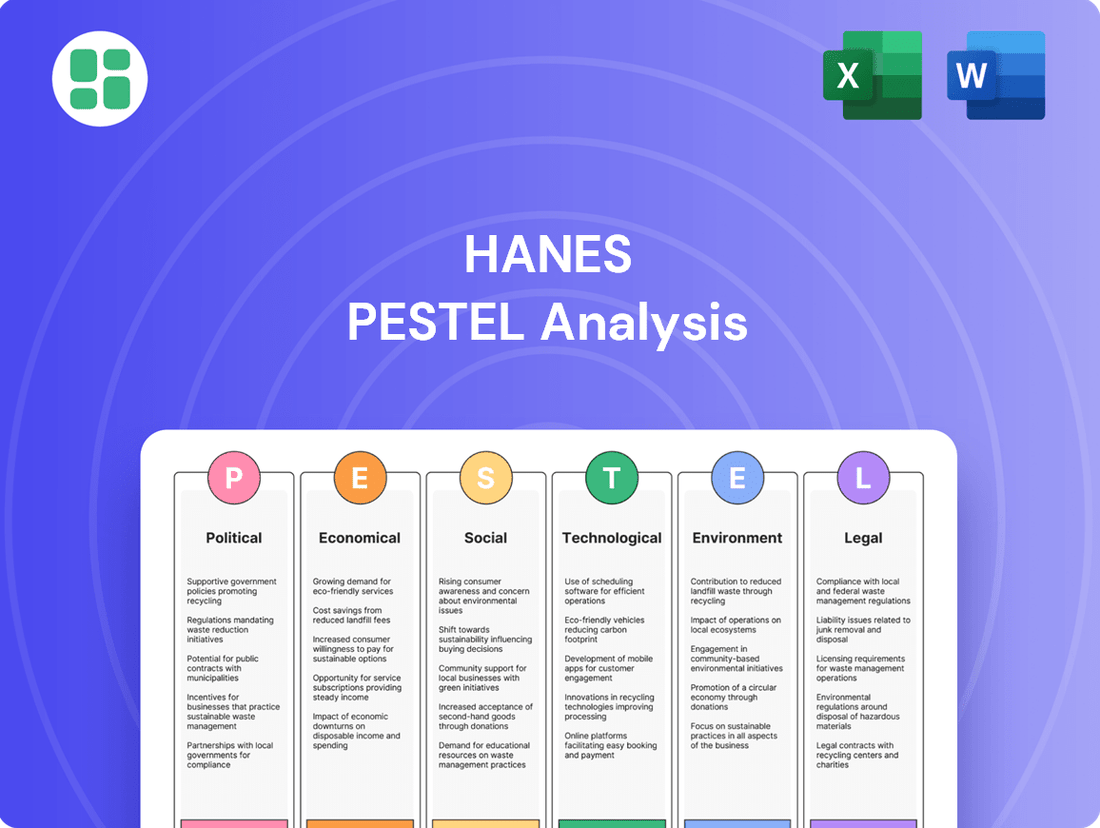

Hanes PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanes Bundle

Uncover the critical political, economic, social, and technological factors shaping Hanes's future with our comprehensive PESTLE analysis. Gain a strategic advantage by understanding these external forces and their impact on the apparel giant. Download the full report now to access actionable intelligence and refine your market approach.

Political factors

Global trade policies, including tariffs and trade agreements, significantly influence Hanesbrands' manufacturing expenses and the smooth operation of its supply chain. As of 2024, U.S. tariffs on textile imports from countries like China, ranging from 7.5% to 25%, continue to present challenges for Hanesbrands, given its substantial reliance on Asian production. Effectively navigating these tariffs through smart sourcing and strategic pricing adjustments is vital for sustaining profitability.

Geopolitical stability is a significant concern for Hanesbrands. Tensions in key manufacturing hubs, such as Vietnam and China, where Hanes has a substantial operational footprint, can directly impact its supply chain. For instance, ongoing trade disputes or regional conflicts could lead to production slowdowns or disruptions, affecting the availability of goods for consumers.

The company's global presence, with manufacturing facilities in countries like Indonesia as well, makes it inherently vulnerable to political shifts. In 2024, for example, several Southeast Asian nations experienced heightened political scrutiny regarding labor practices and trade agreements, which could indirectly influence Hanesbrands' operational costs and sourcing strategies.

These geopolitical risks translate into tangible financial implications. Production delays can increase logistics expenses and necessitate finding alternative, potentially more expensive, suppliers. In 2025, the apparel industry is already navigating rising input costs, and geopolitical instability could exacerbate these challenges, impacting Hanesbrands' profitability and inventory management.

