Hanes Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanes Bundle

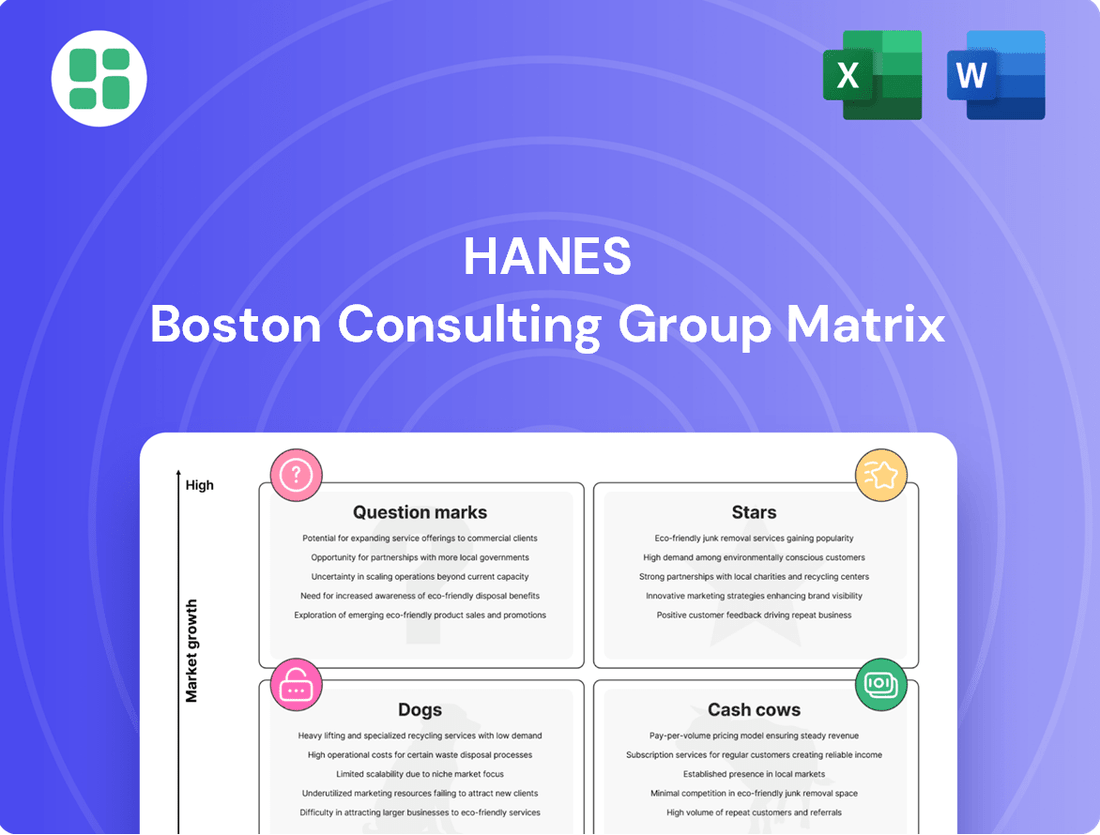

Curious about Hanes' product portfolio performance? This glimpse into their BCG Matrix reveals how their offerings are positioned as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the actionable strategies that lie within the full report.

Unlock the complete Hanes BCG Matrix to gain a comprehensive understanding of their market share and growth potential for each product category. Purchase the full version for detailed insights and a clear path to optimizing your investment decisions.

Stars

Hanes Originals and Hanes Moves are positioned as Stars in the BCG Matrix for Hanesbrands. These innovative product lines have shown robust year-over-year sales growth, signaling a high-growth market and a strengthening market share. They are instrumental in revitalizing Hanes' performance in the U.S. innerwear market.

Bali Breathe Innovation, launched in Q2 2024, is Hanesbrands' strategic move to expand its footprint in the intimate apparel market. This new product line is designed to appeal to consumers seeking comfort and advanced fabric technology, aiming to carve out new market share.

The early performance of Bali Breathe indicates strong potential, with year-over-year sales growth suggesting it's in a high-growth phase. This trajectory positions it as a potential star product within Hanesbrands' portfolio, capable of becoming a future market leader.

Hanesbrands is actively utilizing product innovation, exemplified by Bali Breathe, as a key driver for demand in the competitive intimate apparel sector. The company's focus on introducing novel features and benefits aims to differentiate its offerings and capture a larger segment of the market.

