Hanes Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanes Bundle

Hanes's competitive landscape is shaped by powerful forces, from the intense rivalry among established brands to the constant pressure from substitute products. Understanding these dynamics is crucial for any stakeholder in the apparel industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hanes’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Hanesbrands' suppliers generally hold moderate bargaining power. This is largely because the primary raw materials, such as cotton and synthetic fibers used in basic apparel, are widely available and considered commodities. While Hanesbrands has significant vertical integration, meaning they own many of their manufacturing facilities, they still depend on outside sources for these essential inputs.

The sheer scale of Hanesbrands' operations, as a global leader in apparel, means they purchase vast quantities of materials. This substantial purchasing volume tends to lessen the individual leverage of most raw material suppliers, as Hanesbrands represents a significant portion of their business, making it harder for any single supplier to dictate terms.

For Hanesbrands, the bargaining power of suppliers is generally kept in check by low switching costs for common raw materials like generic fibers. This means Hanesbrands can readily shift to alternative suppliers for these basic inputs without incurring significant expense or disruption. For instance, in 2023, Hanesbrands continued its strategy of diversifying its sourcing for cotton and polyester, a key component in its apparel, to mitigate risks associated with any single supplier.

However, the situation shifts for more specialized inputs. If Hanesbrands requires components with unique specifications or materials sourced from suppliers adhering to stringent sustainability certifications, the costs and complexities of switching can increase. This is particularly relevant as the company increasingly focuses on ESG initiatives, meaning a supplier’s compliance with these standards can create higher switching barriers, thereby increasing their bargaining power.

Hanesbrands actively works to manage supplier relationships and optimize its supply chain, aiming to reduce its dependence on any single source. This focus on efficiency and responsiveness in its operations, including its extensive global manufacturing footprint, helps to maintain leverage. By building strong relationships and exploring multiple sourcing avenues, the company can better negotiate terms and ensure a stable supply of materials, even for specialized needs.

The threat of raw material suppliers moving into apparel manufacturing, known as forward integration, is generally low for companies like Hanesbrands. This is because it demands substantial capital outlays and specialized knowledge in areas such as fashion design, brand building, and extensive retail networks.

Suppliers typically don't possess the established brand equity or the crucial retail partnerships that Hanesbrands has cultivated over years. For instance, a fabric mill, while proficient in textile production, would face immense challenges in replicating Hanesbrands' consumer reach and marketing prowess, which is vital in the competitive apparel market.

This low likelihood of suppliers integrating forward significantly curtails their bargaining power. They are less likely to dictate terms or raise prices aggressively when they cannot easily bypass Hanesbrands and sell directly to consumers.

Uniqueness and Differentiation of Supplier Offerings

For basic apparel, most raw materials are essentially commodities, meaning there's not much difference between what various suppliers offer. This lack of uniqueness generally keeps supplier power in check.

However, the growing emphasis on sustainability is changing this dynamic. Suppliers who can provide certified organic cotton, recycled polyester, or other innovative eco-friendly materials are finding themselves with more leverage. These differentiated offerings are increasingly sought after by both consumers and brands like Hanesbrands, giving these specialized suppliers more bargaining power.

- Commoditized Materials: Standard cotton or polyester offers little differentiation among suppliers, limiting their pricing power.

- Sustainable Demand: In 2024, the global sustainable apparel market is projected to reach over $10 billion, highlighting the growing importance of eco-friendly materials.

- Supplier Leverage: Suppliers of certified organic or recycled materials can command higher prices due to increased demand and limited availability of truly differentiated options.

Impact of Supplier Inputs on Hanesbrands' Cost Structure

The bargaining power of suppliers is a key factor influencing Hanesbrands' cost structure. While raw material costs, such as cotton and polyester, represent a substantial portion of its cost of goods sold, Hanesbrands leverages its considerable scale and ongoing strategic initiatives to manage these impacts effectively.

- Scale Advantages: Hanesbrands' large purchasing volume provides leverage with suppliers, allowing for potentially better pricing and terms.

- Supply Chain Optimization: The company actively pursues supply chain efficiencies, including sourcing diversification and improved logistics, to mitigate supplier power.

- Cost-Saving Measures: Hanesbrands implements various cost-saving programs across its operations, which can offset some of the pressure from rising input costs.