Hanesbrands navigates a complex web of global labor regulations, with variations in minimum wage policies and worker rights across its operating countries directly impacting labor costs. For instance, in 2024, minimum wage increases in several key manufacturing regions, such as parts of Asia, could add to operational expenses. Adhering to these diverse laws and maintaining fair working conditions is critical for Hanesbrands' ethical sourcing and brand reputation.

Governmental Support and Incentives

Governmental support, especially for sustainable textile manufacturing and domestic production, can significantly benefit Hanesbrands. For instance, by embracing energy-efficient practices, Hanes reported substantial savings. In 2023, the company highlighted its progress in reducing greenhouse gas emissions, a move often supported by green energy incentives in various operating regions.

Conversely, shifts in government policies or a decline in supportive measures could introduce new operational costs or regulatory hurdles for Hanes. The company’s proactive stance on sustainability, including investments in renewable energy and water conservation, positions it to potentially leverage future governmental incentives aimed at environmental stewardship. For example, many countries are expanding tax credits for companies investing in clean manufacturing technologies, a trend Hanes is likely monitoring closely.

- Governmental support for sustainable textile manufacturing offers Hanesbrands a competitive edge.

- Energy efficiency initiatives have led to significant cost savings for the company.

- Changes in regulatory frameworks or a lack of incentives could increase operational burdens.

- Hanes' investments in sustainability align with global trends in green manufacturing incentives.

Political Stability in Key Markets

Political stability in major markets is a crucial element for Hanesbrands, as it directly influences consumer confidence and their willingness to spend. Uncertainty can dampen demand for apparel and other consumer goods. For instance, geopolitical tensions or unexpected policy shifts in key regions can lead to a pullback in discretionary spending, impacting Hanesbrands' sales volumes and overall revenue.

Hanesbrands' international operations are particularly sensitive to these political dynamics. Fluctuations in foreign exchange rates, often exacerbated by political instability or economic policy changes in other countries, can significantly affect the reported value of their international sales. In 2023, Hanesbrands reported that its international segment represented a substantial portion of its net sales, making it vital to monitor political climates in these regions.

- Economic Impact: Political instability can trigger currency devaluations, increasing the cost of imported goods and potentially reducing consumer purchasing power in key international markets.

- Consumer Confidence: Surveys in late 2024 and early 2025 continue to highlight the correlation between perceived political stability and consumer sentiment, directly affecting spending on non-essential items like apparel.

- Regulatory Environment: Changes in trade policies, tariffs, or labor regulations stemming from political shifts can alter operating costs and market access for Hanesbrands.

- Market Access: Political unrest or sanctions in certain countries can restrict Hanesbrands' ability to operate or sell its products, leading to lost revenue opportunities.

Governmental trade policies, including tariffs and trade agreements, significantly influence Hanesbrands' manufacturing expenses and supply chain operations. For instance, in 2024, U.S. tariffs on textile imports from countries like China, ranging from 7.5% to 25%, continue to present challenges for Hanesbrands due to its substantial reliance on Asian production.

Geopolitical stability is a significant concern, as tensions in key manufacturing hubs like Vietnam and China can directly impact Hanesbrands' supply chain, potentially leading to production slowdowns or disruptions. The company's global presence, with facilities in countries like Indonesia, also makes it vulnerable to political shifts and varying labor regulations, which can influence operational costs.

Political stability in major markets is crucial for Hanesbrands, as it directly influences consumer confidence and spending on apparel. Uncertainty can dampen demand, impacting sales volumes and revenue. In 2023, Hanesbrands reported that its international segment represented a substantial portion of its net sales, highlighting the importance of monitoring political climates in these regions.

| Political Factor | Impact on Hanesbrands | 2024/2025 Relevance |

| Trade Policies & Tariffs | Increases manufacturing costs, affects supply chain efficiency | U.S. tariffs on textiles (7.5%-25%) remain a challenge for Asian sourcing. |

| Geopolitical Stability | Risk of supply chain disruptions, operational impacts in manufacturing hubs | Tensions in Vietnam and China can affect production continuity. |

| Labor Regulations | Influences labor costs and compliance requirements | Minimum wage increases in Asian manufacturing regions impact operational expenses. |

| Consumer Confidence | Affects demand for apparel and overall sales revenue | Political uncertainty can lead to reduced discretionary spending on non-essential items. |

What is included in the product

This Hanes PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

Provides a clear, actionable framework that simplifies complex external factors, enabling Hanes to proactively address potential challenges and capitalize on opportunities.

