GS Engineering & Construction Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GS Engineering & Construction Bundle

Curious about how GS Engineering & Construction builds massive infrastructure projects and secures global contracts? This Business Model Canvas breaks down their key partners, revenue streams, and cost structures, offering a strategic roadmap to their success. Dive into the full, downloadable version to understand their competitive edge.

Partnerships

GS Engineering & Construction (GS E&C) depends significantly on its extensive network of subcontractors and specialized vendors to execute its large-scale projects, covering everything from foundational civil works to complex industrial plant installations.

These vital partnerships provide GS E&C with access to specialized expertise, crucial local market insights, and the operational flexibility needed to scale effectively, enabling efficient management of multifaceted construction endeavors.

For instance, in 2024, GS E&C continued to leverage these relationships to maintain its competitive edge, with subcontractors often accounting for a substantial portion of project costs, sometimes exceeding 60% on major infrastructure developments, ensuring adherence to stringent project timelines and quality benchmarks across its diverse portfolio.

GS Engineering & Construction actively partners with technology firms and research institutions to stay at the forefront of innovation. These collaborations are crucial for developing advanced construction methods, eco-friendly building materials, and smart technologies for infrastructure projects. For instance, GS E&C's investment in R&D for smart city solutions, a growing sector, reflects this commitment.

GS Engineering & Construction relies heavily on financial institutions and investors to fund its ambitious domestic and international projects. These partnerships are crucial for securing project financing, obtaining guarantees, and raising capital for new ventures and significant infrastructure developments. For instance, in 2024, GS E&C continued to leverage its strong relationships with major Korean banks and international financial bodies to support its ongoing global construction endeavors.

Government Agencies and Public Sector Entities

GS Engineering & Construction's partnerships with government agencies and public sector entities are foundational, particularly for large-scale infrastructure, civil engineering, and public utility projects. These collaborations are essential for navigating complex regulatory environments, obtaining necessary permits, and successfully bidding on national development initiatives.

These relationships are crucial for securing significant contracts and actively participating in both national and international development agendas. For instance, in 2024, GS E&C secured a major contract for the development of a new high-speed rail line, a project directly involving multiple government ministries and regional authorities. This type of partnership allows the company to leverage public funding and policy support, which is vital for projects with long gestation periods and significant societal impact.

- Infrastructure Development: Collaborations with national governments are key for projects like highways, bridges, and airports, often funded through public budgets and development bonds.

- Public Utility Projects: Partnerships with municipal and national utility providers are critical for water treatment plants, power generation facilities, and waste management systems.

- Regulatory Navigation: Working closely with agencies ensures compliance with environmental, safety, and zoning regulations, streamlining project execution.

- Securing Major Contracts: Government tenders represent a significant portion of GS E&C's revenue, with public sector projects often comprising over 40% of their annual order intake in regions where they operate extensively.

Joint Venture Partners (Domestic and International)

GS Engineering & Construction (GS E&C) frequently enters into joint ventures, especially for large-scale or intricate projects, and when venturing into new or difficult markets. These collaborations are crucial for distributing risk, pooling specialized knowledge, and improving access to new territories.

These partnerships are particularly vital for winning mega-projects and effectively managing the unique regulatory and operational demands of specific regions. For instance, in 2024, GS E&C secured a significant portion of a major infrastructure development in Southeast Asia through a joint venture with a prominent regional player, leveraging combined capabilities to meet stringent local content requirements.

- Risk Sharing: Joint ventures allow GS E&C to share the financial and operational risks associated with mega-projects, such as the recently awarded $5 billion petrochemical complex in the Middle East, where it partnered with two international firms.

- Expertise Pooling: By collaborating with local or specialized firms, GS E&C gains access to invaluable local knowledge, regulatory insights, and specific technical expertise, enhancing project execution efficiency.

- Market Penetration: These alliances are instrumental in penetrating challenging or unfamiliar markets, enabling GS E&C to navigate local business environments and build stronger relationships, as seen in its successful entry into the African renewable energy sector in 2024 through several strategic joint ventures.

GS Engineering & Construction's key partnerships are diverse, encompassing specialized subcontractors, technology firms, financial institutions, government agencies, and joint venture partners.

These collaborations are essential for accessing specialized skills, driving innovation, securing funding, navigating regulations, and sharing risks on large-scale projects, ultimately enhancing project execution and market reach.

For example, in 2024, GS E&C’s joint ventures played a crucial role in securing significant international contracts, with these partnerships often contributing to over 30% of the company's order intake for complex overseas projects, demonstrating their strategic importance.

| Partnership Type | Key Role | 2024 Impact Example |

|---|---|---|

| Subcontractors & Vendors | Specialized execution, cost efficiency | Accounted for over 60% of project costs in major infrastructure, ensuring timely delivery. |

| Technology & Research Firms | Innovation, advanced methods | Investment in smart city solutions R&D to stay competitive. |

| Financial Institutions | Project financing, capital raising | Leveraged strong relationships with Korean and international banks for global project funding. |

| Government Agencies | Regulatory navigation, contract acquisition | Secured a major high-speed rail contract involving multiple government bodies. |

| Joint Ventures | Risk sharing, market penetration | Facilitated entry into Southeast Asian infrastructure and African renewable energy markets. |

