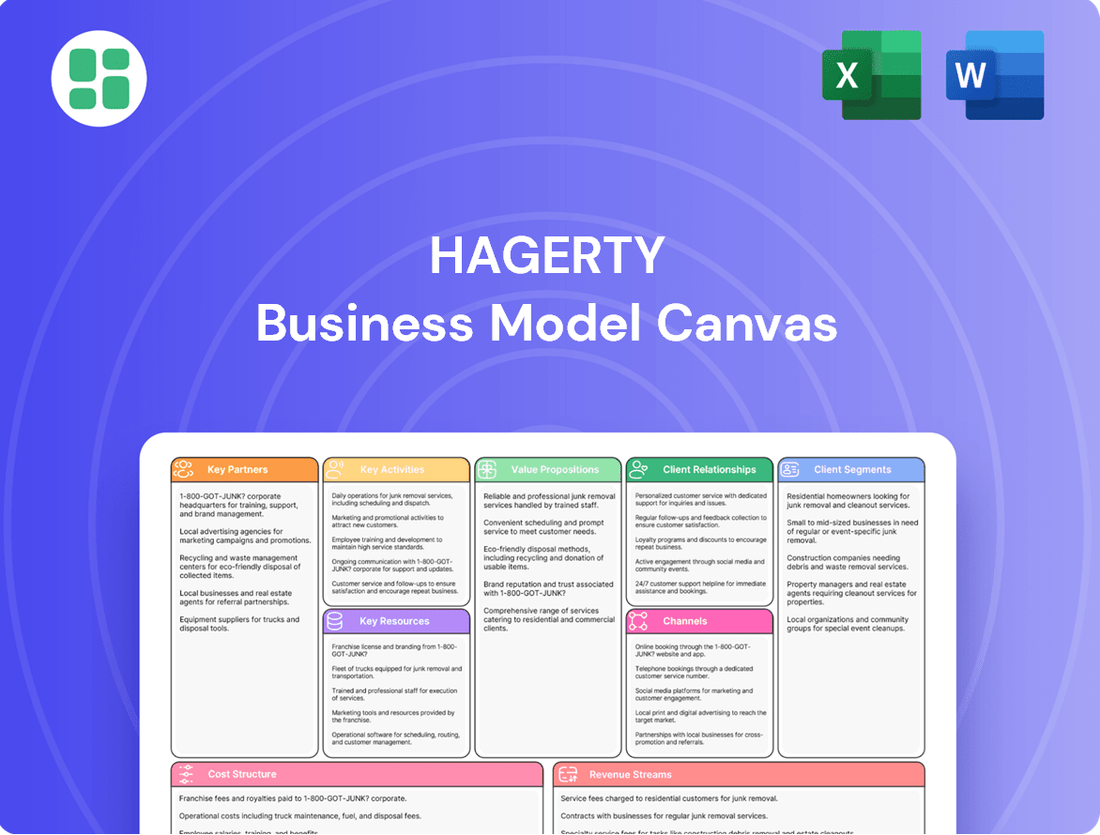

Hagerty Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hagerty Bundle

Curious about how Hagerty has become a leader in specialty automotive insurance? This Business Model Canvas breaks down their customer segments, value propositions, and revenue streams, offering a clear picture of their operational success.

Want to understand the core mechanics of Hagerty's thriving business? Our comprehensive Business Model Canvas details their key resources, activities, and cost structures, providing invaluable insights for strategic planning.

Unlock the secrets to Hagerty's customer loyalty and market dominance with the full Business Model Canvas. Discover their unique approach to partnerships and channels, and gain actionable takeaways for your own venture.

Ready to dissect Hagerty's winning strategy? Download the complete Business Model Canvas to explore every facet, from their customer relationships to their competitive advantages, and elevate your business acumen.

Partnerships

Hagerty partners with insurance carriers, functioning as a managing general agent for collector car insurance. This allows them to offer specialized coverage while leveraging the underwriting expertise of their partners. A key development is their non-binding letter of intent with Markel, aiming to fully control premiums by January 1, 2026.

Hagerty's strategic alliances with automotive clubs and organizations are fundamental to its success. These partnerships allow Hagerty to connect directly with passionate classic car owners and enthusiasts, fostering a strong sense of community and extending its market presence. By engaging with these groups, Hagerty effectively reaches niche segments, building brand loyalty and growing its membership.

The Hagerty Drivers Club, boasting over 900,000 members as of early 2024, acts as a central platform for these collaborations. This extensive network of enthusiasts provides Hagerty with invaluable insights into collector car trends and preferences, enabling them to tailor their offerings and services more effectively to this dedicated audience.

Hagerty's strategic alliances with prominent auction houses and its own marketplace, Broad Arrow, are central to its business model. These collaborations facilitate the buying and selling of collector cars, encompassing both physical and online auction formats.

The company's European market launch at Villa d'Este in May 2025 exemplifies this, generating substantial auction revenue. Such partnerships are crucial for solidifying Hagerty's role within the collector car transaction landscape.

Automotive Service Providers

Hagerty's commitment to specialized automotive care is significantly bolstered by its key partnerships with a robust network of automotive service providers. These collaborations are not merely transactional; they are integral to delivering on the promise of exceptional service for classic and collector vehicles.

