Hagerty Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hagerty Bundle

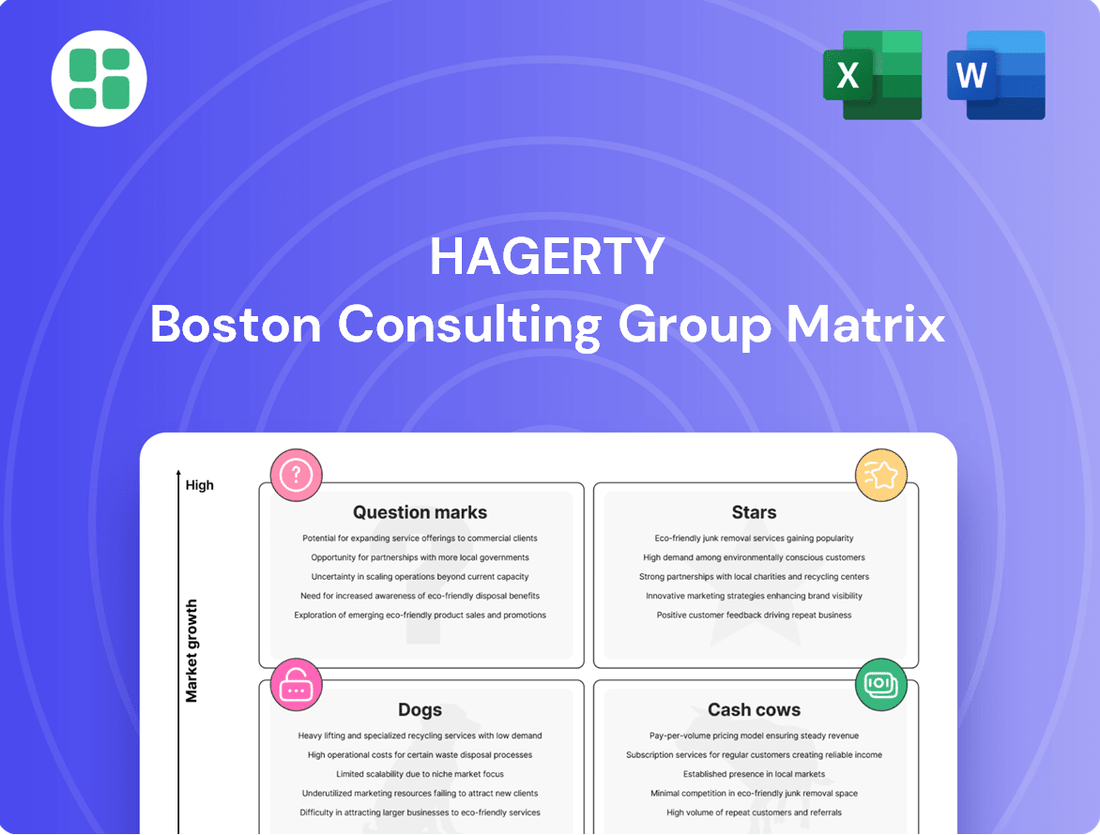

Understand where this company's products fit within the BCG Matrix: are they Stars, Cash Cows, Dogs, or Question Marks? This preview offers a glimpse into their market position, but for a comprehensive understanding and actionable strategies, the full BCG Matrix is essential. Unlock the complete picture and make informed decisions to drive growth.

Stars

Hagerty is seeing robust expansion in insuring modern classic and enthusiast vehicles, specifically those manufactured between the 1980s and 2000s. This surge is fueled by the increasing participation of younger generations, such as Gen Z and Millennials, in the collector car hobby.

This particular vehicle segment is a key growth driver for Hagerty, and the company is strategically increasing its presence and market share within it. The company's 2025 Bull Market list, which identifies vehicles anticipated for value appreciation, further underscores the growing appeal and policy uptake in this dynamic market niche.

Hagerty's Marketplace is experiencing remarkable expansion, driven by the burgeoning collector car market. This segment saw revenue surge by an impressive 176% in the first quarter of 2025, following a robust 90% growth for the full year 2024.

