GS Engineering & Construction PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GS Engineering & Construction Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping GS Engineering & Construction's future. Our comprehensive PESTLE analysis provides the strategic intelligence you need to anticipate market shifts and identify growth opportunities. Download the full version now and gain a distinct advantage in your decision-making.

Political factors

Government investment in infrastructure is a major driver for GS Engineering & Construction (GS E&C). Increased spending on projects like high-speed rail, new highways, and renewable energy facilities directly boosts GS E&C's civil engineering and infrastructure divisions, creating substantial new order opportunities.

For instance, the South Korean government's commitment to national land development plans, including smart city initiatives and eco-friendly urban regeneration, provides a robust pipeline for GS E&C. These large-scale public works are essential for the company's revenue growth and long-term strategic planning.

The predictability of government infrastructure budgets is paramount. In 2024, global infrastructure spending is projected to reach trillions, with significant portions allocated to transportation and energy sectors, directly benefiting companies like GS E&C that specialize in these areas.

The South Korean construction sector operates under a rigorous regulatory framework, with the government emphasizing stringent safety and quality control measures. This is particularly relevant for companies like GS Engineering & Construction, which must adhere to these standards to maintain their operating licenses.

Following several high-profile construction accidents in recent years, regulatory bodies have intensified their oversight. For instance, in 2023, the Ministry of Land, Infrastructure and Transport announced stricter penalties, including potential business suspensions, for companies failing to meet safety protocols, impacting companies with lapses in oversight.

GS Engineering & Construction must proactively manage these evolving legal landscapes. Ensuring unwavering compliance with updated building codes and safety regulations is not just a matter of avoiding penalties but is crucial for safeguarding the company's reputation and its ability to secure future projects.

GS Engineering & Construction's global operations are deeply intertwined with the political stability of host nations. For instance, ongoing geopolitical tensions in regions where GS E&C has significant infrastructure projects can disrupt construction timelines and increase operational costs. A shift in international trade policies, such as new tariffs or sanctions, could directly impact the cost of imported materials, a critical factor for large-scale construction ventures.

The company's ability to secure and execute projects is also shaped by bilateral relations. Strong diplomatic ties between South Korea and countries like the United Arab Emirates, a key market for GS E&C with projects valued in the billions, can smooth the path for project approvals and foster a more predictable business environment. Conversely, strained diplomatic relations can introduce significant hurdles.

Government Housing Supply Policies

Government policies focused on increasing housing supply, especially in major urban centers, directly influence GS Engineering & Construction's (GS E&C) building and housing operations. For instance, South Korea's Ministry of Land, Infrastructure and Transport announced plans in early 2024 to accelerate urban regeneration projects, aiming to boost housing availability in Seoul and surrounding areas. This directly translates into a more predictable demand for GS E&C's expertise in residential construction and urban development.

Initiatives such as urban redevelopment and reconstruction, often bolstered by government subsidies or streamlined regulations, provide a consistent pipeline of work for companies like GS E&C. In 2024, the South Korean government continued to emphasize these types of projects, with an estimated 100,000 new housing units planned through redevelopment and reconstruction by 2025. This policy environment supports GS E&C's residential segment by creating a stable market for its construction services.

- Urban Redevelopment Focus: Government incentives for urban renewal projects, such as tax breaks and expedited permitting, directly benefit GS E&C's housing division.

- Supply-Side Stimulation: Policies aimed at increasing the overall housing stock, like those targeting metropolitan areas, create a favorable market for construction firms.

- Regulatory Environment: Easing of building regulations or zoning laws for specific housing projects can reduce development costs and timelines for GS E&C.

ESG Policy Integration and Support

Governments worldwide are increasingly mandating and incentivizing sustainable building practices, directly impacting construction firms like GS Engineering & Construction (GS E&C). This push for Environmental, Social, and Governance (ESG) integration means policies are shifting to favor companies that demonstrate strong environmental stewardship and social responsibility. For instance, South Korea, GS E&C's home market, has set ambitious decarbonization targets, which translate into policy support for green building technologies and energy-efficient construction.

GS E&C's proactive engagement with national ESG objectives, including its involvement in government-backed renewable energy projects and initiatives promoting low-carbon infrastructure, positions it favorably. This alignment can unlock preferential treatment in public tenders and create new avenues for business development in the burgeoning green construction sector. For example, the South Korean government's Green New Deal, launched in 2020, aims to create 1.94 million jobs by 2025 through investments in green infrastructure and renewable energy, a significant policy driver for companies like GS E&C.

- ESG Policy Integration: Governments are enacting policies that require or reward sustainable construction, influencing project selection and operational standards.

- Incentives for Green Building: Tax credits, subsidies, and favorable financing are becoming common for projects adhering to strict environmental standards.

- Decarbonization Targets: National climate goals, such as those in South Korea, drive demand for energy-efficient buildings and renewable energy infrastructure.

- Government Initiatives: Participation in national programs related to green energy and decarbonization can provide GS E&C with competitive advantages and new market opportunities.

Government policies significantly shape GS Engineering & Construction's (GS E&C) operational landscape. Increased public investment in infrastructure, particularly in transportation and renewable energy, directly fuels demand for GS E&C's services. For instance, the South Korean government's ongoing commitment to smart city development and urban regeneration projects provides a consistent pipeline of work.

