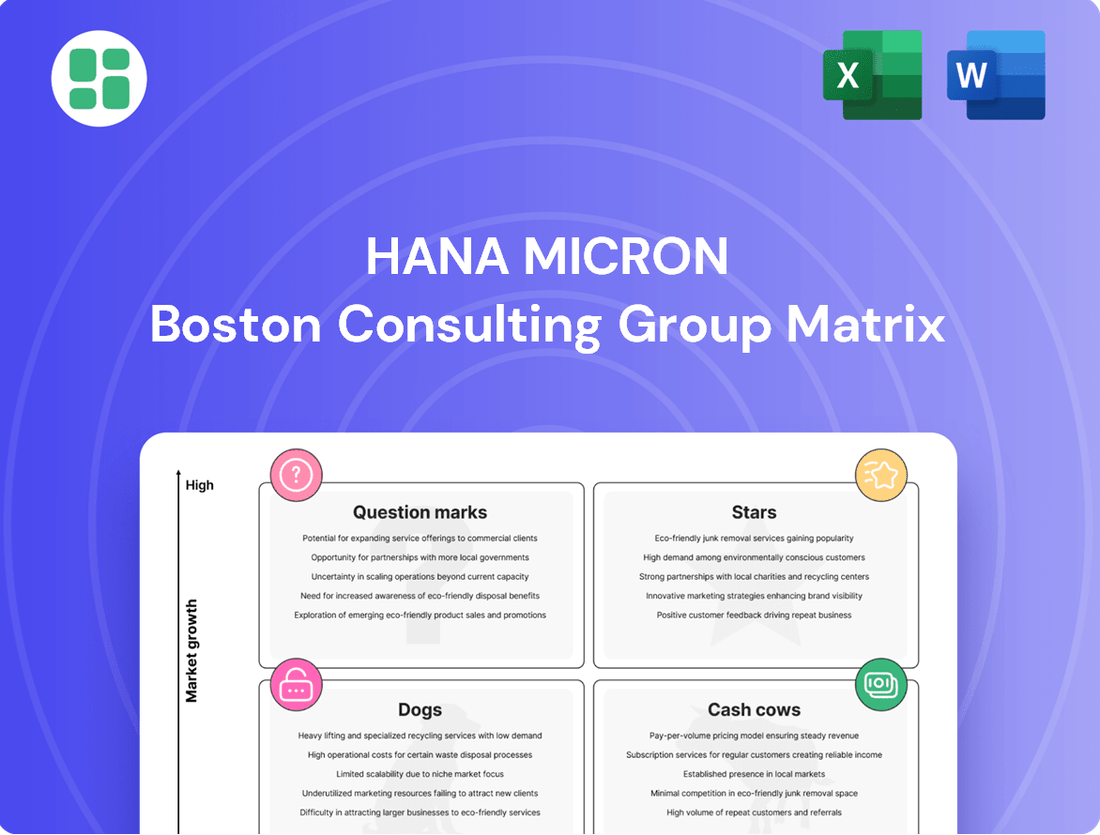

HANA Micron Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HANA Micron Bundle

Understand where HANA Micron's products shine as Stars, generate consistent revenue as Cash Cows, or require careful consideration as Dogs and Question Marks. This initial glimpse is just the tip of the iceberg.

Unlock the full potential of HANA Micron's market strategy by purchasing the complete BCG Matrix. Gain a comprehensive understanding of each product's position and receive data-driven insights to optimize your portfolio.

Don't miss out on the strategic advantage. Invest in the full BCG Matrix report today for a detailed breakdown, actionable recommendations, and a clear roadmap to maximizing HANA Micron's growth and profitability.

Stars

Hana Micron's dedication to cutting-edge packaging, including flip-chip and wafer-level solutions, is a significant Star in the BCG matrix, especially for AI and HPC. These technologies are crucial for enabling the performance demanded by these advanced computing sectors.

The market for advanced packaging is booming, with projections indicating a robust 19.2% increase by 2025, fueled by the insatiable demand from AI devices and expanding data centers. Hana Micron is strategically positioned to capitalize on this trend.

Their collaboration with Samsung, notably in testing AI phone packaging, underscores Hana Micron's strong footing in this rapidly expanding, high-potential market segment.

The demand for High Bandwidth Memory (HBM) is experiencing explosive growth, largely fueled by the insatiable needs of AI-driven data centers. This surge positions HBM packaging as a clear Star within the BCG matrix. Hana Micron's advanced capabilities in ultra-thin wafer processing and sophisticated 3D stacking are foundational to delivering these cutting-edge, high-performance memory solutions.

