Hagerty Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hagerty Bundle

Hagerty's competitive landscape is shaped by the interplay of five critical forces, from the bargaining power of its customers to the intensity of rivalry within the automotive enthusiast market.

Understanding these dynamics is crucial for anyone looking to navigate or invest in this unique industry. The full Porter's Five Forces Analysis provides a comprehensive, data-driven framework to dissect these pressures.

Ready to move beyond the basics? Get a full strategic breakdown of Hagerty’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The concentration of suppliers significantly impacts Hagerty's bargaining power. If Hagerty relies on a limited number of providers for essential inputs like reinsurance or specialized technology for underwriting and digital services, these suppliers gain considerable leverage. For instance, the reinsurance market, particularly for specialty insurance, is dominated by a few large players. In 2024, the top five global reinsurers controlled a substantial portion of the market share, meaning Hagerty has fewer alternatives if these key suppliers dictate terms or increase prices.

Hagerty faces significant switching costs, particularly with core technology platforms like Duck Creek. Migrating such systems involves substantial financial outlays for new licensing, implementation, data migration, and extensive employee training, potentially running into millions of dollars. These costs are amplified by the operational disruption and the time required to ensure seamless integration and compliance, which can extend over many months.

The uniqueness of Hagerty's supplier offerings significantly impacts their bargaining power. If Hagerty relies on highly specialized services, like niche reinsurance for classic cars, these suppliers possess greater leverage due to the difficulty in finding comparable alternatives. For example, in 2024, the collector car insurance market saw specialized underwriting expertise become increasingly valuable, making it harder for insurers to switch providers without compromising coverage quality.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, while less common in the specialty insurance sector, is a factor to consider for Hagerty. If a major reinsurance provider, for instance, were to decide to enter the direct-to-consumer classic car insurance market, it could disrupt Hagerty's operations. This would essentially mean a supplier becoming a competitor.

Assessing the barriers to entry for such a move is crucial. Suppliers would need to develop expertise in underwriting specialty risks, building a customer base in the automotive lifestyle niche, and establishing brand recognition. For example, a reinsurance company might have the capital, but replicating Hagerty's deep understanding of classic car culture and its associated risks presents a significant hurdle.

- Supplier Integration Risk: The potential for reinsurance providers or other key partners to move into direct classic car insurance poses a competitive threat.

- Barriers to Entry: Significant hurdles exist for suppliers, including specialized underwriting knowledge and building brand loyalty within the enthusiast community.

- Market Dynamics: While capital might be available, replicating Hagerty's established niche expertise and customer relationships is a considerable challenge for potential integrating suppliers.

Importance of Hagerty to Suppliers

Hagerty's significance to its suppliers plays a crucial role in shaping their bargaining power. If Hagerty constitutes a substantial portion of a supplier's annual revenue, that supplier is likely to be more accommodating to Hagerty's demands, as losing Hagerty's business could significantly impact their own financial stability. For instance, if a specialized automotive parts manufacturer relies on Hagerty for 30% of its sales, Hagerty holds considerable leverage.

Conversely, if Hagerty represents only a minor fraction of a supplier's overall client base, the supplier possesses greater bargaining power. In such scenarios, the supplier is less dependent on Hagerty and can afford to dictate terms or even walk away from the relationship if their interests are not met. Consider a general insurance underwriter that services thousands of clients; Hagerty's business might be a small percentage of their total book, giving the underwriter more room to negotiate.

- Supplier Dependence: The degree to which suppliers depend on Hagerty's business directly influences their bargaining power. Higher dependence weakens supplier power.

- Client Diversification: Suppliers with a diverse client portfolio are less vulnerable to Hagerty's influence, thereby increasing their leverage.

- Hagerty's Market Share: Hagerty's own market share within its niche also impacts supplier negotiations; a dominant Hagerty can command better terms.

- Supplier Specialization: Highly specialized suppliers catering to Hagerty's unique needs may find their bargaining power reduced due to Hagerty's limited alternative sourcing options.