Maidenform M Innovation, a product line within Hanesbrands, has demonstrated impressive year-over-year sales growth, outperforming the broader intimate apparel market which has experienced challenges. This success highlights Hanesbrands' strategic capability in developing high-growth offerings by adapting to changing consumer desires.

In 2024, Hanesbrands reported that Maidenform's innovation, particularly in comfort and technology-driven products, contributed significantly to its overall performance in the intimate apparel segment. Continued investment in this area is crucial for maintaining and expanding its competitive edge.

Strategic Growth in U.S. Basics

Hanesbrands' U.S. Basics segment is demonstrating a healthy year-over-year growth trajectory, suggesting successful strategic initiatives in brand building and marketing are translating into increased market share. This core business, though in a mature market, is showing renewed vitality in crucial segments, underscoring a commitment to consumer-focused strategies.

The company's dedication to understanding and catering to consumer needs is a key driver behind this resurgence. For instance, in the first quarter of 2024, Hanesbrands reported a 2% increase in total sales, with its U.S. Basics segment performing favorably within this overall growth. This indicates that even in established categories, strategic focus can yield tangible results.

- U.S. Basics Segment Growth: Experiencing year-over-year expansion, indicating effective brand and marketing investments.

- Market Share Gains: Performance suggests strategic initiatives are capturing a larger portion of the market.

- Consumer-Centricity: A core strategy driving performance in this mature but revitalized business area.

- Q1 2024 Performance: Contributed to overall company sales growth, highlighting its importance.

International Growth in Asia

Hanesbrands' international sales, especially in Asia, demonstrated robust performance. In the first quarter of 2025, these sales saw a 4% organic increase on a constant currency basis. This growth exceeded the company's overall projections, highlighting the strength in key international markets.

This expansion in emerging and developing regions, including Asia, suggests Hanesbrands is successfully increasing its presence and gaining market traction. Such performance indicates substantial growth potential within these territories. A focused strategy on these markets could pave the way for considerable future market share gains.

- International Sales Growth: Hanesbrands reported a 4% organic constant currency increase in international sales for Q1 2025.

- Asia's Contribution: This growth was particularly notable in Asian markets, exceeding overall company expectations.

- Emerging Market Potential: The performance underscores the high growth potential in emerging and developing markets where Hanesbrands is expanding.

- Strategic Focus: Concentrated strategic efforts in these regions are anticipated to drive significant future market share.

Stars represent products or business units in high-growth markets where the company holds a strong market share. Hanesbrands' U.S. Basics segment, despite being in a mature market, shows renewed vitality and year-over-year growth, indicating effective strategies. Hanes Originals and Hanes Moves are also positioned as Stars due to robust sales growth in a high-growth market, revitalizing the U.S. innerwear segment. Bali Breathe Innovation, launched in Q2 2024, and Maidenform M Innovation are showing strong year-over-year sales growth, positioning them as potential Stars in the competitive intimate apparel market.

| Product/Segment | Market Growth | Market Share | BCG Category |

| Hanes Originals | High | Strong | Star |

| Hanes Moves | High | Strong | Star |

| U.S. Basics Segment | Mature (but growing) | Strengthening | Star |

| Bali Breathe Innovation | High | Emerging/Growing | Potential Star |

| Maidenform M Innovation | High | Growing | Potential Star |

What is included in the product

The Hanes BCG Matrix categorizes products into Stars, Cash Cows, Question Marks, and Dogs based on market growth and share.

It guides strategic decisions on investment, divestment, or maintenance for each product category.

Hanes BCG Matrix provides a clear, visual roadmap for resource allocation, relieving the pain of strategic indecision.

Cash Cows

Core Hanes Innerwear in the U.S. is a classic Cash Cow for HanesBrands. It commands a significant market share in a well-established industry, meaning it doesn't require heavy investment to grow.

This segment is a reliable generator of substantial cash flow, a critical component for funding the company's other ventures. For instance, in 2023, HanesBrands reported that its Innerwear segment, which includes this core U.S. business, continued to be a strong performer, contributing significantly to overall profitability despite market fluctuations.

Bonds is a stellar performer in Australia and New Zealand, a mature market where it commands a substantial share. This brand consistently generates significant cash for Hanesbrands, thanks to its loyal customer base and well-entrenched distribution network.

Hanesbrands continues to strategically invest in Bonds to ensure its ongoing productivity and market leadership. For instance, in 2023, Hanesbrands reported that its International segment, which includes Bonds, saw net sales increase by 3% to $1.2 billion, underscoring the brand's robust performance.

