GS Engineering & Construction SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GS Engineering & Construction Bundle

GS Engineering & Construction boasts impressive global reach and a strong track record in large-scale projects, but faces intense competition and potential economic downturns. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on their opportunities.

Want the full story behind GS Engineering & Construction’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

GS Engineering & Construction boasts extensive EPC capabilities, covering everything from complex civil projects and high-rise buildings to critical plant construction for oil, gas, and power, as well as environmental facilities. This wide-ranging expertise allows them to tackle diverse project types and client requirements across the globe.

The company's global footprint is a significant strength, with a particularly strong presence in key markets like the Middle East, Vietnam, and Australia. For instance, in 2023, GS E&C secured substantial orders in these regions, contributing to their overall revenue growth and demonstrating their ability to execute large-scale projects internationally.

GS Engineering & Construction is showing impressive strength in securing new business. In the first half of 2025, they've already achieved 55% of their W14.3 trillion annual new order goal. This momentum is a clear indicator of strong market demand for their services.

The Building and Dwellings Division is a significant contributor to this success, having landed W6.4391 trillion in new contracts. These include substantial redevelopment projects, highlighting the company's capability and market position in a key sector.

GS Engineering & Construction is heavily investing in cutting-edge technologies to boost efficiency and explore new markets. For instance, their collaboration with Honeywell aims to digitally transform energy plants, showcasing a commitment to innovation.

The company is also making strategic moves in artificial intelligence, specifically for developing smarter building facilities. This forward-thinking approach positions GS E&C to capitalize on the growing demand for intelligent infrastructure solutions.

Furthermore, GS E&C is a key player in Urban Air Mobility (UAM) infrastructure, having revealed advanced vertiport designs and actively participating in pilot programs. This focus on future mobility demonstrates their dedication to pioneering new construction frontiers.

Commitment to Sustainability and ESG

GS Engineering & Construction demonstrates a robust commitment to sustainability and Environmental, Social, and Governance (ESG) principles. This commitment is evident in their clearly defined ESG strategy, which prioritizes eco-friendly construction methods, aims to reduce greenhouse gas emissions, and upholds ethical governance standards.

GS E&C Australia, as an example, actively pursues sustainable construction practices, focusing on efficient resource utilization and generating positive social impact. This strategic alignment with global sustainability trends not only bolsters their brand reputation but also attracts clients and investors who prioritize environmental responsibility.

- ESG Strategy: Focus on eco-friendly construction, emission reduction, and ethical governance.

- GS E&C Australia: Emphasizes sustainable building, resource efficiency, and social impact.

- Market Appeal: Enhances brand image and attracts environmentally conscious stakeholders.

Improving Profitability and Financial Stability Initiatives

GS Engineering & Construction (GS E&C) has demonstrated a remarkable improvement in its financial performance, highlighting a key strength in its ability to enhance profitability and financial stability.

The company reported a substantial 41.8% increase in operating profit for the first half of 2025, a testament to its successful turnaround strategies. This positive trend was further bolstered by a significant surge in net profit during the third quarter of 2024.

These financial gains are largely attributable to the effective settlement of construction costs on major projects and a deliberate strategic shift to divest from less profitable business segments. This focus on optimizing its project portfolio and cost management is a core strength.

Furthermore, GS E&C is proactively strengthening its financial foundation by exploring avenues such as the potential sale of subsidiaries. This initiative aims to generate crucial capital for future growth and investment, underscoring its commitment to long-term financial health.

- Profitability Turnaround: Operating profit up 41.8% in H1 2025; Q3 2024 saw soaring net profit.

- Cost Management Success: Improved profitability linked to settlement of construction costs on key projects.

- Strategic Divestment: Exiting low-profit ventures to focus resources on more lucrative opportunities.

- Financial Stability Measures: Pursuing subsidiary sales to secure cash for strategic growth initiatives.