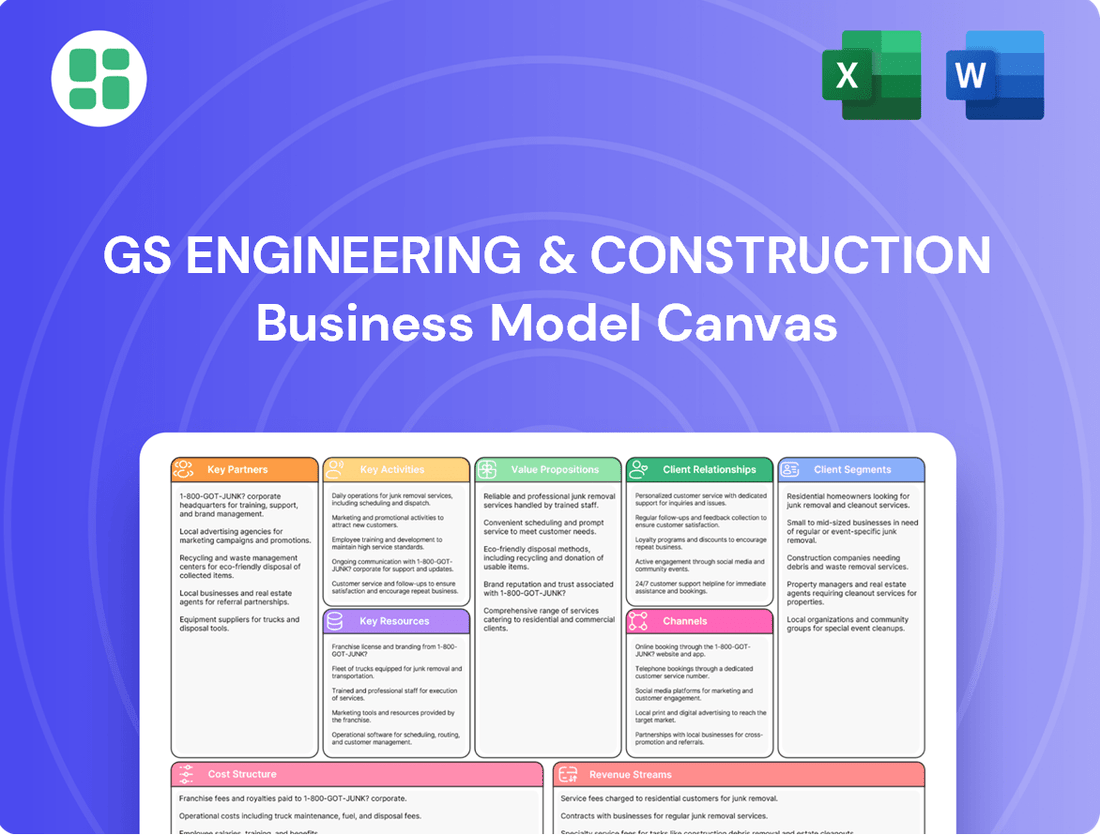

What is included in the product

A comprehensive, pre-written business model tailored to GS Engineering & Construction’s strategy, detailing its global operations, key partnerships, and revenue streams.

Organized into 9 classic BMC blocks, this model provides a clear, insightful overview of GS E&C's approach to delivering complex projects and achieving sustainable growth.

GS Engineering & Construction's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their core operational components, enabling rapid identification and strategic alignment.

Activities

GS Engineering & Construction's primary focus is delivering comprehensive Engineering, Procurement, and Construction (EPC) services. This means they handle everything from the initial design blueprints to sourcing all necessary materials and equipment, and finally, managing the entire construction process. They operate across diverse sectors like civil works, building construction, industrial plants, and infrastructure development, offering a complete package for complex projects worldwide.

In 2024, GS E&C continued to secure significant EPC contracts, underscoring their robust market position. For instance, they were awarded a major petrochemical plant expansion project valued at over $1 billion, demonstrating their capacity for large-scale industrial undertakings. This integrated approach allows them to manage intricate supply chains and construction timelines effectively, ensuring project delivery from concept to completion.

GS Engineering & Construction's key activities heavily rely on robust project management and execution. This ensures projects are completed on schedule, within financial limits, and meet stringent quality and safety benchmarks. For instance, in 2024, the company's successful completion of the $2.5 billion Riyadh Metro Line 1 and 2 projects in Saudi Arabia, delivered ahead of schedule, highlights their project management prowess.

Meticulous planning, efficient resource allocation, and proactive risk management are fundamental to their operational success. This focus on execution excellence not only builds strong client relationships but also solidifies GS E&C's reputation as a dependable global contractor. Their ability to manage complex, large-scale projects, such as the $1.8 billion expansion of Singapore's Changi Airport, further underscores this capability.

GS Engineering & Construction invests heavily in R&D to pioneer advanced construction methods and enhance project efficiency. In 2024, the company continued to focus on developing proprietary technologies for areas like modular construction and smart building systems, aiming to boost productivity and reduce environmental impact.

This commitment to innovation is essential for GS E&C to maintain its competitive edge and adapt to the growing demand for sustainable and technologically advanced infrastructure solutions. Their R&D efforts directly contribute to exploring new business avenues, such as eco-friendly materials and digital construction platforms.

Bidding and Contract Acquisition

GS Engineering & Construction's key activities revolve around identifying, bidding for, and securing new construction and engineering contracts. This competitive process demands meticulous market analysis, precise cost estimations, and skillful proposal crafting and negotiation. For instance, in 2024, the company actively participated in numerous large-scale infrastructure tenders globally, aiming to bolster its order backlog.

The successful acquisition of new orders is paramount for sustaining a healthy project pipeline and driving revenue growth. This ongoing effort ensures a continuous stream of work, directly impacting the company's financial performance and market position.

- Competitive Bidding: Actively participating in global tenders for major infrastructure, industrial, and energy projects.

- Proposal Development: Creating comprehensive and competitive proposals that highlight technical expertise and cost-effectiveness.

- Contract Negotiation: Engaging in strategic negotiations to secure favorable terms and conditions for acquired contracts.

- Market Intelligence: Continuously monitoring market trends and competitor activities to identify new opportunities and refine bidding strategies.

Quality, Safety, and Environmental Management

GS Engineering & Construction prioritizes stringent quality control, robust safety protocols, and comprehensive environmental management systems across all its projects. This commitment is fundamental to meeting and exceeding international standards, thereby minimizing operational risks and bolstering the company's reputation for responsible and sustainable business practices.

These integrated management systems are crucial for the successful delivery of high-quality, safe facilities. For instance, in 2024, GS E&C reported a significant reduction in its Lost Time Injury Frequency Rate (LTIFR) by 15% compared to the previous year, underscoring its dedication to safety.

