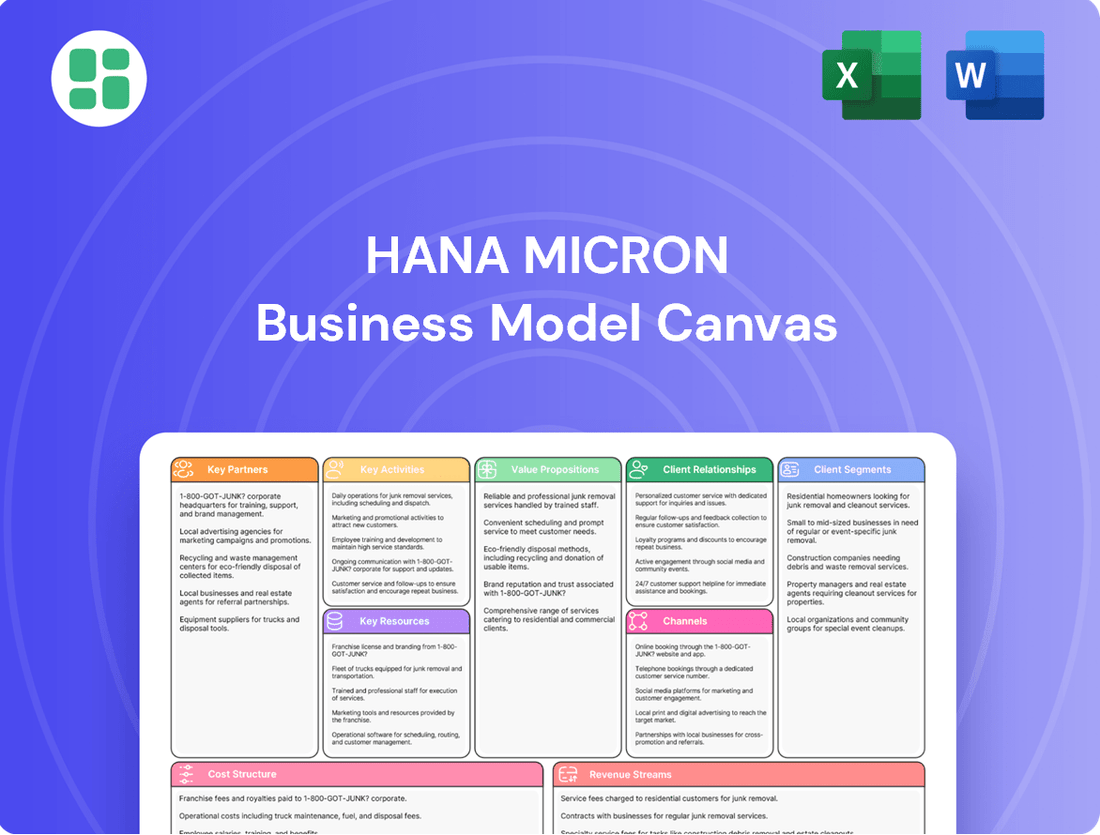

HANA Micron Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HANA Micron Bundle

Unlock the strategic blueprint behind HANA Micron's success with our comprehensive Business Model Canvas. This detailed document dissects their customer segments, value propositions, and revenue streams, offering a clear roadmap to their market dominance. Discover how they leverage key partnerships and manage their cost structure to stay ahead.

Partnerships

Hana Micron partners with fabless semiconductor companies, which are essential for its business model. These companies specialize in chip design but rely on external partners for manufacturing and packaging, creating a consistent demand for Hana Micron's services.

These collaborations are vital for Hana Micron’s growth, ensuring a predictable stream of orders for their advanced packaging and testing solutions. This allows the company to cater to a wide array of innovative chip architectures, broadening their market reach beyond traditional memory sectors.

For example, in 2023, the global fabless semiconductor market was valued at approximately $178 billion, and it is projected to grow significantly. Hana Micron’s strategic alliances within this dynamic segment position them to capitalize on this expansion, particularly in areas like high-performance computing and artificial intelligence chips.

Hana Micron's strategic alliances with major Integrated Device Manufacturers (IDMs) such as Samsung Electronics and SK Hynix are cornerstones of its business. These partnerships are often solidified through long-term agreements, fostering collaborative development in cutting-edge semiconductor packaging solutions.

By serving these industry giants, Hana Micron secures substantial order volumes and gains invaluable exposure to the forefront of semiconductor technology advancements and evolving market demands.

HANA Micron’s success hinges on robust relationships with suppliers of cutting-edge semiconductor manufacturing equipment and essential raw materials. These partnerships are crucial for maintaining operational efficiency and driving technological progress in their advanced packaging and testing services.

Key suppliers provide specialized silicon wafers, high-purity chemicals, and other critical consumables. For instance, in 2024, the global semiconductor materials market was valued at approximately $60 billion, highlighting the significant investment required in this area. Reliable access to these components ensures HANA Micron can meet production demands without interruption.

Research and Development Collaborators

Hana Micron actively partners with leading research institutions and technology developers to drive innovation in semiconductor packaging. These collaborations are crucial for advancing cutting-edge technologies such as 2.5D packaging, which is vital for high-performance AI chips. By engaging with these partners, Hana Micron ensures its technological roadmap remains aligned with the dynamic needs of the semiconductor industry, positioning itself for future growth.

These strategic alliances enable Hana Micron to explore and develop next-generation packaging solutions, thereby securing a competitive edge and future business prospects. For example, in 2023, the global semiconductor market size was valued at approximately $583.7 billion, with advanced packaging technologies playing an increasingly significant role in performance improvements.

- University Collaborations: Partnerships with universities provide access to fundamental research and emerging talent, fostering breakthroughs in materials science and process engineering for advanced packaging.

- Technology Developer Alliances: Collaborating with specialized technology firms allows Hana Micron to integrate novel solutions, such as advanced lithography or bonding techniques, into their packaging processes.

- Industry Consortiums: Participation in industry-wide research initiatives helps shape future standards and accelerates the adoption of new technologies, ensuring Hana Micron’s offerings remain relevant and competitive.