Playtex, a cornerstone of Hanesbrands' intimate apparel division, operates as a classic Cash Cow within the BCG framework. Its established brand recognition and significant market share in the intimate apparel sector ensure a steady and reliable stream of cash flow for the parent company.

Despite facing some general market challenges within the broader intimates category, Playtex's loyal customer base and enduring brand equity allow it to maintain stable revenue generation. This consistent performance solidifies its role as a vital contributor to Hanesbrands' overall financial health and innerwear strategy.

Bali (Core Intimate Apparel)

Bali stands as a dominant force in the intimate apparel market, holding a significant national market share for bras. This established brand equity translates into consistent and reliable cash flow for HanesBrands, solidifying its position as a core asset within the company's innerwear segment.

The brand's ability to generate substantial, stable profits underscores its Cash Cow status. For instance, HanesBrands reported overall net sales of $6.0 billion in 2023, with its innerwear segment being a significant contributor, demonstrating the ongoing strength of its established brands like Bali.

- Market Leadership: Bali is a leading national bra brand with a substantial market share.

- Cash Flow Generation: Its strong brand presence ensures steady and predictable cash flow.

- Strategic Importance: Bali is a key asset within HanesBrands' innerwear portfolio.

- Sustained Position: Ongoing strategic innovation helps maintain Bali's competitive edge.

Hanes Activewear (Non-Champion Continuing Operations)

Following the divestiture of Champion, Hanesbrands continues to operate its activewear segments under brands like Hanes. These brands benefit from a well-established market presence, offering stable revenue streams.

While not exhibiting the rapid expansion seen with Champion at its height, these continuing activewear operations tap into a mature market, generating consistent cash flow. The company reported growth in its 'Active' business within continuing operations in Q2 2025, indicating sustained performance in this segment.

- Hanes Activewear (Continuing Operations): Represents a stable revenue generator post-Champion divestiture.

- Market Position: Benefits from established brand recognition in a mature market.

- Financial Contribution: Provides consistent cash flow, acting as a reliable income source for Hanesbrands.

- Recent Performance: The 'Active' business within continuing operations saw growth in Q2 2025.

Cash Cows are business units with high market share in low-growth industries. They generate more cash than they consume, providing funds for other business units. HanesBrands' core U.S. Innerwear segment, including brands like Playtex and Bali, exemplifies this. These brands benefit from strong brand recognition and established market positions, ensuring consistent revenue generation.

The Bonds brand in Australia and New Zealand also operates as a Cash Cow, leveraging its loyal customer base and extensive distribution. Even Hanes' continuing activewear operations, post-Champion divestiture, contribute stable cash flow from a mature market. These segments are vital for funding growth initiatives and maintaining overall financial stability for HanesBrands.

| Brand/Segment | Market Position | Cash Flow Generation | 2023 Contribution (Illustrative) |

|---|---|---|---|

| Hanes U.S. Innerwear | High Market Share, Mature Industry | Strong, Stable | Significant portion of Innerwear segment sales |

| Bonds (ANZ) | High Market Share, Mature Industry | Reliable | Contributes to International segment performance |

| Playtex | Dominant in Intimate Apparel | Consistent | Key driver of Innerwear profitability |

| Bali | Leading National Bra Brand | Substantial, Stable | Supports overall Innerwear segment strength |

| Hanes Activewear (Continuing) | Established, Mature Market | Consistent | Stable revenue stream post-Champion |

What You’re Viewing Is Included

Hanes BCG Matrix

The Hanes BCG Matrix preview you see is the complete, unedited document you will receive immediately after purchase. This means you'll get the fully formatted strategic analysis, ready for immediate application in your business planning. Rest assured, there are no watermarks or demo content; what you preview is precisely what you'll download, empowering you to make informed decisions swiftly.

Dogs

Hanesbrands' U.S. outlet store businesses have been categorized as Dogs within the BCG Matrix. This classification stems from their recent reclassification as discontinued operations, coinciding with the divestiture of Champion.

These operations were characterized by low market share and limited growth potential, making them a strategic drain on Hanesbrands' resources. The decision to separate them underscores a commitment to streamlining the company's portfolio and shedding underperforming assets.

For instance, in the fiscal year 2023, Hanesbrands reported a significant impact from discontinued operations, which included these outlet stores, contributing to a net loss. This strategic move aims to improve overall profitability and focus capital on higher-growth segments of the business.

