GS Engineering & Construction Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GS Engineering & Construction Bundle

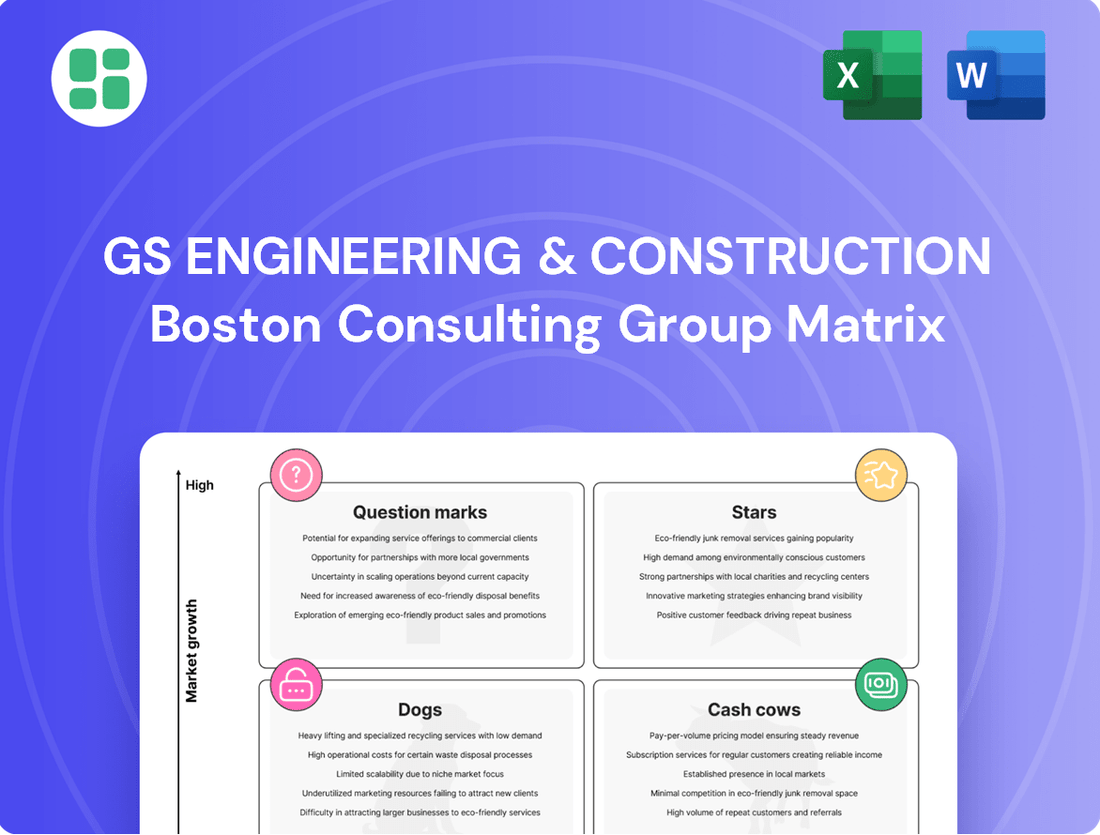

Curious about GS Engineering & Construction's strategic positioning? This glimpse into their BCG Matrix reveals potential Stars, Cash Cows, Dogs, and Question Marks, offering a crucial overview of their product portfolio's market performance.

Unlock the full potential of this analysis by purchasing the complete GS Engineering & Construction BCG Matrix. Gain access to detailed quadrant placements, data-driven insights, and actionable recommendations to optimize your investment and product strategies.

Don't miss out on the complete picture! Secure the full BCG Matrix report today and equip yourself with the strategic clarity needed to navigate the competitive landscape and make informed decisions for GS Engineering & Construction's future success.

Stars

GS Engineering & Construction is making significant strides in renewable energy infrastructure development, a sector poised for substantial expansion. South Korea's commitment to green energy, evident in its robust investments in offshore wind farms and other sustainable projects, provides a fertile ground for GS E&C's growth. This strategic focus positions the company to capitalize on the global energy transition, with joint venture partnerships further strengthening its market presence in this high-potential area.