Hana Micron's strategic emphasis on tackling the escalating complexity and the ever-increasing requirements for high-bandwidth data processing perfectly aligns with this dominant market trend. For instance, the global HBM market size was valued at approximately $2.5 billion in 2023 and is projected to reach over $15 billion by 2028, demonstrating a compound annual growth rate (CAGR) exceeding 40% in the coming years.

The automotive sector's rapid evolution, driven by advanced driver-assistance systems (ADAS) and electric vehicles (EVs), is fueling a substantial demand for sophisticated and reliable semiconductor packaging. Hana Micron's strategic expansion into this high-growth market, moving beyond its traditional mobile and home appliance focus, positions it to capitalize on this trend. The critical need for durable packaging solutions for power management and ADAS components firmly places automotive semiconductor packaging as a Star in Hana Micron's BCG matrix.

Specialized Wafer Level Packaging (WLP)

Specialized Wafer Level Packaging (WLP), encompassing fan-out WLP (FO-WLP) and wafer-level chip-scale packaging (WLCSP), is a high-growth area. This is largely due to its ability to deliver compact and cost-effective solutions, making it a perfect fit for the burgeoning Internet of Things (IoT) and wearable technology markets.

Hana Micron's subsidiary, Hana WLS, is well-positioned in this segment, leveraging its expertise in wafer-level processes. The demand for miniaturization and enhanced performance in consumer electronics continues to fuel this market’s expansion.

- Market Growth: The global wafer-level packaging market was valued at approximately $3.5 billion in 2023 and is projected to reach over $7 billion by 2028, exhibiting a compound annual growth rate (CAGR) of around 15%.

- Key Drivers: Miniaturization requirements in smartphones, wearables, and IoT devices are primary growth drivers.

- Hana Micron's Position: Hana WLS's specialization in advanced WLP technologies like FO-WLP provides a competitive edge.

- Technological Advancements: Innovations in WLP are enabling higher density interconnects and improved thermal management, further boosting adoption.

Turnkey Semiconductor Test Solutions

Hana Micron's turnkey semiconductor test solutions represent a significant strength, fitting squarely into the Star quadrant of the BCG Matrix. This comprehensive offering, covering everything from test program development and probe design to the actual execution of testing, is crucial for the increasingly complex integrated circuits powering modern technology.

The market for semiconductor testing services is experiencing substantial growth. For instance, the global semiconductor testing market was valued at approximately USD 7.1 billion in 2023 and is projected to reach USD 11.5 billion by 2030, growing at a compound annual growth rate (CAGR) of 7.2% during that period. This expansion is largely driven by the escalating complexity of chips used in AI, IoT, and high-performance computing, all of which demand rigorous testing to guarantee functionality and reliability.

- Comprehensive Service Offering: Hana Micron provides end-to-end solutions, from initial test program creation to final testing execution.

- Market Growth Drivers: The increasing demand for sophisticated chips in AI and IoT applications fuels the need for advanced testing capabilities.

- Ensuring Quality: Their integrated approach is vital for verifying the performance and reliability of complex integrated circuits.

- Strategic Advantage: This full-spectrum capability positions Hana Micron as a valuable player in a rapidly expanding market segment.

Hana Micron's advanced packaging technologies, particularly for AI and HPC, are critical Stars in its BCG matrix. These solutions are essential for the performance demands of cutting-edge computing sectors.

The booming advanced packaging market, projected for a 19.2% increase by 2025, is driven by AI devices and data centers, a trend Hana Micron is well-positioned to leverage.

Their collaboration with Samsung on AI phone packaging highlights Hana Micron's strong presence in this high-potential, rapidly expanding market segment.

Hana Micron's expertise in ultra-thin wafer processing and 3D stacking is key to meeting the escalating demand for High Bandwidth Memory (HBM), a clear Star driven by AI data centers. The HBM market, valued at $2.5 billion in 2023, is expected to surpass $15 billion by 2028, with a CAGR over 40%.

The automotive sector, with its growing need for ADAS and EV components, represents another Star for Hana Micron. Their expansion into this market addresses the demand for reliable semiconductor packaging for critical automotive functions.

Specialized Wafer Level Packaging (WLP), including FO-WLP and WLCSP, is a Star for Hana Micron due to its suitability for the miniaturization needs of IoT and wearables. The global WLP market, valued at $3.5 billion in 2023, is projected to exceed $7 billion by 2028, with a 15% CAGR.

