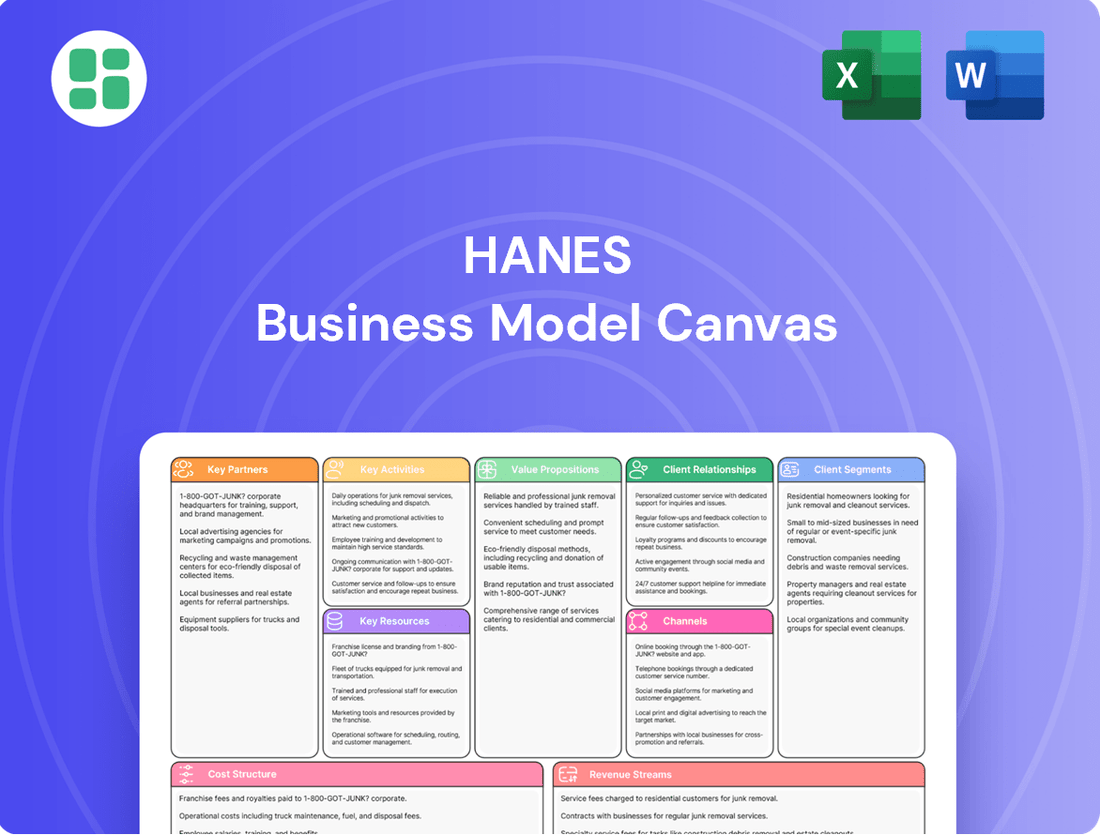

Hanes Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanes Bundle

Explore the core components of Hanes's enduring success with our comprehensive Business Model Canvas. Uncover their customer relationships, revenue streams, and key resources that drive their market dominance. Perfect for anyone seeking to understand the strategic framework of a retail giant.

Partnerships

Hanesbrands Inc. cultivates extensive relationships with a diverse array of retailers, from mass merchandisers to specialty shops, forming the backbone of its global apparel distribution. These vital partnerships ensure widespread availability of its popular brands, including Hanes, Bonds, Maidenform, and Playtex, reaching consumers across numerous markets.

The company actively strengthens ties with its most important retail partners. This focus aims to secure more prominent shelf placement and expand distribution across various sales channels, a strategy that contributed to Hanesbrands' net sales of $6.5 billion in 2023.

Hanesbrands relies on a vast network of global supply chain partners, operating in over 45 countries, to source raw materials, components, and finished goods. These relationships are critical for achieving cost-effectiveness, upholding product quality, and ensuring ethical sourcing practices throughout its operations.

In 2024, Hanesbrands continued to emphasize real-time visibility into supplier performance. This allows them to actively monitor and manage compliance with both internal corporate standards and external regulatory mandates, ensuring a robust and responsible supply chain.

Hanesbrands collaborates with technology and innovation partners to integrate advanced analytics and AI into its operations. This focus aims to sharpen demand forecasting accuracy and elevate customer engagement strategies. For instance, in 2024, Hanesbrands continued to invest in digital transformation initiatives, seeking partners to enhance its supply chain visibility and optimize inventory management through predictive modeling.

Logistics and Transportation Partners

Hanesbrands relies heavily on its logistics and transportation partners to keep its global supply chain moving smoothly. These include freight carriers, warehousing providers, and shipping companies that handle everything from raw materials to finished goods. This network is crucial for ensuring products reach shelves and customers efficiently and affordably.

A key aspect of Hanesbrands' commitment to sustainability in its logistics is its renewed partnership with the U.S. EPA's SmartWay Transport program. This collaboration underscores their dedication to minimizing the environmental impact of their transportation operations.

- Freight Carriers: Essential for moving large volumes of goods between manufacturing, distribution, and retail points.

- Warehousing Services: Provide storage and inventory management, ensuring products are available when and where needed.

- Shipping Companies: Facilitate the final delivery to retailers and direct-to-consumer channels.

- SmartWay Partnership: Demonstrates a focus on reducing carbon emissions and improving fuel efficiency in transportation, a critical factor for a global apparel company.

Licensing and Brand Management Firms

Hanesbrands leverages licensing and brand management firms to extend the reach of its portfolio. For instance, the strategic divestiture of its global Champion business to Authentic Brands Group in June 2024 exemplifies this approach. This partnership allows Hanesbrands to streamline its operations and concentrate on core growth areas.

These collaborations enable Hanesbrands to benefit from the expertise of partners who manage brand extensions and market presence in specific niches or regions. This strategic focus, coupled with the divestment of non-core assets, positions Hanesbrands for a more agile and targeted business model.

