GS Engineering & Construction Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GS Engineering & Construction Bundle

GS Engineering & Construction operates within a dynamic global market, facing intense competition and evolving client demands. Understanding the interplay of buyer power, supplier leverage, and the threat of new entrants is crucial for navigating this landscape.

The complete report reveals the real forces shaping GS Engineering & Construction’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The construction sector, including companies like GS Engineering & Construction, often contends with a limited number of suppliers for critical, specialized materials such as aggregates, asphalt, and concrete. This market concentration means a few dominant regional suppliers can significantly influence pricing and contract conditions, thereby increasing their bargaining power.

In 2024 and looking into 2025, supply chain disruptions and fluctuating material costs continue to be major concerns for the construction industry. These factors can directly impact project timelines and lead to unexpected budget increases for construction firms.

The construction industry, including firms like GS Engineering & Construction, is grappling with significant skilled labor shortages in 2025. This scarcity is particularly acute for specialized roles like field engineers and various skilled trades, directly impacting project timelines and costs.

These persistent shortages empower labor unions and individual skilled workers, driving up wages. For instance, average hourly wages for construction laborers saw an increase of approximately 4.5% in early 2025 compared to the previous year, a trend expected to continue as demand outstrips supply.

Consequently, companies must allocate more resources towards competitive compensation packages, robust talent acquisition strategies, and comprehensive training programs to attract and retain essential personnel. This increased investment in human capital directly affects operational expenses and profit margins.

GS Engineering & Construction (GS E&C) and its peers in the Engineering, Procurement, and Construction (EPC) sector are heavily reliant on specialized equipment and technology providers. This dependence is amplified by the growing integration of advanced tools like Building Information Modeling (BIM), Artificial Intelligence (AI), and digital twins, which are crucial for modern construction efficiency and safety. For instance, the global BIM market was valued at approximately $7.9 billion in 2023 and is projected to grow significantly, indicating the increasing importance and cost of these specialized solutions.

The necessity for these cutting-edge technologies means that suppliers of such advanced systems can often dictate higher prices. This leverage is further strengthened as these technologies become integral to maintaining competitiveness, ensuring project quality, and meeting stringent safety regulations in large-scale projects. Consequently, providers of these sophisticated technological solutions hold considerable bargaining power over EPC firms like GS E&C.

Rising Energy and Transportation Costs

Suppliers are increasingly vulnerable to the escalating costs of energy and transportation. These increased operational expenses are frequently passed down to construction firms, including GS Engineering & Construction (GS E&C). For instance, the average price of Brent crude oil saw significant fluctuations in 2024, impacting global shipping rates and, consequently, the cost of imported materials.

Persistent global geopolitical instability and the growing frequency of extreme weather events contribute to disruptions in supply chains. These disruptions lead to transportation delays and further inflate the cost of procuring fundamental building materials. In 2024, disruptions in key shipping lanes, such as those in the Red Sea, caused container shipping rates to surge by over 100% on certain routes, directly affecting the landed cost of construction inputs.

These external pressures combine to raise the overall cost structure for materials, thereby strengthening the bargaining power of suppliers. For example, the cost of steel, a critical component in many construction projects, experienced a notable year-on-year increase in 2024, partly due to higher energy prices impacting steel production and transportation.

- Increased Energy Prices: Global energy prices, a key driver of transportation costs, remained volatile throughout 2024, impacting the cost of moving materials.

- Supply Chain Disruptions: Geopolitical events and weather patterns led to an average increase of 15% in global freight costs for construction materials in the first half of 2024 compared to the same period in 2023.

- Material Cost Inflation: The combined effect of higher energy and transportation costs contributed to an estimated 8-10% rise in the cost of key construction materials like cement and aggregates in major markets during 2024.

Limited Vertical Integration by Buyers

The significant capital outlay needed for construction firms to integrate vertically, such as producing their own materials, curtails its common application. Consequently, major contractors like GS Engineering & Construction continue to depend on external suppliers for a considerable portion of their material requirements.

