Hagerty PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hagerty Bundle

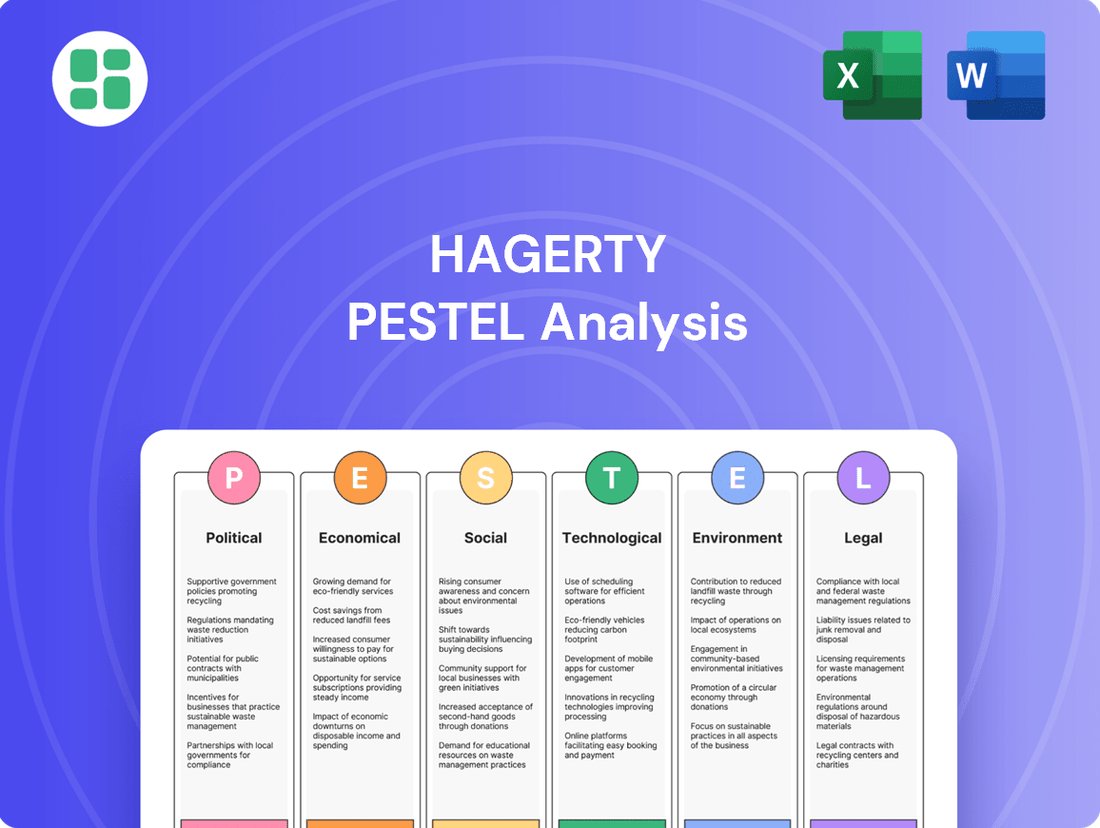

Gain a critical understanding of the external forces shaping Hagerty's trajectory. Our meticulously researched PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting their operations. Equip yourself with actionable intelligence to refine your own market strategy. Download the full version now for immediate insights.

Political factors

Changes in insurance regulatory frameworks, like solvency requirements and consumer protection laws, directly influence Hagerty's operational costs and product development. For instance, evolving data privacy regulations, such as those following GDPR principles, necessitate significant investment in compliance and cybersecurity measures, impacting overall efficiency.

Policy decisions concerning vehicle classification, particularly for historic or collector vehicles, are critical. For example, shifts in how classic cars are categorized for insurance purposes could alter Hagerty's core market accessibility and pricing strategies, potentially affecting their 2024 revenue streams.

Political stability and trade policies in Hagerty's key operational markets, including the US and UK, are also crucial. Unfavorable trade agreements or political instability can disrupt supply chains for vehicle repair parts or impact the cross-border movement of insured vehicles, thereby affecting Hagerty's service delivery and international growth plans.

Government policies directly impact the collector car market. For example, evolving regulations around internal combustion engines could influence the long-term desirability and usability of classic vehicles, potentially affecting their market value. In 2024, several regions are considering stricter emissions standards, which may indirectly boost interest in historically significant, non-emissions-compliant vehicles as a finite asset.

Trade policies, including import and export tariffs on collector vehicles and their parts, also shape the market. Fluctuations in these tariffs can alter the cost of acquiring and maintaining classic cars, influencing both domestic and international collector activity. For instance, a proposed tariff increase on automotive parts in late 2024 could raise restoration costs for enthusiasts.