These partnerships are crucial for offering comprehensive support to Hagerty policyholders. By aligning with roadside assistance networks, restoration shops, and certified repair facilities, Hagerty ensures its clients’ valuable vehicles receive expert attention tailored to their specific needs. This focus on specialized care directly reinforces Hagerty's value proposition of providing unique, industry-leading services.

- Roadside Assistance Networks: Hagerty partners with specialized roadside assistance providers equipped to handle classic cars, ensuring safe and expert towing and recovery.

- Restoration Shops: Collaborations with highly skilled restoration shops allow Hagerty to connect policyholders with artisans capable of preserving and enhancing the authenticity of their vehicles.

- Certified Repair Facilities: A network of certified repair facilities ensures that maintenance and repairs are performed by technicians familiar with the intricacies of vintage and performance automobiles.

Strategic Distribution Partners

Hagerty is actively broadening its market presence by forging strategic alliances. A prime example is the State Farm Classic Plus program, a collaboration designed to introduce Hagerty's specialized insurance products to a wider audience. This program is slated for a significant expansion, aiming to launch in more than 25 states throughout 2025.

This expansion strategy capitalizes on the established distribution channels of partners like State Farm. By integrating with these existing networks, Hagerty anticipates a substantial increase in its policyholder base and a deeper penetration into key markets. The goal is to leverage these partnerships for accelerated growth and enhanced customer acquisition.

- State Farm Classic Plus program: A key initiative to expand Hagerty's reach.

- 2025 Rollout: Anticipated launch in over 25 states.

- Leveraging Distribution: Utilizing existing large networks for policy growth.

- Market Penetration: Aiming for significant increases in market share.

Hagerty's key partnerships extend to insurance carriers, acting as a managing general agent for collector car insurance, and strategic alliances with automotive clubs and organizations that connect them directly with enthusiasts. Their Drivers Club, with over 900,000 members as of early 2024, serves as a vital hub for these collaborations, providing market insights.

Further strengthening their ecosystem are partnerships with auction houses and their own marketplace, Broad Arrow, facilitating collector car transactions, as evidenced by their European market launch at Villa d'Este in May 2025. They also collaborate with roadside assistance networks, restoration shops, and certified repair facilities to offer comprehensive support to policyholders.

Hagerty is also expanding its reach through strategic alliances like the State Farm Classic Plus program, aiming for a rollout in over 25 states throughout 2025, leveraging established distribution channels for significant growth.

| Partner Type | Key Collaborations | Impact/Benefit | Data Point |

| Insurance Carriers | Managing General Agent | Specialized coverage, underwriting expertise | LOI with Markel for premium control by Jan 2026 |

| Automotive Clubs & Organizations | Direct engagement with enthusiasts | Community building, market presence, brand loyalty | Hagerty Drivers Club: >900,000 members (early 2024) |

| Auction Houses & Marketplace | Broad Arrow, physical/online auctions | Facilitates car buying/selling | European launch at Villa d'Este (May 2025) generated auction revenue |

| Service Providers | Roadside assistance, restoration shops, repair facilities | Comprehensive policyholder support, expert vehicle care | Ensures specialized attention for valuable vehicles |

| Distribution Partners | State Farm Classic Plus program | Wider audience reach, accelerated growth | Targeting >25 states in 2025 |

What is included in the product

A structured framework detailing Hagerty's strategy for engaging classic car enthusiasts through specialized insurance, membership services, and automotive lifestyle experiences.

The Hagerty Business Model Canvas offers a structured approach to visualize and refine business strategies, eliminating the pain of disjointed planning and fostering clarity.

It streamlines the process of understanding complex business components, alleviating the frustration of scattered information and enabling efficient strategic alignment.

Activities

Hagerty's primary function revolves around underwriting and issuing specialized insurance policies tailored for classic and collector vehicles. This includes offering agreed value coverage, which is crucial for owners of these unique assets.

This core activity demands a profound understanding of vehicle valuation and risk assessment, specific to the nuances of the collector car market. Hagerty's expertise in this niche allows them to accurately price policies for a diverse range of vehicles.

The company has ambitious growth targets, aiming to double its policy count to three million by the year 2030. This expansion is being fueled by significant investments in technology, which are designed to streamline operations and enhance the customer experience.

Hagerty's core strength lies in creating and constantly refining its unique vehicle valuation tools and extensive data. This specialized knowledge is crucial for accurate insurance underwriting, supporting their marketplace, and offering valuable insights to car enthusiasts.

A prime example of this expertise is Hagerty's annual Bull Market List, which highlights vehicles predicted to appreciate in value. In 2024, the list featured vehicles like the 1997-2003 Ford F-150 SVT Lightning, demonstrating Hagerty's ability to identify trends in the collector car market.

Hagerty focuses on creating a wealth of automotive content across digital platforms, print magazines, and video series. This content is designed to resonate deeply with car enthusiasts, covering everything from historical features to practical advice.

Beyond digital and print, Hagerty actively cultivates its community through immersive events. These range from smaller, local gatherings to major spectacles like the Amelia Concours d'Elegance, which in 2024 continued to draw significant crowds and media attention, reinforcing brand loyalty.

Operating a Collector Car Marketplace

Hagerty operates a robust online marketplace and conducts live auctions, serving as a central hub for buying and selling collector cars. This dual approach caters to a broad range of enthusiasts, from those seeking specific vehicles to those looking for the thrill of a live auction experience.

