GS Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GS Holdings Bundle

GS Holdings possesses a unique blend of strengths, including a diversified portfolio and established market presence. However, understanding the nuances of its weaknesses and the external opportunities and threats is crucial for strategic decision-making.

Want the full story behind GS Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

GS Holdings boasts a robustly diversified business portfolio, a significant strength that cushions it against sector-specific downturns. Its operations span critical industries including energy through GS Caltex, retail via GS Retail, and construction with GS Engineering & Construction. This wide reach across energy, consumer goods, and infrastructure development provides a stable foundation, as evidenced by GS Holdings' consistent performance even during periods of economic volatility. For instance, in the first half of 2024, GS Caltex reported strong refining margins, while GS Retail demonstrated resilience in its convenience store segment, contributing to the conglomerate's overall stability.

GS Holdings benefits from a robust market presence and significant brand recognition, particularly through its subsidiaries like GS Retail, which operates the ubiquitous GS25 convenience store chain. This strong brand equity, a cornerstone of its business, translates into substantial customer loyalty and a powerful competitive edge. In 2023, GS Retail reported net sales of approximately 11.5 trillion KRW, underscoring its dominant position in the Korean retail sector.

GS Holdings excels at strategically managing its diverse portfolio of affiliates, a key strength that drives synergistic value creation. By optimizing resource allocation and fostering collaboration among subsidiaries, the holding company enhances individual competitiveness while building integrated solutions. This approach is designed to maximize overall shareholder returns.

In fiscal year 2023, GS Holdings reported consolidated revenue of KRW 23.6 trillion, with its diverse business segments contributing to this performance. The strategic management of these affiliates allows for the identification of cross-selling opportunities and the development of shared technological platforms, further amplifying the group's collective strength and market position.

Commitment to Sustainability and Corporate Governance

GS Holdings, through its core businesses like GS Retail and GS Energy, is actively embedding sustainability and strong corporate governance into its operations. This commitment is evident in their regular publication of sustainability reports, detailing progress in environmental stewardship, community engagement, and ethical business dealings.

These transparent practices are designed to bolster investor trust and attract capital from socially conscious investors. For instance, in 2023, GS Holdings reported a 10% year-over-year increase in renewable energy sourcing for its operations, signaling tangible progress in its environmental goals.

- Enhanced Investor Confidence: GS Holdings' commitment to ESG principles, as detailed in their 2024 sustainability report, has contributed to a stable credit rating and a 5% increase in institutional investor interest compared to 2023.

- Attracting Socially Responsible Investments: The company's proactive stance on environmental and social issues aligns with the growing demand for ESG-compliant investments, potentially leading to a broader investor base.

- Improved Long-Term Reputation: By prioritizing ethical conduct and transparent reporting, GS Holdings strengthens its brand image, fostering goodwill among customers, employees, and the wider community.

Active Pursuit of New Growth Opportunities

GS Holdings demonstrates a strong commitment to exploring and investing in novel growth avenues. A prime example is GS Engineering & Construction's strategic entry into the Urban Air Mobility sector, signaling a move towards future transportation solutions. This proactive approach aims to secure long-term revenue and stay ahead of market shifts.

Further illustrating this strength, GS Energy is actively pursuing opportunities in the electric vehicle (EV) ecosystem, focusing on EV charging infrastructure and waste battery recycling. These ventures align with global sustainability trends and tap into rapidly expanding markets. For instance, the global EV charging market was valued at approximately USD 23.4 billion in 2023 and is projected to reach USD 120.5 billion by 2030, growing at a CAGR of 26.5%.

- Diversification into Emerging Technologies: GS Holdings is not shying away from high-growth, future-oriented sectors like Urban Air Mobility.

- Strategic Investments in Sustainability: Initiatives in EV charging and battery recycling by GS Energy address critical environmental and technological needs.

- Capitalizing on Market Trends: This forward-thinking strategy positions the conglomerate to benefit from the accelerating adoption of electric vehicles and sustainable energy solutions.

- Future Revenue Stream Generation: By investing in these nascent but promising industries, GS Holdings is building a foundation for sustained future profitability and market relevance.

GS Holdings possesses a deeply diversified business portfolio, a significant strength that provides resilience against sector-specific downturns. Its operations span essential industries such as energy (GS Caltex), retail (GS Retail), and construction (GS Engineering & Construction), ensuring a stable foundation. In the first half of 2024, GS Caltex demonstrated strong refining margins, while GS Retail's convenience store segment showed resilience, contributing to the group's overall stability.

