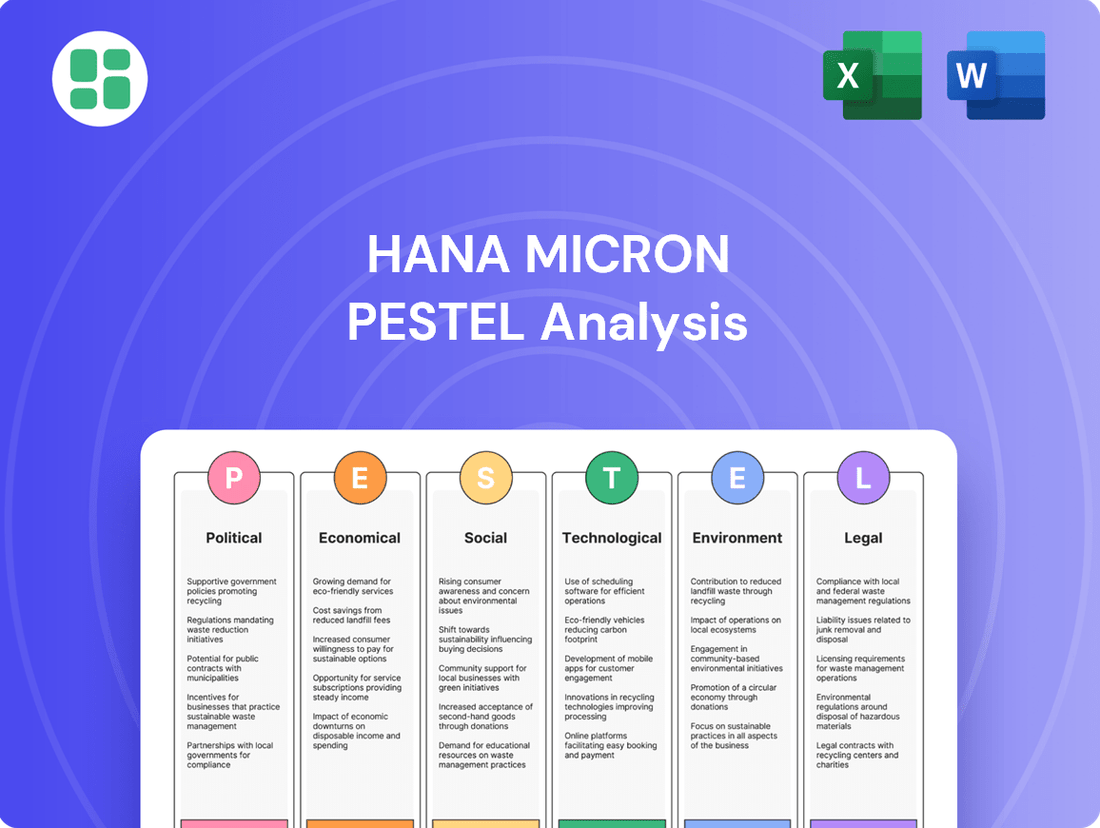

HANA Micron PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

HANA Micron Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping HANA Micron's trajectory. This comprehensive PESTLE analysis provides actionable intelligence to navigate market complexities and identify strategic opportunities. Download the full version now to gain a decisive advantage.

Political factors

South Korea is demonstrating robust support for its crucial semiconductor industry. For 2025, the government is allocating over KRW 14 trillion in policy financing specifically for the chip sector. This significant financial backing aims to bolster companies like Hana Micron.

Beyond direct financing, these initiatives include enhanced tax breaks for research and development activities and capital expenditures on new facilities. Furthermore, access to low-interest loans is being provided, directly reducing the cost of doing business and encouraging growth and innovation within the semiconductor ecosystem.

Escalating trade tensions, particularly between the US and China, are significantly reshaping the global semiconductor landscape. This dynamic is prompting a strategic realignment of supply chains, with many companies actively seeking to reduce their reliance on China.

Vietnam is rapidly emerging as a crucial hub for this diversification. Hana Micron's strategic investment in Vietnam is a direct response to this trend, catering to client demands for production relocation away from China to circumvent geopolitical risks and potential tariffs.

Governments globally recognize semiconductors as vital for national security, prompting policies to bolster domestic production and supply chain resilience. This strategic imperative is driving significant investment in local manufacturing facilities and advanced packaging technologies. For instance, the US CHIPS and Science Act, enacted in 2022, allocated over $52 billion to incentivize semiconductor manufacturing and research within the United States, aiming to reduce reliance on foreign suppliers.

