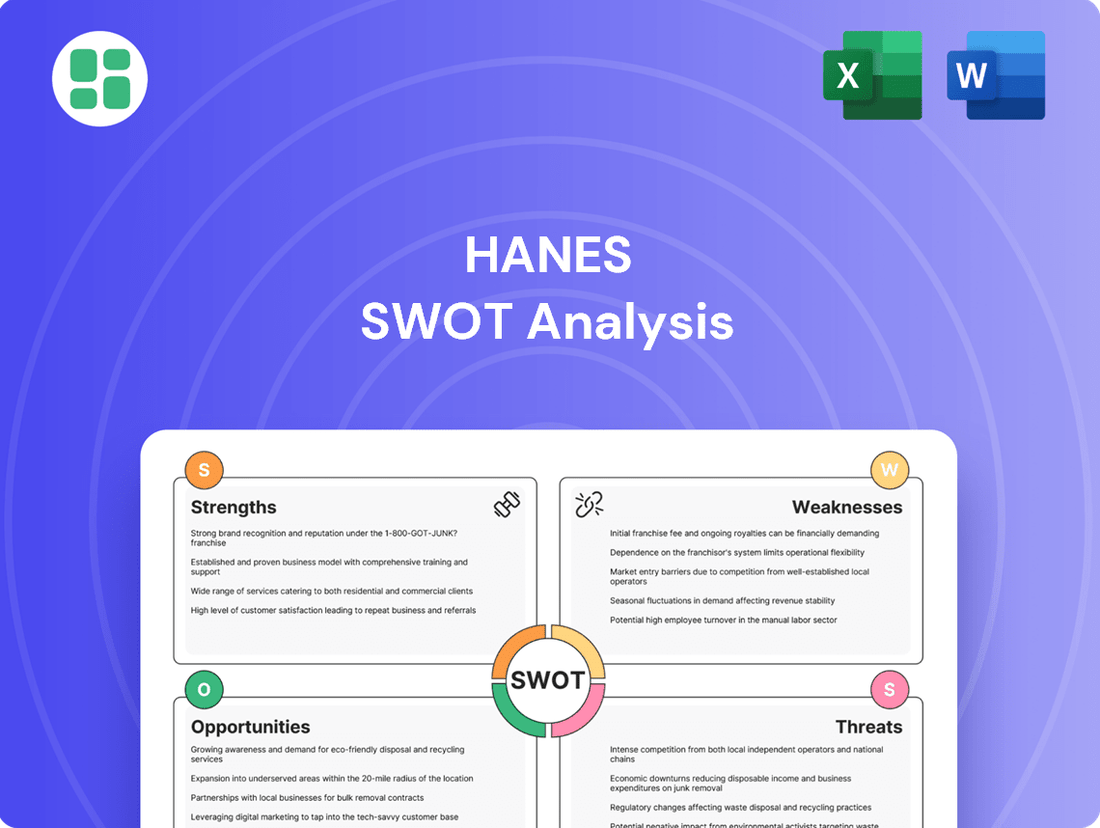

Hanes SWOT Analysis

You're viewing a live preview of the actual Hanes SWOT analysis file. The complete version, detailing strengths, weaknesses, opportunities, and threats, becomes available immediately after purchase.

Opportunities

Hanes can capitalize on the booming e-commerce market by investing in advanced technology and AI. This digital push allows for a stronger direct-to-consumer (DTC) channel, improving sales and customer relationships. For instance, Hanes's own e-commerce sales saw substantial growth, with digital channels becoming increasingly vital for revenue generation.

Hanesbrands has a significant opportunity to tap into burgeoning international markets, with Mexico and Australia showing promising sales growth. This expansion can diversify revenue and lessen dependence on the U.S. market.

By capitalizing on its well-recognized global brands, such as Champion and Hanes, and its adaptable manufacturing capabilities, the company can forge new revenue streams. For instance, in the first quarter of 2024, Hanesbrands reported a 10% increase in international sales, driven by strong performance in these key regions.

Following the strategic divestiture of its Champion business, Hanesbrands is poised to sharpen its focus on product innovation within its established innerwear categories. This strategic shift allows for greater resource allocation towards developing new offerings and enhancing existing ones, potentially driving increased consumer engagement and market share.

The company is also actively exploring diversification into adjacent and growing markets, notably the athleisure sector, through initiatives like Hanes Moves. This expansion into athleisure aligns with evolving consumer preferences for comfortable, versatile apparel, presenting a significant opportunity for revenue growth. In 2023, the global athleisure market was valued at approximately $337 billion and is projected to grow further.