The bargaining power of suppliers is a critical factor for Hagerty, influencing its costs and operational flexibility. When suppliers are concentrated, possess unique offerings, or face low switching costs for Hagerty, their leverage increases, potentially leading to higher prices or less favorable terms.

Hagerty's reliance on specialized services, such as niche reinsurance for classic vehicles, amplifies supplier power. In 2024, the specialized nature of underwriting for unique assets meant fewer providers could offer tailored solutions, giving those providers more sway in negotiations.

The threat of suppliers integrating forward into Hagerty's market, while less common, could shift the power dynamic. For instance, a major reinsurer entering the direct specialty insurance space would directly compete, altering supplier-customer relationships.

The degree to which Hagerty represents a significant portion of a supplier's revenue is a key determinant of supplier bargaining power. If Hagerty is a major client, suppliers are more incentivized to accommodate Hagerty's needs, thereby reducing their leverage.

| Factor | Impact on Hagerty's Bargaining Power | Example/Data Point (2024) |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power | Top 5 global reinsurers held a significant market share in specialty lines. |

| Switching Costs | High switching costs increase supplier power | Migrating core underwriting platforms can cost millions and take months. |

| Uniqueness of Offering | Unique offerings increase supplier power | Specialized reinsurance for collector cars had limited alternative providers. |

| Forward Integration Threat | Potential threat increases supplier power | Reinsurers entering direct insurance could disrupt market dynamics. |

| Hagerty's Importance to Supplier | Low importance increases supplier power | Suppliers serving many clients have less dependence on Hagerty. |

What is included in the product

This Porter's Five Forces analysis provides a comprehensive examination of the competitive forces impacting Hagerty, offering insights into industry attractiveness and strategic positioning.

Easily identify and address competitive threats with a visual, actionable framework.

Customers Bargaining Power

Customer price sensitivity for Hagerty's target market, classic and collector vehicle owners, is a nuanced factor. While these enthusiasts often prioritize specialized care and agreed value coverage, which can justify higher premiums, they are not immune to price comparisons. For instance, in 2024, the average cost of collector car insurance can range significantly, but owners will still evaluate Hagerty's offerings against those of other specialty insurers or even standard auto policies if their vehicles are occasionally used.

The unique value proposition of Hagerty, such as expert claims handling and restoration assistance, can mitigate some price sensitivity. However, economic conditions in 2024, including inflation and potential shifts in discretionary spending, could heighten this sensitivity. Customers may become more inclined to seek out the most cost-effective solution that still meets their core needs for protecting valuable assets, even if it means a slightly less comprehensive service package.

The availability of substitute offerings significantly impacts Hagerty's bargaining power with its customers. If customers can easily find alternative insurance providers or automotive lifestyle services, their power increases. For instance, a classic car owner might consider a standard auto insurance policy from a major insurer, even if it lacks Hagerty's specialized coverage, or seek out separate providers for valuation, roadside assistance, or community forums.

In 2024, the broader insurance market continued to see a rise in digital comparison tools, making it simpler for consumers to shop around. While Hagerty targets a niche market, the general trend of increased accessibility to alternative solutions for automotive needs, from general insurance to specialized services, means customers have more options than ever before, thereby strengthening their negotiating position.

Customers today possess unprecedented access to information regarding pricing, policy features, and market comparisons. This transparency, amplified by the digital age, significantly bolsters their bargaining power as they can readily research and compare available options.

Hagerty itself contributes to this informed landscape through its own valuation tools and comprehensive market reports, further empowering customers with knowledge. For instance, Hagerty's Hagerty Valuation Tools, widely used by collectors and enthusiasts, provide detailed insights into classic car values, enabling more informed purchasing and selling decisions.