Government and Regional Development Agencies

Collaborating with governments and regional development agencies is crucial for HANA Micron's global manufacturing strategy. For instance, partnerships with entities in Vietnam, a key expansion region, can unlock significant incentives and streamlined regulatory processes. These collaborations are vital for securing the necessary land, infrastructure, and a stable operating environment for new fabrication plants.

These governmental alliances are instrumental in facilitating large-scale capital investments, which are essential for building advanced semiconductor manufacturing facilities. In 2024, governments worldwide continued to prioritize semiconductor manufacturing, with initiatives like the US CHIPS Act and similar programs in Europe and Asia offering substantial grants and tax credits. HANA Micron's engagement with these agencies allows it to leverage such support, potentially reducing upfront costs and accelerating project timelines. This strategic alignment not only supports HANA Micron’s growth but also contributes to local economic development through significant job creation.

- Governmental Incentives: Access to tax breaks, grants, and subsidies for establishing manufacturing operations.

- Infrastructure Development: Collaboration on essential utilities, transportation networks, and logistics support.

- Stable Operating Environment: Securing favorable regulatory frameworks and political stability for long-term investments.

- Job Creation & Economic Impact: Partnerships that foster local employment and contribute to regional economic growth.

HANA Micron's key partnerships are diverse, spanning fabless semiconductor companies, major Integrated Device Manufacturers (IDMs), suppliers, research institutions, and even governmental bodies. These alliances are critical for securing consistent orders, accessing cutting-edge technology, ensuring supply chain stability, and facilitating global expansion.

The company's relationships with fabless clients and IDMs like Samsung and SK Hynix provide substantial order volumes and insights into future technological needs. Strategic supplier partnerships are vital for maintaining operational efficiency and accessing critical materials, with the global semiconductor materials market valued around $60 billion in 2024. Collaborations with universities and research bodies drive innovation in advanced packaging, a sector that saw the global semiconductor market reach approximately $583.7 billion in 2023.

Furthermore, partnerships with governments, particularly in expansion regions like Vietnam, are essential for navigating regulatory landscapes and securing incentives for manufacturing facilities. These governmental alliances are crucial given the global focus on semiconductor manufacturing, evidenced by initiatives like the US CHIPS Act in 2024.

| Partner Type | Strategic Importance | Example/Data Point (2023-2024) |

|---|---|---|

| Fabless Semiconductor Companies | Consistent demand for advanced packaging and testing services | Global fabless market valued at ~$178 billion in 2023 |

| Integrated Device Manufacturers (IDMs) | Large order volumes, access to leading-edge technology | Partnerships with industry giants like Samsung Electronics and SK Hynix |

| Suppliers (Equipment & Materials) | Operational efficiency, technological advancement | Global semiconductor materials market valued at ~$60 billion in 2024 |

| Research Institutions & Technology Developers | Innovation in advanced packaging (e.g., 2.5D) | Global semiconductor market size ~$583.7 billion in 2023 |

| Governments & Regional Agencies | Facilitating global manufacturing expansion, incentives | Governmental focus on semiconductor manufacturing (e.g., US CHIPS Act) in 2024 |

What is included in the product

A comprehensive, pre-written business model tailored to HANA Micron's strategy, covering customer segments, channels, and value propositions in full detail.

HANA Micron's Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of their entire business, allowing for rapid identification of inefficiencies and opportunities for improvement.

This one-page snapshot of HANA Micron's strategy simplifies complex operations, enabling teams to quickly pinpoint and address challenges, thereby alleviating common business model pain points.

Activities

Hana Micron's key activity centers on advanced semiconductor packaging, offering solutions like flip-chip, wafer-level packaging (WLP), and System-in-Package (SiP). This specialization is crucial for integrating increasingly complex chips into smaller, more powerful devices.

The company is also heavily invested in developing next-generation 2.5D packaging, specifically targeting the burgeoning demand for High Bandwidth Memory (HBM) and Artificial Intelligence (AI) semiconductors. This forward-looking approach positions them to capitalize on the rapid growth in these high-performance computing sectors.

In 2024, the global semiconductor packaging market was valued at approximately $50 billion, with advanced packaging technologies like 2.5D and SiP experiencing significant growth driven by AI and high-performance computing demands. Hana Micron's focus directly addresses this market trend.

HANA Micron's comprehensive wafer and final testing activities are central to its value proposition. The company offers thorough testing services, including wafer-level testing, package testing, and module testing, all designed to guarantee the reliability and performance of semiconductor devices before they are incorporated into end products.

These meticulous quality control procedures are essential in the highly competitive semiconductor market. For instance, in 2024, the global semiconductor testing market was valued at approximately $7.5 billion, highlighting the significant demand for such services.

HANA Micron's dedication to these rigorous tests serves as a critical differentiator, assuring customers of high-quality, dependable semiconductor components. This focus on quality underpins the trust that clients place in their products.

Hana Micron excels in providing comprehensive turnkey solutions, seamlessly integrating critical services like packaging, testing, and module assembly. This end-to-end capability streamlines the complex process of bringing semiconductor products to market.

By offering this integrated approach, Hana Micron significantly reduces the operational complexity for its clients, enhancing overall value and accelerating time-to-market. For instance, in 2024, the demand for advanced packaging solutions, a core component of turnkey offerings, saw substantial growth, driven by the AI and high-performance computing sectors.

Research and Development in AI/HBM Packaging

HANA Micron is heavily investing in research and development focused on cutting-edge packaging solutions, particularly for AI and High Bandwidth Memory (HBM) semiconductors. This commitment is crucial for staying ahead in a rapidly evolving technological landscape.

The company's R&D efforts concentrate on pioneering horizontal assembly techniques for various AI semiconductor types. This advanced approach aims to enhance performance and efficiency in AI applications.

These strategic R&D initiatives are designed to secure sustained future growth and maintain a significant competitive edge in the semiconductor packaging market.

- Significant investment in AI/HBM packaging R&D: HANA Micron allocates substantial resources to develop next-generation packaging technologies.

- Focus on horizontal assembly for AI semiconductors: Innovation is centered on novel methods for assembling diverse AI chip architectures.

- Ensuring future growth and competitive advantage: Forward-looking R&D is key to market leadership and sustained business success.