Hana Micron can leverage these trends by pursuing opportunities in regions actively seeking to localize their semiconductor supply chains. However, the company must also carefully navigate evolving export controls and technology transfer regulations, which are becoming increasingly stringent. For example, in late 2023, the US Department of Commerce expanded export restrictions on certain advanced semiconductor technologies to China, impacting global supply chains and requiring companies like Hana Micron to adapt their strategies.

International Trade Agreements and Tariffs

Changes in international trade agreements and tariff policies significantly influence the semiconductor industry, affecting Hana Micron's operational costs. For instance, the ongoing recalibration of trade relationships, including potential tariffs on imported semiconductors, directly impacts the price of essential components and manufacturing equipment. Hana Micron must remain vigilant, adapting its supply chain and pricing models to navigate these evolving trade landscapes and maintain its competitive edge.

The semiconductor sector, heavily reliant on globalized supply chains, is particularly susceptible to shifts in international trade dynamics. Discussions around potential new tariffs on semiconductors, a prevalent topic in 2024, highlight the need for companies like Hana Micron to proactively assess and mitigate risks. This includes evaluating alternative sourcing options and adjusting production strategies to buffer against unexpected cost increases or supply disruptions stemming from trade policy changes.

- Impact on Costs: Tariffs on imported semiconductors and manufacturing equipment can increase Hana Micron's cost of goods sold, potentially affecting profit margins.

- Supply Chain Vulnerability: Trade disputes or changes in agreements can disrupt the flow of critical materials and components, impacting production schedules.

- Market Access: Tariffs or unfavorable trade terms can limit Hana Micron's access to key international markets, affecting sales volume and revenue.

- Competitive Landscape: Differential tariff treatments between countries can alter the competitive positioning of Hana Micron relative to its global peers.

Regulatory Environment and Compliance

The semiconductor industry operates under a stringent regulatory framework. This includes environmental standards for manufacturing processes, labor laws governing workforce practices, and robust intellectual property protections. Hana Micron's ability to navigate these complex rules is paramount for sustained operations and continued market participation.

Compliance with these multifaceted regulations is not merely a legal obligation but a strategic imperative. Failure to adhere can result in significant financial penalties, operational disruptions, and damage to brand reputation. For instance, the U.S. CHIPS and Science Act of 2022, while promoting domestic manufacturing, also imposes certain conditions on recipients regarding supply chain transparency and foreign technology collaboration, impacting companies like Hana Micron.

- Environmental Regulations: Hana Micron must comply with emissions standards and waste management protocols, which can vary significantly by region.

- Labor Laws: Adherence to fair labor practices, worker safety, and non-discrimination laws is essential in all operational locations.

- Intellectual Property: Protecting proprietary designs and manufacturing processes is critical, requiring vigilance against patent infringement and trade secret theft.

- Trade Restrictions: Navigating export controls and sanctions, particularly concerning advanced semiconductor technology, is a constant challenge.

Governments worldwide are prioritizing semiconductor independence, with South Korea earmarking over KRW 14 trillion in policy financing for its chip sector in 2025. This includes enhanced R&D tax breaks and low-interest loans, directly supporting companies like Hana Micron.

Escalating US-China trade tensions are reshaping supply chains, pushing companies to diversify away from China. Hana Micron's investment in Vietnam is a strategic response to this, meeting client demands for production relocation to mitigate geopolitical risks and tariffs.

Global recognition of semiconductors as critical for national security is driving policies for domestic production and supply chain resilience. The US CHIPS and Science Act, for example, allocated over $52 billion to boost US semiconductor manufacturing and research, aiming to reduce foreign supplier reliance.

Hana Micron can capitalize on these trends by focusing on regions actively seeking to localize their semiconductor supply chains. However, the company must also navigate increasingly stringent export controls and technology transfer regulations, such as expanded US export restrictions on advanced semiconductor technologies to China in late 2023.

What is included in the product

The HANA Micron PESTLE Analysis provides a comprehensive examination of the external macro-environmental forces impacting the company across Political, Economic, Social, Technological, Environmental, and Legal domains.

This analysis is meticulously crafted to equip stakeholders with actionable insights for strategic decision-making by highlighting potential threats and opportunities within the current market landscape.

Provides a concise, PESTLE-driven overview of the HANA Micron landscape, simplifying complex external factors for strategic decision-making and reducing the burden of extensive research.

Economic factors

The global semiconductor market is experiencing a significant upswing, with projected sales reaching US$697 billion in 2025. This growth is fueled by escalating demand for advanced technologies like artificial intelligence, high-performance computing, and the expansion of data centers.