Switching Costs for Customers

Switching costs for Hagerty's customers, particularly those in the classic and collector car insurance niche, are a significant factor in their bargaining power. These costs aren't just financial; they encompass the effort and potential loss of intangible benefits. For instance, a customer moving from Hagerty might face administrative tasks to transfer policies and re-establish coverage details. More importantly, they could lose access to Hagerty's specialized community, exclusive events, and the deep understanding of collector vehicles that Hagerty's underwriters and claims adjusters possess.

Lower switching costs generally give customers more leverage. If it's easy and inexpensive to move to a competitor, customers are more likely to do so if they are dissatisfied or find a better deal elsewhere. This pressure can force Hagerty to maintain competitive pricing and high service standards. For example, if a competitor offered comparable specialized coverage with a simpler onboarding process and a lower premium, customers might be tempted to switch, especially if they don't heavily value Hagerty's community aspects.

The specific inconveniences can vary. Some customers might find that their unique vehicle modifications or historical context are better understood and insured by Hagerty, making a switch to a general insurer problematic. This specialized knowledge acts as a de facto switching cost. In 2024, the insurance market continued to see a demand for specialized services, with many niche providers competing for customer loyalty. While specific switching cost data for Hagerty isn't publicly available, the general trend in specialty insurance suggests that deep product knowledge and associated services can create sticky customer relationships.

- Administrative Hassle: The time and effort required to find a new insurer, complete new applications, and provide vehicle documentation.

- Loss of Specialized Benefits: Forgoing Hagerty's access to exclusive events, curated content, and a community of like-minded enthusiasts.

- Expertise Gap: The risk of moving to an insurer less familiar with the nuances of classic and collector vehicles, potentially leading to inadequate coverage or claims issues.

- Potential for Higher Premiums Elsewhere: While seeking lower costs, customers might find that general insurers charge more for specialized coverage, negating the savings.

Customer Group Concentration

Hagerty's customer base, primarily individual classic and collector car owners, is largely fragmented. This fragmentation significantly limits the bargaining power of any single customer. For instance, in 2024, Hagerty serves hundreds of thousands of policyholders, with no single policyholder representing a substantial portion of revenue.

While individual customers have limited power, the potential for collective action through affinity groups or large collector associations could introduce some bargaining leverage. However, Hagerty actively engages with these groups, often through partnerships and sponsorships, which tends to align their interests rather than create adversarial bargaining.

- Customer Base Fragmentation: Hagerty's customer base is predominantly composed of individual classic and collector car enthusiasts, making it highly fragmented.

- Limited Individual Bargaining Power: The sheer number of individual policyholders means no single customer can exert significant influence on pricing or terms.

- Potential for Collective Influence: While individual power is low, organized collector groups or associations could potentially wield some collective bargaining power.

- Mitigation through Engagement: Hagerty's proactive engagement with enthusiast communities helps to manage and often neutralize potential collective bargaining threats.

The bargaining power of customers for Hagerty is generally low due to the fragmented nature of its niche market. Individual classic and collector car owners, while passionate, do not represent a significant portion of Hagerty's overall business, limiting their ability to influence terms. For example, in 2024, Hagerty continued to serve a vast and diverse base of enthusiasts, meaning no single customer's demands could substantially impact the company's operations or pricing strategies.