Regulatory frameworks, especially concerning safety and quality, are critical. Stricter enforcement and penalties for non-compliance, as seen with intensified oversight following past accidents, necessitate robust adherence to evolving building codes. This focus on safety directly impacts operational costs and project execution for GS E&C.

Geopolitical stability and international relations also play a crucial role. Disruptions from regional tensions or shifts in trade policies can impact project timelines and material costs, while strong diplomatic ties, such as those between South Korea and the UAE, can facilitate smoother project approvals and a more predictable business environment.

Government initiatives aimed at increasing housing supply, such as urban redevelopment programs, directly benefit GS E&C's residential construction division. Policies supporting green building practices and decarbonization targets, like South Korea's Green New Deal, further create opportunities for companies aligning with these ESG objectives.

| Policy Area | Impact on GS E&C | Example/Data Point (2024/2025 Focus) |

|---|---|---|

| Infrastructure Investment | Increased project pipeline, revenue growth | Global infrastructure spending projected to exceed $2.5 trillion in 2024, with significant allocation to transportation and energy. |

| Regulatory Compliance | Increased operational costs, emphasis on safety protocols | South Korean government's stricter penalties for safety violations announced in 2023. |

| Geopolitical Relations | Project risk, material cost fluctuations | Bilateral ties with UAE, a key market for GS E&C, influence project execution. |

| Housing Policies | Demand for residential construction services | South Korea's early 2024 plan to accelerate urban regeneration, aiming for 100,000 new housing units by 2025. |

| ESG/Green Building | New market opportunities, competitive advantage | South Korea's Green New Deal aims to create 1.94 million jobs by 2025 through green infrastructure investment. |

What is included in the product

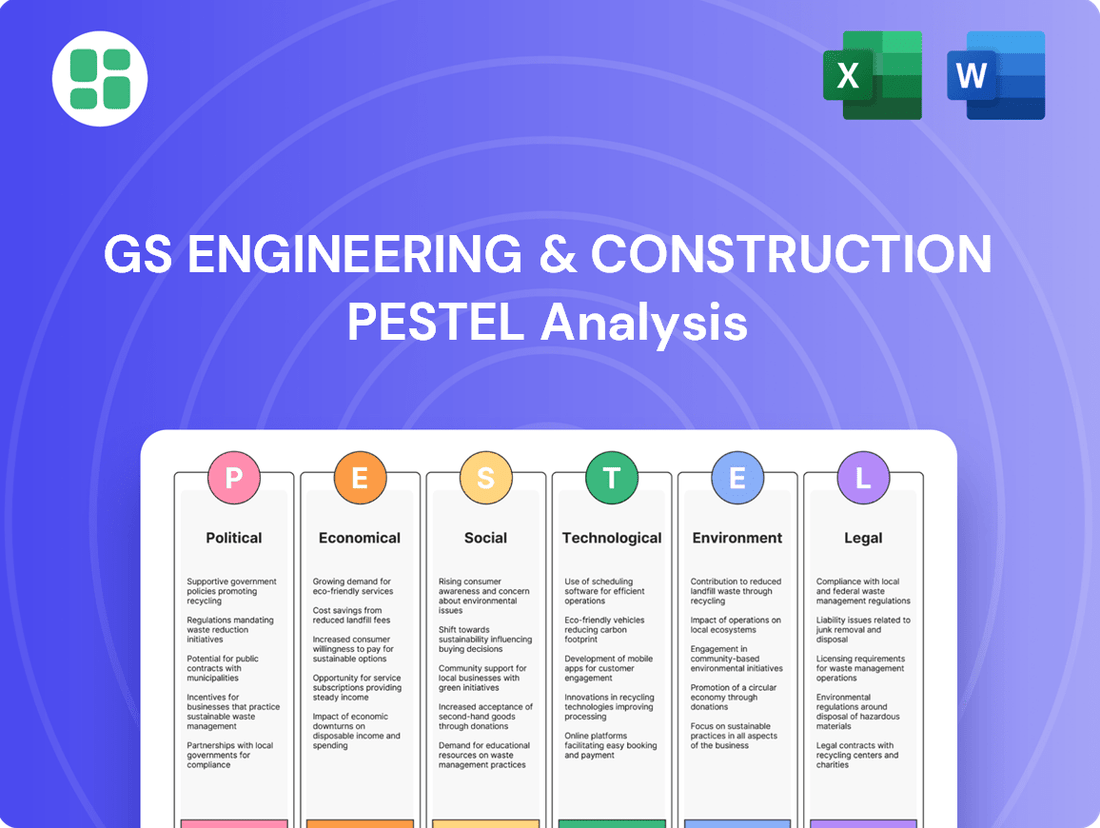

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing GS Engineering & Construction, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into market dynamics and regulatory landscapes, empowering strategic decision-making for stakeholders.

A concise, actionable GS Engineering & Construction PESTLE analysis that highlights key external factors to proactively address potential market disruptions and inform strategic decision-making.

Economic factors

The health of both the South Korean and global economies significantly influences the demand for GS Engineering & Construction's services. Robust economic expansion generally translates to higher investment in infrastructure, commercial properties, and housing, which directly benefits GS E&C's varied projects.