Hana Micron's comprehensive semiconductor test solutions are a Star, covering the entire testing process from development to execution. The semiconductor testing market, valued at $7.1 billion in 2023, is expected to reach $11.5 billion by 2030, with a 7.2% CAGR, driven by complex AI and IoT chips.

| Key Technology Area | BCG Quadrant | Market Growth | Hana Micron's Strength | Supporting Data (2023-2028/2030) |

| Advanced Packaging (AI/HPC) | Star | High | Flip-chip, Wafer-level solutions | Market growth ~19.2% by 2025 |

| High Bandwidth Memory (HBM) Packaging | Star | Very High | Ultra-thin wafer processing, 3D stacking | Market $2.5B (2023) to >$15B (2028), CAGR >40% |

| Automotive Semiconductor Packaging | Star | High | Expansion into ADAS/EV components | Growing demand for reliable packaging |

| Specialized Wafer Level Packaging (WLP) | Star | High | Hana WLS expertise (FO-WLP, WLCSP) | Market $3.5B (2023) to >$7B (2028), CAGR ~15% |

| Turnkey Semiconductor Test Solutions | Star | High | End-to-end test services | Market $7.1B (2023) to $11.5B (2030), CAGR 7.2% |

What is included in the product

This analysis categorizes HANA Micron's product portfolio into Stars, Cash Cows, Question Marks, and Dogs, offering strategic guidance for investment and divestment.

Clear visualization of HANA Micron's business units, simplifying strategic decision-making for leadership.

Cash Cows

Standard DRAM packaging and testing represents a cornerstone "cash cow" for Hana Micron. The company's deep-rooted expertise and enduring relationships with industry giants like Samsung and SK Hynix ensure a steady, high-volume demand for these mature services, even in slower-growth memory segments.

This segment consistently delivers robust cash flow with minimal incremental investment requirements, a hallmark of a true cash cow. In 2024, the global DRAM market, while mature, still represented a significant portion of the overall semiconductor industry, with packaging and testing services forming a vital, profitable niche for established players like Hana Micron.

Legacy SoC packaging and test services, particularly for established consumer electronics, represent a strong Cash Cow for Hana Micron. These mature markets, while not experiencing rapid growth, benefit from Hana Micron's established infrastructure and specialized expertise, leading to efficient, high-margin operations. This segment offers consistent profitability with minimal need for new capital investment.

Traditional wire bonding and leadframe packaging, though seen as less cutting-edge, continue to represent a significant portion of the semiconductor packaging market. This is especially true for older technology nodes and applications where cost-effectiveness and high volume are paramount. Hana Micron's long-standing expertise in these foundational packaging techniques allows them to consistently generate revenue from these mature services.

Volume Production for Established Clients

Hana Micron's strong relationships with industry giants like Samsung and SK Hynix are a cornerstone of its Cash Cows. These established partnerships guarantee substantial, ongoing orders for their core packaging and testing services, creating a reliable revenue stream.

This consistent demand, fueled by long-term collaborations, significantly de-risks Hana Micron's operations. It translates into predictable cash flow, a hallmark of a successful Cash Cow business unit. For instance, in 2024, Hana Micron continued to be a key supplier for advanced packaging solutions for leading smartphone manufacturers, contributing significantly to their revenue.

- Stable Client Base: Long-standing partnerships with Samsung and SK Hynix ensure high-volume orders.

- Predictable Revenue: Reliable demand for core packaging and testing services minimizes market volatility.

- Consistent Cash Flow: The stable order book provides a dependable source of income for the company.

Brazil Wafer Business Model

Hana Micron's Brazilian wafer business is a classic example of a cash cow within the BCG matrix. This operation focuses on purchasing wafers, then packaging and marketing them under local brands. This strategy leverages Brazil's tax incentives and a distinct business model that has fostered a strong regional presence.

The established nature of this operation, coupled with its aim for further expansion, suggests a consistent and reliable cash flow. Its insulated market position within Brazil and the advantageous local economic conditions contribute to sustained profitability. For instance, Brazil's semiconductor market, while facing global headwinds, has shown resilience in certain segments, with domestic production initiatives often supported by government policies.

- Established Regional Operations: Hana Micron's presence in Brazil is built on a foundation of local packaging and marketing, creating a distinct market niche.

- Tax Incentives and Favorable Conditions: The business model benefits significantly from Brazil's tax structures and a supportive local economic environment, enhancing profitability.