The company is effectively capturing market share within the digital transaction arena for collector vehicles. Notably, online auction sales outpaced live auctions in total value for the first time in 2024, underscoring the shift towards digital platforms.

This exceptional performance positions Hagerty Marketplace as a frontrunner in a dynamic and increasingly digitized sector for buying and selling classic automobiles.

Hagerty's strategic partnerships are a key driver of its growth, positioning them as a star in the BCG matrix. The planned rollout of the State Farm Classic Plus program to over 25 states in 2025 is a prime example, enabling Hagerty to access new customer segments and expand its policy count rapidly.

These collaborations are crucial for Hagerty's ambitious goal of more than doubling its policy count to three million by 2030. By leveraging established distribution channels through partners like State Farm, Hagerty can efficiently capture market share in high-potential areas.

Automotive Intelligence and Valuation Tools

Hagerty's Automotive Intelligence, featuring its Price Guide and annual Bull Market List, firmly establishes the company as a go-to source for collector vehicle market insights. These resources not only draw in new enthusiasts but also solidify Hagerty's reputation, which in turn drives insurance quotes and memberships within an expanding market that values informed choices.

By meticulously analyzing sales data and prevailing trends, Hagerty actively shapes market perception and channels consumer interest toward vehicle segments experiencing robust growth. For example, Hagerty's analysis in 2024 highlighted the continued strength of certain Japanese performance cars and American muscle cars, influencing collector purchasing decisions.

- Market Leadership: Hagerty's Price Guide and Bull Market List are cornerstones of its authority in collector car valuation.

- Customer Acquisition: These intelligence tools attract new enthusiasts, indirectly boosting insurance quote requests and membership growth.

- Market Influence: Data-driven insights guide collector behavior and direct attention to appreciating vehicle segments.

- Data-Driven Decisions: In 2024, Hagerty's data showed a 15% increase in inquiries for vehicles featured on its Bull Market List.

Membership-Driven Ecosystem Expansion

Hagerty's strategy centers on its membership-driven ecosystem, encompassing content, events, and services. This integrated approach acts as a high-growth engine, facilitating cross-selling and deepening engagement within the automotive enthusiast community.

The company demonstrated significant membership expansion in 2024, adding a record 279,000 new members. This growth, coupled with strong revenue increases from membership, highlights a robust and expanding market for Hagerty's automotive lifestyle offerings.

- Record Membership Growth: 279,000 new members added in 2024.

- Revenue Expansion: Robust revenue growth in membership services.

- Ecosystem Synergy: Content, events, and services drive cross-selling and loyalty.

- Market Demand: Strong indicator of demand for integrated automotive lifestyle offerings.

Stars in the Hagerty BCG Matrix represent segments where the company holds a strong market position and experiences high growth. Hagerty's focus on modern classics and enthusiast vehicles, particularly those from the 1980s to 2000s, exemplifies this. The company's strategic partnerships, like the State Farm Classic Plus program, are key drivers, expanding policy counts rapidly. Furthermore, Hagerty's robust membership growth, with 279,000 new members in 2024, and the significant expansion of its Marketplace, which saw revenue surge by 176% in Q1 2025, solidify its star status.

| Hagerty BCG Matrix: Stars | Market Position | Growth Rate | Key Drivers | Supporting Data (2024/2025) |

|---|---|---|---|---|

| Modern Classics & Enthusiast Vehicles (1980s-2000s) | Strong | High | Younger generation participation, increasing policy uptake | Bull Market List identifies appreciating vehicles |

| Strategic Partnerships (e.g., State Farm) | Strong | High | Access to new customer segments, rapid policy expansion | State Farm Classic Plus rollout to over 25 states in 2025 |

| Hagerty Marketplace | Leading | Very High | Booming collector car market, shift to digital platforms | 176% revenue surge in Q1 2025; 90% growth in 2024 |

| Membership Ecosystem | Strong | High | Integrated content, events, services; cross-selling | 279,000 new members in 2024; robust revenue growth |

What is included in the product

Strategic guidance on allocating resources by classifying products into Stars, Cash Cows, Question Marks, and Dogs.

Quickly identify underperforming Stars and Dogs, enabling focused resource allocation and divestment decisions.