- Brand Extension: Licensing partners manage the development and marketing of new product lines under Hanesbrands' established labels.

- Market Focus: These firms specialize in specific geographic regions or consumer segments, optimizing brand visibility and sales.

- Portfolio Streamlining: Divesting certain brands, like Champion in June 2024, allows Hanesbrands to concentrate resources on its most promising growth opportunities.

- Operational Efficiency: By outsourcing brand management for specific extensions, Hanesbrands reduces its operational complexity and overhead.

Hanesbrands' key partnerships are crucial for its global distribution and supply chain, ensuring its popular brands reach consumers efficiently. The company actively cultivates relationships with retailers, from mass merchandisers to specialty shops, to secure prominent shelf placement and expand its sales channels. These collaborations are vital for Hanesbrands' net sales, which reached $6.5 billion in 2023.

The company also relies on a vast network of global supply chain partners, operating in over 45 countries, to source materials and manufacture goods, emphasizing cost-effectiveness and ethical practices. In 2024, Hanesbrands focused on enhancing real-time supplier performance monitoring to ensure compliance with internal and external standards.

Furthermore, Hanesbrands collaborates with technology and innovation partners to integrate advanced analytics and AI, improving demand forecasting and customer engagement. The strategic divestiture of its global Champion business to Authentic Brands Group in June 2024 exemplifies its approach to streamlining operations and concentrating on core growth areas through brand management firms.

| Partner Type | Role | Impact/Focus | Example/Data Point |

|---|---|---|---|

| Retailers | Distribution Channels | Widespread product availability, enhanced shelf placement | Net sales of $6.5 billion in 2023 |

| Supply Chain Partners | Sourcing & Manufacturing | Cost-effectiveness, quality, ethical sourcing, compliance | Operations in over 45 countries |

| Technology Partners | Innovation & Analytics | Demand forecasting, customer engagement, digital transformation | Investment in AI and predictive modeling in 2024 |

| Brand Management Firms | Brand Extension & Focus | Market presence, portfolio streamlining | Divestiture of Champion business in June 2024 |

What is included in the product

A detailed exploration of Hanes' operations, outlining its broad customer base, diverse distribution channels, and core value propositions focused on comfort and affordability.

Condenses complex Hanes operations into a clear, actionable framework, simplifying strategic analysis and identifying areas for efficiency.

Provides a visual roadmap of Hanes' value proposition and customer relationships, streamlining communication and problem-solving for stakeholders.

Activities

Hanesbrands actively designs and develops new apparel, emphasizing comfort and current trends in categories like innerwear and activewear. This process includes research into materials and fit to align with changing consumer desires.

The company is investing in its innovation pipeline, utilizing AI-driven analytics to improve how it predicts demand and develops new products. For instance, in 2023, Hanesbrands reported a sales increase in its Innerwear segment, partly driven by new product introductions and strategic marketing efforts.

Hanesbrands' manufacturing and sourcing is a core activity, with a strong emphasis on company-owned facilities globally. This approach, as of 2024, grants them significant control over product quality and adherence to ethical labor standards throughout their production chain.

This vertical integration is key to Hanesbrands' operational efficiency and cost management. In 2024, the company continued its strategic focus on supply chain consolidation and optimization, aiming to reduce fixed costs and enhance overall operational efficiencies.

Hanesbrands actively manages its portfolio of well-known brands, including Hanes, Bonds, Maidenform, and Playtex, through significant global marketing and brand management efforts. These initiatives encompass a range of advertising, digital marketing, and promotional strategies tailored to diverse consumer groups, aiming to enhance brand recognition and desirability.

In 2024, Hanesbrands continued its strategic focus on brand development and e-commerce expansion. This approach is designed to drive growth not only through the company's direct-to-consumer channels but also by strengthening relationships with retail partners.

Distribution and Logistics Management

Hanes manages a vast global distribution network, a critical activity for getting its apparel to market efficiently. This encompasses everything from keeping track of inventory and managing warehouses to arranging transportation, all aimed at speeding up delivery and cutting expenses.

In 2023, Hanesbrands reported a net sales decrease of 4% to $5.58 billion, highlighting the ongoing challenges in optimizing its supply chain and distribution. The company is actively consolidating its distribution centers to streamline operations and enhance responsiveness.

- Global Network: Overseeing a complex international web of distribution and logistics is fundamental to Hanes' operations.

- Operational Focus: Key activities include inventory control, warehousing solutions, and transportation management to ensure timely product delivery.

- Efficiency Drive: Hanes is committed to supply chain optimization, evidenced by initiatives like distribution center consolidation to boost efficiency and reduce costs.

Sales and Customer Relationship Management

Hanesbrands actively cultivates robust relationships with its retail partners, a critical component of its sales strategy. This involves dedicated key account management to secure prime shelf space and expand distribution, a focus that contributed to Hanesbrands achieving approximately $6.0 billion in net sales for the fiscal year 2023. The company also prioritizes its direct-to-consumer (DTC) channel, leveraging e-commerce platforms to connect directly with shoppers.

The sales force management is integral to executing these strategies, ensuring effective outreach and support across all sales avenues. This direct engagement allows Hanesbrands to better understand consumer needs and adapt its product offerings accordingly.

Key activities in this area include:

- Managing relationships with major retail chains to enhance product visibility and availability.

- Developing and executing sales strategies for the direct-to-consumer e-commerce channel.

- Optimizing the performance of the internal sales team through training and support.

- Securing increased shelf space and distribution gains with key retail partners, as demonstrated by their ongoing efforts in 2023.

Hanesbrands' key activities revolve around designing and developing apparel, with a significant focus on innovation and leveraging AI for demand forecasting. Their vertically integrated manufacturing and sourcing approach, utilizing company-owned facilities globally as of 2024, ensures quality control and ethical production. Furthermore, the company actively manages its brand portfolio through extensive marketing, including digital strategies, and cultivates strong relationships with retail partners while expanding its direct-to-consumer e-commerce presence.