Shifts in taxation policies, particularly concerning wealth, luxury goods, and capital gains on collectibles, directly influence the classic car market. For instance, a proposed increase in capital gains tax rates in the United States, which could take effect in 2025, might make the appreciation of classic cars less attractive as an investment for some. Conversely, jurisdictions offering favorable tax treatments for historic vehicles, such as certain exemptions on property taxes for classic cars in some US states, can significantly bolster collector interest and, by extension, Hagerty's business by making ownership more financially viable.

International Trade Relations and Tariffs

Hagerty's global reach means international trade relations and tariffs are significant. For instance, the US-China trade war, though somewhat de-escalated by 2024, introduced volatility. Tariffs on automotive parts or even luxury goods can directly impact the cost of classic vehicles and their restoration, potentially affecting collector demand and, consequently, Hagerty's insurance and service offerings.

The ongoing evolution of trade agreements, such as potential adjustments to the USMCA or new EU trade policies, directly influences cross-border movement of vehicles and parts. For example, a 2024 report indicated that automotive trade disputes could add several percentage points to the cost of imported components. This directly impacts the accessibility and affordability of classic car ownership, a core segment for Hagerty.

- USMCA Impact: Continued stability or renegotiation of the United States-Mexico-Canada Agreement influences parts sourcing and vehicle movement within North America.

- EU Trade Dynamics: Evolving EU trade policies and potential tariffs on specific vehicle categories or parts could affect European collector markets and Hagerty's operations there.

- Global Supply Chains: Disruptions or favorable trade terms in key manufacturing regions for classic car parts can influence restoration costs and enthusiast spending.

Support for Heritage and Cultural Industries

Government policies directly impact the heritage automotive sector. In 2024, many countries continue to offer incentives or protections for historic vehicles, recognizing their cultural and economic value. For instance, special registration classes and tax exemptions for classic cars encourage ownership and preservation, creating a more robust market for Hagerty's services.

Political support can manifest in various ways, from direct funding for heritage preservation initiatives to favorable legislation. In the UK, for example, the Historic Motor Vehicles Act provides exemptions from certain regulations, benefiting owners and related businesses. Such political recognition fosters a positive environment for enthusiasts and, by extension, for companies like Hagerty that cater to this niche.

- Government funding for heritage sites and events: In 2024, European Union cultural heritage funding programs allocated significant resources to projects involving historic transportation, indirectly supporting the classic car ecosystem.

- Tax exemptions for classic vehicles: Many US states offer property tax or sales tax exemptions for vehicles over a certain age, encouraging continued use and maintenance.

- Legislative recognition of the automotive heritage industry: The ongoing debate in many nations around emissions standards and vehicle age requirements often includes provisions or discussions about protecting historic vehicles.

Political factors significantly shape Hagerty's operating environment, influencing everything from regulatory compliance to market accessibility for collector vehicles. Governmental policies on vehicle classification, emissions, and taxation directly impact the desirability and cost of owning classic cars. For example, in 2024, several US states are considering or have implemented tax incentives for classic car owners, boosting market activity.

Trade policies and international relations also play a crucial role, affecting the cost and availability of parts and vehicles across borders. Fluctuations in tariffs, such as those impacting automotive components, can increase restoration expenses for enthusiasts. The stability of trade agreements like USMCA in 2024 continues to be a key consideration for parts sourcing and vehicle movement within North America.

Government support, including legislative recognition and potential funding for heritage preservation, can foster a positive climate for the collector car industry. In 2024, initiatives like special registration classes and tax exemptions for historic vehicles in various countries encourage ownership and market growth, directly benefiting Hagerty's core business.

Regulatory frameworks, especially concerning data privacy and consumer protection, necessitate ongoing investment in compliance. Evolving insurance regulations and solvency requirements also influence operational costs and product development strategies for Hagerty.

What is included in the product

This Hagerty PESTLE analysis examines the influence of external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing actionable insights for strategic decision-making.

The Hagerty PESTLE Analysis offers a structured framework to identify and understand external factors, alleviating the pain of navigating complex market dynamics and potential disruptions.

Economic factors

Global economic growth is a key driver for the collector car market. When economies are robust, consumers tend to have more disposable income, making them more likely to spend on luxury goods and discretionary items like classic vehicles. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight uptick from previous years, suggesting a potentially favorable environment for Hagerty's market.

Conversely, economic slowdowns or recessions can significantly impact demand. During periods of uncertainty, consumers often cut back on non-essential purchases. This can lead to a decrease in collector car sales and a reduced need for specialized insurance services. The market for these vehicles is sensitive to shifts in consumer confidence and wealth.

Higher disposable income directly translates to increased spending power for collectors. As personal incomes rise, more individuals can afford to invest in classic cars, whether as a hobby or as an investment. This trend is evident as Hagerty reported a 12% increase in its insured fleet value in 2023, reaching $34.7 billion, indicating strong underlying demand driven by consumer wealth.