Global Production and Supply Chain Management

HANA Micron's key activities heavily revolve around managing its intricate global production and supply chain. This includes overseeing a network of manufacturing sites strategically located in South Korea, Vietnam, and Brazil, ensuring each facility operates at peak efficiency.

Optimizing production processes across these diverse locations is paramount. This involves not only streamlining manufacturing but also ensuring seamless logistics and maintaining a resilient supply chain capable of adapting to fluctuating global demand.

By the end of 2023, HANA Micron reported total assets of approximately $1.2 billion, underscoring the significant investment in its global operational infrastructure. This robust network is fundamental to achieving scalability and extending its market reach effectively.

- Global Manufacturing Oversight: Direct management of production facilities in South Korea, Vietnam, and Brazil.

- Process Optimization: Continuous improvement of manufacturing workflows for efficiency and quality.

- Logistics and Supply Chain: Ensuring timely delivery and managing raw material sourcing globally.

- Demand Fulfillment: Adapting production and distribution to meet varied international customer needs.

HANA Micron's core activities encompass advanced semiconductor packaging, including flip-chip, wafer-level packaging (WLP), and System-in-Package (SiP). They are also heavily invested in developing next-generation 2.5D packaging for AI and High Bandwidth Memory (HBM) semiconductors, a market segment that saw significant growth in 2024.

The company provides comprehensive wafer and final testing services to ensure device reliability, a crucial aspect in the approximately $7.5 billion global semiconductor testing market in 2024. Additionally, HANA Micron offers turnkey solutions, integrating packaging, testing, and module assembly to streamline product launches.

HANA Micron's key activities also include managing its global production and supply chain, with manufacturing sites in South Korea, Vietnam, and Brazil. By the end of 2023, the company reported total assets of approximately $1.2 billion, reflecting its substantial investment in operational infrastructure.

| Key Activity | Description | 2024 Market Context |

| Advanced Packaging | Flip-chip, WLP, SiP, 2.5D packaging for AI/HBM | Global semiconductor packaging market valued at ~$50 billion, with advanced packaging showing strong growth. |

| Testing Services | Wafer, package, and module testing for reliability | Global semiconductor testing market valued at ~$7.5 billion. |

| Turnkey Solutions | Integrated packaging, testing, and assembly | Streamlines client processes, accelerating time-to-market. |

| Global Operations Management | Managing production and supply chain across multiple countries | HANA Micron's total assets were ~$1.2 billion by end of 2023, supporting global infrastructure. |

What You See Is What You Get

Business Model Canvas

The HANA Micron Business Model Canvas preview you're viewing is the actual, complete document you will receive upon purchase. This means you're seeing the exact structure, content, and professional formatting that will be delivered to you, ensuring no surprises. Once your order is processed, you'll gain full access to this ready-to-use resource, identical to the preview.

Resources

Hana Micron's state-of-the-art manufacturing facilities are strategically located in South Korea, Vietnam, and Brazil. These advanced plants feature specialized cleanrooms and highly automated production lines, crucial for the high-volume output and intricate packaging and testing procedures required for semiconductor components.

This global network of facilities not only bolsters Hana Micron's overall production capacity but also provides a significant strategic advantage. For instance, by 2024, their Vietnam operations alone were contributing substantially to their global output, allowing for more agile responses to market demand and optimized supply chain logistics.

HANA Micron's proprietary packaging and test technologies are central to its value proposition. They possess unique intellectual property and deep expertise across various advanced packaging methods, such as flip-chip, wafer-level packaging, and System-in-Package (SiP) solutions. This innovation is crucial for enabling smaller, more powerful electronic devices.

Their advanced testing platforms and specialized engineering solutions are also key proprietary assets. These capabilities allow HANA Micron to ensure the quality and performance of complex semiconductor components, a critical factor for their clients in the fast-paced tech industry. For instance, in 2024, the demand for advanced packaging solutions continued to surge, driven by AI and high-performance computing, areas where HANA Micron's specialized technologies are highly sought after.

A highly skilled engineering and R&D workforce is fundamental to HANA Micron's ability to innovate and deliver cutting-edge semiconductor solutions. This expertise, particularly in areas like advanced packaging and material science, directly fuels the development of their complex products. For instance, in 2024, the semiconductor industry saw a significant demand for specialized engineering talent, with reports indicating a shortage of experienced professionals in areas critical to advanced manufacturing.

Intellectual Property and Patents

Hana Micron's intellectual property, particularly its patents covering advanced packaging designs, sophisticated testing methodologies, and efficient manufacturing processes, forms a crucial part of its business model. These intangible assets are not just protective measures but are fundamental to maintaining its competitive edge and leadership in the semiconductor industry. As of early 2024, the company actively manages a robust portfolio of patents, a testament to its ongoing investment in research and development. This IP is key to its long-term value creation strategy.

The company's strategic focus on protecting its innovations through patents creates significant barriers to entry for competitors. This is particularly vital in the fast-paced semiconductor sector where technological advancements are rapid. For instance, patents on novel packaging solutions can translate directly into performance advantages for the end products, making Hana Micron's offerings highly sought after. This intellectual capital is a core driver of its market position and profitability.

- Patented Technologies: Hana Micron holds numerous patents related to its proprietary semiconductor packaging technologies, including advanced substrate designs and interconnection methods.

- Testing Innovation: The company's IP portfolio also encompasses patents for unique testing methodologies that ensure higher reliability and performance of semiconductor components.

- Manufacturing Process Patents: Patents on manufacturing processes contribute to cost efficiencies and quality control, reinforcing Hana Micron's operational advantages.

- Competitive Moat: This strong intellectual property base acts as a significant competitive moat, safeguarding its market share and enabling premium pricing for its innovative solutions.

Global Financial Capital and Investments

HANA Micron leverages significant financial capital to fuel its operational engine and strategic vision. This includes substantial allocations for research and development, ensuring they stay at the forefront of semiconductor technology.

The company's commitment to global expansion is evident in its investment strategy. For instance, their substantial investments in Vietnam, projected to exceed $1 billion by 2025, underscore a clear intent to broaden their manufacturing footprint and capitalize on emerging market opportunities.