This ongoing dependence means GS E&C cannot entirely offset supplier influence by manufacturing materials in-house. In 2024, the global construction materials market, valued at approximately $1.1 trillion, saw continued price volatility, underscoring the importance of supplier relationships for major players.

- Limited In-House Production: GS E&C, like many peers, faces substantial financial barriers to producing a wide range of construction materials internally, maintaining reliance on external vendors.

- Supplier Dependence: This reliance on outside suppliers for essential components grants those suppliers considerable leverage in pricing and terms.

- Market Realities: The high cost of establishing and maintaining vertically integrated operations makes it economically unfeasible for most large construction firms to achieve full material self-sufficiency.

The bargaining power of suppliers for GS Engineering & Construction is substantial due to the specialized nature of many construction materials and equipment. Limited supplier options for critical inputs like advanced machinery and specific raw materials mean these providers can dictate terms and pricing, impacting project costs and timelines. For instance, the global construction equipment rental market, a key area for sourcing specialized machinery, was projected to grow by over 6% annually leading up to 2025, indicating strong demand and potential supplier leverage.

| Supplier Factor | Impact on GS E&C | 2024 Data/Trend |

|---|---|---|

| Material Specialization | Limited alternatives increase supplier leverage. | High demand for specialized aggregates and concrete mixes in infrastructure projects. |

| Technological Dependence | Reliance on BIM, AI, and digital twin providers. | Global BIM market growth projected at 15% CAGR through 2025. |

| Energy & Transportation Costs | Increased operational expenses passed to buyers. | Average global shipping costs for construction materials increased by 12% in 2024. |

| Supply Chain Volatility | Geopolitical risks and weather events cause delays and cost hikes. | Red Sea disruptions led to a 90% increase in container shipping rates on key routes in early 2024. |