Interest rate fluctuations directly impact the cost of financing for classic cars, a key factor for many Hagerty customers. As of mid-2024, the Federal Reserve's benchmark interest rate remains elevated, making loans for high-value vehicles more expensive and potentially dampening demand. This higher cost of borrowing can reduce the liquidity in the collector car market by making it less attractive for buyers who rely on financing.

A sustained higher interest rate environment, as seen through 2024 and projected into early 2025, can deter potential buyers, especially those new to the collector car hobby or those looking to finance a significant portion of their purchase. This trend could lead to slower sales cycles and potentially impact Hagerty's insurance and valuation services, which are tied to the health of the collector car market.

The availability of specialized lending for collector vehicles is also a critical component of the lending environment. While traditional lenders may be more cautious in a rising rate climate, the presence of niche lenders catering to this market, like those Hagerty partners with, can provide crucial support. However, the terms and accessibility of these specialized loans are still subject to broader economic conditions and prevailing interest rates.

Rising inflation in 2024 and 2025 directly impacts the cost of vehicle restoration and maintenance. Specialized parts, often sourced from niche suppliers, have seen price increases, with some reports indicating a 5-10% jump in classic car component costs over the past year. This surge affects the overall expense of keeping vintage vehicles in top condition.

The increased cost of parts and specialized labor, which can now run 15-20% higher for skilled restoration technicians, directly influences insurance valuations and claims for companies like Hagerty. Higher restoration expenses can lead to increased agreed-upon values for insured vehicles, and subsequently, higher payouts in the event of a claim, putting pressure on Hagerty's underwriting and claims management.

Economic pressures on enthusiasts, such as higher living costs and potentially reduced discretionary income due to inflation, can affect their ability to fund ongoing maintenance and restoration projects. This could lead to a slowdown in the market for classic car services and parts, impacting the long-term health and growth of the enthusiast community Hagerty serves.

Currency Exchange Rate Volatility

Currency exchange rate volatility significantly impacts Hagerty's international operations. Fluctuations in exchange rates can alter the cost of acquiring imported classic cars and parts, directly affecting inventory costs and pricing strategies. For instance, a stronger US dollar in 2024 might make it cheaper for US buyers to purchase European collector cars, potentially boosting Hagerty's sales in that segment, but conversely, it could make US-based vehicles more expensive for international buyers.

These currency shifts also influence the attractiveness of different markets for both buying and selling. A weakening Euro could make the European market a more appealing destination for collectors seeking to expand their portfolios, a trend Hagerty's global clientele would monitor closely. Conversely, a robust Euro might deter international investment in European classic car markets, impacting Hagerty's business development in those regions.

- Impact on Imported Goods: A 10% appreciation of the USD against the Euro in late 2024 could reduce the cost of acquiring European classic cars by a similar margin for US-based buyers.

- Market Attractiveness: Persistent currency weakness in a key market like the UK could make it a more attractive acquisition hub for Hagerty's international clientele, potentially increasing cross-border transaction volumes.

- Revenue Stream Diversification: Hagerty's revenue streams are influenced by the relative strength of currencies in its operating markets, with a diversified global presence mitigating some of the risks associated with individual currency movements.

Investment Trends and Alternative Assets

The classic car market is in constant dialogue with other alternative investment avenues like fine art, prime real estate, and other luxury collectibles. Investors are always weighing where their capital can achieve the best returns, and this dynamic directly affects demand for classic vehicles. For instance, in 2024, while traditional markets saw fluctuations, the alternative asset sector, including collectibles, showed resilience, with some segments experiencing growth. This competition means that the perceived return on investment for classic cars, as tracked by valuation indices, is a critical factor in their market appeal.

Shifting investment trends can significantly impact the demand for classic cars. As interest rates change or as other asset classes offer more attractive yields, capital may flow away from collectibles. Hagerty's own data from late 2024 indicated that while the overall collector car market remained robust, certain segments experienced stronger appreciation than others, influenced by broader economic sentiment and investor appetite for tangible assets. This highlights the importance of understanding how classic cars are positioned relative to other investment options.

Hagerty's valuation tools and marketplace services are intrinsically linked to how classic cars are perceived as an asset class. When classic cars are viewed favorably compared to, say, the art market or luxury watches, Hagerty's platform benefits from increased activity. For example, the Hagerty Market Index, which tracks the value of collector cars, showed a modest increase in the first half of 2025, reflecting continued interest, yet it also demonstrated that performance varied by specific vehicle types and eras. This underscores the need for sophisticated valuation and market analysis to navigate these evolving investment trends.

- Competition with Alternative Assets: The classic car market competes with art, real estate, and other luxury collectibles for investor capital.

- Impact of Shifting Trends: Changes in investor sentiment and perceived returns on investment for classic cars directly influence market demand.

- Hagerty's Position: Hagerty's valuation tools and marketplace are shaped by the comparative standing of classic cars as an asset class.

- Market Performance Data: The Hagerty Market Index showed varied performance across vehicle segments in early 2025, reflecting diverse investor preferences.

