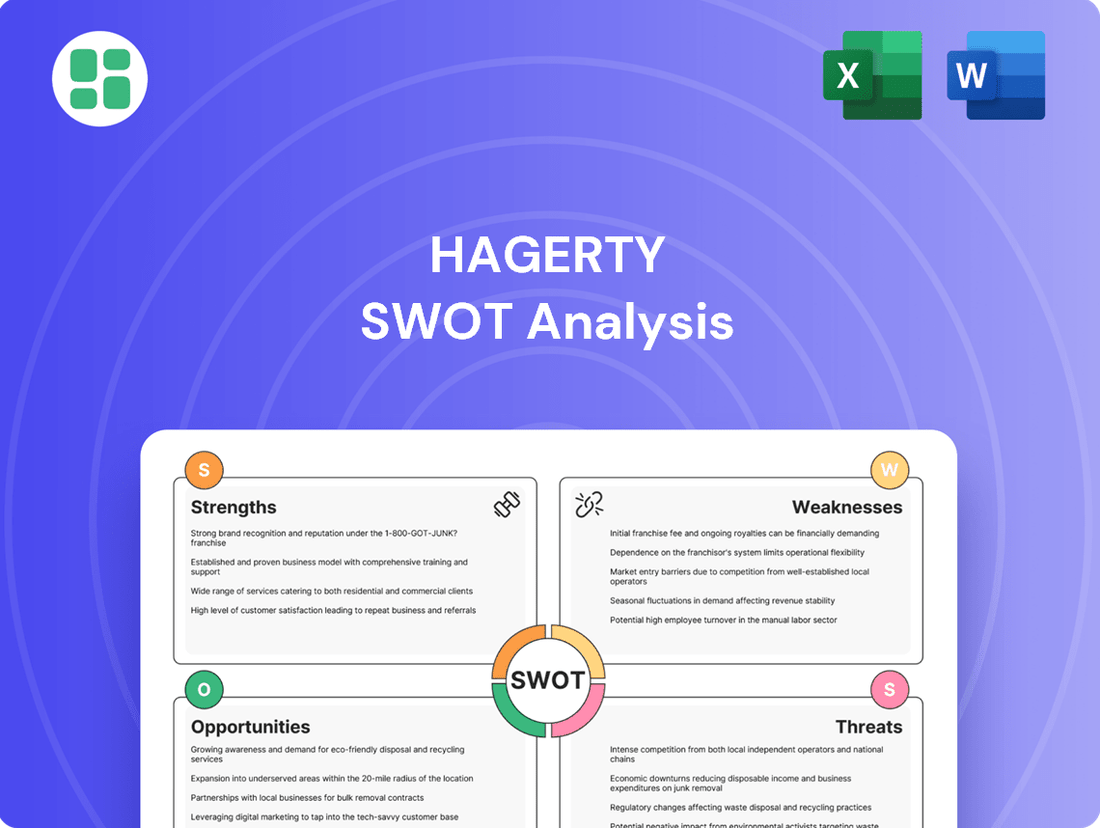

Hagerty SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hagerty Bundle

Hagerty's strengths lie in its niche market focus and strong brand loyalty, but its reliance on a specific customer base presents a significant weakness. Opportunities for expansion into related services are abundant, yet competitive pressures and evolving market trends pose considerable threats.

Want the full story behind Hagerty's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hagerty commands a leading global position in the specialized insurance market for classic and enthusiast vehicles. This dominance is built on a strong brand reputation, meticulously developed over many years of dedicated service to a passionate community. The company’s commitment to its customers is reflected in its impressive Net Promoter Score of 82, a figure that substantially outpaces the typical industry average and highlights exceptional customer satisfaction and loyalty.

Hagerty’s strength lies in its diversified revenue streams extending well beyond traditional insurance. The company has cultivated a robust automotive enthusiast ecosystem, offering services like vehicle valuation tools, roadside assistance, and a dedicated marketplace through its Broad Arrow auction division.

Further solidifying its community engagement, Hagerty provides rich automotive content and hosts various events. The Hagerty Drivers Club, a key component of this ecosystem, boasts nearly 900,000 paid members as of early 2024, demonstrating significant customer loyalty and multiple touchpoints for revenue generation.

Hagerty's financial performance is a significant strength, with the company achieving an impressive 20% year-over-year revenue growth in 2024. This momentum carried into the first two quarters of 2025, where Hagerty continued to report strong financial results.

The company has confidently projected continued revenue and profit expansion throughout 2025. This positive outlook is underpinned by an ambitious target to significantly increase its policy count, aiming to more than double it to three million by 2030, demonstrating a clear growth strategy.