What is included in the product

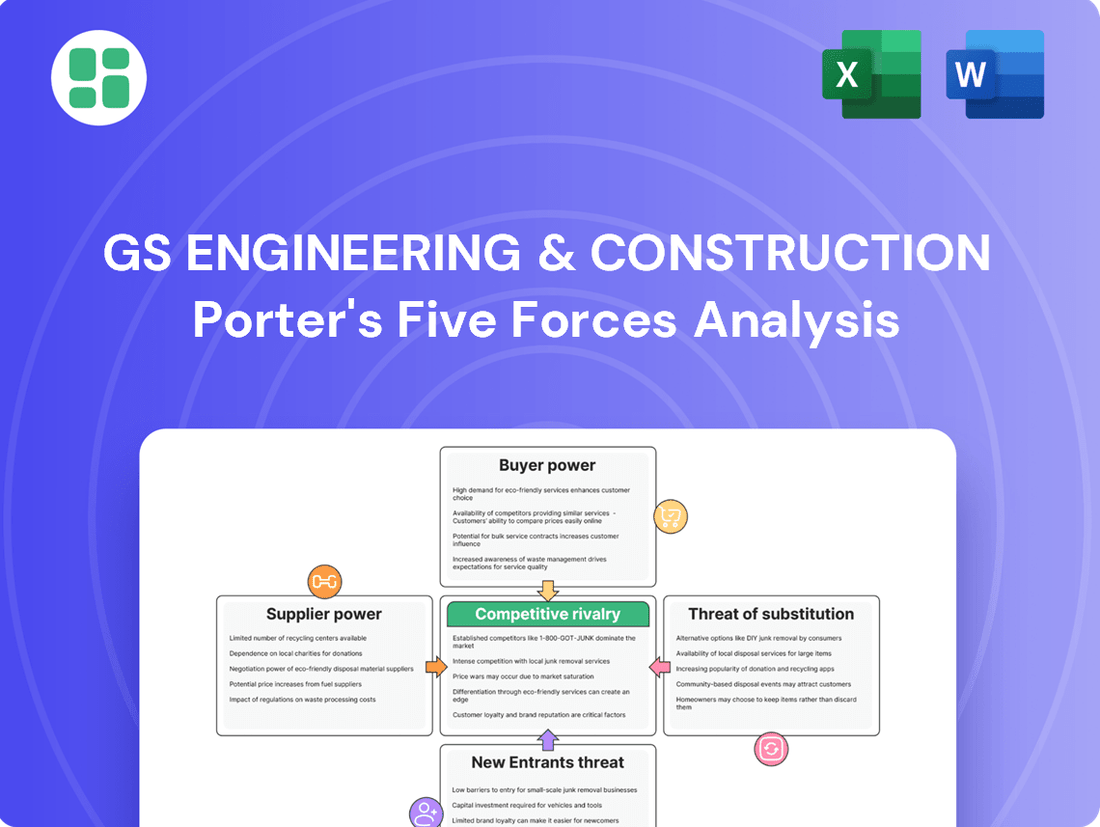

This analysis meticulously examines the competitive forces impacting GS Engineering & Construction, providing insights into supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Instantly identify and mitigate competitive threats with a dynamic, visual representation of each Porter's Force, enabling proactive strategy adjustments.

Customers Bargaining Power

GS Engineering & Construction's large-scale project clients, such as government entities and major corporations undertaking significant infrastructure or industrial developments, hold considerable sway. These clients, often investing billions, can dictate terms, pushing for lower prices and exacting quality specifications that directly impact GS E&C's margins.

For instance, the sheer volume of business these clients represent means they can often negotiate favorable payment schedules and demand extensive warranties, further concentrating their bargaining power. In 2024, major infrastructure projects, like the expansion of transportation networks or the development of new energy facilities, often involve these large-scale clients, making their negotiation leverage a critical factor for GS E&C.

Competitive bidding is a cornerstone of the Engineering, Procurement, and Construction (EPC) sector, significantly amplifying the bargaining power of customers. This process allows clients to solicit proposals from numerous qualified contractors, creating a marketplace where GS Engineering & Construction must vie for business.

In 2024, the intense competition among South Korean EPC giants like GS Engineering & Construction, Samsung C&T, and Hyundai E&C means customers can readily compare pricing and service offerings. This dynamic directly translates into downward pressure on project costs and a heightened expectation for superior value delivery from contractors.

Customers in this environment possess the clear advantage of being able to negotiate more favorable terms and conditions, as they can easily switch to a competitor offering a better deal. This leverage is a direct consequence of the fragmented nature of the bidding process itself.

Clients in the construction sector are placing a significant emphasis on keeping project expenses in check and adhering rigorously to schedules. This demand for cost control and schedule certainty is a key factor influencing the bargaining power of customers.

The economic climate, particularly with persistent inflation and escalating material costs, as seen through 2024 and projected into 2025, intensifies financial pressures on subcontractors and suppliers. Customers expect the primary contractor, like GS Engineering & Construction, to absorb and manage these cost fluctuations effectively, thereby strengthening their negotiating leverage.

Consequently, clients are more inclined to favor contractors who demonstrate a proven ability to deliver projects efficiently and within the allocated budget. This capability directly translates into increased bargaining power for customers, as they can dictate terms more effectively to secure reliable and cost-effective project execution.

Preference for Integrated and Sustainable Solutions

Customers increasingly favor construction partners who can deliver comprehensive, sustainable, and energy-efficient projects. This preference is driving demand for integrated project delivery models and green building practices, allowing clients to select firms that actively support their environmental objectives and offer innovative, eco-friendly solutions.

The construction industry is witnessing a significant shift towards smart city technologies and sustainable development. For instance, the global green building market was valued at approximately USD 100 billion in 2023 and is projected to grow substantially, indicating a strong customer appetite for environmentally conscious construction.