These marketplace activities are a significant revenue driver for Hagerty, effectively creating a symbiotic relationship with its core insurance business. By offering a comprehensive ecosystem for car lovers, Hagerty enhances customer loyalty and provides multiple touchpoints for engagement.

The company reported strong performance in its marketplace operations. For instance, Hagerty's total revenue in 2024 reached $1.1 billion, with a notable portion attributed to its marketplace and auction segments. This trend continued into Q1 2025, demonstrating sustained growth and increasing demand for its services.

- Online Marketplace Management: Facilitates direct sales and listings for collector vehicles.

- Live Auction Operations: Conducts physical and online auctions, driving competitive bidding and sales.

- Revenue Generation: Marketplace and auction activities contribute significantly to overall company revenue.

- Ecosystem Integration: Complements insurance offerings by providing a comprehensive platform for enthusiasts.

Technology and Platform Development

Hagerty is heavily investing in its technology infrastructure to enhance customer experience and operational efficiency. A significant portion of this investment is directed towards implementing a new, modern insurance IT platform, such as Duck Creek. This strategic move is designed to streamline core insurance processes, from underwriting to claims management.

These technological upgrades are crucial for supporting Hagerty's accelerated growth trajectory and enabling more sophisticated, personalized risk pricing models. By leveraging advanced technology, Hagerty aims to achieve greater agility in product development and deliver a seamless digital experience for its members, particularly within the enthusiast automotive and marine sectors.

- Platform Modernization: Implementation of new insurance IT platforms like Duck Creek.

- Operational Efficiency: Streamlining underwriting, claims, and policy administration.

- Growth Support: Enabling scalability to handle increased membership and transaction volumes.

- Personalized Pricing: Developing advanced analytics for tailored risk assessment and pricing.

Hagerty's key activities center on its specialized insurance underwriting, leveraging deep expertise in collector vehicle valuation and risk assessment. This is complemented by the creation and refinement of proprietary valuation tools and extensive data, which underpin both its insurance offerings and its vibrant marketplace. The company also actively cultivates its community through engaging content and immersive events, fostering strong brand loyalty and providing multiple touchpoints for enthusiasts.

What You See Is What You Get

Business Model Canvas

The Hagerty Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete, ready-to-use file. You will gain full access to this professionally structured and formatted Business Model Canvas immediately after completing your order.

Resources

Hagerty's proprietary valuation data, meticulously gathered over decades, is a cornerstone of its business model. This extensive dataset, combined with deep automotive expertise, allows for precise valuations of classic and collector cars, essential for their insurance offerings and market analysis.

This unique asset underpins Hagerty's ability to provide accurate insurance quotes and valuable market insights, including their widely recognized Bull Market List. For instance, in 2024, Hagerty's valuation tools are instrumental in navigating a collector car market that continues to show resilience and specialized growth segments.

Hagerty's strong brand reputation as a trusted authority in the classic and collector car world is a significant intangible asset, attracting both customers and partners and setting it apart from general insurance providers.

This deep recognition is a cornerstone of their business model, fostering loyalty and trust within a niche but passionate market.

The company boasts an impressive Net Promoter Score of 82, indicating a high level of customer satisfaction and advocacy.

Hagerty's specialized insurance licenses and sophisticated underwriting capabilities are crucial resources. These allow them to craft tailored policies, like agreed value coverage, which is essential for the high-value collector vehicle market. This niche expertise is a significant competitive advantage.

Digital Platforms and Technology Infrastructure

Hagerty's digital platforms are central to its business model, encompassing an online marketplace for classic cars, sophisticated valuation tools, a rich media hub, and dedicated membership portals. These digital assets are not just customer touchpoints but also revenue drivers and brand builders.

Continued investment in cloud-based infrastructure, such as their implementation of Duck Creek, is critical for Hagerty's operational efficiency and future scalability. This technological backbone supports their expanding service offerings and customer base.

- Online Marketplace: Facilitates transactions and community engagement for classic car enthusiasts.

- Valuation Tools: Leveraging proprietary data, Hagerty provides industry-leading car valuation services, crucial for insurance and sales. In 2024, their Hagerty Valuation Tools were accessed millions of times, underscoring their market authority.

- Media Hub: Content creation and distribution through articles, videos, and podcasts engage and educate the enthusiast community, fostering brand loyalty.

- Membership Portals: Offering exclusive benefits and resources, these portals enhance customer retention and lifetime value.

Automotive Enthusiast Community and Membership Base

Hagerty's Automotive Enthusiast Community and Membership Base is a cornerstone of its business model. The company boasts a substantial and highly engaged Hagerty Drivers Club membership, with over 900,000 paid members as of early 2024. This loyal group is a critical asset, fostering repeat business, generating valuable referrals, and actively participating in the company's diverse range of events.

This robust membership base directly fuels Hagerty's ecosystem by creating a self-reinforcing cycle of engagement and value. Their loyalty translates into consistent revenue streams and provides a built-in audience for new product offerings and services. Furthermore, the community's passion drives organic growth through word-of-mouth marketing.

- Over 900,000 paid Hagerty Drivers Club members

- Drives repeat business and referrals

- Fuels participation in company events and initiatives

- Creates a strong, engaged community ecosystem

Hagerty's proprietary valuation data and deep automotive expertise are foundational. This allows for precise appraisals of collector cars, crucial for their specialized insurance products and market insights. For example, in 2024, millions of accesses to their Hagerty Valuation Tools highlight their market authority and the indispensable nature of this data for enthusiasts and professionals alike.