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means all sections, formatting, and content are identical to the final deliverable, ensuring no surprises. You'll gain immediate access to this complete, ready-to-use file, allowing you to directly apply its insights to your business strategy.

Resources

Hanesbrands' key resources are anchored by its robust portfolio of well-established brands. This includes enduring names like Hanes, Maidenform, and Playtex, which have cultivated significant consumer trust and market presence over time. These brands represent a substantial intangible asset, driving customer loyalty and providing a distinct competitive edge.

While Champion was a significant brand, Hanesbrands has strategically divested its global operations, focusing its resources on its core innerwear and activewear segments. This strategic shift allows for concentrated investment in brands like Hanes, which continues to be a dominant force in the innerwear market. In 2023, the Hanes brand alone generated substantial revenue, underscoring its importance.

Hanesbrands operates a robust global manufacturing and supply chain infrastructure, with a significant portion of its facilities being company-owned. This ownership provides direct control over production and distribution, fostering efficiency and cost-effectiveness across its worldwide operations.

This integrated network of factories and distribution centers is crucial for Hanesbrands' ability to manage its supply chain tightly. For instance, in 2023, the company continued to optimize its global footprint, leveraging its owned assets to streamline operations and respond to market demands, a strategy that underpins its competitive advantage.

The company-owned infrastructure also serves as a key channel for embedding sustainability initiatives directly into its business model. By controlling its manufacturing and logistics, Hanesbrands can more effectively implement and monitor environmental and social governance practices throughout its value chain, aligning with growing consumer and investor expectations for responsible business conduct.

Hanesbrands' success hinges on its extensive and skilled workforce, encompassing everything from product design and manufacturing to the intricate networks of logistics, marketing, and sales. This deep pool of talent is essential for driving innovation, ensuring smooth operations, and effectively carrying out the company's strategic vision.

The company's management team brings a wealth of experience, guiding Hanesbrands through the dynamic apparel market. Their expertise is critical for making sound decisions and adapting to changing consumer demands and industry trends. For instance, in 2023, Hanesbrands continued to invest in its people, recognizing that human capital is a key differentiator in achieving operational excellence and market leadership.

Furthermore, Hanesbrands emphasizes the passion of its associates, who are dedicated to producing high-quality goods while maintaining a strong commitment to environmental responsibility and social well-being. This commitment is reflected in their ongoing efforts towards sustainability, a core value that resonates with both employees and consumers.

Intellectual Property and Design Capabilities

HanesBrands' intellectual property, including proprietary designs, patents, and trademarks for its extensive apparel lines, forms a crucial asset. These protections are vital for safeguarding its unique product offerings and manufacturing innovations.

The company's robust design and innovation capabilities are paramount to its market position. These strengths enable the continuous development of new apparel, ensuring HanesBrands remains competitive. For instance, in 2023, the company continued to invest in its design studios and R&D to bring fresh styles and improved comfort to its brands like Champion and Hanes.

- Proprietary Designs: HanesBrands holds numerous design registrations for its apparel, differentiating its products in a crowded market.

- Patents: The company possesses patents related to innovative fabric technologies and manufacturing processes, enhancing product performance and efficiency.

- Trademarks: Key brand names such as Champion, Hanes, Bali, and Maidenform are registered trademarks, representing significant brand equity and consumer recognition.

- Design & Innovation Investment: HanesBrands allocates resources to advanced analytics and trend forecasting to drive product innovation, a strategy that has historically supported sales growth.

Financial Capital

Financial capital is the lifeblood of Hanesbrands' operations, enabling everything from daily functioning to strategic growth initiatives. Adequate financial resources, encompassing robust cash flow from operations, readily available credit facilities, and strategic access to capital markets, are critical. These resources directly fund essential areas like investments in new technology, supply chain enhancements, marketing campaigns, and the crucial task of debt reduction.

In 2024, Hanesbrands demonstrated its financial strength by generating a significant $264 million in operating cash flow. This strong performance was instrumental in allowing the company to make substantial progress on its financial obligations. Specifically, the company successfully paid down over $1 billion in debt during the same year, highlighting a commitment to improving its financial structure and reducing leverage.

- Operating Cash Flow: Hanesbrands generated $264 million in operating cash flow in 2024, providing essential funds for business activities.

- Debt Reduction: The company prioritized financial health by paying down over $1 billion in debt in 2024.

- Capital Allocation: These financial resources are vital for investing in technology, supply chain improvements, and marketing efforts.

- Access to Capital: Maintaining access to credit facilities and capital markets ensures ongoing funding for strategic initiatives.

Hanesbrands' key resources are its strong brand portfolio, including Hanes and Maidenform, which drive customer loyalty. The company also possesses a significant global manufacturing and supply chain infrastructure, largely company-owned, offering control over production and distribution. Its skilled workforce, from design to sales, is crucial for innovation and operations, supported by experienced management.

Intellectual property, such as proprietary designs and patents for fabric technologies, protects its unique offerings. Furthermore, strong financial capital, demonstrated by $264 million in operating cash flow in 2024 and over $1 billion in debt paid down that year, fuels investments and strategic initiatives.

| Resource Category | Key Components | 2024 Data/Significance |

|---|---|---|

| Brands | Hanes, Maidenform, Playtex | Strong consumer trust and market presence |

| Infrastructure | Company-owned global manufacturing & supply chain | Direct control over production, efficiency |

| Human Capital | Skilled workforce, experienced management | Drives innovation, operational excellence |

| Intellectual Property | Proprietary designs, patents, trademarks | Safeguards unique products and manufacturing innovations |

| Financial Capital | Operating Cash Flow, Debt Reduction | $264M operating cash flow; $1B+ debt paid down |

Value Propositions

Hanesbrands delivers comfort and quality in everyday apparel, a key draw for consumers seeking reliable basics. This focus on comfort is a significant factor in purchasing decisions for innerwear, activewear, and hosiery. For instance, Hanes' Champion brand, a significant contributor to their activewear segment, saw net sales of $1.7 billion in 2023, underscoring the market's demand for comfortable, performance-oriented clothing.