GS Engineering & Construction's extensive EPC capabilities, spanning civil, plant, and environmental projects, allow them to undertake a wide array of complex global initiatives.

Their strong international presence, particularly in the Middle East and Vietnam, is a key asset, evidenced by significant order wins in these regions throughout 2023.

The company demonstrates robust new business acquisition, achieving 55% of its W14.3 trillion annual new order target by the first half of 2025, with the Building and Dwellings Division alone securing W6.4391 trillion in contracts.

GS E&C is actively investing in future technologies like AI for smart buildings and UAM infrastructure, signaling a commitment to innovation and pioneering new construction frontiers.

| Metric | H1 2025 | 2023 |

|---|---|---|

| New Order Target Achievement | 55% (of W14.3T) | N/A |

| Building & Dwellings New Contracts | W6.4391T | N/A |

What is included in the product

Delivers a strategic overview of GS Engineering & Construction’s internal and external business factors, highlighting its strengths in project execution and market position, while also identifying weaknesses in diversification and opportunities in emerging markets, alongside threats from global competition and economic volatility.

Offers a clear, actionable framework to identify and leverage GS Engineering & Construction's strengths while mitigating weaknesses and external threats.

Weaknesses

GS Engineering & Construction faces significant financial headwinds due to its substantial debt. As of the close of 2024, the company's net debt reached W3.1 trillion, an increase driven by escalating costs on its ongoing construction projects.

While an anticipated improvement in cash flow during 2025, bolstered by apartment move-ins, offers some relief, the current debt burden necessitates rigorous financial oversight. This high leverage amplifies the company's exposure to financial risks, especially in a challenging economic climate.

The company's price-to-book (P/B) ratio, currently positioned at the lower end of its historical spectrum, underscores the market's perception of these financial risks and the impact of unfavorable housing market conditions on its valuation.

GS Engineering & Construction's significant reliance on the building and housing sector, a major revenue driver, presents a notable weakness. This segment is projected to see a slowdown in revenue growth through 2025, directly impacting the company's top line.

The company's valuation has been negatively affected by the current unfavorable housing market conditions. A persistently high housing cost ratio further compounds this issue, indicating potential margin pressures and reduced profitability within this key business area.

This dependence on the cyclical nature of the domestic housing market introduces inherent volatility into GS Engineering & Construction's financial performance. Fluctuations in housing demand and costs can lead to unpredictable earnings and investor sentiment.

A significant weakness for GS Engineering & Construction stems from past incidents, notably a construction site collapse. This event resulted in an eight-month ban on securing new construction contracts in South Korea, impacting GS E&C and its partners from April to November 2024. While ongoing projects are unaffected, this regulatory action directly curtails the company's ability to pursue new business opportunities, potentially impacting future revenue streams and market competitiveness.

This regulatory penalty not only restricts immediate growth but also poses a threat to GS E&C's reputation within the industry. Such incidents can erode client confidence and investor sentiment, making it more challenging to win bids and attract capital in the short to medium term. The company's market standing could be diminished as a result of these past safety lapses and the subsequent penalties.

Slowing Revenue Growth in Traditional Segments

GS Engineering & Construction is facing a slowdown in its traditional business areas. For 2025, the company has projected a slight dip in overall revenue, with building and housing segments expected to see slower growth. This deceleration in core operations could present hurdles for expanding the company's top line.

While growth in plant and new business sectors is anticipated to help offset this trend, the company’s success hinges on its capacity to effectively counter the deceleration in its established segments. The ability to pivot and capitalize on emerging opportunities will be key to maintaining robust revenue expansion.

- Revenue Guidance: GS E&C has guided for a slight decrease in overall revenue for 2025.

- Segment Slowdown: Building and housing revenue is particularly expected to slow down.

- Mitigation Strategy: Growth in plant and new businesses is intended to counterbalance this deceleration.

- Key Challenge: The company's ability to offset the slowdown in traditional segments with new ventures is critical for future growth.