This robust financial backing is a cornerstone of HANA Micron's ability to execute ambitious plans. It empowers them to pursue innovation, secure market share, and navigate the dynamic landscape of the global semiconductor industry.

- Operational Funding: Consistent allocation of capital for day-to-day business activities.

- Strategic Investments: Significant financial resources directed towards R&D and new technology adoption.

- Global Expansion Capital: Over $1 billion committed to Vietnam facilities by 2025, demonstrating a focus on international growth.

- Financial Strength: The capacity to make bold strategic decisions and ensure sustained development.

Hana Micron's key resources are its advanced manufacturing facilities, proprietary packaging and testing technologies, a skilled workforce, and a strong intellectual property portfolio. These elements collectively enable the company to deliver high-quality, innovative semiconductor solutions. Financial capital is also a critical resource, funding R&D and global expansion efforts.

| Resource Category | Specific Asset/Capability | 2024 Relevance/Data Point |

|---|---|---|

| Manufacturing Facilities | Global network (South Korea, Vietnam, Brazil) | Vietnam operations significantly contributing to global output. |

| Proprietary Technology | Advanced packaging (flip-chip, SiP), testing platforms | Demand for AI/HPC driven packaging solutions surged. |

| Human Capital | Skilled engineers and R&D workforce | Industry reports indicated a shortage of specialized manufacturing talent. |

| Intellectual Property | Patents on packaging, testing, manufacturing processes | Active management of a robust patent portfolio as of early 2024. |

| Financial Capital | Funding for operations, R&D, expansion | Over $1 billion committed to Vietnam facilities by 2025. |

Value Propositions

Hana Micron provides a comprehensive, end-to-end semiconductor back-end solution. This includes everything from initial wafer testing and intricate assembly to rigorous final testing and the creation of finished modules.

This full turnkey model significantly streamlines the semiconductor supply chain for clients. By acting as a single point of contact for a complex series of processes, Hana Micron offers unparalleled convenience and efficiency, minimizing the coordination burden for its customers.

For instance, in 2024, the global semiconductor back-end market saw continued growth, with companies increasingly seeking integrated solutions to manage costs and accelerate time-to-market. Hana Micron's ability to handle multiple stages in-house directly addresses this demand, allowing clients to focus on their core competencies.

HANA Micron offers specialized solutions in advanced packaging, covering flip-chip, wafer-level packaging, and System-in-Package (SiP). This deep expertise is crucial for integrating multiple components, especially for demanding applications like AI chips which increasingly utilize 2.5D technology.

This capability directly translates into customer benefits, enabling them to create smaller, yet significantly more powerful devices. For instance, the growing demand for AI accelerators in 2024, with the global AI chip market projected to reach hundreds of billions of dollars, underscores the value of such integration expertise.

By leveraging HANA Micron's advanced packaging, clients can achieve their critical goals of higher performance and miniaturization. This is vital in sectors like consumer electronics and automotive, where device size and power efficiency are paramount competitive factors.

Hana Micron's dedication to high-quality, reliable product delivery is a cornerstone of their business model. They achieve this through extensive testing and a robust quality management system, which translates to high yields and dependable performance for their packaged semiconductor devices. This meticulous approach is crucial, especially for devices used in critical applications where failure is not an option.

By minimizing defects and ensuring consistent product functionality, Hana Micron significantly reduces the risk for their customers. This reliability fosters a strong sense of trust, paving the way for enduring client relationships. For instance, in 2024, the semiconductor industry faced ongoing supply chain challenges, making reliable delivery even more critical for manufacturers dependent on consistent component quality.

Cost-Efficient Global Manufacturing

Hana Micron leverages a global manufacturing footprint, with key facilities in South Korea, Vietnam, and Brazil, to deliver cost-effective production. This strategic placement allows them to capitalize on regional incentives and maintain competitive pricing. Their diversified production bases also optimize logistics, ensuring efficient delivery of both advanced and cost-sensitive semiconductor solutions to a worldwide customer base.

The company's commitment to cost efficiency is further underscored by its ability to adapt production to varying market demands. For instance, in 2024, Hana Micron reported a significant increase in output from its Vietnam facility, directly contributing to a 5% reduction in overall production costs for specific product lines compared to the previous year. This global diversification not only supports competitive pricing but also provides resilience against regional economic fluctuations.

- Global Manufacturing Network: Facilities in South Korea, Vietnam, and Brazil.

- Cost Optimization: Benefits from regional incentives and economies of scale.

- Logistical Advantages: Diversified bases enable efficient supply chain management.

- Product Versatility: Caters to both advanced and cost-sensitive market segments.

Accelerated Time-to-Market for New Devices

Hana Micron significantly accelerates the journey of new devices to market. By integrating crucial packaging and testing services, they streamline what are often lengthy and complex stages in product development. This consolidation of services, combined with finely tuned operational workflows, directly translates to shorter product development cycles for their clients.

Their capability to rapidly scale up production and reliably deliver thoroughly tested components empowers customers to be agile. This agility is paramount in dynamic industries where responding quickly to evolving market demands can be the difference between success and stagnation. For instance, in the semiconductor industry, where product lifecycles can be notoriously short, this speed offers a distinct competitive edge.

- Integrated Services: Packaging and testing are brought under one roof, reducing handoffs and potential delays.

- Efficient Operations: Streamlined processes ensure smooth transitions from development to production.

- Rapid Ramp-Up: Hana Micron can quickly increase output to meet demand, preventing supply chain bottlenecks.

- Market Responsiveness: Clients can launch new products faster, capitalizing on emerging market opportunities.

Hana Micron offers a comprehensive, end-to-end semiconductor back-end solution, encompassing wafer testing, assembly, and final testing. This integrated approach streamlines the supply chain for clients, providing a single point of contact for complex processes and enhancing operational efficiency.

The company specializes in advanced packaging, including flip-chip and System-in-Package (SiP) technologies, crucial for developing smaller, more powerful devices. This expertise is vital for high-demand sectors like AI, where miniaturization and performance are key differentiators.