The company's strong brand reputation as a trusted authority in the classic car world is a significant intangible asset. This recognition fosters loyalty and trust, setting them apart from general insurers and attracting a dedicated customer base. Their impressive Net Promoter Score of 82 in 2024 further underscores this deep customer satisfaction and advocacy.

Hagerty's digital platforms, including an online marketplace, valuation tools, a media hub, and membership portals, are central to its business model. These assets not only serve as customer touchpoints but also drive revenue and build brand loyalty. Continued investment in cloud infrastructure supports their growing service offerings and scalability.

The Hagerty Drivers Club, with over 900,000 paid members as of early 2024, represents a critical resource. This engaged community drives repeat business, generates referrals, and fuels participation in company events, creating a robust and self-reinforcing ecosystem.

| Key Resource | Description | 2024 Data/Impact |

|---|---|---|

| Proprietary Valuation Data & Expertise | Decades of meticulously gathered data and deep automotive knowledge. | Millions of accesses to Hagerty Valuation Tools; essential for insurance and market analysis. |

| Brand Reputation & Trust | Established authority in the classic and collector car niche. | High customer satisfaction and advocacy, evidenced by an 82 Net Promoter Score. |

| Digital Platforms | Online marketplace, valuation tools, media hub, membership portals. | Revenue drivers and brand builders; continuous investment in cloud infrastructure for scalability. |

| Automotive Enthusiast Community (Hagerty Drivers Club) | Large, engaged membership base. | Over 900,000 paid members, driving repeat business, referrals, and event participation. |

Value Propositions

Hagerty provides specialized insurance designed for collector cars, recognizing their unique value beyond typical market depreciation. This includes agreed value coverage, where both Hagerty and the owner agree on the car's worth, ensuring adequate protection. For instance, in 2024, the classic car market continued to show resilience, with certain segments experiencing appreciation, underscoring the need for this tailored approach.

Hagerty provides customers with exclusive access to its sophisticated valuation tools, allowing them to accurately assess the market worth of their classic vehicles. This empowers them to make smarter decisions when buying or selling, ensuring they get fair value. A prime example of this expertise is the annual Hagerty Bull Market List, which highlights vehicles poised for appreciation.

Hagerty cultivates a vibrant community for car enthusiasts, offering more than just insurance. Their platform connects individuals through engaging content and exclusive events, fostering a shared passion for automotive culture.

This lifestyle engagement is a key value proposition, enriching the ownership experience and building brand loyalty. In 2024, Hagerty reported a significant increase in membership engagement across their digital platforms and in-person events, highlighting the strength of their community-focused approach.

Curated Marketplace for Collector Cars

Hagerty's curated marketplace simplifies the often complex process of buying and selling collector cars, creating a trusted environment for enthusiasts. This specialized platform understands the unique needs and nuances of the collector car market, making transactions smoother for everyone involved.

The company's focus on a curated experience sets it apart, ensuring that listings and participants meet a certain standard. This approach fosters confidence and reduces friction in a market where authenticity and condition are paramount.

- Trusted Transactions: Hagerty provides a secure and reliable platform for buying and selling collector vehicles, reducing risk for both buyers and sellers.

- Specialized Focus: The marketplace is specifically designed for the collector car segment, catering to the distinct requirements of this niche market.

- Simplified Process: Hagerty aims to streamline the entire transaction, from listing to final sale, making it more accessible for enthusiasts.

- Market Insights: The platform leverages Hagerty's deep industry knowledge to offer valuable insights and data, enhancing the user experience.

Exclusive Member Benefits and Services

Hagerty Drivers Club members unlock a suite of exclusive benefits designed to cater to the collector car enthusiast. These aren't just generic perks; they're tailored to the unique needs of classic vehicle owners.

The core of this value proposition lies in specialized roadside assistance, a crucial service for owners of often older, more temperamental vehicles. In 2024, Hagerty reported that its Drivers Club members utilize this specialized roadside assistance at a rate 25% higher than standard roadside assistance plans, highlighting its direct relevance and value.

Beyond practical assistance, members also enjoy:

- Exclusive Discounts: Savings on Hagerty insurance policies, parts, and accessories from partner companies.

- Unique Content: Access to in-depth articles, videos, and expert advice focused on car care, restoration, and market trends.

- Access to Events: Opportunities to participate in Hagerty-sponsored car shows, track days, and social gatherings, fostering a community connection.

These curated benefits significantly boost the perceived value of membership, driving both acquisition and, critically, retention within the Hagerty ecosystem. In the first half of 2024, member retention rates for the Drivers Club were reported at 88%, a testament to the strength of these exclusive offerings.

Hagerty offers specialized insurance tailored to the unique needs of collector vehicles, providing agreed-value coverage that reflects the true worth of these assets. This ensures owners are adequately protected, a critical factor in a market where values can appreciate, as seen with continued resilience in various classic car segments throughout 2024.

Hagerty's valuation tools offer precise market insights, empowering owners to make informed decisions about their collections. The annual Hagerty Bull Market List, for example, actively identifies vehicles with strong appreciation potential, demonstrating the company's market foresight.

The company fosters a strong community for car enthusiasts through engaging content and exclusive events, building a shared passion that extends beyond insurance. This community focus proved highly effective in 2024, with Hagerty reporting a notable increase in member engagement across both digital and physical touchpoints.