Skilled Labor Shortage

The South Korean construction sector, GS Engineering & Construction's primary operating environment, is grappling with a pronounced shortage of skilled labor. This scarcity directly impacts operational efficiency, potentially inflating labor costs and causing project timelines to slip. For instance, by late 2024, reports indicated a growing deficit in experienced construction workers across various trades, a trend expected to persist into 2025.

This persistent workforce issue presents a significant hurdle for GS E&C and its peers. The difficulty in securing adequately trained personnel can compromise project quality and create challenges in meeting contractual deadlines.

- Increased Labor Costs: The demand for skilled workers outstrips supply, driving up wages and overall project expenses.

- Project Delays: A lack of qualified workers can slow down construction progress, leading to missed deadlines and potential penalties.

- Quality Concerns: Inexperienced or insufficient labor can sometimes lead to compromises in the quality of work performed.

- Need for Innovation: Companies must invest in training, technology, and potentially foreign labor to mitigate this ongoing weakness.

GS Engineering & Construction's substantial debt, reaching W3.1 trillion by the end of 2024 due to escalating project costs, poses a significant financial risk. The company's low price-to-book ratio reflects market concerns about this leverage and the impact of a challenging housing market. Furthermore, a pronounced shortage of skilled labor in South Korea is expected to continue into 2025, potentially increasing labor costs and causing project delays.

The company's heavy reliance on the domestic housing market, which is projected to experience slower revenue growth in 2025, presents another weakness. Unfavorable housing market conditions and high housing cost ratios are already pressuring profit margins. A past construction site collapse led to an eight-month ban on new contracts in South Korea from April to November 2024, directly limiting future business opportunities and potentially impacting its market standing.

| Financial Metric | 2024 (End) | Trend/Impact |

|---|---|---|

| Net Debt | W3.1 trillion | Increased due to project costs; significant financial risk. |

| Price-to-Book Ratio | Lower end of historical spectrum | Indicates market perception of financial risks and housing market impact. |

| Skilled Labor Availability | Shortage (expected to persist into 2025) | Increases labor costs, risks project delays and quality issues. |

| Building & Housing Revenue Growth | Projected slowdown for 2025 | Directly impacts top-line performance. |

| Regulatory Action | 8-month ban on new contracts (Apr-Nov 2024) | Restricts new business opportunities and affects market competitiveness. |