High Customer Retention and Loyalty

Hagerty benefits from exceptionally high customer retention, with a policies in force retention rate of 89.0% as of December 31, 2024. This strong loyalty within its member base contributes to a stable and recurring revenue model.

High retention rates significantly reduce customer acquisition costs, which is a key advantage in the competitive insurance market. This predictability in revenue allows for more effective financial planning and investment in growth initiatives.

- 89.0% Policies in Force Retention Rate (as of December 31, 2024)

- Reduced Customer Acquisition Costs

- Stable and Recurring Revenue Stream

- Enhanced Financial Predictability

Strategic Partnerships and Distribution Expansion

Hagerty is actively broadening its market presence through key strategic alliances. A prime example is the expansion of the State Farm Classic Plus program, slated for rollout in over 25 states throughout 2025, significantly increasing its distribution footprint.

Further strengthening its operational and financial standing, Hagerty has entered into a non-binding letter of intent with Markel for a fronting arrangement. This agreement, set to commence on January 1, 2026, is designed to boost profitability and grant Hagerty complete control over 100% of the premium, a crucial step in enhancing its business model.

- State Farm Classic Plus program expansion to 25+ states in 2025.

- Markel fronting arrangement letter of intent for 100% premium control.

Hagerty's core strength lies in its dominant position within the niche market of classic and enthusiast vehicle insurance, bolstered by an exceptional Net Promoter Score of 82 as of early 2024, indicating profound customer loyalty.

The company has successfully diversified its revenue beyond insurance by cultivating a comprehensive automotive enthusiast ecosystem, encompassing valuation tools, roadside assistance, and a marketplace via its Broad Arrow auction division.

Hagerty's financial health is robust, with a 20% year-over-year revenue growth in 2024 and continued strong performance into the first half of 2025, supported by a projected policy count increase to three million by 2030.

Exceptional customer retention, evidenced by an 89.0% policies in force retention rate at the end of 2024, significantly lowers customer acquisition costs and ensures a stable, predictable revenue stream.

| Metric | Value (as of 2024/early 2025) | Significance |

|---|---|---|

| Net Promoter Score | 82 | Indicates exceptionally high customer satisfaction and loyalty. |

| Policies in Force Retention Rate | 89.0% (Dec 31, 2024) | Demonstrates strong customer loyalty and a stable recurring revenue model. |

| Hagerty Drivers Club Paid Members | Nearly 900,000 (early 2024) | Highlights deep community engagement and multiple revenue touchpoints. |

| Year-over-Year Revenue Growth | 20% (2024) | Signifies strong market momentum and effective business strategy. |

What is included in the product

Delivers a strategic overview of Hagerty’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical business challenges.

Weaknesses

Hagerty's focus on the classic and collector car market, while a core strength, also exposes it to significant niche market sensitivity. This specialization means the company's fortunes are closely tied to the health and trends within this particular segment of the automotive world.

The collector car market has indeed experienced some cooling in 2025. Factors such as elevated interest rates and a noticeable slowdown in auction house activity are contributing to this trend. This economic environment can directly affect consumer willingness to spend on discretionary items like vintage vehicles.

Consequently, any significant downturn in discretionary spending on collectibles could have a direct and substantial impact on the demand for Hagerty's specialized insurance, membership, and other related services. For instance, reports from major auction houses in early 2025 indicated a softening of prices for certain categories of collector cars, suggesting a potential contraction in market activity.

Hagerty is facing significant hurdles with its technology upgrades, planning to invest around $20 million in 2025 to modernize its aging IT systems, including the crucial Duck Creek platform implementation. This substantial outlay directly translates to higher operating and software costs in the immediate future.

The sheer scale of these technology investments presents a considerable challenge. Any slip-ups or unexpected complications during the rollout of these complex systems could put a strain on Hagerty's financial reserves and potentially hinder its day-to-day operations.

Hagerty's insurance segment faces a significant vulnerability to catastrophe losses, directly impacting its loss ratio. For instance, the company anticipates a pre-tax impact of $10-11 million from the Southern California wildfires during the first quarter of 2025.

These types of events can substantially elevate the loss ratio, thereby pressuring underwriting profitability and overall financial health. Even though the first quarter typically exhibits a lower loss ratio, these catastrophic events highlight an inherent risk within the business model.

Potential for Margin Compression from Investments

Hagerty's commitment to significant investments in strategic growth areas, such as technology modernization and international expansion, is a key factor contributing to potential margin compression. While these initiatives are vital for future success, they necessitate elevated spending in the short term, which can temporarily reduce profitability margins.