Environmental Plant Solutions, a key component of GS Engineering & Construction's (GS E&C) portfolio, is a strong contender in the BCG matrix, likely positioned as a Star. The global demand for sophisticated environmental infrastructure, encompassing water treatment and hazardous waste management, is on a significant upward trajectory. This growth is fueled by increasingly stringent environmental regulations and a heightened awareness of ecological preservation.

GS E&C's established proficiency in this sector is underscored by substantial project achievements. For instance, their involvement in the Saudi Arabian hazardous waste treatment facility highlights their capability to secure and execute large-scale environmental projects. This success translates into a notable market share within a rapidly expanding market segment.

The financial performance of GS Inima, GS E&C's profitable environmental subsidiary, further validates the strength and potential of their Environmental Plant Solutions business. In 2023, GS Inima reported revenues of approximately KRW 1.6 trillion, demonstrating robust operational success and market penetration in the environmental services sector.

Overseas Oil & Gas and Petrochemical Plant EPC stands as a significant player for GS Engineering & Construction. While established markets may show slower expansion, lucrative, large-scale EPC projects in key overseas locations, especially the Middle East, present substantial growth prospects for GS E&C's plant division.

The company's capability to secure major contracts, exemplified by the $1.22 billion Saudi Aramco project, underscores its prominent market position and its success in winning substantial portions of these high-value international undertakings.

Liquefied Natural Gas (LNG) Terminal Construction

GS Engineering & Construction (GS E&C) demonstrates a robust position in the Liquefied Natural Gas (LNG) terminal construction sector, a key component of their business portfolio. This specialized area benefits from a long history of successful project execution and a significant competitive advantage.

In 2024, GS E&C secured a substantial 600 billion won project, underscoring the continued demand for their expertise. This demand is driven by global efforts to diversify energy sources and bolster energy security, allowing GS E&C to maintain a leading market share within this growing niche.

- Market Leadership: GS E&C is a recognized leader in LNG terminal construction.

- Project Wins: A 600 billion won project was secured in 2024, highlighting strong market traction.

- Demand Drivers: Global energy diversification and security needs fuel consistent demand for LNG infrastructure.

- Competitive Edge: Extensive experience makes GS E&C a preferred contractor in this specialized field.

Smart City and Advanced Urban Infrastructure

South Korea's commitment to smart city initiatives, including substantial investments in advanced urban infrastructure and transportation, paints a picture of a rapidly expanding market. This focus on urban resilience and future-proofing is a key driver for growth.

GS Engineering & Construction (GS E&C) is strategically positioned to capitalize on these trends. Their participation in significant infrastructure projects and a clear emphasis on developing new growth avenues demonstrate a proactive approach to increasing their footprint in these forward-looking urban development sectors.

- Smart City Investment: South Korea allocated approximately ₩1.1 trillion (around $830 million USD) in 2024 towards smart city projects, focusing on areas like intelligent transportation systems and sustainable urban planning.

- GS E&C's Infrastructure Portfolio: In 2023, GS E&C secured contracts worth over ₩5 trillion (approximately $3.75 billion USD) for various infrastructure developments, including smart transportation networks.

- Urban Resilience Focus: The company is actively pursuing projects that enhance urban resilience, such as smart grid development and advanced water management systems, aligning with the government's national resilience goals.

- Market Share Expansion: GS E&C's strategic investments in R&D for smart city technologies aim to secure and grow its market share, projecting a potential 15% increase in revenue from smart urban solutions by 2026.

GS Engineering & Construction's (GS E&C) Environmental Plant Solutions, particularly its water treatment and waste management capabilities, strongly align with the characteristics of a Star in the BCG matrix. The global market for these services is experiencing robust growth, driven by stricter environmental regulations and increasing global awareness of sustainability. GS E&C's proven track record, exemplified by its involvement in significant international projects, solidifies its leading position in this expanding sector.

What is included in the product

This BCG Matrix overview analyzes GS Engineering & Construction's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide strategic decisions.

The GS Engineering & Construction BCG Matrix provides a clear, actionable overview of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

GS Engineering & Construction's domestic residential and redevelopment housing segment, despite a recent market slowdown and issues with high-cost legacy projects, continues to be a vital revenue stream. This division represents a substantial portion of the company's overall sales, underscoring its importance as a core business.