For instance, South Korea's GDP growth was projected to be around 2.2% in 2024, indicating a moderate but positive environment for domestic construction demand. Globally, while growth forecasts vary, a general trend of recovery in many regions supports international project opportunities for companies like GS E&C.

However, economic downturns or slowdowns can dampen project pipelines and intensify competition within the construction sector. A slowdown in global trade or investment could particularly impact GS E&C's overseas ventures, necessitating careful risk management and strategic diversification.

Fluctuations in interest rates directly impact the cost of capital for GS Engineering & Construction (GS E&C) and its clientele. For instance, the Bank of Korea maintained its benchmark interest rate at 3.50% through early 2024, a level that influences borrowing costs for major infrastructure and real estate developments.

Higher interest rates can significantly inflate project financing expenses, potentially leading to the postponement or cancellation of large-scale undertakings. This also affects the affordability of housing units for end-buyers, dampening demand in the residential construction sector.

Conversely, a reduction in interest rates, such as potential cuts anticipated in late 2024 or 2025, can act as a catalyst for increased investment. This stimulates construction activity by making it cheaper for both developers and consumers to finance projects and purchases.

The real estate market in South Korea, a key operational area for GS Engineering & Construction (GS E&C), significantly influences its financial performance. For instance, during the first half of 2024, while housing prices showed some stabilization, concerns about affordability persisted, with the housing cost burden ratio remaining a consideration for potential buyers.

Deterioration in housing market conditions, marked by reduced buyer interest or a surge in unsold inventory, directly impacts GS E&C's building and housing segments. A contraction in demand can lead to lower sales volumes and potentially affect project profitability.

Conversely, a robust recovery in the real estate sector, characterized by consistent presale activity and upward price trends, is vital for GS E&C's sustained revenue growth. As of late 2024, the market has seen a gradual increase in apartment presales, indicating a potential positive shift for developers like GS E&C.

Raw Material and Labor Costs

The fluctuating costs of essential materials like steel and cement, alongside labor expenses, significantly influence GS Engineering & Construction's (GS E&C) project profitability. For instance, the average price of rebar, a key steel product, saw considerable volatility in late 2023 and early 2024, impacting construction budgets. When these input costs rise, especially for projects with fixed pricing, it can result in budget overruns and reduced profit margins.

GS E&C's ability to manage its supply chain efficiently and plan its workforce strategically is crucial for navigating these economic challenges. The company's performance is directly tied to its capacity to secure materials at competitive prices and maintain a skilled, cost-effective labor force. Effective mitigation strategies are paramount to protect against these economic pressures.

- Steel Price Impact: Global steel prices, a major component for infrastructure projects, experienced fluctuations in 2024, directly affecting project cost estimations for GS E&C.

- Labor Cost Dynamics: Rising wages and the availability of skilled labor in key markets present ongoing economic considerations for GS E&C's operational expenses.

- Contractual Risk: Fixed-price contracts expose GS E&C to greater financial risk if raw material and labor costs escalate unexpectedly during project execution.

- Mitigation Strategies: Proactive procurement, long-term supplier agreements, and investments in workforce training are vital for GS E&C to buffer against cost volatility.

Foreign Exchange Rate Fluctuations

For GS Engineering & Construction, with its extensive global footprint, fluctuations in foreign exchange rates are a critical economic factor. These shifts directly affect the reported value of overseas earnings and expenses. For instance, a strengthening South Korean Won (KRW) can make GS E&C's projects abroad more expensive for foreign clients, potentially reducing their competitiveness, and also diminishes the value of profits when converted back into KRW.

Conversely, a weaker Won can provide a competitive edge for South Korean firms by making their bids more attractive in local currencies and increasing the repatriated value of foreign earnings. In 2024, the KRW experienced volatility, trading around 1,350 KRW per USD for much of the year, a level that can significantly influence the profitability of international contracts. Managing these currency risks through hedging strategies is therefore paramount for GS E&C's international project success and overall financial health.

- Impact on Revenue: A stronger KRW can decrease the KRW value of revenue earned in USD or other foreign currencies.

- Impact on Costs: Conversely, a weaker KRW can increase the KRW cost of imported materials or equipment for overseas projects.

- Competitiveness: Exchange rate movements influence the price competitiveness of GS E&C's bids in foreign markets.

- Hedging Importance: Effective currency risk management is essential to protect profit margins on international projects.

The overall economic climate, both domestically and internationally, directly shapes the demand for GS Engineering & Construction's services. Positive economic growth, as seen with South Korea's projected 2.2% GDP growth in 2024, typically stimulates investment in infrastructure and real estate, benefiting GS E&C's project pipeline. Conversely, economic slowdowns or global trade disruptions can negatively impact project opportunities and increase competition, requiring strategic diversification and risk management.

Interest rate policies, such as the Bank of Korea's stable 3.50% benchmark rate through early 2024, significantly influence project financing costs for GS E&C and its clients. Higher rates can deter large investments and reduce housing affordability, while anticipated rate cuts in late 2024 or 2025 could spur construction activity by lowering borrowing expenses.

The South Korean real estate market's health is crucial for GS E&C's building and housing segments. While housing prices showed stabilization in early 2024, affordability concerns persist, impacting buyer demand. A recovery in apartment presales, observed in late 2024, suggests a potential positive shift for the sector.