Global economic growth directly influences disposable income, a key factor for Hagerty's market. The IMF projected 3.2% global growth for 2024, indicating a supportive environment for luxury spending. Conversely, economic downturns can reduce demand for discretionary items like classic cars.

Higher disposable income fuels collector car purchases, as seen in Hagerty's 2023 report of a 12% increase in its insured fleet value to $34.7 billion. Interest rate hikes, with the Federal Reserve's rate elevated in mid-2024, increase financing costs for buyers, potentially slowing sales.

Inflation in 2024-2025 raises restoration and parts costs, with component prices up 5-10% and skilled labor 15-20% higher, impacting insurance valuations. Currency exchange rates also play a role; a stronger USD in 2024 could make European cars cheaper for US buyers, influencing international market dynamics.

| Economic Factor | 2024/2025 Impact | Hagerty Relevance |

|---|---|---|

| Global GDP Growth | Projected 3.2% in 2024 | Drives disposable income for collectors |

| Interest Rates | Elevated in mid-2024 | Increases financing costs for classic cars |

| Inflation | Rising 2024-2025 | Increases restoration and parts costs |

| Currency Exchange Rates | Volatile (e.g., USD strength) | Affects international acquisition costs and market attractiveness |

Preview Before You Purchase

Hagerty PESTLE Analysis

The preview shown here is the exact Hagerty PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at Hagerty's operational environment.

The content and structure shown in the preview is the same Hagerty PESTLE Analysis document you’ll download after payment, offering valuable insights into political, economic, social, technological, legal, and environmental factors.

Sociological factors

The car enthusiast landscape is shifting, with the traditional base of older owners aging out. This presents a significant challenge for companies like Hagerty, which cater to classic and collector vehicles. Data from 2024 indicates a growing need to engage younger demographics who may not have the same affinity for vintage models.

Millennials and Gen Z are showing interest in different aspects of car culture, often leaning towards modern performance vehicles, electric cars, or even unique digital experiences related to automobiles. Understanding these evolving preferences is key for Hagerty's long-term strategy. For instance, a 2025 market survey revealed that over 60% of Gen Z respondents expressed interest in sustainable automotive technologies.

Adapting marketing and product offerings to resonate with these younger generations is crucial for sustained growth. This could involve embracing digital platforms, focusing on experiential events, and potentially expanding into segments that appeal to a broader range of automotive interests beyond traditional classics.

Societal shifts are increasingly favoring shared mobility and sustainability, particularly in urban centers. This trend, which saw a significant uptick in ride-sharing service usage in 2024, could gradually impact the traditional perception of personal car ownership, including that of classic vehicles.

While classic cars are often cherished as passion assets, broader societal views on vehicle usage and environmental impact might subtly influence public acceptance and participation in car-related events. For instance, the growing emphasis on reducing carbon footprints, as highlighted by a 15% increase in electric vehicle adoption in major cities during 2024, could indirectly affect the perceived desirability of internal combustion engine classics.

The cultural significance of owning a car is evolving, with younger demographics in particular showing a greater openness to alternative transportation solutions. This evolving cultural landscape suggests that the intrinsic value placed on traditional car ownership, even for enthusiasts, may need to adapt to a more diversified mobility ecosystem.

The pervasive influence of social media and digital communities has fundamentally reshaped how automotive enthusiasts interact and share their passion. Platforms like Instagram, YouTube, and dedicated forums are now central hubs for discovering, discussing, and showcasing classic and collector cars. Hagerty's strategic focus on creating engaging content and fostering these online spaces is crucial for its member acquisition and retention efforts, directly impacting its lifestyle brand appeal.

Interest in Experiential Events and Lifestyle

Modern consumers, particularly within the enthusiast market, increasingly prioritize experiences over mere possession. This shift is evident in the growing demand for memorable activities and lifestyle integration. Hagerty's strategic emphasis on organizing and sponsoring automotive events, rallies, and creating rich lifestyle content directly taps into this evolving consumer preference, offering tangible value that complements its core insurance offerings.

This focus on experiential engagement is a key driver for Hagerty's membership programs. By providing access to unique automotive gatherings and community-building opportunities, the company fosters deeper connections with its audience. For example, Hagerty's Drive Share platform, which allows owners to rent out their classic cars, saw significant growth in 2024, demonstrating the strong appeal of shared automotive experiences. This cultural interest in unique automotive pursuits directly translates into increased participation and robust brand loyalty.

- Experiential Demand: Consumers are willing to spend on events and lifestyle activities related to their passions, a trend observed across multiple demographics in 2024.

- Hagerty's Engagement: The company’s investment in over 2,500 automotive events globally in 2024 highlights its commitment to experiential value.

- Membership Growth: Hagerty reported a 15% year-over-year increase in membership in early 2025, directly linked to their event and content offerings.

- Cultural Alignment: The success of Hagerty's lifestyle approach is intrinsically tied to the enduring cultural fascination with classic cars and the associated community.