Hanesbrands delivers value by offering affordable apparel, ensuring a wide range of consumers can access quality clothing. This commitment to affordability is a cornerstone of their business, making stylish and comfortable basics available to everyone, regardless of income. For instance, in 2024, Hanes continued its focus on value-driven product lines, a strategy that has historically resonated with its broad customer base.

The company's extensive distribution network, primarily through mass retail partners, significantly enhances the accessibility of its products. This widespread availability means Hanes apparel can be found in numerous locations, making it convenient for shoppers to purchase. This strategy directly supports their mission to make sustainable options, like their Renewed Comfort collection, attainable for all consumers.

Hanesbrands leverages its portfolio of trusted and iconic brands, such as Hanes, Bonds, Maidenform, and Playtex, to build strong customer loyalty. Consumers associate these established names with reliability and consistent quality, which significantly lowers the perceived risk when making a purchase. This focus on its powerful brand assets is a cornerstone of the company's strategy.

Wide Range of Products for Diverse Needs

Hanesbrands boasts a wide array of innerwear, activewear, and hosiery, designed to meet the varied demands of consumers across different age groups and lifestyles. This extensive product range allows customers to discover apparel suitable for everyday wear, specific activities, and special occasions, all backed by the Hanes brand's reputation.

The company's commitment extends to sustainability goals, which are often integrated into their product development and marketing efforts. For instance, Hanesbrands has publicly stated goals related to reducing environmental impact in their manufacturing and supply chain processes.

Key aspects of their product strategy include:

- Diverse Product Categories: Offering everything from basic t-shirts and underwear to performance athletic wear and fashion hosiery.

- Brand Portfolio: Leveraging established brands like Hanes, Champion, Bali, and Maidenform to appeal to different market segments.

- Innovation and Comfort: Continuously developing new fabrics and designs focused on comfort, durability, and performance.

- Sustainability Initiatives: Incorporating eco-friendly materials and manufacturing practices into their product lines.

Commitment to Sustainability and Ethical Practices

Hanesbrands champions sustainability and ethical operations, resonating with consumers who prioritize responsible brands. This commitment is a core part of their value, offering more than just apparel. For instance, in 2023, Hanesbrands reported a 10% reduction in greenhouse gas emissions intensity compared to their 2017 baseline, demonstrating tangible progress.

This focus on environmental and social responsibility directly appeals to a growing segment of the market. It adds an ethical layer to the customer experience, fostering loyalty. The company's ambitious goal to positively impact 10 million lives by 2030 underscores this dedication.

Key aspects of their commitment include:

- Reduced Environmental Footprint: Hanesbrands actively works to lower emissions, water consumption, and waste generation across its manufacturing processes.

- Sustainably Sourced Materials: The company is increasing its use of materials like recycled polyester and organic cotton, aiming for greater sustainability in its product lifecycle.

- Ethical Labor Practices: Ensuring fair treatment and safe working conditions for all employees is a cornerstone of their operational philosophy.

- Community Impact: Initiatives aimed at improving the lives of their employees and the communities where they operate are central to their long-term vision.

Hanesbrands offers a compelling mix of comfort, quality, and affordability, making its products highly desirable for everyday wear. This value proposition is further enhanced by the accessibility of its goods through an extensive retail network. The company's strong portfolio of well-known brands, such as Hanes and Champion, cultivates customer trust and loyalty, reinforcing the perceived value of their offerings.

The company's commitment to sustainability and ethical practices appeals to a growing consumer base that prioritizes responsible brands. This focus on environmental and social responsibility, evidenced by their greenhouse gas emission reduction targets, adds significant ethical value. Hanesbrands aims to positively impact millions of lives, integrating social good into its core business model.

| Value Proposition | Description | Supporting Data/Examples |

|---|---|---|

| Comfort and Quality | Delivers reliable comfort and quality in everyday apparel. | Champion brand net sales reached $1.7 billion in 2023, highlighting demand for comfortable activewear. |

| Affordability | Offers accessible, value-driven apparel for a broad consumer base. | Continued focus on value-driven product lines in 2024. |

| Brand Recognition and Trust | Leverages iconic brands like Hanes, Champion, Bali, and Maidenform. | Established brand equity lowers purchase risk and fosters loyalty. |

| Sustainability and Ethics | Integrates eco-friendly practices and social responsibility. | 10% reduction in greenhouse gas emissions intensity (vs. 2017 baseline) reported in 2023; goal to positively impact 10 million lives by 2030. |

Customer Relationships

Hanesbrands prioritizes mass market accessibility and availability, ensuring its products are readily found in numerous retail locations. This widespread distribution means customer relationships are often built through these third-party sellers, making the connection more indirect.

The company focuses on strengthening ties with major retail partners to secure prime shelf space and promotional opportunities. In 2023, Hanesbrands reported that its largest customers accounted for a significant portion of its net sales, highlighting the importance of these relationships in maintaining product availability.

Hanesbrands fosters deep brand loyalty by consistently delivering on comfort and quality across its well-recognized labels. This reliability builds significant trust, encouraging consumers to repeatedly choose Hanesbrands' offerings based on positive past experiences. For instance, in 2024, the company continued to leverage the enduring appeal of brands like Hanes and Champion, which have cultivated decades of consumer confidence.

Hanesbrands is actively cultivating direct connections with its customers through dedicated e-commerce sites and brand-specific online presences. This strategy facilitates tailored marketing campaigns, enables the collection of direct consumer feedback, and provides access to unique product selections, all of which serve to deepen the company's relationship with its end-users.

In 2023, Hanesbrands reported that its direct-to-consumer (DTC) channel represented a significant and growing portion of its sales, with digital sales increasing by double digits year-over-year, demonstrating a clear consumer preference for these engagement methods.

The company's ongoing investment in expanding its e-commerce infrastructure and digital tools is geared towards creating a smooth and integrated experience for consumers across all touchpoints.

Customer Service and Support

HanesBrands prioritizes responsive customer service across its retail partnerships and direct channels to address inquiries and feedback. This commitment to support is crucial for fostering customer satisfaction and bolstering brand loyalty.