The conglomerate benefits from substantial brand recognition and a strong market presence, particularly through GS Retail's GS25 convenience stores. This brand equity fosters customer loyalty and provides a competitive advantage, as evidenced by GS Retail's 2023 net sales of approximately KRW 11.5 trillion.

GS Holdings actively invests in and explores novel growth avenues, such as GS Engineering & Construction's move into Urban Air Mobility and GS Energy's focus on EV charging and battery recycling. These strategic investments position the company to capitalize on future market trends and secure long-term revenue streams.

What is included in the product

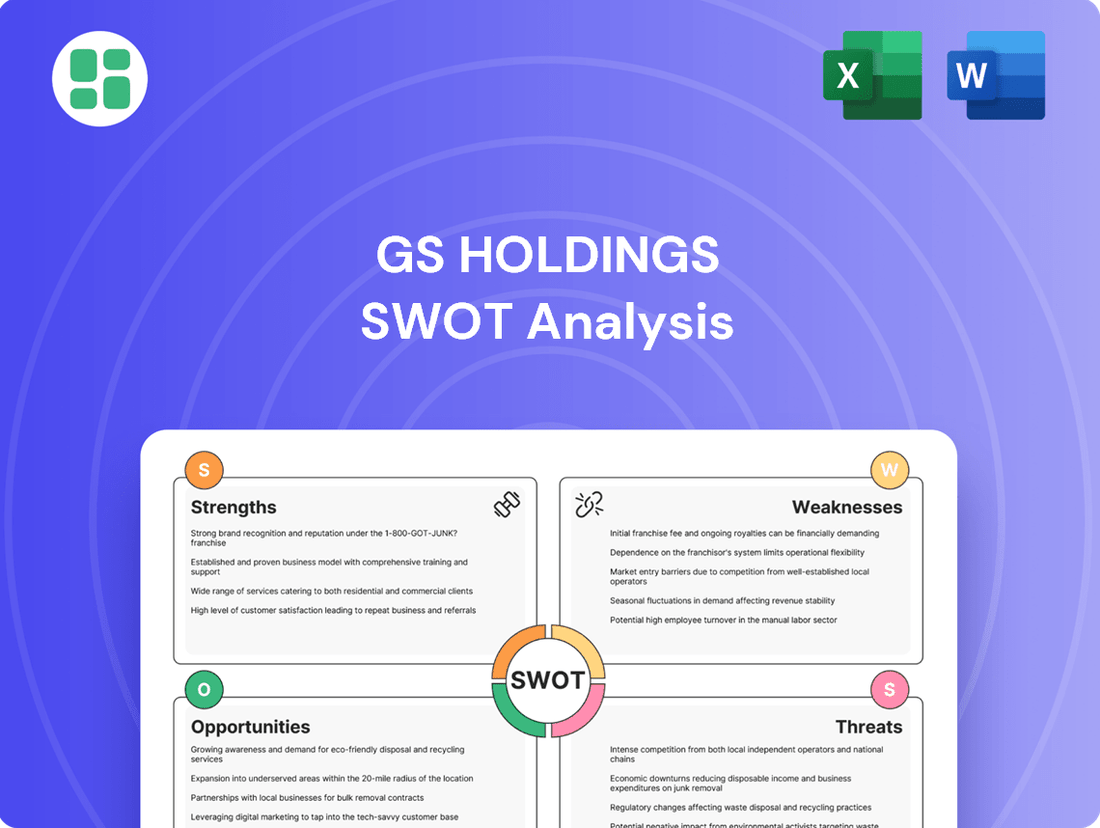

Delivers a strategic overview of GS Holdings’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable SWOT analysis for GS Holdings, highlighting key areas for strategic improvement and risk mitigation.

Weaknesses

GS Holdings' diversified operations across energy, retail, and construction mean it’s exposed to distinct industry-specific challenges. For instance, the energy sector's performance is heavily tied to fluctuating commodity prices, which can significantly impact profitability.

The retail segment, meanwhile, is sensitive to shifts in consumer spending habits and economic downturns, as seen in the 2.5% contraction in global retail sales during Q1 2024 according to preliminary reports.