Sustainability and Environmental Consciousness

Growing environmental awareness and the push for sustainable practices are increasingly influencing consumer behavior and regulatory landscapes. This heightened consciousness could lead to greater scrutiny of classic cars, particularly concerning their emissions. While classic cars represent a small fraction of the total vehicle fleet globally, public perception and potential future regulations might drive innovations in classic car sustainability or influence how events featuring these vehicles are planned and executed. For instance, a 2024 survey indicated that over 60% of consumers consider environmental impact when making purchasing decisions, a trend that could extend to the automotive hobbyist sector.

Hagerty, as a key player in the classic car market, may need to proactively address these evolving environmental concerns to maintain a positive public image and ensure the continued enjoyment of the classic car hobby. This could involve supporting research into cleaner classic car technologies or promoting best practices for event sustainability. The industry is already seeing some shifts, with a growing interest in electric conversions for classic vehicles, suggesting a potential pathway for addressing emissions concerns while preserving automotive heritage.

- Growing environmental awareness: Over 60% of consumers consider environmental impact in purchasing decisions (2024 data).

- Potential scrutiny of classic cars: Emissions remain a focal point for environmental regulations.

- Industry adaptation: Increased interest in electric conversions for classic vehicles.

- Hagerty's role: Need to address environmental concerns for public image and hobby sustainability.

The demographic of car enthusiasts is evolving, with younger generations like Millennials and Gen Z showing different interests than traditional collectors. A 2025 survey indicated that over 60% of Gen Z respondents are interested in sustainable automotive technologies, signaling a shift away from solely appreciating vintage internal combustion engines.

Societal trends are increasingly favoring shared mobility and sustainability, impacting the perception of personal car ownership. Ride-sharing service usage saw a significant uptick in 2024, and the 15% increase in electric vehicle adoption in major cities during the same year highlights a growing environmental consciousness that could indirectly affect the appeal of classic cars.

The cultural significance of car ownership is also changing, with younger demographics more open to alternative transportation. This evolving landscape means that the value placed on traditional car ownership may need to adapt to a more diversified mobility ecosystem.

Technological factors

Hagerty's core operations heavily depend on sophisticated digital platforms for vehicle valuation and its online marketplace. These technologies are crucial for providing collectors with accurate, up-to-date appraisals and facilitating smooth transactions within its membership community.

The company's commitment to innovation in its digital offerings is evident in its continuous development of user-friendly interfaces and advanced valuation algorithms. This focus ensures Hagerty remains a leader in providing reliable data and a seamless experience for its diverse clientele, from novice enthusiasts to seasoned collectors.

In 2023, Hagerty reported a significant increase in its digital engagement, with a substantial portion of its valuation requests and marketplace interactions occurring through its online channels. The security and efficiency of these digital ecosystems are paramount, underpinning the trust members place in Hagerty's services.

Hagerty's use of advanced data analytics and AI is transforming how they underwrite collector vehicle insurance. By processing vast amounts of data specific to the collector car market, they can more accurately assess risk, leading to personalized policies and more efficient claims handling. This precision allows for highly competitive pricing strategies that resonate with their niche customer base.

The integration of big data in 2024 and 2025 enables Hagerty to refine their underwriting models, moving beyond traditional metrics. For instance, AI-driven tools can now predict depreciation curves and identify emerging market trends for specific vehicle makes and models, directly impacting Hagerty's valuation tools and product development.

Telematics and connected car technology are rapidly evolving, even impacting the classic car world. While vintage vehicles don't come equipped with these features, advancements in tracking and diagnostic tools for all cars present opportunities for insurers like Hagerty. These technologies could lead to new insurance models or specialized add-on services for collector vehicles.

Hagerty could investigate how aftermarket telematics can provide benefits such as improved security for classic cars or offer valuable usage-based insights. For instance, a connected device could alert owners to unauthorized movement, enhancing theft prevention. This data might also inform risk assessment, potentially leading to more tailored insurance policies.

The integration of such technologies could spur new product development at Hagerty. Imagine usage-based insurance options for classic cars driven on specific occasions, or data-driven insights that help owners maintain their vehicles better. The global telematics market was valued at approximately $32.1 billion in 2023 and is projected to grow significantly, indicating a strong trend towards connected vehicle data utilization.

Cybersecurity and Data Privacy Protection

Cybersecurity and data privacy are paramount for Hagerty, given its reliance on digital platforms for customer data and financial transactions. A significant data breach could severely erode customer trust and lead to substantial financial penalties. For instance, the average cost of a data breach in 2024 reached $4.73 million, according to IBM's Cost of a Data Breach Report.

Hagerty must maintain continuous investment in advanced security infrastructure to safeguard against increasingly sophisticated cyber threats. Compliance with evolving data privacy regulations, such as GDPR and CCPA, is non-negotiable. Failure to comply can result in fines; California's CCPA, for example, allows for penalties of $2,500 per unintentional violation and $7,500 per intentional violation.