- Pricing Flexibility: While input cost fluctuations can affect profitability, Hanesbrands has shown an ability to manage these through operational improvements and strategic pricing adjustments. For example, in 2023, the company focused on driving productivity and cost savings, aiming to offset inflationary pressures on raw materials and other inputs.

The bargaining power of suppliers for Hanesbrands is generally moderate, primarily due to the commoditized nature of its core raw materials like cotton and polyester. While Hanesbrands' substantial purchasing volume provides leverage, suppliers of specialized or sustainably sourced materials can command greater influence. The threat of forward integration by suppliers is minimal, as they lack the brand equity and retail networks necessary to compete directly with Hanesbrands.

| Factor | Impact on Hanesbrands | 2023/2024 Data Points |

|---|---|---|

| Raw Material Availability | Generally high for basic fibers, limiting supplier power. | Cotton prices fluctuated in 2023, but Hanesbrands diversified sourcing. |

| Supplier Differentiation | Low for commodities; high for certified sustainable materials. | Demand for recycled polyester and organic cotton continues to grow. |

| Switching Costs | Low for commodity materials; higher for specialized inputs. | Hanesbrands actively manages supplier relationships to mitigate risks. |

| Forward Integration Threat | Low; suppliers lack brand and retail infrastructure. | Fabric mills typically focus on production, not consumer-facing operations. |

What is included in the product

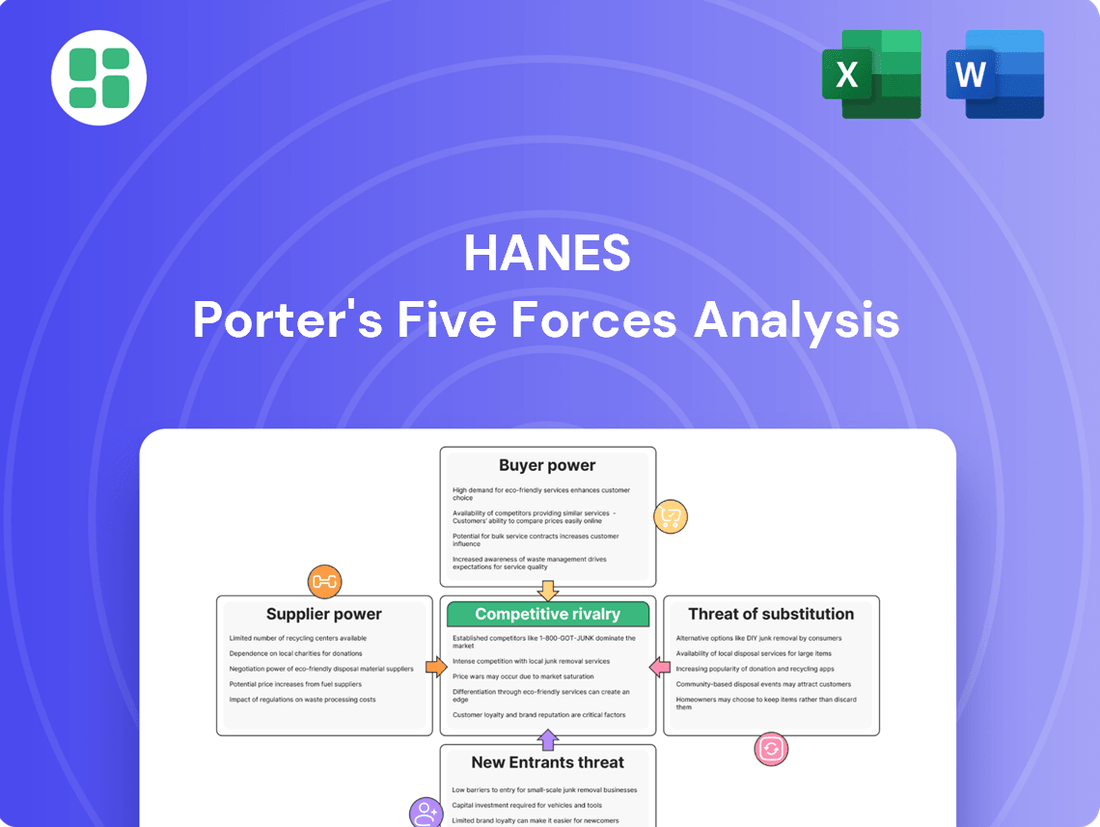

Hanes Porter's Five Forces Analysis dissects the competitive intensity within the apparel industry, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors to inform Hanes' strategic positioning.