Fluctuations in raw material costs, like steel, and labor expenses directly affect GS E&C's profitability. For example, rebar price volatility in early 2024 impacted construction budgets, highlighting the need for efficient supply chain management and strategic workforce planning to mitigate cost overruns, especially in fixed-price contracts.

Foreign exchange rates, with the KRW trading around 1,350 KRW per USD in 2024, critically influence GS E&C's international earnings and competitiveness. A stronger Won can reduce the value of foreign profits and make bids less attractive, underscoring the importance of currency risk management through hedging strategies.

| Economic Factor | Impact on GS E&C | 2024/2025 Data/Trend |

|---|---|---|

| GDP Growth | Demand for construction services | South Korea: ~2.2% projected for 2024; Global: varied recovery trends. |

| Interest Rates | Cost of capital, project viability | Bank of Korea: 3.50% (early 2024); Potential cuts anticipated late 2024/2025. |

| Real Estate Market | Housing and building segment performance | Stabilizing prices with affordability concerns (early 2024); Gradual increase in apartment presales (late 2024). |

| Material & Labor Costs | Project profitability, budget management | Rebar price volatility (early 2024); Rising wages and skilled labor availability are ongoing considerations. |

| Exchange Rates | Value of foreign earnings, bid competitiveness | KRW/USD around 1,350 (2024); Volatility impacts profitability of international projects. |

What You See Is What You Get

GS Engineering & Construction PESTLE Analysis

The preview shown here is the exact GS Engineering & Construction PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting GS Engineering & Construction.

The content and structure shown in the preview is the same document you’ll download after payment, offering valuable insights for strategic planning.

Sociological factors

Continued urbanization, especially in developing economies and South Korea, fuels the need for new housing, offices, and infrastructure, directly benefiting construction firms like GS Engineering & Construction. In 2024, global urbanization rates are projected to continue their upward trend, with a significant portion of this growth occurring in Asia.

Shifting demographics, such as aging populations in developed nations and changing household sizes, impact the demand for specific construction types. For instance, an aging demographic might increase demand for specialized healthcare facilities and accessible senior living complexes, influencing GS E&C's project portfolio.

High-profile construction accidents can significantly erode public trust and damage a company's image. GS Engineering & Construction (GS E&C) faced this reality after a notable incident in Incheon, which led to a temporary halt in operations and increased scrutiny. This event underscores the critical importance of robust safety protocols in the construction industry.

Rebuilding and maintaining public confidence is essential for GS E&C's future success. By implementing and visibly demonstrating stringent safety measures, alongside transparent communication about their efforts, the company can work towards restoring its reputation. This commitment to safety is not just about regulatory compliance but is fundamental to securing future projects and safeguarding its brand value in the competitive market.

The global construction sector, including South Korea, is grappling with a significant shortage of skilled labor, exacerbated by an aging workforce. In 2024, reports indicated that nearly 40% of construction firms globally struggled to find enough qualified workers, a trend that directly impacts project timelines and costs.

For GS Engineering & Construction (GS E&C), addressing this challenge means prioritizing the attraction and retention of skilled professionals. This includes investing in robust workforce development programs and apprenticeships to build a pipeline of talent, ensuring they can meet the increasing demands of complex infrastructure and building projects throughout 2024 and into 2025.

Changing Lifestyle and Housing Preferences

Societal shifts are significantly reshaping how people want to live. There's a growing appetite for homes that are not just shelters but integrated living environments, incorporating smart technology and sustainable features. For instance, the global smart home market was valued at approximately $100 billion in 2023 and is projected to reach over $250 billion by 2028, indicating a strong consumer demand for connected living spaces. This trend directly impacts construction, pushing companies like GS Engineering & Construction to innovate in their residential projects.

GS E&C must align its development strategies with these evolving consumer desires. This includes offering more than just traditional housing; it means creating communities that cater to modern lifestyles, emphasizing energy efficiency and digital integration. The demand for sustainable building practices is also on the rise, with a growing number of consumers willing to pay a premium for eco-friendly homes. In 2024, green building materials are expected to see continued growth, driven by both regulatory support and consumer awareness.

- Smart Home Adoption: Consumer interest in automated and connected homes is a key driver, influencing the integration of IoT devices and digital infrastructure in new builds.

- Sustainability Focus: An increasing preference for energy-efficient designs, renewable energy sources, and eco-friendly materials is becoming a standard expectation.

- Urban Living Preferences: Demand for mixed-use developments that combine residential, commercial, and recreational spaces within a single complex is growing, offering convenience and community.

- Health and Wellness Design: Post-pandemic, there's a heightened emphasis on healthy living environments, including better air quality, natural light, and access to green spaces within residential areas.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for corporate social responsibility (CSR) are significantly shaping how companies like GS Engineering & Construction (GS E&C) function. There's a growing demand for ethical conduct and positive societal contributions, influencing operational strategies and public perception.

GS E&C's commitment to community development and social causes directly impacts its brand reputation and the trust it garners from stakeholders. For instance, in 2023, GS E&C reported significant investment in various social contribution activities, aiming to foster sustainable growth alongside community well-being.

- Community Engagement: GS E&C actively participates in local community projects, enhancing its social license to operate.

- Ethical Management: Upholding transparent and ethical business practices is crucial for maintaining stakeholder confidence and long-term viability.

- Sustainability Initiatives: Investments in eco-friendly construction and social welfare programs are increasingly becoming a benchmark for corporate responsibility.