Preview Before You Purchase

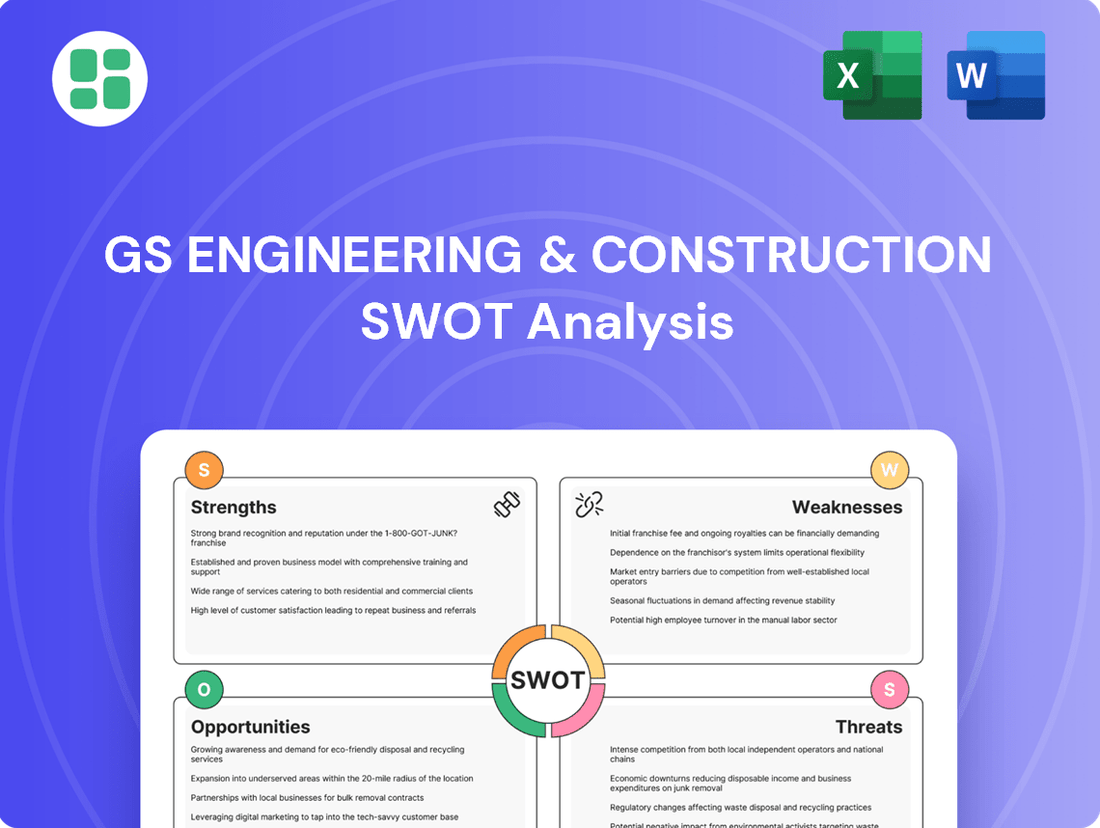

GS Engineering & Construction SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual GS Engineering & Construction SWOT analysis, offering a clear snapshot of its strategic position. Upon purchase, you'll gain access to the complete, in-depth report.

Opportunities

The South Korean construction sector is poised for consistent expansion, fueled by significant government spending on infrastructure projects like transportation networks, energy facilities, and urban development initiatives. This upward trajectory is further supported by a national push towards sustainable building, with increasing mandates for zero-energy buildings.

GS Engineering & Construction is well-positioned to leverage this expanding market. The company's established capabilities across various construction segments, coupled with its commitment to green building technologies, align perfectly with these evolving market demands. For instance, in 2023, South Korea's Ministry of Economy and Finance allocated over 60 trillion KRW (approximately $45 billion USD) towards infrastructure development, a substantial portion of which is earmarked for eco-friendly and smart city projects.

The global Engineering, Procurement, and Construction (EPC) markets for oil & gas and power are poised for substantial growth. Projections indicate the global oil and gas EPC market could reach approximately $210 billion by 2027, while the power EPC sector is expected to see similar expansion, fueled by increasing energy needs and infrastructure development.

GS Engineering & Construction (GS E&C) is well-positioned to capitalize on these trends. Their proven expertise in executing complex EPC projects, evidenced by recent significant contract awards in Saudi Arabia for projects valued in the billions, demonstrates their capacity to secure and deliver large-scale international endeavors.

GS Engineering & Construction is capitalizing on opportunities in emerging technologies like Urban Air Mobility (UAM) infrastructure. The company is actively involved in designing vertiports, a key component for the burgeoning UAM sector, which is projected to see significant growth in the coming years.

Furthermore, GS E&C is pursuing digital transformation solutions for industrial plants, including the integration of AI-powered management systems. This focus on advanced technology adoption is expected to create new revenue streams and significantly improve operational efficiencies for their clients.

Strategic Partnerships and Acquisitions

GS Engineering & Construction can significantly boost its competitive edge by forming strategic alliances. For instance, its ongoing collaboration with Honeywell, focused on digital transformation, is a prime example of how such partnerships can integrate advanced technologies and broaden market access. This synergy is crucial in an industry increasingly driven by smart construction and operational efficiency.