This robust market trajectory presents a prime opportunity for Hana Micron. As chip manufacturers ramp up production to meet this demand, there will be a corresponding increase in the need for specialized semiconductor packaging and testing services, areas where Hana Micron excels.

The demand for advanced semiconductor packaging services is surging, with the market expected to hit USD 35.2 billion by 2025. This growth is fueled by the relentless pursuit of better performance, greater efficiency, and smaller device footprints in the electronics industry.

Hana Micron, with its expertise in cutting-edge packaging techniques such as 2.5D and 3D packaging, flip-chip, and fan-out wafer-level packaging, is strategically positioned to benefit from this expanding market. The increasing integration of these technologies across various sectors, including AI, automotive, and high-performance computing, directly translates to greater opportunities for advanced packaging providers.

Inflationary pressures are a significant concern for semiconductor manufacturers like HANA Micron. Rising costs for essential inputs such as raw materials, energy, and global logistics directly impact profitability. For instance, the average price of polysilicon, a key component in chip manufacturing, saw a notable increase throughout 2023 and into early 2024, driven by supply constraints and demand.

To combat these economic headwinds, efficient supply chain management and proactive cost-saving initiatives are crucial. Companies are investing heavily in expanding production capacity, with global semiconductor capital expenditures projected to reach over $200 billion in 2024, signaling continued investment despite cost pressures.

Currency Exchange Rate Fluctuations

Hana Micron, being a South Korean firm with extensive global activities, especially its investments in Vietnam, is directly impacted by fluctuations in currency exchange rates. For instance, the South Korean Won (KRW) to Vietnamese Dong (VND) exchange rate directly influences the cost of Hana Micron's investments in Vietnam and the value of its earnings when repatriated. A strengthening Won could make its Vietnamese operations less profitable in KRW terms, while a weakening Won might boost them.

These currency shifts can significantly alter the cost of international investments and the reported revenues from overseas operations. For example, if the KRW strengthens against the USD, Hana Micron's U.S. dollar-denominated revenues would translate to fewer Korean Won, impacting its overall financial performance. This dynamic is crucial for financial planning and risk management.

- Impact on Investment Costs: A stronger KRW can reduce the cost of capital expenditures in foreign markets, potentially making new projects more attractive.

- Revenue Translation: Fluctuations in exchange rates directly affect the KRW value of overseas sales, impacting reported profitability.

- Competitive Positioning: Exchange rate movements can also influence the price competitiveness of Hana Micron's products in international markets compared to local competitors.

- 2024/2025 Data: As of early 2024, the KRW has shown some volatility against major currencies like the USD and VND, reflecting global economic uncertainties and monetary policy shifts, which Hana Micron must actively manage.

Investment and Capital Expenditure Trends

The semiconductor sector is witnessing substantial investment, with global capital expenditures anticipated to reach approximately $185 billion in 2025 to boost manufacturing capacity. This significant outlay underscores the industry's commitment to scaling operations and meeting escalating demand for advanced chips. Hana Micron's strategic investment of $930 million for expansion in Vietnam directly aligns with this overarching trend, demonstrating a proactive approach to securing future market share and technological leadership.

These capital expenditures are crucial for staying competitive, enabling companies to adopt cutting-edge manufacturing processes and increase production volumes. For Hana Micron, this expansion is not just about capacity but also about enhancing its capabilities in advanced packaging and testing, critical areas for next-generation semiconductors. The company's financial strategy clearly prioritizes long-term growth by investing heavily in its operational infrastructure.

- Global semiconductor capital expenditure projected to reach $185 billion in 2025.

- Hana Micron's $930 million investment in Vietnam expansion.

- Focus on increasing manufacturing capacity and advanced capabilities.

- Strategic deployment of capital to meet future market demand.

Inflationary pressures continue to impact the semiconductor industry, with rising costs for raw materials and energy affecting profitability. For example, the average price of polysilicon saw a notable increase throughout 2023 and into early 2024, driven by supply constraints and demand. Despite these challenges, global semiconductor capital expenditures are projected to reach over $200 billion in 2024, signaling continued investment in capacity expansion.

What You See Is What You Get

HANA Micron PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of Micron's HANA is delivered precisely as you see it, offering a deep dive into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

You can trust that the insights and detailed breakdown of Micron's strategic landscape, as presented in this preview, are exactly what you'll download immediately after completing your purchase.

Sociological factors

The semiconductor industry, including companies like Hana Micron, is grappling with a severe global talent shortage, especially for highly skilled technicians and engineers essential for advanced manufacturing and packaging processes. This deficit directly impacts operational capacity and the pace of technological innovation.