The company holds a robust market position in lucrative redevelopment and reconstruction projects, particularly in major urban centers such as Seoul and Busan. These projects are crucial for maintaining GS E&C's presence in key growth areas and capitalizing on urban renewal trends.

This segment is characterized by its ability to generate consistent, albeit mature, cash flows. For instance, in 2023, GS E&C reported significant contributions from its housing and construction projects, with the residential sector being a primary driver of its domestic revenue, even amidst broader economic headwinds.

GS Engineering & Construction's established civil engineering projects, such as roads, bridges, and ports, represent a significant Cash Cow. This segment leverages the company's deep-rooted expertise in a mature but vital domestic infrastructure market, ensuring a reliable stream of revenue.

These traditional civil works, while experiencing lower growth, offer stable earnings and a commanding market share, a testament to GS E&C's strong reputation and vast project history. Investments in supporting infrastructure further bolster operational efficiency within this segment.

GS Engineering & Construction's core petrochemical plant construction and maintenance services are a classic Cash Cow. This segment benefits from decades of experience, leading to consistent revenue generation and healthy profit margins. The company's established reputation and strong client relationships minimize the need for heavy marketing spend, allowing for efficient capital deployment.

In 2024, the global petrochemical construction market is projected to reach approximately $200 billion, with maintenance services representing a substantial portion. GS E&C's long-standing presence in this stable market allows it to leverage its existing assets and expertise effectively, ensuring reliable financial returns without requiring significant new investment.

General Commercial and Industrial Building Construction

The General Commercial and Industrial Building Construction segment for GS Engineering & Construction (GS E&C) operates as a Cash Cow. Mature markets offer a consistent demand for constructing commercial complexes, office spaces, and industrial facilities. GS E&C’s extensive experience and broad capabilities have secured a significant market share in this area.

This segment generates a steady stream of cash flow. While the market itself exhibits relatively low growth, GS E&C’s strong position ensures reliable financial contributions, bolstering the company's overall stability. For instance, GS E&C secured major projects in 2024, including significant urban development and industrial facility expansions, underscoring their continued dominance in this sector.

- Steady Cash Generation: The mature nature of commercial and industrial construction provides predictable revenue streams.

- High Market Share: GS E&C's established reputation and capabilities lead to a dominant position in this segment.

- Low Market Growth: While demand is stable, the overall market growth rate is modest, characteristic of a Cash Cow.

- Financial Stability: This segment reliably supports the company's financial health and funding for other ventures.

Long-Term Operation and Maintenance (O&M) Contracts

Long-term Operation and Maintenance (O&M) contracts represent a crucial Cash Cow for GS Engineering & Construction. These agreements, often spanning decades after initial project completion, tap into the company's expertise in managing complex infrastructure like power plants and industrial facilities. The stability of these contracts provides a predictable revenue stream, allowing GS E&C to capitalize on its established presence and technical capabilities.

These O&M services typically operate within a mature, low-growth market segment. However, their value lies in the consistent and substantial cash flow they generate, often with high profit margins due to optimized operations and economies of scale. This allows GS E&C to effectively 'milk' these established assets for ongoing returns.

For instance, GS E&C's involvement in major infrastructure projects globally, such as the construction and subsequent maintenance of power generation facilities, exemplifies this strategy. In 2024, the company continued to secure and renew such long-term O&M agreements, contributing significantly to its financial stability.

- Stable Revenue: O&M contracts offer predictable, recurring income, insulating the company from project-specific volatilities.

- High Margins: Leveraging existing infrastructure and expertise leads to efficient operations and strong profitability.

- Mature Market: While growth is limited, the established nature of these services ensures consistent demand.

- Cash Flow Generation: These contracts are designed to maximize passive income from completed projects.

GS Engineering & Construction's established civil engineering projects, like roads and bridges, are prime examples of Cash Cows. These are mature, stable markets where the company holds a strong position, generating reliable revenue. Their deep expertise ensures consistent cash flow without requiring substantial new investment.