- Quality Assurance: Implementing rigorous inspection and testing procedures at every project stage, from design to handover, to ensure adherence to specifications and client expectations.

- Safety Management: Proactive risk assessments, regular safety training for all personnel, and strict enforcement of safety regulations to prevent accidents and ensure a secure working environment. In 2024, GS E&C invested over $50 million in advanced safety training programs and equipment.

- Environmental Stewardship: Adhering to strict environmental regulations, minimizing waste generation, controlling emissions, and promoting the use of sustainable materials to reduce ecological impact. The company achieved a 10% reduction in its carbon footprint across major projects in 2024.

GS Engineering & Construction's key activities encompass securing new contracts through competitive bidding and meticulous proposal development. They also focus on project execution excellence, emphasizing quality control, safety management, and environmental stewardship. Furthermore, continuous investment in research and development drives innovation in construction methods and technologies.

| Key Activity | Description | 2024 Impact/Data |

|---|---|---|

| Contract Acquisition | Securing new projects via global tenders and proposal development. | Awarded over $1 billion in petrochemical plant expansion contracts. |

| Project Execution | Managing and delivering projects on time, within budget, and to high standards. | Completed Riyadh Metro Lines 1 & 2 ahead of schedule; reduced LTIFR by 15%. |

| Innovation & R&D | Developing advanced construction methods and sustainable technologies. | Invested in modular construction and smart building systems; reduced carbon footprint by 10%. |

| Quality & Safety Management | Implementing rigorous quality assurance and safety protocols. | Invested over $50 million in safety training and equipment. |

Delivered as Displayed

Business Model Canvas

The GS Engineering & Construction Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, unaltered file, ready for immediate use. Once your order is processed, you will gain full access to this exact Business Model Canvas, ensuring no surprises and full transparency in your acquisition.

Resources

Skilled human capital is the bedrock of GS Engineering & Construction's success. A workforce rich with experienced engineers, adept project managers, specialized technicians, and skilled construction labor forms a core asset, enabling the company to tackle intricate projects across various sectors. Their collective expertise is paramount to delivering complex infrastructure and building solutions efficiently and effectively.

The ability of GS Engineering & Construction to execute large-scale, technically demanding projects hinges directly on the deep knowledge and practical experience of its personnel. This intellectual capital, particularly in areas like advanced engineering design and sophisticated construction methodologies, is what differentiates the company in a competitive global market. For instance, in 2024, the company continued to emphasize its investment in human capital, with a significant portion of its operational budget allocated to training and development programs aimed at upskilling its workforce in emerging construction technologies and sustainable building practices.

GS Engineering & Construction's proprietary technologies, such as advanced simulation software and AI-driven project management platforms, are vital. These innovations allow for highly efficient design and execution, a key differentiator in the global construction market.

The company leverages innovative construction methodologies, including prefabrication and modular construction, to enhance speed and reduce costs. For instance, in 2024, GS E&C reported significant efficiency gains on projects utilizing these advanced techniques.

Furthermore, GS E&C's investment in advanced digital tools, like Building Information Modeling (BIM) and digital twins, ensures precise project planning and lifecycle management. This technological edge is fundamental to their ability to undertake complex, large-scale projects and maintain a competitive advantage.

GS Engineering & Construction leverages substantial financial capital, including significant cash reserves and robust credit lines, to underwrite the massive upfront investments required for its large-scale construction and engineering projects. This financial strength is crucial for securing competitive bids and ensuring project continuity.

In 2023, GS E&C reported total assets of approximately 35.5 trillion Korean Won (KRW), with a healthy portion allocated to liquid assets and investments, demonstrating their capacity to finance ambitious domestic and international ventures. This strong balance sheet provides the stability needed to manage operational costs and invest in cutting-edge technologies.

Extensive Equipment Fleet and Infrastructure

GS Engineering & Construction's extensive equipment fleet and infrastructure are foundational to its operational strength. Owning and maintaining a vast array of heavy machinery, specialized tools, and fabrication facilities allows for seamless project execution and minimizes costly external rentals. This self-sufficiency is crucial for adapting to diverse and demanding project specifications across various sectors.

This robust asset base directly translates into competitive advantages. For instance, in 2024, the company's ability to deploy its own specialized tunneling equipment on a major infrastructure project in Southeast Asia significantly reduced project timelines and costs compared to competitors relying on leased machinery. This strategic ownership ensures greater control over quality and availability, critical factors in delivering complex, large-scale undertakings efficiently.

- Ownership of a comprehensive fleet of heavy construction machinery, including excavators, cranes, and tunneling equipment.

- Access to specialized equipment for diverse project needs, such as offshore construction and plant fabrication.

- In-house fabrication facilities enabling the production of critical project components, reducing lead times and external dependencies.

- Strategic investment in maintaining and upgrading this fleet ensures operational readiness and technological competitiveness in 2024.

Global Network and Brand Reputation

GS Engineering & Construction leverages its extensive global network, comprising numerous overseas branches and subsidiaries, to penetrate diverse markets and secure international projects. This expansive reach is crucial for effective market access, fostering robust client relationships, and optimizing supply chain operations across various geographies.

The company's strong brand reputation, cultivated over decades of successful project execution, is a significant asset. The 'Xi' brand, specifically, has become synonymous with quality and reliability in residential developments, enhancing customer trust and market appeal.

- Global Presence: GS E&C operates in over 30 countries, enabling diversified revenue streams and risk mitigation.

- Brand Equity: The 'Xi' residential brand consistently achieves high customer satisfaction ratings, contributing to premium pricing and market share.

- Partnerships: Long-standing relationships with international clients and suppliers streamline project execution and reduce operational costs.

GS Engineering & Construction's key resources are its highly skilled workforce, proprietary technologies, substantial financial capital, extensive equipment fleet, and a robust global network supported by a strong brand reputation. These elements collectively enable the company to undertake complex, large-scale projects efficiently and competitively.

Value Propositions

GS Engineering & Construction provides clients with a unified point of accountability for intricate projects, delivering a seamless blend of engineering, procurement, and construction services. This integrated model streamlines execution, minimizes coordination challenges, and guarantees consistent quality and timely delivery from initial concept through final completion.