The company also has an opportunity to strategically divest non-core assets or underperforming business units. Selling subsidiaries like GS Inima, which operates in the water treatment sector, could unlock substantial capital. This capital infusion would then be available for reinvestment into areas with higher growth potential or those that align more closely with GS E&C's long-term strategic objectives, potentially in areas like renewable energy infrastructure or advanced manufacturing facilities.

- Leveraging digital transformation through partnerships like the one with Honeywell to enhance technological capabilities.

- Exploring divestment of non-core assets, such as GS Inima, to generate capital for strategic reinvestment.

- Acquiring complementary businesses to expand service offerings and market share in key growth sectors.

Urban Redevelopment and Smart City Initiatives

The accelerating pace of urbanization worldwide, coupled with a strong global momentum towards smart city development, offers a fertile ground for growth. GS Engineering & Construction (GS E&C) is particularly well-positioned to capitalize on this trend, especially in dynamic markets like Vietnam, where it already possesses a significant operational footprint.

GS E&C's proven track record in executing complex, large-scale residential and industrial projects provides a solid foundation for its involvement in future urban planning and development initiatives. This expertise allows the company to contribute meaningfully to the creation of sustainable and technologically advanced urban environments.

- Vietnam's urbanization rate is projected to reach 40% by 2025, creating substantial demand for urban infrastructure.

- Global smart city investments are expected to exceed $2.5 trillion by 2026, highlighting a massive market opportunity.

- GS E&C's past projects, such as the Phu My Hung urban area development, demonstrate its capability in large-scale urban planning and execution.

GS Engineering & Construction (GS E&C) is strategically positioned to benefit from the global surge in infrastructure development and the increasing demand for sustainable building practices. The company's established expertise in large-scale EPC projects, particularly in the oil & gas and power sectors, aligns perfectly with projected market growth. For instance, the global oil and gas EPC market is anticipated to reach approximately $210 billion by 2027, with GS E&C having recently secured significant international contracts.

The company is also tapping into emerging markets like Urban Air Mobility (UAM) by developing essential infrastructure such as vertiports, a sector projected for substantial expansion. Furthermore, GS E&C’s focus on digital transformation, including AI-powered management systems for industrial plants, opens new avenues for revenue and operational efficiency improvements for clients.

GS E&C can enhance its market position through strategic alliances, exemplified by its collaboration with Honeywell on digital transformation initiatives, which broadens technological capabilities and market access. Divesting non-core assets, such as GS Inima, could unlock capital for reinvestment in high-growth areas like renewable energy infrastructure, thereby strengthening its strategic focus.

The global push towards smart cities and rapid urbanization presents a significant opportunity, particularly in dynamic markets like Vietnam where GS E&C has a strong presence. With Vietnam's urbanization rate projected to reach 40% by 2025, and global smart city investments expected to exceed $2.5 trillion by 2026, GS E&C's proven capabilities in large-scale urban development are highly relevant.

| Opportunity Area | Market Projection | GS E&C Relevance |

|---|---|---|

| Global Infrastructure & EPC | Oil & Gas EPC: ~$210B by 2027 | Proven large-scale project execution |

| Sustainable Building & Smart Cities | Smart City Investment: >$2.5T by 2026 | Alignment with national green building mandates, Vietnam urbanization (40% by 2025) |

| Emerging Technologies (UAM) | Growing UAM Sector | Vertiport development expertise |

| Digital Transformation | AI Integration in Industrial Plants | New revenue streams, improved client efficiency |

| Strategic Partnerships & Divestments | Collaboration Synergy, Capital Reinvestment | Enhanced capabilities, focus on high-growth sectors |

Threats

GS Engineering & Construction faces a fiercely competitive landscape, both in South Korea and internationally. Established construction giants and agile new players constantly vie for projects, driving down profit margins and necessitating aggressive bidding. For instance, the global construction market, valued at approximately $10.7 trillion in 2023, is projected to grow, but this growth is shared among many participants, intensifying the pressure on companies like GS E&C to innovate and secure lucrative contracts.