Effective customer service plays a vital role in managing consumer expectations and efficiently resolving any issues that arise. For instance, in 2024, HanesBrands continued to invest in digital tools and training for their support teams to enhance response times and problem-solving capabilities, aiming to reduce customer churn.

- Responsive Support: Addressing consumer inquiries and issues promptly through various channels.

- Brand Reputation: Reinforcing brand image through positive customer interactions and problem resolution.

- Customer Satisfaction: Enhancing overall customer experience and loyalty by effectively managing expectations.

- Issue Resolution: Proactively solving problems to minimize dissatisfaction and maintain trust.

Community and Sustainability Initiatives

Hanesbrands cultivates customer loyalty by showcasing its commitment to corporate social responsibility and sustainability. This resonates strongly with consumers who prioritize ethical manufacturing and environmental care. The company actively promotes initiatives like 'Green for Good,' aiming to build a positive brand perception and foster deeper customer connections.

These efforts translate into tangible impact, with Hanesbrands reporting that its philanthropic and associate programs have positively affected 3.4 million lives since 2021. This focus on social good not only enhances brand reputation but also builds a community around shared values.

- Community Engagement: Hanesbrands highlights its CSR and sustainability efforts to attract ethically-minded consumers.

- Brand Image: Programs like 'Green for Good' and life-improvement goals enhance the company's positive brand perception.

- Philanthropic Impact: Since 2021, the company has impacted 3.4 million lives through its various initiatives.

Hanesbrands manages customer relationships through a multi-faceted approach, balancing mass-market retail presence with a growing direct-to-consumer (DTC) strategy. The company leverages its strong brand recognition to foster loyalty, while also investing in digital channels to create more personalized interactions and gather direct feedback.

In 2024, Hanesbrands continued to emphasize its established brands like Hanes and Champion, capitalizing on decades of consumer trust built through consistent quality and comfort. This reliability encourages repeat purchases, a cornerstone of their customer relationship strategy.

The expansion of their e-commerce platform in 2023, which saw double-digit growth in digital sales, underscores a commitment to direct engagement. This allows for more targeted marketing and a smoother customer journey, enhancing overall satisfaction.

Hanesbrands also focuses on corporate social responsibility, with initiatives like 'Green for Good' resonating with consumers who value ethical practices. This commitment to sustainability and community impact, which has touched 3.4 million lives since 2021, further strengthens customer bonds.

| Relationship Aspect | Strategy | 2023/2024 Data/Focus |

|---|---|---|

| Brand Loyalty | Consistent quality, comfort, and strong brand recognition | Leveraging enduring appeal of Hanes and Champion brands |

| Direct Engagement | E-commerce expansion, digital tools | Double-digit growth in digital sales in 2023 |

| Retail Partnerships | Securing shelf space and promotions | Focus on key retail partners for product availability |

| Customer Service | Responsive support across channels | Investment in digital tools for enhanced response times |

| Ethical Consumerism | CSR and sustainability initiatives | Impacted 3.4 million lives since 2021 through programs |

Channels

Hanesbrands heavily relies on major mass retailers like Walmart and Target, alongside department stores, to distribute its wide range of apparel. These partnerships are crucial for achieving significant sales volume and ensuring widespread product availability. In 2023, Hanesbrands' sales through these channels represented a substantial portion of its overall revenue, underscoring their importance for everyday basics.

Hanesbrands leverages its company-owned e-commerce websites, such as Hanes.com and Champion.com, to directly engage with consumers. This strategy provides significant control over brand presentation, pricing strategies, and the valuable customer data collected, enabling more tailored marketing efforts and personalized shopping journeys.

The company's commitment to enhancing its digital presence is evident in its ongoing investments in e-commerce capabilities. This focus is crucial for adapting to evolving consumer purchasing habits and for building stronger, direct relationships with its customer base.

Hanesbrands strategically leverages major third-party e-commerce platforms like Amazon to significantly broaden its digital footprint and reach consumers who favor these established marketplaces. This channel is crucial for expanding market penetration beyond Hanes' own direct-to-consumer websites, tapping into a vast existing customer base.

A notable aspect of Hanes' presence on platforms like Amazon is the inclusion of its products in programs such as Amazon's Climate Pledge Friendly. This initiative not only aligns with growing consumer demand for sustainable options but also enhances brand perception and potentially drives sales among environmentally conscious shoppers.

In 2023, Amazon alone accounted for a substantial portion of online retail sales globally, with gross merchandise volume reaching hundreds of billions of dollars. By participating in such platforms, Hanesbrands ensures its diverse product portfolio, including apparel and intimate wear, is readily accessible to a wider audience, contributing to overall revenue diversification.

Wholesale and Business-to-Business (B2B)

Hanesbrands actively participates in the wholesale and business-to-business (B2B) market, extending its reach beyond direct consumer sales. This channel is crucial for supplying bulk apparel to a diverse range of clients, including promotional product distributors and institutional buyers. In 2024, the company continued to leverage its well-known brands like Hanes, Champion, ComfortWash, and Alternative Apparel to serve these specific market needs.

The company's B2B strategy focuses on providing customized solutions and reliable supply chains for businesses that require large quantities of apparel. This segment is particularly important for the promotional products industry, where branded apparel serves as a key marketing tool. Hanesbrands' established presence and brand recognition in this sector underscore its commitment to this vital distribution channel.

- Wholesale Reach: Hanesbrands supplies apparel to promotional product distributors and institutional clients, catering to bulk order requirements.

- Brand Leverage: Brands such as Hanes, Champion, ComfortWash, and Alternative Apparel are utilized within the B2B segment, especially in the promotional products industry.

- Market Focus: This channel addresses specific market needs for large-volume apparel orders, supporting clients' branding and operational requirements.

International Retail

Hanesbrands leverages a diverse international retail network, adapting to local consumer preferences and market structures. This includes partnerships with major department stores, hypermarkets, and specialized apparel retailers across various continents.

In 2024, Hanesbrands continued to focus on optimizing its international retail presence. For instance, the company reported positive sales momentum in key markets such as Mexico and Australia, underscoring the effectiveness of its tailored channel strategies in these regions.