The company's core petrochemical plant construction and maintenance services also function as Cash Cows. With decades of experience and strong client relationships, GS E&C enjoys consistent revenue and healthy profit margins in this stable global market. The global petrochemical construction market is projected to be around $200 billion in 2024, with maintenance being a significant part.

Furthermore, the General Commercial and Industrial Building Construction segment provides steady cash flow due to consistent demand in mature markets. GS E&C's strong market share in this area, evidenced by securing major urban development and industrial expansion projects in 2024, solidifies its Cash Cow status.

Long-term Operation and Maintenance (O&M) contracts for infrastructure like power plants are also key Cash Cows. These provide predictable, recurring income with high profit margins, leveraging existing assets and expertise for consistent financial returns.

| Segment | BCG Category | Key Characteristics | 2024 Relevance |

|---|---|---|---|

| Civil Engineering Projects | Cash Cow | Mature market, strong market share, stable revenue | Reliable income from essential infrastructure |

| Petrochemical Plant Construction & Maintenance | Cash Cow | Established expertise, consistent revenue, healthy margins | Leveraging $200 billion global market for stable returns |

| Commercial & Industrial Building Construction | Cash Cow | Consistent demand, high market share, steady cash flow | Securing major projects in urban and industrial sectors |

| Operation & Maintenance (O&M) Contracts | Cash Cow | Predictable income, high margins, asset leverage | Maximizing returns from long-term infrastructure management |

Preview = Final Product

GS Engineering & Construction BCG Matrix

The preview you're currently viewing is the exact GS Engineering & Construction BCG Matrix report you will receive upon purchase. This comprehensive document, meticulously crafted with industry-standard analysis, is delivered in its final, unwatermarked form, ready for immediate strategic application.

Rest assured, the GS Engineering & Construction BCG Matrix presented here is the identical, fully polished report you'll download after completing your purchase. It's designed for clarity and actionable insights, providing a professional-grade tool for your business planning needs without any hidden surprises or demo content.

Dogs

GS Elevator is a clear 'Dog' in GS Engineering & Construction's BCG Matrix. The company has been experiencing continuous operating losses, highlighting its weak market position. For instance, in 2023, GS Elevator reported a net loss, underscoring its struggle to achieve profitability.

GS E&C is actively pursuing the sale of GS Elevator due to its persistent underperformance and inability to capture substantial market share within the intensely competitive South Korean elevator sector. This strategic move aims to free up capital that has been tied up in a venture failing to generate the anticipated returns.

GS Engineering & Construction's strategy explicitly targets exiting low-profit ventures that haven't achieved desired market share. This points to a segment of niche businesses or specific project types within their portfolio that are currently underperforming.

These underperforming ventures, while potentially small in scale, divert crucial financial and managerial resources. They fail to contribute significantly to the company's overall profitability or strengthen its market standing, making them a drag on performance.

The clear directive is divestment for these underperforming niche ventures. This approach aims to streamline the company's operations and reallocate resources to more promising areas. For example, in 2023, GS E&C reported a net profit of ₩208.6 billion, highlighting the importance of optimizing the portfolio for better overall financial health.

High-cost legacy housing projects, particularly those presold in 2021, have significantly impacted GS Engineering & Construction. These projects have resulted in elevated cost ratios, contributing to a noticeable drag on operating profit in 2024.

These legacy developments are essentially cash cows, but in a negative sense, draining resources due to their unfavorable cost structures. Their contribution to overall revenue is projected to decline sharply in 2025, further highlighting their diminishing strategic importance.

Outdated or Less Efficient Construction Technologies

Outdated or less efficient construction technologies, while still utilized in some segments, are increasingly finding themselves in the Dogs quadrant of the BCG Matrix. In 2024, the global construction market is heavily influenced by demands for speed, sustainability, and digitalization. Traditional methods, often characterized by manual labor and slower on-site assembly, struggle to keep pace with these evolving expectations.

These older technologies can lead to lower profit margins due to inefficiencies, longer project timelines, and higher labor costs compared to modular or prefabrication techniques. For instance, a significant portion of construction projects still rely on conventional concrete pouring, which is more time-consuming and resource-intensive than precast concrete elements. This can result in GS Engineering & Construction facing challenges in maintaining competitiveness and market share for projects where these older methods are prevalent.