Economic factors

Rising inflation in 2024 and into 2025 directly impacts Hanesbrands' operational costs, from the price of cotton and polyester to wages and shipping fees. This inflationary pressure also squeezes consumers' wallets, potentially leading them to cut back on discretionary purchases, including apparel.

Hanesbrands has acknowledged the difficult consumer environment, with inflation acting as a significant headwind. For instance, in early 2024, persistent inflation continued to affect consumer confidence and spending habits, forcing companies like Hanes to re-evaluate pricing strategies and focus on cost savings to maintain profitability.

The erosion of consumer spending power means Hanesbrands may see reduced demand for its core products. This necessitates a careful balancing act between passing on increased costs through pricing and maintaining competitive price points to avoid alienating price-sensitive shoppers.

Hanesbrands' extensive global operations mean that shifts in foreign exchange rates can significantly influence its reported financial results, affecting both sales figures and overall profitability. For instance, if the U.S. dollar strengthens against other currencies, sales made in those foreign currencies translate into fewer dollars, potentially creating a drag on earnings.

Recent financial reports have highlighted how unfavorable currency movements have acted as headwinds for Hanesbrands' international sales performance. These fluctuations can make products more expensive for overseas consumers or reduce the dollar value of sales generated abroad, impacting the company's top-line growth in the short term.

Looking ahead, Hanesbrands' own financial guidance for 2025 explicitly acknowledges the anticipated impact of foreign currency exchange rate changes. The company projects these currency movements to create headwinds, thereby affecting its net sales outlook for the upcoming fiscal year, underscoring the importance of currency stability for its international revenue streams.

Fluctuations in global supply chain costs, encompassing logistics, shipping, and raw material prices, directly impact Hanesbrands' gross margins. For instance, the company reported that higher freight and input costs contributed to a decline in its gross margin in recent periods, underscoring the sensitivity of its profitability to these external factors.

Hanesbrands has been actively consolidating and optimizing its supply chain to lower fixed costs and increase efficiencies, a strategy that gained momentum in 2023 and continues into 2024. These initiatives aim to streamline operations and improve throughput, thereby mitigating some of the cost pressures.

Effective management of inventory levels and strategic production shifts are crucial for cost control. By optimizing these areas, Hanesbrands seeks to reduce carrying costs and ensure that production aligns with demand, thereby enhancing overall operational efficiency and profitability in a dynamic market environment.

Interest Rates and Debt Management

Changes in interest rates directly affect the cost of Hanesbrands' borrowing, influencing its financial flexibility and ability to fund new projects. For instance, a rising rate environment would increase the expense of servicing existing variable-rate debt and make new debt more costly, potentially impacting profitability.

Hanesbrands has actively worked to improve its debt profile. As of the first quarter of 2024, the company reported a significant reduction in its net debt, demonstrating a commitment to deleveraging. This strategic focus on debt reduction is crucial for enhancing financial stability and creating more capacity for shareholder returns through dividends or buybacks.

The company's deleveraging strategy is a cornerstone of its long-term financial health. By lowering its debt-to-equity ratio, Hanesbrands becomes less susceptible to interest rate volatility and strengthens its balance sheet. This proactive approach is designed to ensure sustained operational performance and improved investor confidence.

- Debt Reduction: Hanesbrands has prioritized paying down its outstanding debt, aiming to strengthen its financial foundation.

- Leverage Improvement: The company has seen a decrease in its leverage ratios, indicating a healthier debt-to-capital structure.

- Interest Rate Sensitivity: Fluctuations in interest rates can impact the cost of servicing Hanesbrands' debt, affecting its net income.

- Strategic Focus: Deleveraging is a key component of Hanesbrands' strategy to enhance long-term stability and shareholder value.

E-commerce Growth and Retail Dynamics

The ongoing surge in e-commerce and the dynamic shifts within the retail landscape demand substantial investment in digital infrastructure and strategic alliances for Hanesbrands. This trend requires a proactive approach to meet evolving consumer purchasing habits.

While Hanesbrands experienced a slight dip in overall U.S. sales, the company is strategically prioritizing innovation and brand enhancement. These efforts are aimed at capitalizing on growth opportunities across its diverse sales channels, particularly within the burgeoning e-commerce sector.

- E-commerce Dominance: Global e-commerce sales are projected to reach $7.7 trillion by 2025, underscoring the critical importance of a robust online presence for apparel retailers like Hanesbrands.

- Digital Investment: Hanesbrands is channeling resources into enhancing its digital capabilities, including website optimization, digital marketing, and supply chain integration to support online sales growth.

- Omnichannel Strategy: The company is focusing on an omnichannel approach, seamlessly integrating online and offline retail experiences to provide consumers with flexibility and convenience.