- Department Stores: Hanesbrands products are widely available in prominent department store chains globally, offering broad consumer reach.

- Hypermarkets: Strategic placement in hypermarkets provides access to a large, diverse customer base seeking everyday apparel and essentials.

- Specialty Apparel Stores: Partnerships with specialty retailers allow for targeted marketing and showcase of specific product lines, enhancing brand perception.

- E-commerce Integration: While focusing on physical retail, Hanesbrands also increasingly integrates its international strategy with robust e-commerce platforms to capture online sales.

Hanesbrands utilizes a multi-channel approach to reach its diverse customer base. Key channels include major mass retailers, its own e-commerce sites, and third-party online marketplaces like Amazon. Additionally, the company engages in wholesale and business-to-business sales, and maintains a significant international retail presence.

In 2023, Hanesbrands continued to see substantial revenue from its relationships with large retailers like Walmart and Target, highlighting the enduring importance of brick-and-mortar distribution for everyday apparel. Its direct-to-consumer e-commerce platforms, such as Hanes.com and Champion.com, also saw continued investment, aiming to foster direct customer relationships and leverage valuable data for personalized marketing efforts.

The company's strategic presence on Amazon in 2023 was critical for expanding its digital reach, tapping into a vast online consumer base and participating in initiatives like Climate Pledge Friendly to appeal to environmentally conscious shoppers. Beyond direct consumer sales, Hanesbrands actively serves the business-to-business sector, supplying apparel for promotional products and institutional needs throughout 2024, leveraging brands like Hanes and Champion.

Internationally, Hanesbrands adapted its channel strategies throughout 2024, with positive sales momentum noted in markets like Mexico and Australia, demonstrating the success of localized approaches in department stores, hypermarkets, and specialty retailers. This global strategy is increasingly integrated with e-commerce to capture online sales opportunities across different regions.

| Channel | Description | Key Brands Utilized | 2023/2024 Relevance |

|---|---|---|---|

| Mass Retailers | Distribution through large chains like Walmart and Target. | Hanes, Champion, Bali, Playtex | Significant revenue driver; broad product availability. |

| Direct E-commerce | Company-owned websites (Hanes.com, Champion.com). | Hanes, Champion, Just My Size | Direct customer engagement, data collection, brand control. |

| Third-Party E-commerce | Platforms like Amazon. | Hanes, Champion, Wonderbra | Expanded digital footprint, access to large customer base. |

| Wholesale/B2B | Supplying promotional product distributors and institutional clients. | Hanes, Champion, Alternative Apparel | Bulk orders, promotional industry focus, reliable supply chains. |

| International Retail | Partnerships with department stores, hypermarkets, specialty retailers globally. | Hanes, Champion, Maidenform | Market adaptation, positive momentum in key regions (e.g., Mexico, Australia). |

Customer Segments

Value-conscious consumers represent a core customer base for Hanesbrands, actively seeking dependable and comfortable everyday apparel that offers excellent bang for their buck. These individuals and families are not looking for designer labels but rather for quality basics that hold up well without breaking the bank. In 2023, Hanesbrands reported net sales of $3.9 billion, underscoring the significant market for affordable apparel.

Hanesbrands' strategy heavily leans into making essential items accessible, understanding that many consumers make purchasing decisions based on price and perceived durability. This segment is particularly receptive to promotions and bulk purchasing opportunities, driving significant volume for brands like Hanes and Champion. The company's commitment to providing value is a key differentiator in a competitive market.

Everyday Apparel Wearers represent a massive segment for Hanes, seeking comfort and durability in their daily clothing. This includes everyone from toddlers needing soft basics to adults looking for reliable activewear and hosiery. Hanes aims to be the go-to brand for the entire family's foundational wardrobe needs.

In 2024, Hanesbrands continued to emphasize its core offerings to this broad consumer base. The company's commitment to providing accessible, quality basics directly addresses the consistent demand from these everyday wearers, a segment that forms the bedrock of its sales volume.

Hanesbrands historically served athletes and active lifestyle enthusiasts through its strong Champion brand, providing performance and comfort in activewear. While Champion's global operations were divested in early 2024, the brand's legacy continues to influence this segment, with Hanes retaining licensing rights for certain categories.

This segment values apparel that supports physical activity, from professional sports to everyday workouts. They seek durability, breathability, and style in their activewear choices, reflecting a commitment to health and wellness.

The market for activewear remains robust, with consumers increasingly prioritizing athleisure for both athletic performance and casual wear. This trend underscores the ongoing demand for comfortable, functional, and fashionable apparel within this demographic.

Comfort-Seekers

Comfort-Seekers represent a crucial customer segment for Hanesbrands, prioritizing an exceptional feel and fit in apparel worn closest to the body. This group actively seeks out brands that deliver on a promise of superior comfort, making Hanes' core value proposition highly resonant. Their purchasing decisions are heavily influenced by the tactile experience and the assurance of all-day ease.

Hanesbrands' strategic focus on comfort and quality directly caters to this segment's primary needs. The company invests in material innovation and product design to ensure its garments meet the high expectations of consumers who place comfort at the forefront. This consumer-centric approach is evident in their product development pipeline.

- Prioritization of Comfort: Consumers in this segment view comfort as the non-negotiable primary attribute when selecting items like underwear and bras.

- Brand Loyalty Drivers: Hanesbrands' established reputation for comfort fosters strong brand loyalty among this group.

- Product Development Focus: The company's ongoing commitment to enhancing fabric technologies and fit ensures continued appeal to Comfort-Seekers.

Brand-Loyal Shoppers

Brand-loyal shoppers represent a core customer segment for Hanesbrands, consistently choosing familiar names like Hanes, Bonds, or Maidenform. This loyalty stems from a deep-seated trust in the quality and consistency these established brands offer, making them less susceptible to competitive switching.

Hanesbrands actively cultivates this loyalty by focusing on its iconic brands, understanding that these consumers value the reliability and heritage associated with their preferred labels. For instance, Hanes' long-standing presence in the innerwear market, dating back to 1901, has fostered generations of loyal customers.