What You See Is What You Get

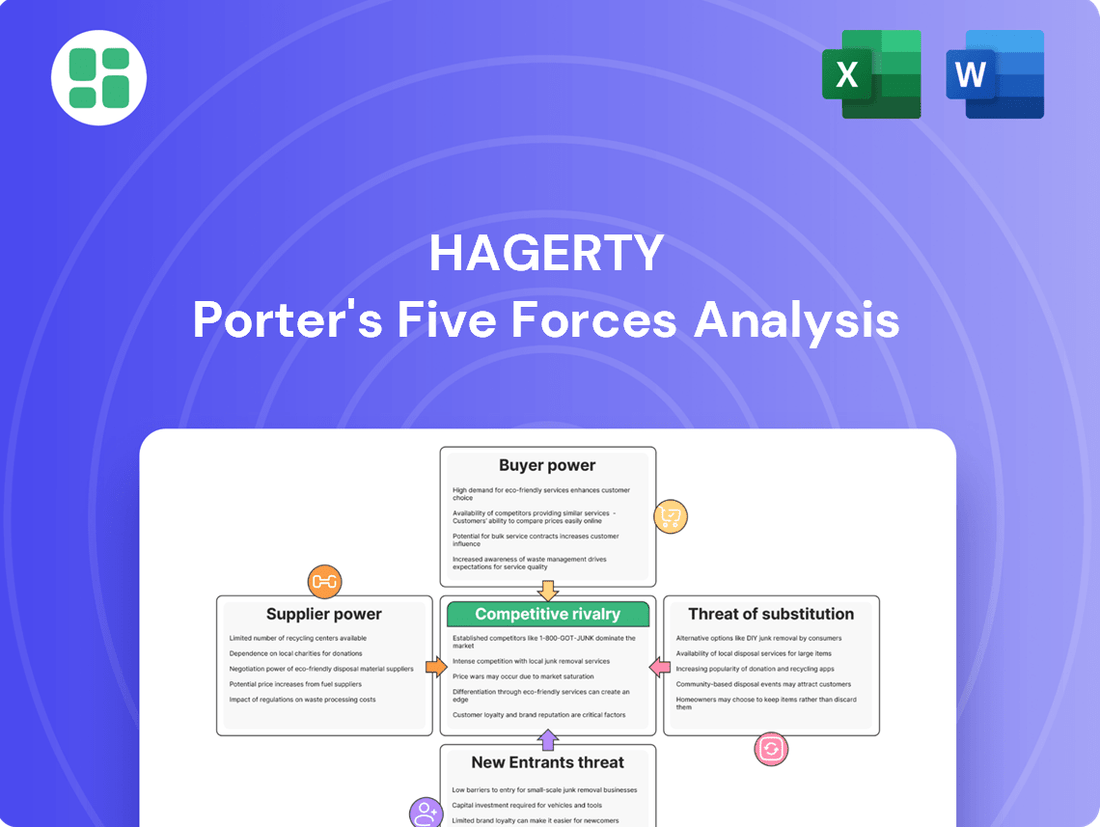

Hagerty Porter's Five Forces Analysis

This preview showcases the complete Hagerty Porter's Five Forces Analysis, offering a deep dive into the competitive landscape of the classic car market. The document you see here is the exact, professionally formatted report you will receive immediately after purchase. It meticulously details the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

Hagerty operates in a market with a mix of direct and indirect competitors. Direct competitors include companies offering specialized insurance for classic and collector vehicles, while indirect competitors encompass general auto insurers who may offer policies that could be considered by some owners, though often without the same level of expertise or tailored benefits.

The number of players in the niche collector car insurance market is relatively concentrated compared to broader auto insurance. While specific market share data for this segment is not always publicly detailed, Hagerty is widely recognized as a dominant leader. For instance, in 2024, Hagerty reported a significant increase in its insured fleet value, reaching approximately $60 billion, indicating a substantial portion of the high-value collector vehicle market is under its purview.

The competitive intensity is influenced by the size and market share of other players. While there are smaller, regional insurers, few possess the scale and specialized focus of Hagerty. This relative size difference suggests that while competition exists, Hagerty's established brand, extensive membership base, and comprehensive service offerings position it strongly against many smaller rivals.

The classic and collector car market experienced robust growth leading up to 2024, with values appreciating significantly. However, this growth has shown signs of moderating, particularly for certain segments of the market.

The specialty insurance segment, which serves this niche, has also seen expansion, but faces increased competition. A slower growth environment, as potentially seen in parts of the collector car market in 2024, can heighten competitive rivalry. Companies then must vie more aggressively for existing customers rather than benefiting from an expanding customer base.