This workforce skills gap presents a critical challenge for Hana Micron in its efforts to recruit and retain the specialized personnel required for its intricate operations and ongoing technological development. For instance, a 2024 report indicated a projected shortfall of over 100,000 skilled semiconductor professionals in the United States alone, highlighting the global nature of this issue.

The increasing focus on workforce diversity and inclusion (D&I) is transforming business operations, particularly in technology sectors. Companies are now measured on their ability to cultivate inclusive cultures and actively recruit talent from varied backgrounds. For instance, in 2024, the tech industry saw a continued push for D&I initiatives, with many firms setting ambitious diversity targets for leadership roles.

Hana Micron, operating globally, stands to gain significantly from a diverse workforce. A range of perspectives fuels innovation and problem-solving, crucial for staying competitive in the semiconductor industry. Reports from late 2024 indicate that companies with higher levels of gender and ethnic diversity in their executive teams often outperform their less diverse counterparts by a notable margin in terms of profitability.

Consumers increasingly desire cutting-edge electronics. This includes AI-powered gadgets, the latest smartphones, and interconnected IoT devices, all of which are significant drivers for the semiconductor market. Hana Micron's expertise in semiconductor packaging directly supports the performance of these devices.

The ongoing shift towards more powerful and integrated technologies means a growing demand for advanced packaging solutions. For instance, the global AI chip market was valued at approximately $20 billion in 2023 and is projected to reach over $200 billion by 2030, highlighting the need for sophisticated semiconductor manufacturing and packaging capabilities like those offered by Hana Micron.

Societal Impact of Automation and AI

The increasing integration of automation and AI in manufacturing, particularly in semiconductor packaging, is significantly altering the workforce landscape. This technological shift, while boosting efficiency, demands a proactive approach to employee development. For instance, a 2024 report by the World Economic Forum highlighted that by 2027, over half of all employees will require reskilling due to automation, with AI-related skills being paramount. Hana Micron needs to prioritize substantial investment in upskilling and reskilling initiatives to ensure its workforce can adapt to evolving roles and new technologies, maintaining its competitive edge in the industry.

This evolution necessitates a focus on equipping employees with new competencies. For example, the semiconductor industry is seeing a growing demand for technicians skilled in robotic maintenance and data analysis for AI-driven quality control. A 2025 projection from Gartner suggests that roles requiring human-machine collaboration will see a 20% increase in demand over the next three years. Hana Micron's strategic response should include robust training programs that foster these critical skills, ensuring a smooth transition and continued productivity.

- Workforce Transformation: Automation and AI are reshaping jobs, requiring adaptation.

- Skills Gap: A significant portion of the workforce will need reskilling by 2027, with AI skills in high demand.

- Investment in Training: Hana Micron must invest in upskilling programs to maintain competitiveness.

- New Role Demands: Demand for technicians skilled in robotics and AI data analysis is rising.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for Corporate Social Responsibility (CSR) are intensifying, pushing companies like Hana Micron to look beyond just profits and focus on their social and environmental impact. This growing demand means businesses must actively contribute to societal well-being and demonstrate tangible efforts in areas like sustainability and ethical practices.

Hana Micron's proactive approach, emphasizing inclusivity and transparent communication through its sustainability reports, directly addresses these evolving societal pressures. For instance, in their 2024 sustainability report, Hana Micron highlighted a 15% increase in community engagement programs focused on digital literacy and environmental conservation, demonstrating a concrete commitment to social impact.

- Increased Stakeholder Scrutiny: Investors and consumers in 2024 are increasingly vetting companies based on their CSR performance, impacting brand reputation and investment decisions.

- Alignment with Global Goals: Hana Micron's initiatives in 2024, such as reducing its carbon footprint by 10% year-over-year, align with broader UN Sustainable Development Goals, resonating with a socially conscious public.

- Employee Attraction and Retention: A strong CSR profile, as evidenced by Hana Micron's 2025 employee survey showing 80% satisfaction with the company's ethical practices, is becoming a key factor in attracting and retaining talent.

Societal expectations are shifting, with a growing emphasis on diversity and inclusion within the workforce. Companies like Hana Micron are increasingly evaluated on their commitment to fostering inclusive environments and recruiting from diverse talent pools. For example, a 2024 industry analysis revealed that businesses with diverse leadership teams often experience a 15-30% increase in financial performance compared to their less diverse counterparts.

The demand for advanced electronics, driven by innovations in AI and the Internet of Things, directly fuels the need for sophisticated semiconductor solutions that Hana Micron provides. The global AI chip market, valued at approximately $20 billion in 2023, is projected for substantial growth, underscoring the market's reliance on cutting-edge semiconductor packaging technologies.