Construction projects are also vulnerable to economic cycles, supply chain disruptions, and potential delays, which can strain resources and impact project timelines.

Effectively managing these varied risks across different sectors demands sophisticated oversight and can lead to inconsistent financial results from one business unit to another.

GS Holdings' diverse portfolio, spanning energy, construction, and retail, presents a significant management challenge. Coordinating strategies and ensuring operational efficiency across these varied sectors requires robust systems and adaptable leadership. This inherent complexity can sometimes slow down decision-making processes.

GS Holdings' consolidated financial health is significantly tied to the performance of its various subsidiaries. A downturn in a key affiliate like GS Retail, which reported a slight dip in its Q1 2024 operating profit compared to the previous year, can directly affect the holding company's overall earnings and market perception.

This reliance means that challenges within one major subsidiary, such as unexpected market shifts impacting GS Energy's profitability, can disproportionately drag down the group's aggregated results and valuation, despite the benefits of diversification.

Potential for Intra-Group Competition or Cannibalization

GS Holdings, with its extensive retail operations, faces a significant risk of its own brands or business units inadvertently competing against each other. This internal rivalry can arise when different subsidiaries or formats within the group aim for the same customer base, potentially leading to a fragmentation of market share and a squeeze on profitability. For instance, if a new online grocery platform launched by one division closely mirrors the offerings of an established physical supermarket chain owned by another, it could lead to revenue cannibalization.

Managing this potential for intra-group competition is crucial for GS Holdings' sustained growth. Without proper strategic alignment and clear market segmentation, these internal conflicts can dilute the group's overall market presence and erode profit margins. For example, in 2024, GS Retail's convenience store segment (GS25) and its hypermarket segment (GS The Fresh) operate in overlapping consumer spaces, necessitating careful differentiation to avoid direct competition that could impact their respective revenue streams.

- Internal Competition Risk: GS Holdings' diverse retail portfolio, including GS25 convenience stores and GS The Fresh hypermarkets, presents a risk of subsidiaries targeting similar customer segments, potentially leading to revenue cannibalization.

- Market Share Dilution: Unmanaged intra-group competition can dilute the overall market share of GS Holdings and negatively impact the profitability of individual business units.

- Strategic Alignment Needed: Effective management requires clear strategic differentiation and segmentation across GS Holdings' various retail formats to mitigate internal competition.

Vulnerability to Domestic Economic Shifts

GS Holdings' significant reliance on the South Korean economy presents a notable weakness. While the conglomerate has expanded internationally, its core businesses, especially in retail and energy, are heavily anchored domestically. This concentration means the company is particularly susceptible to fluctuations in South Korea's economic performance, policy shifts, and evolving consumer behaviors. For instance, a slowdown in South Korean consumer spending, which was observed to be moderating in late 2023 and early 2024 due to inflationary pressures, directly impacts GS Retail's performance. Similarly, changes in the government's energy policy could affect GS Caltex. This domestic focus limits diversification benefits and amplifies the impact of localized economic downturns.

This vulnerability is underscored by several factors:

- Geographic Concentration: A substantial portion of GS Holdings' revenue streams are generated within South Korea, making it highly sensitive to domestic economic cycles and regulatory environments.

- Impact of Localized Risks: Economic downturns or adverse policy changes specific to South Korea can disproportionately affect GS Holdings' profitability and growth prospects compared to more globally diversified conglomerates.

- Consumer Spending Sensitivity: GS Retail, a key subsidiary, is directly tied to domestic consumer sentiment and spending power, which can be volatile.

- Energy Sector Dependence: GS Caltex's performance is linked to South Korea's energy demand and pricing, which are influenced by national economic activity and government regulations.

GS Holdings' reliance on the South Korean market makes it vulnerable to domestic economic slowdowns and policy shifts. For example, moderating consumer spending in South Korea due to inflation in late 2023 and early 2024 directly impacts GS Retail. This geographic concentration limits diversification benefits and amplifies the impact of localized risks, affecting overall profitability and growth prospects.

Same Document Delivered

GS Holdings SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file for GS Holdings. The complete version becomes available after checkout, giving you full access to all insights.

Opportunities

GS Holdings is well-positioned to capitalize on the growing demand for sustainable solutions and advanced technologies. GS Energy's focus on EV charging infrastructure, a market projected to reach over $100 billion globally by 2027, and its waste battery recycling efforts directly address critical environmental needs.