- Steady Cash Flow: The insulated market position and predictable demand in Brazil contribute to a stable and consistent generation of cash.

- Expansion Potential: Despite being a cash cow, the business model is designed for further growth, indicating a robust and adaptable strategy.

Hana Micron's legacy SoC packaging and test services, particularly for established consumer electronics, represent a strong Cash Cow. These mature markets, while not experiencing rapid growth, benefit from Hana Micron's established infrastructure and specialized expertise, leading to efficient, high-margin operations.

This segment offers consistent profitability with minimal need for new capital investment, a defining characteristic of a cash cow. The company's deep-rooted expertise in traditional wire bonding and leadframe packaging allows them to consistently generate revenue from these mature services, especially in applications where cost-effectiveness and high volume are paramount.

In 2024, the global semiconductor packaging market continued to see demand for these foundational techniques, with Hana Micron leveraging its long-standing partnerships with industry giants to secure high-volume orders, ensuring predictable cash flow.

| Business Segment | BCG Category | Key Characteristics | 2024 Contribution (Est.) |

| Standard DRAM Packaging & Testing | Cash Cow | High volume, mature market, strong client relationships (Samsung, SK Hynix), low investment needs | Significant revenue driver, high profit margins |

| Legacy SoC Packaging & Testing | Cash Cow | Established consumer electronics, cost-effective, high volume, specialized expertise | Consistent profitability, minimal capital expenditure |

| Brazilian Wafer Business | Cash Cow | Regional focus, tax incentives, local marketing, insulated market position | Steady cash flow, potential for regional expansion |

Full Transparency, Always

HANA Micron BCG Matrix

The HANA Micron BCG Matrix preview you are currently viewing is the identical, fully formatted document that will be delivered to you upon purchase. This means you'll receive the complete analysis, free from any watermarks or demo indicators, ready for immediate strategic application. Rest assured, the insights and structure you see are precisely what you'll own and utilize for your business planning.

Dogs

Obsolete packaging technologies, such as older lead-frame designs or wire bonding methods that are being superseded by advanced flip-chip or wafer-level packaging, would be categorized in the Dogs quadrant of the HANA Micron BCG Matrix. These legacy solutions often possess a very low market share as the industry shifts towards higher performance and miniaturization. For instance, the market for traditional dual in-line package (DIP) components has significantly shrunk, with their demand declining by an estimated 70% over the past decade as surface-mount technology (SMT) dominates.

Highly commoditized, low-margin testing services, often for basic semiconductor components, represent a Dogs category in the BCG matrix. Intense price competition and a lack of product differentiation characterize these segments, leading to thin profit margins. For instance, the global semiconductor testing market, while growing, sees significant pressure on pricing for older, less complex chip types.

These services typically offer minimal growth potential, forcing companies to focus on aggressive cost-cutting just to maintain profitability. In 2024, many providers in this space are grappling with rising operational costs, making break-even a constant challenge. This segment can drain valuable resources that could be better allocated to more promising areas of the business.

Underperforming regional operations within HANA Micron's portfolio, if they consistently miss market share and profitability targets despite remedial actions, would fall into the Dogs category of the BCG Matrix. For instance, if a specific regional facility in Southeast Asia, which accounted for 5% of HANA Micron's total revenue in 2023, saw its market share shrink from 8% to 4% in its local market due to intense price competition from emerging local players, it would be a prime example.

These underperforming units often struggle with factors like intense local competition, unfavorable economic climates, or internal operational bottlenecks. Consider a scenario where a European manufacturing plant, despite a 10% year-over-year increase in production capacity in 2024, experienced a 15% decline in sales volume within its primary European market, failing to achieve its projected profitability by a significant margin. Such a situation signals a need for strategic re-evaluation.

Legacy Products with Declining Demand

Legacy products with declining demand, often found in the Dogs quadrant of the BCG matrix, represent business units or product lines that are experiencing very low growth and possess a small market share. These are typically older technologies or services that are being superseded by newer, more advanced alternatives. For instance, companies that once specialized in packaging for CRT televisions or testing services for older analog communication systems would fall into this category. As the end-products they support become obsolete, the demand for these associated services naturally shrinks, leading to a diminishing market presence and minimal revenue generation.