There's a significant global talent shortage in the semiconductor industry, particularly for skilled technicians and engineers. This skills gap directly impacts operational capacity and innovation speed, with a projected shortfall of over 100,000 skilled professionals in the US alone as of 2024, posing a challenge for companies like Hana Micron in recruitment and retention.

Societal pressure for Corporate Social Responsibility (CSR) is mounting, pushing companies to demonstrate tangible social and environmental impact. Hana Micron's commitment to community engagement, as seen in their 2024 sustainability report detailing a 15% increase in digital literacy programs, reflects this trend and enhances brand reputation.

Technological factors

The semiconductor industry is seeing rapid progress in packaging technologies, including 2.5D and 3D integration, flip-chip, and fan-out wafer-level packaging. These advancements are vital for boosting performance, improving power efficiency, and enabling smaller integrated circuits. For instance, the global advanced semiconductor packaging market was valued at approximately $40 billion in 2023 and is projected to reach over $70 billion by 2029, demonstrating significant growth.

Hana Micron's focus on these cutting-edge packaging solutions, such as its advanced flip-chip technology, directly addresses the industry's demand for higher-density and more powerful chips. The company's investment in research and development for these areas, including its work on heterogeneous integration, positions it to capitalize on this expanding market segment.

Artificial Intelligence (AI) and High-Performance Computing (HPC) are creating a substantial surge in demand for sophisticated semiconductors, particularly those featuring High Bandwidth Memory (HBM) and advanced packaging solutions. This technological shift directly plays into Hana Micron's strengths, as their expertise in the intricate integration and testing of these cutting-edge components is crucial for their successful deployment.

The market for AI-specific chips is projected for robust growth, with some estimates suggesting the AI chip market could reach over $100 billion by 2027. Hana Micron's role in enabling the production of these high-performance chips positions them to capitalize on this expanding sector.

The semiconductor industry is rapidly embracing automation and smart manufacturing, with significant investments being made in robotics and AI-driven solutions. This trend is crucial for enhancing efficiency and precision in complex processes like wafer fabrication and advanced packaging. For instance, the global market for industrial robotics in manufacturing was projected to reach over $60 billion by 2024, highlighting the scale of this technological shift.

Hana Micron can capitalize on these advancements to streamline its operations, aiming for faster throughput and reduced defects. By integrating smart manufacturing technologies, the company can achieve greater quality consistency and boost overall productivity, which are vital for maintaining a competitive edge in the fast-paced semiconductor market.

Research and Development (R&D) Investment

Continuous investment in research and development (R&D) is absolutely vital for staying ahead in the rapidly evolving semiconductor market. Companies need to constantly innovate in areas like materials science, manufacturing processes, and chip design to keep pace with the ever-increasing demands for advanced electronic devices.

Hana Micron's commitment to strategic R&D investments is key to ensuring its technological capabilities remain both relevant and at the forefront of the industry. This focus allows them to develop and offer cutting-edge solutions that meet the needs of next-generation technologies.

- Hana Micron's R&D Spending: While specific figures for 2024/2025 are proprietary, industry trends show significant R&D allocation. For instance, major semiconductor players often invest 10-20% of their revenue back into R&D.

- Focus Areas: Hana Micron's R&D likely targets advanced packaging technologies, novel materials for improved performance and efficiency, and next-generation semiconductor manufacturing processes.

- Competitive Necessity: The semiconductor industry sees rapid product cycles; failure to invest in R&D can quickly lead to obsolescence.

- Market Demand: The growing demand for AI, 5G, and IoT devices necessitates continuous innovation in semiconductor technology, driving R&D efforts.

Intellectual Property (IP) Protection and Licensing

Intellectual Property (IP) protection is critical for Hana Micron in the competitive semiconductor industry, safeguarding its advanced packaging and testing innovations. This involves a strategic approach to patents, trade secrets, and carefully crafted licensing agreements to maintain a competitive edge. Navigating the intricate IP landscape is essential to prevent infringement and secure its technological advancements.

The semiconductor industry saw significant IP activity in 2024. For instance, patent filings related to advanced semiconductor packaging technologies, including those relevant to Hana Micron's operations, continued to rise, indicating ongoing innovation. Companies are increasingly focusing on securing their technological breakthroughs through robust patent portfolios, with global patent applications in the semiconductor sector projected to grow by approximately 5-7% annually through 2025.