Hagerty effectively differentiates itself by cultivating an integrated automotive lifestyle brand, encompassing exclusive events, engaging media content, and a membership program. This holistic approach aims to foster deep customer loyalty, moving beyond simple product features and reducing the intensity of direct price-based competition within the specialty automotive insurance market.

Switching Costs for Customers

Switching costs for customers are a key factor in understanding competitive rivalry. If it's difficult or expensive for a customer to move from Hagerty to a competitor, Hagerty benefits from increased customer loyalty and reduced pressure from rivals. For example, if a customer has deeply integrated Hagerty's specialized classic car insurance into their existing vehicle ownership, the effort to find and transition to a new provider might be substantial.

Hagerty actively works to increase these switching costs by building a comprehensive ecosystem beyond just insurance. This includes services like Hagerty Drivers Club, Hagerty Marketplace, and Hagerty's valuation tools. These offerings create a sticky customer experience, making it less appealing to leave.

The impact of these switching costs can be seen in customer retention rates. While specific 2024 data on Hagerty's customer switching costs isn't publicly detailed, the company's focus on building this integrated community suggests a strategy to minimize churn. For instance, in 2023, Hagerty reported a strong retention rate, indicating that their ecosystem is likely effective in keeping customers engaged.

- Increased switching costs reduce customer price sensitivity.

- Hagerty's broader service offerings create a stickier customer experience.

- A strong ecosystem discourages customers from seeking alternative providers.

- High retention rates are an indicator of effective switching cost strategies.

Exit Barriers

High exit barriers can trap companies in a market, forcing them to continue competing even when profits are low. This is often due to specialized assets or significant fixed costs that are difficult to recover.

For instance, in the automotive repair industry, specialized tools and training represent substantial investments. A 2024 report indicated that the average independent auto repair shop has over $100,000 invested in diagnostic equipment alone, making a quick exit financially unviable.

- Specialized Assets: Investments in unique machinery or technology that has little value outside the specific industry.

- High Fixed Costs: Significant ongoing expenses like rent, leases, or long-term contracts that must be paid regardless of sales volume.

- Emotional Attachment: Founders or long-term management may have strong emotional ties to the business, resisting closure.

- Government Regulations: Certain industries have regulations that make exiting complex or costly, requiring specific procedures for asset disposal or employee compensation.

Competitive rivalry in the collector car insurance market is characterized by Hagerty's strong leadership position, though it faces competition from both specialized insurers and broader auto insurance providers. The intensity of this rivalry can increase during periods of market moderation, as seen in certain segments of the collector car market in 2024, prompting companies to compete more fiercely for customers.

Hagerty's strategy of building an integrated automotive lifestyle brand, complete with events, media, and a membership program, effectively differentiates it. This approach aims to foster customer loyalty and reduce direct price competition by creating a sticky customer experience. The effectiveness of this strategy is suggested by strong customer retention rates, indicating that customers find value beyond just the insurance policy itself.

Switching costs are a significant factor in mitigating competitive rivalry. By offering a comprehensive ecosystem of services, Hagerty increases the effort required for customers to switch to a competitor. This ecosystem, which includes services like the Hagerty Drivers Club and Hagerty Marketplace, aims to minimize customer churn and maintain Hagerty's market standing.

High exit barriers within the specialty insurance sector can also influence rivalry by making it difficult for companies to leave the market, potentially leading to continued competition even in less profitable conditions. These barriers can include specialized assets and significant fixed costs, making a swift departure financially unfeasible for some players.

SSubstitutes Threaten

The threat of substitutes for Hagerty's specialized collector car insurance is moderate. While general auto insurance policies are readily available and often cheaper, they typically do not offer the nuanced coverage essential for classic vehicles, such as agreed value appraisals or coverage for mileage limitations. For instance, a standard policy might offer actual cash value, significantly undervaluing a rare or meticulously restored vehicle.

Customer propensity to substitute for Hagerty's services, particularly its marketplace, is a key consideration. Classic car owners might opt for broader online platforms like eBay Motors or Bring a Trailer if they perceive them as offering greater convenience, wider reach, or better pricing for their specific needs, even if they lack Hagerty's specialized focus.