Effortlessly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Hanesbrands relies on a diverse retail network, from big-box stores to online channels. Major retailers, by virtue of their substantial order volumes, wield significant influence, pushing for reduced pricing and advantageous terms. In 2023, Hanesbrands' top customers, like Walmart and Target, likely accounted for a considerable portion of their revenue, underscoring their bargaining leverage.

Customers for everyday basics like those Hanesbrands offers are quite sensitive to price. This is especially true now, with inflation making everyday goods more expensive for many families. For instance, in the first quarter of 2024, consumer price index (CPI) for apparel saw a modest increase, highlighting ongoing cost pressures.

This price sensitivity means Hanesbrands has to keep its prices competitive. If prices are too high, shoppers will simply look elsewhere. This can really squeeze the company's profit margins, as they might have to absorb some of the rising costs themselves rather than passing them all on.

Adding to this pressure is the sheer number of choices consumers have. The apparel market is crowded, with many brands offering similar basic items. This abundance of alternatives gives customers more power to demand lower prices, making it harder for any single company to command premium pricing.

The availability of numerous substitutes for basic apparel, such as private labels, other national brands, and unbranded options, greatly empowers Hanes' customers. This abundance means consumers face minimal costs or effort when switching between brands. For instance, in 2024, the athleisure market alone, a significant segment for apparel, saw intense competition with numerous brands offering similar products, driving down prices and increasing consumer choice.

Customer Information and Transparency

The rise of e-commerce and social media has dramatically increased customer access to information. Consumers can now effortlessly compare prices, read reviews, and research product sustainability, significantly boosting their bargaining power. This transparency forces brands like Hanesbrands to offer better value and be more responsive to consumer demands.

In 2024, the demand for transparency in supply chains continued to grow. A significant portion of consumers, estimated to be over 70% in some surveys, indicated a preference for brands with clear ethical and sustainable practices. This trend directly impacts Hanesbrands by increasing customer expectations regarding sourcing and production methods.

- Informed Purchasing: Customers in 2024 utilized online platforms to access detailed product information, leading to more discerning buying habits.

- Price Sensitivity: Easy price comparison tools empowered consumers to seek out the best deals, putting pressure on brands to maintain competitive pricing.

- Sustainability Demands: A growing segment of the market actively sought brands demonstrating commitment to environmental and social responsibility, influencing purchasing decisions.

- Review Influence: User-generated reviews and social media sentiment played a crucial role in shaping purchasing decisions, giving customers collective bargaining power.

Demand for Differentiated and Personalized Products

Modern consumers are increasingly seeking out products that are not only high-quality but also tailored to their individual needs and produced with sustainability in mind. This trend significantly impacts the bargaining power of customers within the apparel industry.

Hanesbrands, while a recognized name, operates heavily in the 'everyday basic apparel' segment. This means the company faces a constant challenge to innovate and adapt its offerings to meet these evolving consumer preferences. Failure to do so risks customers viewing its products as interchangeable commodities, thereby increasing their power to demand lower prices or seek alternatives.

The growing consumer interest in customization and on-demand manufacturing further amplifies this bargaining power. For instance, a 2024 report indicated that 60% of consumers are willing to pay a premium for personalized products. This shift in buying behavior forces companies like Hanesbrands to consider more flexible production models to retain customer loyalty.

- Increased demand for personalization: Consumers are actively seeking unique products.

- Sustainability as a key driver: Eco-conscious choices influence purchasing decisions.

- Commoditization risk: Basic apparel faces pressure from undifferentiated offerings.

- Impact of on-demand manufacturing: Customization options empower buyers.

The bargaining power of customers is a significant force for Hanesbrands, particularly in the competitive landscape of basic apparel. With numerous brands offering similar products, consumers can easily switch, forcing Hanesbrands to remain price-competitive and responsive to evolving demands. This is amplified by increased access to information and a growing preference for personalized and sustainable goods.