- Investment in advanced threat detection and prevention systems is ongoing.

- Regular security audits and penetration testing are conducted.

- Employee training on data privacy best practices is a priority.

- Adherence to global data protection regulations is rigorously maintained.

Advanced Restoration and Maintenance Technologies

Technological advancements are significantly reshaping vehicle restoration. Innovations like 3D printing are becoming crucial for fabricating rare or obsolete parts, ensuring the authenticity and drivability of classic vehicles. For instance, the demand for 3D printed classic car parts saw a notable increase in 2024, with specialized services reporting a 25% year-over-year growth in custom orders.

Material science is also playing a vital role in preservation. New coatings and compounds offer enhanced protection against corrosion and environmental degradation, extending the lifespan and maintaining the aesthetic integrity of classic automobiles. This progress directly impacts the long-term value proposition for collectors and insurers alike.

Hagerty's strategic engagement with these technological shifts is paramount. By potentially integrating or highlighting these advancements through content or partnerships, Hagerty can bolster its support for the enthusiast community. This proactive approach can also influence how insurance policies are structured for vehicles benefiting from cutting-edge restoration techniques, potentially leading to more accurate risk assessments and coverage.

- 3D Printing: Facilitates the creation of historically accurate, hard-to-find components for classic vehicles.

- Material Science: Offers advanced preservation solutions, protecting vehicles from wear and environmental damage.

- Hagerty's Role: Embracing these technologies can enhance community engagement and inform insurance practices.

- Market Impact: These innovations contribute to the sustained or increased valuation of meticulously restored classic cars.

Hagerty's technological foundation is built on advanced digital platforms for valuation and its online marketplace, crucial for accurate appraisals and smooth member transactions. The company's investment in user-friendly interfaces and sophisticated valuation algorithms in 2024 and 2025 solidifies its leadership in providing reliable data and an exceptional experience for all collectors.

Big data analytics and AI are transforming Hagerty's insurance underwriting by enabling more precise risk assessment and personalized policies. For instance, AI-driven tools in 2024 are refining underwriting models by predicting depreciation and identifying emerging market trends for specific vehicle makes, directly influencing valuation tools and product development.

The evolving landscape of telematics and connected car technology presents opportunities for Hagerty, even in the classic car sector. Innovations in tracking and diagnostics could lead to new insurance models or specialized services, potentially offering enhanced security and usage-based insights for classic vehicles.

Technological advancements like 3D printing are revolutionizing vehicle restoration, enabling the fabrication of rare parts, with custom orders for 3D printed classic car parts growing by 25% year-over-year in 2024. Material science innovations are also enhancing vehicle preservation through advanced coatings, protecting against corrosion and environmental damage, thereby extending the lifespan and value of classic automobiles.

| Technology Area | Impact on Hagerty | Data/Trend (2023-2025) |

|---|---|---|

| Digital Platforms | Core for valuation and marketplace operations; enhances user experience. | Significant increase in digital engagement reported in 2023; continuous development of user-friendly interfaces and advanced valuation algorithms. |

| AI & Big Data Analytics | Transforms underwriting, improves risk assessment, and personalizes policies. | AI-driven tools refining underwriting models in 2024-2025; prediction of depreciation curves and identification of market trends. |

| Telematics & Connected Cars | Potential for new insurance models and usage-based insights. | Global telematics market valued at ~$32.1 billion in 2023, with significant projected growth; opportunities for enhanced security and data-driven policies. |

| 3D Printing & Material Science | Revolutionizes restoration by enabling part fabrication and enhancing preservation. | 25% year-over-year growth in custom orders for 3D printed classic car parts in 2024; advancements in coatings protect against corrosion. |

Legal factors

Hagerty navigates a complex web of state and federal insurance regulations, demanding rigorous compliance with licensing, consumer protection, and solvency mandates. For instance, the National Association of Insurance Commissioners (NAIC) continually updates model laws, impacting everything from data security to market conduct, and states adopt these at varying paces, creating a dynamic compliance landscape for Hagerty.

Shifts in regulatory frameworks, such as potential changes to capital requirements or new rules governing digital customer interactions, directly influence Hagerty's operational strategies and necessitate ongoing investment in compliance infrastructure. In 2024, the NAIC continued its focus on cybersecurity, with many states implementing or enhancing data breach notification laws that insurers like Hagerty must meticulously follow.

Maintaining compliance across numerous jurisdictions presents a significant operational challenge for Hagerty, requiring dedicated resources to monitor and adapt to diverse state-specific insurance laws and enforcement priorities. The cost of compliance, including legal counsel, technology upgrades, and personnel training, remains a critical factor in Hagerty's overall financial performance.