- Growing Demand for Sustainability: A significant portion of new construction projects, particularly in developed economies, now incorporate sustainability certifications like LEED or BREEAM, reflecting customer priorities.

- Preference for Integrated Services: Clients are seeking EPC (Engineering, Procurement, Construction) firms that can manage the entire project lifecycle, from initial design to final handover, streamlining processes and ensuring cohesive execution.

- Impact on Contractor Selection: This trend empowers customers by giving them greater leverage to choose contractors who demonstrate a commitment to sustainability and possess the capabilities to deliver advanced, eco-friendly building solutions.

Ability to Diversify Projects and Contractors

Large customers, particularly government bodies and major corporations, often have the financial and operational capacity to divide substantial projects among several contractors. This strategy minimizes reliance on any single firm.

By diversifying projects, these clients gain leverage. They can easily shift work or threaten to do so if a contractor fails to meet expectations regarding performance or contractual terms, thereby increasing their bargaining power.

- Reduced Dependence: Customers splitting projects avoid being tied to one contractor, increasing their flexibility.

- Switching Threat: The ability to switch contractors if dissatisfied significantly enhances customer leverage.

- Price Negotiation: This diversification often allows customers to negotiate better terms and pricing due to increased competition among potential providers.

The bargaining power of GS Engineering & Construction's customers is substantial, driven by the high concentration of large-scale clients and the competitive nature of the EPC sector. These clients, often government entities or major corporations, possess significant financial clout, enabling them to negotiate favorable terms, demand stringent quality, and influence project timelines. The intense competition among major South Korean EPC firms in 2024 further amplifies this customer leverage, as clients can readily compare offerings and switch providers if expectations aren't met.

Customers are increasingly prioritizing cost control, schedule adherence, and sustainability, directly impacting contractor selection and negotiation. The economic climate of 2024, marked by inflation and rising material costs, has amplified customer demands for contractors like GS E&C to absorb these fluctuations, thereby strengthening their bargaining position. This focus on efficiency and value delivery empowers clients to dictate terms more effectively.

The trend towards sustainability and integrated project delivery models also bolsters customer bargaining power. Clients seeking green building practices and comprehensive project management are more inclined to select firms that align with their environmental and operational goals. For instance, the global green building market's significant growth underscores this customer preference, allowing them to choose partners who offer innovative, eco-friendly solutions and can manage the entire project lifecycle.

Customers can also divide large projects among multiple contractors, reducing their dependence on any single firm and increasing their leverage. This strategy allows them to easily shift work or threaten to do so if performance falters, thereby enhancing their ability to negotiate better terms and pricing. This fragmentation of projects is a key factor in the elevated bargaining power of GS E&C's clientele.

| Factor | Impact on GS E&C | 2024 Context |

|---|---|---|

| Client Concentration | High leverage for large clients (government, corporations) | Major infrastructure projects drive this concentration |

| Competitive Bidding | Downward pressure on prices and margins | Intense competition among South Korean EPCs (e.g., Samsung C&T, Hyundai E&C) |

| Cost & Schedule Demands | Need for efficient project management and cost absorption | Inflation and material cost increases exacerbate this |

| Sustainability Preference | Advantage for firms with green building capabilities | Global green building market valued ~$100 billion in 2023 |

| Project Splitting | Increased client flexibility and negotiation power | Clients can diversify risk and demand better terms |

Same Document Delivered

GS Engineering & Construction Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of GS Engineering & Construction delves into the competitive landscape, providing actionable insights into industry attractiveness and strategic positioning. You'll gain a thorough understanding of the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the sector.

Rivalry Among Competitors

The South Korean construction landscape is a battleground, dominated by formidable entities like Samsung C&T, Hyundai E&C, Daewoo E&C, POSCO E&C, and GS E&C. This concentration of powerful players fuels a cutthroat environment where securing major domestic contracts is a constant struggle.