The perceived value proposition of substitutes plays a crucial role. If general marketplaces can adequately facilitate transactions for classic vehicles with less hassle and at a lower cost, customers may indeed switch. For example, a seller might choose a platform with a larger existing buyer base, even if it requires more effort to attract qualified interest.

In 2024, the continued growth of large, general automotive marketplaces suggests a persistent threat. These platforms often benefit from network effects, attracting more buyers and sellers, which can enhance their appeal. Hagerty's challenge is to continually demonstrate the superior value and specialized expertise it offers to retain its customer base against these broader alternatives.

The availability of digital alternatives presents a significant threat to Hagerty's core business. While Hagerty offers a specialized community and insurance for classic car enthusiasts, digital platforms can provide fragmented substitutes. For instance, online forums and social media groups can fulfill the community aspect, and broad insurance comparison websites might offer more generic, albeit less tailored, coverage options.

These digital alternatives, even if not a perfect one-to-one replacement, can siphon off customer segments seeking convenience or lower costs. For example, general classifieds sites or even broader collector car marketplaces can compete for sales and parts sourcing, bypassing Hagerty's curated ecosystem. This trend is amplified as digital adoption continues to grow across all demographics, including classic car owners.

Technological Advancements Enabling Substitutes

Technological advancements are a significant threat, as they can rapidly spawn or bolster substitute offerings that bypass traditional industry players. For example, sophisticated AI-powered valuation tools developed by fintech companies outside the insurance sector could emerge as direct competitors to Hagerty's classic car valuation services, potentially offering more dynamic and data-driven insights. This could disrupt Hagerty's established market position by providing a more accessible or affordable alternative for collectors and enthusiasts.

Furthermore, the rise of digital platforms and online communities presents another avenue for substitution. New social networking sites or specialized forums, potentially leveraging advanced engagement algorithms, could attract and retain Hagerty's core enthusiast base. These digital spaces might offer alternative avenues for members to connect, share information, and even conduct transactions related to classic vehicles, thereby diminishing the perceived value of Hagerty's proprietary network. For instance, while Hagerty reported a significant increase in its digital community engagement in 2024, with millions of unique visitors to its online content, the emergence of a highly specialized, AI-curated digital community could offer a more tailored experience.

- AI-driven valuation tools from non-insurance tech firms could offer sophisticated, real-time vehicle appraisals, challenging Hagerty's expertise.

- Digital communities built on advanced engagement algorithms could attract Hagerty's enthusiast base, offering alternative networking and information-sharing platforms.

- Fintech innovations in fractional ownership or peer-to-peer lending for classic vehicles could bypass traditional insurance and valuation models.

- The increasing digitization of the automotive aftermarket could lead to new platforms for parts sourcing and sales, potentially reducing reliance on established enthusiast networks.

Perceived Value of Hagerty's Integrated Offering

Hagerty's integrated offering, combining specialized insurance, expert valuation tools, dedicated roadside assistance, and a vibrant enthusiast community, creates a significant perceived value. This bundle is designed to be more than just the sum of its parts, fostering loyalty among classic car owners who value this comprehensive ecosystem.

Customers often view Hagerty's bundled services as a superior value proposition that is challenging to replicate by piecing together individual services from different providers. This strong perceived integrated value directly diminishes the threat of substitutes because the convenience and specialized nature of Hagerty's complete package are difficult to match.

- Specialized Insurance: Hagerty's policies are tailored to the unique needs of classic and collector vehicles, offering coverage that standard insurers may not provide.

- Valuation Tools: Access to Hagerty's Price Guide and valuation expertise offers a tangible benefit, aiding in accurate appraisal and informed decision-making.

- Roadside Assistance: The specialized roadside assistance is designed for classic cars, understanding their particular vulnerabilities, which is a key differentiator.