- Stakeholder Trust: A strong CSR record, evidenced by positive community feedback and ethical governance, directly correlates with increased stakeholder trust and support.

Societal trends are increasingly prioritizing sustainable and smart living environments, influencing demand for integrated housing solutions. The global smart home market, valued at approximately $100 billion in 2023, is projected to exceed $250 billion by 2028, highlighting a clear consumer shift towards connected and eco-friendly residences. This necessitates that construction firms like GS Engineering & Construction (GS E&C) innovate their offerings to align with these evolving lifestyle preferences and the growing demand for green building materials, which saw continued growth in 2024.

Public perception and trust are paramount, especially following construction incidents. GS E&C's experience with a past accident in Incheon underscores the critical need for robust safety protocols and transparent communication to rebuild and maintain confidence. By visibly demonstrating stringent safety measures and investing in community development, as evidenced by their significant social contribution activities in 2023, GS E&C aims to bolster its brand reputation and stakeholder trust.

The construction industry faces a critical shortage of skilled labor, with nearly 40% of global firms struggling to find qualified workers in 2024. This challenge directly impacts project timelines and costs, compelling GS E&C to focus on attracting and retaining talent through comprehensive workforce development programs and apprenticeships to meet the demands of complex projects through 2025.

| Societal Factor | Impact on GS E&C | 2024/2025 Data Point |

| Demand for Smart & Sustainable Homes | Drives innovation in residential projects; need for integrated tech and eco-friendly features. | Global smart home market projected to reach over $250 billion by 2028 (from ~$100 billion in 2023). |

| Public Trust & Safety Concerns | Requires rigorous safety protocols and transparent communication to maintain reputation. | Past incidents can lead to temporary halts and increased scrutiny, impacting operations. |

| Skilled Labor Shortage | Affects project timelines and costs; necessitates investment in workforce development. | Nearly 40% of construction firms globally struggled with finding qualified workers in 2024. |

| Corporate Social Responsibility (CSR) | Enhances brand reputation and stakeholder trust through ethical conduct and community engagement. | GS E&C reported significant investment in social contribution activities in 2023. |

Technological factors

GS Engineering & Construction (GS E&C) is actively embracing smart construction technologies like Building Information Modeling (BIM), modular construction, and robotics. This strategic adoption is designed to boost productivity and shorten project timelines, crucial in a competitive global market. For instance, BIM adoption in the construction sector saw significant growth, with a projected market size of over $12 billion globally by 2025, indicating a strong trend towards digital integration.

The integration of automation and robotics in construction sites, a key technological factor, is directly impacting efficiency and safety. GS E&C's focus on these areas can lead to reduced labor costs and fewer workplace accidents. Reports from 2024 suggest that companies utilizing advanced automation in construction experienced an average of 15% reduction in project completion times and a 10% decrease in on-site errors.

GS Engineering & Construction is actively embracing digital transformation within the Engineering, Procurement, and Construction (EPC) sector. This includes the strategic integration of Artificial Intelligence (AI) to enhance plant operations, refine data analytics, and develop sophisticated digital twins, all of which are crucial for gaining a competitive edge. For instance, the company's investment in digital solutions is aimed at optimizing project delivery and operational performance.

A prime example of this commitment is GS E&C's collaboration with leading technology providers. Their partnership with firms like Honeywell underscores a dedication to building robust digital infrastructure. This focus allows them to unlock greater operational efficiency and pioneer innovative solutions in their projects, reflecting a forward-looking approach to the evolving demands of the industry.

Technological advancements are revolutionizing construction, with a significant push towards eco-friendly methods. Innovations in sustainable materials, such as low-carbon concrete and recycled aggregates, are becoming more prevalent. For instance, the global green building materials market was valued at approximately $250 billion in 2023 and is projected to grow substantially, driven by environmental regulations and consumer demand.

GS Engineering & Construction (GS E&C) is strategically positioned to capitalize on these trends. Their investment in green technology and development of environmental facilities, including waste-to-energy plants and water treatment systems, directly addresses the growing need for sustainable infrastructure. This focus not only supports global decarbonization efforts but also creates new revenue streams in a rapidly expanding sector.

Advanced Materials and Engineering Innovations

GS Engineering & Construction (GS E&C) is heavily influenced by advancements in materials science and engineering. Research into novel materials like self-healing concrete and high-performance composites promises to create structures that are not only more resilient but also more economical to build and maintain. For instance, the global advanced materials market is projected to reach over $100 billion by 2027, indicating significant investment and innovation in this sector.

By integrating these cutting-edge technologies, GS E&C can enhance the quality and longevity of its projects, offering a distinct competitive advantage. This focus on innovation is crucial for meeting the evolving demands of infrastructure development and urban planning. The company's commitment to R&D in areas like modular construction and 3D printing of building components directly addresses the need for faster, more sustainable, and cost-efficient construction methods.

Key technological factors impacting GS E&C include:

- Development of sustainable and high-strength materials: Innovations in materials like low-carbon concrete and advanced polymers reduce environmental impact and improve structural integrity.

- Adoption of digital engineering and AI: Utilizing AI for design optimization, predictive maintenance, and project management streamlines operations and enhances efficiency. GS E&C's investment in digital transformation aims to leverage these technologies for improved project delivery.