This intense competition translates directly into aggressive bidding strategies, often pushing profit margins to their limits. For instance, in 2023, major construction firms reported varying levels of profitability, with some experiencing tighter margins on large-scale projects due to the need to win bids against equally capable rivals.

GS Engineering & Construction (GS E&C) navigates a highly competitive global landscape for Engineering, Procurement, and Construction (EPC) projects. The company's significant presence in regions like the Middle East and Africa means it directly contends with established international EPC firms for major plant and infrastructure undertakings.

The global EPC market, projected to reach over $1.5 trillion by 2027, is a battleground for turnkey contracts, fueled by ongoing infrastructure investments and a growing emphasis on renewable energy. This expansion, while positive for the industry, intensifies the rivalry GS E&C faces.

This intense competition isn't confined to national borders; GS E&C's global operational footprint naturally places it in direct rivalry with a diverse array of international EPC players vying for the same high-value contracts.

Companies in this sector intensely vie for new projects to ensure a steady stream of future revenue and maintain growth. This competition directly impacts a firm's ability to build and sustain its project backlog, a vital indicator of its health and future prospects.

GS Engineering & Construction's outlook for 2025 reflects this intense rivalry, with guided new orders expected to decline. This forecast underscores the difficulty companies face in securing new contracts in the current market landscape.

A robust backlog, particularly in redevelopment and reconstruction, is essential for navigating market fluctuations and achieving long-term structural growth. The capacity to win and effectively manage such projects is a significant competitive differentiator.

Technological Advancements and Innovation Race

The competitive rivalry within the construction sector is significantly fueled by a relentless pursuit of technological innovation. Companies are actively integrating advanced tools like digital twins, modular construction techniques, artificial intelligence (AI), and Building Information Modeling (BIM) to boost efficiency, improve safety, and streamline project execution. This drive for innovation means that staying competitive requires substantial and ongoing investment in new technologies and a willingness to adapt quickly.

Competitors are consistently channeling resources into cutting-edge production technologies. The primary aims are to reduce operational costs, achieve environmental, social, and governance (ESG) targets, and carve out a distinct market position. For instance, many firms are exploring AI-powered project management software, which in 2024, saw increased adoption for optimizing resource allocation and predicting potential delays, with some reports indicating efficiency gains of up to 15% on complex projects.

- Digital Transformation Investment: Global spending on construction technology, including AI and BIM, was projected to reach over $100 billion in 2024, highlighting the intense focus on technological advancement.

- Efficiency Gains: Companies adopting modular construction methods in 2024 reported average reductions in project timelines of 10-20% compared to traditional methods.

- AI in Project Management: Early adopters of AI in project scheduling and risk assessment in 2024 experienced a notable decrease in cost overruns, often in the range of 5-10%.

- Sustainability Tech: Investment in technologies supporting ESG goals, such as advanced energy-efficient building materials and waste reduction software, saw a significant uptick in 2024, driven by regulatory pressures and client demand.

Market Share and Diversification Strategies

Leading South Korean construction firms, including GS Engineering & Construction (GS E&C), are actively pursuing diversification to bolster their market share. This strategy involves expanding into burgeoning sectors such as renewable energy projects and advanced smart city infrastructure development. For instance, in 2024, GS E&C announced significant investments in offshore wind power, aiming to capture a substantial portion of this growing market.

Competitive rivalry is intensified by strategic mergers and acquisitions. Companies are consolidating to enhance their market presence and achieve vertical or horizontal integration. This trend is evident in the South Korean construction sector, where consolidation efforts are ongoing, reflecting the intense competition and the drive for greater operational efficiency and market control.

- Market Share Focus: South Korean construction giants like GS E&C are prioritizing market share expansion through strategic initiatives.

- Diversification Avenues: Key growth areas include renewable energy, particularly offshore wind, and smart city development.

- M&A Activity: Mergers and acquisitions are prevalent as firms seek to integrate operations and strengthen their competitive standing.