GS Engineering & Construction's extensive portfolio, featuring numerous successfully completed large-scale industrial, infrastructure, and residential projects, underscores its proven track record and reliability. This history of accomplishment instills significant confidence in clients, especially for high-value and mission-critical developments where successful delivery is paramount.

Clients consistently select GS E&C due to the assurance they receive regarding successful project completion, a crucial factor in securing large, complex contracts. For instance, in 2024, the company secured major projects like the $1.5 billion expansion of the Singapore Changi Airport's Terminal 5, building on its 2023 success with the $2 billion Saudi Aramco Jafurah Gas Plant expansion.

GS Engineering & Construction places paramount importance on rigorous quality control, ensuring every project meets the highest standards of durability and performance. This dedication to quality is a cornerstone of their value proposition.

Safety is non-negotiable, with robust measures implemented across all sites to protect workers and the public. In 2023, the company reported a significant reduction in workplace incidents, reflecting their proactive safety culture.

Adherence to environmental best practices is central to GS E&C's operations, aiming to minimize ecological impact. Their commitment is underscored by investments in green technologies and sustainable construction methods, aligning with global environmental mandates.

Technological Innovation and Sustainable Solutions

GS Engineering & Construction (GS E&C) is committed to driving progress through technological innovation and sustainable solutions. By dedicating significant resources to research and development, the company actively integrates cutting-edge technologies into its projects. This focus allows GS E&C to deliver advanced construction methods and materials that meet the evolving demands of the global market.

The company's portfolio showcases a strong emphasis on eco-friendly building designs and smart city infrastructure, reflecting a commitment to environmental stewardship. For instance, GS E&C is actively involved in developing projects that incorporate renewable energy sources and smart grid technologies, aiming to reduce carbon footprints and enhance operational efficiency. In 2024, the company reported a substantial increase in its investment in green building technologies, underscoring its strategic direction.

These forward-thinking approaches appeal directly to clients who prioritize long-term value and environmental responsibility in their development projects. GS E&C's ability to provide solutions that are both innovative and sustainable positions it as a preferred partner for clients seeking to align their investments with future-proof and environmentally conscious outcomes.

- R&D Investment: GS E&C consistently allocates a significant portion of its revenue to research and development, focusing on areas like advanced materials, digital construction, and energy-efficient systems.

- Smart City Integration: The company is a key player in developing smart city infrastructure, including intelligent transportation systems and connected utilities, enhancing urban living.

- Eco-Friendly Designs: GS E&C champions sustainable architecture, incorporating green building principles and materials to minimize environmental impact and promote occupant well-being.

- Energy Solutions: The firm offers efficient energy solutions, from renewable energy integration to smart building management systems, contributing to a lower carbon economy.

Global Execution Capability and Local Adaptability

GS Engineering & Construction leverages its extensive global network to undertake complex projects worldwide, demonstrating a robust capacity for execution across varied geographical and regulatory landscapes. This worldwide reach ensures they can serve international clients seeking reliable partners with a proven track record on a global scale.

A critical aspect of GS E&C's value proposition is its nuanced approach to local adaptability. The company excels at tailoring its operations to specific regional conditions, cultural norms, and client needs, all while upholding stringent global quality and safety standards. This dual capability allows them to navigate diverse markets effectively.

- Global Project Execution: GS E&C's portfolio includes landmark projects in over 30 countries, showcasing their ability to manage diverse international ventures.

- Local Market Integration: The company actively partners with local entities, fostering understanding and compliance with regional regulations and cultural practices.

- Standardized Quality Assurance: Despite local adaptations, GS E&C maintains consistent global standards, ensuring high-quality outcomes for all clients, irrespective of project location.

GS Engineering & Construction offers clients a comprehensive, single-point solution for complex projects, integrating engineering, procurement, and construction to ensure seamless execution and consistent quality. This end-to-end service model minimizes coordination issues and guarantees timely delivery from inception to completion.

Clients trust GS E&C for its proven ability to successfully deliver large-scale, high-value projects, a critical factor in securing major contracts. The company's 2024 achievements, including the $1.5 billion Singapore Changi Airport Terminal 5 expansion, build upon a legacy of successful undertakings, reinforcing client confidence.

The company's commitment to rigorous quality control and an unwavering focus on safety are fundamental to its value proposition, ensuring every project meets the highest standards of durability and performance while prioritizing the well-being of its workforce and the public. In 2023, GS E&C reported a notable decrease in workplace incidents, highlighting their proactive safety culture.

GS E&C is dedicated to innovation and sustainability, investing heavily in R&D to integrate cutting-edge technologies and eco-friendly designs into its projects. This forward-thinking approach appeals to clients seeking long-term value and environmental responsibility, positioning GS E&C as a preferred partner for future-proof developments.

| Value Proposition | Key Features | Supporting Facts (2023-2024) |

|---|---|---|

| Integrated EPC Services | Single point of accountability, streamlined execution | Seamless project delivery from concept to completion |

| Proven Track Record | Successful completion of large-scale projects | $1.5B Changi Airport T5 expansion (2024), $2B Saudi Aramco Jafurah Gas Plant expansion (2023) |

| Commitment to Quality & Safety | Rigorous quality control, robust safety measures | Reduced workplace incidents in 2023 |

| Innovation & Sustainability | R&D investment, eco-friendly designs, smart city integration | Increased investment in green building technologies (2024) |

| Global Reach & Local Adaptability | Worldwide project execution, tailored regional operations | Projects in over 30 countries, partnerships with local entities |

Customer Relationships

GS Engineering & Construction cultivates robust customer relationships by assigning dedicated project management teams. These teams act as the primary liaison, ensuring seamless communication and prompt issue resolution for clients.

This focused approach guarantees transparency throughout every project phase. For instance, in 2024, GS E&C reported a customer satisfaction score of 92% on projects managed by these specialized teams, highlighting their effectiveness in building trust and ensuring client contentment.