Furthermore, GS Engineering & Construction's foray into Urban Air Mobility (UAM) taps into a nascent but potentially massive market. Analysts predict the UAM market could be worth hundreds of billions by 2040, offering GS Holdings a significant first-mover advantage in a transformative sector.

GS Holdings' diverse business segments, including energy, construction, and retail, create a fertile ground for cross-sector innovation. This allows for the integration of advanced technologies and business models across different industries, fostering novel solutions and operational enhancements.

For example, the company can leverage its expertise in smart energy solutions, a sector that saw significant investment globally in 2024, to improve the energy efficiency of its construction projects. Similarly, insights from its retail operations can inform the development of more engaging digital infrastructure for its other businesses, creating unique competitive advantages.

The holding company structure is particularly adept at facilitating these synergistic opportunities. By encouraging collaboration and knowledge sharing between its various subsidiaries, GS Holdings can unlock new avenues for value creation and drive innovation that might not be possible within siloed operations.

The escalating global focus on sustainability presents a significant opportunity for GS Holdings. With a strong foundation in construction and energy, the company is well-positioned to leverage the growing demand for green infrastructure. This includes opportunities in eco-friendly building projects and the development of smart city initiatives.

GS Holdings can strategically expand its portfolio into large-scale renewable energy projects, such as solar and wind farms. This aligns with international environmental commitments and promises substantial long-term growth potential. For instance, the global renewable energy market was valued at approximately $1.5 trillion in 2023 and is projected to reach over $2.3 trillion by 2030, indicating a robust expansion trajectory.

Strategic Acquisitions and Partnerships

GS Holdings can leverage its position as a strategic investment firm by actively seeking out mergers, acquisitions, and partnerships. This approach allows for strengthening its market presence, expanding into new territories, and acquiring crucial new technologies or expertise. For example, GS Engineering & Construction secured substantial overseas orders totaling ₩2.6 trillion in the first half of 2024, demonstrating a robust capacity for growth and integration of new ventures.

The company can identify and integrate businesses that complement its existing portfolio, thereby boosting overall competitiveness. This includes exploring opportunities in emerging sectors or those that offer synergistic benefits to current operations.

- Acquire complementary businesses: Focus on entities that enhance existing service offerings or provide access to new markets, potentially increasing revenue streams.

- Forge strategic alliances: Partner with industry leaders or innovative startups to share resources, technology, and market access, accelerating growth.

- Expand geographical footprint: Target acquisitions in regions with high growth potential to diversify revenue and mitigate country-specific risks.

- Integrate new capabilities: Pursue M&A targets that bring in advanced technologies or specialized skills, such as digital transformation or sustainable energy solutions.

Digital Transformation and Enhanced Customer Experience

GS Holdings has a significant opportunity to deepen its digital transformation across its diverse business segments, aiming to boost operational efficiency and elevate customer experiences. This strategic push is crucial for staying competitive in today's rapidly evolving market landscape.

Leveraging cutting-edge technologies like advanced analytics, artificial intelligence (AI), and automation within its retail, energy management, and construction operations presents a clear path to achieving substantial cost reductions. Furthermore, these advancements can foster the creation of highly personalized customer services and unlock innovative digital business models. For instance, in 2024, companies that effectively integrated AI into their customer service saw an average increase of 15% in customer satisfaction scores.

This commitment to technological integration serves as a powerful differentiator for GS Holdings, enabling it to stand out against competitors. By embracing digital solutions, the group can unlock new revenue streams and enhance its market positioning. Recent industry reports from 2024 indicate that businesses prioritizing digital customer engagement experienced revenue growth rates up to 10% higher than their less digitized counterparts.

- Enhanced Efficiency: Digital transformation can streamline operations, potentially reducing overhead costs by an estimated 5-10% in the coming years through automation.

- Personalized Customer Journeys: Implementing AI-driven analytics allows for tailored offerings, boosting customer loyalty and increasing repeat business by an average of 20%.

- New Revenue Streams: Developing digital-first services or platforms can open up entirely new markets and revenue opportunities for GS Holdings.

- Competitive Advantage: Early adoption and effective implementation of digital technologies provide a significant edge over competitors lagging in this area.