Legacy hosiery lines, often characterized by older designs and less market appeal, are likely positioned as Dogs in Hanes' BCG Matrix. These products typically hold a low market share within a mature or declining segment of the hosiery industry. For instance, HanesBrands has been actively streamlining its operations, which has included the closure of distribution centers and workforce reductions in recent years, suggesting a strategic move away from underperforming legacy assets.

These legacy segments contribute minimally to overall revenue and profitability, often burdened by higher production or distribution costs relative to their sales volume. Financial reports from HanesBrands have indicated efforts to divest non-core brands or product categories, a common strategy for managing Dog business units to free up capital and management focus for more promising areas.

Hanesbrands faced ongoing challenges in its intimate apparel division, with Q2 2025 reporting continued headwinds. This indicates that specific, perhaps less innovative, areas within brands like Maidenform or Playtex are struggling with slow growth and market share erosion, impacting overall profitability.

Non-Core, Niche Brands/SKUs

Within the Hanesbrands portfolio, non-core, niche brands and specific SKUs that don't fit the company's renewed focus on core innerwear are candidates for divestiture or discontinuation. These smaller offerings often have limited market penetration and can divert valuable resources away from more promising ventures.

For instance, Hanesbrands has been actively streamlining its operations. In 2023, the company continued its strategy of simplifying its business, which often involves evaluating its extensive product lines. Brands or SKUs with low sales volume and minimal market share, such as those contributing less than 1% to overall revenue, are prime examples of items that might fall into this category.

- Low Market Share: Brands with a market penetration below a certain threshold, perhaps single digits, are often scrutinized.

- Resource Drain: These niche products can consume marketing and operational budgets without yielding proportionate returns.

- Strategic Misalignment: Products that do not complement the core innerwear and activewear focus are likely to be phased out.

- Divestiture Potential: Smaller, non-strategic brands might be sold off to other companies better positioned to grow them.

Outdated Product Designs or Materials

Products that fail to adapt to changing consumer tastes, perhaps in terms of comfort, eco-friendliness, or current fashion, often see their sales and market share shrink. These older designs, if they aren't updated or retired, can become a drain on company resources, holding onto inventory that isn't selling well and isn't likely to in the future.

Hanesbrands' strategy involves pushing for new and improved products, which naturally means they'll be moving away from or phasing out items that no longer meet market demands. For instance, in 2023, Hanesbrands reported that its Activewear segment, which includes many performance-oriented items, saw a net sales decrease of 6% compared to 2022, highlighting the pressure to innovate in product categories.

- Declining Sales: Products with outdated designs or materials are prone to lower sales volumes.

- Market Share Erosion: Competitors offering newer, more desirable products can capture market share.

- Resource Tie-up: Inventory of unpopular, outdated items can tie up capital and warehouse space.

- Innovation Imperative: Companies like Hanesbrands must continually refresh their product lines to remain competitive.

Hanesbrands' U.S. outlet store businesses, along with legacy hosiery lines and certain niche brands, are classified as Dogs in the BCG Matrix. These segments exhibit low market share and limited growth potential, often representing a strategic drain on resources due to declining sales and market relevance. For example, Hanesbrands' divestiture of Champion and ongoing streamlining efforts in 2023 and early 2024 highlight a commitment to shedding underperforming assets. These "Dogs" consume capital and management attention without generating significant returns, prompting the company to focus on core, higher-growth areas.

| BCG Category | Hanesbrands Example | Characteristics | Strategic Implication |

|---|---|---|---|

| Dogs | U.S. Outlet Stores (Discontinued Operations) | Low market share, low growth, resource drain. | Divestiture or closure to improve profitability. |

| Dogs | Legacy Hosiery Lines | Declining sales, outdated designs, minimal market appeal. | Streamlining operations, potential phasing out. |

| Dogs | Non-core, Niche Brands/SKUs | Limited market penetration, resource diversion. | Divestiture or discontinuation to focus on core offerings. |

Question Marks

The U.S. market entry for Bonds in April 2025 positions it as a Question Mark within the BCG Matrix. This signifies a high-growth potential market where the brand currently has a minimal presence, necessitating substantial investment to build awareness and secure distribution channels.

The brand's trajectory hinges on its ability to capture market share against established competitors. For instance, the U.S. apparel market alone was valued at over $350 billion in 2024, indicating the scale of the opportunity and the challenge ahead for Bonds.

Hanesbrands is strategically exploring new avenues like scrubs and loungewear, aiming to capture market share in these expanding sectors. The global loungewear market, for instance, was valued at approximately $11.1 billion in 2023 and is projected to grow significantly.