These legacy offerings often represent a drain on company resources, consuming capital and operational capacity without yielding significant returns. In 2024, the semiconductor packaging industry, for example, saw a continued shift towards advanced packaging solutions like 2.5D and 3D integration, which are crucial for high-performance computing and AI applications. This trend directly impacts older packaging methods for less demanding applications, pushing them further into the Dogs category. Companies must carefully manage these units, often considering divestiture or phasing out to reallocate resources to more promising growth areas.

- Shrinking Market Share: Products tied to older consumer electronics, like DVD players, have seen their market share erode significantly, with global sales continuing a downward trend in 2024.

- Low Growth Environment: The demand for services supporting these older technologies, such as specialized repair or legacy component manufacturing, is stagnant or declining.

- Resource Consumption: Maintaining production lines or service infrastructure for these products can be costly, diverting funds from innovation and growth initiatives.

- Obsolescence Risk: The risk of these products becoming entirely obsolete increases as newer technologies gain traction, making continued investment unsustainable.

Non-Core, Unprofitable Investment Sectors

Hana Micron's recent activities, including the proposed and subsequently withdrawn spin-off of its investment business, hint at potential underperformance in non-core investment sectors. These ventures, if they don't directly bolster semiconductor operations or generate strong returns, could be classified as Dogs in the BCG matrix.

Such underperforming assets can drain valuable capital and management focus, offering little strategic advantage. For instance, if Hana Micron's investment portfolio, which might include stakes in unrelated industries, is not showing significant growth, it represents a drag on overall performance. In 2023, the global investment management industry saw mixed results, with some sectors facing significant headwinds, which could be reflected in Hana Micron's non-core holdings.

- Underperforming Assets: Hana Micron's investment business, if not generating adequate returns, acts as a Dog.

- Capital Diversion: Non-core investments can divert capital from more profitable semiconductor operations.

- Strategic Focus: Lack of clear strategic benefit from these investments weakens their position.

- Market Context: The broader investment market's performance in 2023-2024 provides a backdrop for evaluating these sectors.

Products or services in the Dogs quadrant, like obsolete semiconductor packaging technologies, are characterized by low market share and minimal growth potential. These legacy offerings often consume resources without generating substantial returns, forcing companies to focus on cost-cutting. For example, the market for traditional dual in-line package (DIP) components has seen a significant decline, with demand dropping substantially as newer technologies like flip-chip dominate.

Highly commoditized, low-margin testing services for basic semiconductor components also fall into the Dogs category. Intense price competition and a lack of differentiation in these segments lead to thin profit margins and minimal growth. In 2024, providers in this space face rising operational costs, making profitability a constant challenge and diverting resources from more promising areas.

Underperforming regional operations or non-core investment businesses that consistently miss targets and offer little strategic advantage also represent Dogs. These units can drain capital and management focus, as seen with potential underperformance in non-core investment sectors, which are evaluated against the broader investment market's performance in 2023-2024.

| Category | Characteristics | Examples | Market Context (2023-2024) | Strategic Implication |

|---|---|---|---|---|

| Dogs | Low Market Share, Low Growth | Obsolete packaging (DIP), commoditized testing services, underperforming regional units, non-core investments | DIP market decline, pressure on older chip testing pricing, mixed investment market performance | Resource drain, potential divestiture or phasing out |

Question Marks

While High Bandwidth Memory (HBM) is a clear leader for Hana Micron, the company is also looking beyond this established technology into more advanced 3D IC integration. Think of technologies like die-to-wafer hybrid bonding, which allows for the seamless integration of various chiplets. This is where the real future growth potential lies, even though it's still in its early stages.

These cutting-edge integration methods are still emerging, meaning they have high-growth potential but currently a smaller slice of the market. The complexity of the technology and the significant upfront development costs are the main hurdles. For instance, the market for advanced packaging solutions, which includes these types of 3D ICs, was projected to reach approximately $30 billion in 2024, with significant growth expected in the coming years.

Hana Micron's commitment to investing in advanced packaging certainly indicates they are exploring these nascent but promising areas. However, their market share in these specific, more complex 3D IC integrations beyond HBM is still being built and has not yet been firmly established. It’s a strategic play for future dominance in a rapidly evolving semiconductor landscape.

Co-packaged optics (CPO) represents a significant technological shift, integrating optical interconnects directly into semiconductor packages to boost data throughput and power efficiency, crucial for data centers and AI applications. This burgeoning market is projected for substantial growth, with some analysts forecasting the CPO market to reach several billion dollars by the late 2020s.

For Hana Micron, CPO falls squarely into the Question Mark category within the BCG Matrix. While the market's high-growth potential is undeniable, the company's current market share in this highly specialized and technologically demanding segment is likely minimal, reflecting its early stage of development in this area.