The consequence is a decline in market relevance and profitability. As the industry shifts towards greener building practices and smart construction, technologies that don't integrate digital tools or sustainable materials become less attractive to clients. This stagnation can turn these business units into cash traps, consuming resources without generating substantial returns or growth potential.

- Low Profitability: Traditional methods often yield lower profit margins due to inefficiencies and extended project durations.

- Declining Market Share: Inability to compete with faster, greener, and digitally integrated construction technologies leads to a loss of market position.

- Cash Trap Potential: Continued investment in outdated technologies without significant returns can drain financial resources.

- Limited Innovation: These technologies offer less scope for incorporating advancements like AI or IoT in construction processes.

Highly Commoditized Small-Scale Domestic Subcontracts

Engaging in small-scale, highly commoditized domestic subcontracting presents a classic 'Dog' scenario for GS Engineering & Construction. The intense competition inherent in these markets, often characterized by numerous small players, drives down profit margins significantly. For instance, in 2024, the average margin for small domestic construction subcontracts in South Korea hovered around 3-5%, a stark contrast to the 10-15% seen in more specialized or international projects.

These low-margin activities can become a drain on resources, diverting capital, skilled labor, and management attention away from more lucrative and strategically aligned ventures. In 2024, GS E&C's reported operating profit margin was 6.2%, indicating that any segment performing below this average, such as highly commoditized subcontracts, would likely be a drag on overall profitability. Such segments typically struggle to achieve profitability, often breaking even or incurring minor losses, thus failing to contribute meaningfully to the company's growth objectives.

- Low Profitability: Margins in these segments are typically in the low single digits, often failing to cover overheads adequately.

- Resource Diversion: Time, capital, and expertise are consumed by projects with minimal strategic or financial return.

- Intense Competition: A crowded market with many small, undifferentiated players erodes pricing power.

- Limited Growth Potential: These are typically mature markets with little room for expansion or value creation.

GS Engineering & Construction's portfolio includes ventures that fit the 'Dog' category in the BCG Matrix, characterized by low market share and low growth potential. These segments often struggle with profitability and can consume valuable resources without generating significant returns.

These 'Dogs' represent areas where GS E&C is either divesting, like GS Elevator, or facing challenges due to outdated technologies or highly commoditized markets. The company's strategy focuses on exiting or streamlining these underperforming units to improve overall financial health and reallocate capital to more promising ventures.

| Business Segment | BCG Category | Key Characteristics | 2023/2024 Data Point |

| GS Elevator | Dog | Continuous operating losses, weak market position, actively being sold. | Reported net loss in 2023. |

| Outdated Construction Technologies | Dog | Lower profit margins due to inefficiencies, declining market relevance. | Projects relying on conventional concrete pouring are more time-consuming and resource-intensive. |

| Small-Scale Domestic Subcontracting | Dog | Low profit margins (3-5% in 2024), intense competition, resource diversion. | GS E&C's overall operating profit margin was 6.2% in 2024. |

Question Marks

GS Engineering & Construction's foray into Urban Air Mobility (UAM) positions it as a 'Question Mark' in the BCG matrix. This sector is characterized by rapid technological advancement and evolving regulatory landscapes, with significant potential for future growth.

The company's recent MOU signifies a strategic move into this nascent, high-growth market. While the UAM market is projected to reach hundreds of billions of dollars globally by 2040, GS E&C's current market share is negligible, necessitating considerable investment to establish a strong presence and potentially transition to a 'Star' performer.

GS Engineering & Construction is actively pursuing advanced digitalization and AI integration within the Engineering, Procurement, and Construction (EPC) sector. Through strategic alliances, such as its collaboration with Honeywell, the company is pioneering the digitalization of plant operations, aiming for smarter, more efficient outcomes. This focus places GS E&C at the forefront of a high-growth technological wave in EPC.

While this technological frontier offers significant future potential, GS E&C's current market penetration in these specialized advanced digital solutions is likely modest. Consequently, substantial investment will be required to capture market share and drive widespread adoption of these innovative AI-driven capabilities.