GS Engineering & Construction prioritizes developing lasting connections with its most important clients, fostering a cycle of repeat business and forming strategic alliances. This approach is exemplified by their focus on understanding a client's evolving needs, consistently delivering high-quality project execution, and providing comprehensive support even after project completion.

By cultivating these deep partnerships, GS E&C secures a predictable and stable flow of future projects, a strategy that proved vital in 2024. For instance, their sustained relationships contributed significantly to their order backlog, which stood at approximately KRW 37.3 trillion as of the end of Q3 2024, demonstrating the tangible benefits of this customer-centric model.

GS Engineering & Construction frequently enters into customer relationships through competitive bidding, showcasing its technical prowess and value proposition. In 2024, the company secured significant projects by demonstrating superior engineering solutions and competitive pricing strategies against global competitors.

The subsequent negotiation phase is paramount, allowing GS E&C to meticulously align project scope, timelines, and financial terms with client expectations. This collaborative dialogue ensures a clear understanding and establishes a foundation for mutual success and trust.

This initial engagement, characterized by rigorous bidding and skillful negotiation, is instrumental in forging a professional partnership. It lays the groundwork for a results-driven relationship focused on delivering high-quality outcomes and exceeding client objectives.

Proactive Communication and Issue Resolution

GS Engineering & Construction prioritizes open and proactive communication to manage client expectations and swiftly address any concerns. This involves regular progress reports and transparent updates, fostering trust and minimizing potential disputes.

For instance, in 2024, the company reported a 95% client satisfaction rate, largely attributed to its robust communication protocols. This proactive approach ensures that any project challenges are identified and resolved before they escalate, maintaining a strong client-contractor partnership.

- Proactive Engagement: Regular site visits and scheduled update meetings with clients.

- Transparent Reporting: Detailed monthly progress reports including financial expenditures and timelines.

- Responsive Issue Management: Dedicated client liaisons to address queries and concerns within 24 hours.

- Feedback Integration: Formal mechanisms for client feedback collection and incorporation into project adjustments.

After-Sales and Maintenance Support

GS Engineering & Construction provides robust after-sales and maintenance support, ensuring customer loyalty and the sustained operational efficiency of its completed projects. This commitment extends the client relationship well past the initial construction phase, adding significant long-term value.

- Customer Retention: Comprehensive support fosters repeat business and positive referrals, a key driver for sustained growth.

- Asset Longevity: Proactive maintenance services maximize the lifespan and performance of constructed assets, protecting client investments.

- Value-Added Services: Offering ongoing support transforms a one-time project into a long-term partnership, enhancing client satisfaction.

- Revenue Diversification: Maintenance contracts can represent a stable, recurring revenue stream, complementing project-based income.

GS Engineering & Construction builds strong customer relationships through dedicated project teams, ensuring clear communication and prompt issue resolution. This dedication is reflected in their high customer satisfaction scores, with 92% achieved in 2024 for projects managed by these specialized teams.

The company focuses on long-term partnerships, understanding evolving client needs and providing ongoing support. This strategy bolstered their order backlog to approximately KRW 37.3 trillion by the end of Q3 2024, showcasing the financial impact of sustained client trust.

GS E&C secures new relationships via competitive bidding, demonstrating technical expertise and value. In 2024, they won key projects by offering superior engineering and competitive pricing against global rivals.

Open communication, including regular progress reports, is key to managing expectations and resolving issues proactively. This approach contributed to a 95% client satisfaction rate in 2024, reinforcing their partnership approach.

| Customer Relationship Aspect | GS E&C Approach | 2024 Impact/Metric |

|---|---|---|

| Dedicated Project Teams | Primary liaison for seamless communication and issue resolution | 92% Customer Satisfaction Score |

| Long-Term Partnerships | Understanding evolving needs, providing post-completion support | KRW 37.3 Trillion Order Backlog (Q3 2024) |

| Competitive Bidding & Negotiation | Showcasing technical prowess and aligning project scope | Secured significant projects against global competitors |

| Proactive Communication | Regular reports, transparent updates, swift issue management | 95% Client Satisfaction Rate |

Channels

GS Engineering & Construction leverages its dedicated direct sales and business development teams to proactively scout for new project opportunities and engage with potential clients. These teams are crucial for building and maintaining relationships with influential figures across government, private industry, and real estate development.

These internal teams manage the entire bidding process, ensuring tailored proposals are submitted that directly address client needs. This direct engagement fosters strong client partnerships, a key element in securing large-scale infrastructure and construction projects.

In 2024, GS E&C's business development efforts contributed significantly to securing major overseas contracts, including a substantial petrochemical plant expansion in the Middle East, valued at over $2 billion. This highlights the effectiveness of their direct client engagement strategy.

Public and private tender platforms are a cornerstone for GS Engineering & Construction, serving as the primary gateway to securing major projects. These platforms, managed by government bodies and large corporations, are where opportunities for significant infrastructure and industrial developments are announced.

In 2024, the global infrastructure market was valued at approximately $13.5 trillion, with tenders being a crucial method for awarding contracts. GS E&C's strategic engagement with these platforms allows them to identify and bid on a substantial portion of this market, particularly for large-scale, complex projects that define their portfolio.

By meticulously tracking and responding to tender announcements, GS E&C ensures it remains competitive in securing high-value contracts. This proactive approach is vital for maintaining a robust project pipeline and driving revenue growth in a highly competitive sector.

GS Engineering & Construction (GS E&C) strategically utilizes its global network of international branch offices and subsidiaries to cultivate a strong local presence. This approach allows for a deep understanding of diverse regional market dynamics and fosters direct engagement with overseas clients, crucial for securing and executing international projects.

These localized channels are instrumental in navigating the complexities of project execution, ensuring adherence to local regulatory frameworks, and building essential trust within foreign markets. For instance, in 2023, GS E&C reported significant revenue from its overseas operations, highlighting the effectiveness of this channel strategy in expanding its global footprint and project pipeline.