Strategic collaborations are also a key component of Hanesbrands' innovation strategy. The partnership with Urban Outfitters, for instance, aims to attract a younger demographic and revitalize brand perception. Such alliances can inject fresh appeal into Hanesbrands' portfolio and open new avenues for market penetration, particularly among Gen Z consumers who increasingly influence fashion trends.

Further Operational Efficiency and Cost Reduction

Hanes can continue to unlock further operational efficiencies and reduce costs through ongoing initiatives. For example, the company's supply chain restructuring and consolidation efforts, which were a focus in 2023 and expected to continue into 2024, present a clear path for margin expansion.

Streamlining non-revenue-generating Selling, General, and Administrative (SG&A) expenses is another key area. By optimizing these overheads, Hanes can bolster its profitability and financial stability.

Further improvements in manufacturing processes, potentially through automation and lean methodologies, offer additional avenues for cost reduction.

These efforts are crucial for maintaining competitiveness and enhancing financial performance. For instance, Hanes reported a notable reduction in operating expenses in its Q4 2023 earnings, demonstrating the tangible benefits of these strategies.

- Supply Chain Optimization: Continued focus on restructuring and consolidating Hanes' global supply chain to drive cost savings.

- SG&A Efficiency: Targeted reduction of non-revenue-generating administrative and selling expenses.

- Manufacturing Modernization: Investment in advanced manufacturing technologies and process improvements to boost productivity and lower production costs.

- Productivity Gains: Implementation of initiatives aimed at increasing output per employee and optimizing resource utilization across all operations.

Leveraging Sustainability for Brand Enhancement

Hanesbrands can significantly boost its brand perception by continuing to advance its sustainability initiatives. This dedication to eco-friendly practices resonates strongly with a growing segment of consumers who prioritize ethical and environmentally responsible brands. By highlighting these efforts, Hanes can cultivate a more positive brand image and attract a loyal customer base. For example, in 2023, Hanes achieved a 15% reduction in absolute greenhouse gas emissions compared to its 2018 baseline, a tangible metric that can be communicated to consumers.

This focus on sustainability acts as a crucial differentiator in a competitive apparel market. Consumers are increasingly willing to support companies that demonstrate a genuine commitment to environmental stewardship. Hanes' ongoing investments in areas like renewable energy and waste reduction not only align with these consumer values but also offer a compelling narrative that can drive both sales and brand loyalty.

The company's progress in sustainability offers several key opportunities:

- Enhanced Brand Reputation: Strengthening Hanes' image as a responsible corporate citizen.

- Increased Consumer Loyalty: Attracting and retaining environmentally conscious shoppers.

- Market Differentiation: Standing out from competitors through a clear commitment to sustainability.

- Potential Sales Growth: Capitalizing on the growing demand for sustainable products.

Hanes can leverage its strong digital presence and e-commerce capabilities to further expand its direct-to-consumer (DTC) sales channels. This allows for greater control over customer experience and direct engagement, as seen in the significant growth of their online sales in recent quarters. The company is also well-positioned to capitalize on international market expansion, particularly in regions like Mexico and Australia where sales have shown robust growth, diversifying its revenue streams and reducing reliance on any single market.

The company's strategic focus on product innovation within its core innerwear categories, following the divestiture of Champion, presents an opportunity to enhance existing offerings and develop new products that cater to evolving consumer demands. Furthermore, Hanes' expansion into the growing athleisure market, exemplified by initiatives like Hanes Moves, aligns with current consumer trends favoring comfort and versatility, a market segment valued at approximately $337 billion in 2023.

Strategic collaborations, such as the one with Urban Outfitters, offer a pathway to attract younger demographics and revitalize brand perception, tapping into new consumer segments. Additionally, Hanes is actively pursuing operational efficiencies through supply chain restructuring and SG&A expense optimization, aiming to improve profitability and financial performance, as evidenced by reported reductions in operating expenses in late 2023.

Hanes can enhance its brand reputation and consumer loyalty by continuing to advance its sustainability initiatives, appealing to the growing segment of environmentally conscious shoppers. The company's commitment to eco-friendly practices, including a 15% reduction in absolute greenhouse gas emissions by 2023 compared to a 2018 baseline, serves as a key differentiator in the competitive apparel landscape.