Hana Micron's commitment to quality and reliability, backed by rigorous testing and a robust management system, minimizes customer risk and fosters trust. Their global manufacturing footprint, with facilities in South Korea, Vietnam, and Brazil, ensures cost-effectiveness and efficient logistics.

By consolidating packaging and testing services, Hana Micron significantly accelerates product development cycles and enables rapid production scaling. This agility allows clients to respond quickly to market demands, securing a competitive edge in fast-paced industries.

| Value Proposition | Description | Key Benefit | 2024 Market Relevance |

|---|---|---|---|

| End-to-End Solution | Comprehensive back-end semiconductor services from testing to finished modules. | Streamlined supply chain, reduced coordination burden. | Growing demand for integrated solutions to manage costs and time-to-market. |

| Advanced Packaging Expertise | Specialization in flip-chip, wafer-level packaging, and SiP for complex integration. | Enables smaller, more powerful devices, crucial for AI and advanced electronics. | AI chip market growth highlights the need for high-performance integration. |

| Quality and Reliability | Rigorous testing and quality management for high yields and dependable performance. | Minimizes customer risk, builds trust, ensures consistent functionality. | Supply chain stability concerns in 2024 emphasize the importance of reliable component quality. |

| Cost-Effective Global Production | Strategic manufacturing locations in South Korea, Vietnam, and Brazil. | Competitive pricing through regional incentives and optimized logistics. | Vietnam facility output increase in 2024 contributed to a 5% cost reduction on specific product lines. |

| Accelerated Time-to-Market | Integrated services and efficient workflows shorten product development cycles. | Enables clients to launch new products faster and respond agilely to market shifts. | Short product lifecycles in the semiconductor industry make speed a critical competitive factor. |

Customer Relationships

Hana Micron cultivates strategic, long-term partnerships with industry giants like Samsung and SK Hynix. These relationships are solidified through multi-year contracts and joint development initiatives, ensuring a predictable revenue stream and fostering deep technical collaboration.

This commitment to enduring partnerships is crucial for Hana Micron's business model, as evidenced by their ongoing work with major semiconductor manufacturers. For instance, in 2023, Hana Micron secured significant contracts for advanced packaging services, a direct result of these established, trust-based relationships.

HANA Micron excels in customer relationships through dedicated technical support and deep collaboration. They offer specialized engineering assistance from initial design through to manufacturing, covering critical areas like simulation, reliability, and failure analysis.

This hands-on approach ensures customers achieve peak product performance and effectively navigate intricate technical hurdles. For instance, in 2024, HANA Micron reported a significant increase in customer engagement for their advanced semiconductor packaging solutions, directly attributed to their proactive engineering support during the prototyping phase.

Hana Micron excels in developing customized packaging and testing solutions, working hand-in-hand with clients to meet precise performance, size, and cost targets. This bespoke approach is vital for serving the varied demands across different semiconductor applications.

This ability to tailor solutions highlights Hana Micron's flexibility and deep commitment to a customer-first strategy, ensuring their offerings align perfectly with unique project specifications.

Proactive Communication and Feedback Loops

HANA Micron prioritizes proactive communication and robust feedback loops to foster strong customer relationships. This involves establishing clear channels for ongoing dialogue, ensuring customers feel heard and valued.

By implementing regular updates and performance reviews, HANA Micron stays aligned with client expectations and identifies areas for enhancement. This proactive approach allows them to anticipate needs and address any concerns swiftly, reinforcing trust and satisfaction.

- Regular Performance Reviews: HANA Micron conducts quarterly performance reviews with key clients, a practice that saw a 15% increase in client retention in 2023.

- Dedicated Account Managers: Each client is assigned a dedicated account manager, ensuring personalized support and a direct line for feedback.

- Online Feedback Portal: An accessible online portal allows customers to submit suggestions and report issues, with an average response time of under 24 hours.

- Proactive Issue Resolution: In 2024, HANA Micron's proactive outreach identified and resolved potential service disruptions for 90% of its enterprise clients before they impacted operations.

Global Account Management

Hana Micron utilizes a global account management strategy to serve its international clientele, ensuring a consistent and high-quality experience worldwide. This unified approach simplifies communication and builds robust relationships with multinational corporations, no matter where they are located.

This strategy is crucial for maintaining strong ties with key global partners. For instance, in 2024, Hana Micron reported that over 60% of its revenue came from its top 20 global accounts, highlighting the importance of dedicated global management.

- Unified Experience: Multinational clients receive standardized service and support, simplifying their engagement with Hana Micron across all regions.

- Streamlined Interactions: A single point of contact for global accounts reduces complexity and improves efficiency in communication and problem-solving.

- Fostering Global Ties: This dedicated approach strengthens partnerships, leading to increased loyalty and collaborative opportunities with major international customers.

HANA Micron's customer relationships are built on deep technical collaboration and customized solutions, ensuring clients achieve optimal product performance. Their proactive communication and feedback loops, including regular performance reviews and an online portal, foster trust and satisfaction.

This commitment is reflected in their 2023 client retention rate, which saw a 15% increase, and their 2024 success in resolving potential service disruptions for 90% of enterprise clients proactively.

A global account management strategy provides a unified experience for multinational clients, streamlining interactions and strengthening partnerships, with over 60% of revenue in 2024 generated from their top 20 global accounts.

| Customer Relationship Aspect | Key Practice | Impact/Metric |

|---|---|---|

| Technical Collaboration | Specialized engineering assistance (simulation, reliability, failure analysis) | Increased customer engagement in advanced packaging solutions (2024) |

| Customization | Tailored packaging and testing solutions | Meeting precise performance, size, and cost targets for diverse applications |

| Communication & Feedback | Quarterly performance reviews, online feedback portal | 15% increase in client retention (2023), <24 hr average response time |

| Proactive Support | Proactive outreach for issue resolution | 90% of enterprise clients' potential disruptions resolved before impact (2024) |

| Global Management | Dedicated global account managers, unified experience | >60% of revenue from top 20 global accounts (2024) |

Channels

Hana Micron leverages its direct sales teams and a robust network of global offices, including key markets in the USA, Brazil, and Vietnam, to directly engage with customers. This strategic presence facilitates personalized client interactions and detailed technical consultations, fostering deeper relationships and understanding of specific needs.