- Brand Revitalization: Investments in brand marketing and product innovation are key to Hanesbrands' strategy to attract and retain customers in a competitive retail environment influenced by digital trends.

The economic environment in 2024-2025 presents a mixed bag for Hanesbrands, with inflation impacting costs and consumer spending, while interest rate changes affect borrowing expenses. The company's proactive debt reduction strategy is a key factor in navigating these economic shifts, aiming to enhance financial stability and shareholder value.

Global economic uncertainty, including fluctuating foreign exchange rates, continues to pose challenges for Hanesbrands' international sales. The company's financial guidance for 2025 explicitly accounts for these currency headwinds, highlighting the need for careful management of its global revenue streams.

| Economic Factor | Impact on Hanesbrands | Data/Trend (2024-2025) |

|---|---|---|

| Inflation | Increased operational costs (raw materials, wages, shipping); Reduced consumer discretionary spending. | Inflation remained a persistent concern in early 2024, impacting consumer confidence. Projections for 2025 suggest continued, albeit potentially moderating, inflationary pressures. |

| Interest Rates | Higher cost of borrowing; Potential impact on profitability and financial flexibility. | Interest rates saw increases through 2023 and early 2024. While the pace of hikes may slow, rates are expected to remain elevated in 2025, impacting debt servicing costs. |

| Foreign Exchange Rates | Fluctuations affect reported sales and profitability of international operations. | Hanesbrands' 2025 guidance acknowledges anticipated headwinds from currency movements, indicating a continued sensitivity to FX volatility. |

Same Document Delivered

Hanes PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Hanes PESTLE analysis provides a comprehensive overview of the external factors influencing the company's operations and strategic decisions. You'll gain valuable insights into the political, economic, social, technological, legal, and environmental landscape.

Sociological factors

Hanesbrands is navigating a significant shift in consumer desires, with a growing emphasis on comfort, sustainability, and the ever-popular athleisure trend. This directly shapes how Hanes designs and markets its apparel.

In response, Hanes is doubling down on its strengths, focusing on innovation within its foundational basics and activewear lines. The company has actively introduced new athleisure collections to meet this demand, recognizing that consumers increasingly seek products that align with ethical and environmental values.

For instance, Hanes has highlighted its commitment to responsible sourcing and manufacturing, with initiatives aimed at reducing environmental impact. By 2023, Hanes reported progress in its sustainability goals, including efforts to increase the use of recycled materials in its products, a key factor for environmentally conscious shoppers.

Consumers are increasingly prioritizing health and wellness, which directly fuels demand for activewear and apparel made from comfortable, breathable materials. Hanesbrands, through its popular brands such as Champion and Hanes, is strategically positioned to benefit from this shift by providing products that support an active lifestyle. This growing emphasis on well-being also resonates with the market's appetite for functional and adaptable clothing options.

Consumers are increasingly prioritizing sustainability and ethical sourcing in their apparel purchases, pushing companies like Hanesbrands to adopt more responsible practices. This growing demand for ethically produced goods directly influences purchasing decisions, encouraging brands to highlight their commitment to environmental and social responsibility.

Hanesbrands has set ambitious sustainability targets, aiming to significantly increase its use of sustainably grown cotton and reduce greenhouse gas emissions by 50% by 2030 compared to a 2018 baseline. Furthermore, the company is working towards achieving zero waste to landfill across its global operations by 2025, demonstrating a tangible commitment to these evolving consumer values.

Demographic Shifts and Lifestyle Changes

Demographic shifts, such as the aging population in developed markets and the growing millennial and Gen Z consumer base in emerging economies, significantly impact apparel demand. For instance, the U.S. Census Bureau projects the 65+ population to reach 73.1 million by 2030, increasing the need for comfortable and accessible clothing. Hanesbrands must tailor its product lines, from intimate apparel to activewear, to meet the evolving needs of these diverse age groups and household structures, ensuring continued market relevance.

Lifestyle changes, including a greater emphasis on health and wellness, are driving demand for athleisure and comfortable, functional apparel. Hanesbrands' focus on brands like Champion, which saw significant growth in activewear categories, aligns with this trend. As consumer preferences shift towards versatility and comfort, Hanesbrands needs to continue innovating its product offerings to capture these evolving lifestyle demands across various demographic segments.

- Aging Population: By 2030, the U.S. population aged 65 and over is projected to reach 73.1 million, influencing demand for comfortable and easy-to-wear apparel.

- Millennial and Gen Z Influence: These younger demographics, known for their digital engagement and preference for casual wear, represent a growing market segment for Hanesbrands.

- Health and Wellness Trend: The increasing focus on active lifestyles fuels demand for athleisure and performance-oriented apparel, a key growth area for Hanesbrands.