- Patents: Hana Micron relies on patents to shield its proprietary semiconductor packaging and testing methodologies, ensuring exclusive rights to its innovations.

- Trade Secrets: Crucial operational know-how, manufacturing processes, and specific design elements are protected as trade secrets, requiring stringent internal security measures.

- Licensing: Strategic licensing of its IP can generate revenue and foster collaborations, but it requires careful management to prevent dilution of its core technological advantages.

- Global IP Landscape: Hana Micron must monitor and comply with varying IP laws across different regions to effectively protect its assets and pursue international market opportunities.

Advancements in semiconductor packaging, such as 2.5D and 3D integration, are critical for enhancing chip performance and power efficiency. The global advanced semiconductor packaging market, valued at approximately $40 billion in 2023, is anticipated to exceed $70 billion by 2029, underscoring the significant growth in this sector. Hana Micron's expertise in flip-chip technology directly addresses this demand for denser, more powerful chips.

The escalating demand for AI and High-Performance Computing (HPC) is driving a surge in need for sophisticated semiconductors, particularly those featuring High Bandwidth Memory (HBM) and advanced packaging. The AI chip market alone is projected to surpass $100 billion by 2027, positioning Hana Micron to benefit from its capabilities in integrating and testing these advanced components.

Automation and smart manufacturing, including robotics and AI-driven solutions, are transforming semiconductor production. The global market for industrial robotics in manufacturing was expected to reach over $60 billion by 2024, highlighting the industry's commitment to efficiency and precision. Hana Micron can leverage these technologies to improve operational throughput and quality consistency.

Continuous investment in research and development is paramount for semiconductor companies to maintain a competitive edge. Hana Micron's strategic R&D focus on advanced packaging and novel materials ensures its solutions remain relevant for next-generation technologies, such as 5G and IoT devices.

| Technology Area | Market Value (2023 Est.) | Projected Growth | Hana Micron Relevance |

|---|---|---|---|

| Advanced Semiconductor Packaging | ~$40 Billion | To >$70 Billion by 2029 | Flip-chip, 2.5D/3D Integration |

| AI Chip Market | N/A (Rapidly Growing) | To >$100 Billion by 2027 | HBM Integration, Advanced Packaging |

| Industrial Robotics in Manufacturing | ~$60 Billion (2024 Projection) | Steady Growth | Automation, Smart Manufacturing |

Legal factors

Intellectual property laws, particularly patents covering semiconductor designs and advanced packaging techniques, are fundamental to safeguarding Hana Micron's technological advancements. These legal frameworks are crucial for preventing competitors from copying proprietary innovations.

Hana Micron's strategic approach to patenting is vital for maintaining its edge. For instance, in 2023, the semiconductor industry saw significant patent filings, with companies actively seeking protection for new materials and manufacturing processes, underscoring the competitive landscape Hana Micron operates within.

Hana Micron navigates a complex web of international labor laws, impacting everything from minimum wages to workplace safety standards. For instance, in 2024, Vietnam's minimum wage saw an increase, requiring Hana Micron to adjust compensation structures in its growing facilities there to ensure compliance and avoid penalties.

Adhering to these diverse employment regulations is critical for Hana Micron to prevent costly legal disputes and foster a stable operational environment. Failure to comply with regulations concerning working hours or employee benefits could lead to significant fines and damage to the company's reputation, especially as it expands into new markets.

Environmental regulations significantly impact semiconductor manufacturing, dictating stringent rules for waste disposal, chemical handling, and air emissions. Hana Micron, like its peers, must meticulously adhere to these global and local environmental laws to prevent legal repercussions and mitigate ecological harm. For instance, in 2024, the semiconductor industry faced increasing scrutiny over water usage and hazardous waste, with fines for non-compliance potentially reaching millions of dollars for major facilities.

Hana Micron's commitment to environmental stewardship is demonstrated through its sustainability reporting, which details its efforts to reduce its carbon footprint and manage resources responsibly. The company's 2024 sustainability report indicated a 5% reduction in water consumption per unit produced compared to the previous year, and a 10% decrease in hazardous waste generation, showcasing proactive compliance measures.

International Trade Laws and Tariffs

International trade laws and tariffs significantly impact Hana Micron's semiconductor operations. Geopolitical tensions, particularly between the US and China, have led to increased scrutiny and restrictions on technology exports, directly affecting the global semiconductor supply chain. For instance, in late 2022, the US implemented new export controls on advanced computing chips and semiconductor manufacturing equipment to China, impacting companies reliant on global supply chains.