GS Engineering & Construction, like many in the construction sector, faces significant headwinds from fluctuating raw material prices. For instance, global steel prices saw considerable volatility throughout 2024, with some benchmarks experiencing double-digit percentage swings within months, directly impacting the cost of structural components. This volatility, coupled with rising labor costs, which have climbed by an average of 4-6% annually in many key markets through early 2025, directly squeezes project margins and complicates the budgeting process for large-scale infrastructure and building projects.

Global economic uncertainties, including persistent inflation and the potential for a downturn, pose a significant threat to GS Engineering & Construction. For instance, the IMF's World Economic Outlook in April 2024 projected global growth to slow to 2.8% in 2024, down from 3.2% in 2023, highlighting a challenging environment for large capital expenditures.

Geopolitical instability, such as ongoing conflicts and trade tensions, can directly impact GS E&C's international projects. These factors can disrupt supply chains, increase material costs, and lead to project delays or cancellations, directly affecting the company's order pipeline and overall revenue generation.

Regulatory and Environmental Compliance Risks

GS Engineering & Construction, like its peers, navigates a landscape of escalating environmental regulations. These include stricter mandates on emissions reduction and the adoption of sustainable building practices, which are becoming standard across major global markets. For instance, many countries are targeting net-zero emissions by 2050, directly impacting construction material sourcing and operational methods.

Non-compliance with these evolving environmental standards poses significant threats. Penalties can be substantial, and reputational damage from environmental missteps can erode client trust and market standing. Furthermore, the potential for increased operational costs to meet new sustainability benchmarks is a constant consideration.

The construction industry also remains susceptible to further regulatory scrutiny following incidents. A significant environmental lapse or safety breach could trigger more stringent oversight, impacting project timelines and overall project viability. For example, a major pollution event could lead to immediate project shutdowns and extensive investigations, as seen in past industrial accidents.

- Increased operational costs due to the need for greener materials and processes.

- Potential for fines and legal action stemming from non-compliance with environmental laws, such as those related to waste management or carbon emissions.

- Reputational damage impacting future contract bids and investor confidence, particularly as ESG (Environmental, Social, and Governance) factors gain prominence in investment decisions.

- Project delays and stoppages if environmental permits are revoked or new regulations are imposed mid-project.

Challenges in Housing Market and Order Targets

The persistent challenges in the domestic housing market, despite attempts to improve the housing cost ratio, represent a significant threat to GS Engineering & Construction's profitability on residential projects. These unfavorable market conditions could directly impact the financial viability of their ongoing and future developments.

A critical factor for GS Engineering & Construction is meeting its 2025 presale volume target of 16,000 units. Failure to achieve this goal could have cascading negative effects on future revenue streams and overall cash flow, potentially hindering strategic growth initiatives.

- Persistent Housing Market Headwinds: Unfavorable market conditions continue to pressure domestic residential project profitability.

- 2025 Presale Target Crucial: Achieving the 16,000-unit presale volume target is vital for financial stability.

- Revenue and Cash Flow Impact: Shortfalls in presale targets could negatively affect future revenue and cash flow generation.

GS Engineering & Construction faces significant threats from intense competition, volatile material and labor costs, and global economic uncertainties. For example, the IMF projected global growth to slow to 2.8% in 2024. Geopolitical instability can disrupt supply chains and increase project costs.

Escalating environmental regulations pose compliance risks and potential for increased operational expenses. Failure to meet sustainability standards, such as net-zero targets by 2050, could lead to substantial fines and reputational damage. The domestic housing market also presents challenges, with the company needing to hit its 2025 presale target of 16,000 units to secure future revenue and cash flow.

SWOT Analysis Data Sources

This SWOT analysis for GS Engineering & Construction is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations. These sources provide the reliable, data-driven insights necessary for a thorough strategic assessment.