In 2024, the apparel market continued to see intense competition, with consumers leveraging online platforms for price comparisons and product research. This transparency directly translates to greater customer leverage, as demonstrated by the fact that over 70% of consumers, according to some 2024 surveys, expressed a preference for brands with clear ethical and sustainable practices. The rise of customization also plays a role, with reports indicating that as many as 60% of consumers in 2024 were willing to pay more for personalized items, further empowering buyers to seek tailored value.

| Factor | Impact on Hanesbrands | 2024 Data Point |

|---|---|---|

| Price Sensitivity | Customers readily switch for lower prices. | Apparel CPI saw modest increases in Q1 2024. |

| Availability of Substitutes | Numerous brands offer similar basics. | Athleisure market in 2024 showed intense brand competition. |

| Information Access | Online research empowers informed decisions. | Over 70% of consumers prefer transparent brands (2024 surveys). |

| Demand for Personalization | Customization increases buyer leverage. | 60% of consumers willing to pay premium for personalized products (2024 report). |

Full Version Awaits

Hanes Porter's Five Forces Analysis

This preview showcases the complete Hanes Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the apparel industry, including threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products, and intensity of rivalry among existing competitors. The document you see here is precisely the same professionally formatted analysis you'll receive immediately after purchase, ready for your strategic planning needs.

Rivalry Among Competitors

The basic apparel market, Hanesbrands' primary arena, is a mature industry. Projections for its growth are modest, signaling a landscape where expansion opportunities are limited.

This slow growth naturally fuels intense competitive rivalry. Companies like Hanesbrands must aggressively fight for every bit of market share in an already saturated market. For instance, in 2024, the global apparel market is expected to see a growth rate of around 3-4%, a figure that, while positive, underscores the mature nature of the sector.

Compounding these challenges are economic uncertainties and unpredictable consumer demand. These factors create a volatile environment, making it harder for businesses to plan and maintain stable sales volumes.

Hanesbrands operates in a highly competitive landscape, facing formidable rivals like Gildan Activewear and Fruit of the Loom, both significant global apparel manufacturers. In 2024, the apparel industry continues to see a proliferation of private label brands from major retailers, further fragmenting market share and intensifying rivalry.

This crowded market necessitates aggressive pricing, substantial marketing investments, and a constant drive for product innovation to capture and maintain consumer attention. For instance, Gildan reported net sales of $3.1 billion for the fiscal year 2023, showcasing the scale of operations and competitive pressures faced by Hanes.

While Hanesbrands boasts recognizable names like Hanes and Bonds, the basic apparel market often sees products treated as commodities, fueling price-driven competition. For instance, in 2024, the company continued to emphasize its Hanes Moves athleisure line, aiming to carve out distinct market segments through innovation and targeted marketing.

To combat this, Hanesbrands is actively investing in product innovation and brand development to stand out and foster deeper consumer connections. This strategic push is vital for building strong brand loyalty, which serves as a key defense against the pressures of aggressive price wars common in the apparel industry.

Exit Barriers and Fixed Costs

The apparel manufacturing sector is characterized by substantial fixed costs, encompassing significant investments in specialized machinery, extensive factory floor space, and intricate global supply chain networks. These high capital outlays create considerable exit barriers, making it economically challenging for firms to simply cease operations and divest assets. Consequently, companies may be compelled to continue competing even when facing reduced profitability, which naturally fuels more intense rivalry among existing players.

For instance, Hanesbrands has been actively engaged in streamlining its operations and reducing its fixed cost base. In 2023, the company continued its supply chain optimization initiatives, aiming to enhance operational efficiency and flexibility. These strategic moves are crucial for navigating a competitive landscape where high fixed costs can otherwise lock companies into suboptimal market positions.

- High Fixed Costs: Apparel manufacturing requires substantial upfront investment in plant, property, and equipment.

- Exit Barriers: The specialized nature of machinery and infrastructure makes exiting the industry difficult and costly.

- Intensified Rivalry: High exit barriers can force companies to stay in the market, leading to increased competition, especially during downturns.

- Strategic Cost Reduction: Companies like Hanesbrands focus on reducing fixed costs to improve agility and competitive positioning.

Strategic Initiatives and Cost-Cutting

Hanesbrands is navigating intense competition through a robust strategic transformation. This includes significant cost-saving initiatives, aiming to streamline operations and boost profitability in a challenging market. For instance, the company has been focused on reducing its operating expenses to improve its bottom line.