- Household Structure Changes: Evolving family dynamics and single-person households can influence the types and quantities of apparel purchased.

Brand Loyalty and Perceptions

Hanesbrands has historically leveraged strong brand loyalty, built on perceptions of quality, comfort, and value across its portfolio. Brands like Hanes and Maidenform have long-standing recognition, fostering repeat purchases. While Champion was a significant contributor, its sale in late 2023 marks a strategic shift, necessitating renewed focus on other core brands.

The company's success hinges on maintaining positive consumer perceptions, especially in a crowded apparel market. Investments in marketing and product development aim to reinforce these perceptions. For instance, Hanes' "It costs what it costs" campaign in 2024 aimed to highlight affordability and value, resonating with budget-conscious consumers.

Sociological factors significantly influence brand loyalty. In 2024, consumer preferences continued to lean towards brands that align with personal values, such as sustainability and ethical production. Hanesbrands has been increasing its focus on these areas, with initiatives like its "Sustainable Comfort" program, aiming to appeal to a growing segment of socially conscious shoppers.

The company's brand portfolio, including Bonds in Australia and New Zealand, demonstrates how regional sociological nuances can impact brand perception and loyalty. Bonds, for example, has a strong connection with Australian consumers, emphasizing comfort and everyday wear, which differs from the brand positioning in other markets.

Sociological factors, including evolving consumer values and demographic shifts, are paramount for Hanesbrands. The increasing demand for sustainability and ethical practices, exemplified by Hanes' 2030 goal to reduce greenhouse gas emissions by 50% from a 2018 baseline, directly shapes purchasing decisions. Furthermore, demographic trends, such as the projected growth of the 65+ population in the U.S. to 73.1 million by 2030, necessitate adaptable product lines catering to comfort and accessibility.

Brand perception and loyalty are deeply intertwined with these sociological shifts. Hanesbrands' efforts to reinforce perceptions of quality and value, as seen in its 2024 "It costs what it costs" campaign, aim to resonate with consumers prioritizing affordability. The company's regional brand strategies, like Bonds in Australia, highlight how localized sociological nuances influence brand connection and market success.

The pervasive health and wellness trend continues to fuel demand for athleisure and comfortable apparel, a segment where Hanesbrands, particularly with its Champion brand's historical performance, is strategically positioned. This focus on active lifestyles aligns with a broader societal emphasis on well-being, driving consumer preferences for functional and versatile clothing options across various age groups.

| Sociological Factor | Impact on Hanesbrands | Supporting Data/Initiative |

|---|---|---|

| Sustainability & Ethics | Drives demand for responsible sourcing and production. | Goal: 50% GHG reduction by 2030 (vs. 2018); Zero waste to landfill by 2025. |

| Demographic Shifts (Aging Population) | Increases need for comfortable, accessible apparel. | U.S. 65+ population projected to reach 73.1 million by 2030. |

| Health & Wellness Trend | Boosts demand for athleisure and performance wear. | Strategic focus on activewear brands. |

| Brand Perception & Value | Influences consumer loyalty and purchasing decisions. | 2024 "It costs what it costs" campaign highlighting affordability. |

Technological factors

Advancements in automation and robotics are significantly reshaping textile manufacturing, offering Hanesbrands a clear path to enhanced production efficiency and improved product consistency. These technologies directly address the company's ongoing supply chain restructuring and consolidation efforts, which aim to lower fixed costs and boost overall efficiencies. For instance, investments in automated cutting and sewing equipment can drastically reduce manual labor requirements, a key component in cost reduction strategies.

The ongoing surge in e-commerce demands that Hanesbrands invest in sophisticated digital platforms and streamlined online sales capabilities. This includes leveraging personalized marketing to connect with consumers effectively. In 2023, Hanesbrands reported that its direct-to-consumer (DTC) channel, heavily reliant on e-commerce, continued to be a significant growth driver.

Hanesbrands is actively enhancing its e-commerce footprint, understanding its vital role in expanding market reach and fostering deeper customer relationships. The company's strategic focus on modernizing its technology infrastructure aims to bolster its analytical and forecasting abilities, crucial for navigating the dynamic digital retail landscape.

Leveraging data analytics and artificial intelligence offers Hanesbrands significant advantages. These technologies can unlock deeper consumer insights, streamline inventory management, and refine demand forecasting accuracy. For instance, by analyzing vast datasets, Hanes can better understand purchasing patterns and preferences, leading to more targeted product development and marketing campaigns.

Hanesbrands is actively integrating advanced AI-driven analytics to bolster its innovation pipeline. This strategic move focuses on improving demand forecasting precision, optimizing inventory levels across its supply chain, and enabling more personalized marketing strategies. The company aims to enhance operational efficiency and deepen customer engagement through these data-centric initiatives.