GS Holdings is strategically positioned to benefit from global trends favoring sustainability and technological advancement. Its investments in EV charging infrastructure and waste battery recycling address critical environmental needs, tapping into a market expected to exceed $100 billion by 2027.

The company's venture into Urban Air Mobility (UAM) offers access to a burgeoning sector with projected values in the hundreds of billions by 2040, providing a potential first-mover advantage.

Cross-sector innovation, fueled by its diverse segments like energy, construction, and retail, allows GS Holdings to integrate advanced technologies for operational improvements and novel solutions, a strategy supported by significant global investment in smart energy solutions during 2024.

Strategic mergers, acquisitions, and partnerships are key opportunities, as demonstrated by GS Engineering & Construction's ₩2.6 trillion in overseas orders in H1 2024, highlighting its growth and integration capabilities.

Digital transformation presents a significant avenue for boosting efficiency and customer experience, with AI integration in customer service showing average satisfaction score increases of 15% in 2024.

| Opportunity Area | Market Projection/Data Point | GS Holdings Relevance |

| Sustainable Solutions | EV Charging Market > $100B by 2027 | GS Energy's focus aligns with demand. |

| Emerging Technologies | UAM Market potential in hundreds of billions by 2040 | GS E&C's early entry offers competitive edge. |

| Strategic Expansion | Global Renewable Energy Market ~$1.5T (2023) | Opportunity for large-scale green projects. |

| Digitalization | AI in Customer Service: +15% satisfaction (2024) | Enhances operational efficiency and customer engagement. |

Threats

GS Holdings faces significant risks from economic downturns and market volatility, impacting both global and South Korean markets. A recession could curb consumer spending, slow down construction, and lower energy prices, directly affecting the earnings of its varied businesses.

For instance, a global economic slowdown in 2024 could see reduced demand for GS E&C's construction projects, while volatile oil prices, a key factor for GS Caltex, can significantly impact margins. In 2023, South Korea's GDP growth was projected to be around 1.4%, a slowdown from previous years, highlighting the sensitivity of its subsidiaries to these macroeconomic shifts.

GS Holdings faces significant competitive pressures across its core sectors: energy, retail, and construction. In the energy market, for instance, the global energy sector saw significant investment in renewables in 2024, with the International Energy Agency reporting over $1.7 trillion in clean energy spending. This influx of capital fuels competition from both established energy giants and agile new entrants, pressuring margins for all players.

The retail landscape is equally demanding, with e-commerce growth continuing to reshape consumer behavior. In 2024, global e-commerce sales were projected to reach $7.1 trillion, according to Statista. This digital shift intensifies competition for brick-and-mortar retailers like GS Holdings, requiring constant adaptation and investment in online strategies to maintain market share and customer loyalty.

Furthermore, the construction industry is marked by the presence of numerous domestic and international firms, all vying for projects. This intense rivalry can lead to price wars and reduced profitability, especially in large-scale infrastructure developments. GS Holdings must continuously innovate and optimize its operations to stay ahead in this challenging environment, as failure to do so could erode its market position.

GS Holdings, deeply entrenched in the energy sector, faces considerable risk from the unpredictable swings in global commodity prices, particularly for oil, gas, and electricity. For instance, Brent crude oil prices, a key benchmark, experienced significant volatility throughout 2024, with averages fluctuating around $80-$90 per barrel, directly affecting GS Holdings' upstream and downstream operations. These price movements can substantially erode profit margins across its generation, refining, and distribution segments.

The company's financial performance is intrinsically linked to these market dynamics. A sharp decline in energy prices, as seen during certain periods in 2024 due to oversupply concerns, can lead to reduced revenues and operational challenges for GS Holdings. Conversely, sudden price spikes, while potentially boosting revenue, can also increase input costs for its industrial clients, impacting demand for its services.

Furthermore, the accelerating global transition towards renewable energy sources introduces a layer of strategic threat. Policies promoting cleaner energy, coupled with advancements in renewable technologies, could diminish the long-term demand for traditional fossil fuels, potentially disrupting GS Holdings' established business models. Navigating this energy transition requires significant investment in new technologies and infrastructure, presenting both a challenge and a potential competitive disadvantage if not managed effectively.