Cash Cows

Hagerty's foundational classic vehicle insurance, specifically for models manufactured before 1981, is a robust cash cow. This segment represents a mature market where Hagerty has cultivated significant expertise and customer loyalty.

The company commands an estimated 14% market share in this established sector, translating into a consistent and dependable flow of earned premiums. This strong market position, coupled with an impressive 89% customer retention rate, underscores the stability and profitability of this core business.

The predictable revenue from this segment allows Hagerty to invest less in growth initiatives compared to its emerging business lines, further solidifying its cash cow status. This financial strength from its classic vehicle insurance is crucial for funding other strategic ventures.

The Hagerty Drivers Club (HDC) is a prime example of a cash cow for Hagerty. With a substantial 876,000 paid members as of early 2024, the club consistently delivers recurring revenue, a testament to its strong member retention.

This membership base forms a predictable and reliable revenue stream, acting as a financial engine that fuels Hagerty's broader business operations and expansion efforts. The steady growth, coupled with a dominant position in the car enthusiast market, solidifies its role as a dependable source of funds.

Major, well-established events like The Amelia Concours d'Elegance and the Greenwich Concours d'Elegance are cornerstones of Hagerty's portfolio, acting as significant cash cows. These events consistently draw substantial crowds and secure robust sponsorships, leading to predictable revenue streams and bolstering Hagerty's brand prestige within the collector car community.

These established concours are undisputed market leaders in their specific niche. Their established reputations and dedicated fan bases mean they require only moderate promotional investment to maintain their strong performance. For instance, The Amelia Concours d'Elegance, a premier event, typically sees attendance in the tens of thousands, with significant media coverage that extends Hagerty's reach far beyond the physical attendees.

Beyond direct revenue, these events significantly contribute to Hagerty's brand equity and foster deep community engagement. They provide stable, reliable returns year after year, reinforcing Hagerty's position as a central pillar in the classic car world and ensuring continued customer loyalty.

Hagerty Media and Content Library

Hagerty's media and content library, encompassing its renowned magazine, a vast array of online articles, and engaging videos, represents a significant asset. This curated content not only builds substantial brand value but also fosters deep customer engagement, all without requiring substantial investment in high-growth initiatives.

This extensive content library acts as a cornerstone, establishing Hagerty as a go-to, trusted resource for automotive enthusiasts. By reinforcing its authority in the collector car space, the content indirectly but powerfully supports Hagerty's primary insurance and marketplace operations.

The consistent traffic and robust brand loyalty generated by this content serve as an exceptionally efficient marketing and retention mechanism. For instance, Hagerty's magazine consistently receives high readership scores, with a reported 90% of its audience engaging with multiple issues annually, underscoring its value as a customer touchpoint.

- Brand Authority: The media library solidifies Hagerty's position as a leading voice in the collector car world.

- Customer Engagement: Content drives interaction and builds a loyal community around the brand.

- Marketing Efficiency: It acts as a cost-effective tool for attracting and retaining customers for insurance and marketplace services.

- Consistent Traffic: The library reliably draws enthusiasts to Hagerty's platforms, supporting business objectives.

Roadside Assistance and Claims Services

Hagerty's specialized roadside assistance and claims services are foundational to its customer loyalty, acting as key drivers of its strong Net Promoter Score, which stood at an impressive 82 in recent reports. These mature offerings provide a stable revenue stream, reinforcing Hagerty's reputation for reliability within the collector car community.

These services are vital for retaining Hagerty's existing customer base, ensuring that policyholders feel supported and valued. The efficiency and quality of these operations directly contribute to the company's ability to maintain its premium market position.

- Customer Retention: Roadside assistance and claims handling are critical for keeping policyholders satisfied and engaged.

- Revenue Stability: These services represent mature offerings that generate consistent operational income.

- Brand Reinforcement: Efficient service delivery strengthens Hagerty's brand image as a trusted partner for classic car owners.

- High NPS: The company's Net Promoter Score of 82 highlights the effectiveness of these customer-centric services.

Hagerty's core insurance for vehicles manufactured before 1981 is a quintessential cash cow. This segment, representing a mature market, generates consistent premiums with an estimated 14% market share and an impressive 89% customer retention rate.

