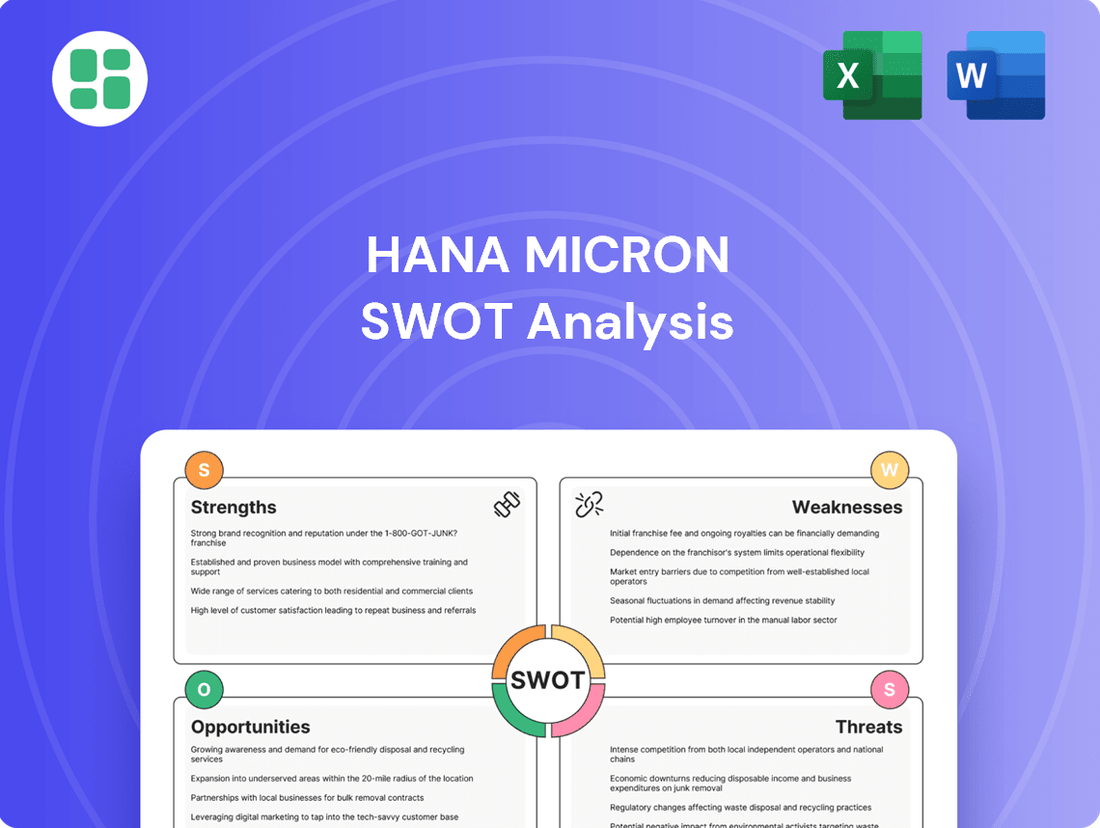

HANA Micron SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HANA Micron Bundle

HANA Micron's strengths lie in its specialized semiconductor packaging technology, a critical component in today's advanced electronics. However, the company faces significant threats from intense market competition and rapidly evolving technological demands.

Want the full story behind HANA Micron's competitive edge and potential vulnerabilities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning and investment decisions.

Strengths

Hana Micron distinguishes itself with a complete turnkey service offering, covering wafer testing, assembly, and final testing for diverse semiconductor products. This integrated approach positions them as a valuable one-stop solution, capable of simplifying complex manufacturing chains for clients.

By providing a streamlined process from start to finish, Hana Micron can significantly reduce lead times and associated costs for their customers. Their comprehensive service portfolio allows for greater efficiency and potentially higher profit margins for those outsourcing their semiconductor back-end operations.

The company's expertise extends across critical areas of the semiconductor industry, including memory, System-on-Chip (SoC), and other advanced integrated circuits. This broad capability demonstrates Hana Micron's adaptability and deep understanding of the evolving needs within the semiconductor manufacturing landscape.