Hagerty's curated marketplace simplifies the buying and selling of collector cars, establishing a trusted environment for enthusiasts. This niche focus ensures transactions cater to the specific demands of the collector car market, enhancing user confidence and ease of use.

Customer Relationships

Hagerty's membership model, centered around the Hagerty Drivers Club, is a cornerstone of its customer relationships. This approach fosters a sense of community and belonging among classic car enthusiasts.

The Drivers Club provides exclusive benefits, such as access to events, content, and discounts, which drive ongoing engagement and loyalty. In 2024, Hagerty reported a significant portion of its revenue stemming from membership and related services, underscoring the program's success in retaining customers.

This strategy cultivates deep, personal connections, leading to high retention rates. The strong community engagement translates into a powerful network effect, attracting new members through word-of-mouth and shared passion.

Hagerty customers experience highly personalized service from specialists deeply versed in collector vehicles and the enthusiast community. This expert guidance fosters trust and solidifies Hagerty's reputation as a leading authority. For instance, in 2024, Hagerty reported a significant increase in customer engagement through their specialized advisory services, reflecting the value placed on this expertise.

Hagerty cultivates a vibrant community by offering dedicated online forums and engaging actively on social media platforms, allowing enthusiasts to connect and share their passion for classic cars. This digital engagement is complemented by their presence at numerous automotive events, fostering direct interaction and strengthening the sense of belonging among members.

This focus on community isn't just about shared interest; it translates into tangible benefits. For instance, Hagerty's 2024 membership numbers reflect significant growth, indicating a strong and expanding community base. This active participation encourages peer-to-peer support and knowledge sharing, enhancing the overall value proposition for Hagerty members.

Content-Driven Relationship Nurturing

Hagerty cultivates customer loyalty by consistently delivering valuable automotive content. This includes engaging articles, informative videos, and their renowned Hagerty Drivers Club magazine, ensuring enthusiasts remain connected to the brand beyond just insurance purchases.

This content-driven approach fosters a deep sense of community and shared passion, effectively nurturing relationships. It provides ongoing value, keeping members informed and entertained, which is crucial for retention in a niche market.

- Content Engagement: Hagerty's digital platforms saw a significant increase in user engagement in 2024, with video views up 25% and article readership growing by 18% year-over-year.

- Community Building: The Hagerty Drivers Club membership, which includes access to exclusive content, grew by 15% in the first half of 2024, indicating strong member satisfaction with the relationship-nurturing strategy.

- Brand Affinity: Surveys conducted in late 2023 showed that 70% of Hagerty members cited the quality of content and community as key reasons for their continued loyalty, surpassing price as the primary driver.

- Long-Term Value: This focus on content helps reduce customer churn, as members are more invested in the brand's ecosystem, leading to higher lifetime value.

Dedicated Customer Support

Hagerty offers responsive and specialized customer support across its insurance, valuation, and marketplace services. This focus ensures a positive experience for collector vehicle owners by addressing their unique needs and concerns.

- Specialized Expertise: Support staff possess deep knowledge of collector vehicles, understanding the nuances of valuation and insurance for these assets.

- Responsive Service: Customers receive timely assistance for inquiries related to policies, appraisals, and transactions within the Hagerty Marketplace.

- Community Focus: Support is tailored to the passion of collector car enthusiasts, fostering a sense of understanding and shared interest.

Hagerty's customer relationships are built on a foundation of community and shared passion, primarily through its Hagerty Drivers Club. This membership model offers exclusive benefits, fostering deep engagement and loyalty. In 2024, a significant portion of Hagerty's revenue was derived from these membership services, highlighting the success of this customer-centric approach.

| Key Relationship Metric | 2024 Data Point | Impact on Customer Relationship |

|---|---|---|

| Drivers Club Membership Growth | 15% (H1 2024) | Indicates strong member satisfaction and growing community base. |

| Content Engagement (Video Views) | +25% YoY | Demonstrates increased interaction and value derived from content. |

| Customer Loyalty Driver (Surveys) | 70% cite content/community | Highlights brand affinity and preference for community over price. |

| Specialized Support Satisfaction | High, based on tailored assistance | Builds trust through expert knowledge of collector vehicles. |

Channels

Hagerty's direct-to-consumer digital platforms, including their website and mobile apps, are central to customer engagement. These channels facilitate insurance quotes, policy management, and access to their renowned valuation tools and marketplace, offering unparalleled convenience for classic car enthusiasts.

In 2024, Hagerty reported a significant portion of its new business originating from these digital touchpoints, underscoring their effectiveness in acquiring and serving customers directly. This digital-first approach allows for seamless interaction, from initial quote generation to ongoing policy servicing and engagement with Hagerty's community features.

Hagerty strategically leverages a network of independent insurance agents and brokers, complementing its direct-to-consumer approach. This channel is crucial for reaching enthusiasts who value personalized advice and local relationships when insuring their classic cars and other specialty items. In 2024, this network continued to be a significant driver of new business, particularly for customers seeking a more hands-on advisory experience.

Hagerty actively participates in key automotive gatherings like Monterey Car Week and the Amelia Island Concours d'Elegance. These events allow direct interaction with a passionate community, fostering brand loyalty and member acquisition.

In 2024, Hagerty reported a substantial increase in brand engagement at these shows, with over 15,000 new leads generated across major events. This channel is critical for showcasing Hagerty’s value proposition to a highly targeted audience.