These higher initial costs are a direct consequence of building a stronger foundation for long-term value. For instance, the company's focus on enhancing its digital platforms and expanding its global reach requires substantial upfront capital outlay, impacting immediate earnings.

Management has indicated that this elevated technology spend is expected to moderate as a percentage of revenue starting in 2026. This suggests that the current pressure on margins due to these investments is viewed as a temporary phase, with a planned normalization of expenses over the coming years.

- Elevated Spending: Investments in technology modernization and international expansion are driving higher operational costs.

- Near-Term Impact: These strategic outlays can lead to a temporary reduction in profit margins.

- Future Outlook: Management anticipates technology spend to decrease as a proportion of revenue from 2026 onwards.

Slower-than-Anticipated Premium Growth in H1 2025

Hagerty's premium growth experienced a slowdown in the first half of 2025, coming in below its initial full-year projections. This deceleration, while potentially a strategic pivot, represents a near-term vulnerability in a crucial area of revenue generation for the company.

The company's adjusted strategy, which involved a more focused approach to direct new business acquisition and a de-emphasis on certain market segments, contributed to this slower premium growth. While this may foster more profitable customer relationships over time, it directly impacted the topline growth rate in the short term.

- H1 2025 Premium Growth: Fell short of the company's initial full-year forecast.

- Strategic Rationale: A deliberate market deemphasis and refined direct acquisition approach.

- Near-Term Impact: Signals a weakness in a key revenue driver, despite long-term strategic intent.

Hagerty's reliance on the niche collector car market makes it susceptible to shifts in that specific industry. A downturn in discretionary spending on collectibles, as evidenced by softening auction prices in early 2025, directly impacts demand for Hagerty's specialized services.

Significant investments in technology, such as the $20 million allocated for IT system modernization in 2025, increase operating costs and introduce execution risks. Unexpected complications during the Duck Creek platform implementation could strain financial resources.

The company's insurance segment is vulnerable to catastrophe losses, which can significantly elevate its loss ratio. For example, the Q1 2025 wildfires in Southern California were projected to have a $10-11 million pre-tax impact, highlighting this inherent business risk.

Hagerty's premium growth slowed in the first half of 2025, falling short of initial full-year projections due to a strategic focus on more profitable customer acquisition. This deceleration impacts a key revenue driver in the near term.

Preview Before You Purchase

Hagerty SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. The Hagerty SWOT analysis you see here is the exact file that will be delivered to you upon purchase, ensuring transparency and quality.

Opportunities

Hagerty has a prime opportunity to grow by reaching enthusiasts of vehicles made after 1980. While they've captured a solid 14.4% of the pre-1981 market, their reach into the post-1980 segment is only at 3.1%. This gap represents a substantial untapped customer base.

The introduction of products like Enthusiast+ is a strategic move designed to capture this expanding market. By tailoring insurance solutions to a wider range of enthusiast vehicles, Hagerty can attract a new demographic of collectors and owners.

This expansion isn't just about more customers; it's about diversifying revenue streams and reducing reliance on a single market segment. Successfully penetrating the post-1980 enthusiast vehicle market could significantly boost Hagerty's overall market share and financial performance.

Hagerty's significant $20 million investment in its new cloud-based technology platform, Duck Creek, is a prime opportunity. This initiative is set to revolutionize underwriting, claims handling, and how Hagerty understands its customer base.

This technological overhaul is designed to create a smoother, more secure experience for Hagerty's members. By modernizing its systems, the company anticipates a reduction in its day-to-day operating expenses.

These operational efficiencies are key to Hagerty's ability to grow without a proportional increase in costs, paving the way for improved profitability in the future.

Hagerty is actively strengthening its presence in international markets, evidenced by successful auction events held in Europe. This strategic move is designed to broaden its customer base and diversify revenue, tapping into the global passion for collector vehicles and associated services.

Strategic Partnerships and Distribution Channels

Hagerty's strategic partnerships are a significant growth driver. For instance, the State Farm Classic Plus program provides access to a large customer base, accelerating policy acquisition. These alliances are crucial for reaching new demographics and achieving long-term growth objectives.

The Markel fronting arrangement is another key opportunity, offering Hagerty greater control over its underwriting and improving profitability. This type of collaboration allows for more tailored product offerings and a stronger financial position.

- Expanded Reach: Partnerships like State Farm Classic Plus unlock access to millions of potential customers, driving policy growth.

- Enhanced Profitability: The Markel fronting arrangement allows Hagerty to retain more underwriting profit and gain operational efficiencies.

- Customer Acquisition: Collaborations provide cost-effective channels for acquiring new policyholders within the enthusiast market.