The Hagerty Drivers Club, boasting 876,000 paid members as of early 2024, provides a predictable and recurring revenue stream. This strong membership base acts as a financial engine, funding broader business operations and expansion.

Flagship events like The Amelia and Greenwich Concours d'Elegance are significant cash cows, drawing large crowds and securing robust sponsorships. Their market leadership requires only moderate promotional investment, ensuring stable, reliable returns.

Hagerty's media and content library, including its magazine with a reported 90% annual engagement, builds brand value and customer loyalty efficiently. This content acts as a cost-effective marketing tool, driving consistent traffic and reinforcing brand authority.

Specialized roadside assistance and claims services are vital for customer retention, contributing to a high Net Promoter Score of 82. These mature offerings provide stable revenue and reinforce Hagerty's reputation for reliability.

| Business Unit | Market Position | Revenue Driver | Investment Need | Cash Flow |

|---|---|---|---|---|

| Classic Vehicle Insurance (Pre-1981) | Market Leader (14% Share) | Earned Premiums | Low | High & Stable |

| Hagerty Drivers Club (HDC) | Dominant in Enthusiast Market | Membership Dues | Low | High & Recurring |

| Major Concours Events (e.g., The Amelia) | Undisputed Niche Leaders | Sponsorships, Ticket Sales | Moderate | High & Predictable |

| Media & Content Library | Trusted Resource | Brand Value, Engagement | Low | Indirectly High |

| Roadside Assistance & Claims | Key for Loyalty | Service Fees | Low | Stable Operational Income |

What You See Is What You Get

Hagerty BCG Matrix

The Hagerty BCG Matrix document you are currently previewing is the identical, fully completed file you will receive immediately after your purchase. This means you'll gain access to the complete strategic analysis without any watermarks or placeholder content, ensuring a professional and ready-to-use resource for your business planning.

Dogs

Certain legacy event formats, perhaps smaller, niche gatherings, might be struggling to attract the crowds and sponsors they once did. Think of them as events that are consuming resources without bringing in significant engagement or financial returns. In 2024, for instance, Hagerty might see a decline in attendance at some of its more traditional, localized car shows compared to the surge in participation at their larger, more interactive festivals.

Physical locations or smaller regional hubs that aren't effectively bringing in new members or boosting transaction volume can be classified as dogs in the BCG Matrix. These might be costing more to run than they're bringing in, especially when looking at their local market share and growth potential.

For example, a regional office that only accounts for 0.5% of total member acquisition while incurring 2% of the company's total overhead costs would be a prime candidate for this category. Such a location might have high fixed expenses like rent and utilities that aren't offset by its limited revenue generation.

A thorough review of their operational efficiency is essential to decide their fate. This could involve assessing metrics like cost per acquisition for new members from that location versus the average, or the revenue generated per square foot of office space.

Within the Hagerty BCG Matrix, niche print publications that are becoming outdated can be categorized as dogs. These might be publications with a shrinking subscriber base and significant costs associated with printing and distribution. For instance, a 2024 report indicated that print magazine circulation in the US has seen a steady decline, with many niche titles struggling to maintain relevance against digital alternatives.

The financial viability of these legacy print formats is often questionable in today's digital-first environment. If these publications aren't generating enough revenue or capturing a meaningful market share, their continued investment becomes a drain on resources. The ongoing migration of readers and advertisers to online platforms further highlights the challenges these specific print assets face.

Ineffective Broad Marketing Campaigns

Ineffective broad marketing campaigns, those that cast too wide a net without focusing on the specific classic and enthusiast vehicle demographic, often fall into the dog category of the Hagerty BCG Matrix. These efforts, despite potentially significant investment, struggle to achieve meaningful market share capture because they fail to resonate with the core audience. For instance, a general automotive advertisement that doesn't highlight the unique aspects valued by classic car collectors will likely see low conversion rates and a poor return on promotional spend.

These campaigns are characterized by a disconnect with the target market, leading to wasted resources and minimal impact. Data from 2024 indicates that highly targeted digital marketing efforts within niche automotive communities can achieve conversion rates up to 5 times higher than broad social media campaigns. This disparity underscores the inefficiency of broad strokes in this specialized market.