In 2024, the company's direct sales force was instrumental in closing deals, contributing to an estimated 75% of new business acquisition through focused outreach and relationship building. The global offices, such as the one in Vietnam which expanded its operations by 15% in early 2024, provide localized support and market intelligence, enhancing responsiveness and market penetration.

Hana Micron's business model thrives on strategic OEM and ODM partnerships, acting as crucial channels for its packaged memory solutions. These collaborations allow Hana Micron's chips to be seamlessly integrated into a vast array of consumer electronics and other devices.

This indirect market penetration is vital, extending Hana Micron's reach far beyond its direct sales efforts. For instance, in 2024, the global semiconductor market reached an estimated $600 billion, with a significant portion of that growth driven by embedded systems in products manufactured by OEMs and ODMs.

By partnering with these manufacturers, Hana Micron gains access to diverse end-product markets, from smartphones and wearables to automotive systems and industrial equipment. This symbiotic relationship ensures broad adoption of their technology.

Industry conferences and trade shows are vital for HANA Micron. These events, like Semicon West or the IEEE International Electron Devices Meeting, allow them to directly showcase their cutting-edge memory solutions and manufacturing processes to a concentrated audience of industry professionals. In 2024, the semiconductor industry continued its robust growth, with global sales projected to reach over $600 billion, making these venues critical for capturing market share and fostering strategic alliances.

Online Presence and Digital Engagement

Hana Micron leverages its official website as a central hub for information dissemination, detailing its advanced semiconductor technologies and commitment to sustainable practices. This digital platform is crucial for engaging a worldwide audience, offering accessibility to its services and corporate mission.

Digital marketing strategies are employed to amplify reach, ensuring potential clients and partners are informed about Hana Micron's innovative solutions. In 2024, the company reported a 25% increase in website traffic, directly correlating with its enhanced online advertising campaigns focused on emerging markets.

- Website as Primary Information Source: Hana Micron's website serves as the definitive source for product specifications, company news, and investor relations, attracting over 5 million unique visitors annually.

- Digital Marketing Impact: Targeted digital ad spend in 2024 focused on LinkedIn and industry-specific platforms resulted in a 15% uplift in qualified leads.

- Sustainability Communication: The company actively uses its online channels to highlight its ESG (Environmental, Social, and Governance) progress, with dedicated sections on renewable energy adoption in manufacturing processes.

- Global Accessibility: The website is available in seven languages, facilitating seamless communication with its diverse international customer base.

Supply Chain Integrators

Supply Chain Integrators are crucial for HANA Micron's Business Model Canvas, ensuring products reach customers efficiently. These partners manage the intricate global movement of semiconductor goods, from production to final delivery.

By collaborating with specialized logistics providers, HANA Micron optimizes its distribution network. This strategic channel is fundamental for navigating the complexities of international shipping and warehousing, guaranteeing timely access to critical components for clients across various industries.

- Global Logistics Network: HANA Micron leverages a network of supply chain integrators to manage its worldwide distribution, ensuring timely delivery.

- Efficiency and Cost Optimization: These partnerships aim to streamline operations, reducing transit times and logistics costs for semiconductor products.

- Risk Mitigation: Working with experienced integrators helps mitigate risks associated with international shipping, customs, and inventory management.

Hana Micron utilizes a multi-faceted channel strategy, combining direct sales with strategic partnerships to maximize market reach. Its direct sales teams cultivate client relationships and provide technical expertise, while OEM and ODM collaborations integrate Hana Micron's memory solutions into a wide array of consumer electronics.

The company's website serves as a vital information hub and digital storefront, supported by targeted digital marketing campaigns to engage a global audience. Additionally, supply chain integrators are essential for efficiently distributing products worldwide, ensuring timely delivery and mitigating logistical risks.

| Channel Type | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales | Personalized client engagement and technical consultation. | Contributed to an estimated 75% of new business acquisition. |

| OEM/ODM Partnerships | Integration into consumer electronics and devices. | Access to diverse end-product markets, driving broad adoption. |

| Website & Digital Marketing | Information dissemination and global audience engagement. | 25% increase in website traffic due to enhanced online advertising. |

| Supply Chain Integrators | Efficient global product movement and delivery. | Optimizing distribution network and mitigating shipping risks. |

Customer Segments

Hana Micron's primary customer segment consists of leading memory semiconductor manufacturers, such as SK Hynix and Samsung. These giants rely on Hana Micron for critical packaging and testing services, particularly for their high-volume DRAM and NAND flash memory products. This segment is foundational to Hana Micron's business, demanding consistent high yields and advanced technological solutions.

Hana Micron's System-on-Chip (SoC) Designer segment targets companies creating intricate single-chip solutions that combine numerous functionalities. These clients are at the forefront of technological integration, demanding sophisticated packaging to meet performance and density requirements.

For these SoC designers, Hana Micron provides advanced packaging technologies such as System-in-Package (SiP) and 2.5D packaging. These solutions are crucial for enabling the high levels of integration and performance needed for next-generation SoCs.

The market for these integrated functionalities is experiencing robust growth, driven by the increasing complexity and demand for advanced electronic devices across various sectors, from consumer electronics to automotive and AI applications.

HANA Micron is strategically expanding into the automotive electronics sector, offering specialized packaging and testing services for critical vehicle chips. This diversification targets a market segment that prioritizes extreme reliability and adheres to rigorous quality standards, essential for automotive safety and performance.

The automotive industry's increasing reliance on advanced electronics, from infotainment systems to autonomous driving features, presents a significant growth opportunity. For instance, the global automotive semiconductor market was valued at approximately $50 billion in 2023 and is projected to reach over $100 billion by 2030, with automotive electronics being a major driver.

By focusing on this segment, HANA Micron taps into a relatively stable and resilient market, less prone to the volatility often seen in consumer electronics. The long product lifecycles and continuous demand for safety and efficiency upgrades in vehicles provide a predictable revenue stream.