Textile Innovation and Material Science

Innovations in textile technology are significantly shaping the apparel industry, presenting Hanesbrands with avenues for product enhancement and differentiation. The development of new fibers, the increasing adoption of sustainable materials, and the creation of advanced performance fabrics are key areas where Hanes can leverage material science. For instance, the company is actively pursuing its sustainability objectives by incorporating recycled polyester and responsibly sourced cotton into its product lines, demonstrating a commitment to these evolving material science advancements.

Hanesbrands' strategic focus on sustainability is directly tied to technological advancements in material science. By 2023, the company reported that 50% of its polyester was recycled, a testament to its investment in and adoption of innovative, eco-friendly materials. This commitment extends to their cotton sourcing, with a goal to use 100% sustainably sourced cotton by 2030, reflecting a proactive approach to integrating cutting-edge, environmentally conscious textiles into their global supply chain.

These technological factors translate into tangible benefits for Hanesbrands:

- Enhanced Product Performance: New fibers and fabric constructions can lead to improved durability, comfort, and functionality in apparel.

- Market Differentiation: Sustainable and innovative materials allow Hanes to offer unique products that appeal to environmentally conscious consumers.

- Cost Efficiencies: While initial investment may be required, advancements in material science can lead to more efficient production processes and reduced waste over time.

- Brand Reputation: A strong focus on sustainable and technologically advanced materials can bolster Hanesbrands' image as a forward-thinking and responsible company.

Supply Chain Technology and Traceability

Hanesbrands is focusing on advanced supply chain technologies to boost transparency and efficiency. By implementing solutions like blockchain, the company aims to improve traceability from raw materials to finished goods, ensuring more ethical sourcing practices. This aligns with a broader strategic priority to optimize its global operations for better responsiveness.

The company's commitment to supply chain optimization is evident in its ongoing investments. For instance, in 2023, Hanesbrands continued to refine its operational network, aiming for greater agility. Technologies that offer enhanced tracking and management are key to achieving this, supporting better inventory control and faster delivery times across its diverse product lines.

The benefits of these technological upgrades are significant:

- Enhanced Transparency: Blockchain technology provides an immutable ledger, allowing for clear visibility into product origins and movement.

- Improved Efficiency: Automation and better tracking reduce manual processes and minimize errors within the supply chain.

- Ethical Sourcing Assurance: Traceability helps verify compliance with labor standards and sustainability goals, crucial for brand reputation.

- Increased Responsiveness: Real-time data allows Hanesbrands to adapt more quickly to market changes and demand fluctuations.

Hanesbrands is leveraging advancements in automation and robotics to boost production efficiency, a key strategy in its supply chain restructuring. The company is also heavily investing in sophisticated digital platforms and e-commerce capabilities to expand its market reach and enhance customer engagement, with its direct-to-consumer channel showing significant growth in 2023.

The integration of data analytics and AI is a priority for Hanesbrands, aiming to improve consumer insights, inventory management, and demand forecasting accuracy. Furthermore, innovations in textile technology, such as new fibers and sustainable materials, are being adopted to enhance product performance and market differentiation. By 2023, 50% of Hanesbrands' polyester was recycled, underscoring this commitment.

Hanesbrands is implementing advanced supply chain technologies, like blockchain, to increase transparency and ethical sourcing. These upgrades are designed to improve traceability, reduce errors, and enhance the company's responsiveness to market changes, contributing to greater operational agility.

Legal factors

Hanesbrands must navigate a complex web of international trade regulations, encompassing import/export laws, customs duties, and various free trade agreements to ensure smooth global operations. Staying compliant is crucial for maintaining efficient supply chains and market access.

Shifts in these regulations, such as the imposition of U.S. tariffs, directly influence Hanesbrands' cost of goods sold and its ability to compete in key markets. The company's financial projections, including its full-year outlook for 2024, explicitly account for the anticipated financial impact of these U.S. tariffs.

Hanesbrands must navigate a complex web of labor laws across its global operations, encompassing minimum wage, overtime, and occupational safety regulations. Ensuring compliance in 2024 and beyond is paramount, especially given the company's significant manufacturing presence in countries with varying labor standards.

While Hanesbrands emphasizes ethical conduct, past criticisms regarding worker conditions, particularly in overseas facilities, underscore the ongoing need for rigorous adherence to labor laws and the strengthening of social responsibility initiatives. For instance, in 2023, the company reported investing in supply chain improvements aimed at enhancing worker well-being and ensuring fair labor practices.