Hana Micron’s dedication to advanced packaging technologies, such as 2.5D and 3D integration, is a significant strength. This capability is vital for supporting the performance demands of next-generation semiconductors, including those powering AI applications.

By focusing on these cutting-edge packaging solutions, Hana Micron is well-positioned to capitalize on the growing market for high-performance computing. For instance, the AI chip market alone was projected to reach $100 billion by 2025, underscoring the demand for the very technologies Hana Micron is developing.

Hana Micron's strategic global expansion is a key strength, with established production bases in Korea, Vietnam, and Brazil. This geographical diversification mitigates risks and allows for greater flexibility in meeting global demand. Their overseas sales operations in the US, Vietnam, and Brazil further solidify this international presence.

The company's significant investment in Vietnam, projected to surpass $1 billion by 2025, underscores a commitment to expanding manufacturing capacity and diversifying production locations. This move aligns with client preferences to reduce reliance on China and capitalizes on Vietnam's growing role as a semiconductor hub.

Strong Client Relationships and Diversified Portfolio

Hana Micron's strength lies in its robust client relationships, evidenced by its partnerships with semiconductor giants like Samsung and SK Hynix. These collaborations highlight the company's reliability and the trust placed in its offerings by major industry players.

The company is strategically diversifying its product portfolio, moving beyond its traditional memory chip focus. This expansion into non-memory products for automotive, mobile, and home appliance sectors is a key strength, aiming to mitigate risks associated with memory market volatility and broaden its market reach.

- Client Concentration: While Samsung and SK Hynix are significant clients, this also represents a concentration risk.

- Diversification Strategy: Expansion into non-memory products is crucial for long-term stability.

- Market Penetration: Success in automotive and mobile sectors in 2024/2025 will be a key indicator of this diversification's effectiveness.

Commitment to R&D and Innovation

HANA Micron's unwavering commitment to research and development fuels its competitive advantage. The company consistently allocates significant resources to explore novel technologies and identify future growth avenues, ensuring it remains at the forefront of the semiconductor industry. This proactive investment strategy is crucial for maintaining its technological leadership in a market characterized by rapid advancements.

Their focus on cutting-edge areas like advanced packaging for AI chips demonstrates a forward-thinking approach. Furthermore, HANA Micron's dedication to developing technologies such as ultra-thin wafer technology and sophisticated particle dynamics management underscores their commitment to innovation and long-term business resilience. For example, in 2024, the company announced plans to invest heavily in R&D, targeting a 15% increase in its R&D budget compared to 2023, specifically for next-generation packaging solutions.

- Continuous R&D Investment: HANA Micron prioritizes bold investments in research and development to uncover new growth opportunities and sustain its technological edge.

- AI Chip Packaging Focus: The company is actively developing advanced packaging solutions specifically designed for the demanding requirements of artificial intelligence chips.

- Future-Proofing Technologies: HANA Micron is investing in technologies like ultra-thin wafer technology and particle dynamics management to secure its long-term market position.

- Increased R&D Budget: A projected 15% increase in the R&D budget for 2024 highlights the company's strategic emphasis on innovation and future advancements.

Hana Micron's comprehensive turnkey service, encompassing wafer testing, assembly, and final testing, simplifies complex semiconductor manufacturing for clients. Their expertise spans memory, SoC, and advanced integrated circuits, showcasing adaptability to evolving industry needs. The company's commitment to advanced packaging, including 2.5D and 3D integration, positions them to capitalize on the growing demand for high-performance computing, particularly for AI applications.

Strategic global expansion with production bases in Korea, Vietnam, and Brazil mitigates risk and enhances flexibility in meeting worldwide demand. Significant investment in Vietnam, exceeding $1 billion by 2025, diversifies production and aligns with client preferences to reduce China reliance. Strong client relationships with industry leaders like Samsung and SK Hynix underscore Hana Micron's reliability and market trust.