- Advancements in construction automation: Robotics and automated systems for tasks such as welding, bricklaying, and site surveying increase speed, precision, and worker safety.

Urban Air Mobility (UAM) Infrastructure Development

The burgeoning sector of Urban Air Mobility (UAM) necessitates substantial infrastructure investment, encompassing vertiports, charging stations, and air traffic management systems. GS Engineering & Construction (GS E&C) is actively forging strategic alliances to position itself at the forefront of this transformative urban transportation evolution.

GS E&C's involvement in UAM infrastructure development is a testament to its foresight in capturing emerging market opportunities. For instance, the company's collaborations aim to address the critical need for specialized landing and takeoff sites, which are projected to see significant growth. By 2030, the global UAM market is anticipated to reach tens of billions of dollars, with infrastructure being a key enabler of this expansion.

- Vertiport Construction: GS E&C's partnerships focus on designing and building safe and efficient vertiports, crucial for the operation of electric vertical takeoff and landing (eVTOL) aircraft.

- Smart City Integration: These infrastructure projects are designed to seamlessly integrate with existing smart city frameworks, enhancing urban connectivity and sustainability.

- Market Growth Potential: The demand for UAM infrastructure is expected to surge as regulatory frameworks mature and passenger adoption increases, presenting lucrative opportunities for construction firms like GS E&C.

GS Engineering & Construction is actively integrating advanced digital technologies like AI and digital twins to optimize operations and project delivery. The company's commitment to automation and robotics is enhancing efficiency and safety on construction sites, with reports in 2024 indicating reduced project times and fewer errors for adopting firms. Furthermore, GS E&C is investing in green construction technologies and sustainable materials, aligning with a global market trend for eco-friendly building solutions projected for significant growth.

| Technological Factor | Description | Impact on GS E&C | Market Data/Trend (2024-2025) |

| Digitalization & AI | Integration of AI, digital twins, and BIM for design, management, and operations. | Enhanced project efficiency, predictive maintenance, improved data analytics. | Global BIM market projected over $12 billion by 2025. AI in construction expected to grow significantly. |

| Automation & Robotics | Use of robots for construction tasks, increasing speed and precision. | Reduced labor costs, improved worker safety, faster project completion. | Companies using automation saw ~15% reduction in completion times (2024 reports). |

| Sustainable Technologies | Development and use of eco-friendly materials and processes. | Reduced environmental impact, compliance with regulations, new market opportunities. | Green building materials market valued at ~$250 billion in 2023, with strong growth projections. |

Legal factors

GS Engineering & Construction (GS E&C) operates within South Korea's rigorous legal framework, with the Construction Industry Basic Act being a cornerstone. This act, along with its associated regulations, dictates everything from contractor qualifications to project safety standards, ensuring a baseline of quality and accountability in the sector.

Adherence to these laws is not optional; it's a critical requirement for GS E&C's operations. Non-compliance, especially concerning safety lapses or structural integrity failures, can lead to significant repercussions. These can include hefty fines, temporary or permanent business suspensions, and substantial damage to the company's reputation, impacting future contracts and investor confidence.

For instance, in 2023, South Korea's Ministry of Land, Infrastructure and Transport imposed penalties on several construction firms for safety violations, highlighting the enforcement of these regulations. While specific penalties for GS E&C are not publicly detailed for every instance, the general trend indicates a serious commitment to regulatory enforcement within the industry, affecting all major players.

South Korea's Serious Accidents Punishment Act (SAPA) directly impacts GS Engineering & Construction by placing greater responsibility on executives for workplace safety. This law means that management faces increased legal jeopardy, pushing for stronger safety protocols and proactive risk management to prevent criminal sanctions.

The SAPA, enacted in January 2022, has already led to investigations and penalties for companies in various sectors. For instance, in 2023, several construction firms faced fines and executive scrutiny following fatal incidents, underscoring the stringent enforcement of this legislation. GS E&C must ensure its safety management systems are not just compliant but demonstrably effective to mitigate these risks.

GS Engineering & Construction (GS E&C) must meticulously navigate a complex web of international contract laws and trade agreements for its global projects. This includes understanding varying legal frameworks, such as those governing construction disputes or intellectual property, across different jurisdictions. For instance, adherence to the UN Convention on Contracts for the International Sale of Goods (CISG) might be crucial for material procurement in certain regions, impacting contract enforceability and risk management.

The company's success in overseas ventures hinges on its ability to comply with the specific legal requirements of host nations. This means staying abreast of evolving trade policies and bilateral investment treaties that could affect project timelines or profitability. For example, a new trade agreement signed between South Korea and a key project location in 2024 could significantly alter import duties or labor regulations, necessitating swift legal adjustments to GS E&C's operational strategies.

Environmental Regulations and Compliance

GS Engineering & Construction (GS E&C) faces a landscape of tightening environmental rules globally, influencing how its projects are planned and executed. These regulations cover everything from air and water pollution to waste disposal and protecting natural habitats.

Staying compliant with these environmental laws is essential. This means GS E&C must invest heavily in robust environmental management systems and adopt more sustainable operational methods. For instance, in 2023, construction projects in South Korea, where GS E&C is headquartered, saw increased scrutiny on construction site dust and noise pollution, leading to stricter enforcement and potential fines for non-compliance.