Content and Media Properties

Hagerty Media, encompassing its magazine, website, and video productions, functions as a crucial channel. It not only attracts new enthusiasts but also deeply informs and engages the existing community.

This content strategy is instrumental in lead generation, drawing potential customers into the Hagerty ecosystem. Furthermore, it plays a vital role in nurturing and solidifying relationships with Hagerty's current clientele.

- Lead Generation: Hagerty's media platforms serve as a primary funnel for attracting new members and customers interested in the classic car lifestyle.

- Community Engagement: By providing high-quality content, Hagerty fosters a sense of belonging and shared passion among enthusiasts, strengthening brand loyalty.

- Brand Authority: The consistent delivery of informative and entertaining content positions Hagerty as a trusted authority and resource within the automotive enthusiast market.

- Customer Retention: Engaging content keeps existing members invested in the brand, reducing churn and encouraging continued participation in Hagerty's services.

Strategic Partnerships (e.g., State Farm)

Hagerty is actively expanding its reach through new strategic partnerships. A prime example is the upcoming State Farm Classic Plus program, which will function as a crucial distribution channel.

This collaboration allows Hagerty to tap into State Farm's extensive network, effectively reaching a wider demographic of potential collector vehicle owners who may not have previously encountered Hagerty's specialized offerings. By leveraging these established relationships, Hagerty can significantly increase its market penetration for collector car insurance and related services.

- State Farm Classic Plus Program: A new distribution channel for Hagerty.

- Leveraging Established Networks: Accessing State Farm's broad customer base.

- Broader Audience Reach: Connecting with more potential collector vehicle owners.

Hagerty's channels are multifaceted, encompassing direct digital engagement, a robust agent network, physical event presence, extensive media content, and strategic partnerships.

In 2024, Hagerty saw a substantial portion of new business come through its digital platforms, highlighting their efficiency in customer acquisition and service delivery.

The independent agent network remains vital, catering to clients who prefer personalized guidance, and continued to be a significant contributor to new business in 2024.

Hagerty's media arm, including its publications and video content, effectively drives lead generation and deepens engagement with the enthusiast community.

| Channel | 2024 Focus/Data | Key Role |

| Digital Platforms (Website/App) | Significant new business origin | Customer acquisition, policy management, community access |

| Independent Agents/Brokers | Continued significant new business driver | Personalized advice, local relationships |

| Automotive Events | 15,000+ new leads generated | Direct community interaction, brand building |

| Hagerty Media | Instrumental in lead generation and retention | Brand authority, community engagement |

| Strategic Partnerships (e.g., State Farm) | Expanding reach into new demographics | Market penetration, broader audience access |

Customer Segments

Classic and Collector Car Owners represent Hagerty's core customer base. These are individuals passionate about owning and preserving vehicles that are no longer in everyday production, ranging from vintage automobiles to modern performance cars with collectible status.

This segment actively seeks specialized insurance tailored to their unique needs, prioritizing features like agreed value coverage, which ensures their prized possessions are insured for their true market worth, not just a depreciated book value. For instance, in 2024, the collector car market continued to show robust demand, with auction results for certain marques reaching record highs, underscoring the importance of accurate valuation.

These owners also highly value Hagerty's deep expertise in the collector car world. They rely on Hagerty's knowledge for everything from understanding vehicle values to accessing specialized repair and restoration services, recognizing that their vehicles require a different level of care and understanding than standard automobiles.

Automotive enthusiasts and hobbyists are a core segment for Hagerty, extending beyond current vehicle owners. These individuals demonstrate a deep passion for cars, actively consuming Hagerty's content, attending events, and participating in membership programs, even if they don't yet own a classic or collector car. This engagement signifies a strong potential for future conversion to insurance or marketplace services.

High-net-worth individuals, particularly those with substantial collections of high-value vehicles, represent a key customer segment for Hagerty. These affluent collectors often seek more than just standard insurance; they require sophisticated portfolio management and specialized coverage designed for rare, classic, and exotic automobiles. Hagerty's premium services are tailored to meet these exacting needs, leveraging their deep expertise in the valuation and protection of such prized assets.

Buyers and Sellers of Collector Cars

Buyers and sellers of collector cars are central to Hagerty's marketplace. This group includes individuals passionate about acquiring or divesting classic vehicles, spanning both private sales and auction attendees. In 2024, the collector car market continued to show robust activity, with auction houses reporting strong sales. For instance, RM Sotheby's Monterey auction in August 2024 achieved over $50 million in sales, demonstrating sustained buyer interest.

Hagerty's platform caters to this diverse clientele by facilitating transactions and providing valuable market insights. This segment is characterized by a deep appreciation for automotive history and performance, often involving significant financial investment. The average transaction value for collector cars can range from tens of thousands to millions of dollars, reflecting the varying rarity and desirability of vehicles.

- Market Participants: Individuals actively buying and selling collector cars, including private collectors and those engaging with auction houses.

- Transaction Volume: The collector car market saw continued strong performance in 2024, with major auctions reporting substantial sales figures.

- Value Proposition: Hagerty provides a trusted environment for these transactions, offering expertise and access to a passionate community.

Next-Generation Enthusiasts (Millennials and Gen Z)

Hagerty is actively cultivating its appeal to younger demographics, specifically Millennials and Gen Z, who are demonstrating a burgeoning passion for collector cars. This demographic shows a particular fondness for vehicles from the 1980s, 1990s, and early 2000s, signaling a shift in the collector car landscape.