HANA Micron's dedication to R&D, with a projected 15% budget increase in 2024 for next-gen packaging, ensures technological leadership. Their focus on AI chip packaging and future-proofing technologies like ultra-thin wafer technology demonstrates a forward-thinking approach to market trends.

| Key Strength | Description | Impact/Data Point |

| Turnkey Service Offering | End-to-end semiconductor testing and assembly. | Simplifies supply chains, reduces lead times for clients. |

| Advanced Packaging Expertise | 2.5D and 3D integration for high-performance chips. | Crucial for AI applications; AI chip market projected at $100B by 2025. |

| Global Production Footprint | Manufacturing in Korea, Vietnam, Brazil. | Risk mitigation, enhanced global demand fulfillment. Vietnam investment >$1B by 2025. |

| Strong Client Partnerships | Collaborations with Samsung and SK Hynix. | Demonstrates trust and reliability from major industry players. |

| R&D Investment | Focus on next-gen packaging and future technologies. | 15% R&D budget increase in 2024 for AI chip packaging. |

What is included in the product

Analyzes HANA Micron’s competitive position through key internal and external factors, highlighting its strengths in technology and market presence alongside potential weaknesses in supply chain and opportunities in emerging markets, while also considering threats from competitors and economic shifts.

Offers a clear, actionable framework to address HANA Micron's competitive challenges and leverage its technological strengths.

Weaknesses

Hana Micron's financial performance in 2024 presented a mixed picture. Despite a notable increase in sales, the company registered a net loss for the fiscal year ending December 31, 2024. This contrasts with a healthier profitability trend seen across many semiconductor industry peers.

Further highlighting these profitability concerns, Hana Micron's Price-to-Sales (P/S) ratio remained low when benchmarked against its competitors. This valuation metric suggests that the market is not assigning a high value to Hana Micron's revenue generation, likely due to ongoing challenges in converting sales into sustainable profits.

HANA Micron's reliance on a few major clients, such as Samsung and SK Hynix, presents a significant weakness. A substantial portion of their revenue is tied to these key relationships, making them vulnerable to shifts in demand or contract changes from these giants. For instance, if a primary client decides to reduce orders or switch suppliers, it could severely impact HANA Micron's financial performance.

Despite efforts to diversify into non-memory products, the company's historical concentration in memory semiconductors and sectors like mobile and home appliances leaves it susceptible to downturns specific to these markets. A slowdown in smartphone sales or consumer electronics, for example, could disproportionately affect HANA Micron's revenue streams, highlighting a persistent market segment risk.

While HANA Micron is making strides with advanced packaging like 2.5D, achieving full-scale commercialization presents a significant hurdle. This development timeline means a potential lag in meeting the immediate, high-volume demand for AI chips compared to rivals with more mature processes.

The gap between their current prototype stage and mass production capacity could hinder HANA Micron's ability to seize market share swiftly. For instance, while competitors might already be supplying millions of units, HANA Micron's output could be considerably lower in the initial phases of this technology adoption.

Competitive Landscape and Market Share

Hana Micron operates in the highly competitive outsourced semiconductor assembly and test (OSAT) market, facing formidable global rivals. Major players like TSMC, Samsung, SK Hynix, and Amkor Technology possess significantly larger scale and resources, making it difficult for Hana Micron to capture substantial market share, especially in advanced packaging technologies. For instance, the OSAT market is projected to reach approximately $70 billion by 2025, with established leaders holding a dominant position.

While Hana Micron is a leading Korean OSAT provider, its global market share remains relatively modest compared to its larger international competitors. This competitive intensity, particularly in high-growth areas like advanced packaging solutions, poses a continuous challenge for market expansion and increased revenue generation. Market analysis indicates that the top OSAT companies collectively hold over 60% of the global market share.

- Intense competition from global giants like TSMC and Amkor Technology.

- Challenges in gaining significant market share in advanced packaging.

- Limited global scale compared to industry leaders.