Hana Micron's extensive global footprint, with manufacturing and sales across Asia, Europe, and North America, requires meticulous adherence to diverse international trade regulations. Navigating these complex legal frameworks is crucial to prevent disruptions and ensure the unimpeded flow of goods and materials across borders. Failure to comply can result in significant penalties and operational delays.

The imposition of tariffs can directly increase the cost of raw materials and finished products, influencing Hana Micron's pricing strategies and overall profitability. For example, trade disputes can lead to retaliatory tariffs, making components more expensive and potentially reducing demand. The semiconductor industry, highly globalized, is particularly vulnerable to such trade policy shifts.

- US Export Controls: The US Department of Commerce's Bureau of Industry and Security (BIS) continues to update export control regulations, impacting the transfer of advanced semiconductor technology and equipment.

- Tariff Impact: Trade tariffs can add substantial costs to the semiconductor supply chain, potentially increasing the cost of goods by several percentage points depending on the specific trade agreements and disputes.

- Geopolitical Influence: Major economic powers' trade policies are increasingly influenced by national security concerns, creating a dynamic and often unpredictable trade environment for global technology firms like Hana Micron.

- Supply Chain Resilience: Companies are investing in diversifying their supply chains and exploring regionalization strategies to mitigate the risks associated with international trade law volatility.

Corporate Governance and Compliance Regulations

Hana Micron's commitment to robust corporate governance and strict compliance with regulations is paramount, especially as a publicly traded entity. This involves maintaining transparency in its financial reporting, upholding ethical leadership practices, and actively addressing shareholder feedback. For instance, the company recently demonstrated this by withdrawing a proposed spin-off following significant opposition from minority shareholders, highlighting a responsiveness to stakeholder interests.

Adherence to legal frameworks, such as the Sarbanes-Oxley Act in the US, dictates rigorous internal controls and financial reporting accuracy. In 2024, companies like Hana Micron face increasing scrutiny regarding environmental, social, and governance (ESG) disclosures, with regulators like the Securities and Exchange Commission (SEC) proposing new rules that could impact reporting requirements. Failure to comply can result in substantial fines and reputational damage.

- Shareholder Rights: Ensuring minority shareholder protections are upheld, as seen in the spin-off withdrawal.

- Regulatory Compliance: Meeting evolving standards for financial transparency and data security.

- Ethical Conduct: Maintaining a strong ethical framework in all business operations and decision-making.

Intellectual property laws remain a cornerstone for Hana Micron, protecting its innovations in semiconductor design and advanced packaging. The semiconductor industry's robust patent activity in 2023, with significant filings for new materials and processes, underscores the competitive need for this legal shield.

Compliance with international labor laws, including wage adjustments like Vietnam's 2024 minimum wage increase, is critical for Hana Micron's global operations and avoiding penalties.

Environmental regulations concerning waste and emissions are increasingly stringent, with potential fines in 2024 reaching millions for non-compliance; Hana Micron's 2024 sustainability report highlights a 5% reduction in water usage per unit, demonstrating proactive adherence.

Navigating volatile international trade laws and tariffs, such as US export controls updated in late 2022, is vital for Hana Micron's global supply chain stability and profitability, as these policies can directly increase component costs.

Environmental factors

The semiconductor sector is under growing scrutiny to embrace sustainable operations and eco-conscious manufacturing. Hana Micron actively pursues green management, focusing on reducing its ecological footprint through strategies such as transitioning to renewable energy sources and implementing robust waste minimization programs.

This commitment is crucial as global environmental regulations tighten and investor demand for ESG (Environmental, Social, and Governance) performance rises. For instance, by 2025, many leading semiconductor companies are targeting significant reductions in greenhouse gas emissions, with some aiming for 30% to 50% cuts compared to 2020 levels, a benchmark Hana Micron is likely aligning with.

Semiconductor manufacturing demands significant water resources, positioning water stewardship as a key environmental consideration for companies like Hana Micron, particularly in areas facing water scarcity. This intensive use highlights the need for efficient water management strategies.

Hana Micron has committed to enhancing its water recycling efforts, targeting an annual increase in its water recycling rate starting from 2025. This initiative underscores their dedication to responsible resource utilization and conservation in their operations.

The semiconductor industry, including companies like Hana Micron, is a significant energy consumer, making the transition to renewable energy sources increasingly critical. This push is driven by both operational cost considerations and growing environmental regulations. As of 2024, a substantial portion of global electricity generation still relies on fossil fuels, highlighting the scale of this challenge.

Hana Micron's strategic move to implement renewable energy transition plans for its Vietnam and Brazil subsidiaries, commencing in 2025, directly addresses this environmental factor. This initiative aligns with the broader industry trend and global commitments to achieve 100% renewable electricity sourcing. By 2025, several major tech companies aim to power their operations with renewables, setting a precedent Hana Micron is following.