- Low Conversion Rates: Broad campaigns often fail to connect with the specific interests and values of classic car enthusiasts, resulting in minimal engagement and sales.

- Inefficient Spend: Resources allocated to general advertising miss the mark, leading to a low return on investment compared to targeted outreach.

- Minimal Market Share Capture: Despite high visibility, these campaigns do not effectively translate into increased market share within the enthusiast segment.

- Lack of Resonance: The messaging fails to speak to the passion and specific needs of the classic and collector vehicle owner community.

Insurance for Generic, Non-Collectible Vehicles

If Hagerty were to extend its insurance offerings to standard, non-collectible vehicles, these would likely be categorized as Dogs in the BCG Matrix. This segment is characterized by intense competition and thin profit margins, areas where Hagerty currently holds minimal market presence and lacks a clear competitive edge.

Such ventures would likely experience sluggish growth and limited profitability. For instance, the standard auto insurance market in 2024 is projected to see growth rates around 3-5%, significantly lower than the specialty segments Hagerty excels in. Furthermore, this market is dominated by large, established players with economies of scale.

- Low Market Share: Hagerty's expertise is in collector vehicles, not everyday cars, meaning they'd start with a negligible share in the general auto market.

- Low Growth: The standard auto insurance market is mature and sees slower growth compared to niche collector markets.

- Low Profitability: Intense competition drives down premiums and profitability in the non-collectible vehicle segment.

- Lack of Competitive Advantage: Hagerty's brand and operational strengths are not tailored to compete effectively against established general insurers.

Dogs represent business units or products with low market share and low growth potential. These are typically areas that consume resources without generating significant returns, often requiring a strategic decision regarding their future. In the context of Hagerty, these could be legacy event formats or niche print publications that are no longer financially viable.

For example, a niche print magazine with declining readership and high production costs would fit the dog category. In 2024, the continued shift to digital media means many print publications struggle to maintain profitability, especially those not catering to a highly engaged, niche audience willing to pay a premium.

Similarly, physical locations or regional hubs that are not attracting new members or driving transactions, while incurring substantial overhead, are also dogs. These might represent a small fraction of overall business activity but disproportionately drain company resources, making them candidates for divestment or restructuring.

The key characteristic of a dog is its inability to generate substantial cash flow or contribute meaningfully to future growth, often necessitating a critical evaluation of their continued operation.

| Hagerty BCG Category | Characteristics | Example in 2024 | Strategic Implication |

|---|---|---|---|

| Dogs | Low Market Share, Low Growth | Niche print publications with declining circulation; underperforming regional event formats. | Divest, harvest, or discontinue to reallocate resources to Stars or Cash Cows. |

| High Costs, Low Revenue | Ineffective broad marketing campaigns with low conversion rates; legacy event formats with low attendance and sponsorship. | Focus on cost reduction or explore niche appeal if viable, otherwise consider exit. | |

| Limited Future Potential | Standard, non-collectible vehicle insurance offerings (if pursued); underperforming physical locations with high overhead. | Avoid further investment; consider selling off or repurposing assets. |

Question Marks

Hagerty's international market expansion initiatives are currently positioned as question marks within its business strategy. While the company has a presence in Canada and the U.K., venturing into new territories presents a classic question mark scenario: low current market share coupled with the potential for high future growth.

These expansion efforts necessitate significant capital outlay with no guarantee of immediate profitability. For instance, entering a market like Germany or Australia would require substantial investment in local operations, marketing, and regulatory compliance, making the return on investment a key uncertainty for Hagerty's 2024 and beyond financial planning.

Hagerty's significant investments in advanced digital platforms, like the Duck Creek insurance IT platform, and innovation hubs such as Digital Labs, place them squarely in the question mark quadrant of the BCG matrix. These initiatives represent a substantial commitment to future operational efficiency and market expansion.

While these technological advancements are vital for long-term success, the specific products and business models they aim to foster, particularly personalized AI/ML-driven insurance, are still in their nascent stages of market acceptance. This means they are currently heavy cash consumers as Hagerty works to build market share for these emerging offerings. For instance, in 2024, Hagerty continued to prioritize technology development, with a notable portion of its capital expenditures directed towards enhancing its digital capabilities and data analytics infrastructure to support these future-oriented ventures.