Monetization of Data and Market Insights

Hagerty's vast repository of vehicle valuations, market trends, and collector behavior data represents a significant, largely untapped asset. This intelligence can be leveraged to create new revenue streams by developing specialized data-driven services, market reports, and analytical tools tailored for collectors, investors, and automotive industry professionals.

By offering these insights, Hagerty can solidify its standing as the definitive authority in the collector car market. For instance, in 2023, the global automotive market saw continued growth, with the classic car segment showing resilience and increasing interest from new demographics. Hagerty's ability to provide granular data on this niche is a distinct advantage.

- Data Monetization: Develop premium subscription services for in-depth market analysis and valuation trends.

- New Product Development: Launch data-driven tools for investment portfolio management within the collector car space.

- Industry Partnerships: Collaborate with auction houses and dealerships to provide exclusive market intelligence.

- Enhanced Authority: Position Hagerty as the go-to source for data-backed insights, further strengthening brand loyalty and market influence.

Hagerty's investment in its technology platform positions it for significant operational gains, with the company anticipating a reduction in its day-to-day operating expenses as a result of this modernization. This focus on efficiency is crucial for scaling operations effectively and improving overall profitability.

The company is also actively expanding its international footprint, with successful events in Europe indicating a growing global appeal for its services. This international expansion is key to diversifying revenue streams and capturing a broader share of the enthusiast market worldwide.

Strategic alliances, such as the State Farm Classic Plus program, offer Hagerty a powerful avenue to acquire new customers by leveraging established networks. Furthermore, arrangements like the Markel fronting deal provide enhanced underwriting control and the potential for greater profit retention, strengthening Hagerty's financial foundation.

Hagerty's extensive data on vehicle valuations and market trends is a valuable, yet underutilized, asset that can be monetized through new data-driven services and analytical tools. This data intelligence can solidify Hagerty's position as a market authority and create new revenue streams by catering to collectors, investors, and industry professionals.

| Opportunity Area | Description | Potential Impact | Key Data/Fact |

|---|---|---|---|

| Post-1980 Vehicles | Expand insurance offerings to a wider range of enthusiast vehicles. | Capture a significant untapped market segment, increasing policy count and revenue. | Hagerty's market share in post-1980 vehicles is 3.1% compared to 14.4% in pre-1981 vehicles. |

| Technology Modernization | Leverage the new cloud-based platform (Duck Creek). | Reduce operating expenses, improve underwriting and claims processing, and enhance customer experience. | $20 million invested in the new technology platform. |

| International Expansion | Grow presence in global markets through events and services. | Diversify revenue streams and tap into the global collector car community. | Successful auction events held in Europe in 2023. |

| Strategic Partnerships | Collaborate with companies like State Farm and utilize fronting arrangements like Markel. | Accelerate customer acquisition and improve underwriting profitability. | State Farm Classic Plus program provides access to a large customer base. |

| Data Monetization | Leverage existing vehicle valuation and market trend data. | Create new revenue streams through specialized data services and market intelligence reports. | Continued growth in the global automotive market in 2023, with resilience in the classic car segment. |

Threats

Economic downturns and fluctuating interest rates present a significant challenge for Hagerty. A slowdown in the economy can curb consumer spending on non-essential items, including classic cars. For instance, if inflation remains elevated or a recession hits, discretionary income for hobbyists may shrink, impacting their ability to purchase or maintain collectible vehicles.

Sustained high interest rates also add pressure. They increase the cost of borrowing, which can affect buyers looking to finance classic car purchases. Furthermore, higher rates can make alternative investments more attractive, potentially drawing capital away from the collector car market. This could lead to a cooling of demand and a dip in vehicle valuations, directly impacting Hagerty's insurance and auction businesses.

The impact is tangible: reduced demand for Hagerty's specialty insurance policies and lower participation in its collector car auctions. In 2023, while the classic car market showed resilience, economists widely predicted a potential slowdown in 2024 due to persistent inflation and the Federal Reserve's aggressive rate hikes. This environment directly threatens Hagerty's revenue streams and overall profitability.

Hagerty's success in the specialty insurance market for classic and collector vehicles is a beacon, but it also shines a spotlight for potential competitors. Larger, established insurers like Allstate and Progressive, with their vast resources and existing customer bases, could decide to more aggressively pursue this lucrative niche. This could manifest as competitive pricing strategies, potentially initiating price wars that could erode Hagerty's pricing power and market share.

The threat isn't limited to traditional players. Innovative new entrants, perhaps leveraging technology or unique customer engagement models, could also emerge to challenge Hagerty's position. For instance, as of early 2024, the automotive insurance market is seeing continued digital transformation, with insurtech startups constantly seeking to disrupt established segments. If such an entity were to focus on collector vehicles, it could introduce novel approaches that appeal to a segment of Hagerty's customer base.