- Stricter Emission Standards: Global efforts to combat climate change are driving more rigorous standards for greenhouse gas emissions from construction machinery and site operations.

- Waste Management and Circular Economy: Regulations are pushing for reduced construction waste and increased use of recycled materials, impacting material sourcing and disposal strategies.

- Water Resource Protection: Compliance with water quality standards for runoff and wastewater discharge from project sites is a growing concern, requiring advanced treatment solutions.

- Biodiversity Impact Assessments: Projects in sensitive ecological areas increasingly require thorough assessments and mitigation plans to protect local flora and fauna.

Labor Laws and Employment Regulations

GS Engineering & Construction (GS E&C) must navigate a complex web of labor laws and employment regulations across its global operations. Compliance with these mandates, covering worker safety, fair wages, acceptable working conditions, and industrial relations, is paramount. For instance, in South Korea, the Occupational Safety and Health Act sets stringent standards for workplace safety, with significant penalties for violations. Failing to adhere to these can lead to costly fines and operational disruptions.

Adherence to labor laws directly impacts GS E&C's ability to prevent legal disputes, foster a stable and motivated workforce, and maintain its social license to operate. In 2024, the International Labour Organization reported that non-compliance with labor standards can result in an average of 10% of a company's annual revenue being lost due to legal fees, fines, and reputational damage. This underscores the importance of proactive compliance.

- Worker Safety Compliance: GS E&C must ensure adherence to national and international safety standards, such as those mandated by OSHA in the US, to prevent accidents and related liabilities.

- Wage and Hour Laws: Compliance with minimum wage laws, overtime regulations, and fair compensation practices is crucial to avoid wage disputes and ensure employee satisfaction.

- Industrial Relations: Managing relationships with labor unions and adhering to collective bargaining agreements are key to maintaining industrial harmony and operational continuity.

- Global Regulatory Landscape: GS E&C's international projects require understanding and complying with diverse labor laws in countries like the UAE and Singapore, each with unique employment regulations.

GS Engineering & Construction (GS E&C) operates within a dynamic legal framework that significantly shapes its operations. The Serious Accidents Punishment Act (SAPA) in South Korea, for instance, imposes direct liability on executives for workplace safety failures, pushing for robust risk management. In 2023, reports indicated increased enforcement of safety regulations across South Korean industries, with construction firms facing penalties for violations, highlighting the critical need for GS E&C to maintain stringent safety protocols.

International operations necessitate adherence to diverse legal systems and trade agreements. GS E&C must navigate varying contract laws, intellectual property rights, and import/export regulations in different countries. For example, changes in bilateral investment treaties or trade policies enacted in 2024 could impact project economics and require swift legal adaptation.

Environmental regulations are increasingly stringent globally, affecting project planning and execution. GS E&C must invest in sustainable practices and comply with rules on emissions, waste management, and water discharge. In 2023, construction sites in South Korea faced heightened scrutiny regarding dust and noise pollution, underscoring the growing emphasis on environmental compliance.

Labor laws and employment regulations are crucial for GS E&C's workforce management across its global projects. Compliance with worker safety, fair wages, and working conditions is essential to avoid legal disputes and maintain operational stability. A 2024 ILO report highlighted that non-compliance with labor standards can lead to significant financial losses, emphasizing the importance of proactive adherence to regulations like South Korea's Occupational Safety and Health Act.

Environmental factors

Global initiatives like the Paris Agreement are intensifying the push for decarbonization within the construction industry, directly impacting companies like GS Engineering & Construction (GS E&C). This translates into a growing demand for sustainable building practices and materials.

GS E&C is under significant pressure to lower its carbon emissions, implement the use of low-carbon construction materials, and incorporate renewable energy sources into its projects. This aligns with their strategic direction, particularly their investments in eco-friendly energy ventures, reflecting a commitment to environmental responsibility.

The construction sector's carbon footprint is substantial, contributing significantly to global greenhouse gas emissions. For instance, the building and construction sector accounted for 37% of global energy-related CO2 emissions in 2022, according to the International Energy Agency (IEA), underscoring the urgency for companies like GS E&C to adopt more sustainable methods.

The increasing scarcity of critical raw materials, like rare earth elements vital for advanced infrastructure and renewable energy projects, presents a significant challenge for construction firms. GS Engineering & Construction (GS E&C) must navigate this by prioritizing resource-efficient construction methods and exploring sustainable material alternatives. For instance, the global demand for construction materials is projected to rise significantly, putting further strain on existing resources.

GS E&C's commitment to innovation in material selection, waste reduction, and recycling directly impacts its environmental footprint and market standing. By adopting circular economy principles, the company can mitigate risks associated with resource volatility and enhance its competitive edge. Reports indicate that the construction industry is a major contributor to global waste, highlighting the importance of GS E&C's efforts in this area.

Growing global concerns over water scarcity and pollution are significantly boosting the demand for sophisticated water management and treatment solutions. This trend directly translates into substantial opportunities for companies equipped with advanced technological capabilities in this sector.

GS Engineering & Construction (GS E&C) is well-positioned to leverage this burgeoning market, particularly through its subsidiary GS Inima Environment. GS Inima Environment has a strong track record in developing and operating environmental facilities, including advanced water treatment plants, aligning perfectly with these increasing global needs.