Intellectual property rights are crucial for Hanesbrands to protect its valuable brand names, distinctive designs, and technological innovations. This legal protection is key to maintaining its market position and fending off counterfeit products that could dilute brand equity. In 2023, Hanesbrands continued to invest in defending its extensive portfolio, which includes globally recognized brands such as Hanes, Bonds, Maidenform, and Playtex, underscoring the importance of robust IP strategies.

Consumer Protection Laws

Hanesbrands must meticulously adhere to consumer protection laws across its global operations. These regulations cover everything from product safety and accurate labeling to truthful advertising and data privacy, all crucial for maintaining customer confidence and sidestepping costly legal repercussions. For instance, in 2023, the Federal Trade Commission (FTC) continued to enforce robust advertising standards, with companies facing significant fines for deceptive practices.

Navigating the diverse legal landscapes for apparel marketing presents a significant challenge. Different countries and regions impose unique requirements concerning product quality, material composition disclosures, and consumer information standards. The European Union's General Data Protection Regulation (GDPR), for example, sets a high bar for data privacy, impacting how Hanesbrands collects and utilizes customer information in its digital marketing efforts.

Key areas of compliance for Hanesbrands include:

- Product Safety Standards: Ensuring all garments meet stringent safety regulations, particularly for children's apparel, to prevent recalls and injuries.

- Truthful Advertising: Avoiding misleading claims about product performance, materials, or origin to uphold brand integrity.

- Data Privacy Compliance: Adhering to evolving privacy laws like GDPR and CCPA to protect customer data and maintain trust.

- Labeling Requirements: Providing accurate and comprehensive information on care instructions, material content, and country of origin as mandated by various jurisdictions.

Environmental Regulations

Environmental regulations are a significant legal factor for Hanesbrands, influencing everything from manufacturing to waste management. Stricter rules on emissions, chemical usage, and disposal necessitate ongoing investment in cleaner technologies and processes. For instance, Hanesbrands has committed to science-based targets for reducing greenhouse gas emissions, aiming for a 50% reduction in absolute scope 1 and 2 GHG emissions by 2030 from a 2018 baseline.

These legal requirements also drive the company's sustainability initiatives. Hanesbrands is working towards zero waste to landfill for its global facilities and targets 100% renewable electricity usage by 2030.

- Compliance Costs: Adhering to evolving environmental laws can increase operational expenses due to investments in pollution control and waste treatment.

- Sustainable Sourcing: Regulations may influence the sourcing of raw materials, pushing for more environmentally friendly options.

- Reporting Obligations: Companies like Hanesbrands must comply with various reporting requirements related to environmental impact and sustainability efforts.

- Product Lifecycle: Extended Producer Responsibility (EPR) laws, which are gaining traction, could impact how Hanesbrands manages its products after sale, particularly regarding recycling and disposal.

Hanesbrands faces legal scrutiny concerning product safety, particularly for children's wear, and must ensure accurate labeling and truthful advertising to maintain consumer trust. Compliance with data privacy laws like GDPR and CCPA is also critical, impacting how customer information is handled in marketing and sales efforts throughout 2024.

Environmental factors

Growing global awareness of climate change is pushing companies like Hanesbrands to prioritize reducing their environmental impact. This means looking closely at how products are made and where energy comes from.

Hanesbrands has made significant strides, reporting a 53% decrease in Scope 1 and 2 greenhouse gas emissions as of 2023 compared to their 2019 baseline. This progress aligns with their ambitious goal to source 100% renewable electricity across all their operations by 2030.

Hanesbrands faces environmental challenges related to water usage, especially in manufacturing locations prone to water scarcity. Stricter regulations on industrial water consumption are a key concern, pushing the company to adopt more efficient practices across its global operations.

The company has demonstrated a commitment to water conservation, achieving significant reductions in its water footprint. For instance, Hanesbrands reported a 21% reduction in water consumption intensity between 2017 and 2022, a testament to their ongoing efforts.

Their proactive approach has been recognized, with Hanesbrands receiving high scores from CDP for water security in recent years, including an A- in 2023. This indicates a robust strategy for managing water-related risks and opportunities, aligning with growing investor and consumer expectations for environmental stewardship.

The growing emphasis on waste reduction and circular economy principles is a significant environmental factor for Hanesbrands. The company is actively pursuing this by implementing robust recycling programs across its operations. This commitment is underscored by their goal of achieving zero waste across all facilities by 2025, a target that demonstrates a clear strategic direction towards minimizing landfill contributions.

Hanesbrands is also exploring innovative ways to extend product lifecycles and divert materials from landfills. Their involvement in upcycling programs is a tangible example of this initiative, transforming post-consumer waste into new products. This approach not only addresses waste management but also aligns with the broader shift towards a more sustainable, circular business model.