- Brand Recognition: Hanes, Bonds, and Maidenform are recognized household names, fostering immediate trust and preference.

- Consistency and Trust: These consumers rely on the predictable quality and fit of their chosen Hanesbrands products.

- Emotional Connection: Decades of positive experiences build an emotional bond, making brand switching less appealing.

- Reduced Marketing Costs: Retaining loyal customers typically requires less marketing spend compared to acquiring new ones.

Hanesbrands serves a broad spectrum of consumers, with a significant focus on value-conscious individuals and families seeking affordable, dependable apparel. This segment prioritizes quality basics that offer good value, driving substantial sales volume for the company's core brands.

Everyday Apparel Wearers, encompassing all age groups, rely on Hanesbrands for comfortable and durable clothing essentials for daily life. The company aims to be the primary source for these foundational wardrobe needs.

While the Champion brand's global operations were divested in early 2024, Hanesbrands continues to cater to active lifestyle enthusiasts through licensing agreements, recognizing the enduring market for performance-oriented athleisure.

Comfort-Seekers are paramount, prioritizing the feel and fit of garments, especially innerwear. Hanesbrands leverages its reputation and fabric innovations to meet the high expectations of this group, fostering strong brand loyalty.

Brand-loyal shoppers, drawn to the heritage and consistent quality of Hanes, Bonds, and Maidenform, represent a stable and valuable customer base. This loyalty reduces marketing costs and ensures a predictable revenue stream.

| Customer Segment | Key Characteristics | Hanesbrands' Approach |

|---|---|---|

| Value-Conscious Consumers | Seek quality basics at affordable prices. | Focus on value proposition, promotions, and bulk purchasing. |

| Everyday Apparel Wearers | Require comfortable, durable clothing for daily use. | Offerings for the entire family's foundational wardrobe. |

| Active Lifestyle Enthusiasts | Prioritize performance and comfort in activewear. | Continued engagement through licensing for athleisure. |

| Comfort-Seekers | Demand superior feel and fit, especially in innerwear. | Investment in fabric innovation and product design. |

| Brand-Loyal Shoppers | Exhibit consistent preference for established brands. | Leverage brand heritage and reliability to maintain loyalty. |

Cost Structure

Manufacturing and production represent a substantial part of Hanesbrands' cost structure. This includes the expenses for raw materials like cotton and synthetic fibers, the wages paid to factory workers, and the general overhead associated with running production facilities.

Hanesbrands' strategy of vertical integration plays a key role in controlling these manufacturing expenses. By managing more of its supply chain internally, the company can achieve better cost efficiencies and ensure a more stable production process.

In 2023, Hanesbrands continued to focus on supply chain optimization as a means to reduce fixed costs and boost operational efficiencies. For instance, the company has been working to streamline its inventory management and distribution networks, aiming for a more agile and cost-effective production flow.

Selling, General, and Administrative (SG&A) expenses are a significant part of Hanesbrands' operational costs, encompassing everything from marketing and advertising campaigns to the salaries of their sales teams and corporate staff. These are the costs associated with running the business beyond the direct production of goods.

Hanesbrands is actively working to optimize these costs as part of its broader strategic transformation. A key focus is on reducing non-revenue-generating SG&A expenses to improve overall efficiency and profitability.

For the fourth quarter of 2024, Hanesbrands reported SG&A expenses totaling $271 million. This figure highlights the substantial investment the company makes in supporting its brands and operations.

HanesBrands faces significant logistics and distribution costs due to its vast global operations and widespread retail presence. These expenses encompass freight charges for moving goods, warehousing to store inventory, and the complex processes involved in fulfilling orders to various sales channels.

In 2023, HanesBrands reported that its cost of goods sold, which includes many of these distribution expenses, was approximately $4.6 billion. The company is actively engaged in supply chain consolidation initiatives, aiming to streamline operations, reduce fixed overheads, and enhance overall customer service efficiency.

Research and Development (R&D) and Innovation Costs

HanesBrands allocates significant resources to Research and Development (R&D) and Innovation Costs. These investments are crucial for developing new and improved apparel products, encompassing everything from initial product design to material innovation and the integration of cutting-edge technology.

A key component of these costs involves expenditures on advanced analytics, such as AI-driven tools for demand forecasting and inventory optimization. These technologies help the company make more informed decisions, reduce waste, and ensure products are available when and where consumers want them. For instance, in fiscal year 2023, HanesBrands continued to focus on enhancing its innovation pipeline, aiming to bring fresh and desirable products to market.

- Product Design & Material Innovation: Ongoing investment in creating aesthetically pleasing and functionally superior apparel.

- Technology Integration: Spending on digital tools and AI for operational efficiency and consumer insights.

- AI for Demand Forecasting: Utilizing artificial intelligence to predict consumer demand and manage inventory effectively.

- Innovation Pipeline Enhancement: Dedicated funding to support the development and launch of new product lines and technologies.

Debt Servicing Costs

As a publicly traded company, Hanesbrands incurs significant debt servicing costs. These primarily consist of interest expenses on its outstanding debt and the principal repayments required to reduce its leverage. These obligations are a critical part of its overall cost structure.

Hanesbrands has actively managed its debt. In 2024, the company demonstrated a strong commitment to deleveraging by paying down over $1 billion in debt. This strategic financial maneuver directly impacts its cost structure by reducing future interest payments.

- Interest Expenses: Costs associated with borrowing funds.

- Debt Repayment: Principal amounts paid back to lenders.

- Deleveraging Efforts: Hanesbrands paid down over $1 billion in debt during 2024.

Hanesbrands' cost structure is heavily influenced by its extensive manufacturing operations, including raw materials, labor, and facility overhead. The company's vertical integration strategy aims to control these expenses, as evidenced by their focus on supply chain optimization in 2023 to reduce fixed costs and improve efficiency.

Selling, General, and Administrative (SG&A) expenses are also a major component, covering marketing, sales, and corporate functions. Hanesbrands reported $271 million in SG&A for Q4 2024, demonstrating a significant investment in brand support and operations, with ongoing efforts to reduce non-revenue-generating aspects of these costs.