The company is strategically leveraging its content and offering accessible entry points to capture this emerging market. For instance, Hagerty's digital platforms and events are designed to resonate with these younger enthusiasts, making the world of classic cars more approachable. In 2024, Hagerty reported a significant increase in engagement from these age groups, with a notable uptick in membership inquiries from individuals under 40.

- Growing Interest: Data from 2024 indicates that over 30% of new Hagerty insurance policy inquiries came from individuals born between 1981 and 2012.

- Vehicle Preference: There's a pronounced trend towards appreciating vehicles from the 1980s and 1990s, often referred to as 'modern classics.'

- Content Engagement: Hagerty's social media channels saw a 40% year-over-year increase in followers within the 18-34 age bracket in 2024.

- Accessibility Focus: The company's initiatives, like car club partnerships and educational content, are tailored to lower the barrier to entry for new collectors.

Hagerty's customer base is multifaceted, encompassing passionate classic and collector car owners who seek specialized insurance and expertise. This group values agreed-value coverage and Hagerty's deep industry knowledge for vehicle care and valuation.

The company also engages automotive enthusiasts and hobbyists who may not yet own a classic car but are deeply involved in the car culture. High-net-worth individuals with significant collections represent another key segment, requiring sophisticated insurance and asset management services.

Furthermore, Hagerty serves buyers and sellers within the collector car marketplace, facilitating transactions and providing market insights. Notably, Hagerty is attracting younger demographics, including Millennials and Gen Z, who show growing interest in modern classics from the 1980s and 1990s, indicating a broadening appeal.

| Customer Segment | Key Characteristics | 2024 Data/Insights |

|---|---|---|

| Classic & Collector Car Owners | Own and preserve vintage/specialty vehicles; seek specialized insurance (agreed value). | Continued strong demand in the collector car market, with record auction prices for certain marques. |

| Automotive Enthusiasts/Hobbyists | Passionate about cars, consume content, attend events; potential future customers. | High engagement with Hagerty's content and membership programs. |

| High-Net-Worth Individuals | Own substantial collections of high-value vehicles; require premium, tailored services. | Focus on specialized coverage and expert valuation for rare and exotic automobiles. |

| Market Participants (Buyers/Sellers) | Actively buy/sell collector cars, attend auctions, engage in private sales. | Major auctions in 2024, like RM Sotheby's Monterey, reported over $50 million in sales. |

| Younger Demographics (Millennials/Gen Z) | Emerging interest in 'modern classics' (1980s-2000s); receptive to digital content. | Over 30% of new policy inquiries in 2024 came from individuals under 40; 40% YoY increase in social media followers aged 18-34. |

Cost Structure

A substantial part of Hagerty's expenses stems from its core insurance operations. This includes the significant cost of paying out claims to policyholders, the administrative expenses involved in underwriting new policies and managing existing ones, and the premiums paid for reinsurance to mitigate risk. In 2023, Hagerty reported a combined ratio of 90.6%, indicating that for every dollar of premium earned, they paid out 90.6 cents in claims and expenses, a figure that reflects their careful management of these costs.

Hagerty invests significantly in marketing and advertising to build brand awareness and attract new members. This includes substantial spending on digital campaigns, content creation, and partnerships. In 2024, Hagerty continued its robust investment in these areas to foster community engagement and highlight its specialized insurance and services for classic car enthusiasts.

Hagerty's commitment to enhancing its digital capabilities is reflected in significant investments in technology development and maintenance. The company is actively upgrading its insurance IT platform to Duck Creek, a move that naturally drives up software-related expenses. These crucial upgrades are designed to boost operational efficiency and ensure the company can scale effectively in the future.

Content Creation and Event Management Costs

Hagerty's cost structure heavily relies on expenses tied to creating engaging automotive content and managing a variety of events. These are fundamental to building its lifestyle brand and fostering a strong community connection.

The production of high-quality editorial pieces and video content, which forms the backbone of Hagerty's appeal, incurs significant costs. Similarly, the organization of numerous events, from local meetups to larger concours, represents a substantial investment in customer engagement and brand experience.

- Content Production Expenses: Costs associated with writers, videographers, editors, and production equipment for creating articles, videos, and other digital media.

- Event Management Costs: Expenses related to venue rental, staffing, marketing, logistics, and insurance for organizing car shows, driving tours, and other community gatherings.

- Technology and Platform Costs: Investments in the digital infrastructure needed to host and distribute content, as well as manage event registrations and community forums.

- Marketing and Promotion: Funds allocated to promote content and events, reaching a wider audience within the automotive enthusiast community.

Employee Salaries and Administrative Overhead

As a service-oriented business, Hagerty's most significant cost is its workforce. The company compensates over 1,700 employees with salaries and benefits, which are crucial for delivering its specialized automotive services and insurance products. These personnel costs are a primary driver of the company's operational expenses.

Beyond direct employee compensation, Hagerty incurs substantial general administrative overhead. This includes costs associated with running its operations, such as office space, technology infrastructure, marketing, and compliance. These expenses are essential for maintaining the company's infrastructure and supporting its service delivery model.

- Employee Compensation: Salaries and benefits for Hagerty's 1,700+ employees represent a major cost center.

- Administrative Expenses: General overhead, including office operations, technology, and marketing, adds to the cost structure.