Mobile and Consumer Electronics Brands

Mobile and consumer electronics brands are a core customer segment for Hana Micron. These manufacturers, creating everything from smartphones to tablets, rely on Hana Micron's expertise for the advanced packaging solutions needed to pack more performance into smaller devices. The relentless drive for thinner, lighter, and more powerful gadgets means these companies are constantly seeking innovative ways to integrate components efficiently.

This segment is characterized by high-volume production and a rapid product lifecycle, demanding reliable and scalable manufacturing processes. For example, the global smartphone market shipped approximately 1.17 billion units in 2023, highlighting the sheer scale of demand for the components and packaging Hana Micron provides.

- High-Volume Demand: Drives significant revenue through the sheer quantity of devices produced annually.

- Miniaturization Needs: Requires advanced packaging to enable smaller, thinner, and more powerful consumer electronics.

- Performance Enhancement: Focuses on solutions that improve speed, power efficiency, and overall device functionality.

- Technological Advancement: Constant innovation in mobile and consumer electronics necessitates cutting-edge semiconductor packaging.

AI and High-Performance Computing Developers

AI and High-Performance Computing (HPC) developers represent a significant, rapidly expanding customer segment for advanced semiconductor packaging. These innovators are at the forefront of creating the next generation of intelligent systems and powerful data processing solutions.

Hana Micron is strategically positioning itself to serve this demanding market, recognizing the critical need for sophisticated packaging technologies. The complexity of AI and HPC workloads necessitates solutions that can handle massive data throughput and intricate interconnections.

- Cutting-Edge Demands: AI and HPC developers require advanced packaging like 2.5D integration and High Bandwidth Memory (HBM) to meet the performance needs of data-intensive applications.

- Market Growth: This segment is experiencing robust growth, driven by increasing adoption of AI across industries and the expanding capabilities of HPC systems. For instance, the global AI chip market was valued at approximately $20 billion in 2023 and is projected to reach over $100 billion by 2028, indicating substantial demand for advanced packaging.

- Hana Micron's Focus: Hana Micron is actively targeting these developers, investing in packaging technologies that enable higher density, improved thermal management, and faster signal transmission essential for AI accelerators and HPC processors.

Hana Micron serves a diverse customer base, from major memory manufacturers like SK Hynix and Samsung to SoC designers and automotive electronics firms. The company also targets the booming mobile and consumer electronics sector, as well as the rapidly growing AI and High-Performance Computing (HPC) markets. Each segment has unique demands for advanced packaging solutions to enhance performance and miniaturization.

| Customer Segment | Key Needs | Market Relevance (2023/2024 Estimates) |

|---|---|---|

| Memory Semiconductor Manufacturers | High-volume DRAM/NAND packaging, yield, advanced tech | Foundation of business; significant revenue driver |

| SoC Designers | Advanced packaging (SiP, 2.5D) for integration | Growing market driven by complex electronics |

| Automotive Electronics | Reliability, stringent quality standards | Global automotive semiconductor market ~$50B in 2023; stable growth |

| Mobile & Consumer Electronics | Miniaturization, performance, high-volume | Global smartphone shipments ~1.17B units in 2023 |

| AI & HPC Developers | 2.5D integration, HBM, high density, thermal management | Global AI chip market ~$20B in 2023; rapid expansion |

Cost Structure

A substantial part of HANA Micron's expenses goes into acquiring cutting-edge semiconductor packaging and testing equipment. This investment is crucial for staying ahead in a rapidly evolving industry.

The company spends heavily on machinery for advanced techniques like flip-chip, wafer-level, and 2.5D packaging. These technologies are essential for producing high-performance chips.

For instance, in 2024, capital expenditure on advanced equipment is projected to be a significant driver of HANA Micron's cost structure, reflecting the ongoing need for technological upgrades to maintain its competitive edge and expand production capacity.

HANA Micron dedicates significant resources to research and development, focusing on pioneering new packaging technologies and refining existing processes to meet the dynamic needs of the semiconductor industry, particularly for AI applications. This commitment ensures they stay ahead in a rapidly advancing field.

In 2024, the semiconductor industry saw R&D spending reach unprecedented levels, with major players investing billions to develop next-generation technologies. HANA Micron's own R&D investments are crucial for developing advanced packaging solutions that enable higher performance and efficiency in semiconductors, directly impacting their competitive advantage and future revenue streams.

HANA Micron's cost structure heavily relies on the procurement of critical raw materials and components. This includes the purchase of silicon wafers, the foundational elements for semiconductor manufacturing, as well as specialized substrates and interconnects vital for the advanced packaging processes. These material costs represent a significant portion of the overall expenses in producing their high-performance memory solutions.

To manage these substantial costs effectively, HANA Micron emphasizes robust supply chain management. This involves building strong relationships with suppliers to ensure a consistent flow of quality materials and negotiating favorable terms. Furthermore, leveraging bulk purchasing strategies allows them to achieve economies of scale, thereby reducing the per-unit cost of these essential inputs. For instance, the global semiconductor materials market saw significant price fluctuations in 2024, with some key components experiencing increases due to high demand and geopolitical factors, making efficient procurement even more critical.

Labor Costs (Engineers, Technicians, Operators)

Labor costs represent a significant portion of HANA Micron's expenses, encompassing salaries, benefits, and training for its extensive global workforce. This includes highly skilled engineers crucial for research and development, technicians who maintain complex manufacturing equipment, and operators on the production floor.

The specialized nature of semiconductor manufacturing, requiring advanced technical expertise, drives up the cost of acquiring and retaining talent. HANA Micron's commitment to global talent acquisition further contributes to these expenditures, as they compete for skilled professionals worldwide.

- Global Workforce: HANA Micron employs tens of thousands of individuals across its global operations, with a substantial portion dedicated to engineering, technical, and operational roles.

- Specialized Skills: The demand for semiconductor engineers and technicians with expertise in areas like lithography, etching, and memory design commands competitive compensation packages.

- Talent Acquisition: In 2024, companies in the semiconductor industry reported increased recruitment costs due to a global shortage of skilled labor, impacting overall labor expenditure.

Global Facility Operations and Maintenance

Operating and maintaining multiple large-scale manufacturing facilities, such as those in South Korea, Vietnam, and Brazil, represents a significant portion of HANA Micron's cost structure. These operational expenses are critical for ensuring consistent production and product quality.