Sustainable Sourcing of Materials

The increasing consumer demand for environmentally conscious products is compelling Hanesbrands to focus on sustainably sourcing its raw materials. This shift is critical for maintaining brand reputation and market share in the apparel industry.

Hanesbrands has committed to using 100% recycled or degradable polyester and sustainably grown cotton. This ambitious goal aligns with global sustainability trends and addresses growing concerns about the environmental impact of textile production.

Supporting this commitment, 75% of Hanesbrands' cotton is already sourced from sustainable farms in the U.S. and Australia. This significant portion demonstrates tangible progress towards their 2025 goals, with plans to further increase this percentage.

- Sustainable Cotton Sourcing: 75% of Hanesbrands' cotton supply met sustainable criteria as of their latest reporting, with a target of 100% by 2025.

- Recycled Polyester Goal: The company aims for 100% of its polyester to be recycled or degradable by 2025, a key initiative to reduce plastic waste.

- Supply Chain Transparency: Enhancing transparency in material sourcing is crucial for verifying sustainability claims and building consumer trust.

Biodiversity and Ecosystem Impact

The impact of manufacturing and sourcing on biodiversity and local ecosystems is an increasingly important environmental consideration for companies like Hanesbrands. As consumer and regulatory pressure grows, understanding and mitigating the ecological footprint becomes crucial. This involves examining how the company's operations, from raw material sourcing to production facilities, affect natural habitats and the biodiversity within them.

While Hanesbrands' sustainability reports may not always detail specific biodiversity metrics, a comprehensive approach to environmental stewardship necessitates addressing these concerns. This means actively working to minimize harm to natural habitats and promoting responsible land use practices throughout its extensive supply chain. For instance, sourcing cotton, a key material, can have significant impacts on land and water use, potentially affecting local ecosystems.

In 2023, the fashion industry faced scrutiny regarding its environmental impact, with reports highlighting the significant water usage and land conversion associated with textile production. For example, cotton cultivation alone accounts for a substantial portion of global pesticide use. Hanesbrands, like its peers, is therefore compelled to evaluate and improve its practices to ensure they are not detrimental to biodiversity.

To address these challenges, companies are increasingly adopting strategies such as:

- Promoting sustainable agriculture: Encouraging farming methods that reduce water consumption and pesticide reliance for raw materials like cotton.

- Implementing responsible sourcing policies: Ensuring that suppliers adhere to environmental standards that protect local ecosystems and biodiversity.

- Investing in habitat restoration: Supporting projects that help to repair or protect natural environments impacted by industrial activities.

- Enhancing supply chain transparency: Gaining a clearer understanding of where materials come from and the environmental practices employed at each stage.

Hanesbrands is actively managing its environmental footprint, with a strong focus on reducing greenhouse gas emissions and increasing renewable energy usage. The company reported a 53% decrease in Scope 1 and 2 emissions by 2023 from a 2019 baseline and aims for 100% renewable electricity by 2030.

Water conservation is another key area, with Hanesbrands achieving a 21% reduction in water consumption intensity between 2017 and 2022 and earning an A- from CDP for water security in 2023.

Waste reduction is also a priority, with a goal of zero waste across all facilities by 2025, supported by recycling programs and upcycling initiatives.

The company is committed to sustainable material sourcing, targeting 100% recycled or degradable polyester and sustainably grown cotton by 2025, with 75% of its cotton already meeting these criteria.

| Environmental Goal | Target Year | Progress/Status | Key Initiatives |

|---|---|---|---|

| Reduce Scope 1 & 2 GHG Emissions | Ongoing (2030) | 53% reduction by 2023 (vs. 2019 baseline) | Energy efficiency, renewable energy sourcing |

| Source 100% Renewable Electricity | 2030 | Active transition | On-site solar, renewable energy credits |

| Reduce Water Consumption Intensity | Ongoing (2025) | 21% reduction by 2022 (vs. 2017) | Water-efficient manufacturing processes |

| Achieve Zero Waste to Landfill | 2025 | Active implementation | Recycling programs, waste diversion strategies |

| Source 100% Recycled/Degradable Polyester | 2025 | Active transition | Material innovation, supply chain partnerships |

| Source 100% Sustainably Grown Cotton | 2025 | 75% achieved (as of latest reporting) | Sustainable farming partnerships, traceability |

PESTLE Analysis Data Sources

Our Hanes PESTLE Analysis is built on a robust foundation of data from reputable sources, including government economic reports, industry-specific market research, and global regulatory updates. We ensure each factor is supported by current and credible information.