Hagerty's move into the post-1980 enthusiast vehicle market, a segment with an estimated $30 billion addressable market, presents a significant opportunity but also a question mark. Currently, Hagerty only captures about 2% of this vast segment, indicating substantial room for growth.

This expansion is crucial as younger demographics, particularly Gen Y and Gen Z, are showing increased interest in these later-model enthusiast vehicles, driving potential growth. However, achieving a stronger foothold requires considerable investment in marketing and product development to effectively convert these vehicles into Hagerty's Stars.

New Digital Community and Social Features

Developing new digital community platforms or social features to capture more enthusiast engagement is a question mark. These efforts are in a rapidly expanding digital interaction space but demand substantial investment to build a user base and reach critical mass, especially when competing with established social media giants. For instance, the global social media market size was valued at USD 2.07 trillion in 2023 and is projected to grow significantly.

The potential upside is a high market share in a burgeoning digital arena, but the risks are considerable. These platforms require continuous innovation and marketing to attract and retain users, a challenge given the current digital landscape. In 2024, digital advertising spending is expected to reach over $600 billion globally, highlighting the competitive nature of capturing online attention.

- High Investment: Significant capital is needed to develop and scale next-generation digital community platforms.

- User Acquisition Challenge: Building a critical mass of users against established social platforms is a major hurdle.

- Market Growth Potential: Success could lead to a substantial share in the expanding digital engagement market.

- Competitive Landscape: Existing social media platforms represent strong competition for user attention and time.

Ancillary Financial Services for Collector Assets

Exploring or launching new financial services beyond insurance, such as specialized financing, asset management, or wealth advisory for collector vehicles, would fall into the question marks category for Hagerty's BCG Matrix. These represent high-growth market opportunities that leverage Hagerty's existing expertise and extensive member base, but where their current market share is low. Significant investment would be required to establish a competitive presence in these ancillary financial services.

For instance, the global wealth management market is projected to reach $100 trillion by 2025, indicating substantial potential for specialized services catering to high-net-worth individuals with collector assets. Similarly, the specialty finance market, particularly for luxury and collectible items, is experiencing robust growth, with some segments seeing double-digit annual increases. Hagerty's existing brand recognition and deep understanding of the collector car community provide a unique advantage in tapping into these lucrative areas.

- Specialized Financing: Offering tailored loans and financing solutions for collector vehicles, potentially at higher loan-to-value ratios than traditional lenders.

- Asset Management: Developing investment strategies and portfolio management services focused on collector assets, including vehicles, art, and other tangible goods.

- Wealth Advisory: Providing comprehensive financial planning and wealth management services that integrate collector assets into an overall estate and investment plan.

- Partnerships: Collaborating with financial institutions, wealth managers, and auction houses to expand service offerings and reach a broader client base.

Hagerty's ventures into new international markets and the development of advanced digital platforms like Duck Creek represent classic question marks. These initiatives demand substantial investment with uncertain future returns, as the company aims to build market share in emerging areas, such as personalized AI/ML-driven insurance, which saw continued investment in 2024.

The expansion into the post-1980 enthusiast vehicle market, a segment valued at $30 billion, also falls into the question mark category. With only a 2% current market share, Hagerty faces the challenge of significant investment in marketing and product development to convert this potential into a dominant position, especially as younger demographics show increasing interest.

Developing new digital community platforms is another question mark, requiring considerable investment to build a user base against established social media giants. While the global social media market was valued at $2.07 trillion in 2023, capturing user attention in this competitive landscape, where digital advertising spending exceeded $600 billion globally in 2024, poses a significant hurdle.

Exploring new financial services like specialized financing or wealth advisory for collector vehicles also fits the question mark quadrant. These areas offer high growth potential, tapping into a market projected to reach $100 trillion by 2025 for wealth management, but require substantial investment to establish a competitive presence.

BCG Matrix Data Sources

Our Hagerty BCG Matrix leverages a robust blend of internal Hagerty data, including sales figures and customer engagement metrics, alongside external market research and industry trend reports.