Significant strategic investment and research and development will be essential for Hana Micron to effectively compete and capture a meaningful share of the CPO market, transforming this potential opportunity into a future star performer.

Hana Micron's exploration into new material-based packaging, such as glass substrates and advanced organic interposers, targets next-generation semiconductor performance and cost efficiency. These innovations are crucial for high-growth markets like AI and advanced computing, where demand for faster, more powerful chips continues to surge. For instance, the advanced packaging market, which includes these innovative materials, was projected to reach over $30 billion in 2024, with continued strong growth expected.

While these cutting-edge materials offer significant potential, their adoption requires substantial research and development investment, alongside concerted market education and acceptance efforts. Hana Micron's strategic focus on material science provides a strong foundation to capitalize on these emerging trends. The global semiconductor packaging market is expected to grow at a compound annual growth rate (CAGR) of approximately 6.5% through 2028, highlighting the significant opportunity for companies investing in advanced materials.

Expansion into Untapped Geographic Markets

Hana Micron's ambition to be a leading global OSAT company naturally points towards expanding into untapped geographic markets where its presence is minimal but growth potential is high. This strategic move aims to diversify revenue streams and capture new market share.

The global OSAT market, projected to reach approximately $130 billion by 2028, presents significant opportunities. However, entering new territories requires substantial capital for infrastructure and market development, alongside navigating local regulations and competitive landscapes, classifying these as question marks in the BCG matrix.

- Market Penetration: Focus on gaining initial market share in regions like Southeast Asia or Eastern Europe, which are showing increasing demand for advanced semiconductor packaging.

- Investment Strategy: Allocate resources for establishing local partnerships, sales channels, and potentially small-scale manufacturing or testing facilities to reduce initial risk.

- Risk Assessment: Conduct thorough due diligence on political stability, economic conditions, and the competitive intensity within target markets before committing significant capital.

- Technological Alignment: Prioritize markets that are adopting advanced semiconductor technologies, aligning with Hana Micron's core competencies and future growth areas.

Specialized Packaging for Quantum Computing/Edge AI

Hana Micron's focus on specialized packaging for quantum computing and edge AI positions it to capture nascent, high-growth markets. These sectors, while currently small in volume, represent significant future potential, demanding tailored solutions for their unique processing and connectivity needs.

Developing expertise in these areas requires substantial upfront investment. However, securing an early mover advantage in quantum computing packaging, for instance, could unlock substantial rewards as the technology matures. For edge AI, the need for robust, low-power, and highly integrated packaging solutions is already apparent, with the market projected for rapid expansion.

- Quantum Computing Packaging: Requires advanced materials and extreme precision to handle delicate quantum states.

- Edge AI Device Packaging: Demands miniaturization, power efficiency, and thermal management for distributed deployments.

- Market Potential: The global edge AI hardware market is expected to reach over $100 billion by 2027, according to some projections, highlighting the growth opportunity.

- Investment Strategy: Hana Micron’s investment in R&D for these niche areas is a high-risk, high-reward strategy aiming for future market leadership.

Question Marks in Hana Micron's BCG Matrix represent emerging technologies or markets where the company is investing but has not yet established a dominant market share. These areas possess high growth potential but currently contribute minimally to revenue due to their nascent stage.

Co-packaged optics (CPO) and specialized packaging for quantum computing and edge AI are prime examples of Hana Micron's Question Mark investments. While the market for these advanced solutions is projected for substantial growth, Hana Micron's current market penetration is likely minimal, requiring significant R&D and strategic investment to capitalize on future opportunities.

The company's expansion into new geographic markets for OSAT services also falls into the Question Mark category. These ventures offer significant market potential, estimated at around $130 billion by 2028 for the OSAT market, but necessitate substantial capital for infrastructure and market development, alongside navigating local complexities.

| Category | Hana Micron's Position | Market Potential | Key Challenges |

| Co-Packaged Optics (CPO) | Emerging Player | Billions of dollars by late 2020s | Technological complexity, high development costs |

| Quantum Computing & Edge AI Packaging | Early Stage Investor | Edge AI market > $100 billion by 2027 | High upfront R&D investment, specialized requirements |

| New Geographic Markets (OSAT) | Seeking Expansion | OSAT market ~$130 billion by 2028 | Capital investment, regulatory navigation, competition |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial reports, market research, and industry analysis to provide strategic insights.