- Intensified Rivalry: These strategies underscore the high level of competition within the South Korean construction industry.

GS Engineering & Construction (GS E&C) operates in a highly competitive construction environment, both domestically in South Korea and globally. This intense rivalry is characterized by aggressive bidding for projects, particularly large-scale infrastructure and plant undertakings. Firms like Samsung C&T, Hyundai E&C, and Daewoo E&C are direct competitors, pushing profit margins as they vie for market share.

The global EPC market, a key area for GS E&C, is projected to exceed $1.5 trillion by 2027, attracting numerous international players. This expansion fuels competition, as companies seek to secure contracts through technological innovation and strategic diversification into areas like renewable energy. For instance, GS E&C's 2024 focus on offshore wind power highlights this trend.

Companies are investing heavily in digital transformation, with global construction technology spending expected to surpass $100 billion in 2024. This includes AI and BIM adoption, with early AI users reporting efficiency gains of up to 15% in 2024. Strategic mergers and acquisitions also play a role, as firms consolidate to enhance market presence and operational efficiency, further intensifying the competitive landscape.

| Competitor | Key Strengths | 2024 Market Focus |

|---|---|---|

| Samsung C&T | Diversified portfolio, strong financial backing | Infrastructure, Energy, Building |

| Hyundai E&C | Global EPC expertise, shipbuilding synergy | Infrastructure, Offshore, Nuclear |

| Daewoo E&C | Strong presence in overseas markets, infrastructure development | Infrastructure, Urban Development, Plant |

| POSCO E&C | Steel industry integration, eco-friendly construction | Infrastructure, Green Energy, Smart Cities |

SSubstitutes Threaten

Modular and prefabricated construction presents a potent substitute threat to traditional building methods. These off-site construction techniques offer significant advantages, including faster project completion times and reduced labor costs, as evidenced by the growing market share of modular building. For instance, the global modular construction market was valued at approximately $100 billion in 2023 and is projected to grow substantially, indicating a clear shift towards these more efficient alternatives.

The rise of advanced materials and green building technologies poses a significant threat of substitutes for traditional construction methods. As environmental consciousness grows, driven by regulations and consumer preference, materials like mass timber, recycled steel, and innovative composites offer lower carbon footprints. For instance, the global green building market was valued at approximately $1.1 trillion in 2023 and is projected to reach $3.1 trillion by 2030, indicating a strong shift towards sustainable alternatives that can directly replace conventional concrete and steel in many applications.

The threat of substitutes is significant for GS Engineering & Construction, particularly with the growing trend of renovating and retrofitting existing structures. Instead of undertaking entirely new construction projects, clients are increasingly opting to upgrade, expand, or repurpose current buildings and infrastructure. This is especially true in environments marked by economic uncertainty and elevated interest rates, which can make new builds a more costly proposition.

This pivot towards renovation and retrofitting diverts capital and demand away from large-scale new development projects, a core area for companies like GS E&C. For instance, in 2024, global construction spending is projected to see a notable portion allocated to modernization efforts rather than ground-up builds, particularly in mature markets where existing infrastructure is abundant.

3D-Printed Construction

While still in its early stages for major projects, 3D-printed construction presents a significant long-term threat of substitution, especially for residential and custom-designed buildings. This innovative approach boasts the potential for considerably quicker build times and minimized material waste, alongside enhanced design freedom. For instance, by 2024, the global 3D construction printing market was valued at approximately USD 2.5 billion, with projections indicating substantial growth.

The advantages of 3D printing in construction, such as reduced labor costs and the ability to create complex geometries, could lead to a gradual shift away from conventional methods. This technological advancement offers a compelling alternative that could capture market share as it matures and becomes more cost-effective for a wider range of applications.

- Faster Project Completion: 3D printing can reduce construction timelines by up to 50% for certain structures compared to traditional methods.

- Material Efficiency: The technology typically uses 30-60% less material, leading to significant cost savings and environmental benefits.