The company's efforts extend to optimizing its supply chain and actively working to reduce its debt burden, both crucial steps in fortifying its financial standing against rivals. By focusing on operational efficiency, Hanesbrands is better positioned to respond to market pressures and invest in growth areas.

Hanesbrands' commitment to financial stability is underscored by investments in technology. These advancements are designed to enhance forecasting accuracy and improve inventory management, directly addressing the need for agility in a highly competitive apparel sector.

- Strategic Transformation: Hanesbrands is implementing a comprehensive plan focused on cost reduction and operational improvements.

- Financial Health: Initiatives include supply chain optimization and debt reduction to strengthen the company's balance sheet.

- Technology Investment: The company is leveraging technology for better demand forecasting and inventory control to gain a competitive edge.

- Cost-Saving Focus: Hanesbrands has identified and is executing specific cost-saving measures to enhance its competitive position.

The basic apparel market, Hanesbrands' primary arena, is a mature industry with modest growth projections, fueling intense competitive rivalry as companies fight for market share. In 2024, the global apparel market's expected growth of around 3-4% highlights this saturation, with private label brands from major retailers further fragmenting the market. This environment necessitates aggressive pricing and marketing, as seen with Gildan's $3.1 billion in net sales for 2023, underscoring the scale of competition.

| Competitor | 2023 Net Sales (USD Billions) | Key Product Areas |

|---|---|---|

| Gildan Activewear | 3.1 | Activewear, socks, hosiery |

| Fruit of the Loom | Not Publicly Disclosed (part of Berkshire Hathaway) | Underwear, activewear, bedding |

| Hanesbrands | 6.59 (2023) | Underwear, activewear, hosiery, intimate apparel |

SSubstitutes Threaten

The threat of substitutes for Hanesbrands' core basic apparel products is quite substantial. Consumers can easily switch to unbranded apparel, private label offerings from major retailers, or even generic, lower-cost alternatives that perform the same basic function. This is particularly relevant as consumers, facing economic pressures and inflation, are increasingly looking for ways to save money. For instance, the average inflation rate in the US hovered around 3.4% for much of 2024, impacting household budgets.

The growing popularity of athleisure wear presents a significant threat of substitution for traditional innerwear and activewear. Consumers are increasingly opting for comfortable, versatile clothing that can be worn for both athletic activities and casual outings. This shift means that products previously categorized solely as innerwear might be replaced by athleisure alternatives, impacting demand for Hanesbrands' core offerings.

Hanesbrands has proactively addressed this trend by introducing its Hanes Moves athleisure line. This strategic move aims to directly compete within the burgeoning athleisure market and capture a share of this evolving consumer demand. The company's 2023 annual report indicated growth in its activewear segment, partly driven by such new product introductions, signaling an effort to mitigate substitution risks.

More broadly, a general consumer preference for comfort-driven clothing further fuels this substitution threat. As individuals prioritize ease and relaxation in their wardrobes, categories that offer enhanced comfort, even if they weren't traditionally considered direct competitors, can become substitutes. This widespread movement towards comfort impacts purchasing decisions across various apparel segments.

The burgeoning second-hand and circular fashion markets pose a significant threat of substitution for new apparel sales. Consumers are increasingly drawn to pre-owned clothing and upcycling initiatives, driven by both a desire for sustainability and cost savings. For instance, the global second-hand apparel market was valued at approximately $177 billion in 2023 and is projected to reach $351 billion by 2027, indicating a substantial shift in consumer spending away from new garments.

Do-It-Yourself (DIY) and Repair Culture

The burgeoning do-it-yourself (DIY) and repair culture presents a subtle but growing threat to apparel companies like Hanes. Driven by increasing environmental awareness and a desire to save money, consumers are more inclined to mend their existing clothing or even fashion new items from scratch. This trend, while not yet a dominant force, could gradually chip away at the demand for new, basic apparel purchases.

For instance, the secondhand apparel market, a close cousin to the DIY ethos, saw significant growth. In 2023, the global secondhand apparel market was valued at approximately $186 billion and is projected to reach $350 billion by 2027, indicating a strong consumer interest in extending the life of garments.

- DIY & Repair Culture: Consumers are increasingly opting to mend or create their own clothing.