- Community Engagement: Hagerty's investment in events, content, and online forums cultivates a sense of belonging and shared passion, enhancing customer stickiness.

The threat of substitutes for Hagerty's specialized services remains moderate, primarily due to the unique needs of collector car owners. While general insurance and online marketplaces exist, they often lack the tailored coverage, expert valuation, and community aspects that Hagerty provides. For instance, a standard auto policy typically doesn't offer agreed-value coverage, a crucial feature for classic cars, which can be significantly undervalued by actual cash value policies. In 2024, the continued growth of broad online automotive platforms highlights the persistent challenge of these substitutes, as they often leverage network effects to attract a wider audience.

Digital alternatives, from online forums fulfilling the community need to broad insurance comparison sites offering generic coverage, can siphon off customers seeking convenience or lower costs. These platforms, even if not a perfect replacement, can chip away at Hagerty's market share. The increasing digitization of the automotive aftermarket further enables new platforms for parts sourcing and sales, potentially reducing reliance on established enthusiast networks. Hagerty's challenge lies in continuously demonstrating the superior value and specialized expertise it offers to retain its customer base against these broader, often more accessible, alternatives.

Technological advancements, such as AI-powered valuation tools developed by fintech companies, pose a significant threat by offering sophisticated, real-time appraisals outside Hagerty's traditional domain. Similarly, new social networking sites or specialized forums, potentially using advanced engagement algorithms, could attract Hagerty's core enthusiast base, offering alternative networking and information-sharing platforms. While Hagerty reported strong digital community engagement in 2024, the emergence of highly specialized, AI-curated digital communities could offer a more tailored experience, directly challenging Hagerty's proprietary network.

Hagerty's strength lies in its integrated offering, bundling specialized insurance, expert valuation tools, dedicated roadside assistance, and a vibrant enthusiast community. This comprehensive package creates significant perceived value that is difficult for substitutes to replicate. Customers often find this bundled approach superior to piecing together individual services, thereby diminishing the threat of substitution due to the convenience and specialized nature of Hagerty's complete ecosystem. For example, Hagerty's Price Guide, a key valuation tool, provides tangible benefits that general marketplaces cannot easily match.

Entrants Threaten

Entering the classic car insurance and automotive lifestyle market requires substantial financial capital. For insurance operations alone, companies need significant reserves to cover potential claims and meet stringent regulatory capital requirements, which can run into tens of millions of dollars depending on the jurisdiction and scale of operations.

Beyond underwriting, building a comprehensive lifestyle brand, as Hagerty has done with its events, Hagerty Drivers Club, and media platforms, necessitates considerable investment in marketing, content creation, and event infrastructure. For instance, major classic car auctions and concours events, key components of the automotive lifestyle, can cost millions to organize and promote, creating a high barrier to entry for new players.

New insurance providers often face significant regulatory hurdles. These include obtaining licenses in multiple jurisdictions, adhering to strict solvency and capital reserve requirements, and complying with ongoing reporting obligations. For instance, in 2024, the average time to obtain an insurance license in a new state could range from several months to over a year, depending on the complexity of the application and the state's specific regulations.

Hagerty, a prominent player in the classic car insurance market, benefits significantly from strong brand loyalty. This loyalty, built over years of specialized service and community engagement, makes it harder for new companies to attract customers. For instance, in 2024, Hagerty reported a substantial customer retention rate, indicating that existing policyholders are unlikely to switch providers without a compelling reason.

Furthermore, the switching costs for Hagerty's customers are not just financial but also involve a loss of specialized knowledge and community benefits. Customers who have built relationships with Hagerty's appraisal and claims teams, or who participate in their events and clubs, face a disruption when considering a new insurer. These intangible switching costs, coupled with the brand's reputation for understanding the nuances of classic car ownership, create a significant barrier to entry for potential competitors in 2024.