Data privacy and security laws like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) significantly shape how Hagerty handles customer information. These regulations, and others emerging globally, dictate how Hagerty must collect, store, and utilize data from its members and digital platform users. Failure to comply can result in substantial financial penalties, with GDPR fines potentially reaching 4% of global annual revenue or €20 million, whichever is higher.

Hagerty operates under a stringent framework of consumer protection laws, mandating transparency in marketing, sales, and service. This includes clear communication regarding their specialized agreed value coverage, ensuring customers fully understand the terms and benefits. For instance, in 2024, the National Association of Insurance Commissioners (NAIC) continued to emphasize fair claims handling practices across the industry, a key area for Hagerty's classic car insurance.

The company's claims process and dispute resolution mechanisms are under particular scrutiny, as these directly impact customer satisfaction and trust. Regulations designed to prevent unfair or deceptive practices are paramount to maintaining Hagerty's reputation and avoiding costly litigation, which can significantly impact financial performance.

Intellectual Property and Content Rights

Hagerty, as a major content creator in the automotive space, navigates a complex legal landscape concerning intellectual property. Protecting its brand, including trademarks for events and its core business, is paramount. This involves safeguarding its original articles, videos, and imagery from unauthorized use, a common challenge for digital media companies. For instance, in 2023, the U.S. Copyright Office reported a significant increase in copyright registrations, highlighting the growing importance of formal IP protection.

Respecting the intellectual property of others is equally crucial for Hagerty. This means ensuring proper licensing or fair use when incorporating vehicle imagery, historical data, or third-party content into its own productions. Failure to do so can lead to costly legal disputes and damage to its reputation. The U.S. Chamber of Commerce estimates that IP-intensive industries contribute trillions to the U.S. economy, underscoring the financial stakes involved in IP management.

- Trademark Protection: Hagerty must actively defend its brand marks, such as the Hagerty name and associated logos, used across its media, events, and insurance products.

- Copyright Enforcement: Protecting original content like articles, video footage, and photography is vital to prevent unauthorized distribution and monetization by others.

- Licensing and Permissions: Obtaining necessary rights for using images of classic cars, historical archives, or music in Hagerty's content is a continuous legal requirement.

- Fair Use Doctrine: Understanding and applying the fair use principles for quoting, referencing, or critiquing existing works is essential to avoid infringement claims.

Vehicle Import/Export and Ownership Laws

Laws governing the import, export, and ownership transfer of classic and collector vehicles directly influence Hagerty's operations and its ability to serve an international clientele. For instance, changes in import duties or restrictions on older vehicles can significantly affect the cost and feasibility of cross-border transactions, impacting market liquidity.

Regulations concerning vehicle titles, historical designations, and the complexities of international sales are critical. In 2024, many countries are reviewing or updating their classic vehicle import regulations. For example, the European Union continues to harmonize its approach to vehicle registration, which can create both opportunities and challenges for Hagerty's members seeking to move vehicles between member states.

Understanding these diverse and often evolving legal frameworks is paramount for Hagerty's global strategy. The company must navigate varying requirements for vehicle inspections, emissions standards for older vehicles, and proof of ownership documentation to ensure smooth transactions for its clients worldwide.

- Cross-border Transaction Complexity: Navigating differing title and registration laws across jurisdictions impacts the ease of buying and selling classic cars internationally.

- Import/Export Duties and Taxes: Tariffs and taxes on imported classic vehicles can fluctuate, directly affecting their final cost and market appeal in different regions.

- Historical Designation Laws: Recognition of a vehicle's historical status can exempt it from certain regulations, but these designations vary significantly by country.

Hagerty's legal landscape is shaped by evolving insurance regulations, data privacy laws like GDPR and CCPA, and consumer protection mandates. Compliance with state and federal insurance laws, including those updated by the NAIC, demands continuous investment in infrastructure and personnel. For instance, the NAIC's focus on cybersecurity in 2024 means Hagerty must adhere to increasingly stringent data breach notification laws across various states.

Environmental factors

While many classic cars are exempt from current emissions standards due to their limited mileage and historical value, the growing focus on environmental protection could introduce new rules. This could affect where and how certain older vehicles can be driven or registered, potentially impacting their desirability and market price. Hagerty actively tracks these evolving environmental policies.

Environmental consciousness is increasingly shaping consumer choices, even within the automotive enthusiast sphere. This growing awareness is driving demand for more sustainable practices across vehicle maintenance, restoration, and event management. For Hagerty, while the direct impact on classic cars might be less pronounced, there's a clear opportunity to engage with the broader automotive enthusiast community by promoting eco-friendly products and processes, potentially through content or strategic partnerships focused on responsible classic car ownership.

Climate change is directly impacting the physical security of classic cars. The rising frequency and intensity of extreme weather events, such as floods, hurricanes, and wildfires, present a significant threat. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, there were 28 separate billion-dollar weather and climate disasters in the United States alone, a record number. This escalating risk means more potential damage to valuable vehicles, leading to increased insurance claims for Hagerty and requiring a re-evaluation of underwriting practices and coverage options.