- Sustainability Drivers: Environmental concerns are a key motivator behind this shift.

- Economic Factors: Cost savings also encourage consumers to repair rather than replace.

- Market Impact: This trend could reduce demand for new basic apparel, although its current scale is relatively small compared to overall market size.

Impact of Digital Fashion and Virtual Experiences

The rise of digital fashion and virtual experiences presents a subtle but growing threat of substitutes for traditional apparel. While virtual try-ons primarily enhance the current shopping journey, they could gradually diminish the perceived necessity of physical garments, especially for items driven by fleeting trends or novelty. For instance, in 2024, the metaverse fashion market was projected to reach $50 billion, indicating a significant shift in consumer engagement with digital attire.

Although these virtual options are not direct replacements for the functional needs of basic clothing, they represent a fundamental change in how consumers interact with and value fashion. This evolution can divert discretionary spending away from physical apparel, impacting categories like fast fashion and occasion wear. By 2025, it's estimated that over 70% of the global population will have some form of metaverse presence, further solidifying the potential for digital alternatives.

- Digital Fashion Market Growth: The metaverse fashion market is expected to continue its rapid expansion, potentially reaching hundreds of billions by the end of the decade.

- Consumer Engagement Shift: Consumers are increasingly allocating time and money to virtual goods and experiences, altering spending priorities.

- Impact on Novelty Apparel: Trend-driven and novelty clothing items are most susceptible to substitution by digital counterparts due to their lower emphasis on pure functionality.

The threat of substitutes for Hanesbrands' basic apparel is significant, encompassing unbranded goods, private labels, and lower-cost alternatives. Economic pressures, like the 3.4% average US inflation in 2024, push consumers toward more budget-friendly options. Furthermore, the booming athleisure market and the growing secondhand apparel market, valued at $186 billion in 2023, present substantial substitution risks by offering comfort and value alternatives.

| Threat Category | Description | Key Drivers | Market Data Point |

| Unbranded/Private Label | Consumers opting for cheaper, non-Hanes brands or store brands. | Price sensitivity, inflation (3.4% US avg. 2024). | N/A (broad category) |

| Athleisure Wear | Versatile clothing replacing traditional innerwear/activewear. | Comfort, lifestyle shift. | Hanes' activewear segment growth (2023). |

| Secondhand/Circular Fashion | Pre-owned or upcycled clothing as alternatives. | Sustainability, cost savings. | Global secondhand apparel market: $186B (2023), projected $350B (2027). |

| DIY & Repair Culture | Mending existing clothes or making new ones. | Environmental awareness, cost savings. | N/A (growing trend) |

Entrants Threaten

The capital needed to build significant apparel manufacturing facilities, establish robust global sourcing relationships, and create efficient distribution networks is immense, acting as a major hurdle for newcomers. For instance, setting up a modern textile manufacturing plant can easily cost tens of millions of dollars, not including the ongoing investment in technology and supply chain infrastructure.

Established companies like Hanesbrands leverage considerable economies of scale. In 2023, Hanesbrands reported net sales of $3.9 billion, a scale that allows them to negotiate better prices for raw materials and achieve lower per-unit production costs. This cost advantage makes it incredibly difficult for smaller, emerging brands to compete on price.

Hanesbrands benefits from deeply ingrained brand recognition and customer loyalty with its stable of popular names like Hanes, Bonds, Maidenform, and Playtex. Newcomers face a steep uphill battle, needing substantial marketing budgets and time to cultivate similar trust and awareness in the competitive basic apparel sector.

Gaining access to established retail channels presents a substantial barrier for new apparel companies. Hanesbrands, for instance, has cultivated strong relationships with major department stores and mass merchandisers, securing prominent shelf space and broad distribution networks. In 2024, Hanesbrands' extensive retail footprint, encompassing thousands of doors across the US, highlights this advantage.

Newcomers would find it exceptionally difficult to replicate this widespread retail presence, often being relegated to online channels initially. This limited reach significantly hampers their ability to compete with established players like Hanesbrands, which benefits from decades of retail partnership and consumer recognition built through these channels.

Supply Chain Complexity and Vertical Integration

Hanesbrands' vertically integrated supply chain, encompassing owned manufacturing facilities, grants significant control over quality, costs, and production schedules. For instance, in 2023, Hanes continued its efforts to optimize its supply chain, aiming for greater efficiency and responsiveness to market demands, a testament to its ongoing investment in this area.