The global water and wastewater treatment market was valued at approximately $650 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 6.5% through 2030, indicating a robust expansion driven by these environmental factors.

Biodiversity Protection and Land Use Impact

GS Engineering & Construction's operations inherently involve significant land transformation, posing a direct risk to local biodiversity and ecosystems. The company must proactively conduct thorough environmental impact assessments, especially for projects initiated in 2024 and 2025, to identify and address potential ecological disruptions. For instance, a major infrastructure project in Southeast Asia, commencing in late 2024, required extensive land clearing, necessitating detailed biodiversity surveys and the implementation of habitat restoration plans to comply with stringent environmental regulations.

Minimizing ecological disruption is paramount for regulatory compliance and corporate social responsibility. GS E&C is expected to deploy advanced mitigation strategies, such as creating wildlife corridors and implementing erosion control measures, to safeguard biodiversity. The company's commitment to these practices is crucial, particularly as global conservation efforts intensify, with initiatives like the Convention on Biological Diversity's Post-2020 Global Biodiversity Framework setting ambitious targets for 2025 and beyond.

- Land Use Impact: Construction projects can lead to habitat fragmentation and loss, affecting species populations.

- Biodiversity Protection Laws: Compliance with national and international regulations is essential to avoid penalties and reputational damage.

- Mitigation Strategies: Implementing measures like habitat restoration and wildlife crossings helps reduce negative environmental effects.

- Environmental Impact Assessments: These are critical for understanding and planning around potential ecological consequences of development.

Waste Management and Pollution Control

Effective waste management, particularly for construction and demolition debris, alongside robust pollution control for air, water, and soil, are paramount environmental considerations for GS Engineering & Construction (GS E&C). The company's dedication to minimizing waste and proactively managing environmental hazards across all its operations is fundamental to its long-term sustainability.

GS E&C's commitment is reflected in its efforts to integrate circular economy principles. For instance, in 2023, the company reported a significant focus on recycling construction waste, diverting approximately 75% of generated materials from landfills through innovative reuse and reprocessing initiatives. This aligns with global trends, as the construction sector is a major contributor to waste streams, making responsible management crucial.

Furthermore, GS E&C actively implements advanced technologies for pollution abatement. This includes investing in state-of-the-art dust suppression systems on project sites, which contributed to a 15% reduction in airborne particulate matter in 2023 compared to the previous year. Similarly, stringent water treatment protocols are in place to ensure discharged water quality meets or exceeds regulatory standards, safeguarding local ecosystems.

- Waste Diversion: GS E&C aims to increase construction waste recycling rates to 80% by the end of 2024.

- Air Quality Monitoring: Continuous monitoring shows a commitment to keeping emissions below stringent international benchmarks.

- Water Stewardship: Investments in advanced wastewater treatment facilities are ongoing, with a target of zero non-compliant discharge events.

- Soil Remediation: Proactive soil management plans are implemented on all sites to prevent contamination and address any existing issues.

The increasing global focus on climate change and sustainability is a significant environmental factor influencing GS Engineering & Construction (GS E&C). This includes stricter regulations on carbon emissions and a growing demand for green building solutions.

GS E&C's strategic investments in renewable energy projects and eco-friendly technologies, such as those in the hydrogen and offshore wind sectors, directly address these environmental pressures. The company is actively working to reduce its operational carbon footprint, a critical aspect given the construction industry's substantial contribution to global emissions.

The construction sector's environmental impact is substantial, with the building and construction sector contributing 37% of global energy-related CO2 emissions in 2022. This underscores the imperative for companies like GS E&C to adopt sustainable practices and materials to meet evolving environmental standards and market expectations.

GS E&C's proactive approach to environmental stewardship, including its commitment to waste reduction and circular economy principles, is crucial for navigating resource scarcity and enhancing its competitive position. The company's efforts in recycling construction waste, aiming for 80% diversion by the end of 2024, highlight its dedication to minimizing environmental impact.

| Environmental Factor | Impact on GS E&C | Key Initiatives/Data (2023-2025) |

|---|---|---|

| Climate Change & Decarbonization | Increased demand for sustainable construction; pressure to reduce carbon footprint. | Investment in green energy ventures; aiming for reduced emissions. The building and construction sector accounted for 37% of global energy-related CO2 emissions in 2022. |

| Resource Scarcity | Challenge in sourcing raw materials; need for efficient material use. | Focus on resource-efficient methods and sustainable material alternatives. |

| Water Management | Growing demand for water treatment solutions; opportunities for GS Inima Environment. | GS Inima Environment's expertise in advanced water treatment facilities. Global water and wastewater treatment market valued at ~$650 billion in 2023, growing at ~6.5% CAGR. |

| Biodiversity & Land Use | Risk of ecological disruption from land transformation; need for impact assessments. | Conducting environmental impact assessments for projects starting in 2024-2025; implementing mitigation strategies like habitat restoration. |

| Waste Management & Pollution Control | Need for effective waste diversion and pollution abatement. | Aiming for 80% construction waste recycling by end of 2024; 15% reduction in airborne particulate matter in 2023. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for GS Engineering & Construction is built on a robust foundation of data from reputable sources. This includes official government publications, reports from international organizations like the World Bank and IMF, and leading industry analysis firms. We also incorporate data on technological advancements and socio-economic trends to provide a comprehensive view.