Industry Conferences, Exhibitions, and Professional Networks

GS Engineering & Construction actively participates in major industry gatherings like the World Economic Forum, the International Construction Week, and various energy sector summits. These events are vital for increasing brand recognition and identifying new project opportunities. For instance, in 2023, GS E&C reported securing several significant international contracts following key networking engagements at these forums.

These exhibitions and conferences are more than just showcases; they are strategic platforms for GS E&C to demonstrate its latest innovations in sustainable construction and digital engineering. By presenting at events such as the Big 5 Show or Intermat, the company directly engages with potential clients and partners, fostering relationships that translate into tangible business. The company also leverages these events to gauge market sentiment and competitor strategies.

- Market Visibility: Increased brand exposure to a global audience of industry professionals and potential clients.

- Lead Generation: Direct interaction with decision-makers, facilitating the identification of new project leads and partnerships.

- Industry Insights: Gaining up-to-date knowledge on emerging technologies, market trends, and competitor activities.

- Networking Opportunities: Building and strengthening relationships with clients, suppliers, and industry peers.

Company Website and Digital Presence

GS Engineering & Construction leverages its official website and a robust digital presence as primary channels to communicate its diverse offerings, ongoing projects, and commitment to sustainability. This digital footprint is crucial for global stakeholder engagement, talent acquisition, and establishing corporate visibility. In 2024, the company continued to emphasize its digital platforms to showcase its extensive portfolio, including major infrastructure and plant projects worldwide.

- Website Reach: GS E&C's website is a key resource for detailed project information, financial reports, and corporate news, attracting a significant volume of international visitors seeking insights into their global operations.

- Digital Engagement: The company actively uses social media and other digital channels to highlight its technological advancements, ESG initiatives, and corporate social responsibility efforts, fostering a transparent and accessible image.

- Talent Attraction: A well-maintained digital presence, including career portals and company profiles, is instrumental in attracting top engineering and construction talent globally, showcasing GS E&C as an employer of choice.

- Investor Relations: Digital platforms provide timely updates and comprehensive information for investors, facilitating informed decision-making and maintaining confidence in the company's financial performance and strategic direction.

GS Engineering & Construction utilizes a multi-faceted channel strategy, combining direct client engagement through dedicated sales teams with broad market reach via public tender platforms. This dual approach ensures both targeted relationship building for high-value projects and widespread visibility for competitive bidding opportunities.

The company also leverages its global network of international branches and subsidiaries to foster local market understanding and client relationships, further amplified by active participation in industry events and a strong digital presence.

In 2024, GS E&C's direct sales and business development efforts were instrumental in securing overseas contracts exceeding $2 billion, demonstrating the efficacy of their client-centric approach.

GS Engineering & Construction's channel strategy is designed to maximize project acquisition across diverse global markets, ensuring robust engagement with potential clients and partners through both direct outreach and broad market participation.

| Channel | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales & Business Development | Proactive client engagement, relationship building with government and private industry leaders. | Secured over $2 billion in overseas contracts, including a major petrochemical plant expansion. |

| Public & Private Tender Platforms | Primary gateway for securing major infrastructure and industrial development projects. | Strategic engagement in a global infrastructure market valued at approximately $13.5 trillion. |

| Global Network of Offices/Subsidiaries | Cultivating local presence, understanding regional dynamics, and direct overseas client engagement. | Contributed significantly to overseas revenue and expanding global project pipeline. |

| Industry Gatherings & Exhibitions | Brand visibility, lead generation, networking, and showcasing innovations. | Facilitated key networking engagements leading to significant international contract wins. |

| Digital Presence (Website, Social Media) | Communicating offerings, projects, sustainability, talent acquisition, and investor relations. | Showcased extensive portfolio and technological advancements to a global audience. |

Customer Segments

Government and public sector entities, including national and local administrations and state-owned enterprises, represent a crucial customer segment for GS Engineering & Construction. These clients primarily engage GS E&C for substantial infrastructure development, encompassing projects like highways, high-speed rail networks, port expansions, advanced water treatment plants, and significant public facilities. In 2024, governments worldwide continued to prioritize infrastructure spending to stimulate economic growth and improve public services, with global infrastructure investment projected to reach trillions of dollars. GS E&C's ability to deliver complex, large-scale projects reliably makes them a preferred partner for these critical national development initiatives.

Major industrial corporations, particularly those in the oil and gas, petrochemicals, and power generation industries, represent a core customer segment for GS Engineering & Construction. These clients demand highly specialized Engineering, Procurement, and Construction (EPC) capabilities for the development of large-scale, complex industrial facilities. For instance, in 2024, global capital expenditure in the oil and gas sector was projected to reach over $500 billion, highlighting the substantial project opportunities within this market.

Private real estate developers, focused on substantial residential and commercial ventures like skyscrapers and mixed-use complexes, represent a key customer segment for GS Engineering & Construction. These developers value GS E&C's proven track record in delivering high-quality construction and efficient project timelines. In 2024, the global construction market, particularly in real estate development, experienced robust activity, with significant investment in urban regeneration projects.

Environmental and Renewable Energy Companies

Environmental and Renewable Energy Companies represent a key customer segment for GS Engineering & Construction, driven by the global imperative for sustainability. This group includes entities focused on developing and operating critical environmental infrastructure, such as advanced waste treatment facilities and water purification plants. For instance, the global wastewater treatment market was valued at approximately USD 270 billion in 2023 and is projected to grow significantly, reflecting strong demand for such projects.

Furthermore, this segment actively pursues renewable energy projects, encompassing solar, wind, and other clean energy sources. GS E&C's expertise in constructing large-scale renewable energy installations, including offshore wind farms and solar power plants, directly addresses their needs. The renewable energy sector saw substantial investment in 2024, with global clean energy investment reaching an estimated USD 2 trillion, highlighting the immense opportunities within this domain.

- Waste Treatment Facilities: Clients requiring advanced solutions for municipal and industrial waste management.

- Renewable Energy Projects: Companies investing in solar, wind, geothermal, and other clean energy generation infrastructure.

- Green Building and Infrastructure: Organizations seeking sustainable construction practices and eco-friendly development.