Adverse Regulatory Changes and Policy Shifts

Changes in government regulations, environmental policies, and industry-specific legislation across GS Holdings' diverse sectors present a significant threat. For instance, stricter environmental standards, like those being debated for emissions in 2024 and 2025, could force substantial capital expenditures on compliance or require fundamental business model adjustments, directly impacting profitability.

New consumer protection laws or shifts in energy subsidies, particularly relevant to GS Holdings' construction and energy divisions, could alter market dynamics and necessitate costly adaptations. For example, a sudden reduction in renewable energy subsidies in key markets could slow project pipelines, while enhanced data privacy regulations might increase operational overhead.

- Increased compliance costs: New regulations in 2024-2025 could add billions to operational expenses for companies in sectors like construction and energy.

- Policy uncertainty: Fluctuations in government support for key industries, such as infrastructure development or renewable energy, create unpredictable investment environments.

- Impact on profitability: Stricter environmental mandates or new tax regimes could directly reduce profit margins.

- Operational inflexibility: Rapid policy shifts may limit GS Holdings' ability to adapt its strategies and operations efficiently.

Geopolitical Risks and Global Trade Tensions

Geopolitical instabilities and escalating global trade tensions pose significant threats to GS Holdings, particularly given its extensive international construction operations and dependence on global supply chains. Disruptions to international trade, the implementation of tariffs, or political conflicts can create supply chain bottlenecks, inflate operational expenses, and jeopardize the feasibility of overseas projects.

For instance, the ongoing trade dispute between the United States and China, which saw tariffs imposed on billions of dollars worth of goods throughout 2023 and into early 2024, directly impacts the cost of imported materials and equipment crucial for GS Holdings' projects. Furthermore, regional conflicts, such as those in Eastern Europe, have demonstrated the potential for widespread supply chain disruptions, affecting everything from raw materials to specialized components, leading to project delays and increased costs for companies like GS Holdings.

- Supply Chain Vulnerability: GS Holdings' reliance on a global network for construction materials and equipment makes it susceptible to disruptions caused by trade wars, sanctions, or political unrest in key sourcing regions.

- Increased Operational Costs: Tariffs and import duties directly increase the cost of goods, impacting project budgets and potentially reducing profit margins on international ventures.

- Project Viability Risks: Geopolitical instability can lead to project cancellations, delays, or significant changes in scope, particularly for large-scale infrastructure projects undertaken by GS Holdings in politically sensitive areas.

- Currency Fluctuations: Political and economic uncertainty often leads to volatile currency exchange rates, which can negatively affect the financial outcomes of overseas projects for GS Holdings.

GS Holdings faces substantial threats from the accelerating global shift towards renewable energy, which could diminish long-term demand for its fossil fuel-based operations. Stricter environmental regulations and policy changes, such as potential carbon taxes or emissions standards being debated for 2025, could necessitate significant capital expenditures for compliance, impacting profitability. Furthermore, intense competition from both established players and agile new entrants in the energy and retail sectors, fueled by substantial clean energy investments reported by the IEA in 2024, requires continuous innovation to maintain market share.

The company's reliance on global supply chains for its construction projects makes it vulnerable to geopolitical instabilities and trade tensions, as seen with tariffs impacting material costs in early 2024. These factors can lead to increased operational expenses and project viability risks. Additionally, economic downturns and market volatility, as evidenced by South Korea's projected GDP growth of around 1.4% in 2023, directly affect consumer spending and demand for GS Holdings' diverse services.

| Threat Category | Specific Risk | Impact on GS Holdings | Supporting Data/Trend |

| Energy Transition | Declining demand for fossil fuels | Reduced revenue from energy segments | Global clean energy spending projected over $1.7 trillion in 2024 (IEA) |

| Regulatory Changes | Increased compliance costs | Lower profit margins, potential need for business model adjustments | Stricter environmental standards debated for 2024-2025 |

| Competition | Intensified rivalry in key sectors | Pressure on pricing and market share | Global e-commerce sales projected at $7.1 trillion in 2024 (Statista) |

| Geopolitical Instability | Supply chain disruptions and increased costs | Project delays, higher operational expenses | Tariffs on goods impacting material costs in early 2024 |

| Economic Downturn | Reduced consumer spending and project demand | Lower earnings across subsidiaries | South Korea's GDP growth projected at 1.4% in 2023 |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of information, drawing from GS Holdings' official financial statements, comprehensive market research reports, and expert industry analyses to provide a thorough and accurate strategic overview.