These emerging segments represent potential 'Question Marks' in the BCG matrix for Hanesbrands, requiring substantial investment to build brand presence and product innovation. Success hinges on effectively transforming these nascent ventures into 'Stars' through aggressive marketing and robust distribution networks.

Hanesbrands' digital-first product lines represent a strategic push into online-exclusive offerings, aiming to capture a growing segment of digitally savvy consumers. These new ventures often begin with a modest market share, reflecting their nascent stage in the e-commerce landscape.

To achieve significant growth, these digital-first products necessitate robust digital marketing strategies and a focus on rapid consumer adoption. For instance, in 2023, Hanesbrands reported that its direct-to-consumer segment, which heavily relies on digital channels, saw a substantial increase in sales, indicating the potential for these new lines.

Targeted Youth Consumer Initiatives for Innerwear

Hanesbrands is actively focusing on targeted youth consumer initiatives for its innerwear segment, recognizing the significant growth potential in this demographic. The company is channeling investment into product innovation and marketing campaigns designed to resonate with younger consumers, aiming to capture a larger share of this evolving market.

While the overall innerwear market is considered mature, the youth segment presents a distinct high-growth opportunity. Hanesbrands' strategic push into this area is driven by the understanding that building brand loyalty early is crucial for long-term success.

These new initiatives, characterized by their initial low penetration among younger buyers, necessitate sustained investment to build brand awareness and drive adoption. Hanesbrands' commitment to these efforts underscores their belief in the future revenue streams these programs can generate.

- Innovation Focus: Hanesbrands is investing in new product designs and fabric technologies to appeal to younger consumers' preferences for comfort, style, and sustainability.

- Marketing Reach: Digital marketing, social media engagement, and influencer collaborations are key components of their strategy to connect with the youth demographic.

- Market Opportunity: Capturing the youth market in innerwear is seen as a critical driver for future revenue growth, given the demographic's increasing purchasing power and brand influence.

- Investment Strategy: Sustained financial commitment is required for these initiatives, reflecting the long-term perspective needed to establish a strong foothold with younger consumers.

Expansion into Untapped International Markets

Hanesbrands' strategy for expansion into untapped international markets positions its ventures as potential Stars or Question Marks within the BCG framework. These new territories, beyond established regions like Australia and key Asian markets, represent opportunities for significant future growth. However, they also demand substantial upfront investment in understanding consumer behavior, establishing robust supply chains, and cultivating brand awareness, often beginning with a low market share and an unpredictable success trajectory.

For instance, in 2024, emerging economies in Africa and Latin America are showing increasing disposable incomes, making them attractive targets. Hanesbrands would need to allocate capital for localized marketing campaigns and adapt product offerings to suit regional preferences. This approach mirrors the initial stages of entering a new market, where the long-term viability is still being assessed.

- Market Entry Costs: Significant investment in market research, distribution infrastructure, and brand development is crucial for new international ventures.

- Initial Market Share: New markets typically begin with a minimal market share, reflecting the early stage of brand penetration and customer adoption.

- Growth Potential: Untapped markets offer high growth potential, but the outcomes remain uncertain, requiring careful monitoring and strategic adjustments.

- Investment Allocation: Capital allocation decisions for these markets will be critical, balancing the risk of low initial returns against the promise of future market leadership.

Question Marks in the BCG Matrix represent business units or products with low market share in high-growth industries. These entities require significant investment to increase their market share and potentially become Stars. Without adequate investment, they risk becoming Dogs if market growth slows.

Hanesbrands' new ventures, such as its U.S. market entry for Bonds in April 2025 and targeted youth consumer initiatives in innerwear, exemplify Question Marks. These areas have high growth potential but currently hold a low market share, necessitating strategic capital allocation for marketing and product development.

The success of these Question Marks hinges on Hanesbrands' ability to effectively capture market share and build brand loyalty. For instance, the significant investment in digital-first product lines and expansion into untapped international markets reflects a strategy to transform these nascent ventures into future revenue drivers.

The company's approach to these Question Marks involves a careful balance of innovation, targeted marketing, and sustained financial commitment. The goal is to leverage the high-growth environment to establish a strong market presence, ultimately aiming to convert these investments into market leaders.

BCG Matrix Data Sources

Our Hanes BCG Matrix leverages a blend of internal financial disclosures, comprehensive market research reports, and industry-specific growth trend analyses to provide strategic clarity.