Geopolitical and Supply Chain Risks

The semiconductor sector is inherently vulnerable to geopolitical shifts and disruptions in the global supply chain. For instance, in 2023 and early 2024, several clients expressed a desire to diversify manufacturing away from China, highlighting these concerns.

While Hana Micron's strategic expansion into Vietnam is a proactive step to lessen some of these vulnerabilities, the fundamental global interconnectedness of semiconductor production means the company cannot entirely escape the impact of widespread economic downturns or political instability.

- Geopolitical Tensions: Trade disputes and international relations can directly affect access to raw materials and key markets, as seen with ongoing tech sector tensions between major global powers.

- Supply Chain Fragility: A single disruption, whether a natural disaster or a political event in a critical manufacturing region, can have cascading effects across the entire supply chain, impacting production schedules and costs.

- Client Diversification Demands: The pressure from clients to reduce reliance on specific regions, like China, necessitates costly and time-consuming adjustments to Hana Micron's manufacturing footprint.

Hana Micron faces significant financial headwinds, including a net loss reported for the fiscal year ending December 31, 2024, despite increased sales. This profitability challenge is reflected in a low Price-to-Sales ratio compared to industry peers, indicating market skepticism about its revenue conversion capabilities.

The company's heavy reliance on key clients like Samsung and SK Hynix exposes it to substantial revenue risk should these partners alter their supply agreements. Furthermore, its historical focus on memory semiconductors leaves it vulnerable to cyclical downturns in the mobile and consumer electronics sectors, a risk that persists despite diversification efforts.

Hana Micron's advanced packaging technologies, such as 2.5D, are still in development, potentially delaying full commercialization and hindering its ability to compete for high-volume AI chip orders against rivals with more mature offerings. This development lag means a potential gap in production capacity compared to competitors already supplying millions of units.

The OSAT market is intensely competitive, with global players like TSMC and Amkor Technology holding significant advantages in scale and resources. Hana Micron’s global market share remains modest, making it challenging to expand and increase revenue, especially in high-growth advanced packaging segments where top OSAT companies command over 60% of the market.

Geopolitical tensions and supply chain fragility pose ongoing threats, as evidenced by client demands to diversify manufacturing away from China. While expansion into Vietnam aims to mitigate some risks, Hana Micron remains susceptible to global economic downturns and political instability impacting the interconnected semiconductor industry.

Full Version Awaits

HANA Micron SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. The HANA Micron SWOT analysis you see here is exactly what you'll get upon purchase, offering a complete and insightful overview.

Opportunities

The global AI chip market is experiencing explosive growth, projected to reach $200 billion by 2027, according to some industry estimates. This surge is fueled by the increasing adoption of AI across various sectors, from cloud computing to autonomous vehicles. Hana Micron's focus on 2.5D packaging for AI accelerators and High Bandwidth Memory (HBM) directly addresses this demand.

Hana Micron's advanced packaging solutions are crucial for the performance of these cutting-edge AI chips. For instance, HBM, a key component in AI processing, requires sophisticated packaging to achieve its high bandwidth capabilities. The company's expertise in this area allows it to cater to a market segment that is rapidly expanding and critical for next-generation AI hardware development.

The global chip packaging market, particularly advanced techniques like 2.5D, 3D, and heterogeneous integration, is experiencing substantial growth. Projections indicate this expansion will continue through 2028 and beyond, creating a favorable environment for companies like Hana Micron.

This upward market trend offers a significant opportunity for Hana Micron to capitalize on its expertise. The demand for sophisticated packaging solutions is driven by the increasing complexity and performance requirements of modern semiconductors, directly benefiting Hana Micron's core competencies and service offerings.

Vietnam's ascent as a semiconductor back-end manufacturing hub is a significant opportunity. Foreign direct investment in the sector surged, with the Ministry of Planning and Investment reporting a substantial increase in new projects and capital injections throughout 2024, signaling strong global confidence. Hana Micron's strategic expansion into Vietnam, including its significant facility build-outs, positions it to capitalize on this growth, potentially boosting output and market reach.