Hagerty, as a specialist insurer, must adapt its risk management strategies to account for these growing environmental hazards. The increasing concern over protecting high-value assets from climate-related damage necessitates innovative solutions in policy design and claims processing. This includes potentially offering specialized coverage for vehicles stored in vulnerable areas or encouraging owners to adopt enhanced protective measures.

Public Perception of Environmental Impact of Hobbies

The growing societal emphasis on environmental responsibility means hobbies, including classic car ownership, face increasing public scrutiny regarding their ecological footprint. For Hagerty, a leader in classic car insurance and services, maintaining a positive public image is crucial, even within this niche market.

While classic cars represent a small fraction of the overall vehicle population, highlighting their cultural significance and relatively low cumulative environmental impact compared to modern daily drivers is a key strategy. For instance, data from 2024 indicates that while classic cars are driven less frequently than modern vehicles, their enthusiast owners often prioritize meticulous maintenance, potentially leading to more efficient operation for their mileage.

- Environmental Scrutiny: Public awareness of climate change and sustainability is rising, potentially impacting perception of hobbies with visible environmental impacts.

- Niche Market Dynamics: Classic car ownership is a passion-driven segment, where cultural value and historical preservation often outweigh immediate environmental concerns for participants.

- Comparative Impact: While not zero-emission, the limited mileage and often specialized use of classic cars mean their total environmental contribution is significantly less than high-mileage, everyday vehicles.

- Hagerty's Role: The company can play a role in educating the public and its members about the nuanced environmental profile of classic vehicles and promoting responsible ownership practices.

Resource Scarcity and Recycling Initiatives

Resource scarcity and evolving recycling initiatives present a nuanced environmental factor for Hagerty and the classic car market. While direct impacts are currently minimal, the long-term availability and cost of specific materials or parts needed for restoration could be influenced by broader global trends in resource management. For instance, increased demand for rare metals or plastics used in older vehicles might see price fluctuations if supply chains are tightened due to scarcity.

New recycling mandates or advancements in material reclamation could also indirectly affect the classic car ecosystem. While the focus is typically on modern vehicle components, shifts in how materials are processed could eventually influence the cost-effectiveness of sourcing or recreating vintage parts. Hagerty, as a key player in classic car preservation, might explore supporting sustainable restoration practices or advocating for responsible material sourcing to mitigate potential future challenges.

Consider the following potential impacts:

- Material Availability: Potential for increased costs or reduced availability of specific metals, plastics, or rubber compounds used in older vehicles due to global resource constraints.

- Recycling Technologies: Advancements in recycling could make certain materials more accessible or, conversely, lead to the obsolescence of older manufacturing processes.

- Sustainable Practices: Opportunities for Hagerty to promote or partner in initiatives that encourage the reuse and responsible disposal of classic car parts, aligning with environmental stewardship.

- Cost of Restoration: While not a primary driver in 2024, future resource pressures could add a small percentage to the overall cost of comprehensive classic car restorations.

The increasing frequency of extreme weather events, such as floods and wildfires, poses a direct threat to the physical security of classic cars. In 2023, the U.S. experienced 28 billion-dollar weather and climate disasters, according to NOAA. This escalating risk necessitates adaptive risk management strategies for insurers like Hagerty, potentially influencing underwriting practices and coverage options for vulnerable vehicles.

While classic cars are driven less than modern vehicles, their enthusiasts often prioritize meticulous maintenance, potentially leading to more efficient operation for their mileage. For instance, data from 2024 suggests that the environmental footprint of a classic car, when driven infrequently, is considerably lower than that of a high-mileage daily driver.

Resource scarcity and evolving recycling initiatives could impact the long-term availability and cost of specialized parts for classic car restoration. While not a primary concern in 2024, future pressures on materials like rare metals or specific plastics might influence restoration costs.

Hagerty can leverage its position to promote sustainable restoration practices and educate members on the nuanced environmental profile of classic vehicles, aligning with growing societal emphasis on environmental responsibility.

| Environmental Factor | 2023/2024 Impact | Potential Future Impact |

|---|---|---|

| Extreme Weather Events | 28 U.S. billion-dollar disasters in 2023 (NOAA) | Increased risk of damage, higher insurance claims, need for specialized coverage. |

| Consumer Environmental Awareness | Growing demand for sustainable practices in enthusiast communities. | Opportunity for Hagerty to promote eco-friendly solutions and responsible ownership. |

| Material Availability & Recycling | Minimal direct impact currently. | Potential for increased restoration costs due to resource constraints or new recycling mandates. |

PESTLE Analysis Data Sources

Our Hagerty PESTLE Analysis is meticulously constructed using a blend of proprietary market intelligence, public government data, and industry-specific reports. This ensures that every aspect, from evolving regulations to emerging technological trends, is grounded in factual, current information.