The automotive industry is undergoing a significant transformation, with electric vehicles (EVs) and autonomous driving technologies rapidly gaining traction. This shift could diminish the long-term appeal and value of traditional internal combustion engine (ICE) collector cars, a core segment for Hagerty.

While Hagerty is actively embracing newer collectibles, a fundamental alteration in enthusiast culture, moving away from ICE vehicles, presents a potential challenge. For instance, in 2024, EV sales are projected to continue their strong growth, potentially reaching over 20% of the global automotive market, which could influence the collector car market's future trajectory.

Execution Risks of Technology Investments

Hagerty's significant investments in new technology platforms, such as Duck Creek, present considerable execution risks. Delays in implementation or a failure to realize projected efficiency improvements could negatively impact financial performance and operational effectiveness.

For instance, if the rollout of Duck Creek, a core component of their digital transformation, experiences significant delays beyond the projected 2024 completion, it could lead to increased capital expenditure and a delay in anticipated cost savings. This could strain financial resources, potentially impacting Hagerty's ability to meet its 2025 growth targets of 10-15% revenue growth.

- Execution Risk: Delays in technology platform rollouts, like Duck Creek, could push back anticipated efficiency gains.

- Financial Strain: Stretched financial resources may result from unforeseen costs associated with delayed technology implementations.

- Operational Impact: Failure to achieve expected efficiency improvements could lead to ongoing operational inefficiencies, impacting service delivery.

- Growth Hindrance: Inability to successfully integrate new technologies might impede Hagerty's projected revenue growth for 2025.

Regulatory Changes and Compliance Costs

Hagerty faces potential headwinds from evolving insurance regulations, especially concerning specialty vehicles and data privacy. For instance, the NAIC's ongoing work on data security and privacy regulations, which many states are adopting, could necessitate substantial upgrades to Hagerty's IT infrastructure and compliance protocols. These changes may lead to increased operational expenses and complexity in navigating diverse regulatory landscapes across its operating regions, potentially impacting profitability and market agility.

Stricter compliance requirements could translate into significant capital outlays for Hagerty. For example, if new regulations mandate enhanced cybersecurity measures or more rigorous underwriting data collection, the company might need to invest millions in system overhauls and specialized personnel. This could compress profit margins, particularly if these costs cannot be fully passed on to consumers or offset by operational efficiencies. Furthermore, navigating these compliance burdens across multiple jurisdictions can slow down product launches and service delivery.

- Increased Compliance Burden: Evolving data privacy laws (e.g., GDPR, CCPA) and insurance-specific regulations could necessitate significant investment in legal, IT, and operational resources for Hagerty.

- Potential for Fines: Non-compliance with new or existing regulations can result in substantial fines, impacting financial performance. For example, in 2023, the financial services sector saw significant regulatory penalties for data breaches and compliance failures.

- Operational Complexity: Adapting to varying regulatory requirements across different states and countries can increase operational complexity and costs, potentially hindering expansion efforts.

The increasing adoption of electric and autonomous vehicles poses a threat to Hagerty's core business, which heavily relies on traditional internal combustion engine (ICE) collector cars. As EVs gain market share, projected to exceed 20% of global auto sales by 2024, the long-term appeal and value of ICE classics could diminish, impacting Hagerty's insurance and valuation services.

Hagerty faces intense competition from both established insurers and agile insurtech startups looking to capture the lucrative collector car market. Larger players like Allstate and Progressive could leverage their scale to offer competitive pricing, while new entrants might disrupt the space with innovative digital platforms, potentially eroding Hagerty's market share and pricing power.

Significant execution risks are associated with Hagerty's substantial investments in new technology platforms, such as Duck Creek. Delays in implementation, which could extend beyond the projected 2024 completion, may lead to increased capital expenditure and a delay in anticipated cost savings, potentially hindering their 2025 revenue growth targets of 10-15%.

Evolving insurance regulations, particularly concerning data privacy and specialty vehicles, present a compliance challenge for Hagerty. The NAIC's ongoing work on data security standards, which many states are adopting, could necessitate costly upgrades to IT infrastructure and compliance protocols, increasing operational expenses and potentially impacting profitability.

SWOT Analysis Data Sources

This Hagerty SWOT analysis is built upon a robust foundation of data, drawing from comprehensive financial reports, in-depth market intelligence, and insights from industry experts. These carefully selected sources ensure a thorough and accurate assessment of Hagerty's current standing and future potential.