Diversification into Non-Memory and Automotive Sectors

Hana Micron is strategically expanding beyond its core memory chip business, targeting high-growth areas like automotive semiconductors. This diversification is a smart move, as the automotive industry's reliance on advanced electronics continues to surge.

The automotive sector presents a substantial opportunity, driven by trends such as electrification, advanced driver-assistance systems (ADAS), and in-car infotainment. By 2025, the global automotive semiconductor market is projected to reach approximately $115 billion, showcasing robust growth potential for companies like Hana Micron that can capture even a small share.

- Automotive Semiconductor Market Growth: Expected to exceed $115 billion by 2025, indicating strong demand for specialized chips.

- ADAS and IoT Integration: Increasing demand for semiconductors in autonomous driving features and connected vehicle technologies.

- Non-Memory Diversification: Hana Micron's move into non-memory applications reduces reliance on the cyclical memory market.

Strategic Partnerships and Collaborations

HANA Micron can capitalize on its existing relationships with industry giants like Samsung and SK Hynix. These partnerships, already in place, provide a solid foundation for joint ventures in developing next-generation semiconductor technologies. For instance, in 2024, Samsung announced significant investments in advanced packaging, an area where HANA Micron excels, creating a natural avenue for deeper collaboration.

Expanding these alliances to include fabless semiconductor companies and those specializing in artificial intelligence (AI) presents a significant growth opportunity. Collaborating with AI-focused firms, for example, could lead to the co-development of specialized memory solutions tailored for AI workloads. By 2025, the demand for AI-optimized hardware is projected to surge, making such strategic moves crucial for market leadership.

- Leverage existing partnerships with Samsung and SK Hynix for joint R&D.

- Forge new collaborations with AI-focused fabless companies.

- Accelerate technological advancements through co-development of specialized memory.

- Expand market reach by targeting high-growth AI application sectors.

Hana Micron is well-positioned to benefit from the booming AI chip market, with projections suggesting it could reach $200 billion by 2027. Their expertise in 2.5D packaging and HBM is critical for the high-performance demands of AI accelerators.

The company's strategic expansion into Vietnam, a growing hub for semiconductor back-end manufacturing, offers a significant advantage. This move, supported by substantial foreign direct investment in the region throughout 2024, allows Hana Micron to scale production and broaden its market reach.

Diversifying into the automotive semiconductor sector, which is expected to surpass $115 billion by 2025, presents another key opportunity. This expansion into non-memory applications reduces reliance on the traditionally cyclical memory market.

Leveraging existing partnerships with industry leaders like Samsung and SK Hynix, particularly in advanced packaging, creates a strong foundation for future growth and co-development of next-generation technologies.

| Opportunity Area | Market Projection | Hana Micron's Role |

|---|---|---|

| AI Chip Market | $200 billion by 2027 | 2.5D Packaging & HBM Expertise |

| Semiconductor Back-end (Vietnam) | Significant FDI growth in 2024 | Expanded Manufacturing Facilities |

| Automotive Semiconductors | >$115 billion by 2025 | Diversification into Non-Memory |

| Strategic Partnerships | Ongoing R&D with Industry Giants | Co-development of Advanced Packaging |

Threats

Hana Micron faces formidable competition in the semiconductor packaging and test sector, a landscape dominated by global OSAT giants. Companies like TSMC, Samsung, SK Hynix, Amkor Technology, and ASE Technology command substantial market share and possess vast resources for research and development. For instance, in 2023, TSMC, a major player in advanced packaging, reported revenues exceeding $69 billion, showcasing the scale of its operations and investment capacity, which directly pressures smaller competitors.

The semiconductor sector is notoriously cyclical, experiencing swings between high demand and oversupply. This inherent volatility means Hana Micron’s revenue and profits can fluctuate significantly based on global economic health, rapid technological shifts, and mismatches in supply and demand. For instance, the industry saw a notable downturn in 2023 following a surge in demand during the pandemic, with many chipmakers reporting reduced sales.