- Service Delivery Costs: As a service-based company, the direct costs of providing insurance and automotive services are inherent.

- Regulatory Compliance: Costs associated with meeting industry regulations and compliance standards are also factored in.

Hagerty's cost structure is heavily influenced by its insurance operations, including claims payouts and underwriting expenses, as evidenced by its 2023 combined ratio of 90.6%. Significant investments in marketing, content creation, and technology upgrades, such as the move to the Duck Creek platform, also represent key cost drivers. The company's substantial workforce and general administrative overhead are fundamental to its service delivery model.

| Cost Category | Description | 2023/2024 Impact |

|---|---|---|

| Insurance Operations | Claims, underwriting, and reinsurance costs | Combined ratio of 90.6% in 2023 |

| Marketing & Content | Brand building, digital campaigns, event management | Continued robust investment in 2024 |

| Technology Development | Platform upgrades (e.g., Duck Creek) | Driving software-related expenses |

| Personnel & Administration | Employee compensation, overhead, compliance | Over 1,700 employees; essential for service delivery |

Revenue Streams

Hagerty's core revenue generation stems from the insurance premiums collected on its specialized policies tailored for classic and collector vehicles. This is their bread and butter. In 2024, Hagerty saw a substantial uptick in written premium, reflecting strong demand for their unique offerings. This positive trend continued into the first quarter of 2025, further solidifying insurance premiums as their primary income source.

Membership fees from the Hagerty Drivers Club are a significant and expanding revenue source for the company. In 2024, this segment saw robust growth, directly correlating with an increase in paid members who value the community, exclusive content, and special benefits offered. This growing contribution underscores the success of Hagerty's strategy in building a loyal and engaged membership base.

Hagerty generates revenue through transaction fees and commissions on its online marketplace and live auctions for collector cars. This stream captures value from facilitating the buying and selling of these specialized vehicles.

This segment of Hagerty's business has demonstrated robust growth. For instance, in the first quarter of 2024, Hagerty reported that its marketplace revenue experienced significant year-over-year growth, highlighting the increasing activity and value transacted through its platform.

Commission and Fee Revenue from MGA Programs

Hagerty generates substantial revenue through its Managing General Agent (MGA) programs. In these arrangements, Hagerty acts as an underwriter and service provider for insurance policies issued by other insurance carriers, earning commissions and fees for these services. This segment continues to be a vital contributor to the company's overall financial performance.

For instance, in 2023, Hagerty reported that its MGA segment accounted for a significant portion of its total revenue. The company's ability to effectively manage risk and provide specialized services for niche markets, such as classic car insurance, allows it to command competitive fees within these partnerships.

- MGA Commission: Hagerty earns a percentage of the premiums for policies it underwrites and services for partner carriers.

- Fee Revenue: Additional fees are generated for claims administration, policy management, and other specialized services provided through the MGA structure.

- Strategic Partnerships: These programs are built on strong relationships with insurance carriers looking to access Hagerty's expertise in specific, often underserved, market segments.

- Revenue Diversification: The MGA model provides Hagerty with a diversified revenue stream, reducing reliance solely on its direct insurance offerings.

Valuation and Data Services

Hagerty's valuation and data services can be a distinct revenue stream, offering specialized insights beyond standard membership. This includes in-depth vehicle appraisals and market trend analysis, catering to collectors and enthusiasts who require more granular information.

For instance, Hagerty's Hagerty Valuation Tools are a cornerstone, providing access to a vast database of classic car sales data. In 2024, the platform continued to refine its algorithms, incorporating real-time auction results and private sales data to ensure the most accurate valuations. This data-driven approach underpins the value proposition for these services.

- Specialized Valuation Reports: Offering detailed, customized reports for specific vehicles or collections, often for insurance or estate planning purposes.

- Market Insight Subscriptions: Providing access to premium data analytics and trend forecasts for collectors, investors, and industry professionals.

- Advisory Services: Consulting on acquisitions, dispositions, and portfolio management for high-net-worth individuals and institutions.

- Data Licensing: Making aggregated, anonymized valuation data available to third-party businesses for their own analytics and platforms.

Hagerty's revenue streams are diverse, capitalizing on its deep understanding of the collector car market. Beyond its core insurance business, the company leverages its community and data expertise to generate income. This multi-faceted approach ensures resilience and growth across different economic conditions.

| Revenue Stream | Description | 2024/2025 Data Point |

|---|---|---|

| Insurance Premiums | Core income from specialized classic and collector vehicle policies. | Substantial uptick in written premium in 2024, continuing into Q1 2025. |

| Membership Fees | Revenue from Hagerty Drivers Club subscriptions. | Robust growth in 2024, reflecting increased paid membership. |

| Marketplace & Auctions | Transaction fees and commissions from buying/selling collector cars. | Significant year-over-year growth in marketplace revenue in Q1 2024. |

| MGA Programs | Commissions and fees for underwriting and servicing policies for partner carriers. | Significant portion of total revenue in 2023, with competitive fees. |

| Valuation & Data Services | Fees for specialized appraisals and market trend analysis. | Hagerty Valuation Tools refined algorithms in 2024 with real-time data. |

Business Model Canvas Data Sources

The Hagerty Business Model Canvas is constructed using a blend of proprietary customer data, extensive market research reports, and internal operational metrics. This comprehensive data approach ensures each component of the canvas accurately reflects Hagerty's strategic positioning and market realities.