New entrants face a formidable challenge in replicating this level of integration. They would need to establish or secure dependable and efficient supply chains, navigating the intricate landscape of sourcing raw materials, managing logistics, and ensuring ethical compliance, all of which represent substantial barriers to entry. The capital investment and operational expertise required are considerable.

- Vertical Integration: Hanesbrands controls its manufacturing, offering a competitive edge in cost and quality.

- Supply Chain Barriers: New entrants must overcome significant hurdles in sourcing, logistics, and ethical sourcing.

- Efficiency Focus: Hanes actively optimizes its supply chain for improved responsiveness and cost-effectiveness.

Regulatory and Sustainability Compliance

The apparel industry faces escalating regulatory and sustainability compliance hurdles, significantly impacting new entrants. For instance, the European Union's proposed Ecodesign for Sustainable Products Regulation (ESPR), expected to be fully implemented by 2026, will mandate stricter requirements for product durability, repairability, and recycled content, demanding substantial upfront investment from newcomers.

New companies must navigate a complex web of environmental and ethical sourcing standards. Compliance with directives like the German Supply Chain Due Diligence Act, which came into effect in 2023, requires robust systems for monitoring human rights and environmental risks throughout the supply chain. This necessitates considerable investment in traceability technology and auditing processes, creating a barrier to entry.

Meeting these evolving demands requires significant capital and specialized knowledge. For example, achieving certifications like the Global Organic Textile Standard (GOTS) or Fair Trade involves rigorous auditing and adherence to strict production criteria, adding to the cost of goods sold for new businesses.

- Increased Capital Requirements: New entrants must allocate significant funds towards compliance infrastructure, certifications, and sustainable material sourcing, potentially increasing initial operating costs by 15-20% compared to established players with existing systems.

- Expertise Gap: Startups often lack the in-house expertise to navigate complex regulations and implement effective sustainability strategies, requiring costly external consultants.

- Supply Chain Complexity: Ensuring ethical sourcing and environmental compliance across global supply chains demands advanced traceability solutions, a significant undertaking for nascent businesses.

The threat of new entrants in the apparel market is significantly mitigated by the substantial capital required for manufacturing, sourcing, and distribution, alongside the established brand loyalty and extensive retail networks enjoyed by incumbents like Hanesbrands. Newcomers face considerable challenges in matching the economies of scale that allow established players to offer competitive pricing, and replicating the widespread market access secured through decades of retail partnerships is a formidable hurdle.

Furthermore, the increasing complexity of regulatory and sustainability compliance, demanding significant investment in specialized knowledge and traceability systems, acts as a further deterrent for emerging businesses. These combined factors create a high barrier to entry, protecting the market position of established companies.

| Barrier Type | Description | Impact on New Entrants | Example Data/Fact |

|---|---|---|---|

| Capital Requirements | Establishing manufacturing, sourcing, and distribution infrastructure. | High initial investment needed, often in tens of millions for modern facilities. | Textile plant setup can exceed $10 million. |

| Economies of Scale | Lower per-unit costs due to large-scale production and purchasing. | New entrants struggle to compete on price against established players. | Hanesbrands' 2023 net sales of $3.9 billion indicate significant scale advantages. |

| Brand Recognition & Loyalty | Established trust and awareness among consumers. | Newcomers require substantial marketing spend and time to build comparable brand equity. | Hanesbrands' portfolio includes well-known brands like Hanes, Bonds, Maidenform. |

| Retail Channel Access | Securing shelf space and distribution networks. | New entrants face limited reach, often starting online, while incumbents have thousands of retail doors. | Hanesbrands' extensive US retail footprint in 2024. |

| Regulatory Compliance | Meeting evolving environmental and ethical standards. | Requires investment in new technologies and expertise for compliance. | EU's ESPR (2026) and Germany's Supply Chain Due Diligence Act (2023) increase compliance costs. |

Porter's Five Forces Analysis Data Sources

Our Hanes Porter's Five Forces analysis is built upon a foundation of diverse data sources, including Hanes' own annual reports and SEC filings, alongside industry-specific market research reports and competitor financial disclosures.