- Design Versatility: Complex and customized architectural designs are more feasible and cost-effective with 3D printing.

- Emerging Market Growth: The 3D construction printing market is expected to grow at a CAGR of over 20% in the coming years, indicating increasing adoption.

Digitalization and Virtual Solutions

The rise of digital twins and advanced simulation tools presents a growing threat of substitutes for traditional construction methods. These technologies can significantly reduce the need for physical prototypes and on-site modifications, thereby streamlining project execution. For instance, a digital twin can accurately model a building's performance and identify potential issues before construction even begins, minimizing costly rework.

While not a direct replacement for physical construction, these digital solutions can alter the scope and nature of the work required. By enabling more precise planning and virtual testing, they can lead to fewer unforeseen challenges during the build phase. This shift impacts the traditional service offerings of construction firms, pushing them to integrate these digital capabilities.

In 2024, the global digital twin market was valued at approximately USD 15.1 billion, with projections indicating substantial growth. This increasing adoption highlights the potential for these virtual solutions to substitute aspects of traditional construction processes. For example, companies are using digital twins for predictive maintenance and operational efficiency, reducing the need for physical interventions.

- Digital Twins: Enabling virtual replication of physical assets for analysis and simulation.

- Advanced Simulation Tools: Predicting performance and identifying potential issues before physical realization.

- Reduced Prototyping: Minimizing the need for physical models through virtual testing.

- Streamlined Processes: Altering the scope and nature of physical work by enhancing planning and virtual validation.

The threat of substitutes is notably present through modular and prefabricated construction, offering faster project completion and reduced labor costs. The global modular construction market, valued around $100 billion in 2023, demonstrates a clear trend towards these efficient alternatives.

Furthermore, advanced materials and green building technologies are emerging as significant substitutes. With the global green building market projected to reach $3.1 trillion by 2030, sustainable materials are increasingly replacing conventional ones, driven by environmental consciousness and regulations.

The shift towards renovating and retrofitting existing structures, rather than new builds, also presents a substitute threat. This trend, amplified by economic uncertainty in 2024, diverts demand from large-scale development projects, a core area for GS Engineering & Construction.

Emerging technologies like 3D-printed construction, though nascent, pose a long-term substitution risk, particularly for residential projects. This method promises faster build times and less waste, with the 3D construction printing market valued at approximately USD 2.5 billion in 2024.

| Substitute Threat | Key Advantages | Market Data/Projections (2023-2024) |

|---|---|---|

| Modular/Prefabricated Construction | Faster completion, reduced labor costs | Global modular construction market: ~$100 billion (2023) |

| Green Building Technologies | Lower carbon footprint, sustainability | Global green building market: ~$1.1 trillion (2023), projected to $3.1 trillion by 2030 |

| Renovation & Retrofitting | Cost-effective alternative to new builds, especially in uncertain economies | Significant portion of global construction spending in 2024 allocated to modernization |

| 3D-Printed Construction | Reduced labor, material efficiency, design freedom | Global 3D construction printing market: ~$2.5 billion (2024) |

Entrants Threaten

The Engineering, Procurement, and Construction (EPC) sector, particularly for large-scale industrial plants and infrastructure projects, demands substantial capital outlays. New companies face significant hurdles in acquiring the necessary heavy machinery, advanced technological licenses, and skilled labor pools. For instance, a single major petrochemical plant construction can easily run into billions of dollars, a figure that deters many aspiring competitors.

The need for specialized expertise and experience significantly raises the barrier to entry for new players in GS Engineering & Construction's (GS E&C) sector. GS E&C's extensive capabilities in civil engineering, building, and intricate plant construction require deep knowledge in engineering, procurement, and project management.

New companies often struggle to match GS E&C's decades-long accumulation of proven project execution and a substantial workforce with the necessary skills to handle large, complex undertakings. For instance, the global engineering and construction market, valued at approximately $11.7 trillion in 2023, demands a high level of technical proficiency that new entrants find challenging to acquire quickly.