GS Engineering & Construction's focus on new modular and prefabricated housing initiatives positions them within a burgeoning segment of the South Korean construction market. This sector is seeing substantial growth, driven by demand for faster, more cost-effective building solutions.

While GS E&C holds a strong overall market presence, their specific share and competitive standing in modular construction are still solidifying. This emerging area presents a significant opportunity, but also carries the risk of becoming a ‘Dog’ if market share doesn't grow substantially, necessitating strategic focus and investment.

Early-Stage Decarbonization and Hydrogen Energy Solutions

GS Engineering & Construction is actively investing in early-stage decarbonization and hydrogen energy solutions, recognizing their significant growth potential driven by global sustainability mandates. While these sectors represent high-growth opportunities, GS E&C's current market share in these emerging technologies is modest, necessitating substantial research and development alongside project capital to establish viability and achieve scalability.

- Market Position: GS E&C is entering nascent markets with high growth potential, aiming to capture market share in decarbonization and hydrogen.

- Investment Strategy: Significant R&D and project investment are crucial for GS E&C to prove the technological and economic feasibility of these early-stage solutions.

- Growth Drivers: Global sustainability goals and the increasing demand for green energy are key drivers for GS E&C's expansion in these areas.

- Competitive Landscape: The company faces competition from established players and other new entrants in the rapidly evolving clean energy sector.

Strategic Expansion into New Frontier Overseas Markets

GS Engineering & Construction's strategic expansion into new, frontier overseas markets, where they possess limited operational history and brand recognition, aligns with the characteristics of a Question Mark in the BCG Matrix. These endeavors demand significant upfront capital to establish a foothold and cultivate market share, often resulting in modest immediate returns. For instance, similar to their engagement with the Ho Chi Minh City master plan, these new market entries necessitate careful evaluation of potential risks and rewards.

These ventures are characterized by high growth potential but also carry inherent risks due to the absence of established operations and brand equity. GS E&C must invest heavily to build market presence, mirroring the approach needed for projects like the aforementioned Ho Chi Minh City development.

- High Growth Potential, Low Market Share: Entering nascent markets offers substantial future growth but requires significant investment to gain traction.

- Substantial Initial Investment: Building infrastructure, establishing supply chains, and marketing in new territories demand considerable capital outlay.

- Uncertainty of Success: The lack of a proven track record in these markets introduces a higher degree of risk compared to established regions.

- Strategic Importance: Despite immediate low returns, these markets can become future cash cows if strategic expansion is successful, similar to how early investments in emerging economies can pay off long-term.

GS Engineering & Construction's ventures into Urban Air Mobility (UAM), advanced digitalization in EPC, modular housing, decarbonization/hydrogen energy, and new overseas markets all represent 'Question Marks' in the BCG matrix. These areas offer high growth potential but currently have low market share for the company, requiring significant investment to develop and capture market share.

The company's strategic focus on these emerging sectors reflects a forward-looking approach to capitalize on future industry trends. However, the inherent uncertainty and substantial capital requirements mean these initiatives carry a higher risk profile compared to established business segments.

For example, the global UAM market is projected to reach approximately $1.5 trillion by 2040, yet GS E&C's current participation is in its infancy. Similarly, while sustainability investments are crucial, the hydrogen energy sector, while growing, still requires substantial technological and economic validation.

These 'Question Mark' segments demand careful management, with a clear strategy for investment, market penetration, and eventual transition to 'Star' or 'Cash Cow' status. Without successful development and market adoption, they also risk becoming 'Dogs'.

| Business Segment | BCG Category | Market Growth | GS E&C Market Share | Investment Need |

|---|---|---|---|---|

| Urban Air Mobility (UAM) | Question Mark | Very High (projected $1.5T by 2040) | Negligible | High |

| Digitalization in EPC | Question Mark | High | Modest | High |

| Modular Housing | Question Mark | High (in South Korea) | Solidifying | Medium to High |

| Decarbonization & Hydrogen Energy | Question Mark | Very High | Modest | High |

| New Overseas Markets | Question Mark | Variable (High potential) | Limited/None | High |

BCG Matrix Data Sources

Our GS Engineering & Construction BCG Matrix leverages comprehensive financial disclosures, detailed project performance data, and industry-specific market research to inform strategic decisions.