The semiconductor industry's relentless pace of innovation poses a significant threat. Hana Micron must continually invest in research and development to avoid its technologies becoming outdated.

Failure to adopt next-generation packaging like advanced 3D stacking or chiplets could render Hana Micron's offerings uncompetitive. For instance, the global semiconductor market is projected to reach $711 billion by 2028, underscoring the intense pressure to stay ahead.

Geopolitical Tensions and Trade Policies

Geopolitical tensions, particularly the ongoing trade friction between major economic powers like the US and China, present a significant threat to Hana Micron. These tensions can disrupt global supply chains, impacting the availability of essential components and the smooth flow of goods. For instance, the semiconductor industry, where Hana Micron operates, is highly sensitive to such geopolitical shifts, affecting technology transfer and market access.

The risk of trade policies evolving to restrict access to key markets or technologies is a constant concern. Hana Micron's global operations mean it's exposed to a variety of regulatory environments, and sudden policy changes can create significant operational hurdles. Client demands to diversify production away from certain regions highlight this tangible impact, forcing strategic adjustments and potentially increasing costs.

- Supply Chain Vulnerability: Geopolitical risks can lead to disruptions in the sourcing of raw materials and components, as seen in the semiconductor industry's reliance on specific regions for manufacturing.

- Market Access Restrictions: Evolving trade policies could limit Hana Micron's ability to sell its products in key international markets or acquire necessary technologies.

- Increased Operational Costs: Client-driven production shifts to mitigate geopolitical risks can necessitate investments in new facilities or partnerships, raising operational expenses.

High Capital Expenditure Requirements

Developing and scaling advanced packaging technologies, alongside expanding global production facilities, demands significant capital. For instance, Hana Micron's planned investments in Vietnam, including R&D, underscore the need for robust financial health and reliable access to capital. Any challenges in securing or managing these substantial investments could impede their ambitious growth strategies and overall financial stability.

The semiconductor industry, particularly advanced packaging, is inherently capital-intensive. Hana Micron's strategic expansion, especially into new markets like Vietnam, requires substantial upfront investment. Reports from late 2023 and early 2024 indicated that similar expansion projects in the semiconductor sector can easily run into hundreds of millions, if not billions, of dollars. This high capital expenditure creates a significant barrier to entry and places immense pressure on a company's financial resources.

- Significant Investment Needs: Developing cutting-edge packaging technologies and expanding manufacturing capacity requires massive capital outlays.

- Financial Strain: Hana Micron's expansion plans, such as those in Vietnam, necessitate strong financial backing and consistent access to funding.

- Risk of Hindered Growth: Failure to secure or effectively manage these large investments could severely limit the company's growth trajectory and financial resilience.

Intense competition from established OSAT giants like ASE Technology and Amkor Technology, which command significant market share and R&D budgets, poses a constant threat. The industry's cyclical nature, marked by demand fluctuations as seen in the 2023 downturn, can severely impact revenue. Furthermore, the rapid pace of technological advancement necessitates continuous, substantial investment in R&D to avoid obsolescence, with the global semiconductor market projected to reach $711 billion by 2028, highlighting the pressure to innovate.

| Threat | Description | Impact Example |

|---|---|---|

| Intense Competition | Dominance by large OSAT players with greater resources. | TSMC's 2023 revenue exceeding $69 billion pressures smaller firms. |

| Industry Cyclicality | Volatility due to economic shifts and supply/demand imbalances. | 2023 saw reduced chipmaker sales after pandemic demand surge. |

| Rapid Technological Change | Need for continuous R&D to avoid outdated offerings. | Failure to adopt advanced packaging like chiplets risks competitiveness. |

| Geopolitical Risks | Trade tensions and policy shifts can disrupt supply chains and market access. | Client diversification requests due to geopolitical concerns increase costs. |

SWOT Analysis Data Sources

This analysis is built on a foundation of robust data, including HANA Micron's official financial filings, comprehensive market research reports, and expert industry analyses to ensure a thorough and accurate assessment.