Stringent regulatory requirements and lengthy permitting processes act as a significant barrier to entry in the construction sector, especially for large-scale infrastructure and environmental projects. For instance, in 2024, the average time to secure permits for major construction projects in the US can extend over a year, involving multiple federal, state, and local agencies. This complexity requires substantial upfront investment in legal, environmental, and compliance expertise, deterring smaller or less capitalized new entrants.

Established Client Relationships and Brand Reputation

Established client relationships pose a significant barrier. GS Engineering & Construction (GS E&C) benefits from decades of trust and successful project execution with major clients, including government agencies and large corporations. This deep-seated credibility makes it challenging for newcomers to displace incumbent firms.

New entrants face an uphill battle against GS E&C's strong brand reputation and extensive network. The ability to secure high-value contracts is often tied to an established player's proven track record and industry connections, which new companies lack.

- Long-standing client relationships: GS E&C has cultivated trust and loyalty with key clients over many years.

- Brand reputation and credibility: A strong brand name built on past successes offers a competitive advantage.

- Extensive network: Established players leverage a wide network of partners and suppliers, which is difficult for new entrants to replicate quickly.

Economies of Scale and Cost Advantages

The threat of new entrants in the construction sector, particularly for large-scale projects like those undertaken by GS Engineering & Construction, is significantly mitigated by substantial economies of scale and inherent cost advantages enjoyed by established players.

Existing large construction firms leverage their size to secure bulk discounts on materials and equipment, optimize labor deployment across multiple projects, and streamline project management processes. For instance, in 2023, major global construction firms often reported procurement savings of 5-10% due to their purchasing volume, a benefit new entrants struggle to access.

These cost efficiencies translate into lower per-unit costs, making it challenging for new, smaller firms to compete on price for major infrastructure or industrial projects. The ability of incumbents to spread their considerable fixed costs, such as specialized equipment ownership and advanced technology investments, across a continuous pipeline of work provides a durable competitive moat.

- Economies of scale in procurement: Large firms can negotiate better prices for raw materials and equipment due to higher order volumes.

- Labor management efficiencies: Established companies have optimized processes for hiring, training, and deploying skilled labor across various projects.

- Project execution expertise: Years of experience allow large companies to manage complex projects more efficiently, reducing waste and delays.

- Fixed cost absorption: The ability to spread high fixed costs over a larger revenue base lowers the average cost per project for incumbents.

The threat of new entrants for GS Engineering & Construction (GS E&C) is considerably low due to immense capital requirements and specialized expertise needed. The sheer cost of machinery, technology, and skilled labor for large-scale projects acts as a significant deterrent.

Additionally, stringent regulations and lengthy permitting processes, which can take over a year in 2024 for major US projects, demand substantial upfront investment in compliance and legal resources. GS E&C's established client relationships and strong brand reputation, built over decades, also create high barriers, making it difficult for newcomers to gain trust and secure contracts in a market valued at approximately $11.7 trillion globally in 2023.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Billions of dollars needed for equipment, technology, and skilled labor. | Very High Deterrent |

| Specialized Expertise | Deep knowledge in engineering, procurement, and project management is crucial. | Very High Deterrent |

| Regulatory Hurdles | Lengthy permitting processes can exceed a year (2024 data). | High Deterrent |

| Client Relationships | Decades of trust and successful project execution with major clients. | Very High Deterrent |

| Brand Reputation & Network | Established credibility and industry connections are difficult to replicate. | Very High Deterrent |

| Economies of Scale | Bulk discounts on materials and optimized labor deployment. | High Deterrent |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for GS Engineering & Construction is built upon a foundation of diverse and reliable data sources. We leverage annual reports, investor presentations, and official company disclosures to understand internal strategies and financial health. This is complemented by industry-specific market research reports, trade publications, and data from reputable financial information providers to capture external market dynamics.