Logistics and distribution costs are substantial due to Hanesbrands' global reach, encompassing freight, warehousing, and fulfillment. In 2023, the cost of goods sold, which includes these distribution elements, was around $4.6 billion, with the company pursuing consolidation to streamline operations and enhance customer service.

The company also invests in Research and Development (R&D) and Innovation, including product design, material advancements, and technology integration like AI for demand forecasting. These investments are crucial for maintaining a competitive product offering and improving operational decision-making.

Finally, debt servicing costs, including interest and principal repayments, are a significant part of Hanesbrands' financial obligations. The company actively managed its debt in 2024, paying down over $1 billion to reduce leverage and future interest expenses.

| Cost Category | Key Components | 2023/2024 Data/Focus |

| Manufacturing & Production | Raw materials, labor, facility overhead | Focus on supply chain optimization, vertical integration |

| Selling, General & Administrative (SG&A) | Marketing, sales, corporate salaries | $271 million in Q4 2024; efforts to reduce non-revenue-generating costs |

| Logistics & Distribution | Freight, warehousing, fulfillment | Cost of Goods Sold approx. $4.6 billion in 2023; supply chain consolidation |

| Research & Development (R&D) / Innovation | Product design, material innovation, technology | Investment in AI for demand forecasting, enhancing innovation pipeline |

| Debt Servicing | Interest expenses, principal repayments | Over $1 billion debt paid down in 2024 |

Revenue Streams

Revenue generated from the sale of innerwear, encompassing underwear, bras, and shapewear, is a cornerstone for Hanesbrands. This segment includes well-recognized brands such as Hanes, Maidenform, Playtex, and Bonds, contributing significantly to the company's overall financial performance.

The innerwear category is fundamentally important to Hanesbrands' business model. It represents a substantial portion of their sales and market presence, driving consistent revenue generation year after year.

Hanesbrands demonstrated strength in this core area, as evidenced by their gain in innerwear market share during the second quarter of 2024. This indicates a positive trend and successful strategy execution within their foundational product lines.

Revenue streams from activewear sales are a cornerstone for Hanes, with products like t-shirts and fleece apparel generating substantial income. In 2023, the Activewear segment of HanesBrands reported net sales of $1.9 billion, showcasing its importance.

While the Champion brand, a key player in activewear, was divested in late 2023, the ongoing sales of other activewear products under brands like Hanes continue to be a significant revenue driver. The company's strategic focus remains on strengthening its core activewear offerings.

Hanesbrands earns revenue by selling a variety of hosiery products, such as socks and sheer stockings, under its well-known Hanes brand. This category has historically been a steady source of income for the company.

While the sale of the U.S. Sheer Hosiery business in September 2023 impacted this segment, the remaining hosiery sales continue to contribute to Hanesbrands' overall revenue picture.

E-commerce Sales

Revenue from direct-to-consumer (DTC) sales via Hanesbrands' own websites and various online marketplaces represents a significant and expanding revenue stream. This direct channel empowers the company to connect with customers more intimately, gather valuable data, and remain agile in the evolving retail environment. Hanesbrands is actively channeling investments into enhancing its e-commerce infrastructure and digital marketing prowess.

In 2023, Hanesbrands reported a notable increase in its online sales, with its DTC channel demonstrating robust growth. This strategic focus on digital engagement is crucial for capturing market share directly from consumers and adapting to shifting purchasing behaviors.

- Direct-to-Consumer Growth: E-commerce sales are a key driver of Hanesbrands' revenue diversification.

- Digital Investment: The company is committed to enhancing its online platforms and digital capabilities.

- Market Adaptability: This channel allows Hanesbrands to respond effectively to changing retail trends and consumer preferences.

- 2023 Performance: Online sales showed positive momentum, underscoring the importance of this revenue stream.

International Sales

International sales are a cornerstone of Hanesbrands' revenue generation, with significant contributions from markets across Europe, Asia, Australia, and the Americas. The company actively pursues a global go-to-market strategy to capitalize on increasing consumer demand in these diverse regions.

In the fourth quarter of 2024, Hanesbrands reported net sales of $252.9 million from its international segment, underscoring the importance of these markets to its overall financial performance.

- Global Reach: Hanesbrands generates substantial revenue from sales across Europe, Asia, Australia, and the Americas.

- Strategic Growth: The company employs a global go-to-market strategy to expand its presence in key international markets.

- Q4 2024 Performance: International segment net sales reached $252.9 million in the fourth quarter of 2024.

Hanesbrands' revenue streams are diversified across several key product categories and sales channels. Innerwear remains a foundational element, supported by strong brands like Hanes and Maidenform, with market share gains noted in Q2 2024. Activewear, despite the divestiture of Champion, continues to be a significant contributor, generating $1.9 billion in net sales in 2023. Hosiery sales, though impacted by business divestitures, still add to the revenue mix.

The company is also heavily invested in its direct-to-consumer (DTC) channel, which saw robust growth in online sales in 2023, reflecting a strategic focus on e-commerce infrastructure and digital marketing. International markets are crucial, with the international segment reporting $252.9 million in net sales for Q4 2024, highlighting the importance of its global strategy.

| Revenue Stream | Key Brands/Products | 2023/2024 Data Points |

|---|---|---|

| Innerwear | Hanes, Maidenform, Playtex | Gained market share in Q2 2024 |

| Activewear | Hanes (t-shirts, fleece) | $1.9 billion net sales in 2023 (prior to Champion divestiture) |

| Hosiery | Hanes (socks, stockings) | Ongoing sales contribute to revenue |

| Direct-to-Consumer (DTC) | Company websites, online marketplaces | Robust growth in online sales in 2023 |

| International Sales | Europe, Asia, Australia, Americas | $252.9 million net sales in Q4 2024 |

Business Model Canvas Data Sources

The Hanes Business Model Canvas is informed by extensive market research, financial performance data, and internal operational reports. These sources provide a comprehensive view of Hanes's current strategies and market position.