Access to Distribution Channels

New entrants face significant hurdles in accessing established distribution channels for classic car insurance. Hagerty, for instance, has cultivated deep relationships with a vast network of independent agents and brokers, a critical pathway to reaching classic car enthusiasts. This intricate web of partnerships, built over decades, provides Hagerty with preferential placement and trust among its target demographic.

Replicating Hagerty's extensive distribution network is a formidable challenge for any newcomer. The company's direct-to-consumer platform, coupled with its partnerships with classic car clubs and events, creates a multifaceted approach that is difficult and time-consuming to match. For example, in 2023, Hagerty reported continued growth in its agent and broker network, underscoring the strength of these established relationships.

- Established Broker Networks: Hagerty's long-standing relationships with insurance brokers provide immediate access to a pre-qualified customer base.

- Direct-to-Consumer Channels: The company's robust online presence and direct sales force bypass intermediaries, offering another competitive advantage.

- Partnerships and Events: Collaborations with classic car clubs and sponsorship of major automotive events ensure visibility and direct engagement with enthusiasts.

Economies of Scale and Experience Curve

Hagerty, as a specialist in collector car insurance, likely benefits significantly from economies of scale in its underwriting and claims processing. This means that as Hagerty handles more policies, its per-policy cost for these operations decreases, creating a cost advantage. For instance, in 2024, the global insurance market saw continued investment in digital platforms, with companies aiming to automate underwriting and claims to reduce operational expenses. Companies with established, efficient digital infrastructure can process applications and settle claims faster and cheaper than new entrants who would need to build this from scratch.

Furthermore, Hagerty's long-standing presence in the collector car niche allows it to leverage an experience curve. This curve represents the learning effect where costs decrease as cumulative production or experience increases. Hagerty's deep understanding of the unique risks associated with collector vehicles, from rare models to classic restorations, translates into more accurate pricing and fewer unexpected losses. This accumulated knowledge is a substantial barrier, as new entrants would need considerable time and capital to develop a similar level of expertise, making it difficult to compete on both price and risk assessment accuracy.

- Economies of Scale: Hagerty's established infrastructure for underwriting and claims processing allows for lower per-policy costs, a significant advantage over new, smaller operations.

- Experience Curve: Decades of specialized knowledge in collector car valuation and risk assessment provide Hagerty with superior pricing accuracy and loss control capabilities.

- Digital Platform Investment: Continued industry-wide investment in automation and digital tools in 2024 means established players with advanced platforms have a cost and efficiency edge.

- Risk Specialization: The nuanced understanding of collector vehicle risks is a proprietary asset that new entrants would struggle to replicate quickly or cost-effectively.

The threat of new entrants into Hagerty's market is significantly mitigated by the substantial capital requirements for both insurance operations and brand building. Establishing an insurance arm alone demands tens of millions in reserves to cover claims and meet regulatory capital mandates, a figure that can escalate with scale and jurisdiction in 2024. Beyond insurance, cultivating a lifestyle brand like Hagerty's, encompassing events and clubs, requires extensive investment in marketing and infrastructure, with major classic car events costing millions to organize and promote.

| Barrier Type | Description | Estimated Cost/Time (2024) |

| Capital Requirements | Insurance reserves, brand development, event infrastructure | Tens of millions for insurance reserves; millions for event promotion |

| Regulatory Hurdles | Licensing, solvency, reporting compliance | Months to over a year for state licensing; ongoing compliance costs |

| Brand Loyalty & Switching Costs | Specialized service, community benefits, relationship capital | High retention rates for established players; intangible costs for customers |

| Distribution Channels | Broker networks, direct-to-consumer platforms, partnerships | Time-consuming to replicate established networks and partnerships |

| Economies of Scale & Experience Curve | Underwriting efficiency, claims processing, risk assessment expertise | Significant cost advantage for established players; learning curve for newcomers |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of robust data, including industry-specific market research reports, company financial statements, and expert interviews with industry insiders. This comprehensive approach ensures we capture the nuances of competitive intensity, buyer and supplier power, and the threat of new entrants and substitutes.