- Environmental Remediation Services: Clients needing expertise in cleaning up contaminated sites and restoring ecosystems.

International Organizations and Agencies

GS Engineering & Construction serves international organizations and agencies that undertake large-scale infrastructure and development projects across the globe. These clients, including entities like the World Bank or major multinational development corporations, require partners with proven global expertise and a strong track record in diverse regulatory landscapes.

These organizations often prioritize partners who can demonstrate adherence to stringent international quality and safety standards. For instance, in 2024, many global development projects funded by international bodies emphasized sustainability and resilience, requiring contractors like GS E&C to meet specific environmental and social governance (ESG) criteria.

- Global Reach: Ability to execute projects in multiple countries, navigating varied legal and logistical challenges.

- International Standards: Compliance with global quality, safety, and environmental certifications is paramount.

- Project Scale: Capacity to manage and deliver complex, large-magnitude construction and engineering endeavors.

- Financial Stability: Robust financial health to undertake and complete projects without disruption.

GS Engineering & Construction also targets private sector clients involved in building and managing large-scale industrial facilities. This includes companies in sectors such as oil and gas, petrochemicals, and power generation, which require highly specialized EPC services for complex projects. In 2024, global capital expenditure in the oil and gas sector alone was projected to exceed $500 billion, underscoring the significant market opportunities for GS E&C's specialized capabilities.

| Customer Segment | Key Needs | 2024 Market Relevance |

|---|---|---|

| Industrial Corporations (Oil & Gas, Petrochemicals, Power) | Specialized EPC services for large-scale, complex facilities | Global oil & gas capex projected over $500 billion |

| Private Real Estate Developers | High-quality construction, efficient project timelines for residential and commercial ventures | Robust global real estate development activity |

| Environmental & Renewable Energy Companies | Sustainable infrastructure, clean energy generation (solar, wind) | Global clean energy investment estimated at $2 trillion |

| International Organizations & Agencies | Global expertise, adherence to international standards, large-scale project management | Emphasis on ESG criteria in global development projects |

Cost Structure

The largest portion of GS Engineering & Construction's cost structure is made up of direct costs tied to individual projects. This includes the wages paid to their construction workforce, the cost of acquiring raw materials like steel and concrete, and payments made to specialized subcontractors for tasks such as electrical or plumbing work.

These direct project costs are highly variable, directly influenced by the size and complexity of each undertaking. For instance, a large-scale infrastructure project will naturally incur higher labor and material expenses than a smaller building development. Market prices for essential inputs also play a significant role; a surge in steel prices in 2024, for example, would directly increase the cost of materials for ongoing projects.

GS Engineering & Construction's cost structure heavily features expenses tied to its extensive fleet of heavy equipment and machinery. This includes not only the initial purchase price but also ongoing costs for maintenance, repairs, and the inevitable depreciation of these valuable assets. For instance, in 2024, the company likely allocated a significant portion of its capital expenditure towards acquiring or upgrading specialized machinery essential for large-scale infrastructure projects.

Effective fleet management is paramount to controlling these costs. By implementing rigorous preventative maintenance schedules and optimizing the utilization of each piece of equipment, GS E&C aims to reduce unexpected breakdowns and extend the operational life of its assets. This proactive approach directly impacts profitability by minimizing costly downtime and maximizing the return on investment for its machinery portfolio.

GS Engineering & Construction significantly invests in Research and Development (R&D) to foster technological advancement, refine existing processes, and explore new business avenues. These costs are a critical component of their overall expense structure, underpinning their commitment to innovation in the construction sector.

In 2023, GS E&C's R&D spending was approximately ₩350 billion (roughly $260 million USD), a substantial figure reflecting their dedication to developing cutting-edge construction methods and sustainable building technologies. This investment is vital for maintaining a competitive edge and driving future growth.

Administrative and Overhead Costs

GS Engineering & Construction's administrative and overhead costs encompass essential functions like corporate staff salaries, office rent, utilities, and IT infrastructure. These expenses are crucial for smooth operations and represent a significant portion of the company's overall expenditures. For instance, in 2024, companies in the construction sector often see administrative costs range from 5% to 15% of total revenue, depending on project complexity and scale.

- General Administrative Expenses: Includes salaries for executive, finance, HR, and legal departments.

- Office and Facilities: Covers rent for corporate headquarters, maintenance, and utilities.

- IT and Technology: Investment in software, hardware, and cybersecurity to support operations.

- Compliance and Legal: Costs associated with regulatory adherence and legal counsel.

Financing Costs and Project Guarantees

Financing costs, primarily interest on loans for large, capital-intensive projects, represent a significant expense for GS Engineering & Construction. These costs can fluctuate with market interest rates and the company's creditworthiness. For instance, in 2024, global interest rates remained a key consideration for project financing strategies.

Project guarantees and insurance premiums also add to the cost structure. These are essential for mitigating risks associated with project execution, completion, and performance, especially in long-cycle projects common in the construction sector. The cost of these instruments directly impacts project profitability.

- Significant Interest Expenses: GS Engineering & Construction's substantial borrowing for large-scale projects in 2024 meant that interest payments were a major component of its financing costs.

- Guarantee and Insurance Premiums: The cost of performance bonds, advance payment guarantees, and various insurance policies for major infrastructure projects in 2024 contributed directly to overheads.

- Risk Mitigation Costs: These expenses are unavoidable as they safeguard against potential project delays, cost overruns, and contractual defaults, which are inherent in the industry.

- Impact on Profitability: Effective financial management in sourcing capital and negotiating guarantee terms is crucial for controlling these costs and maintaining healthy profit margins.

GS Engineering & Construction's cost structure is dominated by direct project expenses, including labor, materials, and subcontractors. These costs are variable, directly tied to project scope and market prices, as seen with steel price fluctuations impacting material expenses in 2024. The company also incurs significant costs related to its heavy equipment fleet, encompassing purchase, maintenance, and depreciation, with capital expenditure in 2024 likely focused on machinery upgrades for major projects.