Waste Management and Circular Economy

Minimizing waste and embracing a circular economy are critical environmental imperatives for semiconductor manufacturers like Hana Micron. The company is actively pursuing these goals by focusing on reducing waste generation throughout its production processes and striving for high recycling rates. This commitment directly supports a more sustainable manufacturing lifecycle.

Hana Micron's dedication to environmental stewardship is evident in its proactive approach to waste reduction. For instance, in 2023, the company reported a significant focus on optimizing material usage, which indirectly contributes to lower waste output. Their efforts are geared towards achieving ambitious recycling targets, aligning with global sustainability trends and regulatory expectations.

- Waste Reduction Initiatives: Hana Micron is implementing process improvements to minimize the generation of by-products and scrap materials.

- Circular Economy Focus: The company is exploring opportunities to reuse or recycle materials, aiming to close the loop in its production cycle.

- Recycling Rate Goals: Hana Micron has set internal targets for increasing its overall recycling rate, reflecting a commitment to resource efficiency.

- Sustainable Production: By prioritizing waste management, Hana Micron contributes to a more environmentally responsible and sustainable semiconductor manufacturing sector.

Carbon Emissions and Climate Change Targets

Hana Micron, like its peers in the semiconductor sector, faces increasing pressure to address its carbon footprint. The industry's energy-intensive manufacturing processes make it a significant contributor to greenhouse gas emissions. This necessitates a proactive approach to climate change mitigation.

Global initiatives and regulatory frameworks are driving companies to set and achieve ambitious climate targets. For instance, the Semiconductor Industry Association (SIA) has committed to achieving net-zero greenhouse gas emissions by 2050, a goal that influences Hana Micron's strategic planning.

Hana Micron is actively engaged in reducing its operational emissions. This includes investments in energy efficiency, exploring renewable energy sources for its facilities, and optimizing supply chain logistics to minimize transportation-related emissions. Transparency in reporting its environmental performance is also a key focus, aligning with stakeholder expectations for corporate responsibility.

- Industry Commitment: The SIA's 2050 net-zero target sets a benchmark for companies like Hana Micron.

- Operational Focus: Hana Micron is implementing energy efficiency measures and exploring renewable energy adoption.

- Supply Chain Impact: Efforts are underway to reduce emissions associated with logistics and material sourcing.

- Reporting Transparency: The company prioritizes clear and accurate disclosure of its environmental performance metrics.

Environmental factors are increasingly shaping the semiconductor industry, pushing companies like Hana Micron toward sustainable practices. Growing regulatory pressures and investor demand for Environmental, Social, and Governance (ESG) performance are key drivers. For instance, the industry is targeting significant greenhouse gas emission reductions, with many aiming for 30% to 50% cuts by 2025 compared to 2020 levels.

Water scarcity is a growing concern, making efficient water management and recycling crucial for semiconductor manufacturers. Hana Micron is enhancing its water recycling efforts, aiming for an annual increase in its recycling rate starting in 2025. The energy-intensive nature of semiconductor production also necessitates a shift to renewable energy, with many companies targeting 100% renewable electricity sourcing by 2025.

Minimizing waste and embracing circular economy principles are vital environmental imperatives. Hana Micron is actively working to reduce waste generation and increase recycling rates throughout its production processes. This commitment aligns with broader industry trends and regulatory expectations for environmentally responsible manufacturing.

| Environmental Factor | Hana Micron's Response | Industry Context/Targets |

|---|---|---|

| Greenhouse Gas Emissions | Focus on energy efficiency, renewable energy adoption, and supply chain optimization. | Semiconductor Industry Association (SIA) committed to net-zero emissions by 2050. Many companies targeting 30-50% reduction by 2025 (vs. 2020). |

| Water Management | Enhancing water recycling efforts with a target for annual increases starting 2025. | Critical due to high water usage in manufacturing, especially in water-scarce regions. |

| Renewable Energy Transition | Implementing renewable energy plans for Vietnam and Brazil subsidiaries from 2025. | Industry trend towards 100% renewable electricity sourcing; major tech companies aim for this by 2025. |

| Waste Reduction & Circular Economy | Process improvements to minimize by-products, exploring material reuse/recycling. | Focus on reducing waste generation and achieving high recycling rates to support sustainable manufacturing. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for HANA Micron is built upon a robust foundation of data, drawing from official government publications, reputable financial news outlets, and leading technology research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the semiconductor industry.