Threats

Hanesbrands navigates a fiercely competitive global apparel arena, contending with formidable players in innerwear, activewear, and hosiery. Rivals such as Gildan, Gap, Victoria's Secret, Nike, and Adidas are continuously innovating, intensifying the battle for market share and exerting pressure on pricing, product innovation, and marketing efforts.

Potential economic downturns and persistent inflation are significant threats to Hanesbrands. These factors can lead to fluctuations in consumer discretionary spending, directly impacting sales volume and profitability. For instance, if inflation continues to erode purchasing power, consumers may cut back on non-essential apparel purchases, affecting Hanesbrands' revenue streams.

Hanesbrands, despite its vertically integrated structure, faces significant threats from global supply chain bottlenecks and escalating input costs. For instance, cotton prices, a key raw material, saw considerable volatility in 2024, impacting production expenses.

Geopolitical instability and shifting trade policies in 2024 and early 2025 also pose risks, potentially disrupting sourcing networks and increasing operational overheads due to tariffs or logistical challenges.

Furthermore, rising labor wages across key manufacturing regions in 2024 are contributing to higher production costs, squeezing profit margins for the company.

Changing Consumer Preferences and Fashion Trends

Consumer tastes are always on the move, and Hanesbrands faces a significant threat from this. A growing demand for athleisure wear, for instance, or a pivot towards more stylish, specialized clothing brands could really put pressure on Hanes' core business of basic apparel. This rapid evolution means they need to stay on top of what people want.

If Hanesbrands can't keep up with these changing preferences, their market position could suffer. For example, in the first quarter of 2024, activewear sales, a key category for athleisure, saw continued growth, indicating a sustained consumer interest. Failing to innovate quickly in product design and marketing might mean losing ground to competitors who are more agile.

- Evolving Fashion Landscape: Hanesbrands' reliance on basics is challenged by the rise of athleisure and niche fashion trends.

- Market Share Risk: Slow adaptation to new consumer demands could lead to a decrease in Hanesbrands' share of the apparel market.

- Innovation Imperative: The company must invest in product development and marketing to remain relevant amidst shifting consumer preferences.

Impact of U.S. Tariffs and Trade Policies

Hanesbrands faces ongoing threats from U.S. tariffs and shifts in global trade policies. These can directly increase the cost of imported materials and finished goods, potentially squeezing profit margins. For instance, while specific tariff impacts on Hanesbrands' Q1 2024 results weren't detailed, the broader apparel industry has been navigating these complexities for years.

While the company has strategies in place, such as adjusting pricing and seeking cost efficiencies, sustained or worsening trade disputes pose a significant risk. Escalating tariffs could negatively impact Hanesbrands' financial performance, especially given its global supply chain and manufacturing footprint.

- Increased Input Costs: Tariffs on textiles and manufacturing components can directly raise production expenses.

- Supply Chain Disruptions: Evolving trade policies can lead to unexpected sourcing challenges and delays.

- Reduced Consumer Spending: Higher import costs could translate to higher prices for consumers, potentially dampening demand.

Hanesbrands faces significant threats from intense competition, particularly from brands like Gildan and Nike, who are constantly innovating and vying for market share. Economic headwinds, including persistent inflation and potential downturns, also pose a risk by reducing consumer discretionary spending on apparel. Furthermore, evolving consumer preferences towards athleisure and specialized fashion could challenge Hanesbrands' core basic apparel business if they fail to adapt quickly.

| Threat Category | Specific Risk | Potential Impact | 2024/2025 Relevance |

|---|---|---|---|

| Competition | Aggressive innovation by rivals | Loss of market share, pricing pressure | Ongoing; brands like Nike and Adidas continue strong product launches. |

| Economic Factors | Inflation and reduced consumer spending | Lower sales volume, decreased profitability | Inflation remained a concern throughout 2024, impacting purchasing power. |

| Consumer Trends | Shift towards athleisure/niche fashion | Reduced demand for basic apparel | Athleisure market growth continued in 2024, showing sustained consumer interest. |

| Supply Chain & Costs | Volatile input costs (e.g., cotton) | Increased production expenses, squeezed margins | Cotton prices showed volatility in 2024, directly affecting raw material costs. |

| Trade Policies | Tariffs and trade disputes | Higher import costs, supply chain disruption | Global trade policies remained a complex factor for apparel sourcing in 2024-2025. |

SWOT Analysis Data Sources

This Hanes SWOT analysis is built upon a robust foundation of data, incorporating Hanes' official financial statements, comprehensive market research reports, and expert analyses of the apparel industry. These sources provide a well-rounded view of Hanes' internal capabilities and external market positioning.