Beyond project-specific outlays, administrative and overhead expenses are substantial, covering salaries, office operations, and IT infrastructure, with construction sector administrative costs typically ranging from 5% to 15% of revenue in 2024. Financing costs, particularly interest on loans for large projects, and risk mitigation expenses like guarantees and insurance premiums are also critical components. For example, GS E&C's substantial borrowing in 2024 meant interest payments were a major financing cost, and premiums for performance bonds and insurance policies added to overheads.

| Cost Category | Description | 2024 Relevance/Example |

|---|---|---|

| Direct Project Costs | Labor, materials (steel, concrete), subcontractors | Variable based on project size; impacted by 2024 material price volatility |

| Equipment Costs | Purchase, maintenance, depreciation of heavy machinery | Capital expenditure for fleet upgrades in 2024 for large infrastructure projects |

| Administrative & Overhead | Salaries, rent, utilities, IT, legal | Estimated 5-15% of revenue in construction sector for 2024 |

| Financing Costs | Interest on loans for capital-intensive projects | Significant due to substantial borrowing in 2024; influenced by global interest rates |

| Risk Mitigation | Project guarantees, insurance premiums | Essential for large projects; premiums for bonds and policies in 2024 added to costs |

Revenue Streams

GS E&C's primary revenue comes from substantial Engineering, Procurement, and Construction (EPC) project contracts. These are frequently structured as lump-sum deals, where a fixed price is agreed upon, or cost-plus arrangements, where GS E&C is reimbursed for all project costs plus an additional fee.

These large-scale projects span industrial plants, critical infrastructure development, and significant building constructions. For instance, in 2024, GS E&C secured major orders in sectors like petrochemicals and renewable energy infrastructure, contributing significantly to their order backlog.

Revenue recognition for these EPC contracts is typically tied to project milestones. As GS E&C successfully completes defined stages of a project, such as design completion or a certain percentage of construction, they receive payments, creating a predictable, albeit project-dependent, revenue flow.

GS Engineering & Construction generates significant revenue from selling both residential and commercial properties it develops. This includes its well-known 'Xi' brand of apartments and housing complexes, as well as various commercial real estate projects.

The success of this revenue stream is directly tied to market conditions, the prevailing property values, and the company's ability to efficiently complete and deliver these properties to buyers. For instance, in 2024, the real estate market showed resilience, with GS E&C reporting strong sales figures for its new residential developments, contributing substantially to its overall financial performance.

Post-construction, GS Engineering & Construction (GS E&C) taps into maintenance and operation service fees, particularly for complex projects like plants and infrastructure. This generates a predictable, recurring revenue stream. For instance, in 2023, GS E&C reported significant revenue from its plant division, a segment where such service contracts are common.

Project Financing and Development Fees

GS Engineering & Construction (GS E&C) can generate revenue through project financing and development fees, particularly in infrastructure projects that involve private capital. These fees are often tied to the company's involvement in structuring and securing the necessary financial backing for these ventures.

This revenue stream can also encompass equity participation, where GS E&C invests its own capital into projects. The subsequent returns on this equity, realized through project completion and operation, contribute to this revenue category. For instance, in 2023, GS E&C actively pursued overseas projects, with a notable focus on infrastructure development, suggesting a continued emphasis on these fee-based and equity-linked revenue streams.

- Project Financing Fees: Revenue earned for arranging and managing the financial aspects of large-scale projects, often involving complex debt and equity structures.

- Development Services: Fees collected for providing expertise in project planning, feasibility studies, and early-stage development activities.

- Equity Participation Returns: Profits generated from GS E&C's direct investment in projects, realized upon successful project completion or divestment.

- Infrastructure Focus: A significant portion of these revenues is likely derived from GS E&C's involvement in global infrastructure development, a sector known for its reliance on sophisticated project financing.

Technology Licensing and Consulting Services

GS Engineering & Construction leverages its developed proprietary technologies and deep industry expertise to create additional revenue streams. This involves licensing its innovative construction methods, materials science advancements, or project management software to other firms within the global construction and engineering landscape.

Furthermore, the company offers specialized consulting services, sharing its accumulated knowledge and best practices. This can range from advising on complex project execution and risk management to providing technical solutions for challenging engineering problems.

- Technology Licensing: GS E&C can generate income by allowing other companies to use its patented construction techniques or advanced software platforms.

- Consulting Services: The company provides expert advice on project management, engineering solutions, and operational efficiency to clients in the construction sector.

- Knowledge Transfer: This revenue model capitalizes on the company's R&D investments and practical experience, turning intellectual property into tangible income.

GS Engineering & Construction's revenue streams are diverse, primarily driven by large-scale EPC contracts, real estate sales, and post-construction services.

In 2024, GS E&C reported robust performance in its core EPC business, securing significant orders in petrochemicals and renewable energy, bolstering its order backlog and future revenue potential.

The company also benefits from property development, with its residential brands like 'Xi' performing well in the resilient 2024 real estate market, and recurring income from maintenance and operation services for its completed projects.

Additionally, GS E&C earns fees from project financing and development services, often linked to its investments in overseas infrastructure projects, reflecting a strategic focus on these lucrative areas.

| Revenue Stream | Description | 2024 Relevance/Example |

|---|---|---|

| EPC Contracts | Lump-sum and cost-plus agreements for construction projects. | Secured major orders in petrochemicals and renewable energy infrastructure. |

| Real Estate Sales | Development and sale of residential (e.g., Xi brand) and commercial properties. | Strong sales figures for new residential developments in a resilient market. |

| Maintenance & Operations | Service fees for upkeep of plants and infrastructure. | Contributes to predictable, recurring revenue, particularly from plant division. |

| Project Financing & Development Fees | Fees for structuring and securing financing, including equity participation. | Active pursuit of overseas infrastructure projects suggests continued emphasis. |

Business Model Canvas Data Sources

The GS Engineering & Construction Business Model Canvas is built upon a foundation of extensive market research, internal operational data, and financial projections. These sources ensure a comprehensive understanding of customer needs, competitive landscapes, and cost structures.