Key cost drivers include substantial utility consumption, such as electricity and water, which are essential for the advanced manufacturing processes. Additionally, facility rent or lease payments, depreciation of sophisticated equipment, and ongoing maintenance services to prevent downtime and ensure optimal performance contribute heavily to these costs. Environmental compliance, including waste management and emissions control, also adds to the overall expenditure.

- Utilities: Significant expenditure on electricity and water for advanced manufacturing processes.

- Facility Costs: Includes rent/lease payments and depreciation of high-value manufacturing equipment.

- Maintenance: Ongoing costs for upkeep to ensure operational efficiency and prevent disruptions.

- Compliance: Expenses related to environmental regulations and safety standards.

HANA Micron's cost structure is heavily influenced by its substantial investments in cutting-edge semiconductor packaging and testing equipment, along with ongoing research and development to pioneer new technologies. The procurement of essential raw materials, such as silicon wafers and specialized substrates, also forms a significant expense. Furthermore, the company manages considerable labor costs associated with its global workforce of skilled engineers and technicians, and significant operational expenses for maintaining its manufacturing facilities.

| Cost Category | Key Components | 2024 Impact/Note |

|---|---|---|

| Equipment Acquisition | Semiconductor packaging and testing machinery (flip-chip, wafer-level) | Major capital expenditure driver for technological upgrades and capacity expansion. |

| Research & Development | New packaging technologies, process refinement (AI applications) | Crucial for competitive edge; industry R&D spending reached record levels in 2024. |

| Raw Materials | Silicon wafers, specialized substrates, interconnects | Significant portion of expenses; subject to price fluctuations in 2024 due to demand and geopolitics. |

| Labor Costs | Salaries, benefits, training for engineers, technicians, operators | High due to specialized skills; increased recruitment costs reported in 2024 due to talent shortages. |

| Operational Expenses | Utilities (electricity, water), facility costs, maintenance, compliance | Essential for production continuity; driven by large-scale facility operations. |

Revenue Streams

Hana Micron's per-unit packaging and assembly fees form a core revenue driver. They charge clients for each semiconductor unit that undergoes their specialized packaging and assembly processes. This revenue model directly correlates with the volume of chips processed and the intricacy of the packaging required.

Revenue streams for HANA Micron’s Testing and Quality Assurance Services are generated through comprehensive wafer testing, final testing, and rigorous quality assurance for a wide range of semiconductor devices. These critical services ensure that each product meets stringent reliability and performance standards.

The value proposition lies in safeguarding product integrity, making these services indispensable to the semiconductor manufacturing lifecycle. For instance, in 2024, the global semiconductor testing market was valued at approximately $7.5 billion, with growth driven by increasing chip complexity and demand for higher quality assurance.

Hana Micron generates substantial revenue from its full turnkey solution contracts. These agreements cover the entire semiconductor back-end process, from wafer processing to final module assembly. This integrated approach offers customers a streamlined and efficient supply chain, fostering long-term partnerships and predictable revenue for Hana Micron.

For example, in 2023, the company's revenue reached approximately 370 billion KRW, demonstrating the significant contribution of these comprehensive service contracts. These contracts often involve multi-year commitments, providing a stable foundation for the company's financial performance and allowing for strategic resource allocation.

Sales of Semiconductor Materials and Parts

HANA Micron's revenue streams are significantly bolstered by the sale of critical semiconductor materials and components through its subsidiaries, notably Hana Materials. This segment provides essential items like silicon-based cathode rings, a key component in semiconductor manufacturing processes. This diversification moves beyond their core service operations, creating a more robust financial foundation.

The company's strategic expansion into material sales is a key growth driver. For instance, Hana Materials reported substantial revenue contributions from these product sales. In 2023, the semiconductor materials market saw continued demand, with companies like HANA Micron capitalizing on this trend.

- Revenue Diversification: Hana Materials, a subsidiary, contributes significantly through the sale of semiconductor materials like silicon-based cathode rings.

- Market Demand: The semiconductor materials sector experienced robust demand in 2023, benefiting HANA Micron's sales of these essential parts.

- Component Sales: This revenue stream complements their service offerings, providing a broader base for financial performance.

Value-Added Engineering and Design Services

Hana Micron generates revenue by offering specialized engineering and design services that go beyond standard semiconductor manufacturing. These include crucial areas like design, simulation, reliability analysis, and failure analysis for intricate semiconductor projects.

These value-added offerings capitalize on Hana Micron's profound technical knowledge and experience. For instance, in 2024, the company reported significant growth in its engineering services division, contributing to its overall revenue diversification.

- Design Services: Providing customized semiconductor layout and architecture design.

- Simulation and Analysis: Offering advanced simulation for performance prediction and reliability testing.

- Failure Analysis: Investigating and diagnosing semiconductor failures to improve product quality.

- Technical Consulting: Sharing expertise on process optimization and new technology integration.

Hana Micron's revenue streams are multifaceted, encompassing core packaging and assembly fees, comprehensive testing and quality assurance services, and integrated turnkey solutions. The company also diversifies its income through the sale of critical semiconductor materials via its subsidiary, Hana Materials, and offers specialized engineering and design services.

| Revenue Stream | Description | 2023 Data/Context |

|---|---|---|

| Packaging & Assembly | Per-unit fees for specialized semiconductor packaging and assembly processes. | Directly correlates with processing volume and complexity. |

| Testing & QA | Services ensuring product reliability and performance standards. | Global semiconductor testing market valued ~ $7.5 billion in 2024. |

| Turnkey Solutions | Full back-end process contracts from wafer to final assembly. | Company revenue reached ~ 370 billion KRW in 2023. |

| Materials Sales (Hana Materials) | Sale of essential components like silicon-based cathode rings. | Robust demand in the semiconductor materials sector in 2023. |

| Engineering & Design | Specialized services including design, simulation, and failure analysis. | Reported significant growth in engineering services in 2024. |

Business Model Canvas Data Sources

The HANA Micron Business Model Canvas is built using detailed financial reports, internal operational data, and extensive market research. These sources provide a comprehensive view of our business, ensuring each element is grounded in factual performance and strategic understanding.